Revaluating Beijing Capital Highways: A 'Robot ETF' with a Complete Industrial Ecosystem

![]() 03/10 2025

03/10 2025

![]() 761

761

In 2025, the robot industry became one of the core driving forces for the revaluation of China's technology assets.

This year's government work report mentioned 'embodied AI' and 'intelligent robots' for the first time, marking this sector as officially at the forefront of the times and revealing a glorious corner of 'hard tech' investment.

Starting from March 10, Beijing Capital Highways' inclusion in the Hang Seng Composite Index officially took effect, and the company is about to return to the Stock Connect list. A closer look reveals that the company's deep layout in the robot industry chain may be a key factor.

With a 'robot fund' in one hand and 'robot companies' in the other, we can glimpse the new logic of current technology industry investment from Beijing Capital Highways' industrial investment layout.

Transformation and Upgrade: Industrial Investment Leading the Robot Wave

As the current 'hot potato' in the global technology sector, the robot sector has performed strongly this year. From the perspective of the Hong Kong stock market, Horizon Robotics has seen an increase of over 150% this year, Unitree Robotics has seen an increase of over 80%, and URobot has seen an increase of over 40%.

Investors are both excited and regretful that there are currently relatively few high-quality listed companies in the robot sector, and a number of leading players in sub-sectors such as Unitree Robotics and Yinhe General have not yet gone public. As NVIDIA's 'strictly selected' partners, both companies participated in the NVIDIA Beijing Appreciation Spring Festival Meeting in 2025. This closed-door meeting, which only invited six Chinese companies, indirectly confirmed their technological potential, and investing in these companies will undoubtedly yield substantial returns.

The Hong Kong Stock Research Institute noticed that behind these star start-ups is the figure of one company - Beijing Capital Highways.

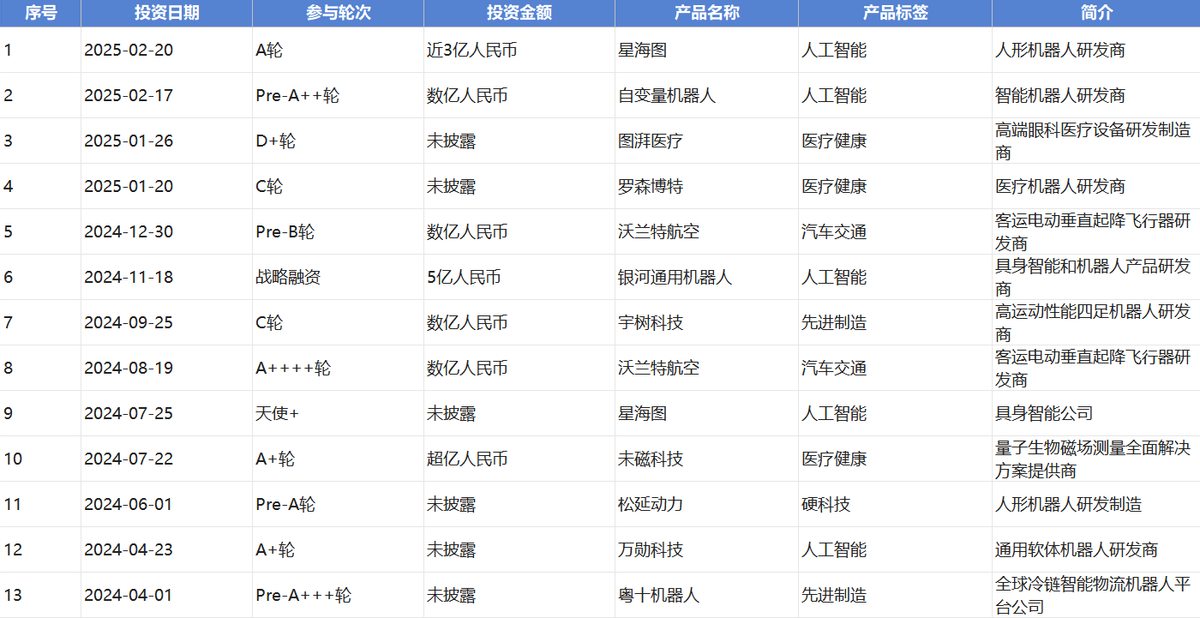

Beijing Capital Highways jointly initiated the establishment of a robot fund with Beijing SASAC, with a total scale of 10 billion yuan. According to Tianyancha data, the fund has invested in more than a dozen promising robot companies, including Unitree Robotics and Yinhe General, covering various sub-sectors such as embodied AI/humanoid robots, medical robots, consumer robots, special robots, and upstream components.

Investment Events of Beijing Robotics Industry Development Investment Fund (LP) (Data Source: Tianyancha)

In fact, Beijing Capital Highways is not a novice in industrial investment. Previously, it participated in the development of the smart electric vehicle industry chain, investing in companies such as Li Auto, Horizon Robotics, and HAOMO.AI.

From Beijing Capital Highways' perspective, from Li Auto, Horizon Robotics to Unitree Robotics, Yinhe General, its industrial investments have frequently hit the mark, making it a 'thrilling template' in the investment world. An in-depth analysis of the company's industrial investment path reveals the strategic transformation behind the changes in its investment direction.

The timeline goes back a decade. In 2015, Beijing Capital Highways was close to insolvency and began to actively seek change, promoting the development of the 'asset management model' in the infrastructure sector, and planning four major business segments: parking, industrial space, REITs, and equity investment. Parking and industrial space operations have brought the company steadily growing revenue; through asset financing means represented by REITs, the securitization of infrastructure assets realizes capital return, laying the foundation for the company's reinvestment and transformation and upgrading; equity investment brings excess returns.

Starting about six or seven years ago, Beijing Capital Highways explored a new model of combining industrial investment and targeted the potential track of 'hard tech' to deploy, successively hitting the two hot areas of smart electric vehicles and robots.

Choosing smart electric vehicles as an entry point demonstrates the company's industrial capital mindset, with investment directions synergizing with its own parking lot business. From smart electric vehicles to robots, the transformation behind the company's industrial investment direction is a prediction of industry development trends: a new technology explosion cycle is coming, and there are many commonalities in software and hardware systems between smart travel and the robot sector, with a high degree of technology reuse. Such 'cross-border' integration is the general trend of future industries.

In fact, enterprises in the smart electric vehicle sector are collectively crossing over to build robots, with players such as Xiaomi, BYD, and XPeng Motors all vigorously developing this field.

This phenomenon reveals that the intelligent robot sector is accelerating its expansion, and industrial development will enter an explosive period in 2025.

Therefore, the capital market is also paying close attention to this industry. Beijing Capital Highways' Gorgeous Turn from an infrastructure operator to a robot enterprise provides the market with a different perspective.

'Investment + Services': Building a Full Industry Chain Ecosystem for Robots, Unlocking the Profit 'Password' This Year

When companies like DeepSeek and Unitree Robotics became popular, some cities reflected on 'why Hangzhou', and now the capital market can also ask 'why Beijing Capital Highways'.

From a traditional enterprise to a representative of infrastructure asset securitization, to a 'hot tech investor', Beijing Capital Highways is like the line from 'Ne Zha 2': 'If there is no path ahead, I will forge one myself.' Specifically, Beijing Capital Highways' path of 'defying fate' has three key steps:

The first step is to accurately bet on growth sectors and invest in unicorn companies.

From smart electric vehicles to robots, from Li Auto to Unitree Robotics, behind its classic investment cases is Beijing Capital Highways' grasp of industry development trends.

The second step is to leverage its own resource endowment advantages to achieve digital and intelligent transformation through investment.

Commercialization has always been one of the gambles in the robot industry, and Beijing Capital Highways not only provides financial support to invested companies but also brings application scenarios and comprehensive post-investment services through its own ecosystem. At the same time, Beijing Capital Highways also nurtures its own business's intelligent transformation through the development of the robot industry. For example, in the parking business sector, the transportation hub parking lots operated by Beijing Capital Highways, such as Beijing Capital Airport, are all testing the automatic charging robots of invested company Wisson, realizing full-process intelligence.

Image Source: Wisson

The third step is to establish a robot company, deeply participate in the industry chain, and create more commercial value.

In addition to long-term 'assisting' invested companies, Beijing Capital Highways also fully leverages its advantages as an infrastructure management and operation service provider to integrate into the process of industrialization.

In February of this year, Beijing Capital Highways established Beijing Shoucheng Robotics Technology Industry Co., Ltd. ('Robot Company'), providing enterprises with in-depth services including financial leasing, sales agency, industry consulting, and supply chain management. This marks the company's deep involvement in the robot industry's operational end, making it a 'technology service provider'. For example, in the sales agency field, the company is building a vertical distribution network covering multiple scenarios, with initial plans to become a strategic-level channel partner for 40 to 50 innovative companies.

The company is expected to have robot-related revenue and profit this year, not only verifying the commercialization capabilities of this model in the robot industry chain but also driving the company's overall performance growth.

Combining investment and operation, Beijing Capital Highways will become a company with a full robot industry chain ecosystem network. Under the multiple catalysis of domestic policies, industrial cycles, and the capital market, the company is expected to usher in historical opportunities.

Since the beginning of this year, the robot industry's policy dividends have continued to be released. More than a dozen provinces and cities, including Beijing, Shanghai, and Guangdong, have included embodied AI, robots, or intelligent robots in their government work reports this year.

With the national policy tilt towards the robot industry chain and China's scenario advantages, the critical point for '1 to N' scaling has arrived. According to the prediction of the GGII, from 2024 to 2030, the average annual compound growth rate of China's humanoid robot market will exceed 61%.

As China's technological innovation ecosystem advantages emerge, the capital market is revaluating the value of Chinese technology enterprises. Goldman Sachs maintains an 'overweight' rating on A-shares and H-shares. Morgan Stanley released a research report stating that investors are increasingly focusing on private companies in the field of embodied/physical AI.

Taking the robot industry as the vanguard, the capital market has sounded the clarion call for value revaluation.

Recently, there has been good news about robot concept stocks. Beijing Capital Highways was included in the Hang Seng Composite Index; Horizon Robotics was included in the Hang Seng Tech Index; and UBTECH Robotics saw its target price raised by Citibank by over 100%.

In this revaluation of the robot industry's value, Beijing Capital Highways will serve as a deep participant in technological change and industrial restructuring, achieving business growth and enhancing shareholder value. As the development ecosystem for robots gradually improves, the company continues to raise the upper limit of the industry, and the current valuation revaluation is only the beginning.

Value Revaluation: The Potential of a Robot 'ETF' in the Intelligent Era

Stefan Zweig wrote in 'The Moment of Glory': The greatest luck in a person's life is to discover their mission in the middle of their life, when they are in their prime.

Amid the wave of technology industry investment, Beijing Capital Highways has a clear development path and a clear goal - to transform into an ecological technology enterprise through the deep integration of industry and capital. At present, the company's growth potential has not been fully unleashed.

First of all, the fact that Beijing Capital Highways has such a profound layout in the robot sector will surely be recognized by the market as the company re-enters Stock Connect.

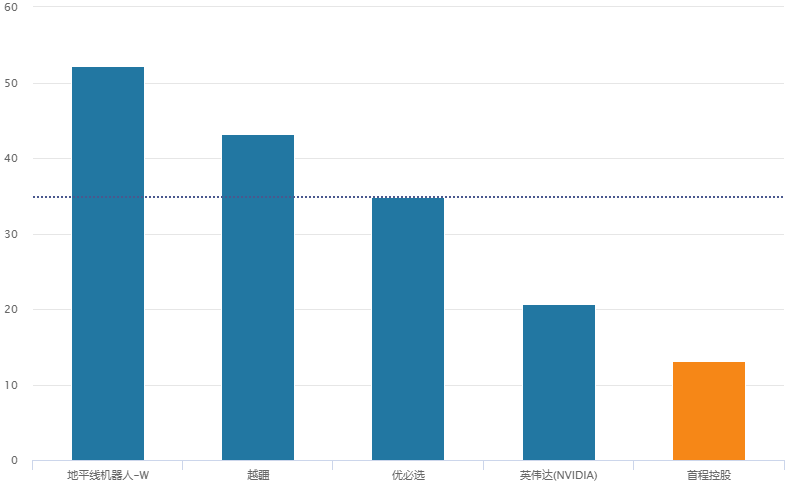

Compared horizontally, this profound layout is not fully reflected in the current valuation. Using the price-to-sales (PS) ratio, which is commonly used in high-growth industries, Beijing Capital Highways presents a relatively undervalued state overall, and the company is also an investor in Horizon Robotics.

Comparison of Price-to-Sales Ratios of Some Hong Kong and US Robot Concept Companies (Image Source: Wind Financial Terminal)

By integrating with existing businesses, Beijing Capital Highways, as a 'robot enterprise', is not only a commercial entity but also an industrial infrastructure in the intelligent era. The company's overall intrinsic valuation logic should be based on platform-type technology enterprises, with further valuation reshaping to come.

It is worth mentioning that under its unique business model, Beijing Capital Highways has two additional layers of growth certainty compared to general technology start-ups: business moats and beta-like characteristics.

On the one hand, mature businesses have built Beijing Capital Highways' operating moat. In the fields of parking and industrial space operations, Beijing Capital Highways holds the operating rights for parking lots and industrial parks across cities nationwide, including Beijing, Shanghai, Guangzhou, and Shenzhen. At the same time, it continues to make efforts in infrastructure REITs, forming a virtuous cycle of existing assets and new investments, which helps ensure revenue stability.

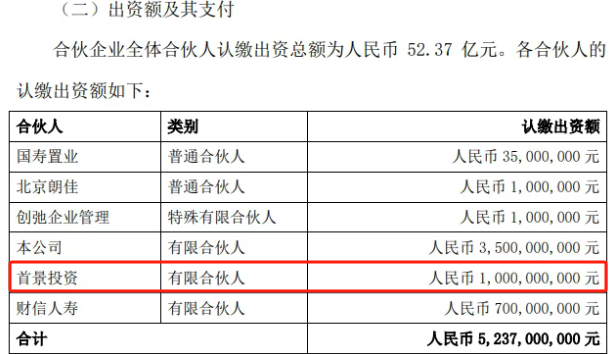

Combined with China Life's announcement in February of this year, Beijing Capital Highways will also increase its investment in the REITs market in the future. The company's indirectly wholly-owned subsidiary Shoujing Investment will jointly focus on investments in the field of infrastructure public REITs with China Life and Caixin Life.

Image Source: China Life Announcement

REITs are becoming an important part of China's major asset classes, entering the accounts of more and more investors. With the healthy development of this market, Beijing Capital Highways will maintain a stable operating condition.

On the other hand, the ecological-level layout in the robot sector will help Beijing Capital Highways steadily enjoy industry dividends.

Beijing Capital Highways has invested in a 'basket of high-quality robot companies' and will benefit from the overall growth of the industry. Previously, Morgan Stanley released a research report stating that we view Tesla as an 'AI ETF' in the US stock market. From this perspective, Beijing Capital Highways is also a 'robot ETF' in the Hong Kong stock market that covers technological innovation to application scenarios. Against the backdrop of the overall upward trend of the robot industry, Beijing Capital Highways has a strong growth certainty.

Looking ahead, REITs will build a growth base, robots will open up imagination space, and Beijing Capital Highways will become a scarce target in the field of technology investment, staying away from alpha fluctuations and focusing on industry beta. As the company re-enters Stock Connect to enhance liquidity, it will accelerate value release.

Source: Hong Kong Stock Research Institute