Understanding Tier 1 and Tier 2 in the Autonomous Driving Industry: Roles, Differences, and Collaboration

![]() 03/17 2025

03/17 2025

![]() 612

612

With the rapid advancement of autonomous driving technology, the supply chain system has become increasingly intricate. Within this complex ecosystem, Tier 1 (first-tier suppliers) and Tier 2 (second-tier suppliers) play indispensable roles, each with distinct responsibilities and positioning. These terms are ubiquitous in describing the hierarchy and responsibilities of various suppliers within the automotive industry chain. Let's delve into what Tier 1 and Tier 2 actually are and the specific differences between them.

Definitions of Tier 1 and Tier 2

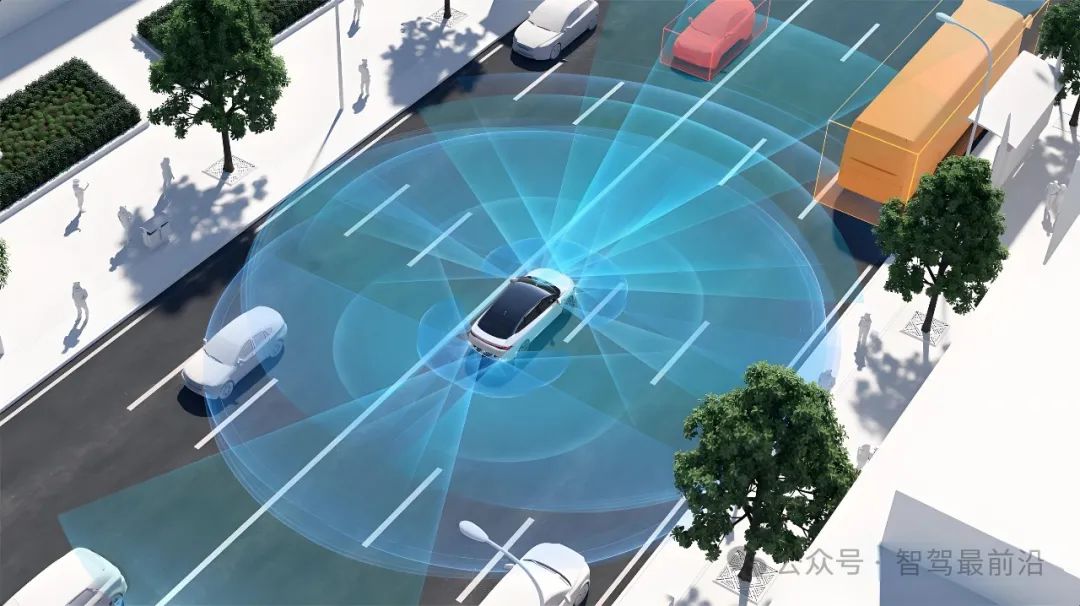

In the autonomous driving industry, Tier 1 and Tier 2 represent two pivotal links in the supply chain, characterized by distinct definitions and responsibilities. Tier 1 suppliers provide complete products or services directly to original equipment manufacturers (OEMs). Their core responsibility lies in integrating various technologies and hardware into fully functional systems, such as Advanced Driver Assistance Systems (ADAS), autonomous driving domain controllers, or battery management systems. These systems must align seamlessly with the technical specifications of OEMs, necessitating a profound understanding of vehicle design, functional requirements, and market objectives. Tier 1 suppliers typically possess robust R&D capabilities, managing complex tasks from design to mass production, and integrating multiple components, technical modules, and software algorithms into their offerings. Their direct interaction with OEMs places them at the heart of the supply chain, requiring not only high-quality products but also participation in long-term technical strategy planning and joint development initiatives with OEMs.

Conversely, Tier 2 suppliers primarily provide technical support, components, or raw materials to Tier 1. Their focus is on foundational technology areas, such as producing sensor chips, semiconductor devices, optical components, or automotive-grade battery materials. Tier 2 suppliers do not generally cooperate directly with OEMs but participate in the industrial chain by supplying Tier 1 with high-quality and reliable components. These suppliers often specialize in specific technologies or product areas, continually enhancing their core competencies to meet Tier 1's demands for high performance and stability. While Tier 2 operates more behind the scenes, their technological breakthroughs are frequently pivotal in driving industry-wide technological advancements.

In the realm of autonomous driving, innovations like high-precision LiDAR and low-power computing chips are indebted to the efforts of Tier 2. Here, Tier 1 and Tier 2 play complementary roles, with Tier 1 focusing on integrating and delivering system-level solutions, while Tier 2 focuses on technological depth and component supply. This collaborative model fosters a bottom-up technological transmission, where Tier 2's foundational innovations support Tier 1's system integration, and Tier 1's market demands, in turn, steer Tier 2's R&D direction. Understanding these roles and definitions is crucial for insights into the operational mechanics of the entire autonomous driving supply chain.

Differences between Tier 1 and Tier 2

The differences between Tier 1 and Tier 2 are manifested in various aspects, including supply chain position, cooperation objects, product complexity, technical capabilities, business models, bargaining power, and industry influence. As the two principal levels in the automotive supply chain, their division of labor and functions are significantly distinct yet complementary, jointly forming the backbone of the autonomous driving industrial chain.

From the perspective of supply chain position and cooperation objects, Tier 1 suppliers are downstream and directly interface with OEMs, serving as direct partners. This cooperative relationship underscores Tier 1's core task of providing system-level products or modules that can be seamlessly integrated into vehicles based on OEM requirements. OEMs often entrust complex functional requirements to Tier 1, which is responsible for the entire lifecycle from product design, system integration, to final mass production. In contrast, Tier 2 suppliers are positioned midstream or upstream, primarily supporting Tier 1. Their role centers on providing specific components, raw materials, or technical support, such as LiDAR chips, domain controller computing units, or high-performance batteries for battery management systems. The cooperation between Tier 2 and Tier 1 is more indirect, and their products typically do not directly interface with OEMs.

In terms of product complexity and technical breadth, the distinction between Tier 1 and Tier 2 is also apparent. Tier 1's primary responsibility is to offer system-level solutions, with products entailing deep integration of hardware and software, requiring simultaneous fulfillment of performance, reliability, cost, and vehicle compatibility criteria. For instance, in ADAS systems, Tier 1 suppliers must fuse data from various sensors like cameras, radars, and LiDAR, achieve environmental perception and decision-making through algorithms, and ultimately transmit signals to the vehicle's execution system. This highly intricate system necessitates cross-domain technical capabilities and a profound understanding of OEMs' technical pathways and design philosophies.

Tier 2's products, on the other hand, are more modular basic components or key technologies, characterized by relatively lower complexity but higher technical depth requirements. For example, the transmitting chip within LiDAR must maintain high performance in extreme temperature environments, and this technological innovation and reliability are Tier 2 suppliers' primary concerns. Although Tier 2's products do not directly face OEMs, their performance directly impacts the overall efficacy of Tier 1 products.

In terms of technical capabilities and business models, Tier 1 and Tier 2 also exhibit marked differences. Tier 1 suppliers must possess robust system integration capabilities and rapid response mechanisms to OEM demands. Their technical prowess encompasses not only hardware production and manufacturing but also comprehensive strengths in software development, algorithm optimization, and system verification. Tier 1 often engages in project design during the early stages of OEM product development and even collaborates on new technology development with OEMs to ensure seamless integration into vehicle systems.

In contrast, Tier 2's technical capabilities are more concentrated in specific domains, with their core competitiveness rooted in focus and deep cultivation. For example, some Tier 2 enterprises may specialize in developing automotive-grade chips, sensor modules, or optical components, enhancing their supply chain competitiveness through technological advancements in these areas. In terms of business models, Tier 1 focuses on large-scale supply contracts, forging long-term cooperative relationships with OEMs; whereas Tier 2 is more flexible, often serving multiple Tier 1 customers and enjoying a broader business reach.

Regarding bargaining power and market position, Tier 1, due to direct cooperation with OEMs, wields more market resources and discourse power. OEMs have a high degree of dependence on Tier 1, positioning Tier 1 favorably within the supply chain. Tier 2's bargaining power is relatively weaker since their products ultimately enter the vehicle market indirectly through Tier 1, and demand fluctuations are significantly influenced by Tier 1's order volumes. However, with the continuous evolution of autonomous driving technology, Tier 2 suppliers' discourse power in certain core technological fields (like chip manufacturing and high-performance sensors) is gradually increasing. Some Tier 2 suppliers with technological exclusivity or industry leadership have even begun to cooperate directly with OEMs, disrupting the traditional supply chain hierarchy.

Overall, the roles and functions of Tier 1 and Tier 2 reflect the division of labor and collaboration within the supply chain. Tier 1 serves as the "system integrator," responsible for assembling multiple technical modules into complete systems for OEM use, while Tier 2 acts as the "technological supporter," focusing on technological innovation and component development and manufacturing. This division enables the entire autonomous driving industrial chain to possess both deep technological support and the ability to cater to a wide range of OEM demands. The differences between the two not only underscore the complexity of the supply chain but also illustrate the autonomous driving industry's high reliance on multi-level technical collaboration.

Collaboration and Industry Impact of Tier 1 and Tier 2

The collaborative relationship between Tier 1 and Tier 2 is the cornerstone of efficient operation within the autonomous driving industry supply chain and a vital catalyst for technological progress and market expansion. As two key levels in the supply chain, their collaboration transcends mere upstream-downstream technological and product linkages, encompassing the entire product development, technological innovation, and market response lifecycle. This collaborative relationship is not merely a clearly delineated cooperation model but also a significant mechanism driving industry advancement.

In terms of collaboration mode, Tier 1, as a direct partner of OEMs, bears the responsibility of system integration and holistic solutions. Based on OEM functional requirements, Tier 1 integrates basic components and technical modules from Tier 2, and through design, testing, and verification, ultimately forms complex systems ready for vehicle application. In autonomous driving, Tier 1 must integrate Tier 2-provided products such as sensors, chips, and optical components into a high-performance environmental perception system, optimizing it with its software algorithms to seamlessly interface with the OEM's technical architecture. This collaborative mode necessitates Tier 1's profound understanding of each Tier 2 component while maintaining overall system control.

Tier 2 plays the role of a "technological innovation engine" within this supply chain, concentrating on technological development in specific fields and supplying Tier 1 with high-quality basic components and technical support. Since Tier 2 does not cooperate directly with OEMs, their technological innovations often exhibit stronger forward-looking and independent traits. For instance, a Tier 2 enterprise might specialize in developing higher-precision LiDAR chips or more efficient computing units, and these technological breakthroughs directly enhance Tier 1 products' overall performance and market competitiveness.

The collaboration between Tier 1 and Tier 2 is also a bidirectional, interactive technological transmission mechanism. Tier 2 provides Tier 1 with high-performance components and technological innovations, while Tier 1, leveraging its understanding of OEM demands and grasp of market trends, drives Tier 2 to adjust its R&D direction. For example, when OEMs impose stricter cost and size requirements on LiDAR, Tier 1 relays this market demand to Tier 2, prompting Tier 2 to refine its product design to better meet practical application needs. This interactive relationship not only enhances supply chain efficiency but also fosters a closer alignment between technological development and market demand.

The mutual collaboration between Tier 1 and Tier 2 propels the rapid development and industrialization of autonomous driving technology. Tier 2's innovations infuse the industry with new technological vitality, while Tier 1's integration capabilities and market insights ensure these technologies' systematic application in vehicles. Their collaboration not only elevates supply chain efficiency but also promotes technological standardization and cost optimization within the autonomous driving industry, laying the groundwork for large-scale industry implementation. Additionally, this collaboration model profoundly impacts the market landscape. Since Tier 1 occupies a dominant position in the supply chain, its choices directly influence Tier 2's market share and competitiveness; whereas Tier 2's technological breakthroughs create more product differentiation opportunities for Tier 1, enabling OEMs to offer more competitive end products.

Future Development Trends

Driven by the rapid progression of autonomous driving technology and the diversification of market demands, future development trends for Tier 1 and Tier 2 will showcase deeper integration, diversified division of labor, and ecosystem characteristics. As the autonomous driving industry enters a new phase of development, the relationship between these two principal supply chain levels will further evolve, with the boundaries of their division of labor and collaboration gradually blurring, and innovation models welcoming more transformations.

In the future, the boundaries between Tier 1 and Tier 2 suppliers will become increasingly blurred, particularly due to the escalating complexity of technology and the evolving demands of OEMs. Tier 2 suppliers are moving closer to providing system-level solutions. Traditionally, Tier 2 focused on the development of basic components or modules, while Tier 1 was responsible for integrating these components into systems usable by vehicles. However, as the technical thresholds for core components such as LiDAR chips and automotive-grade computing platforms continue to rise, some Tier 2 suppliers are transforming from mere component suppliers to more comprehensive technical solution providers, even sharing some of Tier 1's system integration responsibilities to a certain extent. This trend indicates that the traditional division of labor between Tier 1 and Tier 2 will be redefined, with more Tier 2 suppliers directly participating in vehicle technology development or even collaborating directly with OEMs.

Tier 1 suppliers may evolve from mere system integrators to technology ecosystem builders in response to the accelerating iteration of autonomous driving technology and the increasing demand for differentiation from automakers. Future Tier 1 suppliers will not only need to possess strong integration capabilities but also deep technical expertise in software development, data management, AI algorithms, and other related fields. With the growing popularity of end-to-end autonomous driving solutions, system complexity and integration depth have increased significantly. Traditional modular design has become inadequate in meeting market demands, necessitating closer collaboration between Tier 1 and Tier 2 to achieve cross-domain and interdisciplinary technology integration. Tier 1 may build an open technology platform to collaborate with more Tier 2 suppliers, technology startups, and academic institutions, thereby forming an open and diverse technology ecosystem. This ecological strategy will enable Tier 1 to occupy a more proactive position in the supply chain while driving Tier 2's technological progress through platform empowerment.

Tier 2 suppliers will also become more diversified and specialized. As technology becomes more specialized, new technological fields will give rise to a multitude of Tier 2 suppliers focusing on specific functional modules. For instance, with the accelerated application of high-precision maps and vehicle-road coordination technology, Tier 2 enterprises specializing in V2X communication modules may encounter new development opportunities. Leading Tier 2 enterprises can also break through traditional supply chain hierarchy constraints by deepening their core technology areas and directly collaborating with automakers or technology platform enterprises. This trend of "dual-track development" will enable Tier 2 to play more diversified roles in the autonomous driving technology ecosystem.

The cooperation mode between Tier 1 and Tier 2 will also undergo significant changes in the future, with more long-term strategic alliance-based cooperation models replacing traditional procurement relationships. As autonomous driving technology continues to advance, automakers have placed higher demands on suppliers' delivery cycles, technological foresight, and collaborative development capabilities. To better meet these needs, Tier 1 and Tier 2 must establish closer cooperative relationships, shorten technology iteration cycles, and enhance the overall competitiveness of products by sharing R&D resources and jointly overcoming technical challenges. This long-term strategic cooperation will not only strengthen the stability and synergy efficiency of both parties but also make technological innovation more targeted to meet dynamic market demands.

The evolution of policies and regulations will also profoundly impact the future development direction of Tier 1 and Tier 2. As global requirements for the safety, reliability, and sustainability of autonomous vehicles become increasingly stringent, every link in the supply chain will be subject to higher standards. This not only implies that Tier 1 needs to assume greater compliance responsibilities but also requires Tier 2 to provide products that meet stringent automotive-grade requirements.

The relationship between Tier 1 and Tier 2 in the future will gradually shift from the traditional upstream-downstream division of labor model to deep integration and ecological cooperation. In this process, the dual drive of technological innovation and market demand will further accelerate the reshaping of the industrial chain, with new technological trends and business models continually emerging. Whether it's the role expansion of Tier 1 or the diversified development of Tier 2, both will play crucial roles in the future of the autonomous driving industry, jointly driving it towards a more intelligent, modular, and collaborative direction.

As two essential roles in the supply chain of the autonomous driving industry, the relationship between Tier 1 and Tier 2 is not merely a manifestation of division of labor and cooperation but also a vital engine for promoting technological innovation and industrial upgrading. In this complex and dynamic ecosystem, Tier 1 and Tier 2 jointly realize the large-scale application of technology and maximize market value through division of labor and collaboration. As the core link of system integration, Tier 1 not only connects automakers with upstream supply chains but also plays a pivotal role in technology integration and market response. Through cooperation with Tier 2, they transform cutting-edge basic technologies into systematic products that cater to automakers' needs, endowing autonomous driving technology with practical commercial value. Tier 2, as the source of technological innovation, injects continuous vitality into the industry's technological progress by deeply cultivating core technologies such as sensors, chips, and algorithms. This upstream-downstream collaboration not only enhances supply chain efficiency but also provides solid support for the industry's technological innovation and commercial landing.

-- END --