Thanos' snap lifted and fell lightly, did the market hit Trump's Achilles' heel?

![]() 04/15 2025

04/15 2025

![]() 773

773

Hello everyone, I'm Dolphin!

In last week's strategy weekly report, Dolphin used a simplified story to help everyone understand Trump's aggressive tariff policy that has made enemies everywhere. Why does Trump dare to openly tear up the trade order he established and default on debts through various means? Does he have any weaknesses? How should we view the upcoming trade war?

I. Low leverage for residents, AI taking over the next decade

One of the big reasons Trump dares to challenge the world alone is that the domestic economy (both businesses and residents) is relatively robust and full of confidence.

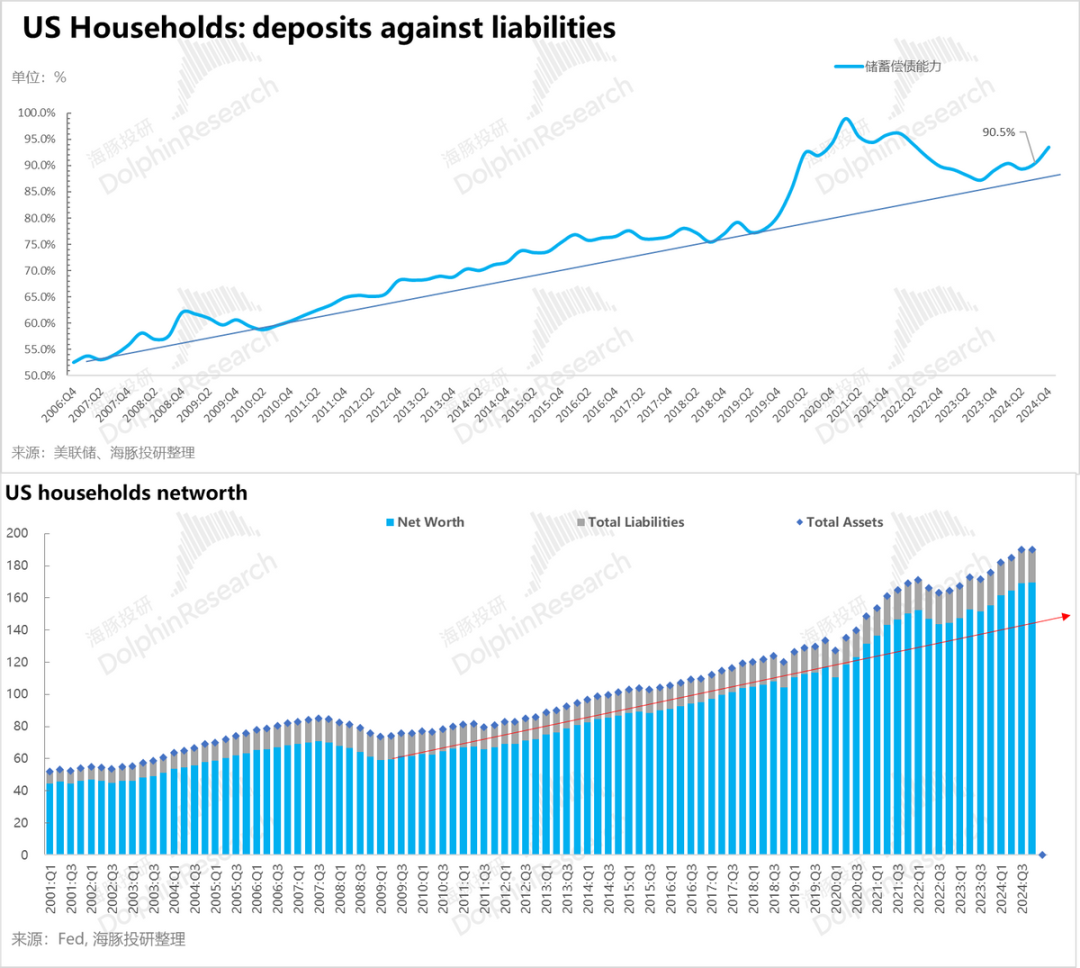

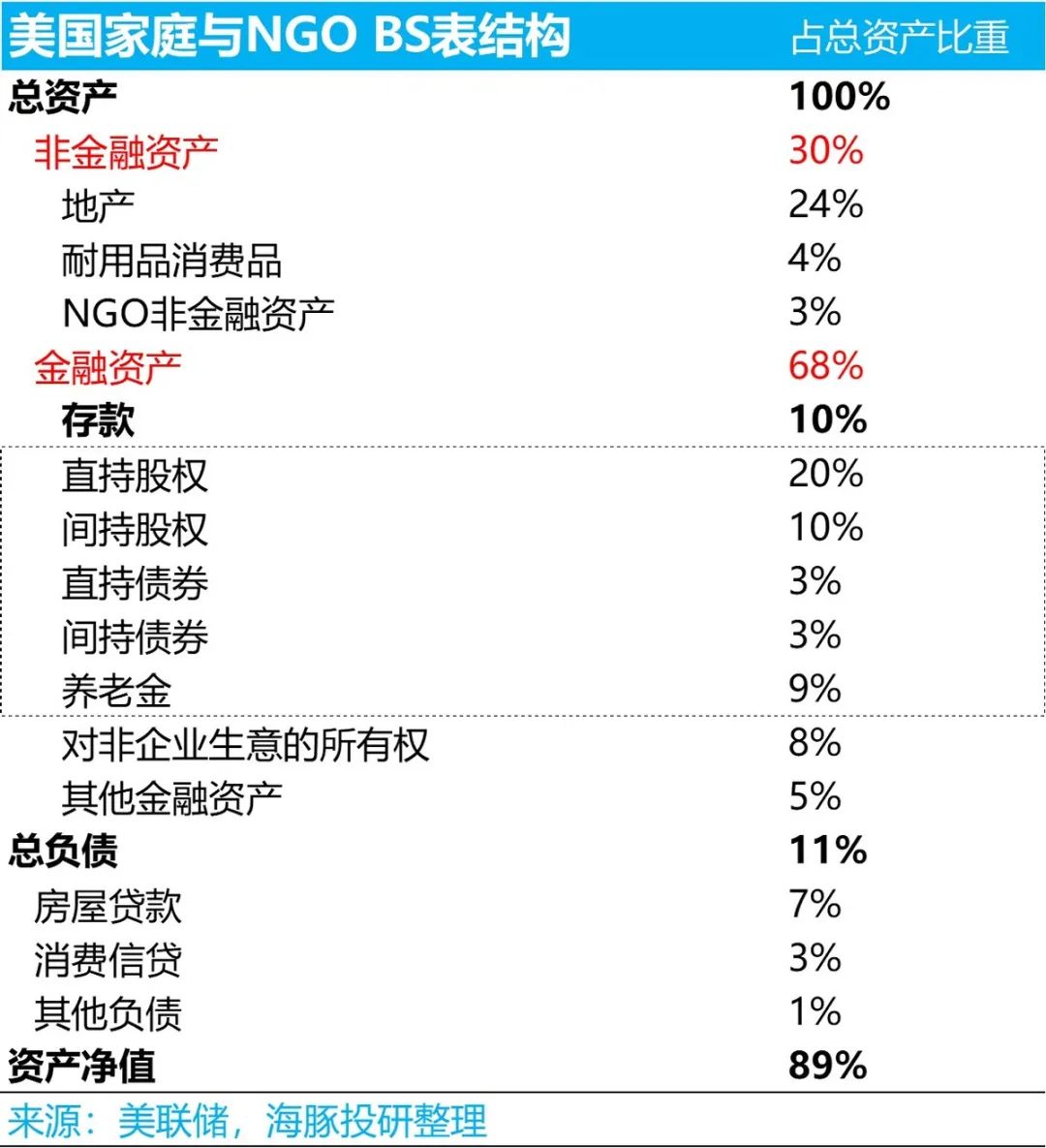

Currently, from the perspective of American household wealth, American household wealth has accelerated after the pandemic, and the overall ability of savings balances to repay and cover liabilities has strengthened. The balance sheets of American residents are currently very healthy.

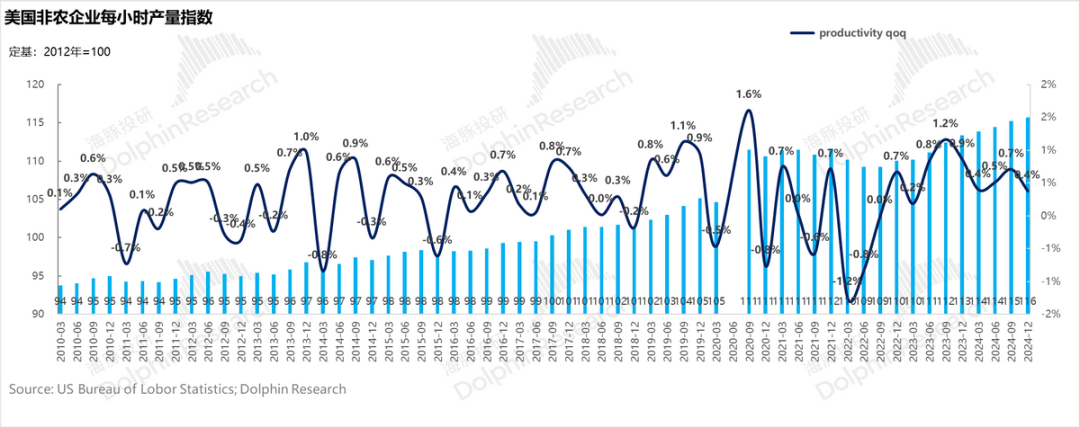

From the perspective of businesses, in the era of AI, most American businesses have entered a new cycle of capital expenditures, beginning to hire and build data factories, with the hope of further improving productivity.

However, the prosperity of the US private sector is not a "special case" for the US without a cost. The cost of the US post-pandemic prosperity is the huge federal fiscal deficit and the increasing pressure to pay interest.

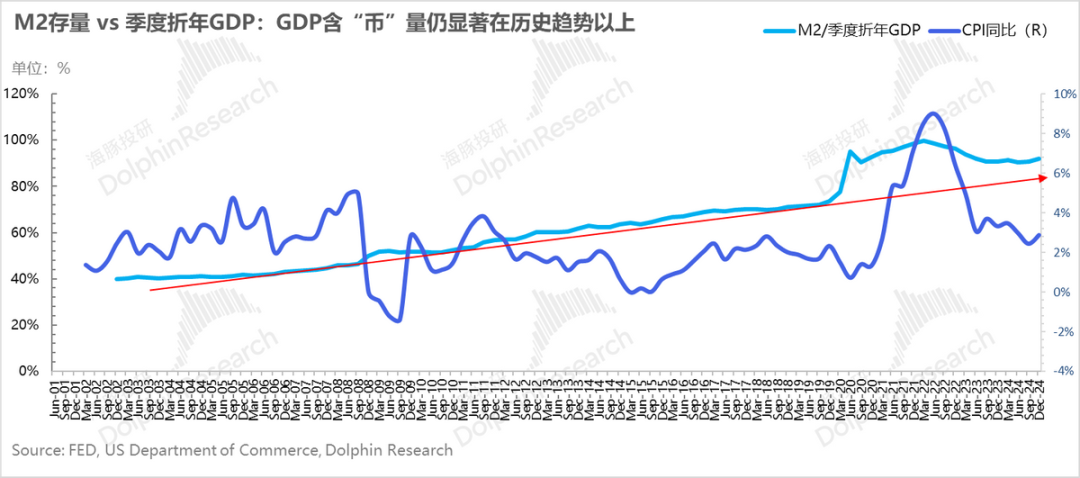

After the massive money printing, although the Federal Reserve has been withdrawing money (Tapering), if calculated by dividing M2 by the real GDP of the United States, as of the fourth quarter of last year, the "GDP money content" of the United States was still above the historical trend value, and the current Federal Reserve has already stopped Tapering.

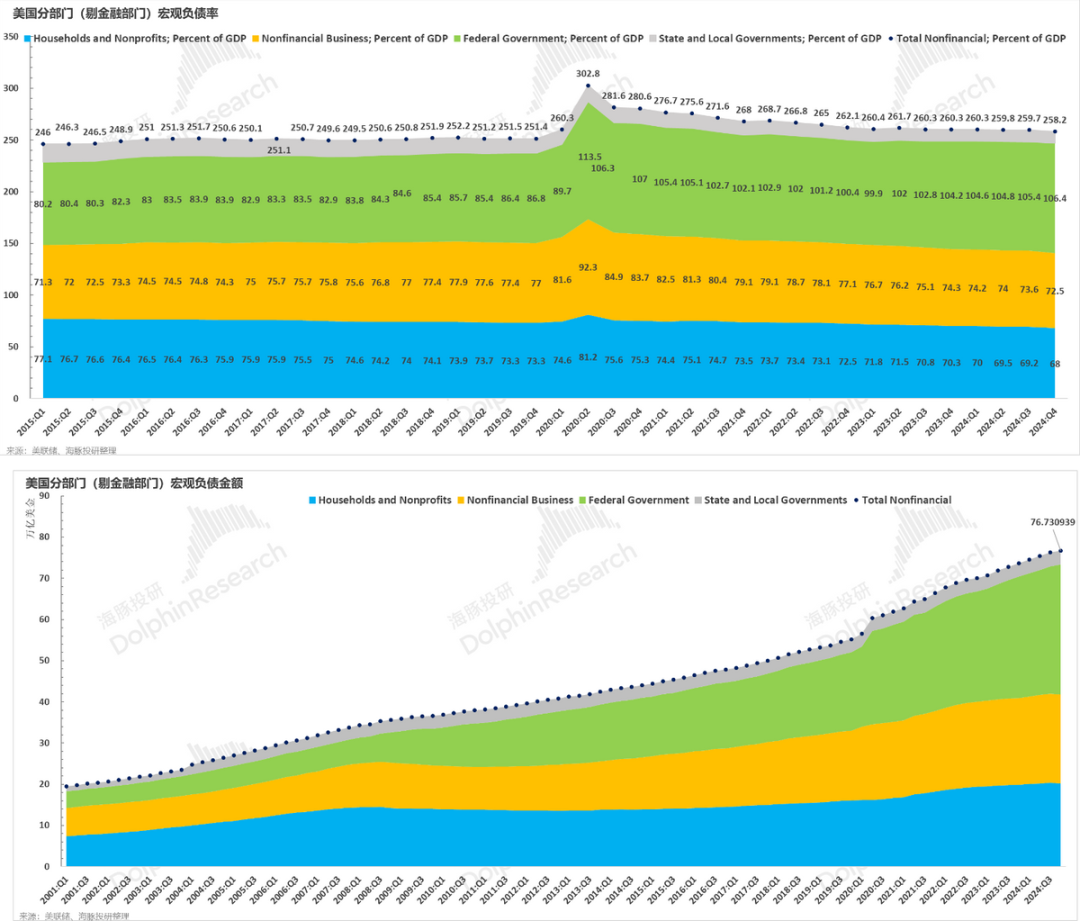

After the pandemic, the leverage ratios of American businesses and residents have continued to decline, but the leverage ratio of the US federal government has continued to rise. Compared to the fourth quarter of 2019 before the pandemic, the US federal fiscal leverage ratio increased by a full 20 percentage points in the fourth quarter of last year.

(PS, Trump, who has always called for reducing the burden of national debt, actually looked back at his first term (2017-2020). Due to tax cuts, even without considering the impact of the pandemic, the federal debt balance of the United States actually accelerated its rise.)

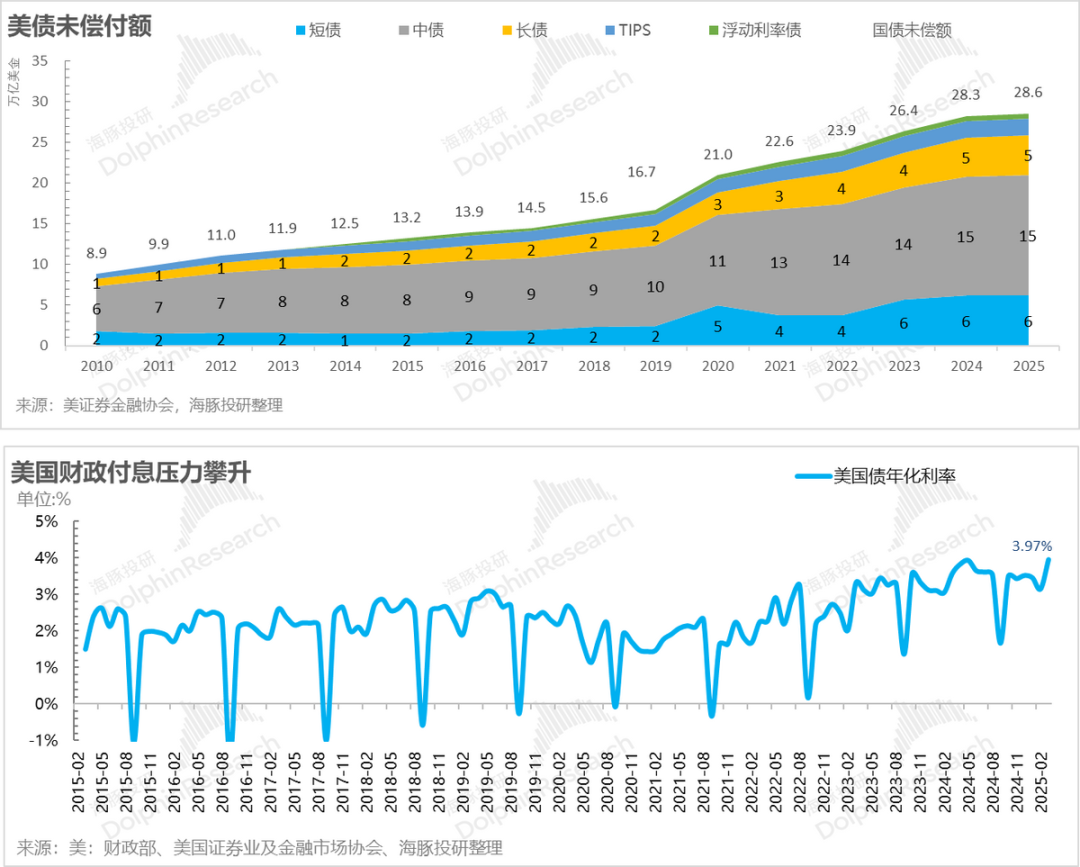

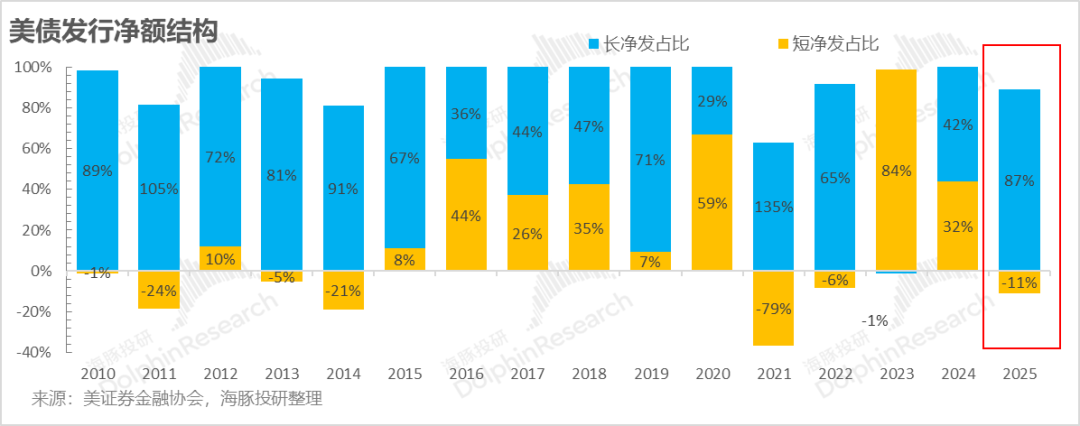

With nearly $30 trillion in debt and a borrowing interest rate of 3.5-4%, the current 10-year Treasury yield has continued to hover above 4.5%, making it impossible for Yellen, the Treasury Secretary during the Democratic Party period, to only use the mismatch of short-term borrowing and long-term use to juggle the funding gap.

And the newly appointed Republican Treasury Secretary, Bessent, is unwilling to do so, striving to return Treasury financing to an era of long-term debt financing. However, the current 10-year Treasury yield has been continuously operating in the range of 4.5%-5%. Directly increasing the proportion of long-term debt in this way will cause the interest payment cost of US Treasuries to rise structurally in the long term.

II. Trump's Achilles' heel

So in this round, although Trump looks aggressive and attacks everywhere, his Achilles' heel is also obvious in Dolphin's view:

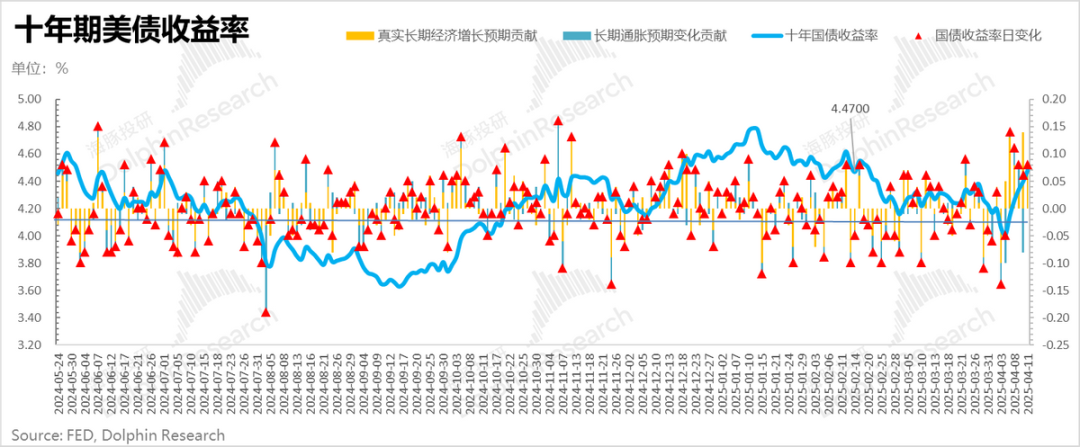

a) Rise in 10-year Treasury yields

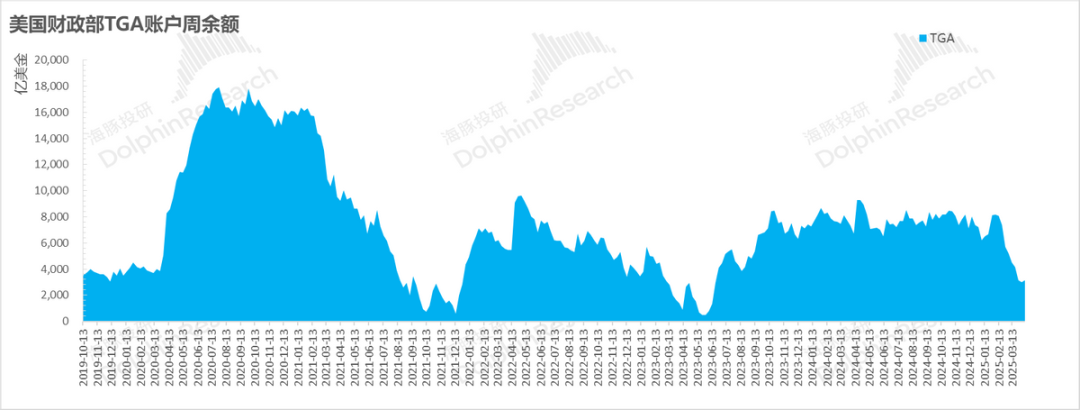

In the second half of 2025, Trump's more aggressive tax cuts are imminent, and the fiscal deficit will widen again. Currently, the Treasury's TGA account has only $300 billion left (a reasonable level should be between $750 billion and $850 billion), which means it's time for the US Treasury to sell bonds vigorously once again.

Under the debt maturity structure of Trump and Bessent, it is already difficult for the 10-year Treasury yield to remain at around 4% without falling. If it rises to 4.5%-5%, if ultra-long-term Treasuries of 10, 20, or 30 years are financed on a large scale at an interest rate of 4-5%, it will undoubtedly structurally increase the interest cost of the United States, which is an unbearable pain.

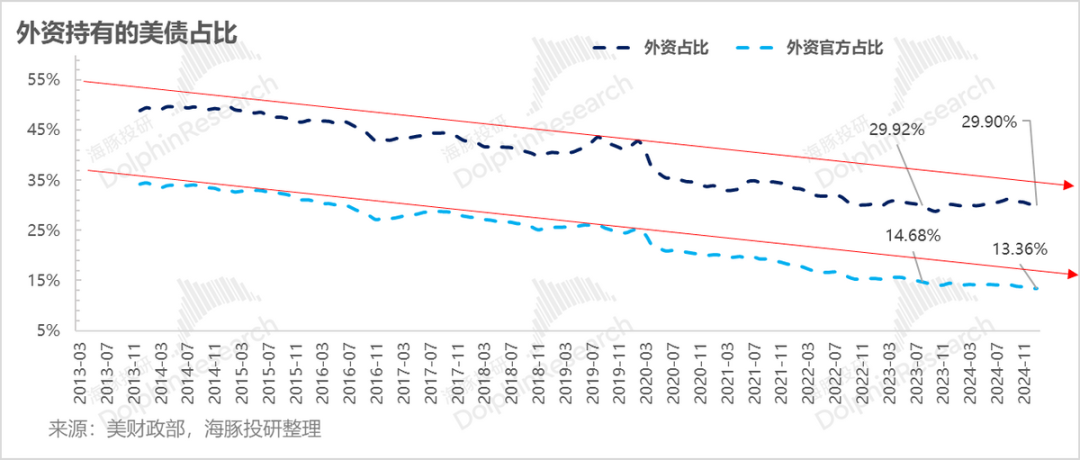

However, the 10-year Treasury yield has risen from 4% to 4.5% in the past week. Although there are rumors that a Japanese bank has exploded, leading to the sale of Treasuries to fill the hole. When asked whether the sharp decline in Treasury bonds was the work of China, US Treasury Secretary Bessent said that China has no choice because selling Treasuries is equivalent to exchanging them for dollars, and exchanging them for dollars creates demand for dollars, which conflicts with China's goal of devaluing the yuan to offset tariffs.

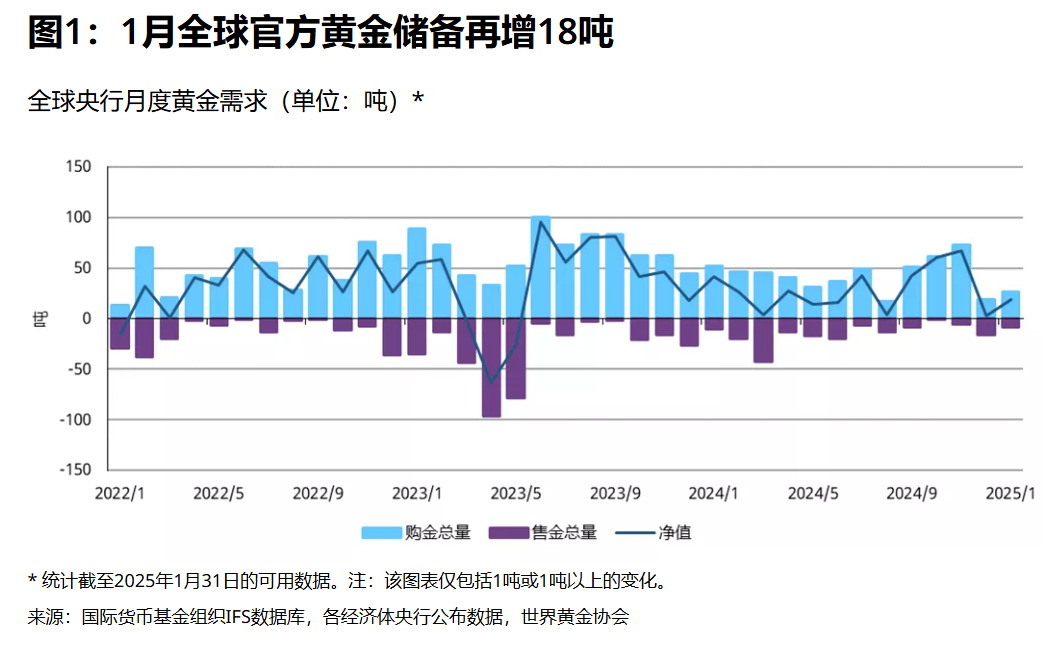

Of course, in Dolphin's view, the logical flaws in this answer are very obvious. While the holdings of Treasuries by foreign official institutions continue to decline, the demand for gold reserves continues to rise. If this is combined with the continuous rise in gold prices, the proportion of gold in global central bank reserves continues to rise.

In fact, regardless of who sells Treasuries, the simultaneous decline in the US dollar, Treasuries, and US stocks will naturally raise concerns that the market will lose confidence in US assets due to the US's reckless behavior. As a comparison, when China's domestic policies underwent major adjustments before, it was given an "uninvestable" rating by major overseas banks early on. The soaring yield of long-term Treasuries is precisely the unbearable pain of this US government that intends to use long-term debt financing.

b) Annihilation of American residents' wealth?

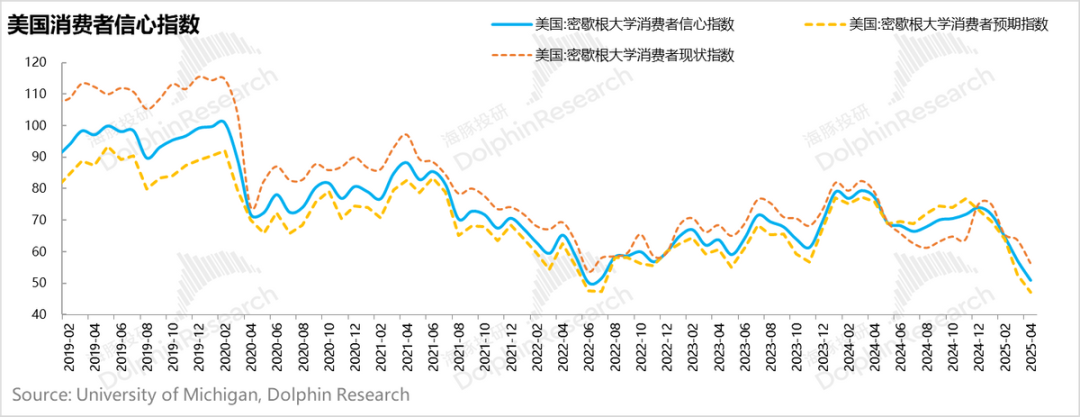

If these two years of domestic deflation have taught us anything, it is that deflation in wages (unemployment, shrinking wages) is just as important as asset deflation, and both have a significant impact on residents' consumption expectations.

Similar to Chinese residents' wealth, which is mostly in real estate, American residents' wealth is mostly in financial assets such as stocks and bonds, and even pensions are invested in financial assets. If stocks and bonds continue to fall significantly at the same time, it will have a significant impact on residents' current payment ability and consumption expectations, which is obviously unfavorable for future economic expectations.

c) Globalized beneficiaries of the United States - financial and technology industries

Among the US Mag 7 covered by Dolphin, the proportion of overseas revenue is generally around 50%. They are the absolute beneficiaries of past free trade in the United States and one of the concrete manifestations of the US trade surplus in service exports such as study abroad, tourism, and intellectual property rights.

One can imagine that once relations deteriorate, whether Japan and Europe will learn from the US treatment of TikTok and treat European companies like Google, Meta, and Amazon in the same way, at least in terms of anti-monopoly, digital taxes, or restrictions on investments by globalized US financial companies in Europe and Japan?

These companies contribute the vast majority of the market value of US stocks. When the game begins to generalize to these US financial and technological assets, will US stocks fall further?

And putting

First, he does not have the ability to fight a protracted tariff war - if tariff negotiations turn into a protracted stalemate, uncertainty will cause the stock market to continue to fall, or negotiators will continue to game Treasury yields, which will be relatively painful for Trump;

And if the high tariffs are made permanent in order to bring manufacturing back, causing stagflation on the supply side, high inflation, and high Treasury yields at the same time, residents' purchasing power will decline, which will be counterproductive.

Second, he does not have the ability to "wage war" against half of Americans and other countries around the world at the same time.

And rationally considering, it is difficult for things that are difficult to reasonably explain to truly happen. This is probably also a key reason why Bessent began to lead US trade negotiations and consumer electronics industry chains such as Apple were temporarily exempted from high tariffs between China and the United States.

But what is certain is that, just like the trade war in 2018, which brought the two US political parties together to reach a consensus on China's tone, will this gradually bring about a consensus on unfair global trade, making the United States increasingly inclined towards conservatism and mercantilism, and accelerating the return of manufacturing industries regardless of which party is in power in the future?

In this process, will China, as a special asset class, continue to be targeted? In response to this possible risk, Dolphin will recently study the delisting of Chinese assets listed on US stocks, the risk of restricted investment by US capital, and possible countermeasures. Please stay tuned.

III. Should we buy or sell US stocks?

Because the worst-case scenario of Trump's global "war" has not actually materialized, and in the deeply integrated global supply chain of consumer electronics and semiconductors, a temporary exemption has been granted in the short term (of course, Trump has threatened that there will be special tariffs targeting these industries later), the market has breathed a sigh of relief.

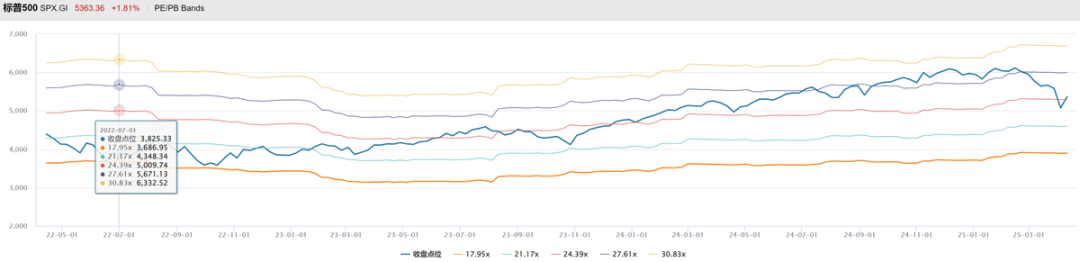

Currently, looking at market pricing, the S&P 500 index has fallen by 10% from the beginning of the year to now. However, after the tariff war in 2025, major banks generally reduced their 2025 EPS forecasts by about 10%. That is to say, in the stock price decline so far, there has actually been no valuation kill.

As we know, among the triple kills in stock prices - killing business, killing valuation, and killing logic, killing performance is actually not scary. What is scary is killing valuation, and the scariest is killing logic. Although there has been talk of recession expectations all along, the pricing of the S&P 500 is very rational and does not involve killing valuation.

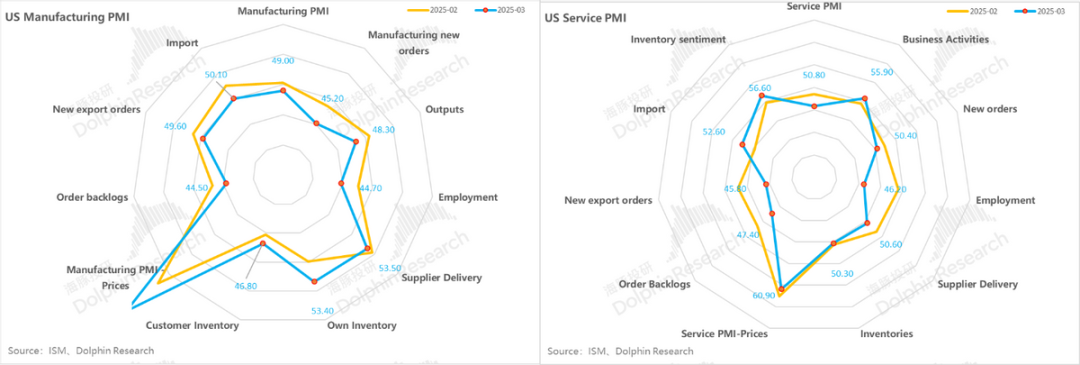

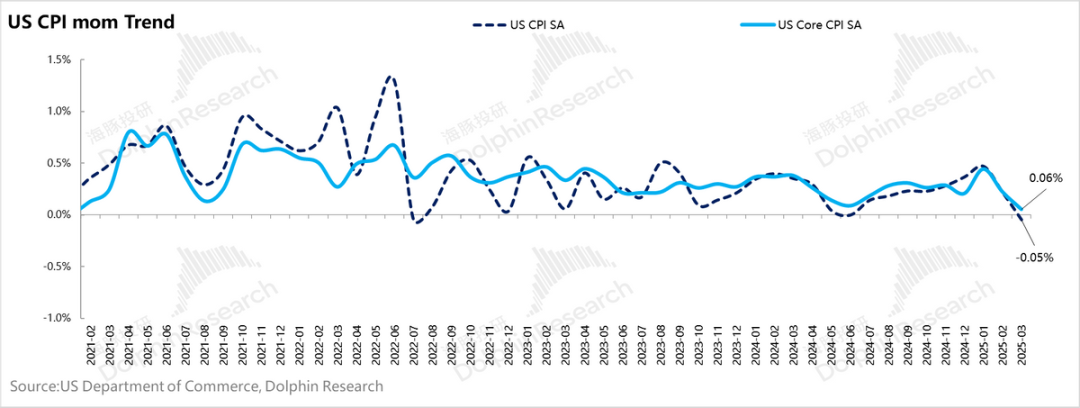

Of course, the core of this pricing is actually supported by fundamentals - the US added 230,000 non-farm jobs in March, which can be described as very impressive. At the same time, the month-on-month growth rate increased by 0.25%, which is also a very healthy and desirable growth state. In addition, CPI fell significantly, with an overall CPI month-on-month growth rate of -0.5%, and core CPI had only a positive growth rate of 0.06%.

Or in other words, the current US stock market has only priced in the EPS changes brought about by tariffs in the short term, but has not considered the situation where tariffs might turn into a real recession or stagflation, further leading to a valuation kill.

And this data actually depends on the economic data performance after the tariff policy is truly implemented in April and May. The worst scenario is that during the US stock earnings season in April and May, advertisers reduce advertising due to uncertainty, listed companies abandon providing earnings guidance one after another, and at the same time, US macroeconomic data deteriorates.

Therefore, for US stocks, Dolphin believes that short-term operations may be possible due to Trump's concession, but when the time horizon is slightly extended, the risks have not been eliminated. Investing in US stocks still requires leaving oneself sufficient safety margins.

IV. Portfolio rebalancing and returns

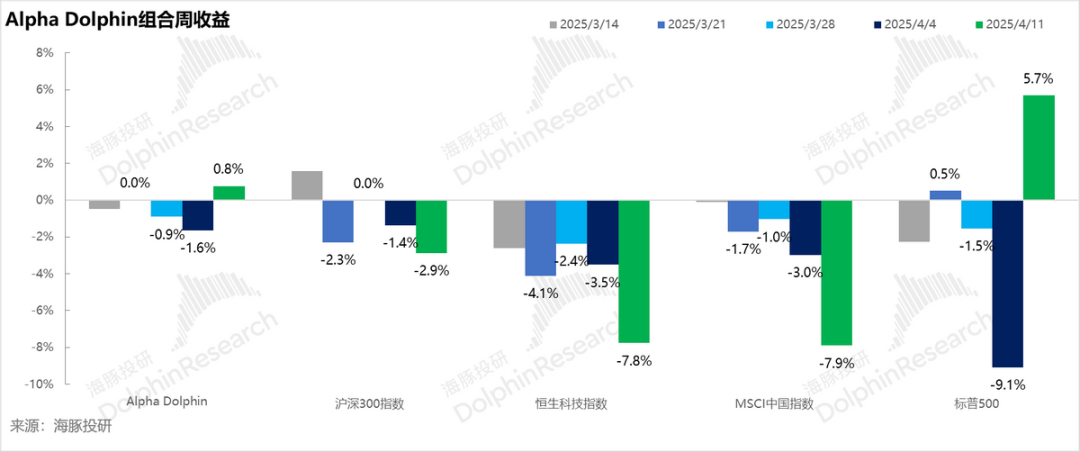

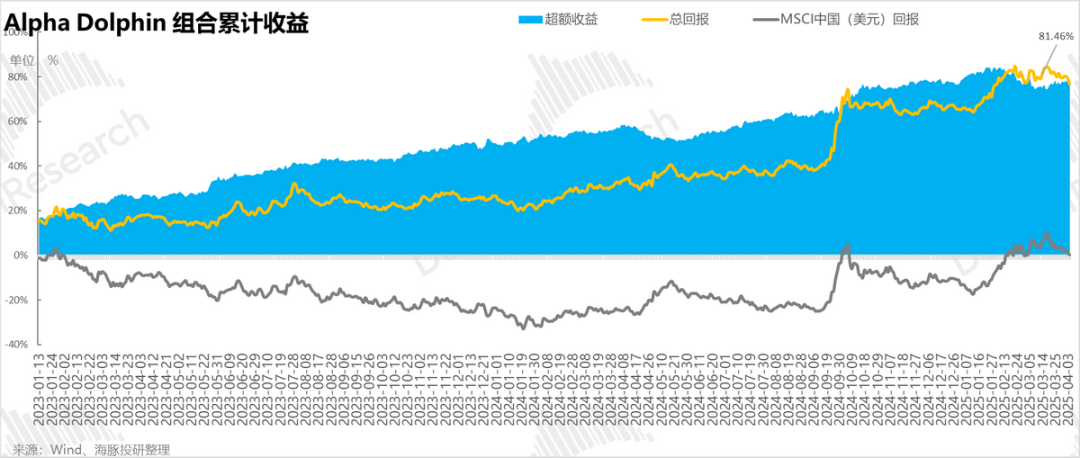

The Alpha Dolphin portfolio did not rebalance last week, and the portfolio return was 0.8%, outperforming the CSI 300 (-2.9%), MSCI China (-7.9%), and Hang Seng Tech (-7.9%), but underperforming the S&P 500 (+5.7%).

From the beginning of the portfolio test (March 25, 2022) to last weekend, the portfolio's absolute return was 78%, and the excess return compared to MSCI China was 86%. From the perspective of net asset value, Dolphin's initial virtual assets of US$100 million exceeded US$181 million as of last weekend.

V. Individual Stock Profit and Loss Contribution

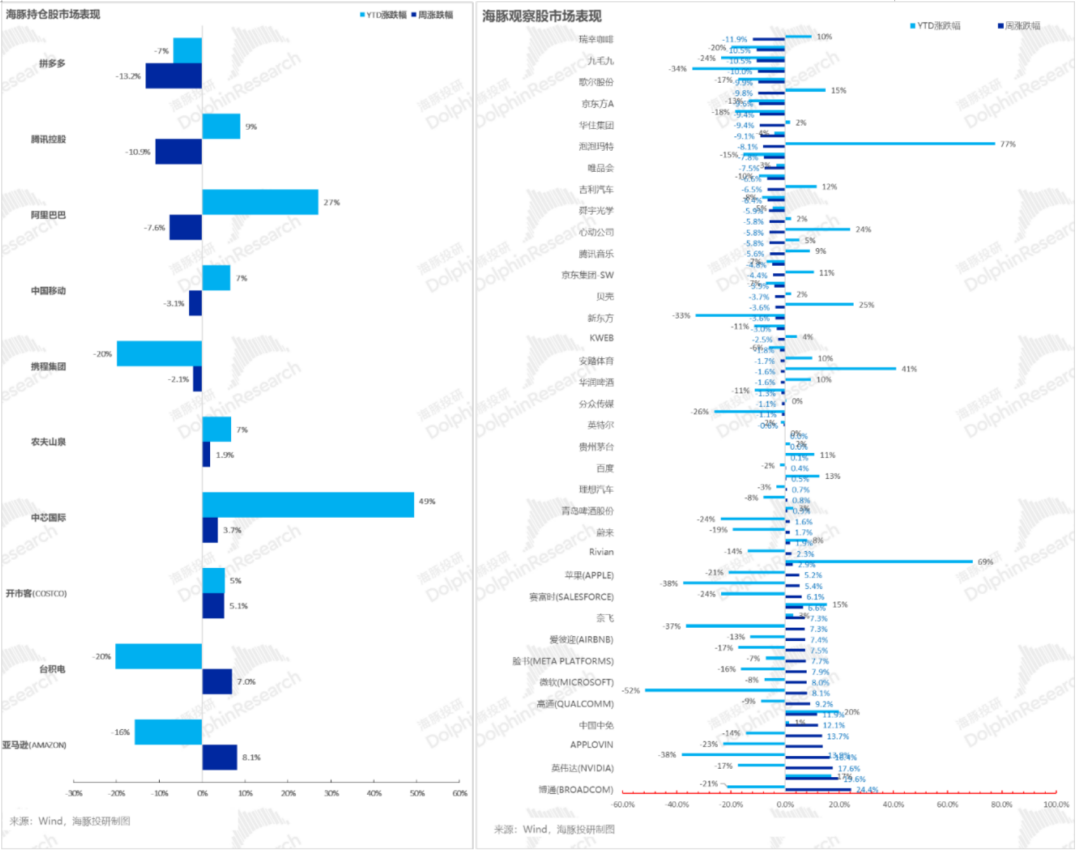

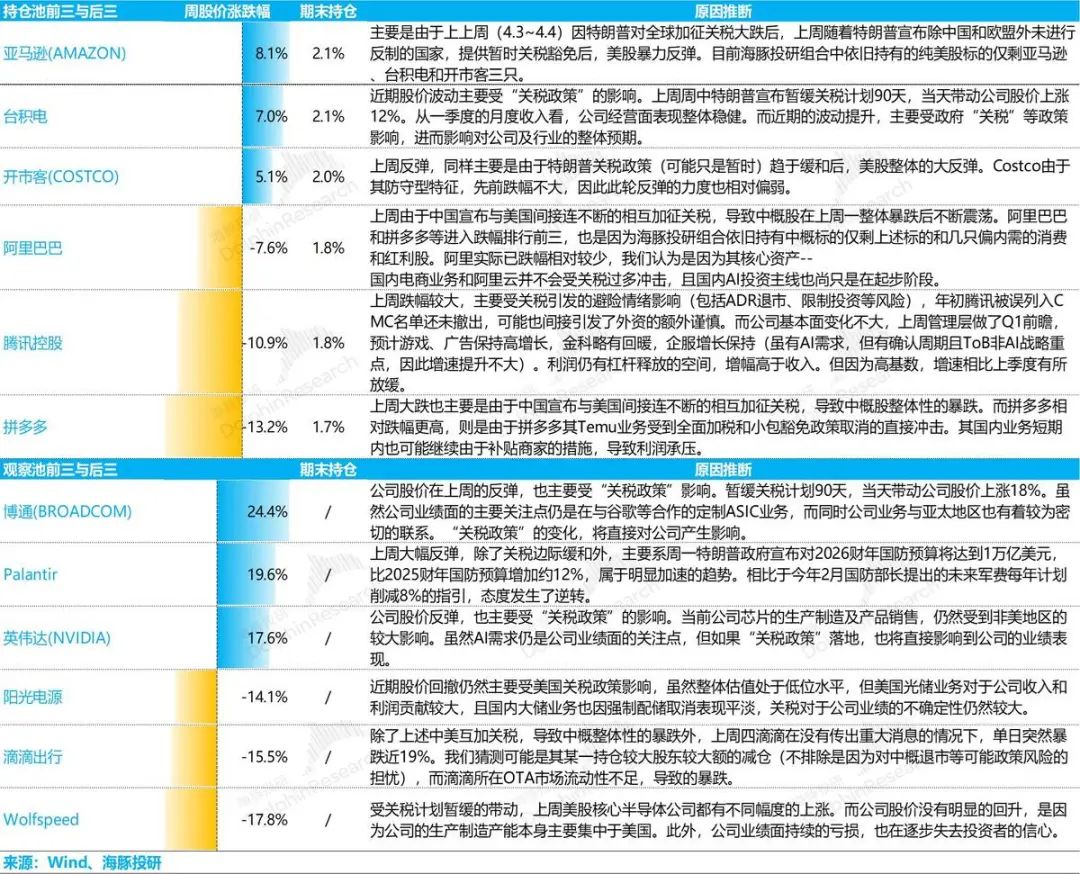

Last week, in the Alpha Dolphin portfolio, overseas Chinese assets that were hit hard by the US's tariff hikes and even faced the risk of delisting became the hardest hit, with share prices continuing to correct. However, due to the US's uniform 10% tariff on other countries, risks decreased, and US stock assets recovered overall.

For specific stocks with larger fluctuations, Dolphin explains as follows:

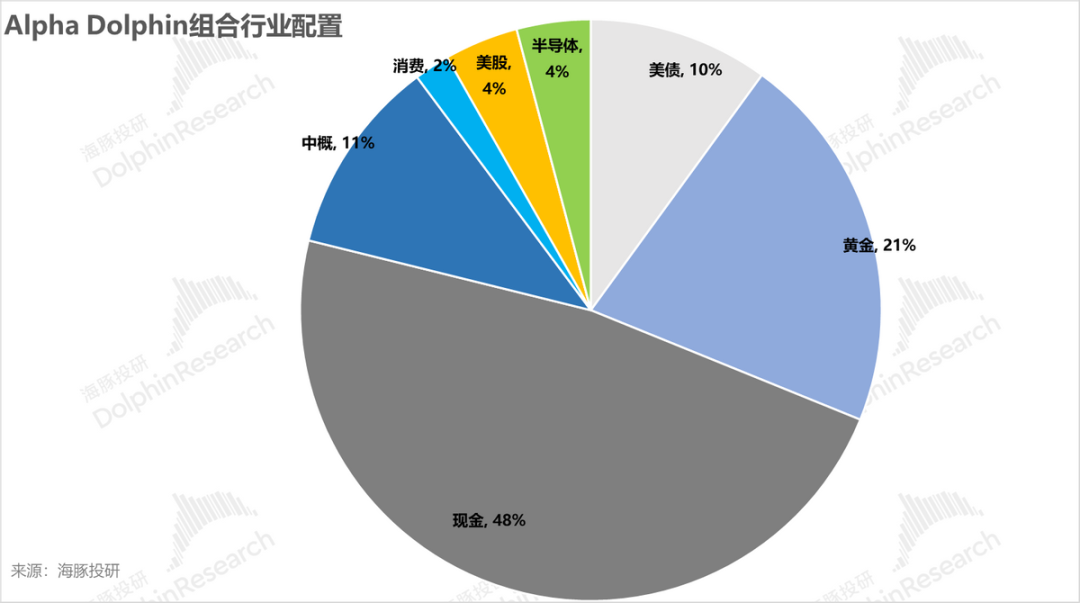

VI. Asset Portfolio Distribution

The Alpha Dolphin virtual portfolio holds a total of 10 stocks and equity ETFs, with 1 being standard and the rest being underweight. Assets other than equities are mainly distributed in gold, US Treasuries, and US dollar cash. Currently, the portfolio is lightly positioned to cope with tariff uncertainty while closely monitoring the potential safety margins of high-quality assets.

As of last weekend, the asset allocation and equity asset position weights of Alpha Dolphin are as follows:

VII. Key Points for This Week:

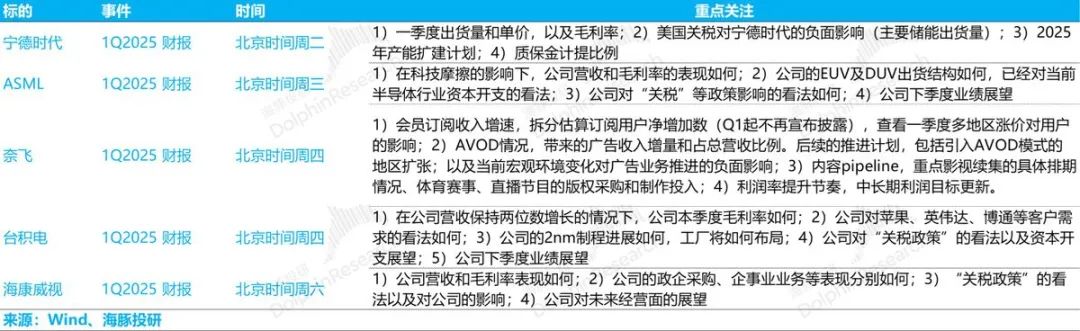

After the holiday, Hong Kong and A-share assets enter the first-quarter earnings release period, and some US stocks also enter the earnings season. At present, first-quarter earnings may no longer be important. More attention is paid to how companies are looking ahead to future performance amid tariff uncertainty, how they are addressing potential tariff risks, and how these guidances affect investors' risk appetite.

- END -

// Reprint Authorization

This article is an original article by Dolphin Investment Research. For reprinting, please obtain authorization.

// Disclaimer and General Disclosure Notice

This report is for general information and data reference only, intended for users of Dolphin Investment Research and its affiliated institutions. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referencing the content or information mentioned in this report bears the risk themselves. Dolphin Investment Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are for reference purposes only. Dolphin Investment Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report may not be construed or regarded as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. They do not constitute recommendations, inquiries, or promotions of relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials would violate applicable laws or regulations or subject Dolphin Investment Research and/or its subsidiaries or affiliated companies to any registration or licensing requirements in that jurisdiction.

This report reflects the personal views, opinions, and analytical methods of the relevant authors only and does not represent the position of Dolphin Investment Research and/or its affiliated institutions.

This report is produced by Dolphin Investment Research and the copyright belongs solely to Dolphin Investment Research. Without prior written consent from Dolphin Investment Research, no organization or individual may (i) produce, copy, replicate, reprint, forward, or otherwise reproduce any form of copy or reproduction in any way, and/or (ii) directly or indirectly redistribute or transfer it to other unauthorized persons. Dolphin Investment Research reserves all relevant rights.