When the Battle for Computing Power Meets Capital Constraints: The ROIC Code Behind Alibaba and Baidu's Divergent AI Strategies

![]() 03/07 2025

03/07 2025

![]() 593

593

Industry analysis often reveals counterintuitive phenomena where corporate actions defy logical expectations, leaving us puzzled and disconnected.

From ChatGPT to DeepSeek, the rapid pace of AI development has been fully demonstrated. Theoretically, enterprises—especially those consistently advocating an "all-in" approach—should increase investment to consolidate their positions in this field and reap significant market rewards.

For instance, Alibaba recently announced an investment of over 380 billion yuan over the next three years to build cloud and AI hardware infrastructure, surpassing the total investment of the past decade. This news sparked widespread industry discussions, and the capital market generally viewed it positively.

Conversely, Baidu's capital expenditure in 2024 showed a contraction trend. By the end of 2024, it held cash and cash equivalents, along with short-term investments totaling 139 billion yuan, with cash comprising over 50% of its market value—an exceptionally high proportion. This suggests that Baidu has substantial cash reserves but is not investing in the future like its peers.

Why is this the case? This piques our curiosity. The core viewpoints of this article are as follows:

First, the primary indicator influencing corporate decision-making in the short term is ROIC (Return on Invested Capital). The different endowments of Baidu and Alibaba lead to distinct business strategies.

Second, the Scaling law remains valid. Only by resolving historical issues and moving forward with a lighter load can enterprises make better bets on the future.

Baidu Under the Inversion of ROIC and WACC

In mid-2024, I noticed Baidu's significant cash reserves and initially believed it was a temporary situation. I anticipated that the company would maintain its cash reserves at a reasonable level through buybacks and increased capital expenditure. I also believed that these large cash reserves provided Baidu with substantial potential to invest in the future. However, none of these scenarios have materialized to date.

This is peculiar. Typically, idle funds due to a large cash holding can affect a company's capital utilization efficiency and hinder the improvement of key financial indicators such as ROE (Return on Equity), which is highly undesirable.

From a financial perspective, in addition to pursuing "dreams," a company's investment in the future must also consider practical efficiency issues, which involve the performance of ROIC.

ROIC is a crucial indicator for evaluating the use of funds invested or utilized by an enterprise and the related returns, used to measure the effectiveness of invested funds.

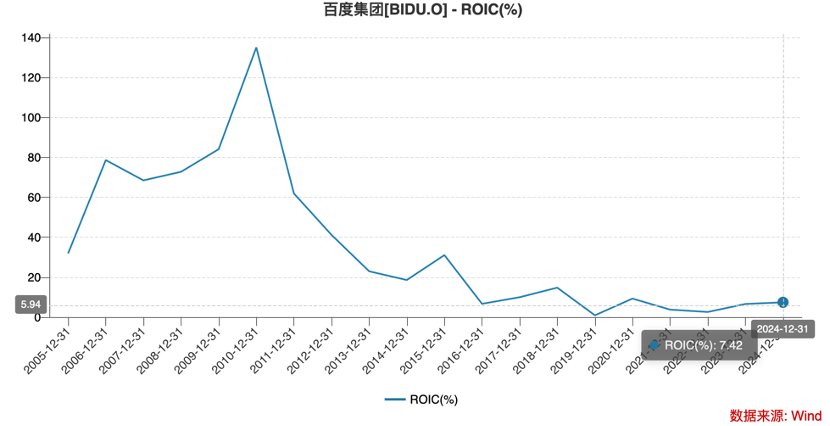

As Baidu is currently transitioning between old and new business models, its cornerstone marketing revenue has shown signs of fatigue, and the AI business, which the market holds high hopes for, has yet to yield significant financial gains. This has placed Baidu's ROIC in an awkward position, essentially in a continuous downward cycle for the past few years.

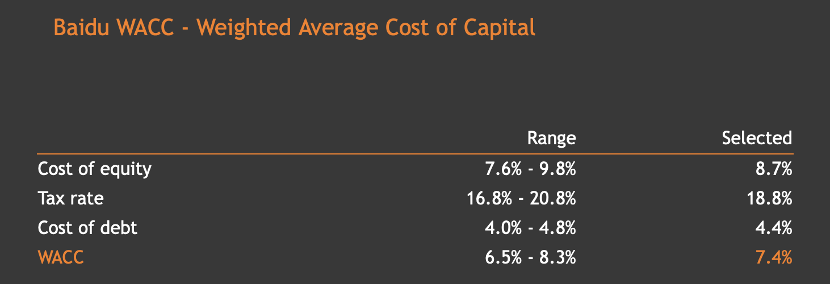

If ROIC represents the return on capital invested by an enterprise, then WACC (Weighted Average Cost of Capital) is the financing cost of the capital invested by the enterprise. According to calculations by valueinvesting.io, Baidu's WACC is approximately 7.4%, nearly equivalent to its ROIC.

This means that if Baidu increases its capital investment, it will be challenging for its returns to cover its capital costs. From a financial perspective, this is generally considered a losing proposition.

Returning to the formula: ROIC = After-tax operating income / (Total capital and assets - Excess cash - Non-interest-bearing current liabilities) = (Net income - Taxes) / (Total capital and assets - Excess cash - Non-interest-bearing current liabilities).

It's not difficult to understand why Baidu is hoarding cash rather than investing it:

Investing additional new cash will increase the denominator in the above formula (i.e., the total capital invested by the enterprise), potentially diluting ROIC performance. Once ROIC falls below the WACC threshold, the income and cost of the new capital invested by the enterprise will be inverted. Furthermore, Baidu's P/B (Price-to-Book ratio) has already fallen below 1, indicating that an additional one yuan of net assets cannot be exchanged for one yuan of market value in the capital market. This erodes shareholders' interests (shareholders prefer profit distribution over investing in losing ventures) and seriously affects market confidence. Especially when the enterprise needs financing, the rating agency's score determines the financing cost.

Some may argue that Baidu should disregard short-term gains and losses and place a significant bet on the future. However, from a market analysis perspective, the AI business and the original search business are part of one large portfolio, rising and falling together. If a substantial bet is placed on the new business without improving the overall ROIC, support for the new business will also be difficult to sustain (the AI strategy will be a protracted battle).

When analyzing corporate behavior, we often admire the entrepreneurial spirit and decisive actions of entrepreneurs. However, from a financial perspective, management's actions must still be subject to relevant constraints: It's not that Baidu doesn't want to invest heavily in AI and increase capital expenditure; rather, it is constrained by realistic financial pressures and perceptions in the capital market.

This is the primary theme of Baidu's operations in 2024:

1) Cost reduction and efficiency enhancement were prioritized throughout the year. Except for marketing expenses (primarily used for product "buying traffic"), other period expenses shrank to varying degrees (e.g., R&D expenses decreased by 9% throughout the year), with employee benefits being the main driver of cost compression.

2) Capital allocation was also more prudent. In early 2023, Baidu initiated a $5 billion buyback plan (as of the end of 2025), and so far has repurchased $1.7 billion, with the buyback process significantly slower (this period was precisely a good opportunity to buy back at low stock prices). In other words, Baidu is currently more inclined to "hold cash and wait," increasing capital expenditure when business operations improve, thus creating a contradiction between reality and theoretical perceptions.

Alibaba Enters a New Cycle Where Investment Returns Are Greater Than Costs

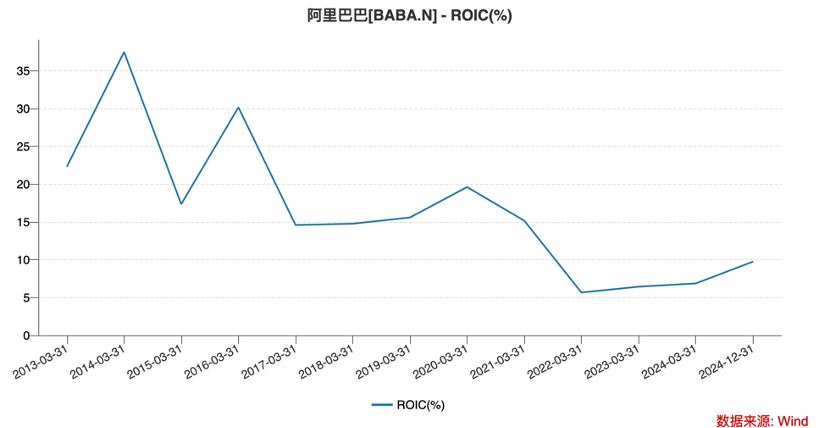

Alibaba's story in the first half closely mirrors that of Baidu. In recent years, ROIC has also experienced significant downward pressure (due to slowing growth in core businesses and a mix of inefficient businesses), and it has been inverted with WACC for a period.

The situation began to change in early 2024, when Joseph Tsai stated that "in terms of capital allocation, we will increase returns to shareholders, exit low-ROIC investments, and raise the return on invested capital to double digits." This was one of the few instances where a Chinese concept enterprise management team specifically mentioned the need to improve ROIC. Subsequently, Alibaba strengthened the following reforms:

1) In terms of operations, it refocused on its core businesses, cutting non-core businesses. High-Xin Retail and Intime Retail began to gradually be divested, while cornerstone businesses Alibaba Cloud and Taobao and Tmall were prioritized for development. For example, in the Q4 2024 financial report, customer management revenue for Taobao and Tmall increased by 9% year-on-year, surpassing market analysts' general expectations of 5%, indicating that customer investment was starting to flow back to Taobao and Tmall.

2) Capital allocation became more aggressive. Throughout 2024, Alibaba conducted $12.5 billion in buybacks and $4 billion in dividends. Based on the market value at the end of 2024, Alibaba's shareholder return rate reached 9.0%, the highest among similar Chinese concept enterprises, enhancing shareholders' sense of cash acquisition and amplifying its advantages in attracting long-term investment funds, which can effectively suppress stock price volatility.

According to WIND statistics for the first three quarters of fiscal year 2025 (Q2-Q4 of the natural year 2024), Alibaba's ROIC jumped to 9.75%, and there is little doubt that it will return to double digits for the full fiscal year.

Alibaba's inversion of WACC and ROIC has completely ended, and it has entered a new cycle where investment returns are greater than costs. This is an opportune time for enterprises to make a new round of capital expenditures.

On the one hand, this relies on Alibaba's deep cash reserve moat. As of the end of 2024, cash and cash equivalents and short-term investments exceeded 450 billion yuan, providing sufficient room for maneuver to optimize capital allocation and improve investor relations. On the other hand, the management team promptly adjusted its operational logic to reverse the business fundamentals, with both the income statement and cash flow statement showing varying degrees of improvement. In contrast, Baidu still has to bear the impact of business transitions on its financial statements, which will also restrict the enterprise's expansion behavior.

In the surging era of AI, enterprises face more than just the question of "which is better, open-source or closed-source large models." Besides technological routes, they must also address concerns about business operations and capital markets, as well as issues like the transition between old and new business models, to provide sufficient ammunition and room for AI to thrive.

Although DeepSeek's success is attributed to algorithms improving efficiency and avoiding the brute force approach of stacking computing power used by overseas counterparts, it's undeniable that the Scaling law has not yet reached its limits, and computing power will continue to be a decisive factor in determining AI efficiency in the future. After resolving historical issues, Alibaba has initiated a new round of AI capital investment. According to media reports, ByteDance, Tencent, and other enterprises are also eager to try and get ready. Baidu really needs to be cautious.