Humanoid Robots: Emerging as the New Frontier

![]() 04/07 2025

04/07 2025

![]() 753

753

At the 2025 Zhongguancun Forum Annual Meeting, humanoid robots stole the spotlight. Domestic heavyweights like JiaSuEvol, Tiangong, and Lingbao CASBOT showcased their diverse offerings, illustrating significant strides from technological advancements to real-world applications. JiaSuEvol's T1 robot garnered attention due to its mass production and deployment in high-difficulty scenarios: Eight T1 robots executed challenging tasks such as climbing a 10° slope and forming dance formations during the opening ceremony, and served as moderators for sub-forums, demonstrating their multi-modal interaction capabilities backed by 200 TOPS of computing power. The product has achieved hundreds of deliveries worldwide, with core team members from Tsinghua University's Robotics Control Laboratory, underscoring a robust technological foundation.

The debut of Tiangong 2.0 highlighted breakthroughs in industrial-grade performance. As China's first robot capable of adaptive walking on complex terrain, it features a dual-battery quick-change system, coupled with millimeter-level dynamic operation precision and 550 TOPS of end-side computing power, enabling it to handle generalized terrains like stairs and sandy areas, providing technical support for specialized scene operations. Lingbao CASBOT's CASBOT 01, with 52 degrees of freedom and 550 TOPS of computing power, demonstrated versatility in welcoming and hosting events, and at the closing ceremony, actual application cases confirmed the transition from stage to reality.

Galbot robots from Galaxy Universal and coffee robots collaborated to complete retail scene services, while Songyan Power's N2 robot entered the commercial market with a starting price of 39,900 yuan, capturing attention with performance features such as backflips and a running speed of 3.5 meters/second. These products collectively point to a trend: The industry is transitioning from "technological showmanship" to deep scene cultivation. Jin Wei, member of the Standing Committee of the Beijing Municipal Party Committee and Deputy Mayor, mentioned at the forum that humanoid robots, alongside open-source projects like RISC-V and Chang'an Chain, constitute an innovative ecosystem, with policies and industrial chain coordination accelerating technology commercialization.

At the conference, the "Fifteen Key Directions for Embodied Intelligence" were unveiled, marking the first time China has compiled a systematic roadmap for embodied intelligence technology development. These directions encompass: multimodal embodied perception, embodied autonomous learning, embodied large models, embodied world model construction, embodied manipulation, embodied navigation and path planning, embodied human-robot collaboration, group embodied intelligence, embodied knowledge reasoning, embodied intelligence simulation platforms, migration and generalization from embodied intelligence simulation to real environments, embodied intelligence security, embodied dialogue and interaction, embodied reinforcement learning and adaptive control, and embodied consciousness and emotion.

In 2025, embodied intelligence was included in the government work report for the first time. It has emerged as a critical direction for China's future industry cultivation and a "key area" in global technological competition and cooperation, marking a new stage in the deep integration of artificial intelligence and the real economy. As a quintessential representative of embodied intelligence, humanoid robots are regarded as one of the best carriers for realizing embodied intelligence.

Relevant data indicates that China's embodied intelligence market exceeded 480 billion yuan in 2024. From a scientific research perspective, embodied intelligence offers a fresh perspective for the industry to understand human intelligence's essence. From a technological application standpoint, embodied intelligence boasts extensive application prospects. From an industrial layout perspective, there are over 100 related enterprises in China, with total financing exceeding 10 billion yuan. Among them, service robots, intelligent manufacturing, and other sub-sectors have become hotspots, with embodied intelligence achieving breakthroughs in various fields such as logistics handling, industrial manufacturing, healthcare, and elderly care.

01

Humanoid Robots Experience an "Order Explosion"

Since the beginning of this year, the domestic robot market has continuously introduced "new products," with humanoid robots maintaining high popularity. Behind the heated market, people are also inquisitive about the actual implementation scenarios for humanoid robots and who is acquiring these robots.

According to CCTV news reports, practitioners have stated that the popularity of humanoid robots has surged since the year's start. Currently, factory orders are fully booked, with new orders continually pouring in. Robots are rapidly integrating into our daily lives, and for manufacturers, the stage of "mass production competition" has already commenced.

Leju (Suzhou) Robotics Technology Co., Ltd. recently announced that the company's current orders have been scheduled until May or June, with basically one robot needing to be delivered for every one that rolls off the production line. This production line was commissioned at the end of 2024 and can produce approximately 2 to 3 humanoid robots per day.

Wang Song, the company's general manager, revealed that the current application scenarios for these humanoid robots primarily fall into three areas: the first is scientific research and laboratories, the second is humanoid robots for guiding and shopping assistance in exhibition halls and commercial services, and the third is material sorting and handling in industrial scenarios.

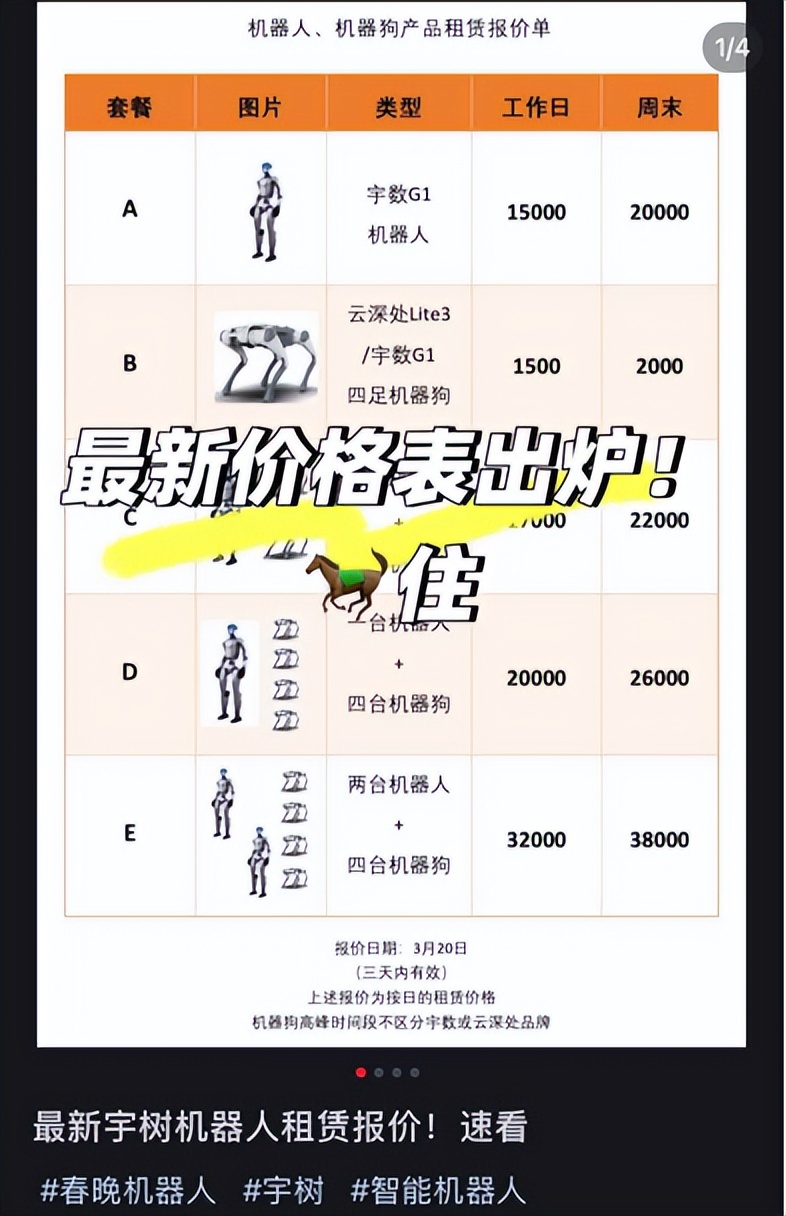

In addition to manufacturers producing humanoid robots, many businesses have keenly sensed business opportunities and opened up a new market for robot leasing. By searching the second-hand market, e-commerce platforms, and social media, it is evident that the current robot market is booming, with leasing prices averaging over 1,000 yuan per day. Although the Spring Festival Gala featured Unitree Technology's H1 robot, the majority of robots currently available for rent on second-hand leasing platforms are G1 humanoid robots and Go2 robot dogs. Even so, many stores still advertise "Spring Festival Gala same-model humanoid robot rentals" on their sales pages to attract customers.

From a leasing price perspective, there is considerable variation in the market, with daily rental prices generally ranging from 1,000 to 25,000 yuan. Leasing services are comprehensive, providing not only on-site goods but also technical personnel for performance support. The leasing fees cover a series of services such as robot transportation, debugging, and on-site support.

The thriving robot leasing market is becoming a pivotal lever for tapping into the consumer-grade C-end market. With the deep integration of embodied intelligence technology and large models, humanoid robots have transcended the limitations of traditional industrial scenarios, demonstrating diverse service potentials such as household management, educational companionship, and health monitoring. For instance, robots equipped with large natural language processing models can achieve precise semantic understanding and complete complex household tasks through a visual-haptic multimodal perception system. This technological breakthrough makes the leasing model the optimal entry point for consumers to experience cutting-edge technology. The current high premium phenomenon in the leasing market precisely confirms the structural transformation of supply and demand relationships - the growth rate of consumer demand for intelligent services has outpaced the speed of hardware popularization.

From a cost curve perspective, the leasing model is reshaping the logic of market penetration. The official price of Unitree Technology's G1 robot is 99,000 yuan. If calculated based on the current return rate in the leasing market (with monthly income exceeding 200,000 yuan per unit), consumers only need to pay one-fifth of the hardware cost for leasing fees to obtain usage rights. This "Experience-as-a-Service" model significantly lowers the threshold for technological experimentation. Industry forecasts indicate that the global robot leasing market will exceed 10 billion yuan in 2025, while the growth rate in the Chinese market will average over 35% annually. This growth momentum closely mirrors the market curve during the early stages of smartphone popularization.

However, it should be noted that the current application scenarios for robots are relatively limited, primarily concentrated in fields such as exhibitions and performances, and there is still a distance before meeting consumer rigid demand and achieving C-end popularization.

02

Financing Boom and Sober Reflection

From the end of 2024 to the beginning of 2025, China's embodied intelligence sector witnessed a capital explosion period, with multiple companies successfully completing large-scale financing, significantly accelerating the technology commercialization process.

In December 2024, Beijing Xiaoyu Smart Manufacturing Technology Co., Ltd., the first large-model robot company invested in by Xiaomi, completed a 100 million yuan A-round of financing, exclusively invested by the Beijing Information Industry Development Investment Fund. The company focuses on developing a "general brain" for the industrial field, empowering robots to complete complex tasks through multimodal large model technology. Its technological roadmap has received continuous funding support from Xiaomi, the Institute for AI Industry Research (BAAI), and other institutions.

On January 7, 2025, SmartSquare announced the completion of hundreds of millions of yuan in Pre-A round financing, led by Fortune Capital and DH Capital. Founded by Dr. Guo Yandong, the company pioneered the commercialization of intelligent robots equipped with embodied large models through its end-to-end VLA (Vision-Language-Action) technological route. Its self-developed AI2R Brain model surpasses leading Silicon Valley companies in spatial perception and operation success rates and is deployed on the Alpha Bot series of robots. Just two months later, SmartSquare completed its Pre-A+ round of financing, with cumulative financing reaching hundreds of millions of yuan, accelerating scene implementation.

During the same period, Fourier Intelligence completed nearly 800 million yuan in Series E financing, jointly funded by institutions such as Guoxin Investment and Pudong Venture Capital, to propel the iteration of the second-generation humanoid robot GR-2. In February 2025, Zero-Cube Robotics (incubated by Tsinghua University) received tens of millions of yuan in angel round financing, planning to mass-produce 500 multi-model robots in the service and education industries. Zibianliang Robotics completed hundreds of millions of yuan in Pre-A++ round financing, led by Lightspeed China Partners and Legend Capital, with the funds being utilized for the training of the next-generation general large model. Its technological route has received support from multiple parties, including the Beijing Robotics Industry Fund.

On March 26, embodied intelligence startup TARS announced the completion of a 120 million dollar angel round of financing. This round of financing was jointly led by BlueRun Ventures and Qiming Venture Partners, with participation from Linear Venture, Hengxu Capital, Hongtai Fund, Legend Capital, Xianghe Capital, and Hillhouse Capital. The financing will primarily be used for product and technology research and development, model training, scene expansion, and other directions. According to introductions, this is currently the largest angel round financing record in China's embodied intelligence industry. Officially, TARS was formally established on February 5, 2025, and is an AI-driven embodied intelligence technology company with capabilities in embodied intelligence large models, ontology research and development, and mass production of software and hardware integrated products.

As the industry progresses rapidly, recent market news indicates that Jinshajiang Ventures' Zhu Xiaohu stated that he is exiting humanoid robot companies in batches. This remark has garnered market attention: On the one hand, Zhu Xiaohu's viewpoint starkly contrasts with the current fiery robot sector; on the other hand, regarding the development of humanoid robots, the commercialization path is indeed still unclear at present.

Current humanoid robots are still somewhat distant from the public's imagination. Although the development potential of humanoid robots' "embodied intelligence technology" is immense, it is still in a critical stage of transitioning from laboratory exploration to industrialization breakthroughs. While implementation and application in industrial scenarios will drive the landing of this technology, there is still a long way to go in other scenarios.

Multiple industry insiders have pointed out that current investments in the robotics field have shown significant differentiation, with state-owned funds becoming the dominant force. A fundraising responsible person in the primary market stated that this year, some local state-owned funds have clearly listed robots as a key investment direction. Among the over 110 disclosed robot sector investment and financing events, funds with state-owned backgrounds account for over 40%.

Under this policy orientation, the traditional approach of dollar funds faces challenges. The aforementioned fundraising responsible person analyzed that with 90% of LP funds coming from state-owned assets, investment institutions need to adapt to the orientation of "new productive forces," while dollar funds exhibit disadvantages in terms of IRR performance and IPO exit channels. Recent actions by Jinshajiang Ventures have confirmed this trend: In March, it announced the split of its China and U.S. businesses, with the newly established Informed Ventures taking over U.S. investments; in February, it completed an asset disposal of 229 million yuan through a GP-led S fund transaction.

At the project level, Jinshajiang Ventures has divested from targets including Xinghaitu and Songyan Power. Business records indicate that they exited their angel round investment in Xinghaitu in September 2024, holding 0.29% of shares, and Songyan Power in January 2025, holding 1.6% of shares. Xinghaitu's latest funding round attracted investors such as Ant Group and BV Baidu Ventures, while Songyan Power remains committed to the research and development of general AI ontologies.

03

Navigating Certainty Amidst the Chaos

The evolution of humanoid robots mirrors that of groundbreaking technologies like electric vehicles and smartphones – initial controversy and bubbles fail to obscure their transformative potential. Capital withdrawals serve to drain excess liquidity from the industry, whereas the surge in orders and technological advancements underscore genuine market demand. The challenge lies in companies striking a balance between "hoarding resources" (financing reserves) and "digging deep wells" (commercialization efforts), while policymakers must shun "campaign-style investments" in favor of fostering an inclusive and innovative ecosystem. As the founder of Xinghaitu eloquently put it, "Ignore the noise, work diligently, and time will reveal the truth."