The Wind of Public Listing Has Reached Honor: Can It Spark the A-share Market?

![]() 07/14 2025

07/14 2025

![]() 615

615

The wind of public listing has finally reached Honor.

Have you noticed that with the completion of its shareholding system reform at the end of last year, paving the way for an initial public offering (IPO), and a significant reshuffle of senior executives earlier this year, Honor's listing process has gained significant momentum? In late May of this year, Peng Qiuen, Honor's Chief Financial Officer, revealed that the company had completed its shareholding system reform by the end of 2024 and had hired relevant institutions to initiate preparatory work for the listing. A month later, good news arrived: Honor had obtained listing tutoring filing, with CITIC Securities serving as the tutoring securities trader, marking the official commencement of Honor's listing journey.

Earlier this month, in response to inquiries about the latest progress of Honor's listing, Peng Qiuen explained that a company's path to going public involves six stages, and Honor has now entered the second stage, namely listing tutoring. This stage is expected to last for at least three months, and the progress is currently proceeding smoothly. His statement not only reassures Honor's existing shareholders, giving them hope of realizing their investments, but also fills the outside world with anticipation for Honor's imminent transformation into a public company.

In other words, everyone is keenly interested in whether Honor's listing can ignite the A-share market. This hinges not only on its existing achievements, particularly in its core mobile phone business, but also on its future growth potential. Only by demonstrating substantial development potential can Honor continue to garner the favor of investors. Thus, the question arises: Can Honor leverage its strong capabilities to knock on the door of the secondary market and prove its worth in the harsh glare of capital?

Honor Refuses Backdoor Listing, Opting for Independent Public Offering

Looking back at Honor's development history, from its inception within Huawei at the end of 2013 to its formal separation in November 2020, nearly seven years have passed. Relying on Huawei's extensive business network, going public was never a consideration for Honor. However, since its independence in November 2020, with a new "parent," Honor has had to balance the interests of shareholders while developing its own business.

As a result, going public has become a critical issue that Honor must address. However, rushing into a public listing is not an option, and for Honor, which is progressing steadily according to its inherent rhythm, there is no immediate urgency. This is evident in Honor's relatively calm response to various listing rumors. Prior to announcing its intention for an independent listing, Honor's "shell resource concept stocks" underwent multiple rounds of speculation, frequently stirring up ripples in the financial market.

As early as August 2021, Bird was rumored to be involved in Honor's backdoor listing. Although the company issued two clarification announcements stating that the rumors were untrue, its share price still increased by more than 20% within three days. Similarly, the rumor that Honor would backdoor list through Tianyin Holding directly contributed to a several-fold increase in Tianyin Holding's share price. As a distributor and shareholder of Honor, Tianyin Holding consistently denied any such plans.

Furthermore, other rumored backdoor listing partners for Honor included multiple Shenzhen state-owned listed companies such as Shenzhen Zhenye A, Shenzhen Urban Transport, and Shenzhen Textile A, all of which experienced abnormal share price movements. Shenzhen Zhenye A, for instance, experienced five daily limit-ups within six trading days, while Shenzhen Textile A's share price increased by more than 40% within ten days. This demonstrates that regardless of whether these companies intentionally or unintentionally speculated on their shell company status, as long as they were linked to the star enterprise Honor, there was clearly profit to be made.

However, in November 2023, Zhao Ming, the former CEO of Honor, clearly stated that backdoor listing had never been an option, and Honor would definitely pursue an independent public offering in China. Internal documents of Honor also emphasized that to achieve the company's strategic development in the next stage, it would continuously optimize its shareholding structure, attract diversified capital, and facilitate the company's listing on the capital market through an IPO. At this point, speculation about Honor's backdoor listing subsided, and an independent listing became its sole option.

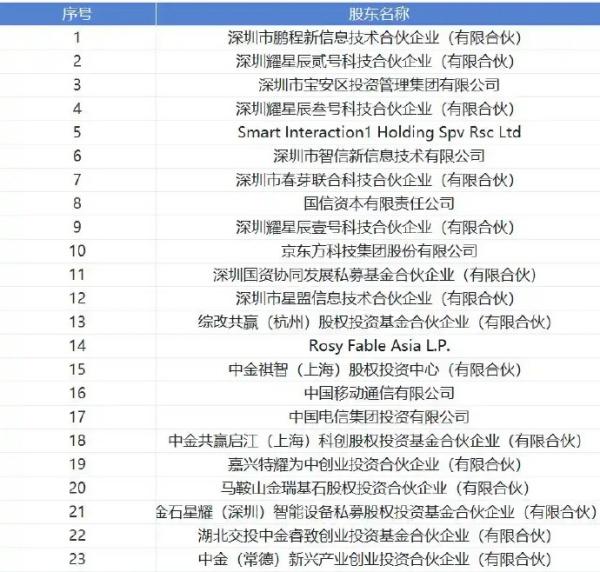

To facilitate its public offering, Honor has indeed made considerable efforts to attract diversified capital and has achieved certain results. In 2022, Honor welcomed new investors such as BOE, Guoxin Capital, and Shenzhen Bao'an District Investment Management Group Co., Ltd., with Shenzhen state-owned assets choosing to increase their investment once again. In 2024, when the listing was confirmed, Honor frequently received capital infusions. In August, it happily received investment from China Mobile. Two months later, China Telecom, Tefa Fund, funds under CICC Capital, funds under Cornerstone, and the agent investment platform Jinshixingyao also invested in Honor.

According to Tianyancha, as of the end of 2024, Honor had a registered capital of approximately 32.2 billion yuan and a total of 23 shareholders, encompassing state capital, distributors, supply chains, mobile operators, third-party capital, among others, presenting a very impressive lineup. This explains why Honor has been able to rise rapidly. Simultaneously, with the continuous expansion of shareholders, Honor's board of directors has also undergone certain changes. In November 2023, Wu Hui, the former chairman of Shenzhen Water (Group) Co., Ltd., representing Shenzhen state-owned assets, became the chairman of Honor, aiming to propel the company's listing process forward, while Wan Biao, who previously served as chairman, was changed to vice chairman and later resigned in September of last year.

Since the beginning of 2025, although the leadership change earlier in the year inevitably raised concerns about Honor's prospects, fortunately, the team's morale and business fundamentals remain relatively stable. Notably, Honor embarked on the listing process amidst doubts and negative voices, yet the listing progress has been very smooth, which is quite inspiring. Perhaps in the near future, Honor will stage a spectacular listing ceremony, undoubtedly a capital carnival. Not only senior executives such as Li Jian and Peng Qiuen but even Zhao Ming will achieve financial freedom, reach the pinnacle of their careers, and provide an exit channel for early shareholders.

Honor's Current Situation: Mobile Phone Fundamentals Under Pressure

For Honor, which has been independent for nearly five years, going public is undoubtedly a major test. Only by producing solid results can it obtain a ticket to the capital market. At the outset of its independence, Honor's share in the domestic market plummeted from a peak of 16.7% to 3%. However, leveraging the research and development team split from Huawei and a relatively complete supply chain, Honor restored its product iteration rhythm in less than four months.

Since then, Honor has made concerted efforts to attract diversified capital and enhance its product line. With the support of shareholders such as Tianyin Holding and Aiside, which are distributor giants, Honor quickly rebounded from its trough and can now compete with mainstream players like Xiaomi and OV, consistently ranking among the top three domestically and occasionally securing the top spot. Admittedly, Honor's rise is closely tied to its own efforts, but it is also linked to the opportunity window naturally created by Huawei's absence.

Due to well-known reasons, Huawei's 5G chip supply once faced extreme difficulties, causing it to become the only mobile phone manufacturer selling 4G phones in the 5G era. Honor astutely seized this once-in-a-lifetime opportunity by offering similar products with almost identical experiences, earning the title of "Huawei alternative" and attracting a large number of Huawei fans, laying a solid foundation for its ascent. In my opinion, Honor's strategy was clever, but it cannot be sustained in the long run, as once Huawei returns in full strength, even if Honor achieves pixel-level replication of Huawei, it may struggle to retain users.

Sure enough, at the end of August 2023, Huawei Mate60, equipped with the Kirin 5G chip, was officially launched, sounding the clarion call for Huawei's comprehensive counterattack. At that time, public opinion was abuzz with discussions about which mobile phone manufacturer would be most impacted by Huawei's return. Some said it would be Apple, while others claimed it would be Xiaomi. Of course, Honor was also mentioned. In fact, prior to the launch of Huawei Mate60, namely in early August 2023, Zhao Ming made his stance clear. He welcomed Huawei's 5G return, stating, "If this news is true, probably the happiest people are me and many of my Honor colleagues."

However, facts have proven that Huawei, with its formidable combat effectiveness, is a tougher competitor than Apple, especially in the high-end market with higher margins. Honor inevitably faces greater competitive pressure, followed by fluctuations in market share. I observed that Huawei's domestic market share began to accelerate its growth in Q3 2023, and this time node coincided precisely with the starting point for Honor's market share decline. At that time, Honor topped the market with a share of 19.3% before entering a downward trajectory.

From Q1 to Q4 2024, Honor's market share was 17.1%, 15%, 14.6%, and 13.26%, respectively. Notably, its ranking in Q4 even fell to fifth domestically, indicating that its high-profile moment was fleeting, whereas Huawei, which has returned in full strength, has firmly secured a spot among the top three domestically. Facing this harsh reality, it is estimated that Zhao Ming was far from pleased and was under immense pressure. At this juncture, Honor's internal situation was also unstable. Hence, you will see that in January of this year, Zhao Ming, who had been at the helm of Honor for nearly 10 years, left the company amidst controversy, and Li Jian, a former Huawei warrior, took over as CEO of Honor.

Upon taking office, Li Jian's primary task was to stabilize the morale of the team. Regardless of how much doubt and negative voices emanate from the outside world, having a strong inner resolve is crucial. Simultaneously, he also endeavored to carry out organizational reforms and establish a talent matrix. For instance, in April, he launched the "Eagle Plan" in the China region to reconstruct competitiveness. In Li Jian's view, if a business cannot be sustained in the long run, it is ultimately due to organizational issues.

Of course, it is not an overnight success for Honor to drive competitiveness upgrades through organizational reforms. Expecting immediate results is unrealistic, but it is a wise move in the long term. This means that when you observe that Honor fell out of the top five in Q1 (Canalys data) and Q2 (BCI data) this year, becoming one of the "Others," do not be surprised. It signifies that the pain Honor is enduring is still ongoing but not yet over. On the contrary, after major internal adjustments and the successive launch of new products, Honor is performing better. Li Jian boldly stated that Honor's goal is to return to the top three domestically by the end of this year.

Indeed, the robust sales of the Honor 400 series and Honor Magic V5 demonstrate that Honor has regained its vitality, and the capable Honor seems to be back. As for whether it can indeed enter the top three domestically as scheduled by the end of the year, it is still too early to tell. After all, Huawei, Xiaomi, OPPO, and vivo are all formidable opponents. Let's wait and see. Time will prove everything!

The Key to Honor's New Capital Story Lies in Its Execution

Currently, there are two listed companies in the mobile phone industry: Xiaomi, which listed on the Hong Kong Stock Exchange in 2018, and Transsion, which listed on the STAR Market in 2019. As we all know, the story of "the first stock in the XX industry" is highly popular in the capital market. For Honor, which has missed the first opportunity to become "the first stock in the smartphone industry," if it continues to solely narrate the story of smartphones, it may not be widely recognized by the capital market. Instead, it must tell a new story from a different perspective.

According to my observation, as early as November 2023, Zhao Ming was already aware of this issue. "(In the secondary market) Honor has not found a comparable object because the development path taken by Honor is distinct from the choices of many companies." Clearly, Honor is reluctant to anchor itself to a specific comparable object in the secondary market as it may adversely affect its valuation. Unfortunately, he did not stay on to lead Honor through its listing journey. After Li Jian took office, he packaged a new story for Honor as an "AI terminal ecosystem company."

The so-called AI terminal ecosystem company encompasses both the currently popular and future-representing AI technology, as well as the highly imaginative terminal ecosystem, spanning mobile phone fundamentals and various IoT devices. This is precisely the core of Honor's "Alpha Strategy," namely that Honor is committed to transforming from a smartphone manufacturer into a globally leading AI terminal ecosystem company. To this end, Honor plans to invest $10 billion over the next five years in developing AI terminal technology, ecosystems, and partnerships, infusing new momentum into unlocking human potential.

I believe that Honor's new story is indeed quite compelling, and the substantial investment underscores its determination, which can indeed attract investors. However, the crux lies in its execution—only by demonstrating tangible results to investors can it be sufficiently persuasive and ultimately win their confidence. At present, both narrow AI mobile phones and broad AI terminals are in their nascent stages, and AI has not yet become the primary selling point driving user purchases.

Highly anticipated AI applications can be broadly categorized into three types: firstly, integrating large model technology into specialized applications such as voice summaries, smart searches, and image editing; secondly, embedding AI within the underlying operating system to bolster its perception and reasoning capabilities, thereby supporting more intricate operations; and thirdly, embedding AI capabilities into hardware, services, and even third-party services, building upon the second category. It is evident that these categories are progressively interrelated, with deeper integration necessitating higher standards for AI technology and its ecosystem.

For Honor, both the Magic Live system incorporated into the 2016 Honor Magic and Zhao Ming's order of 2,000 coffee cups using the YOYO intelligent agent last year exemplify its profound AI expertise. Indeed, since last year, Honor has vigorously invested in AI. However, AI research, development, and application demand substantial capital, top talent, and profound technical expertise. Despite Honor's financial abundance and aggressive recruitment, there remains uncertainty about its ability to swiftly overcome key technical hurdles and develop AI technologies and products with core competitiveness.

Furthermore, constructing a comprehensive AI ecosystem for Honor necessitates forging close partnerships with numerous entities, aligning the interests and resources of all parties, and managing complex integrations, which contribute to a lengthy ecosystem development cycle. This poses a formidable challenge. The rapid advent of the AI era has made AI a critical battleground for the mobile phone industry, compelling Honor to promptly introduce market-responsive and competitive products during its transformation, leaving little room for experimentation; otherwise, it risks missing market opportunities.

Put simply, while the ambition is grand, the realities are challenging. Honor's transformation journey is fraught with difficulties and uncertainties. It should neither be overestimated in the short term nor underestimated in the long term. In other words, Honor's Alpha Strategy presents both immense opportunities and significant challenges. True implementation is paramount, as it directly influences its listing valuation and growth potential. Let's go!