Post-DeepSeek Era: Alibaba's Qwen Targets Consumer Market, Tencent's Yuanbao Surpasses Doubao

![]() 02/27 2025

02/27 2025

![]() 502

502

Author | Sun Pengyue

Editor | Da Feng

If 2023 was the "Year of AI Training" and 2024 the "Year of AI Inference", 2025 has emerged as the "Year of DeepSeek".

Two years into the AI era, the market has finally witnessed a true game-changer. DeepSeek has captured the imagination of China and the world alike.

Moreover, its significance transcends business logic, rising to the level of national strategy.

Where pioneers lead, others follow.

Unsurprisingly, domestic tech giants Alibaba and Tencent have been at the forefront of the "DeepSeek wave".

Alibaba Cloud: Alibaba Invests 380 Billion Yuan

Just over two months into 2025, Alibaba AI has delivered a series of positive developments.

First, Alibaba formed an exclusive partnership with the Spring Festival Gala, serving as the event's exclusive e-commerce interaction platform and cloud computing AI partner, showcasing its AI and cloud services to the world.

Subsequently, riding the AI wave sparked by DeepSeek, Alibaba Cloud secured 60-70% of new users.

Beyond leveraging DeepSeek's traffic, Alibaba also landed a major order from Apple.

On February 13, at the 2025 Dubai World Governments Summit, Alibaba co-founder and chairman Joseph Tsai announced a collaboration with Apple to develop AI functionality for iPhones in the Chinese market.

Over the past two months, Alibaba's share price has surged by over 50%, thanks to its AI-centric strategy.

The day before yesterday, Alibaba CEO Simon Wu announced that the company would invest more than 380 billion yuan over the next three years to build cloud and AI hardware infrastructure, surpassing the total investment of the past decade. This sets a new record for the largest-ever investment by a Chinese private enterprise in cloud and AI hardware infrastructure.

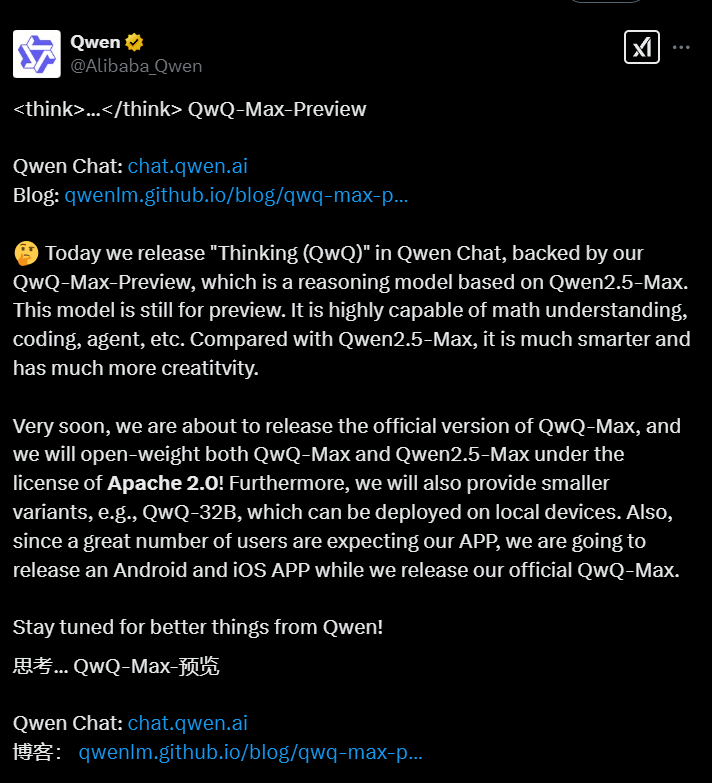

Notably, Alibaba's own Qwen open-source model family is also a leading player in the industry, beyond leveraging traffic from other AI models.

Since August 2023, Alibaba Cloud has successively open-sourced four generations of models, including Qwen, Qwen1.5, Qwen2, and Qwen2.5, covering sizes ranging from 0.5B to 110B and modalities such as large language, multimodal, mathematics, and code.

According to data from Hugging Face, the world's largest AI open-source community, the number of derivative models of Alibaba's Qwen open-source large model has exceeded 100,000, consistently leading American open-source models like Llama and ranking first among the world's largest open-source models.

Even in the open-source model rankings published by Hugging Face, the top ten contestants are all derivatives of Qwen.

While most Qwen family applications target the B2B market, which is less visible to ordinary users, the Qwen family ranks among the top tier in the global AI market, both in terms of model quantity and quality.

Following the CEO's announcement of the 380 billion yuan investment, the Qwen family has adopted a more aggressive approach.

Qwen QwQ

Yesterday, February 25, Qwen launched the QwQ-Max-Preview model, a deep reasoning model based on the AI large model Qwen2.5-Max flagship version. It also launched the qwen.ai domain name, enabling users to directly access and use AI.

Next, Qwen QwQ plans to launch an independent app, clearly targeting the consumer market like DeepSeek. This signals that the B2B-focused market shark will soon enter the mass market.

With unprecedented investment, Alibaba is poised to cultivate its own "Doubao" and "Yuanbao".

Tencent: Dual-model Yuanbao Initiates Marketing War

Three months into 2025, which AI market, besides DeepSeek, has responded with the most fervor?

The answer is Tencent's Yuanbao.

This may seem surprising since, in the AI era, Tencent was among the last major players to launch its self-developed general large model and consumer applications.

Pony Ma once stated at the 2023 Tencent Annual Meeting: "For the industrial revolution, it's not crucial to 'bring out the light bulb one month earlier.'" This reflects Tencent's cautious approach to AI.

However, as a super app with 1.382 billion monthly active users (WeChat + WeChat), Tencent has always held the most crucial resource in the AI market: traffic.

In mid-February, Tencent's grayscale test of integrating DeepSeek into WeChat search led to a 7% surge in its share price.

According to 36Kr, due to users' overwhelming enthusiasm for the DeepSeek model, Tencent urgently coordinated and deployed "Yuanbao" to support WeChat search on February 18, providing users with more entry points and choices.

Tencent has pushed Yuanbao, which was relatively unknown in the AI market last year, to the forefront.

Tencent has accelerated its large model business, making bold moves.

It has integrated DeepSeek into 14 software products, including Tencent Docs, QQ Browser, QQ Music, and Tencent Maps, making it the company with the most integrated products among major players.

Tencent Yuanbao has introduced the industry's first "dual-modal" slogan, allowing users to switch between the DeepSeek-R1 full-blooded version and the Hunyuan T1 deep thinking model through the Tencent Yuanbao app.

In addition, Yuanbao has added a text-to-image function, leveraging DeepSeek's image recognition to provide a differentiated experience.

Whether the "dual-modal" combination can dominate the market remains uncertain. However, backed by Tencent's ecosystem, Yuanbao clearly benefits from its synergies.

Within WeChat and the Yuanbao app, after receiving an answer from DeepSeek, users can share the question-and-answer process with WeChat friends with one click, displayed in card form in the dialog box.

Tencent Yuanbao is an AI large model that fully leverages social attributes, consistent with Tencent's brand tone.

Tencent Yuanbao App

Beyond opening its ecosystem, Tencent has also fired the first shot of user acquisition in 2025.

Starting from February 15, Tencent Yuanbao launched large-scale advertising campaigns across multiple mainstream platforms, including official accounts, video platforms, Bilibili, and Zhihu, even taking over the ad position for the keyword "deepseek" on Baidu.

According to data from DataEye, a digital content marketing service provider, the amount of advertising materials for Yuanbao increased by 345.1% month-on-month.

With significant investments in advertising, Tencent Yuanbao rose to second place in China's Apple free app download rankings on February 22, second only to DeepSeek, which topped the list.

This is the first time Tencent Yuanbao has surpassed Doubao, proving that Tencent is already a significant player.

Whether through active and rapid external traffic acquisition or indirect traffic diversion from the 1.382 billion WeChat ecosystem, Tencent's presence is undeniable.

ByteDance: Doubao Rejects DeepSeek

Yuanbao's download volume surpassing Doubao is putting more pressure on ByteDance.

Last year, Doubao was far ahead in China and was undoubtedly the star product in the consumer AI application space. Even Tencent's Yuanbao seemed to replicate Doubao's previous strategy of "heavy investment and buying traffic".

Data shows that in January 2025, the monthly active users of the Doubao app reached 78.61 million, ranking first among domestic AI applications and second globally, after ChatGPT.

Unfortunately, before Doubao could savor its success, DeepSeek emerged as a formidable competitor.

Currently, Doubao's top priority is addressing the impact of DeepSeek.

Perhaps many are unaware that the Doubao large model is one of the very few that refuse to integrate DeepSeek. Within the entire ByteDance system, only one consumer product, Feishu, has launched the DeepSeek model.

This silent confrontation may reflect ByteDance's belief that the Doubao large model can catch up with DeepSeek's level.

According to the latest news, Doubao is conducting a small-scale test of a deep thinking model but has not confirmed the release date.

Obviously, to compete with DeepSeek and other large companies that have integrated it, the most direct and effective response for ByteDance is to launch a new self-developed reasoning large model as soon as possible.

ByteDance Doubao App

Alibaba invests heavily, Tencent buys traffic, and ByteDance remains silent.

This is the current state of play among the major players in the AI battle.

Amid the unrelenting social media onslaught of DeepSeek, "heavy investment + burning money" has become the norm.

Simultaneously, the rules of the AI world have been rewritten. The past narrative of large models has been disrupted, and the sole focus on DAU has been overturned. All players are compelled to adapt to the DeepSeek era.

At least for now, there is no absolute winner in this artificial intelligence war.