Tesla FSD Arrives in China: A Tripartite Struggle of Technology, Policy, and Market

![]() 02/28 2025

02/28 2025

![]() 607

607

Regardless, the launch of Tesla's Full Self-Driving (FSD) in China showcases the adaptability and scalability of pure vision AI in intelligent driving. Despite several high-profile live test failures around February 25, 2025, where Tesla's FSD in China ran red lights, occupied bus lanes, and struggled at busy intersections, these incidents have sparked widespread online discussions about its performance. Instead, let's delve into the intricate dance of technology, policy, and market dynamics behind Tesla's FSD entry into China.

Has the 'wolf' finally arrived? On February 25, 2025, Tesla China quietly rolled out an update to software version 2024.45.32.12, introducing the Chinese version of FSD. Officially dubbed the "FSD Smart Driving Assistance Function," rather than the foreign "FSD Full Self-Driving," it includes new capabilities like "Urban Road Autonomous Driving" and "Automatic Lane Changing," widely perceived as FSD's disguised debut in China. This move follows Musk's visit to China in April 2024 to seek FSD approval, which faced numerous delays, even being dubbed "jerk-style marketing" by netizens.

However, the Chinese version of FSD isn't the "full package." It's strictly limited to L2-level driving assistance and only supports HW4.0 hardware models produced after February 2024. The function description conspicuously avoids "full self-driving," contrasting sharply with the American version's bold claim of "driving on any road." What further astounds consumers is the 64,000 yuan optional fee for this feature, while domestic competitors like Huawei ADS and XPeng NGP offer "software for free or low-cost subscriptions." Technological Breakthrough: From "Online Learning" to Bus Lane Challenges

The most significant hurdle for Tesla FSD in China is its complex road environment, vastly different from North America. Musk candidly stated, "Bus lane rules in China are extremely complex, and entering them by mistake results in a ticket." To tackle this, Tesla adopted a "circuitous route": using publicly available Chinese road videos for simulated training, then inputting the data into a simulator to repeatedly test bus lane scenarios. While this "cloud learning" model addresses data compliance issues, online test results suggest its training quality may lag behind local companies like Huawei and XPeng, which rely on real-time data.

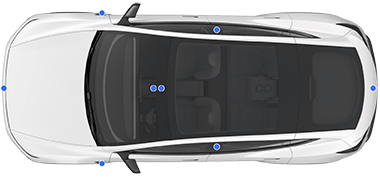

Alternatively, this Tesla FSD release could be an initial version without specialized Chinese training. The deeper contradiction lies in technological routes. Tesla insists on a pure vision solution, relying solely on eight cameras, even eliminating the cheapest sensor, ultrasonic radar.

In contrast, Chinese automakers, whether high-end like Huawei Hongmeng Zhixing or mass-market like BYD Tian Shen Zhi Yan C, typically adopt a multi-sensor redundancy solution of "camera + millimeter-wave radar, or + lidar." We excel at driving down hardware prices.

Policy Undercurrents: Data Security and Computing Power Dilemma

FSD's entry into China reflects a microcosm of the Sino-US technology competition. China mandates localized vehicle data storage. Tesla established a data center in Shanghai and passed security inspections, but its core AI training still relies on American supercomputing clusters. The US government, citing "technological hegemony," banned Tesla from deploying the Dojo supercomputer in China and restricted high-end NVIDIA chips from entering, slowing model iteration.

Policy approval twists were dramatic. During Musk's 2024 China visit, Tesla reached a map cooperation agreement with Baidu, once seen as the key to breaking the deadlock. However, US regulator investigations into Tesla Autopilot accidents and China's cautious approach to driverless and L3-level certification repeatedly stalled FSD. Ultimately, on February 24, Tesla quietly launched it as "function optimization," avoiding the sensitive term "full self-driving."

Market Impact: Catalyst or Stepping Stone?

At the 2025 China Electric Vehicle Hundred People Forum expert-media exchange meeting, Ouyang Minggao, academician of the Chinese Academy of Sciences and vice chairman of the forum, noted, "I initially feared Tesla's FSD would dominate upon arrival, disrupting the Chinese intelligent driving market. Now, my concerns have eased due to DeepSeek." Over 20 automakers have accessed the domestic AI large model DeepSeek, accelerating autonomous driving technology and intensifying market competition.

As discussed in our previous article, "What is DeepSeek? Why Will It Disrupt the Field of Artificial Intelligence?", DeepSeek's innovation lies in cost-effective, high-performance LLM AI, fostering technological equality. It will propel AI agent applications across industries, particularly in autonomous driving, reducing technical thresholds for computing power and algorithms, accelerating autonomous driving's arrival in China. This shifts the competition from technological advancement to application-driven scenarios, where Chinese enterprises excel.

Moreover, Tesla's "high-price strategy" is facing resistance. The 64,000 yuan optional fee exceeds domestic consumers' expectations, while brands like XPeng, Li Auto, and Huawei Hongmeng Zhixing capture the market with "hardware standard + software service" models or even free subscriptions for several years.

More critically, Tesla's main models, the Model Y/3, have been on the market for years, facing competition from new entrants like Xiaomi SU7 and Zhijie S7. An analyst bluntly stated, "FSD is Tesla's last card in China. If it cannot quickly prove its value, it may become a comparison parameter at Chinese automotive competitor press conferences."

Future Battle: The 'Chinese Solution' to Autonomous Driving

Despite challenges, FSD's entry into China is a milestone, introducing the European and American end-to-end AI autonomous driving system to the Chinese market. During the live broadcast of FSD's launch, there were no safety incidents, but comments like "veteran drivers still have their skills when driving abroad" showed Tesla's solid foundation but lack of adaptation to the Chinese driving environment.

China's policy level has also broken the ice on L3/L4 autonomous driving responsibility determination, injecting momentum into the industry. For Tesla to truly take root, it needs to solve three key issues: localizing data loops by deploying a supercomputing center in Shanghai to reduce dependence on American computing power; restructuring the price system with a monthly subscription model to lower the experience threshold; and adapting to Chinese scenarios by optimizing algorithms for lane cutting and mixed traffic with non-motor vehicles.

As netizens say, "The proof of the pudding is in the eating." This technological gamble may determine whether China's autonomous driving enters the "Tesla era" or an era of "many rising powers." *Reproduction and excerpts are strictly prohibited without permission - Reference Materials: Join our knowledge planet to download extensive first-hand materials in the automotive industry, including the above references.