DeepSeek's Potential Impact on the A-share Market: Can It Replicate OpenAI's Success?

![]() 02/11 2025

02/11 2025

![]() 542

542

This is the 809th article published by the Xijing Research Institute, and the 750th original article by Dean Zhao Jian.

In the stock market, two narratives consistently captivate investors: "money printing" and "technological revolution." With the emergence of DeepSeek, a groundbreaking innovation in the large model industry, can it replicate the "monetary shock" of September 24, 2024, in the A-share market, sparking a significant "technological shock" in 2025 and propelling China's bull market to new heights? Indeed, since the release of DeepSeek R1, AI-related industries and concept sectors have already witnessed a sharp surge in structural bull market activity.

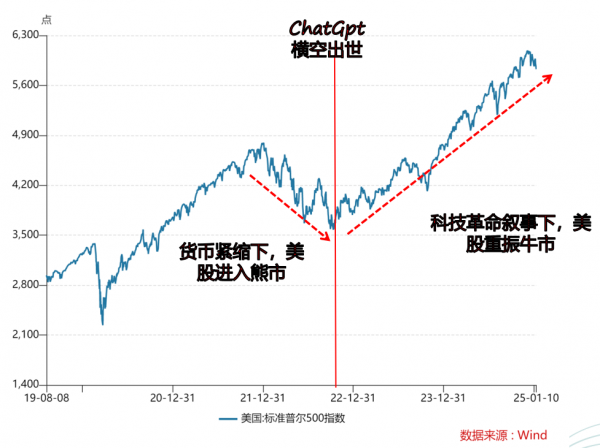

A comparable example is the impact of OpenAI on the US stock market. The AI revolution narrative sparked by ChatGPT rescued the US stock market from collapse and subsequently fueled an epic bull run. In early 2022, rampant inflation in the United States forced the Federal Reserve to aggressively raise interest rates and shrink its balance sheet. The narrative of money printing faltered, and the US stock market experienced its steepest sustained decline in recent years, teetering on the brink of collapse. However, OpenAI's ChatGPT emerged in November, initiating a global AI revolution that reignited investor enthusiasm and poured massive funds back into the US stock market.

To some extent, this technological revolution led by Silicon Valley scientists and physicists saved both the US stock market and the American economy. The seven tech giants contributed 70% of the gains in the US stock market. The booming stock market maintained robust consumer spending through the wealth effect, bolstering optimistic expectations. Coupled with substantial capital expenditures driven by AI technological upgrades, the American economy not only achieved a soft landing but also stood out amidst global economic weakness.

ChatGPT's emergence saved the US stock market and helped the American economy achieve a soft landing.

Here, it's crucial to understand the symbiotic relationship between capital market prosperity and modern economic growth. With a bull market in stocks and asset price gains outpacing inflation, the returns in the fund and pension accounts held by the American middle class and above also surpassed inflation. Consequently, inflation was offset by property income, and the wealth effect continued to stimulate consumption. Simultaneously, the spiraling rise in prices and wages consistently pushed up employment demand, maintaining a historically low unemployment rate despite the influx of nearly ten million immigrants in recent years. However, low-income groups and younger generations without financial assets investments, though experiencing nominal wage increases and relatively abundant job opportunities, remained victims of inflation. Many Americans lack a savings habit, making them acutely aware of the pain of rising living costs, which directly or indirectly contributed to Trump's comeback.

This macroeconomic logic chain is seamless. As hyperinflation threatened to collapse the American economy and stock market, the generative AI revolution emerged, rejuvenating the faltering stock market bubble and, to some extent, balancing severe inflation through asset price bubbles. Meanwhile, lingering inflation continued to propel nominal income and consumption. The vast AI infrastructure and new capital expenditures by enterprises supported the nominal aggregate demand of the American economy, which remained robust amidst China's deflation and Europe's weakness in the global recovery.

Paradoxically, China's economy began moving towards deflation in 2022, accompanied by a comprehensive discount reassessment of asset prices such as real estate and stocks. International investors popularized the "ABC" strategy, meaning "Anywhere But China," implying that avoiding Chinese assets would yield desirable returns. For a deflationary large economy, nominal asset returns continually decline, and asset valuations shrink exponentially due to credit and leverage. Starting in 2022, investors discounted assets in Greater China as deflationary, with the real estate sector dragging down nominal aggregate demand and tightening the debt cycle, leading to simultaneous asset shrinkage and debt deflation. China's national balance sheet and national asset market value management faced enormous challenges. Global capital was pessimistic about Chinese assets, and capital reductions further exacerbated the deterioration of Chinese asset valuations. If this represents an era's liquidation, assets in Greater China, including Hong Kong stocks, have fallen into a near-perpetual valuation night (Zhao Jian: The Liquidation of an Era and the Perpetual Night of Valuation).

However, modern economies are not driven by a single variable. While the economic downturn cycle evokes a profound sense of fate, forces of resistance are also growing. The first resistance force stems from the policy side, particularly the People's Bank of China, a "monetary leviathan" capable of altering the pricing of RMB assets. The desperate counterattack by the People's Bank of China and various ministries and commissions began with the "September 24 New Deal" in 2024, introducing the first narrative capable of stimulating animal spirits in China's stock market – massive money printing. The two major stock market stabilization tools provided the market with free put options, akin to the Federal Reserve. Additionally, innovations in central debt financing tools and the expansion of local special bond usage on the fiscal side offered a means to address China's current largest systemic risk – local debt. Spilled water cannot be collected, and debts cannot be fully repaid, but they can be restructured and sustained through replacements. By narrowly maintaining the period during which real estate and local debt do not collapse, space is created for the replacement of old drivers with new ones brought about by new productive forces. This macro shift, applicable this year, involves replacing external demand with internal demand. The pain of this profound transformation is unprecedented since China's reform and opening up. Thus, when the Political Bureau of the Central Committee elevated "stabilizing the real estate and stock markets" to a political task, it signals that policy resistance will enter a new phase of all-in commitment.

The second resistance force originates from the "invisible hand" of the market economy and entrepreneurs. During economic downturns, time becomes cheaper, and the opportunity cost of innovation diminishes. Following a deep adjustment in the real estate sector, massive factor resources, capital, and labor accumulated in this industry begin shifting to other sectors. When tens of millions of workers and tens of trillions of capital flood into other fields, these sectors fall into intense internal competition. The essence of this competition is the struggle for limited demand among crowded factors. Supply expands rapidly, but demand, tied to labor income growth and long-term expectations, rises relatively slowly, leading to overcapacity and demand contraction. Currently, both CPI and PPI are experiencing levels of sluggishness and duration rarely seen in history. However, it's reassuring that the reduced factor costs from de-real-estatization, whether money or people, have significantly enhanced Chinese manufacturing's competitiveness. Amidst global inflation, Chinese manufacturing continues to export high-quality, low-cost goods, contributing substantially to reducing global inflation. In 2024, China's current account surplus even reached one trillion dollars, a miracle in human economic history, reflecting the current imbalance between internal and external economic development in China.

Here, I emphasize the innovation spurred by the "invisible hand" in the second resistance force, with DeepSeek as a prime example. Though DeepSeek's funds stem from the revenue of quantitative funds in the capital market, the young entrepreneurs represented by Liang Wenfeng did not use their earnings to buy real estate like previous generations but invested in innovation, exploration, and knowledge seeking. Ultimately, they made a significant impact in the AI revolution wave. While DeepSeek R1 isn't a revolutionary scientific breakthrough, it's a remarkable engineering innovation that significantly accelerates the application process of large models by optimizing engineering to enhance efficiency, reduce costs, and open weights. This is crucial for China's industries, which boast abundant application scenarios. Therefore, DeepSeek's thunderclap reinvigorated the stagnant capital market with "animal spirits," and the technology sector led the market into a "tech bull" era.

The industrial upgrade of large models facilitated by DeepSeek will have three positive impacts on the A-share market:

First, it reinjects imagination into China's equity assets, thereby elevating the valuation center of the entire new productive forces sector. Notably, "large model+" and "AI+" can be applied across various industries, not limited to the information technology sector; almost all industries can adopt a large model approach.

Second, it promotes investment in new AI infrastructure and drives fundamental economic recovery. Currently, the fiscal side lacks good projects rather than investment funds, as the annual special debt of four trillion yuan plus is sufficient. With worthwhile investment projects, local government infrastructure construction will revive, driving fundamental recovery. It's foreseeable that the rise of the large model industry will prompt local governments to accelerate the construction of fixed assets such as chip industrial parks, supercomputing centers, and new energy systems, thereby improving the effectiveness of investment demand and compensating for domestic demand deficiencies.

Third, enterprises and government departments will increase capital expenditures on large model systems, and the resulting investment demand will also provide robust support for the economy and employment. The primary contradiction in China's economy today is insufficient demand, including insufficient effective investment demand. The explosion of the large model industry ignited by DeepSeek will encourage various enterprises and governments to increase related system investments, enabling all businesses and services, including governance by government departments, to be revamped using AI. The investment demand in this area is immense. Undoubtedly, this will significantly save enterprises' costs and boost short-term EPS, which is also conducive to the valuation of the capital market.

So, can DeepSeek, like OpenAI, ignite a "tech bull" in China's capital market and usher in a wave of medium-term market trends, thereby succeeding the "monetary bull (water bull)" since September 24? We cannot draw direct analogies but can only suggest a high probability, with structural market trends already underway. There will undoubtedly be fluctuations in the future, but they are unlikely to end abruptly. In the long run, in the era of AI "replacing" humans, to survive, one must become a "capitalist" owning equity assets. AI-related assets should be the cornerstone of one's portfolio. This is essentially a hedge – when you are replaced by a robot, the company that produces the robot will pay you dividends, provided you own the company's stock. Therefore, it's foreseeable that in the future, when people lose their jobs and subsequent labor income due to being replaced by robots, property income represented by equity dividends and interest may be the only compensation and source of income. This is a vision, but it fully underscores the importance of financial investment and asset management in the era of artificial intelligence.