BYD Unveils High-End Autonomous Driving: NVIDIA Reaps Astronomical Profits

![]() 02/12 2025

02/12 2025

![]() 669

669

On February 10, just before the Lunar New Year, BYD dropped a bombshell announcement, stating that it would introduce its "Divine Eye" high-end autonomous driving technology to models priced at 100,000 yuan. Amid the catchphrase "more features, no price increase" at the launch event, competitors felt a shiver of apprehension, vividly recalling how the Qin PLUS, priced at 99,800 yuan, ignited a fierce price war.

Recent car buyers were also hard-hit by the "more features, no price increase" revelation. "I couldn't sleep all night after watching the launch event," one car owner lamented on social media.

The American chip giant NVIDIA stands to quietly reap substantial profits. It is reported that BYD anticipates selling 5 million vehicles by 2025, with the penetration rate of models equipped with the Divine Eye reaching 80%. Additionally, sources revealed to Luca Auto that BYD has placed an order for 4 million NVIDIA autonomous driving chips this year. BYD's order alone vastly surpasses the total shipments of NVIDIA's Orin series chips for the entire year of 2024.

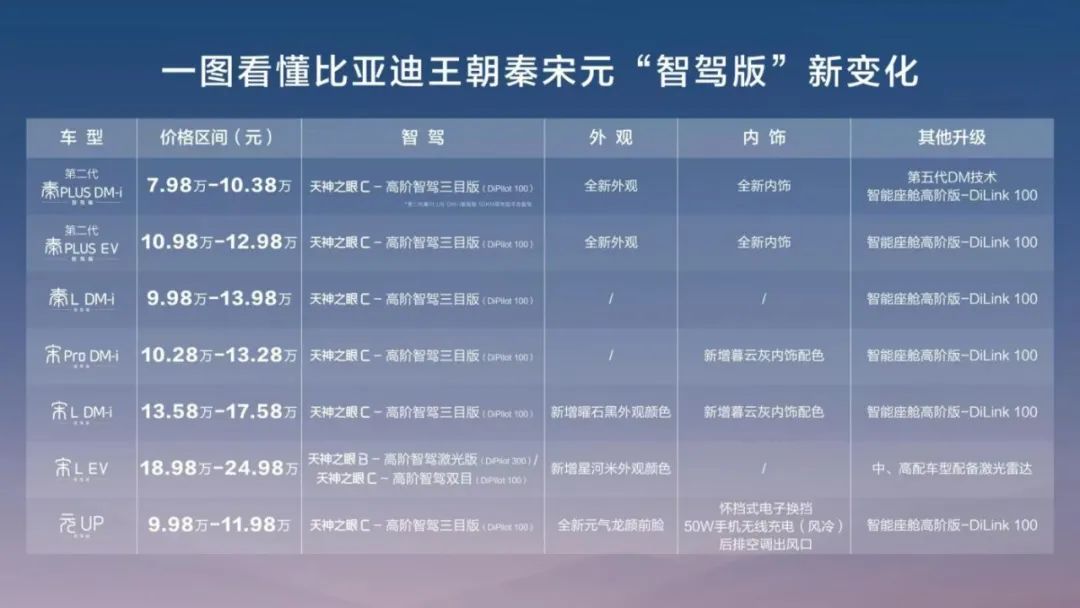

February 10 was destined to be a sleepless night for Chinese automakers. At last night's launch event, BYD unveiled 21 autonomous driving models simultaneously, including the Seagull autonomous driving version priced from 69,800 yuan. Zhang Zhuo, general manager of BYD's Ocean Network Sales Division, proclaimed that this marked the first time high-end autonomous driving has entered the 70,000 yuan market.

2025 heralds an imminent fierce battle for intelligent driving...

The early bird catches the worm

BYD's newly launched "Divine Eye" system encompasses three technical solutions: Divine Eye A - High-End Autonomous Driving Triple Laser Version (DiPilot 600), primarily used for the premium brand Yangwang; Divine Eye B - High-End Autonomous Driving Laser Version (DiPilot 300), suitable for Denza and select BYD models; and Divine Eye C - High-End Autonomous Driving Triple Camera Version (DiPilot 100), widely equipped on BYD brand models.

The chip solutions for Divine Eye ABC are predominantly provided by NVIDIA, including Dual OrinX, Single OrinX, and OrinN (primary).

The day before BYD announced the Divine Eye, Changan Automobile also unveiled its latest intelligent driving plan. Its subsidiary Deep Blue Automobile announced plans to equip all models with high-end autonomous driving above L2.5 level by 2025. Taking the newly launched Deep Blue S05 as an example, the entire series is fitted with the self-developed DEEPAL AD PRO autonomous driving system, with a starting price of 119,900 yuan.

Compared to 2024, the price of high-end autonomous driving has dropped significantly. What makes competitors uneasy is that BYD vows to bring high-end autonomous driving to the price range below 100,000 yuan. Taking the most basic OrinN solution DiPilot 100 as an example, the cost of a set of autonomous driving system is approximately 4,000-5,000 yuan. If it's the OrinX solution, the cost is even higher, at around 7,000 yuan.

What does this mean? Taking a 100,000 yuan Corolla as an example, the cost of the engine is only 7,000-8,000 yuan, and this is based on the premise that Corolla has sold tens of millions of units globally, allowing Toyota to achieve substantial economies of scale.

Everyone knows that the key to popularizing high-end intelligent driving lies in cost. For a model priced above 150,000 yuan, covering this cost is not difficult. However, for a model priced at the 100,000 yuan level, it poses a severe test of the automaker's cost control capabilities. Admittedly, with BYD's scale, the cost of intelligent driving can be amortized later due to economies of scale. But at this stage, the "more features, no price increase" approach still necessitates a significant amount of capital investment.

Previously, Wang Chuanfu had publicly stated that he would invest 100 billion yuan in intelligence. At the February 9 launch event, Changan also announced that it had invested over 114.8 billion yuan over seven years under the "BeiDou Tianshu" plan. What does a 100 billion yuan investment entail? It is roughly equivalent to the cumulative financing scale of leading new forces over the years.

Intelligent driving is a war of attrition. Just like the Qin PLUS priced at 99,800 yuan sparking a price war, for other automakers, there may not be much room for choice in whether to follow suit or not.

NVIDIA is the biggest winner

The day after the launch event, Yu Chengdong of Huawei posted on his WeChat Moments, stating, "Intelligent driving, being just barely usable versus being user-friendly and safe, are entirely different realms." Although the saying "you get what you pay for" is an unchanging commercial truth, speed is crucial. Whoever seizes the initiative is more likely to capture the minds of users, especially when there is no clear industry standard for "high-end intelligent driving" at present.

At last night's launch event, BYD asserted that intelligent driving is not a multiple-choice question but a required answer, not an extra credit item but an entry ticket. This statement resonated deeply in 2025. Those involved in rolling out high-end autonomous driving include not only automakers like Li Auto, Xpeng, and BYD but also external suppliers like Huawei and Momenta.

Due to factors such as cost, the penetration rate of high-end autonomous driving has been limited over the past two years. The shipments of Orin chips in China have generally hovered around 1 million units. According to statistics from the Senior Industry Intelligence Automobile Research Institute, in the first 11 months of last year, 878,300 new vehicles equipped with the NVIDIA Orin platform were delivered, with a total chip shipment of 1.8548 million units. Among them, NIO and Xpeng accounted for 50%. Meanwhile, Huawei's automotive business is growing at an astonishing rate, capturing NVIDIA's share. In other words, NVIDIA's journey in China in 2025 would not have been so smooth.

However, BYD's 4 million chip orders have turned the tide of competition.

Sources indicated that in 2024, BYD's high-end autonomous driving products accounted for a very low proportion of its total sales, less than 5%, mainly involving high-end brands such as Fangchengbao, Denza, and Yangwang. In 2025, BYD plans to sell 4 million new vehicles with high-end driving, which means that the volume of Orin chips in China will double, and the market share of Momenta, the primary supplier of the Divine Eye, will also reach a new height.

With its enormous scale advantage, BYD will compete with Huawei for the top spot in intelligent driving. As we mentioned in previous reports, as more automakers opt for Huawei's solutions, the price of Huawei's intelligent driving is expected to drop by 10,000-30,000 yuan. When BYD utilizes the lower-cost Orin N solution to popularize high-end autonomous driving, this signifies that the competition in intelligent capabilities is not merely about whose hardware or technology is superior but, more importantly, who excels at cost control.

It's not just Huawei. Other models utilizing the Orin solution for high-end autonomous driving may also need to consider cost reduction plans. Before the Lunar New Year, He Xiaopeng revealed that the delivery of the Xpeng MONA M03 MAX version would be postponed to the second quarter. The Xpeng MONA M03 was initially marketed as "the only one with high-end autonomous driving under 200,000 yuan," with the top-of-the-line MAX version equipped with two Orin X chips. Furthermore, mainstream automakers adopting the Orin solution include Li Auto, NIO, ZEEKR, WEY, Xiaomi, etc.

As product homogeneity intensifies, a lower price point is undoubtedly a more cost-effective solution for consumers. During BYD's launch event last night, Leapmotor announced that the Leapmotor B10, which is "the first to equip lidar urban autonomous driving within 150,000 yuan," will commence presales in March. It has been less than a year, and urban autonomous driving has evolved from the MONA M03 priced at 200,000 yuan to the Leapmotor B10 priced within 150,000 yuan. In 2025, the downward trend in the price of high-end autonomous driving is already a foregone conclusion, with new force automakers bearing the brunt.