Unveiling Intelligent In-Vehicle Terminals: The Indispensable Hub for Autonomous Driving

![]() 03/31 2025

03/31 2025

![]() 673

673

At the heart of the Internet of Vehicles (IoV) technology, intelligent in-vehicle terminals have undergone rapid development in recent years, becoming a cornerstone in the realms of automotive intelligence and autonomous driving. Encompassing functions such as intelligent navigation, real-time communication, entertainment interaction, and safety monitoring, these terminals offer comprehensive support to drivers and passengers alike. As the demand for autonomous driving and intelligent connected vehicles surges, the market for intelligent in-vehicle terminals is expanding exponentially. However, this growth is accompanied by challenges in technological innovation, market competition, industrial chain coordination, and policy regulations.

Introduction

As a pivotal technology in the evolution of automotive intelligence, intelligent in-vehicle terminals are gaining increasing significance. In the transition from mechanization to intelligence, these terminals provide indispensable support for smart vehicle interaction, safe driving, and entertainment services. Their core functionalities span four key areas: intelligent navigation, real-time communication, in-vehicle entertainment, and safety monitoring. By integrating high-precision maps with real-time traffic data, navigation systems offer precise route planning. The communication module facilitates seamless data exchange among vehicles, infrastructure, and the cloud. The entertainment system enhances the in-car experience through audio-visual content and voice interaction, while the safety system bolsters active safety and driving assistance capabilities through sensor-algorithm collaboration.

With the convergence of IoV, artificial intelligence, big data, and 5G communication technology, the development of intelligent in-vehicle terminals has entered a new era. Additionally, the rise of new energy vehicles has expanded the market potential for these terminals. Nevertheless, obstacles persist, including high technical barriers, data privacy and security concerns, and a lack of standardization. Collaborative efforts from industry, enterprises, and government are urgently needed to address these challenges.

Definition and Classification of Intelligent In-vehicle Terminals

2.1 Industry Definition

An intelligent in-vehicle terminal is an integrated smart device embedded within vehicles. Through the synergy of hardware and software, it offers a suite of services including navigation, entertainment, communication, and security. As a cornerstone of IoV, these terminals facilitate real-time interaction between in-vehicle and external information, supporting driving decisions, enhancing safety, and optimizing the driving experience. By leveraging high-precision navigation and real-time traffic data, they dynamically adjust routes to avoid congestion and save time. Furthermore, they serve as vital support for autonomous driving, perceiving the vehicle's surroundings and generating data for autonomous driving decision-making modules.

Today, intelligent in-vehicle terminals offer diverse functionalities beyond mere navigation and entertainment. Features like in-vehicle connectivity, voice assistants, and driver status monitoring further enhance the driving experience and safety. As virtual reality and artificial intelligence technologies advance, these terminals are poised to provide richer, more intuitive interactions, becoming crucial interfaces and service platforms for intelligent connected vehicles.

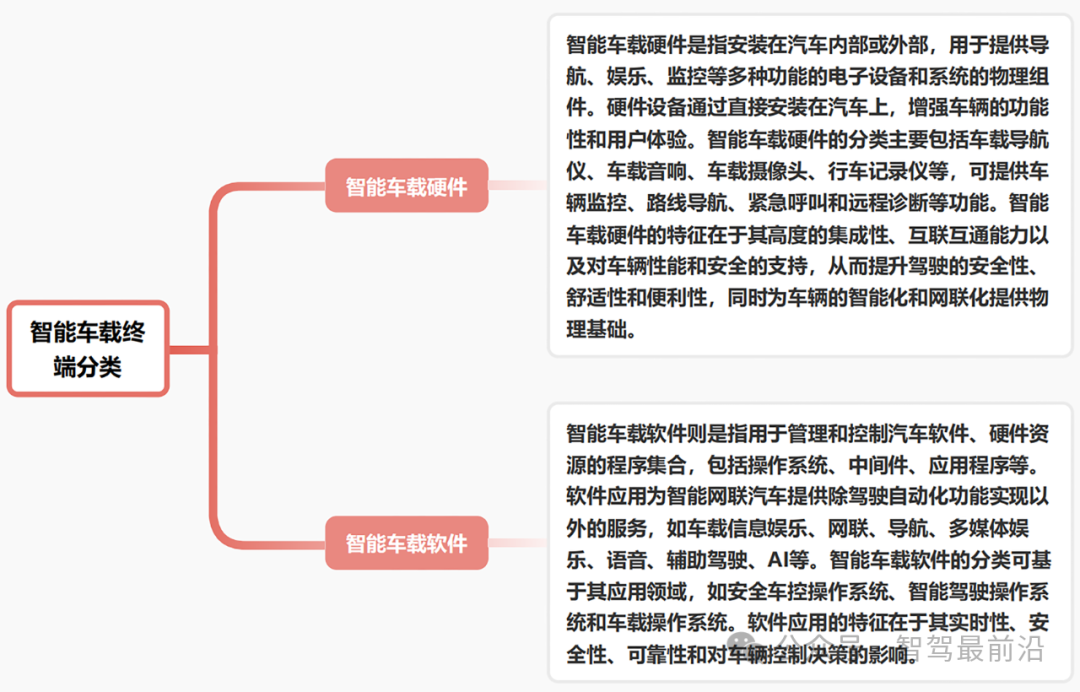

2.2 Classification

Based on physical form and technical function, intelligent in-vehicle terminals can be categorized into hardware and software components, each playing distinct yet complementary roles in the operation of intelligent connected vehicles.

Industry Classification of Intelligent In-vehicle Terminals

Intelligent In-vehicle Hardware

The hardware component serves as the physical foundation, encompassing in-vehicle displays, navigators, cameras, sensors, and more. These devices collaborate with other electronic systems to collect, transmit, and display data. For instance, in-vehicle cameras provide panoramic views and identify pedestrians, vehicles, and traffic signs through computer vision algorithms, supporting Advanced Driver Assistance Systems (ADAS). Radar sensors and LiDAR work in tandem to accurately measure the distance and movement of surrounding objects, providing critical data for autonomous driving environmental perception.

Intelligent In-vehicle Software

The software component handles data processing and decision support, including in-vehicle operating systems, applications, and middleware. It analyzes sensor data in real-time and generates driving instructions based on algorithmic decisions. For example, a deep learning-based driving behavior analysis system can detect driver fatigue and issue alerts. With the proliferation of IoV technology, the scope of intelligent in-vehicle software is expanding, from voice assistants to IoT control, covering security, entertainment, and service domains.

The deep integration of hardware and software equips intelligent in-vehicle terminals with comprehensive capabilities in environmental perception, data processing, and real-time interaction. This trend not only diversifies terminal functionalities but also lays the groundwork for future technological advancements.

Industry Characteristics and Development History of Intelligent In-vehicle Terminals

3.1 Industry Characteristics

Technology-driven innovation is the lifeblood of the intelligent in-vehicle terminal industry. Breakthroughs in artificial intelligence, big data analysis, and 5G communication technology have progressively enhanced terminal functionalities. Through deep learning algorithms, terminals can understand driver behavior and habits, offering personalized services. Meanwhile, 5G communication has significantly accelerated information exchange among vehicles, laying a solid foundation for autonomous driving technology.

Government policies provide external impetus for the industry's development. China has introduced various policies to foster intelligent connected vehicles, such as financial subsidies, tax incentives, and testing venue construction. These measures not only propel market growth but also facilitate technical standard formulation. With growing emphasis on data security and privacy, industry players are strengthening self-regulation and data encryption, promoting market standardization while safeguarding user rights.

Cross-border integration is evident, with traditional automakers and internet technology companies collaborating closely. Huawei, for instance, has developed the highly integrated in-vehicle intelligent system HiCar through partnerships with leading automakers, blurring industry boundaries. This integration not only broadens terminal application scenarios but also invigorates the industry ecosystem.

3.2 Development History

The evolution of intelligent in-vehicle terminals can be divided into three stages: budding, startup, and high-speed development, each marked by unique technological advancements, market shifts, and policy support.

Budding Stage (2014-2016)

This stage witnessed the nascent formation of the intelligent in-vehicle terminal industry. With 4G mobile communication networks reaching full commercialization, the concept of IoV gained public attention. Basic terminal functions like navigation, driving recording, and simple entertainment interaction emerged as initial exploration areas. In 2014, internet giants like Baidu, Alibaba, and Tencent ventured into intelligent in-vehicle technology by launching navigation and voice assistant services via smartphone connections, transitioning terminals from standalone hardware to hardware-software integrations. Products like intelligent rearview mirrors and in-vehicle tablets integrating navigation and entertainment entered the market, paving the way for terminal popularization. Despite limited technological capabilities, this period cultivated consumer awareness and laid the groundwork for future demand.

Startup Stage (2017-2019)

The startup stage was marked by concentrated policy introductions and rapid ecosystem development. In 2017, China's "Medium and Long-term Development Plan for the Automotive Industry" outlined intelligent connected vehicles as a strategic focus. Major cities like Beijing, Shanghai, and Guangzhou established autonomous driving test zones, providing real-world platforms for terminal applications. Technological progress was significant, with big data and AI gradually integrating into in-vehicle systems. Voice interaction evolved from mechanical commands to more natural human-computer dialogue. ADAS were integrated into multiple mass-produced vehicles, driving demand for high-performance sensors and computing units. While market size grew rapidly, non-uniform technical standards hindered product compatibility, posing major challenges.

High-speed Development Stage (2020-2024)

Since 2020, the intelligent in-vehicle terminal industry has experienced explosive growth, fueled by the expanding new energy vehicle market, 5G network proliferation, and deepening AI application. According to the China Association of Automobile Manufacturers, China's new energy vehicle sales surpassed 9 million in 2023, a 37.9% year-on-year increase. As a key supporting technology, intelligent in-vehicle terminals are widely used in navigation, intelligent cockpits, and assisted driving. The IoV standard system has been progressively refined, providing clear technical direction for industry players. With strong government support and growing market demand, the terminal market has achieved a compound annual growth rate exceeding 20%. Looking ahead, 6G network deployment and AI algorithm optimization will further diversify terminal functionalities, propelling the industry towards maturity.

Industry Chain Analysis of Intelligent In-vehicle Terminals

4.1 Upstream Industry

The upstream industry chain comprises suppliers of core raw materials and technical components, including chip manufacturers, sensor producers, and communication technology providers. Chips, for instance, are crucial for intelligent in-vehicle terminals due to their need for high-efficiency data processing and computing. China's burgeoning integrated circuit industry has seen local players like Huawei and Unisoc excel in automotive chips. Huawei's Ascend AI chip supports complex deep learning calculations for in-vehicle terminals, finding widespread use in speech recognition and environmental perception systems.

Moreover, sensors serve as pivotal tools for the environmental perception of in-vehicle terminals, directly influencing their accuracy and real-time performance. In recent years, multi-modal sensors, including LiDAR, millimeter-wave radar, and cameras, have witnessed breakthroughs in resolution, perception distance, and anti-interference capabilities. For instance, Hesai Technology's 64-line LiDAR has gained widespread adoption in numerous autonomous driving projects due to its high resolution and cost-effectiveness. Nonetheless, the upstream industry chain confronts certain bottlenecks; on one hand, the high R&D investment in chips and sensors, coupled with significant technical barriers, has led to a concentrated supply chain. On the other hand, certain key components still rely on imports, necessitating further reduction of supply chain risks.

4.2 Midstream Industry

The midstream sector primarily comprises equipment manufacturers and system integrators, tasked with transforming upstream core technologies and raw materials into finished intelligent in-vehicle terminals that cater to market demands. Leading enterprises such as Desay SV have offered highly intelligent product solutions to automakers by continuously enhancing software and hardware integration capabilities. Desay SV's intelligent cockpit system, which integrates in-vehicle voice assistants, high-resolution displays, and panoramic images, markedly improves the in-vehicle interactive experience. Additionally, midstream enterprises prioritize modular and scalable design in product development and manufacturing to accommodate the customization requirements of various automakers. For example, Bosch's open platform facilitates rapid integration of third-party applications and algorithms, providing flexible solutions to vehicle manufacturers. However, fierce competition in the midstream industry prompts enterprises to continually increase R&D investments to solidify their technological advantages and market positions.

4.3 Downstream Industry

The downstream industry chain is dominated by automakers and end-users. Intelligent in-vehicle terminals provide consumers with an enhanced driving experience through deep integration with the entire vehicle. For example, BYD equips its high-end models with standard in-vehicle intelligent terminals, encompassing navigation, entertainment, driving assistance, and other functional modules, which bolster user brand loyalty and market competitiveness. With the rise of ride-sharing and online car-hailing, the application scenarios for intelligent in-vehicle terminals have broadened. In platforms like Didi and Gaode's online car-hailing services, in-vehicle terminals utilize location and traffic data to offer real-time recommendations and dynamic scheduling for drivers and passengers. However, the diverse needs of the downstream market impose higher standards on intelligent in-vehicle terminals, encompassing product stability, compatibility, and scalability. Therefore, terminal enterprises must continually optimize product design and service ecosystems to meet consumers' multifaceted expectations for intelligent driving experiences.

Market Size and Competitive Landscape

5.1 Market Size

The market for intelligent in-vehicle terminals has exhibited rapid growth in recent years. According to industry reports, the global market size increased from 169.758 billion yuan in 2019 to 307.190 billion yuan in 2023, marking a compound annual growth rate of 15.98% during this period. Notably, the Chinese market has been fueled by surging sales of new energy vehicles and the proliferation of IoT technology in vehicles. It is projected that from 2024 to 2028, the market size will expand from 374.150 billion yuan to 823.376 billion yuan, with the compound annual growth rate rising to 21.80%. The primary drivers of this growth include technological advancements, policy support, and diversifying user needs.

Technological progress is crucial for the expansion of the smart in-vehicle terminal market. With the continuous evolution of AI, big data, and 5G communication technology, the functionality and reliability of smart in-vehicle terminals have significantly improved. The widespread adoption of 5G communication technology has drastically accelerated the speed of information exchange between vehicles and between vehicles and infrastructure, providing robust network support for autonomous driving. Furthermore, vehicles with autonomous driving at Level 2 and above are becoming increasingly prevalent, and these vehicles heavily rely on smart in-vehicle terminals for multifunctional systems such as environmental perception, voice interaction, and navigation optimization. Especially in Level 3 and 4 autonomous driving systems, high-precision maps, LiDAR, and terminals work in tandem, further driving the demand for smart in-vehicle terminals.

Policy support has played a pivotal role in market growth. The Chinese government has issued several policies to bolster intelligent connected vehicles and their supporting technologies, such as the "Innovative Development Strategy for Intelligent Connected Vehicles" and the "Development Plan for the New Energy Vehicle Industry (2021-2035)." These policies have actively promoted infrastructure construction, lowered industry entry barriers, and advanced technology standardization. Government investment in IoT pilot projects has not only accelerated the application and promotion of in-vehicle terminals in specific scenarios but also provided a real-world testing environment for industry enterprises to further validate product reliability and safety.

The escalating demand for intelligent driving experiences among consumers has opened up vast market opportunities for smart in-vehicle terminals. Modern consumers perceive automobiles not merely as modes of transportation but as intelligent mobile spaces. The advancements in smart in-vehicle terminals in terms of safety, convenience, and entertainment align well with this shift. Brands like Tesla and Li Auto have significantly bolstered their market competitiveness and won user favor by integrating highly intelligent in-vehicle systems. These terminal devices encompass functions such as driving assistance, voice recognition, and in-car entertainment, offering users a differentiated experience and thereby increasing market acceptance and demand for smart in-vehicle terminals.

Looking ahead, with the continuous maturation of autonomous driving technology, the market demand for smart in-vehicle terminals will further expand. By 2030, it is anticipated that the market penetration rate of highly automated vehicles (Level 3 and above) will exceed 50% globally, with the demand for smart in-vehicle terminals in these vehicles being several times that of traditional models. Additionally, the gradual deployment of 6G networks will further enhance the technical capabilities of in-vehicle terminals, such as ultra-low latency and high-speed data transmission, giving rise to more intricate application scenarios. Thus, driven by multiple factors encompassing technology and market demand, the smart in-vehicle terminal industry holds immense development potential, with considerable room for market expansion.

5.2 Competitive Landscape

Currently, the competitive landscape of the smart in-vehicle terminal industry is highly concentrated, with leading enterprises occupying a dominant position through technological innovation and market expansion. Key players include Desay SV, NavInfo, Huawei, Bosch, among others. These enterprises have distinguished themselves in the competitive market through sustained R&D investments and technological upgrades. For instance, Desay SV has successfully launched multiple highly integrated in-vehicle terminal products leveraging its deep technical expertise in smart cockpits and IoT. By the end of 2023, its R&D investment accounted for 9.26% of operating revenue, with R&D personnel comprising 45.26% of the total workforce, underscoring the company's robust technological innovation capabilities. Furthermore, Desay SV has emerged as a significant supplier in the Chinese in-vehicle terminal market through deep collaborations with vehicle manufacturers.

The competitive landscape is primarily shaped by technological thresholds, capital investment, and talent scarcity. The core technologies of smart in-vehicle terminals encompass sensor fusion, edge computing, speech recognition, high-precision maps, and other fields, which demand substantial time and capital investment for development. Qualcomm has continuously invested in the automotive chip sector, providing powerful computing performance and low-power support for in-vehicle terminals through its Snapdragon Ride platform. In the sensor field, companies like Hesai Technology have significantly enhanced the environmental perception capabilities of terminal devices through breakthroughs in hardware technologies such as LiDAR. The development of in-vehicle terminals demands a high level of talent, and the supply of high-end, multidisciplinary talents (e.g., AI algorithm engineers and IoT protocol designers) is insufficient, further raising industry entry barriers.

In the future, the competitive landscape of the smart in-vehicle terminal industry will continue to concentrate around leading enterprises, primarily due to the significant economies of scale associated with the "intelligent vehicle network ecosystem" they have established. These ecosystems integrate smart cockpits, intelligent driving, and IoT, further enhancing user stickiness through multi-scenario coverage and service optimization. Huawei, for example, cooperates with multiple vehicle manufacturers through its HiCar platform, offering integrated solutions ranging from in-vehicle hardware to software applications, encompassing navigation, audio-visual entertainment, intelligent voice interaction, and other fields. Additionally, leading enterprises leverage their technological advantages and brand influence to dominate the process of industry standard formulation. Bosch's participation in industry standardization activities has laid a solid foundation for the global expansion of its in-vehicle terminal products.

It is noteworthy that the high concentration of the industry does not preclude opportunities for small and medium-sized enterprises. Some innovative startups are carving out niches in specific fields through technology segmentation and differentiation strategies. Some companies focus on developing in-vehicle entertainment systems or voice interaction technologies, providing modular solutions to automakers. Moreover, with the rise of open platforms, vehicle manufacturers are actively collaborating with small and medium-sized enterprises to co-develop in-vehicle terminal applications tailored to their needs.

In conclusion, future competition in the smart in-vehicle terminal industry will extend beyond mere product performance comparisons to encompass contests of ecosystem building capabilities. By integrating resources and overcoming technical barriers, leading enterprises are expected to secure a larger share of the global market, while small and medium-sized enterprises must innovate and cooperate to carve out new survival spaces.

Technical Challenges of Smart In-vehicle Terminals

As the cornerstone of the IoT and autonomous driving domains, smart in-vehicle terminals confront various technical challenges amidst escalating functionality and technological complexity. These challenges encompass data processing and real-time performance, as well as crucial issues like network latency, communication security, and user privacy protection. Addressing these technical bottlenecks is crucial for propelling industry development and enhancing user experience.

6.1 Data Processing and Real-time Performance

The diversification of smart in-vehicle terminal functions and the complexity of application scenarios have made real-time processing of massive data a core challenge. In multi-sensor fusion autonomous driving systems, in-vehicle terminals must integrate data from various sensors, including LiDAR, millimeter-wave radar, and high-definition cameras, which often reach hundreds of gigabytes per second. In highway scenarios, vehicles must instantaneously perceive the distance, speed, lane position, and obstacle information of surrounding vehicles, with this data processed and fed back to the driving decision system within milliseconds. Currently, most in-vehicle terminals utilize chips with limited computing power, struggling to support efficient processing in complex scenarios. This computational limitation not only affects the reliability of autonomous driving but may also lead to decision delays, posing safety hazards.

To tackle this issue, a variety of technological advancements have emerged in recent years. NVIDIA's Orin in-vehicle computing platform, exclusively designed for autonomous driving, boasts a computing power of up to 254 TOPS (tera operations per second), significantly enhancing the real-time data processing capabilities of in-vehicle terminals. Furthermore, the application of edge computing technology has opened up new avenues for in-vehicle terminals. By shifting some data processing tasks from the cloud to in-vehicle terminals or edge nodes, it reduces latency and improves system response speed. Baidu's Apollo platform leverages edge computing to achieve low-latency environmental perception and path planning. However, the widespread adoption of edge computing still faces hurdles, such as high hardware costs and the delicate balance between computing power and energy consumption.

6.2 Network Latency and Communication Security

Network latency is a pivotal factor influencing the communication efficiency and driving safety of smart in-vehicle terminals. These terminals need to interact with other vehicles, infrastructure, and the cloud through V2X (vehicle-to-everything) technology, where low-latency networks are essential for ensuring data real-time performance. In autonomous driving scenarios, when a vehicle detects a potential collision risk, it must transmit alert information to surrounding vehicles within a millisecond through V2V (vehicle-to-vehicle) technology. High network latency can delay information transmission, thereby increasing accident risks.

Currently, the proliferation of 5G networks provides robust technical support for reducing communication latency, with end-to-end latency as low as 1 millisecond. Nonetheless, 5G still has limitations in coverage and stability, particularly in remote areas and complex road conditions, where network performance may fall short of expectations. As 6G technology research and development advance, smart in-vehicle terminals are expected to achieve even more efficient information interaction in the future, but commercial application of this technology still requires time.

Communication security is another significant technical challenge faced by smart in-vehicle terminals. With frequent data uploads and downloads, their communication links are highly vulnerable to cyberattacks. Hackers could intercept communication between in-vehicle terminals and the cloud, tamper with driving instructions, or steal user privacy data. To mitigate this threat, the industry has progressively introduced multi-layered data encryption and authentication mechanisms. For instance, blockchain technology is applied to V2X communication networks, ensuring data integrity and security during transmission through distributed ledgers and encryption algorithms. However, blockchain technology faces challenges such as high computing power consumption and low transaction speed in practical deployments, and its application in the field of smart in-vehicle terminals is still in its nascent stages.

6.3 User Privacy Protection

The widespread adoption of smart in-vehicle terminals has led to extensive collection and processing of user data, including driving behavior data, location data, voice commands, and images captured by in-car cameras. While these data enhance personalized services, they also pose risks of privacy breaches. For example, some automakers' in-car navigation systems record users' driving routes and upload them to the cloud, and unauthorized access or misuse of this information can severely infringe on user privacy.

Currently, privacy protection has emerged as a critical issue in the smart in-vehicle terminal industry. The implementation of China's "Data Security Law" and "Personal Information Protection Law" has raised the bar for industry compliance. Regulations mandate that automakers and terminal manufacturers must clearly inform users and obtain their consent when collecting user data. Additionally, enterprises must employ technological means to anonymize sensitive data, thereby reducing the risk of data abuse. Some enterprises, such as Tesla, have already begun exploring this area by storing user data locally and restricting cloud uploads, thereby enhancing user trust in privacy protection. However, beyond technological measures, the industry must also establish more transparent privacy protection standards and conduct audits and supervision of enterprises' privacy practices through third-party institutions to foster a safer industry ecosystem.

Policy Support and Future Prospects

The evolution of smart in-vehicle terminals is fueled not only by technological advancements and market demand but also by policy guidance and support. In recent years, the Chinese government has promulgated a series of policy measures to propel the rapid development of smart in-vehicle terminals and related industries. From infrastructure construction to standard system enhancement, from demonstration application promotion to legal and regulatory frameworks, these policies have provided a solid foundation for the industry's growth. As technology advances and the market matures, the future trajectory of the industry is becoming increasingly clear, encompassing technological upgrades, market expansion, and the formation of a global competitive landscape.

7.1 Policy Support

Infrastructure Construction

Infrastructure construction is indispensable for the development of smart in-vehicle terminals. The government has invested heavily in upgrading the Internet of Vehicles infrastructure, creating a conducive environment for the practical application of smart in-vehicle terminals. The "Pilot Work Plan for the 'Vehicle-Road-Cloud Integration' Application of Intelligent Connected Vehicles" underscores the importance of smart road construction and the promotion of V2X communication technology in vehicle-road coordination. The progress of pilot projects has provided opportunities for technical validation of smart in-vehicle terminals and facilitated technical collaboration among enterprises. For instance, in the autonomous driving demonstration zones in Chongqing and Wuhan, smart road equipment can already communicate in real-time with in-vehicle terminals, offering dynamic traffic signals and precise navigation support for autonomous vehicles.

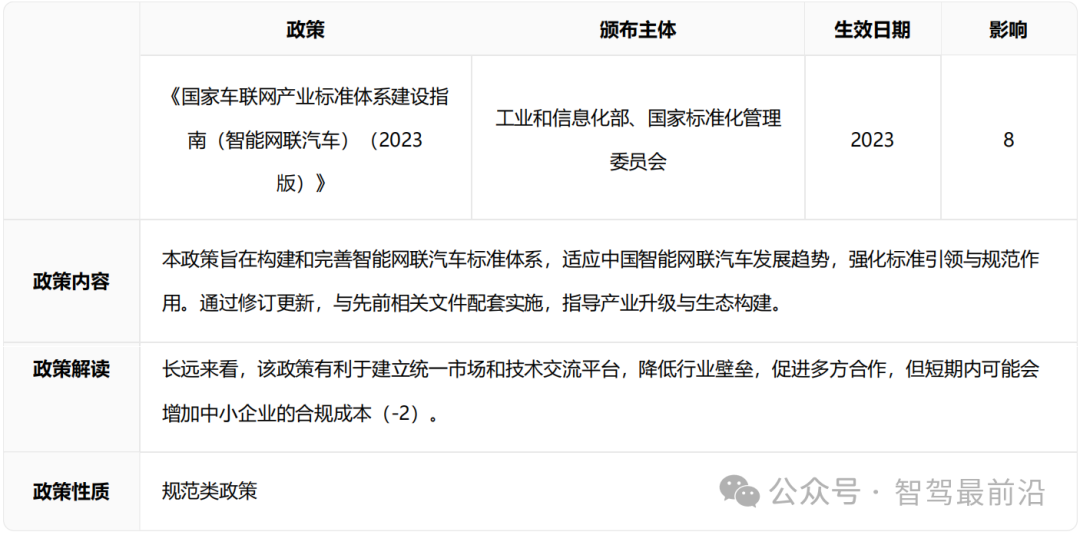

Standard System Improvement

The formulation and promotion of industry standards are crucial for the widespread adoption of smart in-vehicle terminals. The "National Guideline for the Construction of the Industrial Standard System for the Internet of Vehicles (Intelligent Connected Vehicles)" released in 2023 outlines a multi-dimensional standard framework encompassing hardware interfaces, communication protocols, safety testing, and privacy protection. Standardization not only enhances product compatibility and safety but also reduces development costs and avoids redundant investments by enterprises. When developing Internet of Vehicles standards, China has drawn upon the technical frameworks of the International Organization for Standardization (ISO) and the Society of Automotive Engineers (SAE) while incorporating local technical practices and market demands, giving Chinese enterprises a competitive edge in international markets. Furthermore, standardization has facilitated technological collaboration among enterprises, such as the partnership between technology companies like Tencent and Huawei and traditional automakers to develop more compatible smart in-vehicle terminal solutions.

Legal and Regulatory Guarantees

As the functionalities of smart in-vehicle terminals expand, issues related to data security and privacy protection have garnered increasing social attention. The enactment of China's "Data Security Law" and "Personal Information Protection Law" has set legal boundaries for industry development, compelling enterprises to adhere to compliance requirements during the collection, storage, and use of user data. For instance, regulations stipulate that when in-vehicle terminals collect user location data, they must ensure data encryption during transmission and prohibit commercial use without user consent. Additionally, the "Innovative Development Strategy for Intelligent Vehicles" emphasizes the protection of network and data security, encouraging enterprises to develop in-vehicle terminal equipment that meets international safety standards. Driven by policies, enterprises have progressively increased their R&D investments in data encryption, anonymization, and security certification, thereby bolstering user trust and the industry's overall sustainable development.

7.2 Future Prospects

Technological Intelligent Upgrade

In the future, with the maturation of 6G communication technology and quantum computing, the performance of intelligent in-vehicle terminals will undergo a significant enhancement. For example, 6G networks' ultra-low latency (expected to be less than 0.1 milliseconds) and ultra-high-speed transmission (1000 times faster than 5G) will further elevate the efficiency of data interaction between in-vehicle terminals and the cloud. This will enable the implementation of more high-real-time application scenarios, such as multi-vehicle collaborative driving in complex road conditions and real-time high-precision map updates. Meanwhile, the introduction of quantum computing is anticipated to address the computing power constraints of in-vehicle terminals in processing ultra-large-scale data, providing robust support for multi-sensor fusion. Additionally, virtual reality (VR) and augmented reality (AR) technologies will be more extensively applied in smart cockpits, allowing drivers to interact more intuitively with the vehicle system through head-mounted display devices, such as 3D display of real-time navigation information and simulation of complex driving scenarios.

Further Market Expansion

With the proliferation of autonomous driving technology, the market demand for intelligent in-vehicle terminals will experience exponential growth. By 2030, it is anticipated that the penetration rate of highly autonomous vehicles (Level 3 and above) in China will exceed 50%. These vehicles rely heavily on intelligent in-vehicle terminals compared to traditional vehicles. For instance, Level 4 autonomous vehicles necessitate the integration of high-precision maps, multi-modal perception systems, and in-vehicle interaction devices, all supported by intelligent in-vehicle terminals. Additionally, the rise of ride-sharing and smart logistics has created new growth avenues for the in-vehicle terminal market. For example, autonomous taxis (Robotaxis) and driverless cargo vehicles, driven by market demand, will become pivotal application scenarios for intelligent in-vehicle terminals.

Formation of Global Competitive Landscape

As intelligent in-vehicle terminal technology continues to evolve, global market competition is intensifying. China, the United States, and Europe have emerged as the three primary regions for industry development, with governments and enterprises striving to gain a competitive edge through policy support and technological innovation. For instance, Chinese enterprises are gradually gaining traction in the global market, backed by localized policies and substantial market demand. Huawei's HiCar platform and Baidu's Apollo platform have already garnered international influence. In the European and American markets, companies like Tesla and Bosch maintain their leadership through technological innovation and brand effect. As industry standards gradually converge, Chinese enterprises are expected to capture a larger share of the global market based on their technological prowess and cost advantages.

In summary, policy support fosters a conducive external environment for the development of intelligent in-vehicle terminals, while technological innovation and market demand serve as the internal drivers propelling the industry forward. Looking ahead, intelligent in-vehicle terminals will continue to play a pivotal role in the automotive industry's intelligent transformation, fueled by the synergy of technology, market, and policy. Simultaneously, they will also encounter new development opportunities and challenges in the global competitive landscape.

Conclusion

As a vital component of the Internet of Vehicles and autonomous driving, intelligent in-vehicle terminals have achieved remarkable progress over the past decade. Evolving from simple navigation and entertainment functions to highly integrated environmental perception and driving assistance systems, intelligent in-vehicle terminals have become cornerstone technologies in the automotive industry's intelligent transformation. However, their rapid advancement has also been accompanied by numerous technical challenges, including data processing, communication security, and privacy protection. Additionally, the industry's high technical barriers and market concentration make it difficult for small and medium-sized enterprises to enter, with competition primarily concentrated among leading players.

Owing to policy incentives and relentless technological advancements, the market for intelligent in-vehicle terminals boasts promising prospects. It is anticipated that, fueled by the proliferation of autonomous driving and the burgeoning demand for ride-sharing services, the market size will accelerate at a rapid pace. Furthermore, the incorporation of novel technologies like 6G communication, quantum computing, and artificial intelligence offers boundless opportunities for refining terminal functionalities and expanding application scenarios. Nonetheless, to ensure sustainable growth within the industry, it remains crucial to address concerns over data security and privacy protection, while fostering a balanced global competitive environment through standardization and international collaboration. In the foreseeable future, intelligent in-vehicle terminals will continue to spearhead the automotive industry's intelligent transformation, driven by both technological advancements and market forces, ultimately delivering safer, more efficient, and more convenient travel experiences for humanity.

-- END --