The Dawn of the Global AI Arms Race

![]() 02/12 2025

02/12 2025

![]() 622

622

As 2025 commences, the world's attention has converged on AI, heralding a new era.

Following China's DeepSeek's astonishing impact on the global tech scene, nations worldwide are suddenly rushing to unveil large models and construct data centers.

Elon Musk hinted that xAI will soon release its own model, potentially surpassing DeepSeek; the French AI startup Mistral AI recently launched Le Cha, dubbed the world's fastest "AI Super Assistant," 13 times faster than ChatGPT; and the Indian government announced plans to develop a domestic large language model within the next 10 months to challenge both DeepSeek and OpenAI.

The demand for large models necessitates immense computing power, prompting a global race to build data centers. In January of this year, shortly after taking office, President Trump unveiled the "Stargate" plan: investing $500 billion over the next four years to construct up to 20 super-large data centers.

Simultaneously, UK Prime Minister Keir Starmer announced an ambitious "AI Opportunity Action Plan" in January, aiming to transform the UK into an "AI Superpower." Tech companies have pledged £14 billion to this end, creating 13,250 new jobs, including significant data center projects in Wales and Liverpool.

France, the UK's neighbor, recently held a two-day AI Action Summit. On the eve of the summit, President Macron announced that France will invest over €109 billion (about $113 billion) to create a French version of "Stargate." Currently, 35 locations have been identified in France for data center construction. Macron aspires to establish Europe as a leader in artificial intelligence (AI).

India is also heavily investing in AI. In January, the Reliance Group, led by India's richest man Mukesh Ambani, announced plans to build a super data center with the world's largest capacity in Jamnagar, India, with a total investment of about $20-30 billion.

During the ongoing LEAP exhibition in Saudi Arabia, Datavolt signed a $5 billion agreement with Neom to construct one of the world's largest AI data centers. The development of AI in Middle Eastern countries is also accelerating.

Will 2025, with its rapid advancements, truly mark the year that AI reshapes the world?

DeepSeek's sudden popularity was a shockwave. On January 27, DeepSeek simultaneously topped the free download charts on the Apple App Store in both China and the US, overtaking the previously dominant ChatGPT. Just half a month prior, the DeepSeek app had launched on iOS and Android app markets.

This is the first time an app from China has achieved such a feat, stirring widespread astonishment.

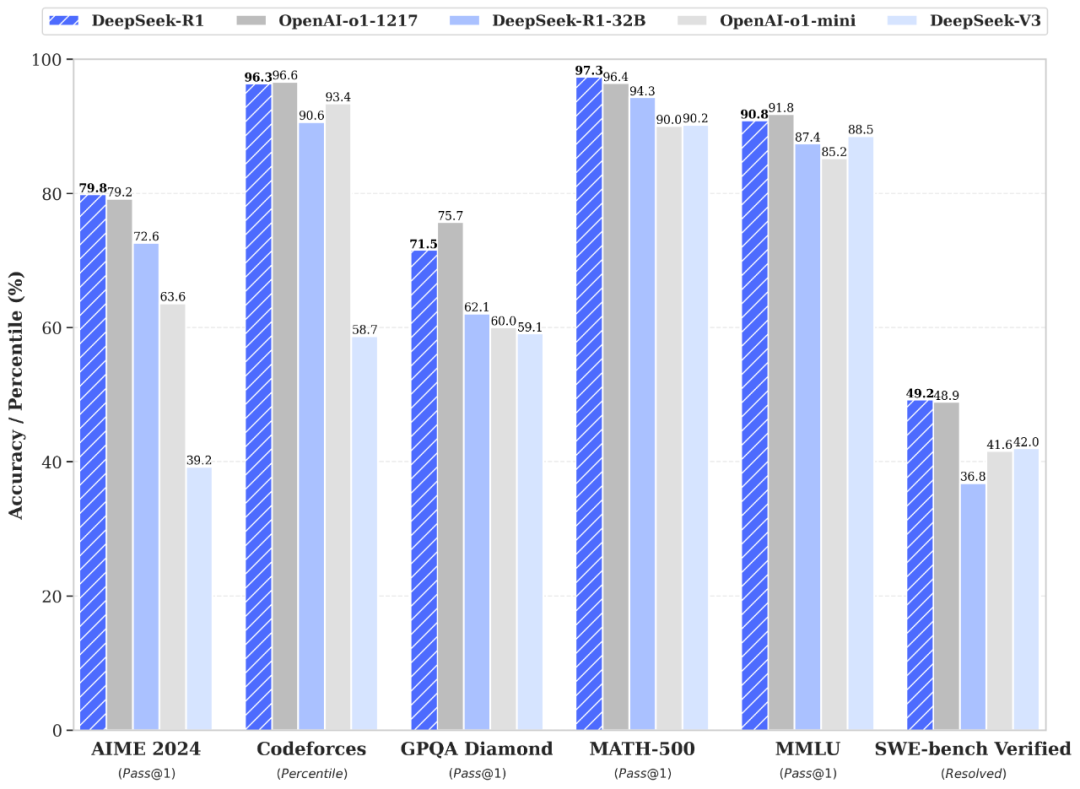

The DeepSeek-R1 model matches OpenAI GPT-4 in various capabilities, yet its total training cost is only $5.576 million, compared to GPT-4's approximate $100 million.

The world began to truly grasp China's explosive potential in large AI models – even with limited resources, China can create its own large models by innovating the infrastructure of large models.

Subsequently, many countries exhibited signs of "panic": Australian Treasurer Jim Chalmers urged caution when using DeepSeek and banned its use in government systems and devices; South Korea strengthened supervision of DeepSeek-related applications, and relevant departments began reviewing companies using DeepSeek; France and Ireland inquired about DeepSeek on grounds of data security; Italy directly banned DeepSeek; and the US Congress stipulated in a new bill that downloading DeepSeek could result in a maximum sentence of 20 years in prison.

Beyond panic, there is a greater sense of "awakening."

ChatGPT has long been the benchmark for global large models, but it had to adapt after DeepSeek's popularity. On January 24, OpenAI made the ChatGPT O3Mini version, which originally cost $200 per month for a subscription, free. On February 1, OpenAI also launched its latest reasoning model, o3-mini. Similar to DeepSeek, o3-mini adds internet search and the ability to display the thinking process. In terms of access, ChatGPT has opened the o3-mini model to all users for free, with ChatGPT Pro users enjoying unlimited access, and Plus and Team users' message limits increased from 50 per day to 150.

After experiencing DeepSeek, Musk also remarked, "You can expect China to do many great things, and DeepSeek is one of them." However, he emphasized that xAI, which he founded, will soon release its own model, potentially even better than DeepSeek. This new model, named Grok-3, is said to have completed pre-training using ten times more computing power than Grok-2. Greg Yang, a mathematician at xAI, demonstrated a conversation with Grok-3 on the platform on January 19 this year. Various signs indicate that Musk is actively engaging in this large model competition.

On February 6 this year, French AI startup Mistral AI released the iOS and Android versions of Le Cha, hailed as the world's fastest "AI Super Assistant." It can access the internet in real-time and has multimodal capabilities. It is not only free but also said to be 13 times faster than ChatGPT in feedback speed. In just a few days, Mistral soared to the top of the French App Store. President Macron recently mentioned Le Cha multiple times in a program, acting as a "salesman" and urging the French to "download" it.

Influenced by the current AI boom, the Indian government stated on January 30 that it plans to develop a domestic large language model within the next 10 months to challenge DeepSeek and OpenAI. India's Minister of Information Technology Ashwini Vaishnaw said that with foundational work completed, the government is now focusing on building an AI system tailored to India's unique needs. It is expected that by the end of this year, six major developers will launch foundational AI models. According to Indian media, the government has approved 18 proposals aimed at accelerating AI solutions in key areas such as agriculture and climate change. These support measures include providing computing power, data, and funding.

Earlier, on December 17, 2024, the Technology Innovation Institute (TII), supported by the UAE government, announced the launch of Falcon 3, the latest generation of open-source small language models (SLM). Compared to large language models (LLM), SLMs have fewer parameters, a simpler design, and advantages such as high efficiency, low cost, and the ability to be deployed on devices with limited resources. In other words, they can run efficiently on lightweight infrastructure like laptops.

Of course, before this, the UK, Japan, South Korea, Russia, Canada, and Israel also had their own large models. Today, this competition has reached a new peak.

Muath Alduhishy, Executive Officer of Advanced Research, Development, and Innovation (RDI) at Saudi Information Technology Company (SITE), used the term "Sovereign AI" to summarize this trend. This signifies that AI has transcended the realm of technology and business, evolving into a form of "Sovereign AI".

In the current global AI landscape, what pattern do countries find themselves in?

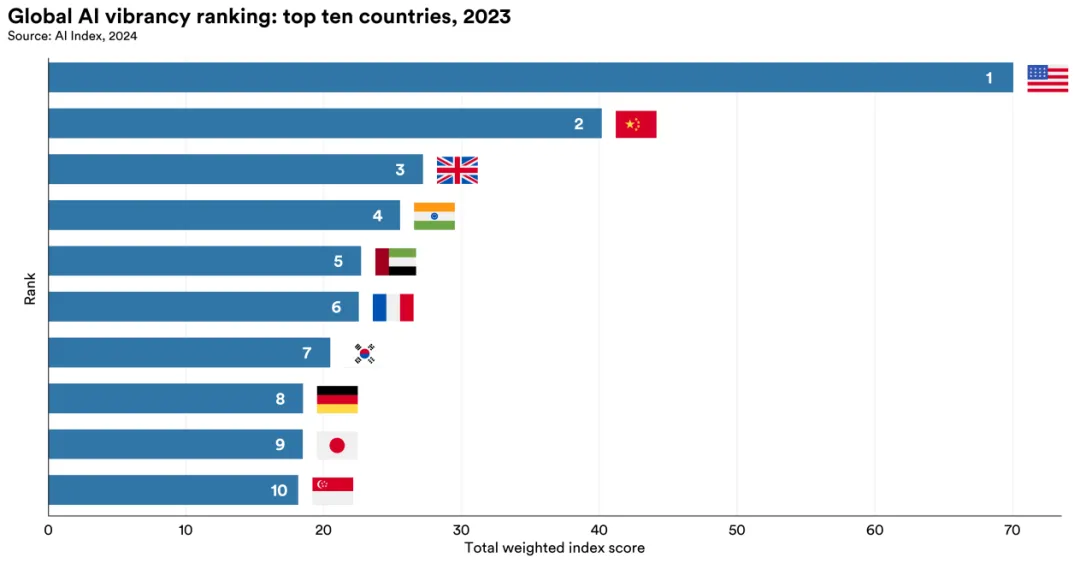

Stanford University, the most influential institution in the global AI field, released the "Global AI Power Rankings" on November 21, 2024, comprehensively evaluating and ranking the AI activity of 36 countries through 42 indicators.

Global AI Vitality Rankings: Top 10 Countries in 2023

The US ranks first in the total weighted index score. In developing famous machine learning models, the US reached 61 models in 2023, with ChatGPT from OpenAI and Gemini from Google as the most notable examples. Additionally, the US has proactively approached AI regulation, passing a total of 23 AI-related laws since 2017.

China ranks second, excelling in research and development, economy, and infrastructure. Thanks to its vast market, ample infrastructure such as networks and computing power, and data support from large-scale industrial production capacity, China has emerged with numerous excellent large models, including those from major companies like Baidu, Alibaba, Tencent, ByteDance, Huawei, and iFLYTEK, as well as startups like DeepSeek, Kimi, and MiniMax.

The report also notes China's strong growth momentum in AI innovation, particularly in patent applications, with the number of AI patents granted almost three times that of the US. This is crucial for China's large AI models to swiftly transition from following to achieving original breakthroughs.

The UK ranks third, performing particularly well in research and development, education, policy, and governance. India ranks fourth, and the UAE ranks fifth. France ranks sixth, performing strongly in policy and governance, education, and infrastructure. South Korea ranks seventh, with its telecom company KT releasing the country's first AI model Mi:dm in October 2023. However, South Korea's large AI models are mainly dominated by large chaebol companies, lacking an active startup ecosystem. Germany ranks eighth and is a significant contributor to AI research, ranking fourth in producing famous machine learning models. South Korea, along with Japan and Singapore, ranks among the top ten, highlighting the growing importance of AI in Asian economies.

Stanford University stated that in this ranking, the performance of different regions underscores the global nature of AI and the varied strategies adopted by countries to promote its development and deployment. Many national leaders have recognized AI's geopolitical significance and are striving to enhance their country's AI development level.

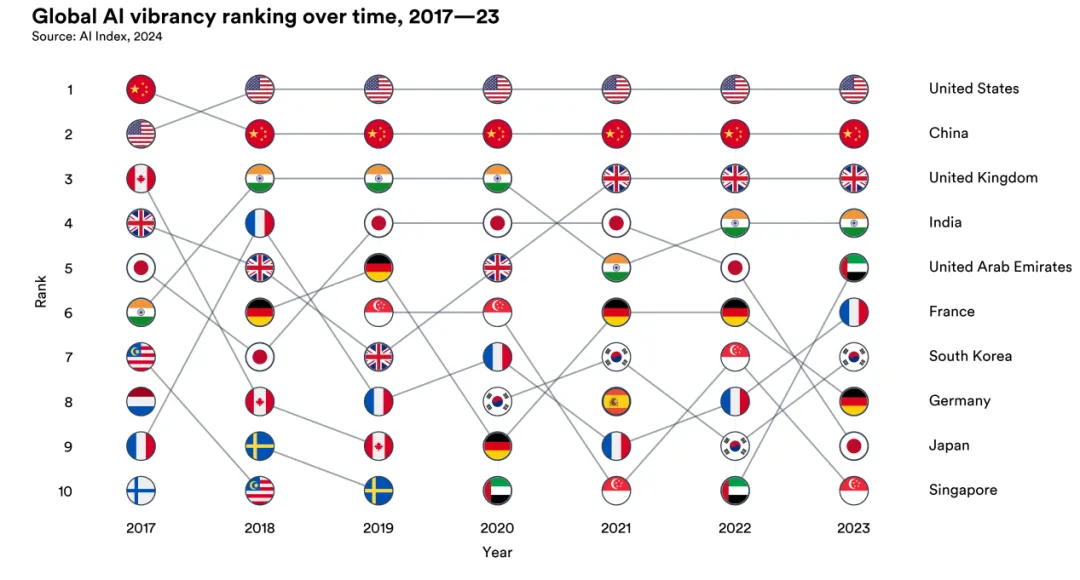

Changing Competitive Landscape of Global AI Vitality from 2017 to 2023

The above chart illustrates the evolving competitive landscape of global AI vitality from 2017 to 2023. It reveals three distinct competitive tiers: The first tier is consistently dominated by the US and China; the second tier is relatively stable, including the UK and India; the third tier is more variable, with countries like France, Germany, Japan, Singapore, and South Korea frequently swapping positions within it.

Undoubtedly, the US and China have become the focal points of global AI competition, with the gap between latecomers continually widening.

France Invests €109 Billion to Create a French Version of "Stargate"

From February 10-11, the Global AI Action Summit was held in Paris, France. This summit was attended by representatives from about 100 countries, including heads of state, business leaders, scientists, and civil society members, to discuss the application and global governance of AI.

At the conference, President Macron announced that France will invest nearly €109 billion in AI development to create a French version of "Stargate." This includes a strategic framework agreement announced jointly by France and the UAE on February 6 to build a 1-gigawatt (GW) AI data center in France, with an estimated investment scale of $30-50 billion. Additionally, Canadian investment giant Brookfield Asset Management plans to invest €20 billion in French AI infrastructure by 2030, aiming to help Europe catch up with China and the US in AI.

Macron believes that if France and Europe do not want to lag behind in global AI development, they need to accelerate their efforts. He hopes Europe will become a leader in AI, and the first step is "investment, investment, investment." Currently, 35 locations in France have been identified for data center construction. According to France's 2030 plan, the government will invest an additional €400 million to support nine AI clusters, including Rennes, Saclay, Grenoble, and Toulouse. These clusters will undertake interdisciplinary research and provide additional training.

The US Invests $500 Billion to Build the 'StarGate'

'StarGate' is a plan proposed by US President Trump after taking office in January this year, hailed as the 'largest AI infrastructure project in history.'

The plan involves OpenAI, Japan's SoftBank, and US Oracle Corporation establishing a joint venture called 'StarGate' and investing $500 billion in AI infrastructure in the US over four years.

In fact, since ChatGPT's popularity, demand for high-performance computing and storage has surged. Data center construction in the US has boomed, making it the most sought-after commercial real estate in the country. Tech giants such as Google, Microsoft, and Meta have entered the market, investing billions of dollars in data center expansion.

China Began 'New Infrastructure' for Data Centers Four Years Ago

China, on the other hand, proposed the 'new infrastructure' plan, including data centers, as early as 2020. Since then, Alibaba Cloud announced an investment of 200 billion yuan over three years to build data centers, Tencent invested 500 billion yuan over five years to deploy new infrastructure, and Baidu plans to increase the number of intelligent cloud servers to 5 million within 10 years.

To streamline the allocation of resources, including energy and data, the nation has initiated the 'East Data, West Compute' initiative, leveraging the eastern region's data abundance and the western region's energy surplus to orchestrate a grand strategy for the transformation of the data center industry.

India Invests $30 Billion in Data Center Construction

As a co-host of the Paris AI Action Summit, India has also stepped up its efforts in data center development.

On January 31, India's Reliance Group announced plans to invest between $20 billion and $30 billion to build a data center in Jamnagar with a total installed capacity of 3GW. If successful, this project will emerge as the world's largest data center in terms of capacity.

This ambitious data center plan has garnered significant attention from international investors, including tech giants like Microsoft, Google, and Amazon, who have increased their investments in Indian data centers. For instance, Microsoft announced in early January this year that it would invest $3 billion in India over the next two years to construct new data centers and foster AI technology development. Amazon Web Services declared on January 23 that it would invest $8.3 billion in cloud infrastructure in the Indian state of Maharashtra, as part of a broader plan to invest $12.7 billion in India by 2030.

Historically, India lagged behind in the number of hyperscale data centers. As of 2023, India had only about 18 hyperscale data centers, compared to nearly 100 in China. However, India's data center market is anticipated to grow substantially in the coming years. According to India's Ministry of Electronics and Information Technology, data center capacity in India is projected to surge from the current 819 megawatts (MW) to 1,800 MW by 2026.

Amidst intensifying competition for large models, the global data center arms race has reached new heights.

Saudi Arabia Welcomes Billions of Dollars in New Investments in Data Centers

While the Paris AI Summit was underway, the fourth LEAP exhibition was also being held in Riyadh, Saudi Arabia. At this year's LEAP exhibition, artificial intelligence and the digital economy were the hottest topics. During the conference, Cliff Chau, managing partner of IDG Capital, joined Hazman Hilmi Sallahuddin, chief investment officer of the Malaysian Public Servants Retirement Fund (KWAP), and other guests to discuss 'Asia-Middle East Cross-border Investment: Technology and Digital Infrastructure Collaboration'. Notably, Saudi Cloud Computing Company (SCCC), a leading cloud service provider in Saudi Arabia, was jointly established by IDG Capital, Saudi Telecom, and Alibaba Cloud.

At the LEAP exhibition, several global tech giants announced new plans for Saudi Arabia: Tencent Cloud revealed plans to invest over $150 million (approximately 1.096 billion yuan) in infrastructure, resources, and related investment construction in the Middle East, with Saudi Arabia being the site for its first Middle East data center. US data center giant Equinix announced an investment of $1 billion to build a 100MW AI data center. Datavolt signed a $5 billion agreement with Neom to construct one of the world's largest AI data centers.

During this period, Lenovo also held a groundbreaking ceremony for its new manufacturing base in Riyadh. The factory, set to commence production in 2026, will produce up to one million computers and servers annually.

The UAE Deploys Data Centers in France and Colombia

Also on February 11, the World Government Summit 2025 kicked off in Dubai, UAE. Artificial intelligence and the digital economy were among the summit's core topics. During the conference, Baidu founder Robin Li engaged in a compelling dialogue with Omar Sultan Al Olama, the UAE's Minister of AI. Li emphasized the need for continuous investment in chips, data centers, and cloud infrastructure to create better and smarter next-generation models. Al Olama, on the other hand, expressed his anticipation for next year's conference, envisioning all fleets supported by self-driving vehicles from Luobo Kuaipao.

Recently, the UAE has also been actively deploying data centers. In addition to the recently announced AI data center with France, on February 5, the UAE signed a cooperation agreement with Colombia to assist in establishing three strategic data centers in the northern city of Santa Marta.

The UK Classifies Data Centers as 'Critical National Infrastructure'

On January 13 this year, UK Prime Minister Rishi Sunak unveiled the UK government's AI action plan, aiming to establish the UK as a 'world leader' in this field. The government has pledged to boost the country's computing power by 20 times by 2030 and construct new supercomputers to meet the computing demands of AI products.

Concurrently with the announcement of this plan, several large tech companies have committed a total investment of 14 billion pounds (approximately $17.4 billion) in the UK to build the necessary AI infrastructure. For example, London-based AI infrastructure company Nscale announced plans to invest $2.5 billion (2 billion pounds) in the UK data center industry over the next three years. Last October, four major US tech companies—ServiceNow, CoreWeave, CyrusOne, and CloudHQ—announced a joint investment of 6.3 billion pounds (approximately $8.2 billion) in data center construction in the UK.

In September 2024, Peter Kyle, the UK's Minister of Science, Innovation, and Technology, announced that the government had classified UK data centers as 'critical national infrastructure'. The UK ranks third globally in the number of data centers, with most concentrated in London and along the M4 highway. However, these areas have substantial energy demands, leading to project delays or stoppages due to insufficient power capacity.

The global data center construction plans mentioned above alone entail a cost of $700 billion. This competition for AI leadership through data centers is fiercely intense.

Nevertheless, the real test lies ahead.

While the importance of data centers is undeniable, more is not always better, and bigger is not necessarily superior.

Essentially, data centers sell electricity—in current data center operating costs, IT electricity fees account for over 30%, and environmental electricity fees (cooling, lighting, etc.) comprise approximately 20%, totaling more than 50%. In some older, smaller, and scattered data centers, as the Power Usage Effectiveness (PUE) increases, electricity fees can exceed 60% of operating costs.

The upper limit of data center project supply in a region is contingent upon the region's supporting power facilities, which are constrained by grid planning.

Taking the US as an example, data centers in the country are predominantly located in northern Virginia. Currently, the state's high-voltage transmission line capacity has reached its limit, causing delays in new data center projects. To address this, Virginia passed a bill to expedite the approval of a $60 million transmission project, a move supported by several industry giants, including Amazon.

According to Industrial Information Resources (IIR), the power demand of US data centers is expected to more than double from 17GW in 2022 to 35GW by 2030.

To cope with this growing power demand, data center operators are continually enhancing their technology. For instance, by employing advanced cooling technology and renewable energy, data centers are gradually transitioning towards green and environmentally friendly development. Many data centers are also starting to utilize wind and solar energy to reduce their reliance on traditional energy sources.

Furthermore, the rapid development of the data center industry has sparked discussions regarding land resources and environmental protection. For example, Microsoft's new project is anticipated to result in the loss of nearly 8 acres of wetlands and over 1,600 feet of stream channels, a situation that has garnered the attention and discussion of environmental protection organizations. In the future, balancing data center construction needs with environmental protection will become a crucial issue for industry development.

A few years ago, China's data centers also encountered a growth bottleneck due to energy and environmental challenges. However, since 2022, the country has coordinated resource planning and implemented the 'East Data, West Compute' project, completing the overall layout design of the national integrated big data center system. This innovative approach, combining eastern data with western energy, has effectively addressed these issues.

In contrast, overseas countries currently have limited cases of coordinated planning for data centers. Especially in countries where electricity supply cannot maintain large and stable supplies, hastily constructing large data centers may lead to an energy crisis and impede the healthy development of the data center industry.

Moreover, the paramount value of data centers lies in promoting the development of the digital economy. However, the overseas digital economy's growth does not occur overnight. Constructing large data centers without considering the local digital economy's development level may lead to issues such as vacant data center rooms and insufficient rack occupancy rates.

In fact, in recent years, domestic data center-related companies have accelerated their overseas expansion. Leading cloud service providers such as Tencent Cloud, Alibaba Cloud, and Huawei Cloud began deploying data centers in markets like Southeast Asia and the Middle East years ago. Additionally, third-party IDC service providers like Qinhuai Data, 21Vianet, Sinnet, GDS, and Runze Technology have also ventured abroad to invest, construct, and operate data centers overseas.

Compared to European and American data center giants, Chinese IDC companies are rapidly deploying in emerging markets and deeply integrating into the construction of local data economies, driving the development of the local digital economy.

It is foreseeable that in the global AI competition, China's new infrastructure experience will demonstrate even greater value.

References:

[1] Stanford University releases: 'Global AI Power Rankings', Global Technology Map