Critical Market Dynamics: NVIDIA's H20 AI Chip, Despite 80% Performance Cap, Witnesses Surge in Demand in China

![]() 04/07 2025

04/07 2025

![]() 554

554

Recent media reports have highlighted a shortage of NVIDIA's H20 chips in the Chinese market. Some Original Equipment Manufacturers (OEMs) have revealed that H20 inventories are nearly exhausted, prompting them to prioritize profits and allocate supplies to major customers.

This supply shortage has resulted in price inversions, with servers equipped with H20 experiencing price hikes, and vendors who can secure H20 chips raising their sales prices accordingly.

What is the H20 chip? It is NVIDIA's restricted AI chip, based on the H100 but with over 80% of its performance limited, specifically tailored for the Chinese market.

Not only is its performance restricted, but it has also undergone adjustments in architecture and software compatibility, such as retaining the Hopper architecture while disabling key tensor cores and limiting overclocking and cluster expansion through firmware locks.

Nevertheless, it is currently the only dedicated AI chip that NVIDIA can legally sell in China. More powerful AI chips like the H100, A100, H800, A800, H200, GB200, and others are all banned from being sold to the Chinese market by the United States.

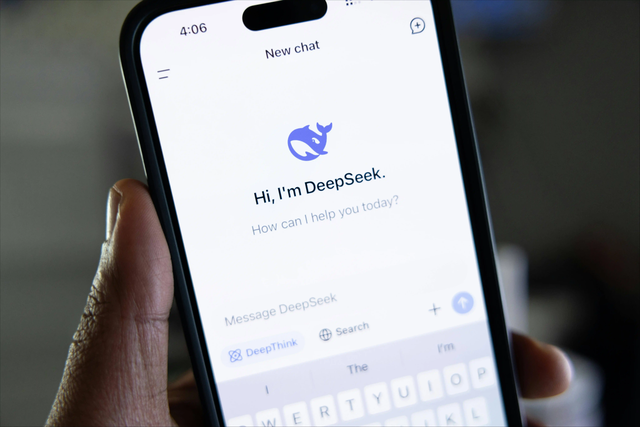

Initially, it was believed that such H20 chips would not be popular in China due to the availability of domestic chips with stronger performance. Furthermore, with the rise of Deepseek (DS) in 2025, the demand for computing power seemingly declined, with many viewing DS as the disruptor bursting NVIDIA's computing power bubble.

So, why is the H20 still so sought after in the Chinese market? The reason is straightforward: in the short term, DS has actually catalyzed the demand for AI chips.

Due to the popularity of DS, local governments, financial institutions, automakers, internet companies, and others are all rushing to deploy privatized models, leading to exponential growth in the demand for GPUs, the computing power infrastructure supporting this AI deployment.

While the H20's performance is limited and not as powerful as the H100, it is perfectly suited for applications like DS that do not require high computing power for large models. Its lower performance can still be advantageous in such scenarios.

Another significant advantage of the H20 is its CUDA ecosystem, coupled with its large memory capacity. The standard version is equipped with 96GB of HBM3 memory, while the newly launched H20 version boasts an increased memory capacity of 141GB, which is highly beneficial for AI deployments.

According to experts, if a model is originally trained using CUDA, switching to another ecosystem without CUDA could require up to six months of time and effort, with no guarantee of success, posing significant risks.

Therefore, many companies prefer using the restricted H20 over domestic AI chips because, despite its lower performance, it still functions within the robust CUDA ecosystem.

Data indicates that H20 sales in China reached $12 billion in 2024 and are projected to exceed $20 billion in 2025. This underscores the seriousness of the situation in the AI chip field, and domestic AI vendors must step up their efforts, not only in enhancing their chips but also in strengthening their ecosystems.