Who Reigns Supreme in AI Vision Profitability?

![]() 02/11 2025

02/11 2025

![]() 602

602

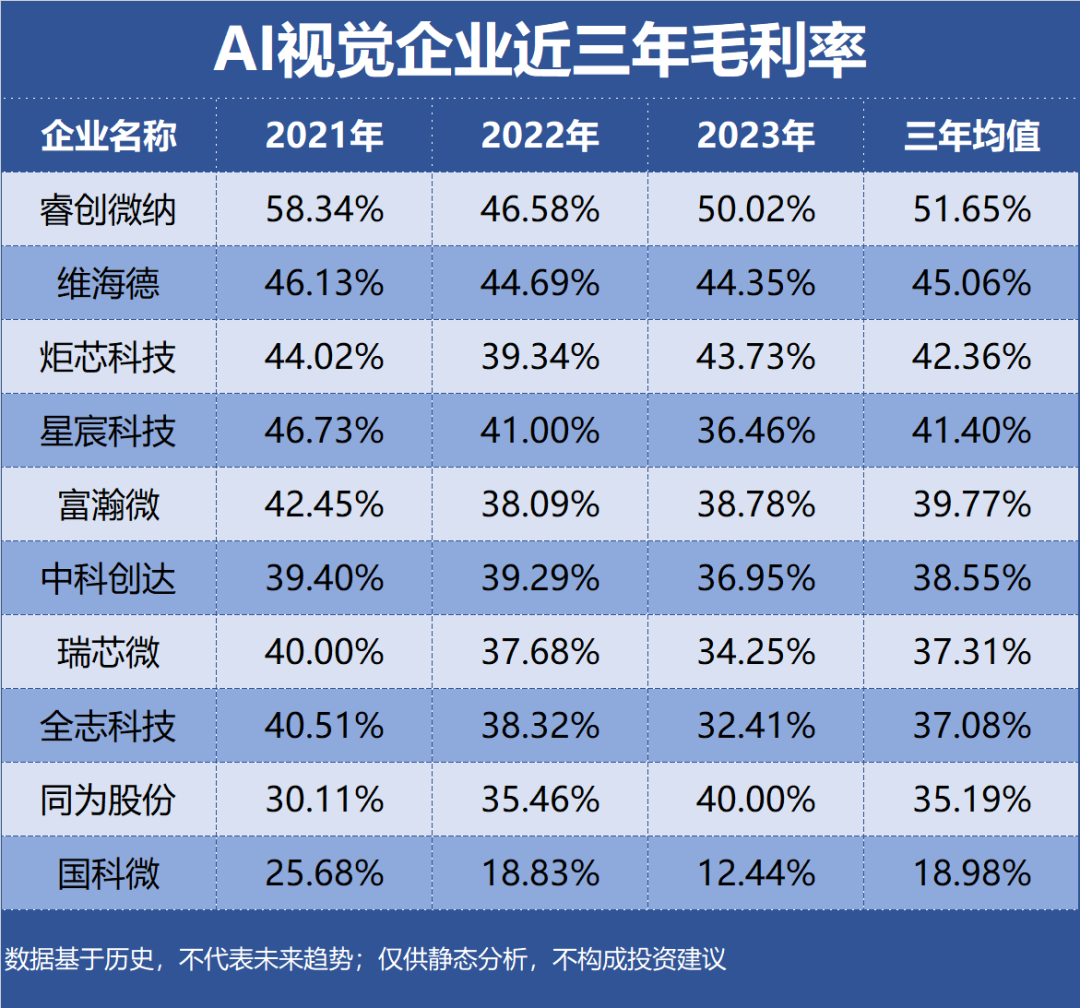

The Doubao large model team has unveiled the latest advancements in their video generation model, "VideoWorld," which perceives the world exclusively through vision. Unlike multimodal heavyweights like Sora, DALL-E, and Midjourney, VideoWorld stands as the industry pioneer, achieving independence from language models. This article delves into the [Profitability] aspect of our enterprise value series, analyzing 15 AI vision companies based on metrics such as Return on Equity (ROE), Gross Profit Margin, and Net Profit Margin. Note that the data presented is drawn from historical information, intended for static analysis only, and does not predict future trends or constitute investment advice.

Top 10 AI Vision Enterprises by Profitability:

No.10 Weihai De

- Industry Segment: Security Equipment

- Profitability: ROE 16.76%, Gross Margin 45.06%, Net Margin 20.94%

- Performance Forecast: No current performance forecasts available

- Main Products: Cameras, contributing 82.27% of revenue with a gross margin of 45.93%

- Company Highlights: Weihai De boasts core ISP algorithm technology, fulfilling diverse customer product requirements.

No.9 Tongwei

- Industry Segment: Security Equipment

- Profitability: ROE 12.67%, Gross Margin 35.19%, Net Margin 11.38%

- Performance Forecast: No current performance forecasts available

- Main Products: Frontend video surveillance products, accounting for 70.87% of revenue with a gross margin of 42.79%

- Company Highlights: Tongwei offers mature AI ISP technology product lines, already on the market.

No.8 Guokewei

- Industry Segment: Digital Chip Design

- Profitability: ROE 9.66%, Gross Margin 18.98%, Net Margin 6.28%

- Performance Forecast: ROE declined to 2.36% in the past three years, with the latest forecast at 2.08%

- Main Products: Smart vision series, contributing 48.23% of revenue with a gross margin of 11.66%

- Company Highlights: Guokewei's 4K AI vision processing chip, GK7606V1 series, features a dual-core A55 processor, supporting 4K codec and AI ISP dual 3D noise reduction.

No.7 Thundersoft

- Industry Segment: IT Services

- Profitability: ROE 10.30%, Gross Margin 38.55%, Net Margin 12.04%

- Performance Forecast: ROE declined to 5.03% in the past three years, with the latest forecast at 3.77%

- Main Products: Technical services, accounting for 41.70% of revenue with a gross margin of 38.53%

- Company Highlights: Thundersoft holds drive development and ISP Tuning permissions for NVIDIA's Jetson and DRIVE platforms, a first for a Chinese company.

No.6 Actions

- Industry Segment: Digital Chip Design

- Profitability: ROE 7.18%, Gross Margin 42.36%, Net Margin 13.81%

- Performance Forecast: ROE fluctuated between 3%-15% in the past three years, with the latest forecast at 4.90%

- Main Products: Bluetooth audio SoC chips, contributing 73.93% of revenue with a gross margin of 47.60%

- Company Highlights: Actions' edge AI audio chip platform, leveraging SRAM's analog-digital hybrid in-memory computing, targets voice, audio, and visual recognition applications.

No.5 Fullhan

- Industry Segment: Digital Chip Design

- Profitability: ROE 17.79%, Gross Margin 39.77%, Net Margin 18.01%

- Performance Forecast: ROE declined to 10.48% in the past three years, with the latest forecast at 9.37%

- Main Products: Professional video processing products, contributing 66.04% of revenue with a gross margin of 37.11%

- Company Highlights: Fullhan specializes in high-performance video codec IPC and NVR SoC chips, alongside ISP chips.

No.4 Allwinner

- Industry Segment: Digital Chip Design

- Profitability: ROE 9.16%, Gross Margin 37.08%, Net Margin 13.08%

- Performance Forecast: ROE peaked at 19.30% in the past three years, with the latest forecast at 7.58%

- Main Products: Smart terminal application processor chips, contributing 85.75% of revenue with a gross margin of 32.10%

- Company Highlights: Allwinner's NPU-accelerated vision processing SoC chips are in mass production.

No.3 Xincheng

- Industry Segment: Digital Chip Design

- Profitability: ROE 36.83%, Gross Margin 41.40%, Net Margin 20.68%

- Performance Forecast: ROE declined to 10.38% in the past three years, with the latest forecast at 10.65%

- Main Products: Smart security solutions, contributing 68.66% of revenue with a gross margin of 33.58%

- Company Highlights: Xincheng's core IPs, including A1, ISP, audio, video, display, and perception, are entirely self-developed.

No.2 Raytron

- Industry Segment: Military Electronics

- Profitability: ROE 11.39%, Gross Margin 51.65%, Net Margin 16.16%

- Performance Forecast: ROE fluctuated between 8%-15% in the past three years, with the latest forecast at 11.47%

- Main Products: Infrared thermal imaging, contributing 87.05% of revenue with a gross margin of 53.72%

- Company Highlights: Raytron has successfully developed and mass-produced a range of products, including low-cost infrared modules based on ISP chips.

No.1 Rockchip

- Industry Segment: Digital Chip Design

- Profitability: ROE 12.98%, Gross Margin 37.31%, Net Margin 14.37%

- Performance Forecast: ROE declined to 4.53% in the past three years, with the latest forecast at 15.15%

- Main Products: Integrated circuits, contributing 99.11% of revenue with a gross margin of 34.00%

- Company Highlights: Rockchip has a rich technical background in audio, video, display, and ISP. Its RV series of vision chips leverage low-power solutions and proprietary ISP technology, suitable for AI glasses.

Top 10 AI Vision Enterprises by Profitability, ROE, Gross Margin, and Net Margin in the Last Three Years: