Xiaomi, JD.com, Alibaba, and Tencent Lead the Charge: A Major "Arms Race" in Embodied Intelligence

![]() 03/31 2025

03/31 2025

![]() 812

812

In our previous article, "Why China Will Likely Shine Alone in the Global 'Embodied Intelligence Era'?" we proposed that embodied AI, or physical AI, is igniting the next wave of AI innovation. Endowing AI with physical entities has emerged as a pivotal direction for the future of the AI industry and will undoubtedly become a focal point of AI competition among major powers.

In this grand game of technological prowess, beyond the comparison of industrial ecosystem development and policy support, the competition among leading enterprises across various countries in terms of technological research and development, as well as scenario implementation, is paramount. Recently, both domestic giants and startups have significantly ramped up their efforts, making the embodied intelligence track a magnet for investment. Following the trend of large models, a fresh round of AI's "arms race" has already commenced.

Clustering of Enterprises in Embodied Intelligence and a Surge in Startup Funding

Towards the end of 2024 and the beginning of 2025, substantial capital flooded into the embodied intelligence sector.

In December 2024, Beijing Xiaoyu Intelligent Manufacturing Technology Co., Ltd., the first large model robot company invested in by Xiaomi, announced the completion of its A round of financing worth hundreds of millions of yuan. This round was exclusively funded by the Beijing Information Industry Development Investment Fund. This marks the second time Xiaoyu Intelligent Manufacturing has secured financing at the hundred million yuan level, following its angel round. The company focuses on developing large model robot technology tailored for the industrial field, aiming to create a "universal brain" for robots capable of adapting to diverse tasks.

On January 7, 2025, Zhipingfang announced the completion of hundreds of millions of yuan in Pre-A round strategic financing, jointly led by Fortune Capital and DH Asset Management, with Cornerstone Capital as a follow-on investor. Founded by Dr. Guo Yandong, a national-level innovative leading talent, Zhipingfang is the earliest enterprise in China to explore the end-to-end VLA technology route and has consistently maintained an industry-leading position. In 2024, it pioneered the commercialization of intelligent robots equipped with end-to-end VLA embodied large models. On March 6, Zhipingfang swiftly announced the completion of a new round of Pre-A+ financing exceeding hundreds of millions of yuan, successfully securing two rounds of financing totaling hundreds of millions of yuan within just two months. The funds will primarily be utilized to propel the application of embodied intelligent robots in large-scale commercial scenarios. Reports indicate that Zhipingfang's domestic embodied large model significantly outperforms Silicon Valley's leading models in terms of general spatial perception and generalization operation success rate. Its self-developed AI2R Brain embodied large model has been successfully deployed on the Alpha Bot series of robots.

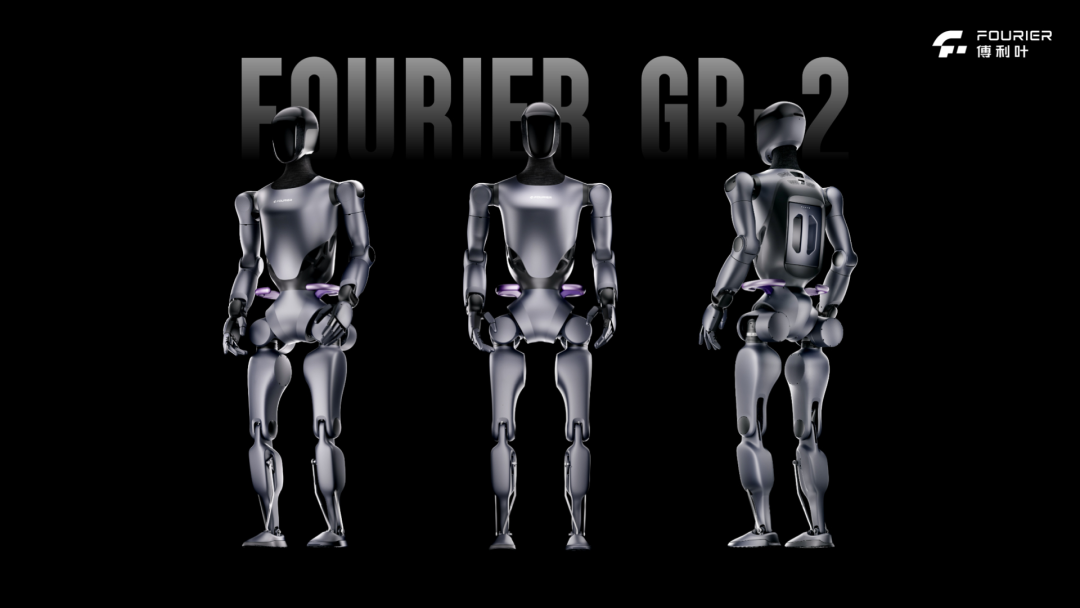

Also on January 7, Fourier Intelligence announced the completion of a new round of financing, with the total amount of Series E financing reaching nearly 800 million yuan. This round was jointly participated in by institutions such as Guoxin Investment, Pudong Venture Capital, Zhangjiang Science & Technology Investment, Zhangke Yaokun Fund, Prosperity7, and Junshan Capital. The company's mission is to "create the best embodied ontology for AI." In the recently concluded 2024, Fourier Intelligence launched the GRx series of robotic products, including the GR-2.

Figure: Fourier Intelligence's GRx series robotic product GR-2

On February 6, Lingcifang Robotics, a developer of embodied intelligent humanoid robots, completed tens of millions of yuan in angel round financing and secured tens of millions of yuan in orders. The company was founded in January 2025 and is jointly incubated by Tsinghua University and the Jianghuai Frontier Technology Collaborative Innovation Center. This year, it plans to achieve mass production and deployment of over 500 multi-model humanoid robots across various industries, including service, education, entertainment, and exhibition.

In mid-February, embodied intelligence startup Independent Variable Robotics (X Square Robot) completed hundreds of millions of yuan in Pre-A++ round financing. This round was led by Lightspeed China Partners and Legend Capital, with follow-on investments from Beijing Robotics Industry Fund and Shenqi Capital. The funds will be used for the training and scenario implementation of the next-generation unified embodied intelligence general large model. Independent Variable Robotics was founded in December 2023 and is dedicated to realizing universal robots through the research and development of embodied intelligence general large models. In November 2024, it completed hundreds of millions of yuan in Pre-A and Pre-A+ round financing.

Major Players Compete to Enter the Field

Parallel to the startup funding surge is the race by major players to secure their positions, with many startups being backed by these industry giants.

Earlier, Alibaba participated in the strategic financing of universal robot startup Zhuji Power, Meituan invested in Yinhe Universal and Unitree Robotics, and Tencent invested in Leapmotor and UBTECH years ago. More recently, on February 20, Xinghaitu announced the completion of a new round of A round financing totaling nearly 300 million yuan. This round was exclusively led by Ant Group, with continued investments from existing shareholders such as Hillhouse Capital, IDG Capital, Beijing Robotics Industry Fund, Baidu Ventures, and Tongge Venture Capital.

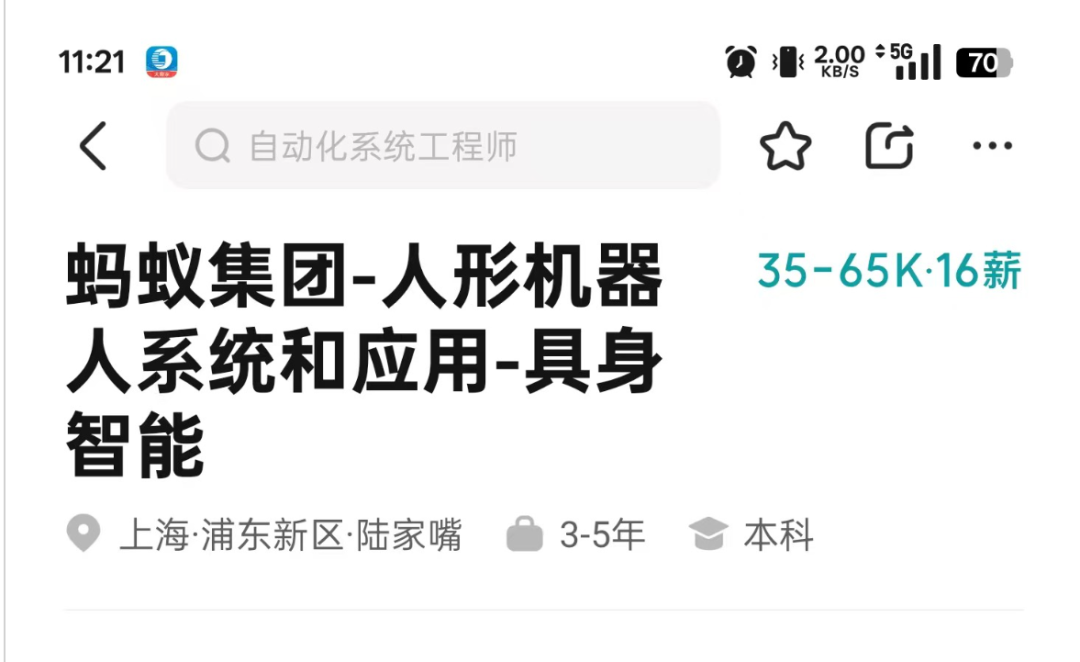

Recently, Ant Group also posted multiple job openings related to embodied intelligence on recruitment platforms, attracting considerable attention. Industry insiders revealed that Ant Group had already been advancing embodied intelligence-related businesses in 2024. Ant Group officially responded that the group continues to expand its layout and increase investment in artificial intelligence. Last year, it registered and established Ant Lingbo Technology Co., Ltd., focusing on embodied intelligence technology and product research and development.

Similarly, Zhiyuan Robotics, founded by "Mr. Zhi Hui Jun," recently completed a new round of financing led by Tencent. According to insiders, Zhiyuan Robotics is also in talks for a new round of financing at a valuation of 15 billion yuan.

In addition to external investment methods like financing, some major players have directly entered the field from within. Recently, Shanghai Securities News reported that JD.com has ventured into the embodied intelligence sector, focusing on household scenarios, and has established relevant business departments. Sources close to JD.com stated that the company places great emphasis on innovation and application in fields such as artificial intelligence, automation, and robotics, with multiple internal teams also deploying research and development in cutting-edge directions like embodied intelligence.

Moreover, there are major players aiming to build an ecosystem and become "shovel sellers." For instance, in November 2024, the Huawei (Shenzhen) Global Embodied Intelligence Industry Innovation Center was established and signed strategic cooperation memoranda with 16 enterprises, including Leapmotor, Han's Robot, Topstar, Zhongjian Technology, and Zhaowei Machinery and Electronics. It is understood that this innovation center was established through cooperation between Huawei, the Qianhai Administration of Shenzhen, and the People's Government of Bao'an District. The relevant person in charge revealed that Huawei will collaborate with upstream and downstream enterprises in the industrial chain in the later stages to build embodied intelligence basic laboratories, create an embodied intelligence product technology trading platform, and apply it in relevant application scenarios. Guotai Junan Securities Research Institute believes that Huawei's positioning in the humanoid robot industry may be akin to NVIDIA, existing as a "shovel seller." "For Huawei, how to effectively market its Ascend chips and build an ecosystem is the most important and urgent task at present."

Overall, with the impetus of top-level policies and the active layout of enterprises, China's embodied intelligence industry is demonstrating a robust development trend. According to data from Top Research Institute, in 2023, the market size of embodied intelligence in China reached 157.27 billion yuan. With technological breakthroughs on the large model front, the market size of embodied intelligence is anticipated to grow at a compound annual growth rate of 16.5% to reach 225.9 billion yuan by 2027.

Challenges in Technology and Commercial Implementation

However, as the embodied intelligence industry is still in its nascent stage, enterprises entering this field need to overcome challenges in multiple aspects, including technology stacks, data accumulation, cost control, and commercialization:

Technical Challenges

The core of embodied intelligence lies in enabling AI to interact with the physical world, necessitating breakthroughs in the three crucial links of perception, decision-making, and execution.

Firstly, at the computing and algorithm level, the success of large models like GPT-4 and Gemini has propelled AI's progress in natural language understanding and reasoning abilities. However, in the realm of embodied intelligence, relying solely on large models is insufficient; it is essential to integrate methods such as reinforcement learning (RL) and imitation learning (IL) to empower agents with decision-making capabilities in real environments. Simultaneously, due to the extensive environmental interaction involved in embodied intelligence, self-supervised learning becomes paramount. For example, Meta AI utilizes self-supervised visual learning to optimize the visual perception ability of robots. Traditional tactile systems employ separate models for each task, heavily reliant on labeled data and specific sensors. Meta Sparsh completely revolutionizes this approach. As a universal model, it can adapt to various sensors and tasks, utilizing self-supervised learning on a vast database comprising over 460,000 tactile images, without the need for labeled data.

Then, at the perception layer, embodied intelligence needs to "see, hear, touch, and move" like humans. Therefore, multi-sensor fusion is a significant direction for technological advancement. Among various perception systems, the visual system is undoubtedly the most critical environmental perception channel for humanoid robots - binocular cameras provide color and depth information, lidar offers detailed environmental modeling, millimeter-wave radar can operate round-the-clock, and infrared sensors can adapt to low-light environments. Different sensors complement each other across various dimensions of visual perception, making the trend of multi-sensor fusion evident. Additionally, sensors such as hearing, touch, and encoder inertial measurement units (IMU) also play crucial roles in embodied intelligence environmental interaction, flexible movement, and posture balance.

Finally, at the movement and execution layer, there is ample room for development in directions such as humanoid robots, quadruped robots, and flexible robotic arms, exemplified by Boston Dynamics' Spot and Tesla Optimus' biomimetic muscle joint design. Currently, one of the bottlenecks faced by embodied intelligence is the issue of energy consumption. Startups can explore ultra-low-power chips (like the RISC-V architecture) and efficient battery management systems (BMS) to enhance robots' endurance.

Data and Cost Dilemmas

Despite the rapid development of embodied intelligence technology, for enterprises entering this field, particularly startups, the lack of training data is a pressing challenge that needs to be addressed. Embodied intelligence demands massive amounts of interactive data, but data acquisition faces bottlenecks: on one hand, real-world interactive data is difficult to collect and relies on physical environment testing, which is costly; on the other hand, the domestic data closed-loop ecosystem is immature, lacking large-scale available embodied intelligence datasets.

However, enterprises also have corresponding strategies, such as utilizing simulation environments (like Mujoco, Isaac Sim) for large-scale simulation training and integrating Sim2Real (simulation to reality) migration technology to reduce dependence on real data. Federated Learning can also be adopted to share interactive data from different enterprises and lower data training costs.

Apart from data issues, embodied intelligence involves real-time perception, computation, and control, requiring robust computing capabilities. However, high-performance computing chips are costly, making them unaffordable for startups. In this regard, the recently emerged lightweight models represent a significant breakthrough tool. Furthermore, the development of a domestic computing ecosystem is urgent, and a mature domestic supply chain can reduce the cost of core hardware.

Business Model Challenges

Lastly, the business model of embodied intelligence is still being explored. Due to high costs, it is challenging to swiftly promote the C-end market, while the implementation of B-end applications has a lengthy cycle. In the future, enterprises might explore the "Robots as a Service (RaaS)" model, allowing customers to utilize robots through leasing, thereby reducing the initial investment cost for customers.

Postscript

Embodied intelligence is not only the next battlefield for technological competition but also has the potential to restructure productivity and lifestyle, becoming a new generation of universal technology platforms following smartphones and electric vehicles. Amidst the intensifying global technological competition, if China's embodied intelligence startups can find breakthroughs in technology, data, cost, and implementation, they are poised to carve out a niche in the global market.

References:

Zhipingfang Secures Hundreds of Millions of Yuan in Pre-A+ Round Funding, Successfully Completing Two Rounds of Financing Totaling Several Hundred Million Yuan in Just Two Months, Investment Circle

Fourier Intelligence Announces Closure of Latest Financing Round, Bringing Total Series E Funding to Nearly 800 Million Yuan, Fourier Intelligence Official Website

"Lingcifang Robotics," Founded by a Team of Post-00s Alumni from Tsinghua University, Closes Angel Round with Tens of Millions of Yuan in Investment, Investment Circle

Independent Variable Robotics Raises Hundreds of Millions of Yuan in Pre-A++ Round within a Month, Backed by Cornerstone Capital

JD.com Confirms Entry into the Field of Embodied Intelligence, Establishing Multiple Internal Teams for Cutting-Edge R&D Initiatives, IoT Media

Huawei Establishes Global Embodied Intelligence Industry Innovation Center, Positioning Itself as a Key Enabler in the Sector, Yicai Global

Pushing the Boundaries of Embodied AI: Meta's Approach to Infusing Human-Like Touch and Dexterity into AI Systems, UNITE.AI

Embodied Intelligence Series (II): Sensors - Empowering Robots with the Capacity to Perceive the World, Sina Finance