AI Heavy Investment and Tariff Disruptions: Is Amazon Navigating Another "Crouching Period"?

![]() 05/07 2025

05/07 2025

![]() 638

638

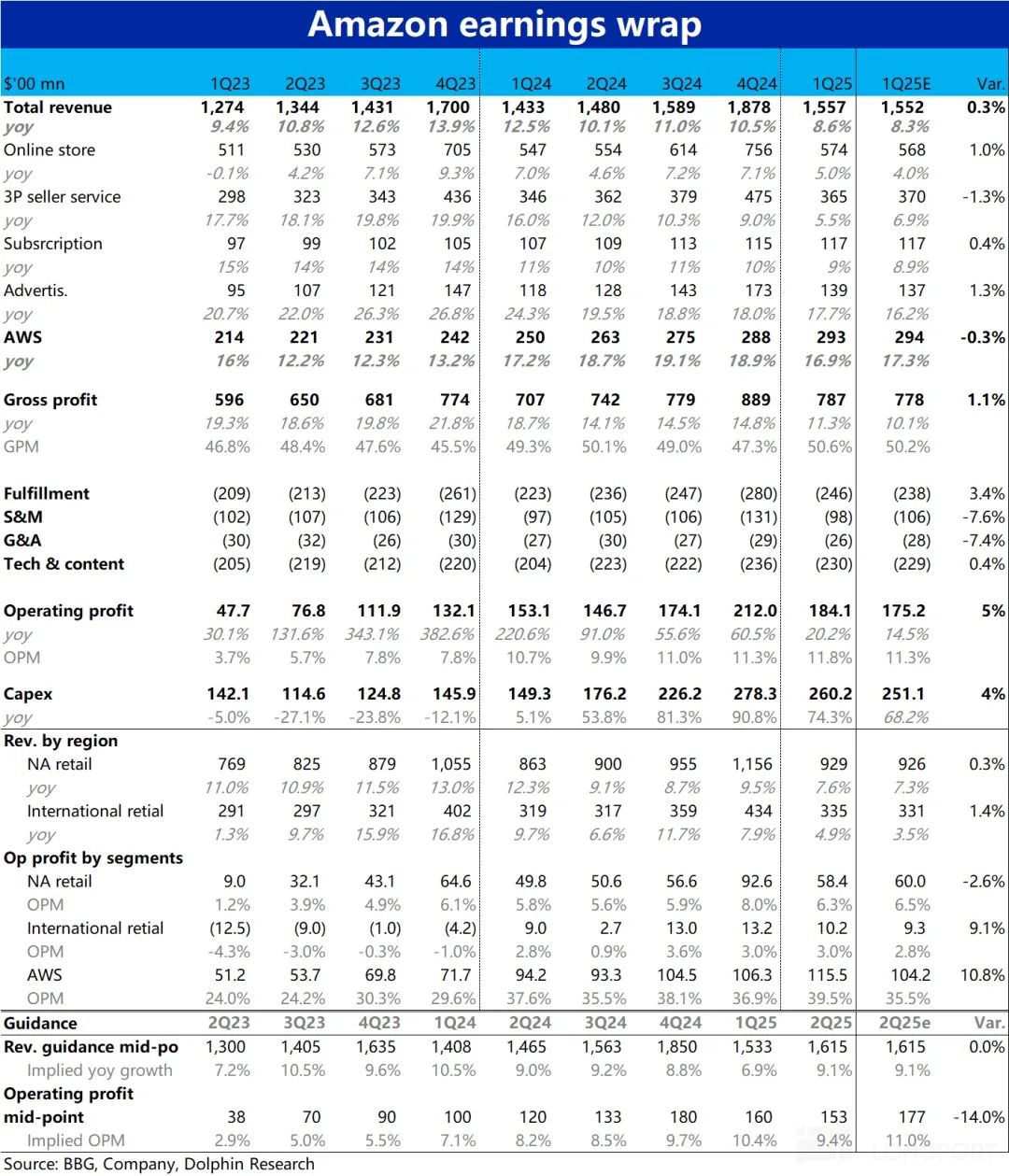

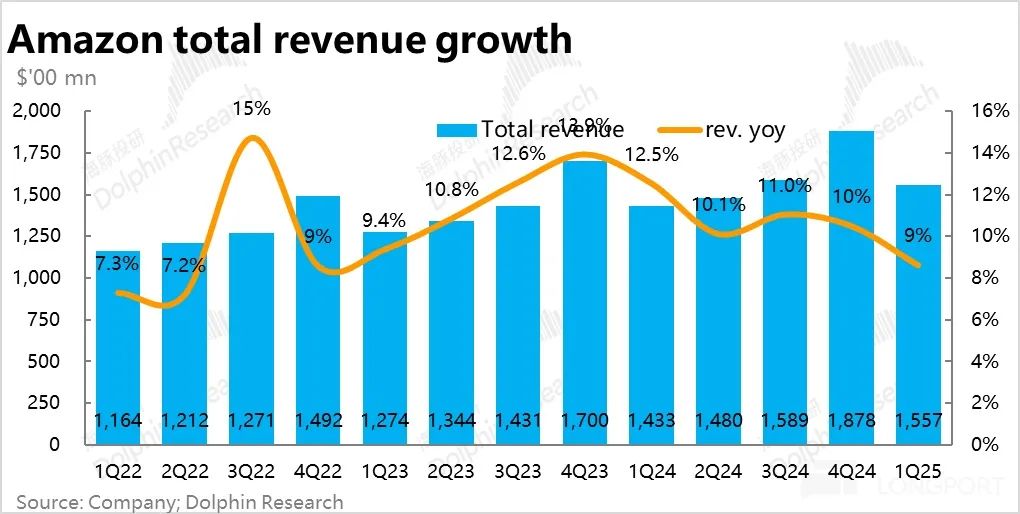

After the U.S. markets closed on May 2, Amazon released its financial report for Q1 2024. The quarterly performance was underwhelming, yet it met overly conservative expectations. The primary concern centered around the company's low profit guidance for the next quarter, suggesting a sequential decline in profit margins. Specific details are as follows:

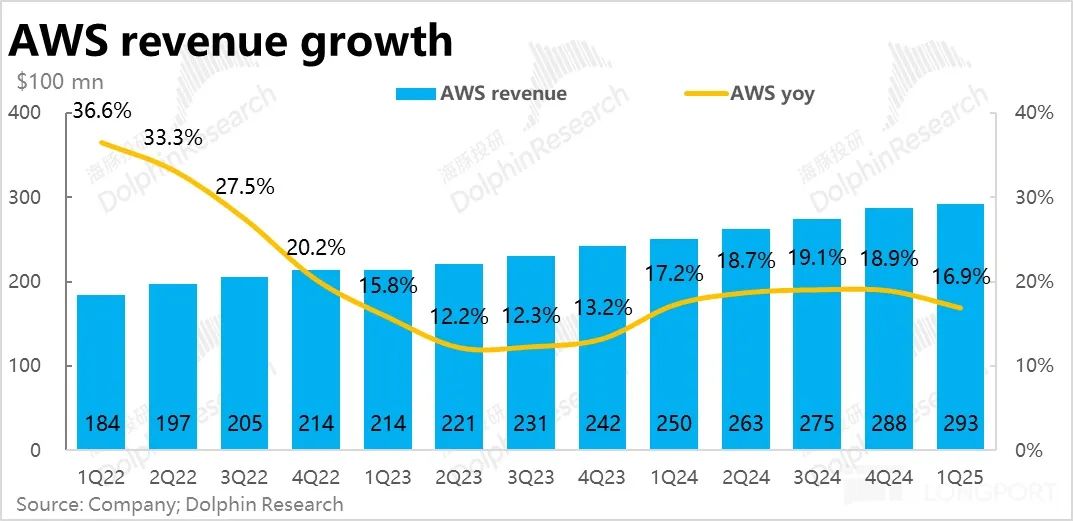

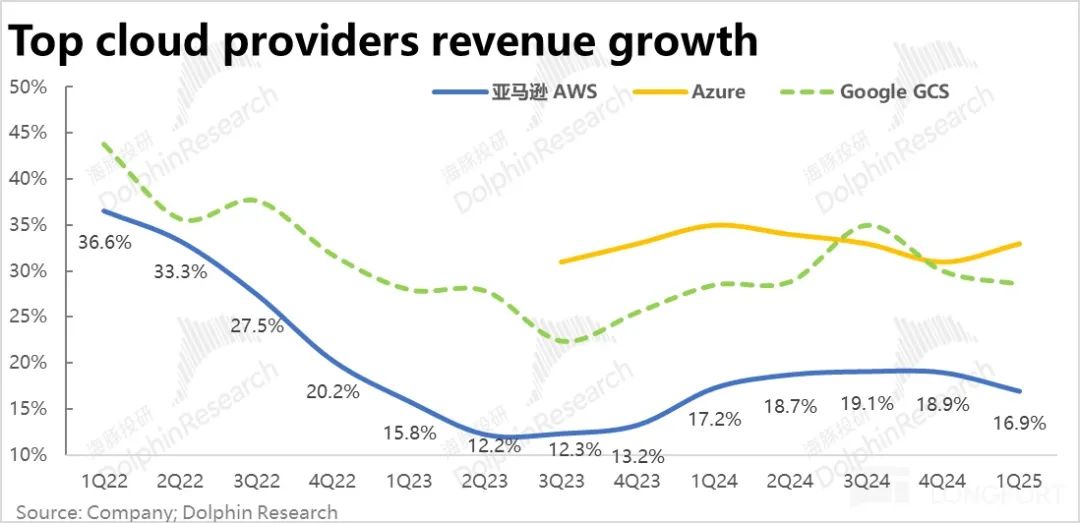

1. AWS Growth Stalls, Yet Profits Surpass Expectations: AWS's revenue growth rate for this quarter was 16.9%, roughly 2 percentage points slower than the previous quarter and below seller expectations of 17.3%. It did not outperform Azure, which showed robust growth. However, AWS's performance was within expectations given the market's subdued outlook before the results were announced.

Comparatively, both GCP and AWS displayed a slowing growth trend, similar to Azure, although Azure's accelerated growth was primarily driven by its AI business. Traditional non-AI businesses also showed a slight slowdown, indicating a weakening in corporate spending on non-AI demands. Thus, AWS's lackluster performance was expected.

Some research suggests that AWS faces more significant bottlenecks than Azure in acquiring high-performance GPUs and new data center/computing power supplies, which may be constraining AI demand (while traditional demand remains weak). This could explain why AWS's growth failed to accelerate.

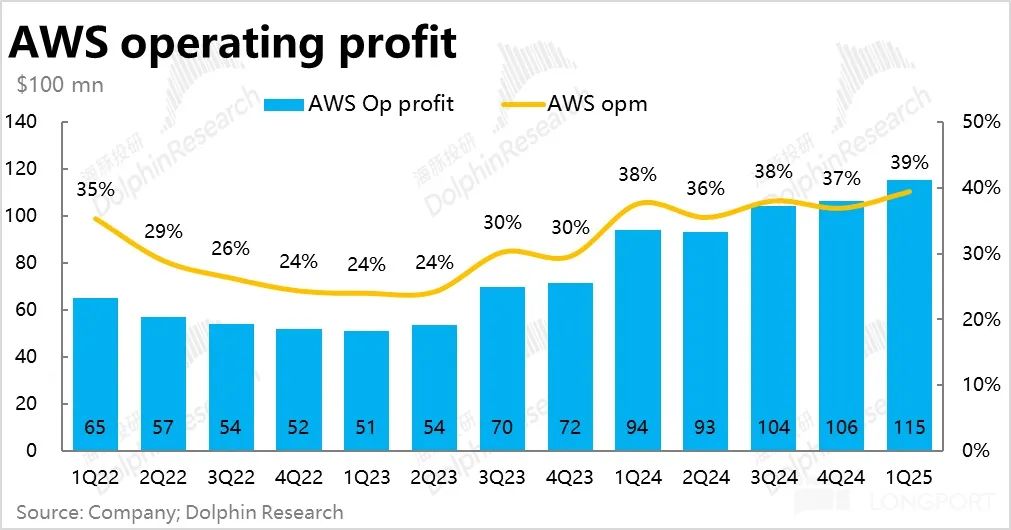

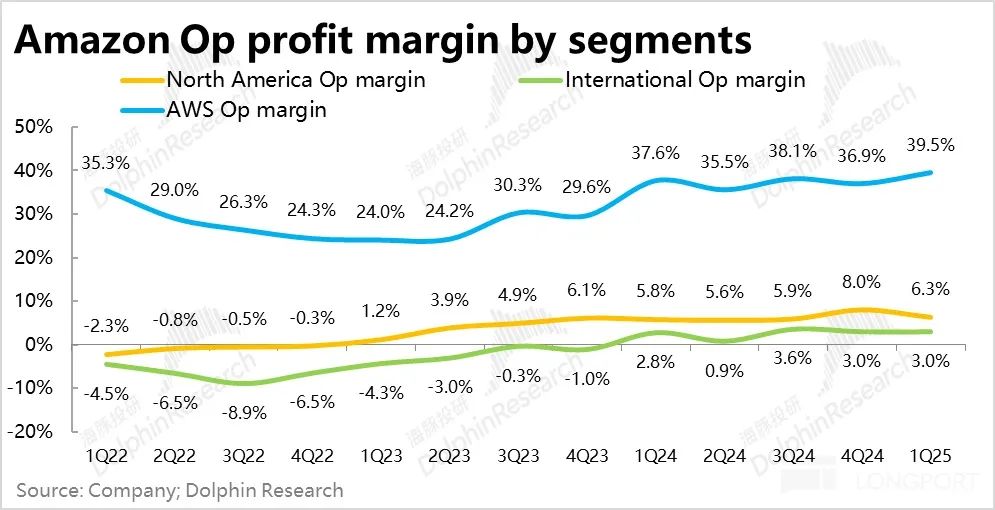

2. AWS Profits Exceed Expectations Despite Mediocre Growth: AWS's operating profit margin for this quarter was an impressive 39.5%, exceeding both the previous quarter and market expectations by 2.6 and 4 percentage points, respectively. Despite the company shortening server depreciation life from 6 to 5 years in January, leading to higher depreciation and expected profit margin declines, AWS's profit margin significantly increased.

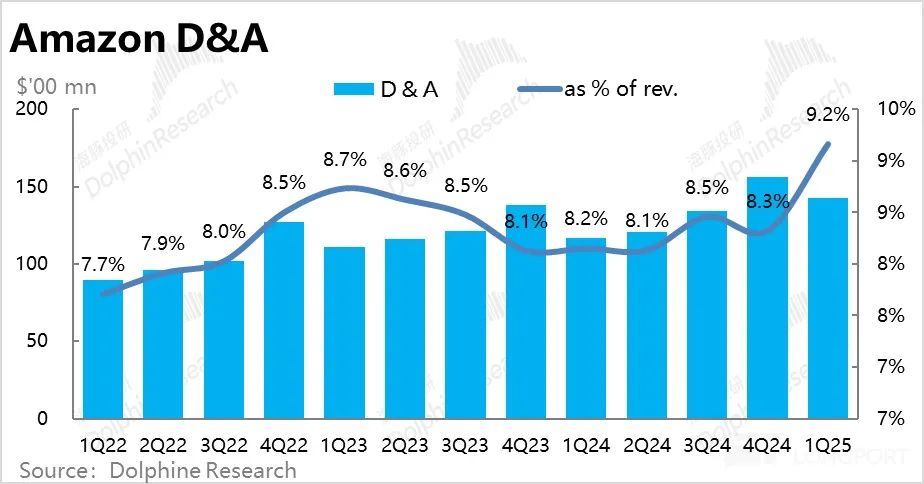

Depreciation as a proportion of total revenue did increase by 0.9 percentage points to 9.2%, yet AWS's profit margin expanded notably. It is crucial to scrutinize management's explanations for this anomaly and assess any potential one-time favorable factors.

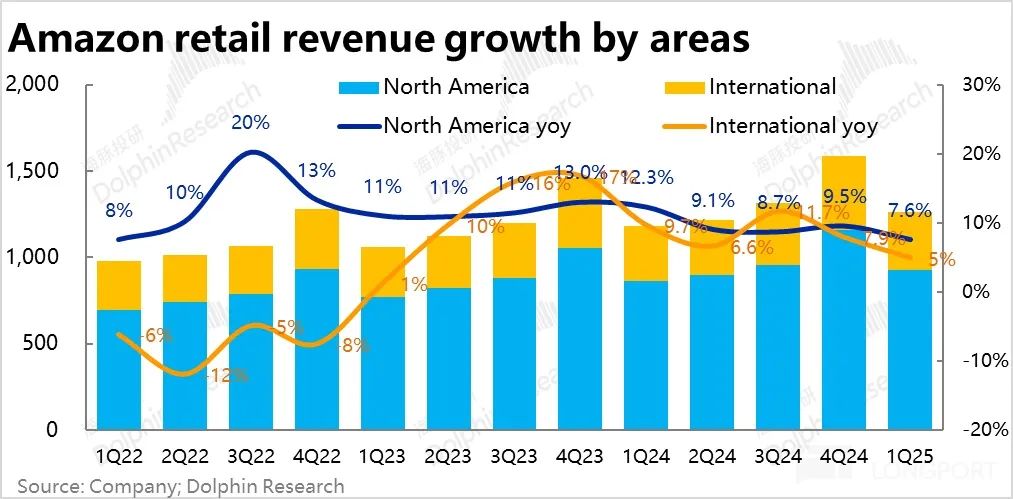

3. Retail Sales Weaken in Both North America and Internationally: Revenue from the pan-retail segment totaled $126.4 billion this quarter, with a year-on-year growth rate of 6.9%, 2.2 percentage points slower than the previous quarter. However, due to adverse currency exchange rate effects, actual performance surpassed the market's conservative expectations.

Regionally, North American retail sales, unaffected by exchange rates, declined from 9.5% to 7.6%, indicating weakening consumption. International retail business growth also plummeted by 3 percentage points to 4.9%. Excluding currency effects, however, the actual year-on-year growth rate in international regions was 8%, decelerating by only about 1 percentage point, aligning closely with North American growth rates.

Growth in North America and international regions like Europe, where Amazon operates prominently, did show signs of weakening. While absolute performance was underwhelming, it was not as dire as sellers feared due to tariffs and macroeconomic factors.

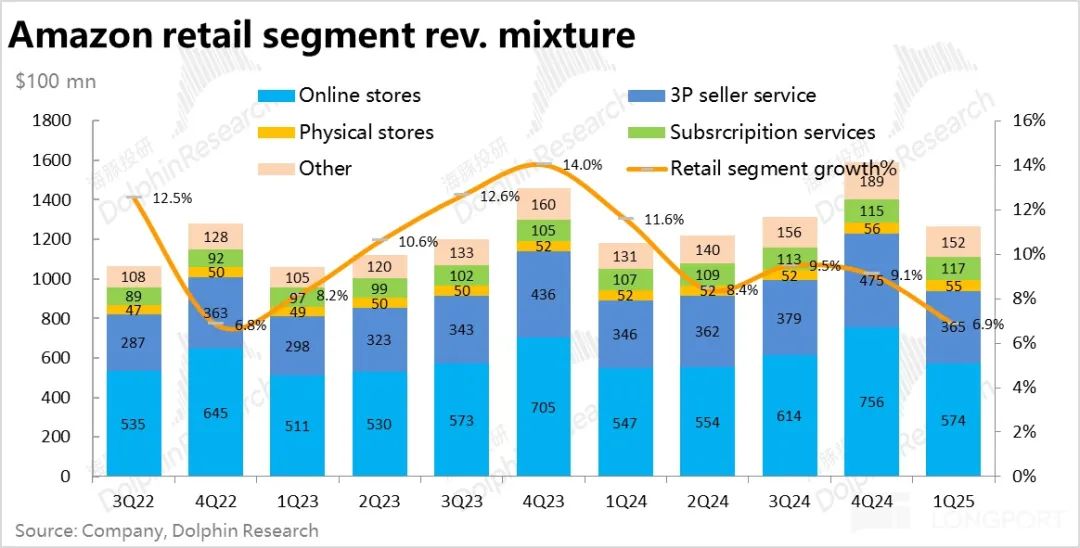

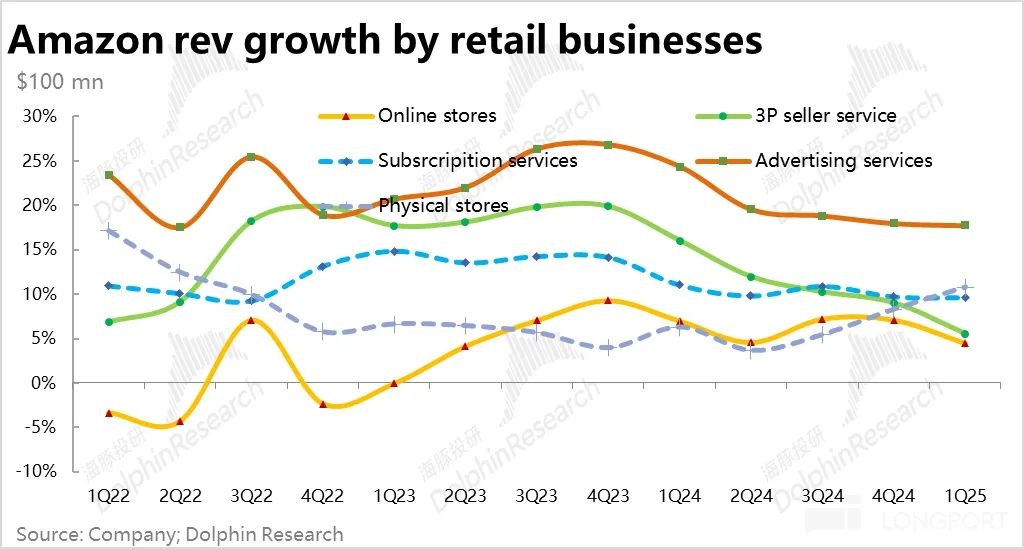

4. 1P & 3P Retail Struggle, While Advertising and Subscriptions Show Resilience: Within the pan-retail business, 1P self-operated retail and 3P merchant services both witnessed a 2 percentage point decrease in growth rates on a constant exchange rate basis, to 6% and 7%, respectively. Both fell to mid-single-digit growth rates, reflecting weak consumption.

The 1-percentage-point growth rate difference between the two segments also indicates that the 3P business's monetization rate is no longer increasing significantly, in line with the company's commitment not to raise fees for 3P merchants in 2025.

In contrast, subscription service revenue demonstrated its inherent stability, with a year-on-year growth rate of 9.6%, essentially unchanged from the previous quarter. Excluding exchange rate impacts, the growth rate actually increased by 1 percentage point. Advertising revenue growth also outperformed expectations, with actual growth of 17.7%, a slight 0.3 percentage point deceleration from the previous quarter and higher than market expectations of 16.2%.

Similar to Netflix and Google & Meta, the subscription business exhibits higher certainty and countercyclical resilience in the early stages of macroeconomic deterioration. Moreover, major advertising giants generally showed resilient growth in the first quarter.

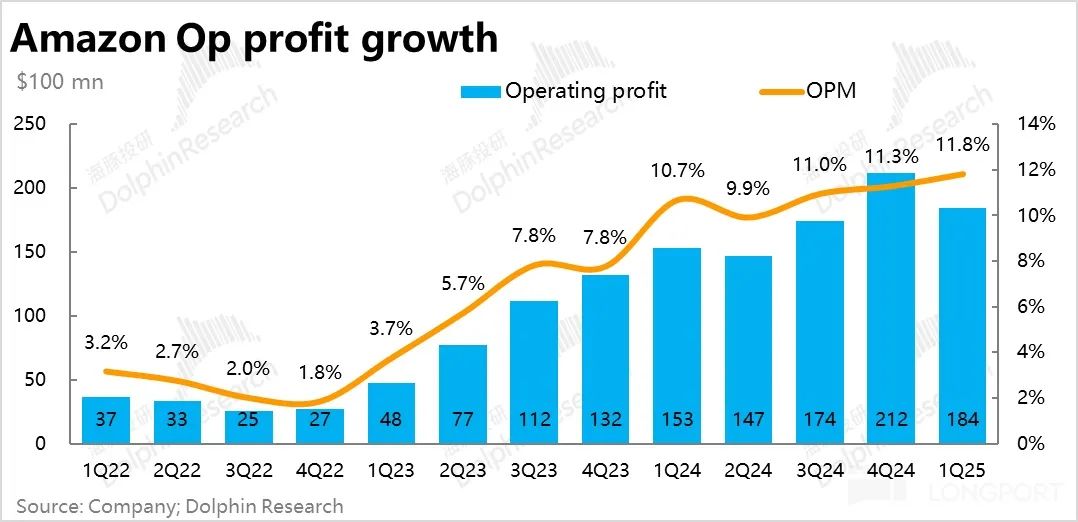

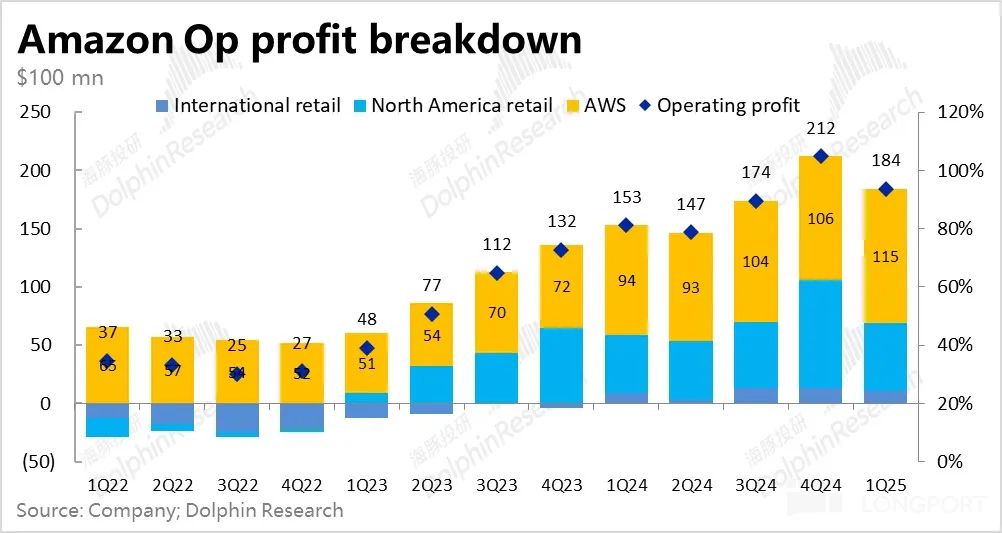

5. Profitability Remains Stable Despite Challenges: The company achieved an operating profit of $18.4 billion for this quarter, slightly exceeding seller expectations of $17.5 billion and the upper limit of previous guidance of $18 billion. Despite macroeconomic weakness and significant policy changes, profit performance for this quarter was solid.

By segment, the AWS business's operating profit margin unexpectedly increased significantly, contributing an additional $1 billion in profits than anticipated. Conversely, retail business profits in North America fell below expectations, with an operating profit margin of only 6.3%, a 1.7 percentage point decrease from the previous quarter and below market expectations of 6.5%.

Given the company's continued investment in fulfillment assets like next-day/same-day delivery, the rapid profit margin improvement cycle in the retail business, which has lasted nearly two years, may indeed have ended at this stage.

However, the operating profit margin in international regions was 3% this quarter, flat compared to the previous quarter and higher than market expectations of 2.8%. Unlike the mature North American region, where scale effects and profit margin releases are in the middle to later stages, international regions may still have considerable room for long-term profit improvement trends, even with short-term disturbances, as they are still in the early stages of efficiency improvement and profit enhancement.

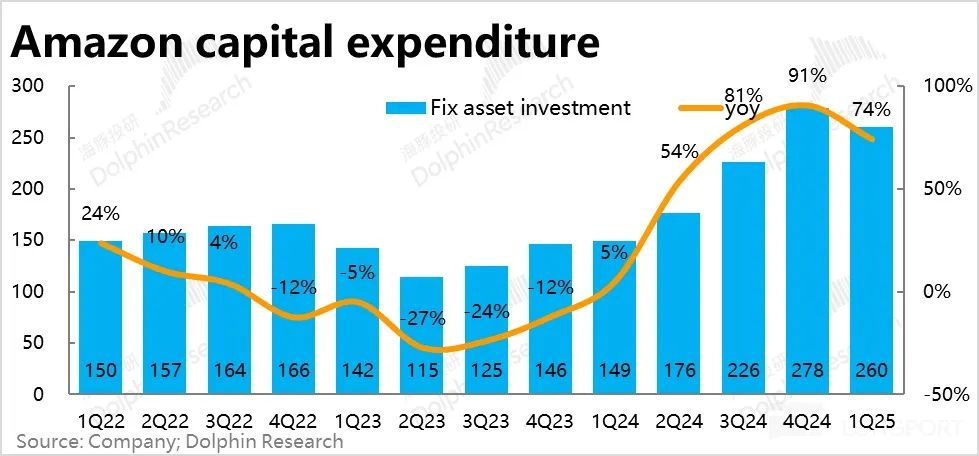

6. High Capex Continues: Amazon's Capex for this quarter remained high at $26 billion, slightly lower than the fourth quarter of last year but still higher than seller expectations of $25.1 billion, maintaining a significant investment scale. This reassures upstream semiconductor and mid-to-downstream AI demand.

7. Next Quarter Guidance Indicates Modest Growth and Margin Compression: For the next quarter, the company expects revenue to range from $159 billion to $164 billion, with a median value consistent with market expectations, implying a year-on-year growth rate of 9.1%. Considering virtually no adverse currency exchange rate effects in the next quarter, the growth rate will be less than 0.9 percentage points slower than this quarter. Given the gradual emergence of tariff impacts in the second quarter, this revenue guidance is favorable.

At the profit level, the guidance for operating profit in the next quarter is $13 billion to $17.5 billion, with the upper limit slightly lower than market expectations of $17.7 billion. Even considering the upper limit, the implied operating profit margin for the next quarter is 10.8%, lower than the 11.8% for this quarter, indicating a significant profit margin contraction. Whether due to the return of AWS's unexpectedly strong profit margins this quarter or the continued decline in retail business profit margins, management's explanation will be crucial.

Dolphin Investment Research Viewpoint:

In summary, Amazon's performance for this quarter was generally underwhelming. On the growth front, the pan-retail segment saw a significant decline in growth rates (although subscriptions and advertising were relatively resilient, their growth rates also slowed). AWS growth did not bring any surprises, with no signs of acceleration. On the profit front, while the company's overall profits slightly exceeded expectations due to AWS's unexpectedly strong profit margins, the profit margins in the core North American retail business did indeed decline significantly and by a larger margin than anticipated, signaling a shift from a profit release cycle back to an investment cycle.

This quarter's results lacked substantial highlights, mainly because market expectations were overly conservative due to macroeconomic and tariff factors, making the actual performance appear less worrisome than feared.

Looking ahead, the company's guidance for revenue growth in the next quarter did not slow down much compared to this quarter, which is stronger than Dolphin Investment Research's expectations, given the emerging tariff drag. However, the guidance for profit margin contraction is concerning, suggesting that profit margins for both the retail and AWS businesses will shrink.

Regarding specific businesses, market expectations for AWS are currently pessimistic. Many sellers anticipate that AWS revenue growth will not accelerate throughout 2025. The reasons may include the subdued outlook for traditional non-AI demand and AWS's significant bottlenecks in AI computing power supply.

Similar to Azure, as Amazon continues to increase Capex, the market will question when these new investments will lead to new growth. If AWS fails to demonstrate the key signal of "accelerated growth" for an extended period, it will become increasingly unacceptable.

The pan-retail business is more directly affected by tariff and macroeconomic consumption factors. While recent performance has not been as bad as feared, it has indeed shown signs of overall weakness. As long as tariff and recession risks persist, even if current performance is good, the market may question future deterioration, necessitating caution.

Recently, Amazon seems intent on increasing fulfillment investments again. While returning to an expansion cycle is a long-term positive, it will undoubtedly pressure retail business profitability in the short term.

Therefore, Amazon's recent performance has lacked significant highlights and been heavily influenced by tariff and macroeconomic factors. Dolphin Investment Research believes Amazon is entering another period of mismatch between short-term inputs and outputs. Nonetheless, its long-term competitive barriers remain unchanged, making it a fundamentally sound company.

The company's current market value corresponds to a PE valuation of approximately 29x based on 2025 after-tax operating profit. Given the current downward profit margin cycle, while not expensive compared to historical levels, the absolute valuation is not inexpensive.

Detailed Comments:

I. AWS: No Growth Highlights, Yet Unexpectedly Strong Profits

AWS's revenue growth rate for this quarter was 16.9%, roughly 2 percentage points slower than the previous quarter and below seller expectations of 17.3%. AWS's growth remains unsatisfactory, and the company faces the same challenge as Azure—substantial Capex investments with no clear timeline for accelerated growth.

Microsoft's financial report yesterday delivered this important signal, yet market expectations for AWS to re-accelerate in the second half of this year remain low, based on recent performance and market sentiments.

Among the three major cloud computing hyperscale providers, besides Azure, both GCP and AWS showed a clear slowing growth trend. Even Azure's accelerated growth was primarily driven by a 3-percentage-point increase in AI business contribution growth, while traditional non-AI businesses also slowed slightly. This suggests a common trend among cloud providers—weakening corporate spending on traditional non-AI demands.

According to securities firm research, AWS faces more significant bottlenecks than Azure in acquiring high-performance GPUs and new data center/computing power supplies, constraining AI demand release. This explains the market's general expectation that AWS will struggle to accelerate in the second half of the year.

However, in terms of profits, AWS significantly exceeded expectations this quarter. The operating profit margin was 39.5%, not only not declining but also 2.6 and 4 percentage points higher than the previous quarter and market expectations, respectively.

Since the company announced in January that it would shorten the depreciation life of servers from six to five years, resulting in a gradual increase in depreciation-related Capex, common sense (and market expectations) dictated that AWS's profit margins would decline this quarter. However, the actual profit margin significantly increased, defying these predictions. Attention should be directed towards the management's explanation of the reasons behind this increase and whether any one-time favorable factors were at play.

II. Consumption Did Weaken, but Subscriptions and Advertising Were More Resilient Than Expected

Pan-retail revenue for this quarter stood at $126.4 billion, with a year-on-year growth rate of 6.9%, 2.2 percentage points slower than the previous quarter. Nonetheless, due to adverse currency exchange rate effects, actual performance surpassed market expectations. Regionally, the growth rate of North American retail sales, unaffected by exchange rates, dropped from 9.5% to 7.6%, indicating a weakening of consumption in North America.

The nominal growth rate of international retail business plummeted by 3 percentage points to 4.9%, yet it still exceeded market expectations of 3.5%. Excluding the impact of adverse currency exchange rates, the actual year-on-year growth rate in international regions was 8%, with a deceleration of only about 1 percentage point, closely mirroring the growth rate in North America.

Overall, growth in North America and international regions where Amazon operates, such as Europe, did indeed show signs of weakening, and performance was not stellar. However, it was not as dire as sellers had anticipated, who were "spooked" by tariffs and macroeconomic factors.

Delving into each specific segment: ① Self-operated retail business grew by 5% year-on-year and 6% on a constant exchange rate basis, with a deceleration of 2 percentage points. Revenue from 3P merchant services also decelerated by 2 percentage points to 7% on a constant exchange rate basis.

1P retail and 3P business decelerated to mid-single-digit percentage growth. The growth rate difference between the two narrowed to just 1 percentage point, suggesting that the monetization rate of the 3P business is no longer increasing, in line with the company's prior commitment not to increase fees for 3P merchants by 2025.

② Subscription service revenue underscores the inherent stability of its model. Despite a significant slowdown in the retail business, it grew by 9.6% year-on-year this quarter, essentially unchanged from the previous quarter. Excluding exchange rate effects, the growth rate actually increased by 1 percentage point. This aligns with the defensive logic currently applied to stocks like Netflix.

③ Advertising revenue growth this quarter also exceeded expectations, with actual growth of 17.7%, only a slight deceleration of 0.3 percentage points quarter-on-quarter, and significantly higher than market expectations of 16.2%. Due to the slowing growth trend of the aforementioned 1P and 3P retail revenue, as well as negative macroeconomic and policy impacts, market expectations for Amazon's advertising revenue were conservative ahead of earnings.

However, in terms of actual performance, similar to Google and Meta, these major advertising giants in the market have at least demonstrated resilient growth in the first quarter. It remains to be seen whether this growth momentum can be sustained into the subsequent second quarter.

III. North American Retail Profit Margins Declined as Expected, Relying Solely on AWS to Save the Day

In terms of overall revenue, due to the general slowdown in pan-retail business growth, AWS also failed to exhibit impressive growth. The company's total revenue for the quarter was $155.7 billion, an 8.6% year-on-year increase, slightly better than the expected 8.3%. This was an average performance.

In terms of profits, the company achieved an operating profit of $18.4 billion this quarter, slightly above the sell-side expectation of $17.5 billion and the upper limit of the previous guidance of $18 billion. Amidst market concerns about potential profit surprises due to factors like weakening consumption and increased investments, the actual performance can be deemed satisfactory.

However, by segment, the operating profit margin of the AWS cloud business exceeded expectations, contributing an additional $1 billion in actual profit compared to forecasts.

In the retail business, the operating profit margin in North America was only 6.3%, a full 1.7 percentage points lower than the previous quarter and below market expectations of 6.5%. While the market had anticipated a narrowing of profit margins, the actual situation was even worse. Considering the company's continued investment in fulfillment assets such as next-day/same-day delivery, the period of rapid profit margin improvement in the retail business, which has lasted for nearly two years, may indeed be coming to an end.

In contrast, the operating profit margin in international regions was 3% this quarter, unchanged from the previous quarter and higher than market expectations of 2.8%. This suggests that, compared to the mature North American region, where scale effects and profit margin release are in the second half, international regions may still have considerable room for long-term profit improvement trends due to being in the early stages of efficiency improvement and profit enhancement, despite short-term disturbances.

Looking ahead, as the impact of tariff shocks is officially reflected in Q2, the profit margins of the retail business may indeed continue to narrow in the short to medium term. It remains to be seen whether the AWS business, which exceeded profit margin expectations, can maintain its performance and prevent the group's overall profit margin from declining.

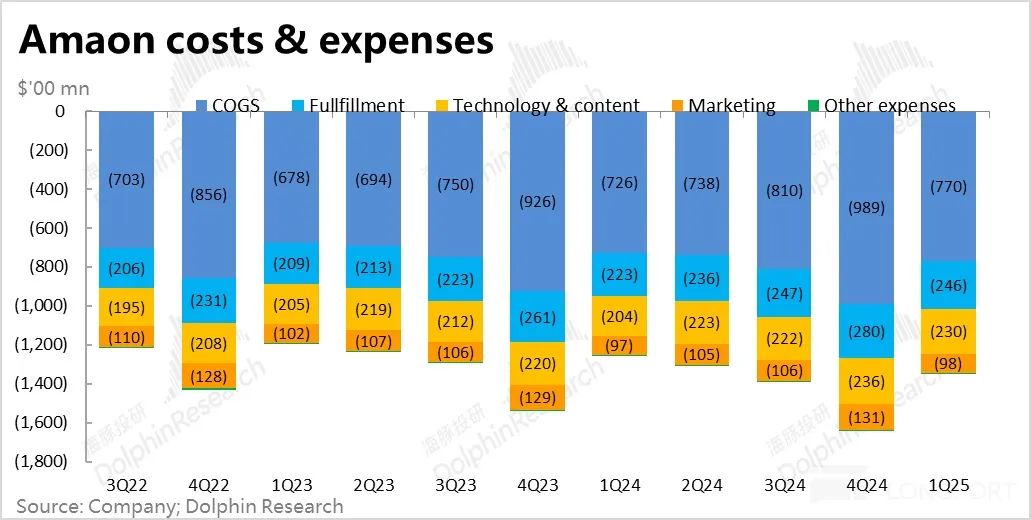

IV. Some Expenses Began to Expand, with Both Capex and Depreciation Continuing to Increase Significantly

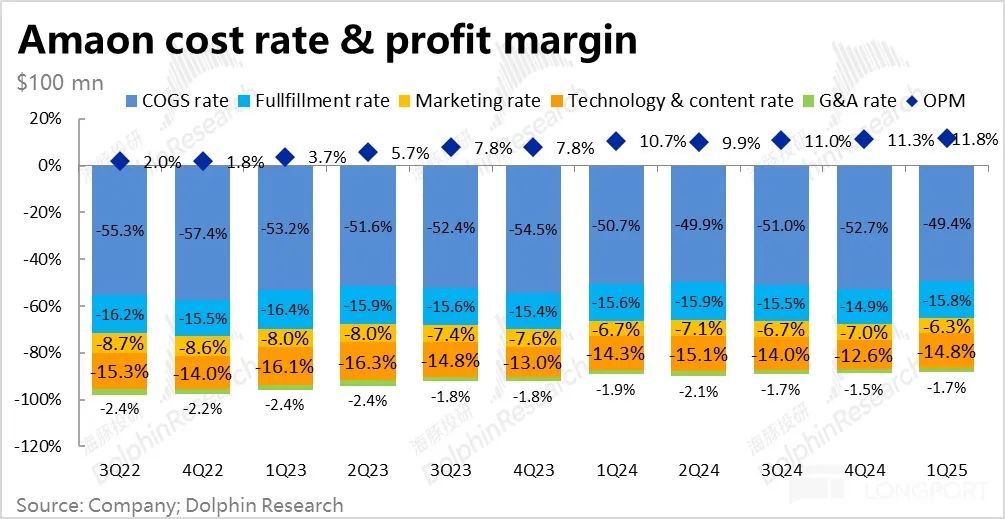

From a cost and expense perspective: 1) The quarter's gross margin was 50.6%, an expansion of 1.3 percentage points year-on-year and higher than the expected 50.2%. Considering that actual amortization and depreciation for this quarter increased significantly by 22% year-on-year, accounting for 9.2% of total revenue (an increase of 0.9 percentage points quarter-on-quarter), the drag on gross profit has increased. Therefore, the gross margin exceeding expectations suggests a common inducement behind the substantial overachievement of AWS profit expectations.

2) From an expense perspective, the proportion of fulfillment expense rate has ceased to decline and instead expanded by 0.2 percentage points year-on-year, indicating that the retail business's fulfillment end may have shifted from profit release to re-investment. Additionally, the proportion of R&D and content expenses also expanded by 0.5 percentage points, reflecting increased investment in AWS and subscription business audio-visual media production.

Meanwhile, marketing and management expense ratios continued to contract year-on-year, reflecting the company's persistent efforts to control expenses and mitigate the impact on earnings in a challenging macroeconomic environment.

Furthermore, Amazon's Capex for this quarter was still as high as $26 billion (note: this figure is disclosed in the company's cash flow statement and may have slight deviations from those mentioned in the earnings call, but the general trend is consistent). Although it declined slightly from the previous quarter (4Q of last year), possibly due to seasonal fluctuations, it was still higher than the sell-side expectation of $25.1 billion, undoubtedly maintaining a very high level of investment. This also provides reassurance to upstream semiconductor and mid-to-downstream AI demand.

- END -

// Repost Authorization

This article is an original by Dolphin Investment Research. For republication, please obtain authorization.

// Disclaimer and General Disclosure Note

This report is intended for general comprehensive data use only and is designed for general browsing and data reference by users of Dolphin Investment Research and its affiliates. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referring to the content or information in this report does so at their own risk. Dolphin Investment Research shall not be liable for any direct or indirect liability or loss arising from the use of the data contained in this report. The information and data in this report are based on publicly available information and are for reference purposes only. Dolphin Investment Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report should not be construed as or deemed to be an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or promotions for relevant securities or related financial instruments. The information, tools, and data in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data would contravene applicable laws or regulations or result in Dolphin Investment Research and/or its subsidiaries or affiliates being subject to any registration or licensing requirements in that jurisdiction.

This report reflects only the personal views, opinions, and analysis methods of the relevant author and does not represent the position of Dolphin Investment Research and/or its affiliates.

This report is produced by Dolphin Investment Research, and its copyright belongs solely to Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no institution or individual may (i) produce, copy, replicate, reprint, forward, or create any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Investment Research reserves all relevant rights.