Why does this race, even more money-burning than OpenAI, attract Silicon Valley tycoons?

![]() 04/17 2025

04/17 2025

![]() 666

666

Author: Eric, Editor: Yifan

An energy revolution in a race against time

As AI races ahead, few realize that the energy grid supporting this technological revolution is under immense pressure.

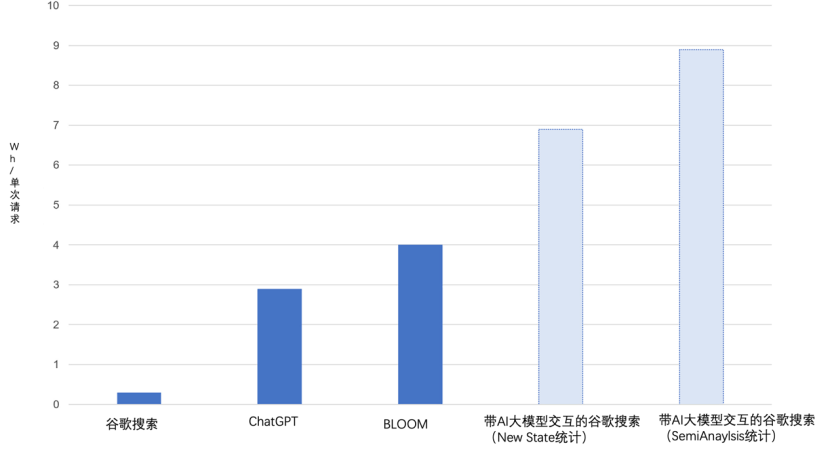

Sam Altman, the CEO of OpenAI, has mentioned that future AI will require breakthroughs in energy, as AI's electricity consumption will far exceed expectations. Data shows that ChatGPT previously responded to approximately 200 million requests daily, a process that consumed over 500,000 kWh of electricity. SemiAnalysis estimates that a single request to Google Search with large model interaction features consumes nearly 9Wh of electricity.

Estimated energy consumption per request for various AI systems compared to standard Google Search (2023)

Data Source: Alex de Vries, The growing energy footprint of artificial intelligence, Celpress, 2023

Elon Musk has also predicted that the AI industry will shift from being "silicon-constrained" to "electricity-constrained" in the future. By 2027, the entire AI industry is expected to consume 85 to 134 terawatt-hours (1 terawatt-hour = 1 billion kWh) of electricity annually, roughly equivalent to Beijing's total electricity consumption in 2023. Hence, some joke that the end of AI is electricity.

In Altman's view, while solar energy and energy storage can also generate electricity to power AI, nuclear energy is the best approach. He further predicts that nuclear fusion will become the primary global power generation method, serving as the "cheapest, most abundant, most reliable, and most dense energy source."

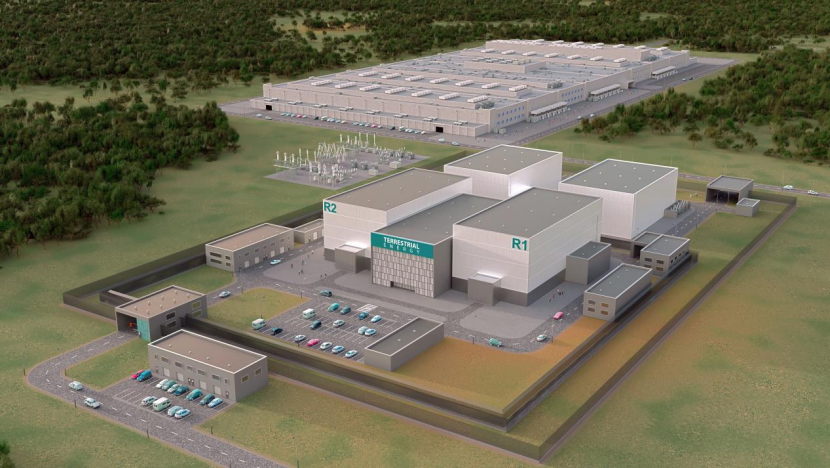

Against this backdrop, a nuclear energy startup named Terrestrial Energy is gaining capital favor with a combination of "molten salt reactors + SPAC listing." On March 27, Terrestrial Energy announced its merger with a special purpose acquisition company (SPAC) for a listing, expected to raise $280 million in financing. The merged entity plans to list on Nasdaq. This is the second nuclear energy startup to go public through a SPAC, following Oklo, where Sam Altman serves as chairman. It is also the first publicly listed developer of molten salt nuclear reactors.

Why is Terrestrial Energy attracting capital bets?

Founded in 2012, Terrestrial Energy is headquartered in North Carolina, USA, with a core team composed of nuclear engineers, materials scientists, and energy industry veterans.

Unlike traditional nuclear power plants, which are massive, Terrestrial Energy is a developer of small modular nuclear power plants using advanced reactor technology. It focuses on developing the Integral Molten Salt Reactor (IMSR), a miniaturized, modular fourth-generation nuclear energy technology that occupies only one-tenth of the space of traditional nuclear power plants and does not rely on water sources for cooling.

Capital's bet on Terrestrial Energy lies primarily in three aspects: model, regulation, and commercialization.

From a technical model perspective, traditional nuclear power plants use solid uranium fuel rods, while the IMSR dissolves uranium fuel in fluoride salts to form liquid fuel. This design model offers three major advantages.

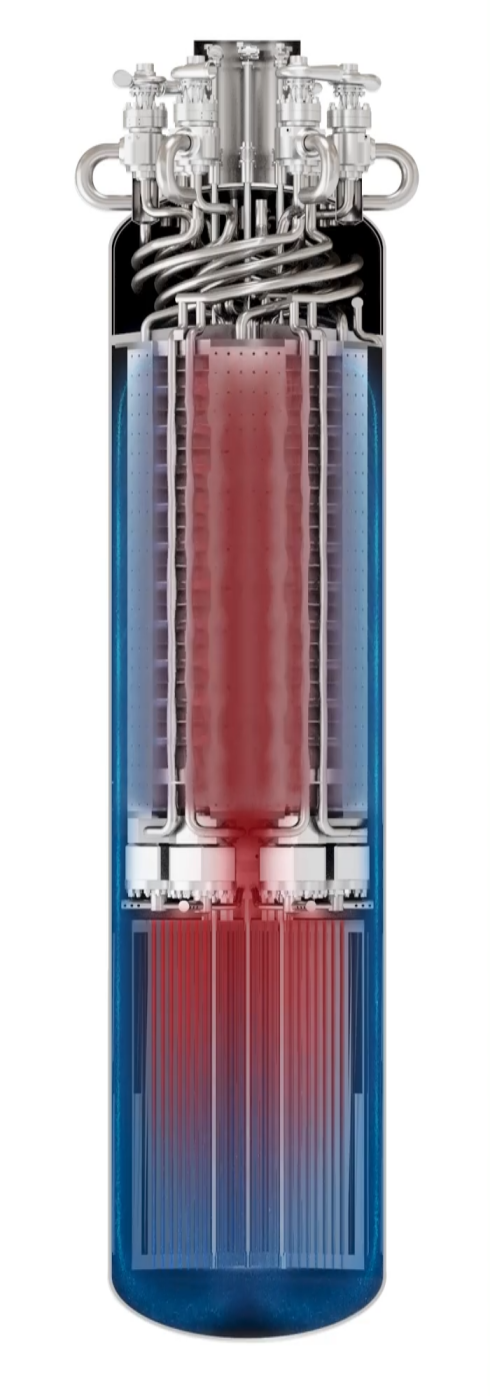

Firstly, safety. The IMSR reactor resembles a large, sealed thermos, with liquid molten salt and key components enclosed in replaceable modules without external piping, eliminating the risk of pipe ruptures found in traditional nuclear power plants. Molten salt remains liquid at high temperatures and will automatically flow into safety containers due to gravity in case of system failure, avoiding the risk of core meltdown.

Image Source: Terrestrial Energy Website

Secondly, economics. IMSR core modules are produced on factory assembly lines and assembled on-site like building blocks, significantly reducing construction time. The thermal efficiency of IMSR is 50% higher than that of traditional light water reactors, producing 40% less nuclear waste, and only requiring a "fuel tank" replacement every seven years, resulting in lower maintenance costs.

Additionally, there is flexibility. The IMSR can supply power to both large cities and remote mining areas or islands. During off-peak hours, excess electricity can be converted into thermal energy for storage and released during power shortages, enabling flexible integration with the intermittency of wind and solar power.

From a regulatory perspective, nuclear energy startups need to interact with regulators, and their development can be severely hindered if they encounter obstacles. Currently, Terrestrial Energy's regulatory journey is relatively smooth, providing some reassurance to investors.

In 2023, the Canadian Nuclear Safety Commission (CNSC) completed a vendor design review of the IMSR plant design, making it the first fourth-generation reactor design to complete a CNSC vendor design review in Canada. Meanwhile, Terrestrial Energy has also closely collaborated with the U.S. Nuclear Regulatory Commission (NRC) since 2016. In 2024, the U.S. Department of Energy (DOE) awarded Terrestrial Energy a GAIN credential for IMSR fuel testing.

In terms of commercialization, leveraging its model advantages and overcoming regulatory hurdles, Terrestrial Energy has demonstrated commercialization potential.

Currently, it has established partnerships and signed agreements with organizations such as Westinghouse Fuels, Energy Solutions, Schneider Electric, the U.S. Department of Energy, and Argonne National Laboratory. For example, it is jointly developing the IMSR power plant control system with Schneider Electric to promote the implementation of cogeneration technology.

Before this SPAC financing, Terrestrial Energy had already raised $94 million through private equity financing, with investors including funds associated with the U.S. Department of Energy and several hedge funds. Of the $280 million raised, Terrestrial Energy stated that 60% will be used for the construction of the first commercial reactor, 30% for fuel recycling technology research and development, and the remaining funds for expanding into the European market.

SPAC: Why has it become the new favorite of nuclear energy companies?

Last May, Oklo, the nuclear fission company chaired by Altman, became the first nuclear energy startup to go public through a SPAC. Now, Terrestrial Energy follows suit as the second.

Why do nuclear energy startups favor the SPAC model? What makes it attractive? In fact, SPAC stands for "Special Purpose Acquisition Company." It is a capital operation akin to "listing first, finding projects later," mainly consisting of three steps:

Shell Creation: Sponsors establish a shell company with no business operations and conduct an IPO to raise funds;

Merger and Acquisition: Identify a target company within two years and complete the merger, with the latter automatically obtaining listed status;

Monetization: If the merger fails, funds are refunded; if successful, investors receive "stock + warrant" rights.

In 2020, the fundraising volume of SPACs in the United States reached $83.042 billion, surpassing traditional IPOs for the first time.

Compared to traditional IPOs, SPACs offer nuclear energy companies three key advantages:

Upfront Capital: SPAC mergers can inject hundreds of millions of dollars in cash into nuclear energy startups at once, such as the $516 million Oklo received through a SPAC, sufficient to cover the construction cost of its first reactor.

Valuation Lock-in: Pre-financing through PIPE (Private Investment in Public Equity) avoids valuation erosion due to market fluctuations. By locking in $280 million before the SPAC merger, Terrestrial Energy ensured that its technology development was not disturbed by secondary market sentiment.

Regulatory Avoidance: SPACs do not require the lengthy inquiries and public roadshows of traditional IPOs, making them particularly suitable for technology-sensitive nuclear energy companies. While traditional IPOs typically take 18 months, SPAC mergers only take 4-6 months. Terrestrial Energy's molten salt fuel formula has not been publicly disclosed, leveraging the confidentiality benefits of SPACs.

In essence, SPACs allow "trading capital for time," enabling nuclear energy startups to gain market trust and resource support even when their technology is not yet mature.

However, SPACs are not perfect and have been questioned by some investors. After all, of the nearly 500 SPAC transactions completed since 2019, more than one-fifth of the companies have share prices below $1. Oklo's share price plummeted by 54% on its first day of trading after going public through a SPAC. Some bearish investors have questioned Oklo's lack of revenue and completed reactors, with the first project not expected to be grid-connected until 2027, posing significant commercialization uncertainties. Additionally, the U.S. SEC's strengthened SPAC disclosure reviews, requiring nuclear energy companies to disclose technology failure probabilities and fuel supply chain risks, may also increase regulatory uncertainties.

Nevertheless, a considerable number of investors remain optimistic about the role of SPACs, believing they can provide nuclear energy startups with sufficient ammunition for commercial reactor construction, technology research and development, and market expansion.

Commercialization of nuclear energy technology: An energy revolution in a race against time

Many Americans welcome the development of nuclear energy. A poll by Bisconti, a third-party research institution in the United States, shows that 77% of the American public supported nuclear energy in 2024, exceeding 75% for the fourth consecutive year. This result represents a significant shift from the nearly one-to-one support-to-opposition ratio 30 years ago.

It can be seen that many technology giants are also betting on nuclear energy. Besides investing in Oklo, Altman has also invested in Helion Energy, aiming to achieve nuclear fusion power generation by 2028. As early as 2008, Bill Gates founded TerraPower, with the goal of designing and building the next generation of nuclear power plants, with the first plant expected to be operational by 2030. In 2021, Jeff Bezos participated in a $130 million Series E investment in General Fusion, a Canadian nuclear power company.

These giants are targeting a massive market - data shows that the global scale of nuclear technology industrialization is nearly $1 trillion. A report released by the International Energy Agency (IEA) shows that annual investment in the nuclear energy sector has increased by nearly 50% in the past three years, exceeding $60 billion.

Currently, nuclear energy technology is accelerating its transition from the laboratory to the market. Although its commercialization timeline varies due to differences in technical routes and regulatory environments, small modular reactors (SMRs) and fourth-generation nuclear fission technologies have emerged as frontrunners, while nuclear fusion is still on the verge of breakthroughs.

SMRs, with their standardized design, short construction cycles (3-5 years), and flexible siting advantages, are the most likely candidates for nuclear energy technology commercialization in the short term. Oklo plans to commission its first 15-megawatt fast reactor at the Idaho National Laboratory in 2027 and has signed long-term power purchase agreements with data centers and shale oil companies.

Although nuclear fusion is hailed as the "ultimate energy source," its commercialization still needs to overcome both physical and regulatory barriers. The International Atomic Energy Agency (IAEA) conservatively estimates that commercial nuclear fusion will not be available until after 2050, with the core challenge being the achievement of stable "net energy gain" (Q-value) and engineering validation.

Additionally, the U.S. government's attitude towards nuclear energy is somewhat wavering. While accelerating nuclear energy development, it maintains a high degree of vigilance and imposes stringent requirements on project reviews. Oklo has stated that dealing with regulators is more difficult than finding customers.

In summary, the commercialization of nuclear energy is not solely a technological competition but a game of capital endurance, policy determination, and social consensus. SMRs and fourth-generation reactors are expected to open up the market by 2030, while nuclear fusion will require more time.

Reference materials:

1. The POWER Interview: Terrestrial Energy's Push to Commercialize Molten Salt Reactors for Industrial and Grid Applications (Power)

2. Decoding SPAC, one article is enough (Deheng Law Firm)