AI Glasses Wave: Chip Manufacturers Ride the Surge

![]() 04/08 2025

04/08 2025

![]() 769

769

Text/VR top by Wan Li

From CES to MWC this year, a cascade of novel AI glasses products have been unveiled, signaling the dawn of a fierce hundred-glasses war.

As the main control chip constitutes a significant portion of the cost of AI glasses and critically impacts the user experience, this article delves into the current landscape and future trends of the AI glasses chip industry.

Image source: Xiaomi

Three Evolutionary Paths for AI Glasses Chips: Native, Headphones, and Watches

Given the nascent nature of AI glasses, the chip solutions behind them are still in the exploratory phase. From the perspective of product form evolution, there are primarily three chip routes:

Native Route: Currently, there are only two main control chips specifically designed for the glasses platform, both from Qualcomm: AR1 and AR2. AR2, released in 2022, adopts a distributed architecture and relies on mobile phone computing power in complex scenarios. Its terminal product is from Japan's MiRZA. However, since AR2 needs to be tightly coupled with Qualcomm SoCs, its market acceptance is limited.

The AR1 chip, launched in 2023 and initially introduced by Ray-Ban Meta, has garnered significant industry attention due to the latter's robust sales. According to incomplete statistics, the Raybird V3, Rokid Glasses, Yijing Virtual SW3010, Leishen AI Smart Glasses, and upcoming Xiaomi and Alibaba AI glasses will all be equipped with this chip. This solution offers an excellent overall experience but comes with a higher BOM cost of around $60. Additionally, rumors suggest that Qualcomm will release an iterative version of AR1 this year, upgrading it to a 3nm process.

Headphones/AIoT Route: Built upon existing Bluetooth main control chips and integrated with touch control chips and AI voice recognition chips, this approach is akin to TWS headphones. It allows for the quick and cost-effective integration of a pair of glasses.

This route is commonly seen in low-end AI glasses that often lack features like photography and AI assistants. Moreover, since the speaker of AI glasses is farther from the ears, the sound output power is significantly higher than that of ordinary headphones.

Incidentally, in previous years, the explosion of the TWS headphone market led many chip manufacturers to prosper and successfully go public. Now, as the AI glasses track takes off, it may become one of these manufacturers' key focus areas.

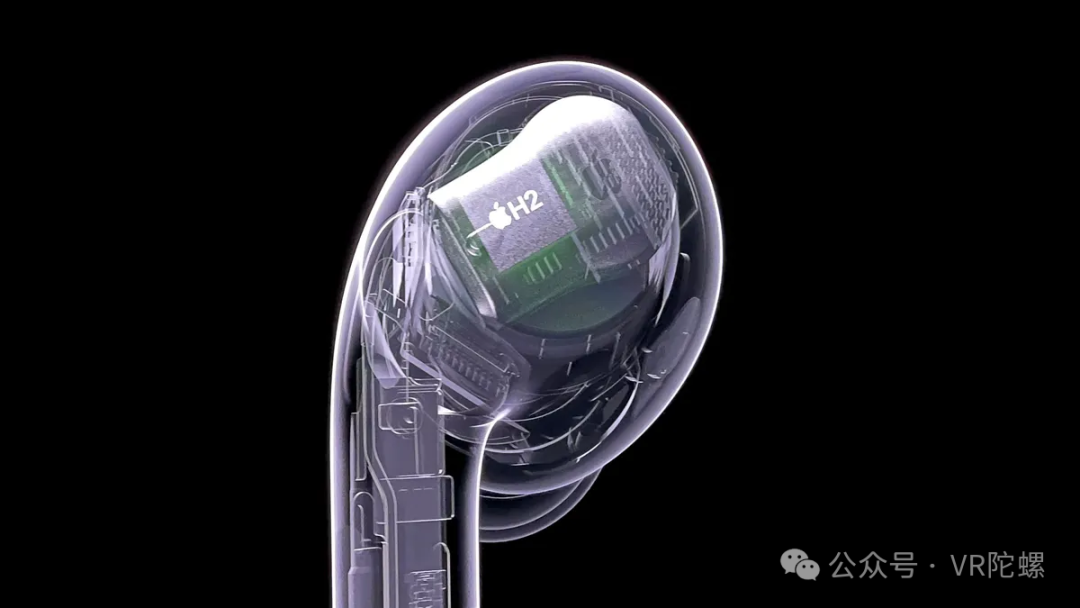

Image source: Apple

Smartwatch Route: In some ways, AI glasses share many similarities with current smartwatches. Both are wearable devices with high demands on chip performance, energy efficiency, and size.

With the smartwatch market being relatively mature and offering numerous chip solutions, adopting smartwatch chips is a common choice for AI glasses manufacturers. For instance, Shanji AI Snap Mirror's W517 and the Qualcomm W5100 selected by the BleeqUp Ranger unveiled at MWC recently were originally designed for the smartwatch platform.

It's worth noting that the smartwatch platform is not entirely compatible with AI glasses in some aspects. For example, the watch chip's integrated positioning system may not be utilized by AI glasses, while the NPU unit, a rigid demand for AI glasses, needs to be realized through external attachments in watch chips. For instance, Shanji AI Snap Mirror introduces a voice wake-up chip (Guoxin GX8002) on top of w517 to enable AI voice interaction.

Furthermore, the process of the smartwatch chip platform is relatively loose, resulting in certain disadvantages in power consumption performance.

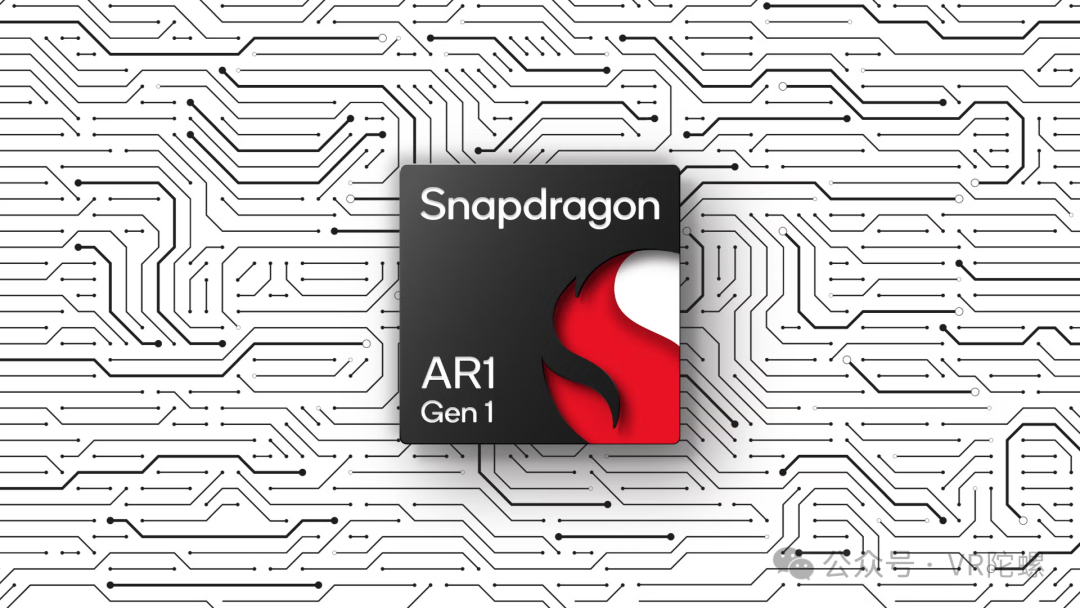

Image source: Qualcomm

Three Chip Selection Solutions: Balancing Cost and Scenario

Earlier, we classified the main control chips based on the product form development of AI glasses. If classified by chip combination, they can be broadly divided into three categories:

Solution 1: System-level SoC, such as Qualcomm AR1 and Unisoc w517. A single chip integrates modules like CPU, GPU, ISP, DSP, WiFi, Bluetooth, etc., offering robust performance that can meet most AI glasses needs. However, such SoCs often require running the Android system, and power consumption control in certain scenarios is still not extreme.

Solution 2: MCU+ISP, where MCU refers to a microcontroller, commonly known as a single-chip microcomputer. Its integration and performance are weaker than SoC-level chips but excel in battery life and size. The MCUs on AI glasses are mostly optimized based on existing Bluetooth audio main control chips and need external ISP for photography and video recording. For example, Looktech AI glasses and ByteDance's new AI glasses (rumored online) adopt this solution.

However, there are exceptions. For instance, the recently released Canan K1 uses Action's T31ZX as its main control chip, which integrates VPU and ISP and supports 2K shooting. Action chips have previously been used primarily in the security field.

Corresponding to the SoC solution, MCUs mostly run in small systems like RTOS and Linux, offering excellent power consumption control and certain advantages in application startup speed. For example, one of Canan K1's major selling points is its ability to start the system in 0.4s and achieve instant capture in 0.3s.

Looktech, image source: Internet

Solution 3: SoC+MCU, this solution balances the performance of Solution 1 with the power-saving benefits of Solution 2. For instance, in heavy-duty scenarios like photography, the SoC handles the task, while the MCU manages lighter tasks like music playback.

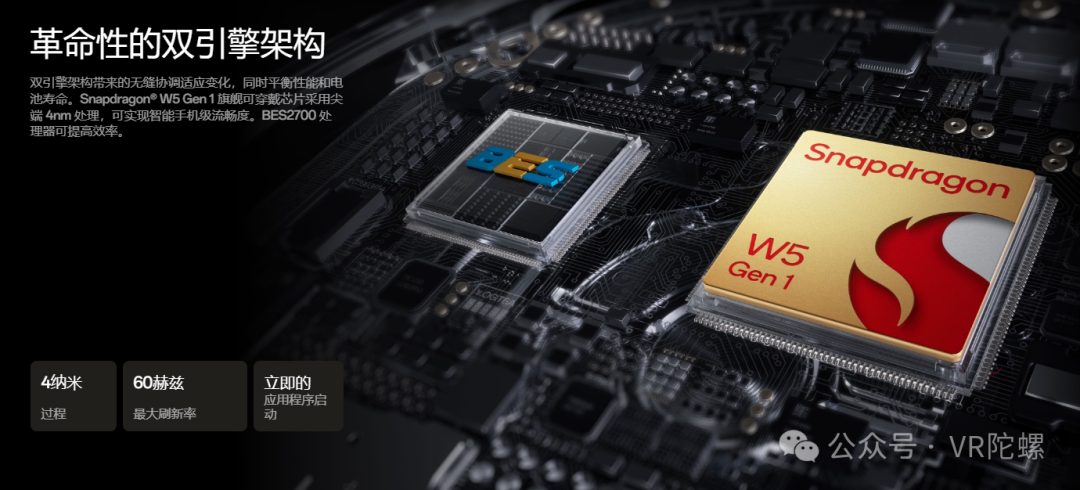

Some smartwatch products on the market have adopted a dual-chip strategy, such as OPPO watch X. Additionally, rumors suggest that the upcoming Xiaomi AI glasses will also employ this solution (Qualcomm AR1 + BES2700).

The drawback of this solution is its high cost and the need to balance the dual-system architecture of the dual chips.

Dual-chip architecture of OPPO Watch X, image source: OPPO

For chip selection, terminal manufacturers need to consider numerous factors, with cost being paramount. As the "hundred-glasses war" intensifies, "low price" has emerged as a key product feature. Early last year, there were frequent calls for Xiaomi AI glasses priced at 999 yuan (which proved unrealistic), and by year-end, the Shanji AI Snap Mirror co-creation version officially entered the 999 yuan range, causing a minor price shock in the industry.

In more cost-sensitive markets, the shipping cost of AI glasses is even more exaggerated. During Shanghai Optical Week this year, an AI glasses supplier told VR Gyroscope that their shipping price was only 150 yuan.

Since chips constitute a significant portion of the BOM cost of AI glasses, using different chips can help control costs. Taking the current two mainstream SoC chips as examples: Qualcomm AR1 and Unisoc w517, their prices are approximately $60 and $10, respectively, representing a significant price difference. For pure audio glasses devices, their cost can be further reduced by using Bluetooth chips as the main control, such as MINISO's smart music glasses, which use Bluetrum's AB5656C2 with a unit price of only about 1 yuan.

Earlier, there were rumors that ByteDance would adopt the MCU+ISP solution (BES2800 + Yanjimi ISP). It's reported that after tuning, the ISP chip's performance can approximate that of AR1, but the overall chip cost is only a fraction of AR1. This chip solution can keep the BOM cost of glasses within 1,000 yuan.

Shanji AI Snap Mirror press conference, image source: Internet

Furthermore, since various AI glasses have different functional scenarios, manufacturers can achieve maximum efficiency by wisely selecting different chips.

For example, Xingji Meizu MYVU does not come with a camera. Using AR1 or w517 would be wasteful. Therefore, this product adopts the MCU solution (BES2800). Similar camera-less AR glasses include Even Reality G1 and Halliday (Actions solution). Products like Jiering AI audio glasses are similar, needing to handle relatively simple audio demands, so an ordinary Bluetooth main control chip suffices, combined with an AI wake-up chip for voice interaction.

Another scenario arises when the SoC cannot meet specific needs. For instance, the AR1 chip supports 12 million-pixel photography. For products requiring higher-resolution shooting, this solution may be inadequate. For example, the recently released AI Glasses series by Transsion includes a model with a 50 million-pixel camera from OmniVision's OV50D, potentially the highest pixel count for AI glasses currently. Correspondingly, this product employs the uncommon WuQi Microelectronics WQ7036 + STMicroelectronics STM32N6 + ISP solution.

In summary, one can not only roughly gauge a product's price range based on the AI glasses' main control chip but also predict the chip solution behind it based on the product's functional characteristics.

Chip Manufacturers' New Moves Amid the AI Glasses Boom

The AI glasses market is still in an early stage of rampant growth. However, for upstream manufacturers, with the continuous robust sales of Ray-Ban Meta and widespread external attention, numerous chip manufacturers have begun to attack and attempt to gain a foothold in this market.

VR Gyroscope understands that many chip manufacturers have started developing system-level chip solutions for AI glasses, integrating MCU, Bluetooth, ISP, DSP, etc., to provide one-stop support for ODM and brand manufacturers.

Regarding SoC manufacturers, besides Qualcomm, MTK, Unisoc, and NVIDIA all plan to develop dedicated chips for AI glasses. For MCU chip manufacturers, there have also been numerous recent announcements. Below is an incomplete list:

BES: The new generation of AI glasses chip 2900 is expected to be available in the second half of the year, further integrating ISP;

StarChip: At the beginning of this year, it released the SSC309QL ISP chip specifically designed for AI glasses, supporting 12 million-pixel photography, already integrated into Looktech AI glasses;

Fullhan Microelectronics: Indicated on an interactive platform that the company has been closely collaborating with customers and plans to launch AI glasses chips in 2025;

Actions: Rumors suggest the company plans to release a new generation of dedicated chips for AI glasses this year;

Allwinner Technology: The company indicated that it would monitor the market demand and technological advancements in AI glasses;

Rockchip: During CES this year, it showcased AI glasses based on RV1106B, supporting 5 million-pixel video recording and 12 million-pixel photography;

Espressif Systems: The open-source AI glasses project Openglass adopts the company's esp32s3 chip;

STMicroelectronics: Released the microcontroller STM32N6 at the end of last year, with an NPU computing power of 0.6TOPS, already applied to Transsion AI glasses;

Guoxin Microelectronics: Released a comprehensive smart glasses audio and sensor solution at the end of last year, including the previously mentioned GX8002.

VR Gyroscope understands that, in the view of many industry practitioners, SoC+MCU will be the ideal choice for future AI glasses, ensuring performance while considering battery life. Besides Xiaomi AI glasses, future products from Nomad Technology and Alibaba AI glasses may also opt for this route.

Moreover, the further integration of eSIM cellular networks into AI glasses may also be a trend. This integration can reduce glasses' dependence on mobile phones and enable all-day online connectivity.

Closing Thoughts

Looking back at the development of consumer electronic devices, the industry seems perpetually in a stage of technological breakthroughs: integrating room-sized servers into desktop computers and further advancing them towards laptops. Now, the industry has embarked on integrating computer-level performance into mobile devices. If AI glasses are considered the next computing platform, this relentless pursuit of product size and chip performance will undoubtedly continue.

From the hundred-glasses war to the competition among AI chip manufacturers, the AI glasses industry is poised to enter a golden era of rapid development.