AI Language Learning App Speak's Investor Discusses AI Applications: Seeing Opportunities in the Convergence of B2B and B2C

![]() 03/07 2025

03/07 2025

![]() 562

562

"Accel primarily supports products and teams that offer users a 5 to 10-fold improvement in experience."

Caijing Tuya has learned that recently, Accel partner Ben Quazzo shared his investment case on the AI language learning unicorn "Speak" and his perspectives on AI-related consumer applications in an interview.

Late last year, Speak announced the completion of a $78 million Series C funding round led by Accel, pushing the company's post-money valuation to $1 billion. Notably, Speak is also a startup backed by OpenAI through its fund.

The Value of AI Voice Applications: Revolutionary Impact + High Fidelity

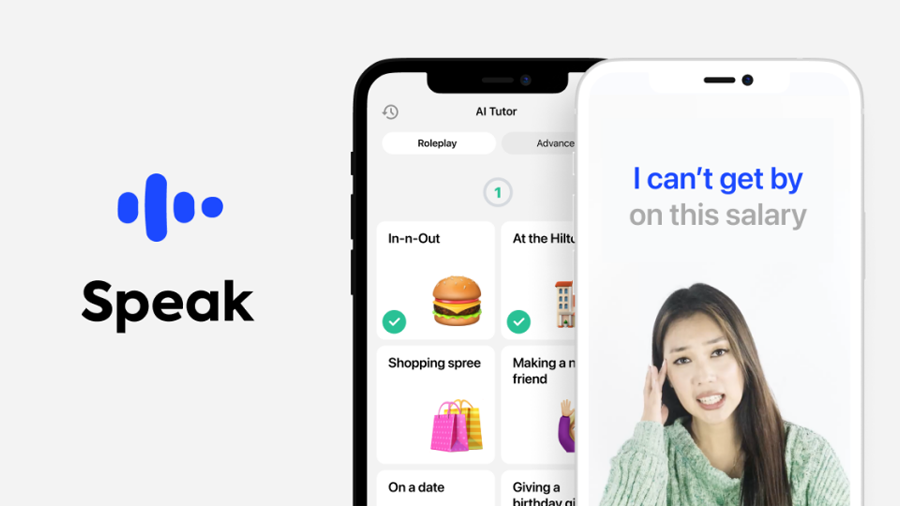

Ben Quazzo explained that Speak teaches learners how to communicate and converse in English through speech and audio, contrasting sharply with previous methods centered on memorization and grammar rules. This approach helps learners achieve fluency and delivers learning outcomes often overlooked by traditional teaching methods.

Previously, Ben Quazzo tweeted that Speak leverages AI to recreate the nuanced experience and strong interactivity of conversing with native speakers, indicating that Speak simulates human-like natural language communication and provides personalized courses for learners.

Based on OpenAI's Whisper and GPT-4, Speak offers feedback on pronunciation, more natural vocabulary, and grammar through its proprietary model. Additionally, it is amassing a vast dataset of spoken language use cases with second language annotations, enabling Speak to provide a unique voice model for individuals with foreign accents.

As of the end of 2024, Speak's app had been downloaded over 10 million times, offering 25 million personalized courses. Users on the platform engaged in 1 billion spoken exchanges. Approximately 10% of the population in the South Korean market has used Speak to learn English, and over 200 companies utilize Speak for Business, with an employee adoption rate of 85%.

In 2025, Speak plans to expand beyond Asia, targeting Europe, Latin America, and the United States. The company will focus on driving the growth of Speak for Business and the continuous development of its AI-driven learning engine.

Beyond Valuation: A Focus on Product Positioning of AI Consumer Applications

In today's AI-centric primary market, most funds flow towards enterprise service companies, with decreased attention on consumer applications. Quazzo noted, "Investing in the consumer sector hasn't been straightforward over the past decade, but AI is transforming this landscape. We see opportunities in the convergence of some B2B applications with the consumer side. Accel primarily supports products and teams that offer users a 5 to 10-fold improvement in experience—whether in language learning in the consumer sector or in areas related to music, health, and well-being."

Regarding valuation, many American AI companies have attained high valuations before generating revenue. Quazzo believes there is still significant uncertainty in valuation fluctuations. "Early investors will inevitably encounter numerous local maxima and minima. Accel focuses on the primary factors driving enterprise value growth over the next decade. If we invest in the right product and team committed to their mission, we won't be overly concerned about the valuation at the time of entry when we look back."

This year, NVIDIA's share price has fluctuated significantly, dropping over 20% from its peak, causing a general decline in valuation in the US private equity market. Quazzo emphasized viewing changes in the secondary market objectively and calmly. "We should consider where these companies will be in five or ten years. This is a significant challenge, but it doesn't necessarily correlate with daily stock market price fluctuations."

Previously, Michael Anders, founding partner of the venture capital fund Iconic, told Bloomberg that the cooling market sentiment towards consumer technology investments could be advantageous. "At least we can start making moves now. We've shed some of the bubble and reduced some of the constraints of FOMO sentiment."

This article was originally published by the public account Caijing Tuya (ID: caijingtuya). For reprints, please contact Tuya Jun.