Azure Revitalizes, Microsoft Reemerges as a Crucial AI Pillar

![]() 05/07 2025

05/07 2025

![]() 672

672

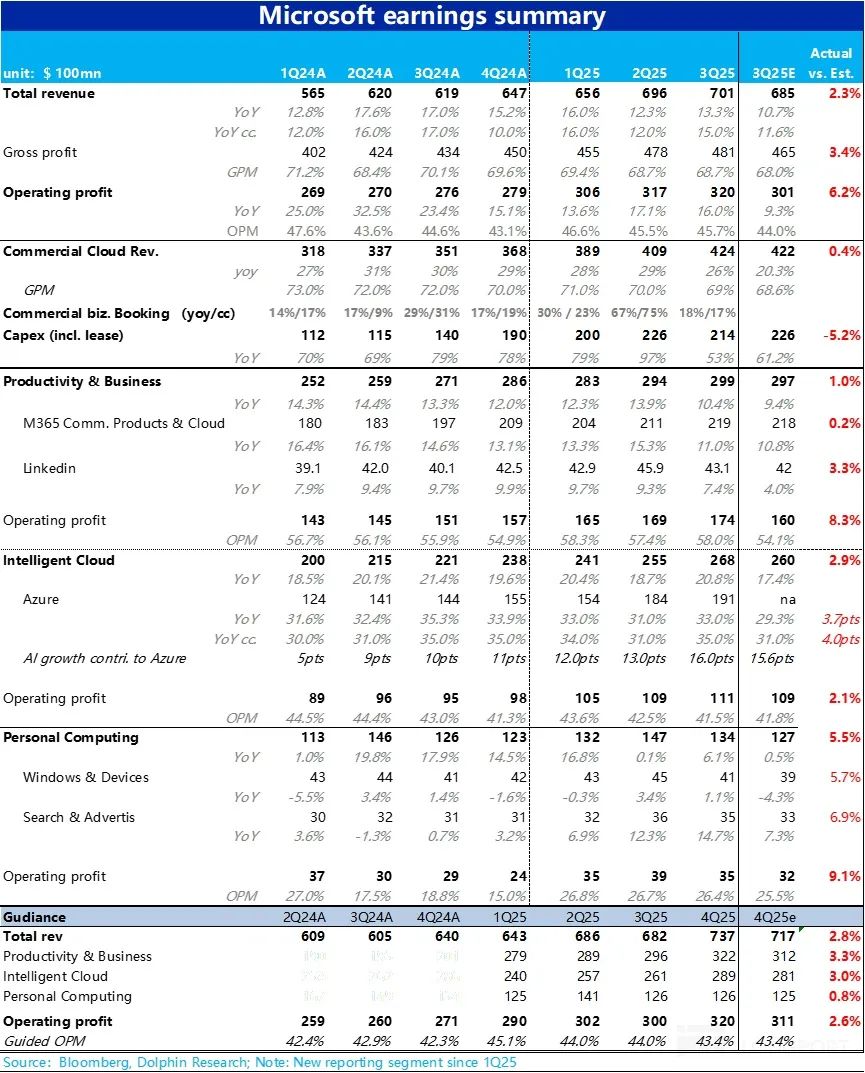

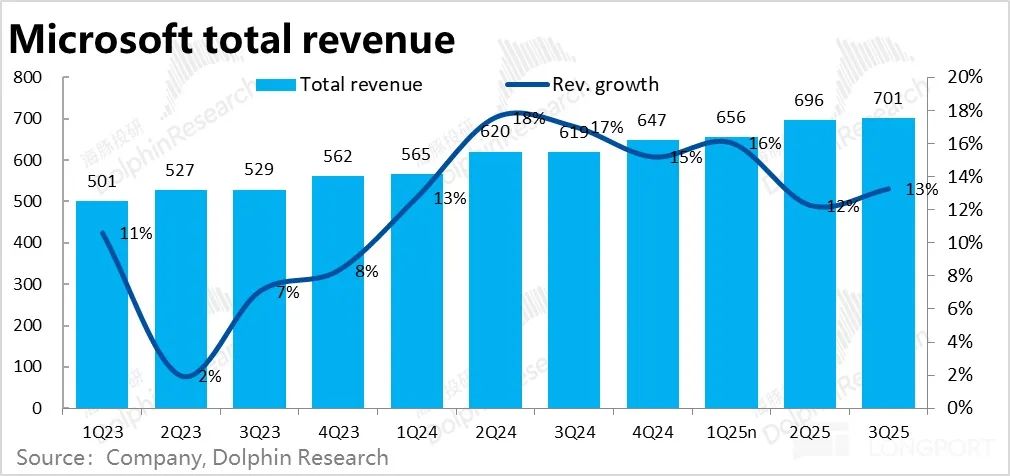

After the US markets closed on May 1, Beijing time, Microsoft unveiled its fiscal Q3 2025 earnings report, covering the period ending in March. The report showcased accelerated revenue growth and expanding profit margins, surpassing market pessimism regarding slowing revenue and contracting operating profit margins. Notably, the core Azure business exceeded expectations. Key highlights include:

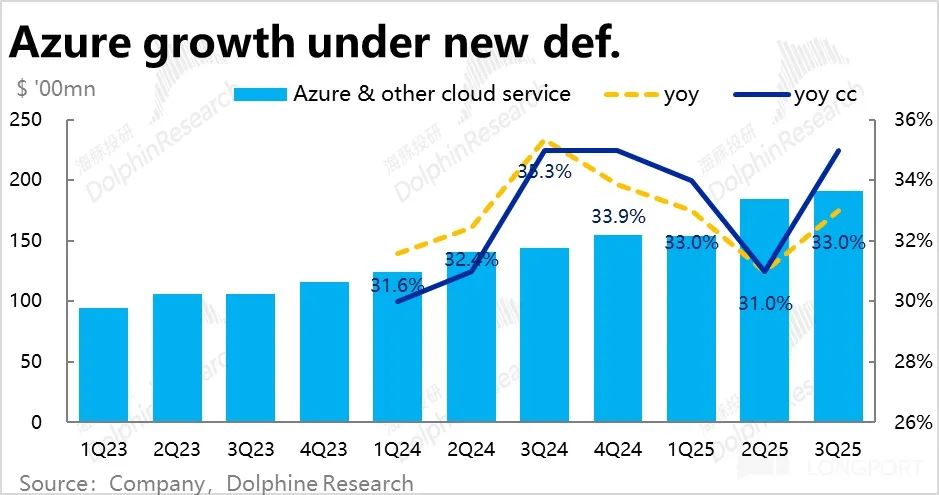

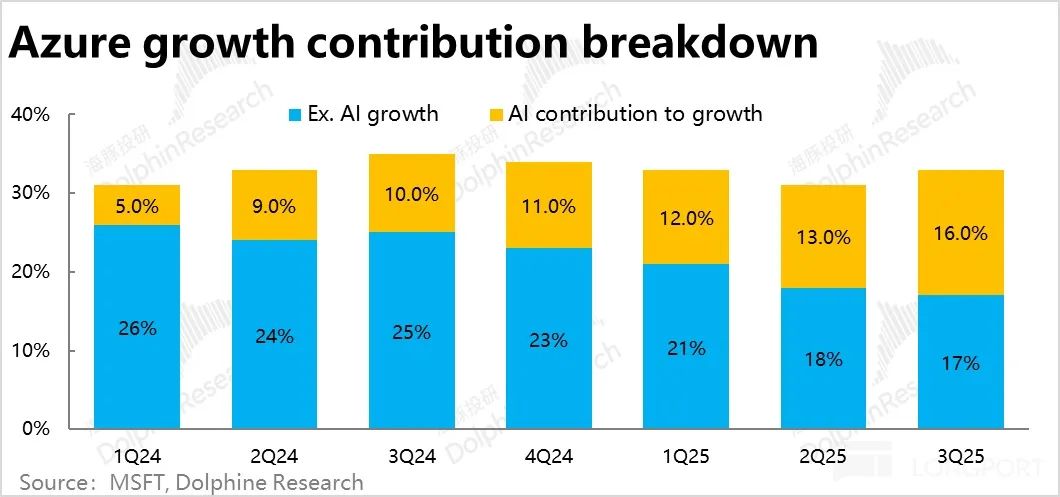

1. Azure Accelerates Ahead of Forecasts, Marking a Turning Point: The closely watched Azure business registered a 33% year-over-year revenue growth for this quarter, or 35% excluding currency impacts—a sequential increase of 2 percentage points (ppt) and 4ppt from the previous quarter. This notably outstripped market expectations of flat sequential growth.

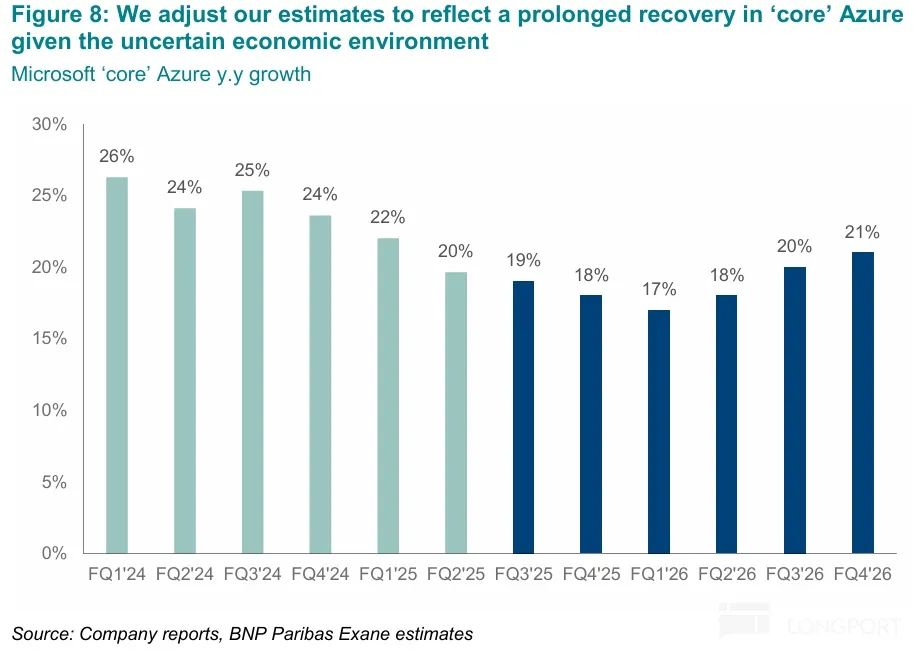

Prior to the earnings release, 1Q surveys indicated weakening IT investments by enterprises and a bleak macroeconomic outlook, leading to generally low market expectations for Azure. Additionally, expectations for the key inflection point of "Azure growth accelerating again" were significantly delayed, with waning confidence in its occurrence. However, this quarter's outstanding performance and guidance for Azure growth at 34%~35% (constant currency) in the next quarter officially confirmed that the "Azure growth acceleration" arrived earlier than anticipated.

2. AI Demand Remains Robust, Non-AI Demand Not as Weak: AI demand contributed 16ppt to Azure's growth rate this quarter, a substantial 3ppt sequential increase and the largest single-quarter boost since 2Q24. While strong AI demand was well-anticipated, with consensus expectations of a 15.4% contribution, actual performance closely matched these forecasts.

Therefore, the primary reason for Azure's overall growth exceeding expectations this quarter was that demand for traditional non-AI businesses wasn't as dire as feared. The implied growth rate for non-AI traditional business contributions this quarter was 17%, down 1ppt sequentially from the previous quarter but notably higher than consensus expectations of 14.7% growth.

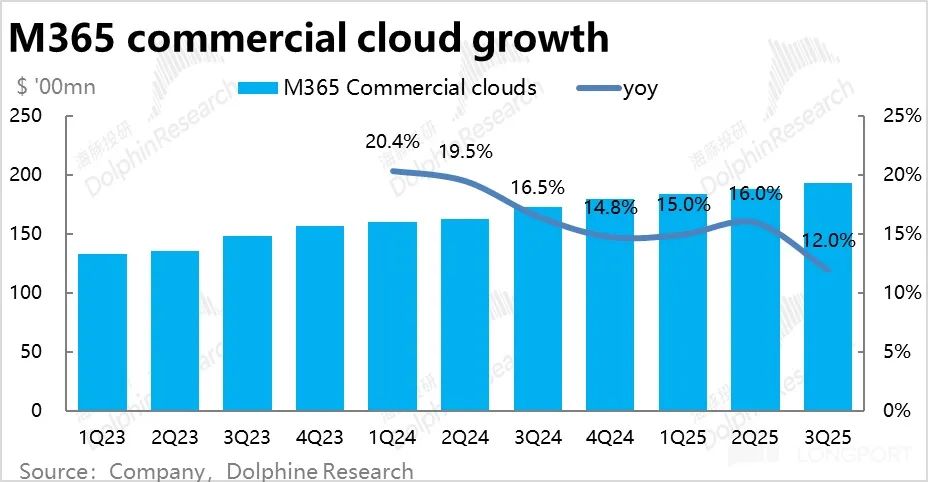

3. High Market Expectations for Copilot, Yet No Major Surprises: Microsoft 365 Commercial Cloud, the second most significant and closely watched business, saw revenue grow 12% this quarter. While this appears as a sharp slowdown from the previous quarter, it was primarily due to adverse currency impacts, with growth at a constant currency rate of 15%, roughly consistent with the previous quarter.

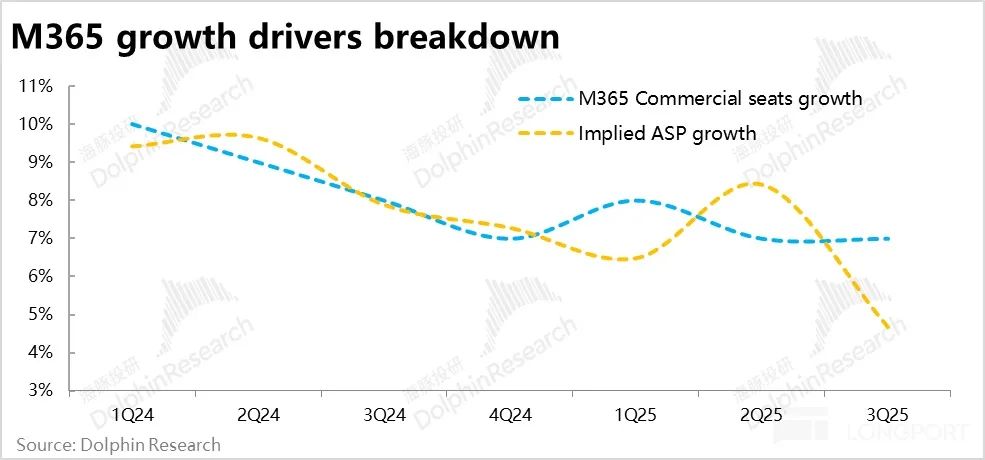

In terms of price-volume drivers, the number of commercial M365 subscriptions increased 7% year-over-year, with stable growth rates from the previous quarter. According to disclosures, this was mainly driven by increased usage by small and medium-sized enterprises and frontline workers. Average revenue per user (ARPU) growth seemed to narrow, but this was also due to adverse currency impacts. In reality, both price and volume growth remained relatively stable.

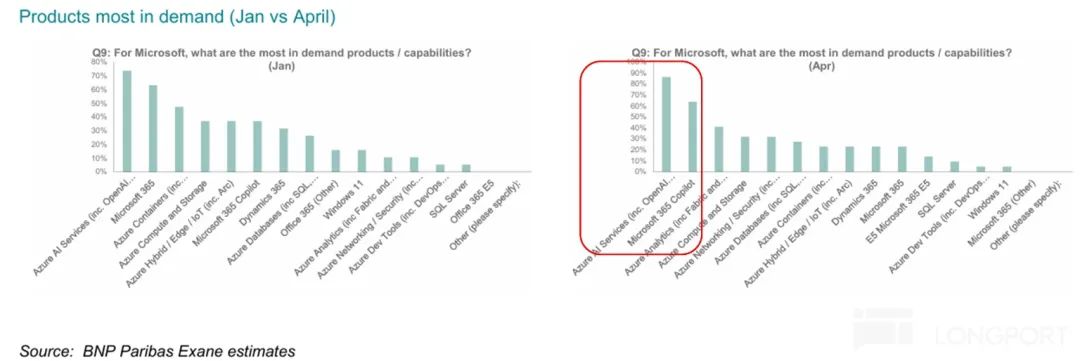

However, Dolphin Investment Research understands that the market had high expectations for M365 Copilot before the earnings release. Microsoft management recently stated that M365's initial cohort had expanded subscriptions by about 10x. An enterprise survey also revealed that M365 Copilot was the second most intriguing product for businesses.

Yet, this quarter's commercial M365 business only slightly outperformed expectations, seemingly without any significant contribution from Copilot. Judging by the results, Copilot has yet to emerge as a successful product capable of truly driving substantial revenue growth.

4. Concerns Over AI Overinvestment Amidst Data Center Leasing Reductions: With recent reports of Microsoft and even Amazon reducing data center leasing, one of the key market concerns is whether AI has entered a phase of "overinvestment." The investment stance of cloud computing giants (commonly referred to as hyperscale by foreign investors), exemplified by Microsoft, holds significant guidance for the upstream semiconductor industry and the robustness of downstream AI demand.

This quarter's actual Capex was $21.4 billion, slightly down from the previous quarter, reflecting a slight moderation in Microsoft's investment stance. However, the absolute value of over $21 billion remains substantial and aligns with market expectations for a full-year Capex budget of approximately $86 billion for fiscal 2025.

During this quarter's earnings call, management stated that Capex in 4Q would increase from this quarter's level and maintained guidance that Capex spending would continue to grow in fiscal 2026, albeit at a slower year-over-year rate. Evidently, Microsoft's commitment to continued investment remains unchanged, albeit at a more rational pace rather than a reduction in investment. This quarter's outperforming Azure growth also validates the necessity of Capex investment.

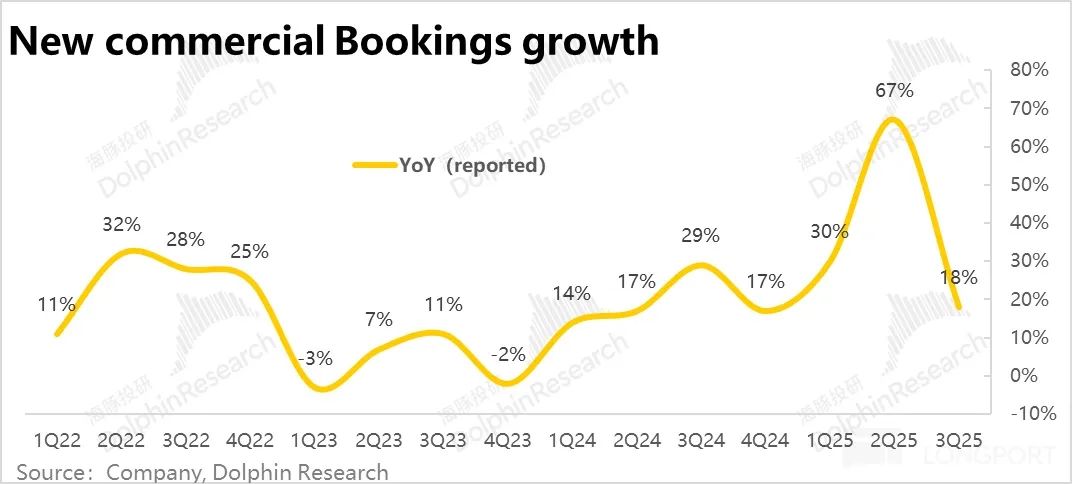

5. Leading Indicators Exhibit Fluctuations: In contrast to the previous quarter, which saw weak revenue growth but strong leading indicators, this quarter witnessed revenue growth exceeding expectations, yet leading indicators fluctuated significantly. Specifically:

The growth rate of new enterprise contract values this quarter was only 18% (17% at constant currency), a sharp drop from the previous quarter's surge of 67% to previous normal levels. Considering recent news, it's plausible that OpenAI migrating some computing power demand to other platforms had an impact, but it's also possible that enterprises indeed reduced new IT spending amidst a weakening macro outlook.

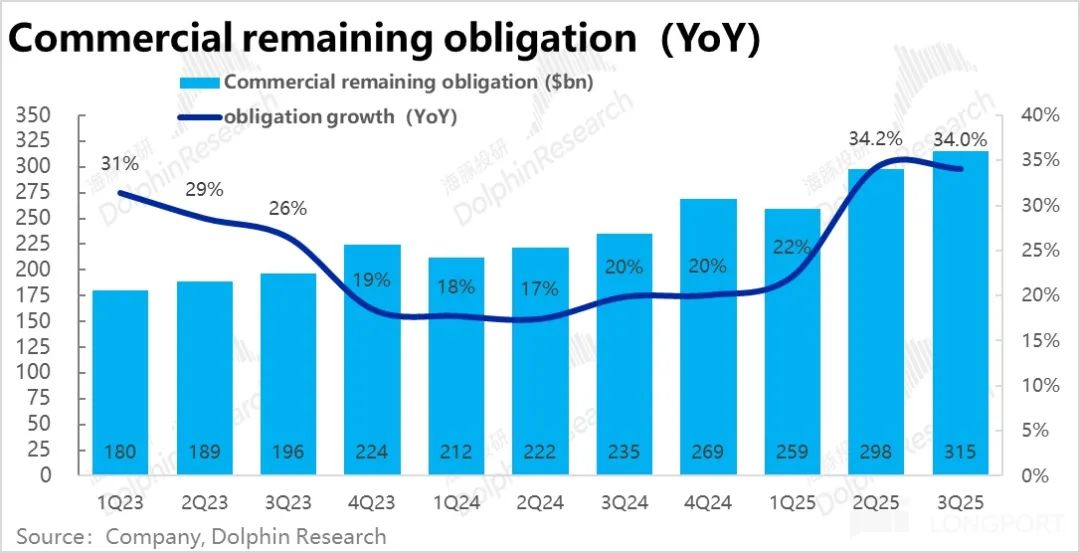

The year-over-year growth rate of the backlog of enterprise contracts awaiting fulfillment, a stock indicator, was still 34%, not far from the growth rate after a significant jump in the previous quarter. However, the year-over-year growth rate for the portion to be recognized within 12 months was only 17%, while the long-term portion grew 47% year-over-year.

Evidently, the growth in high-certainty unfulfilled balances in the short term isn't high, matching the significantly slower growth in new contract signings. While long-term growth is impressive, changes in the broader environment may affect the ultimate conversion of long-term spending commitments into revenue. Therefore, if macroeconomic conditions deteriorate, whether overall IT spending by enterprises will slow down requires close attention.

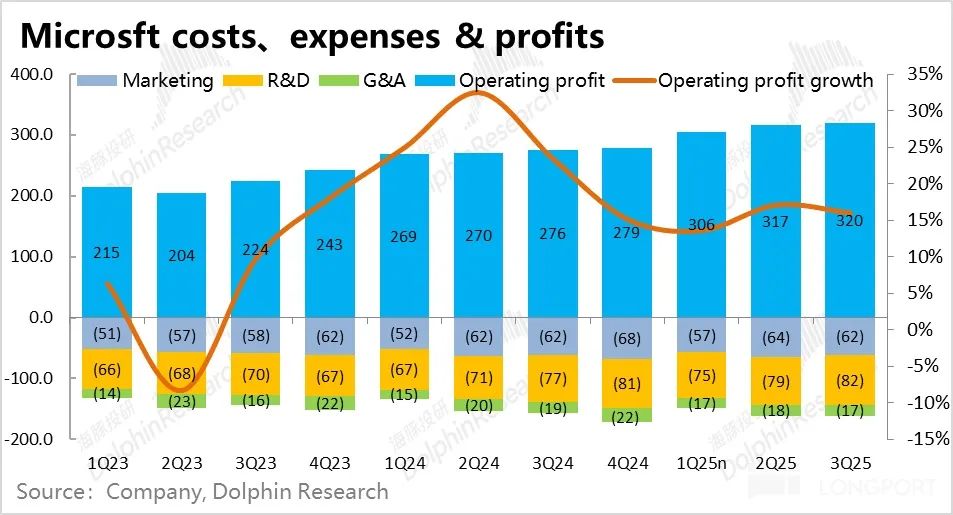

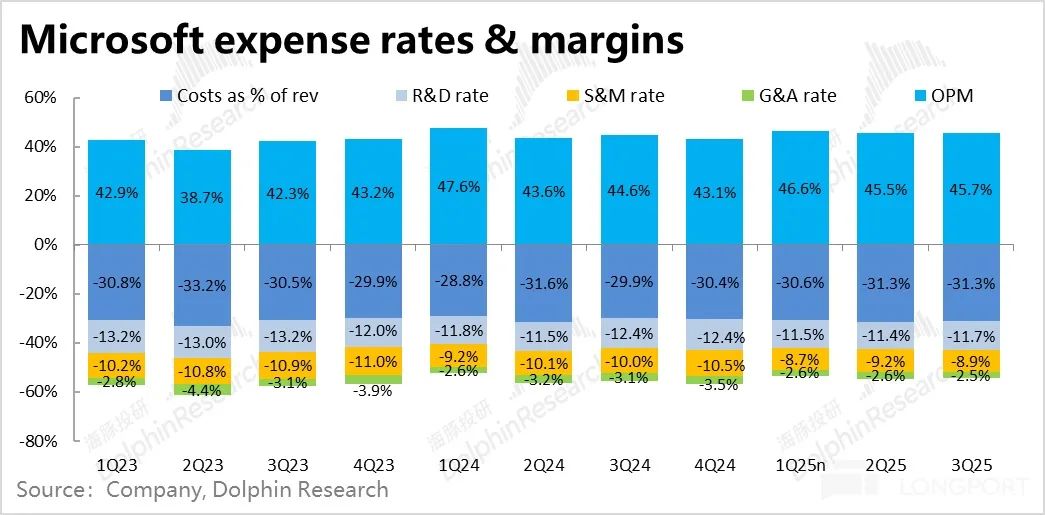

6. Cost Control Mitigates Gross Margin Decline, Profit Margins Continue to Expand: In terms of costs and profitability, Microsoft's performance this quarter was also noteworthy. Contrary to market expectations of an end to the profit margin expansion cycle and operating profit growth lagging revenue growth, Microsoft's profit margins continued to expand.

Gross margin-wise, Microsoft's gross margin this quarter was 68.7%, a year-over-year decline of 0.4ppt, reflecting the extent to which high Capex investment dragged on gross margin, but better than the expected 68%. With revenue exceeding expectations by approximately $2 billion, actual cost expenditure this quarter remained within the guidance range of $21.7~21.9 billion. The drag on gross margin from high investment wasn't as significant as the market feared.

From a cost perspective, Microsoft's total marketing, R&D, and administrative expenses this quarter increased by only 2.4% year-over-year. Even with revenue significantly exceeding original guidance, actual total expense expenditure of $16.15 billion was lower than the lower end of the guidance range of $16.4~16.5 billion. The 9% year-over-year decline in other administrative expenses contributed significantly.

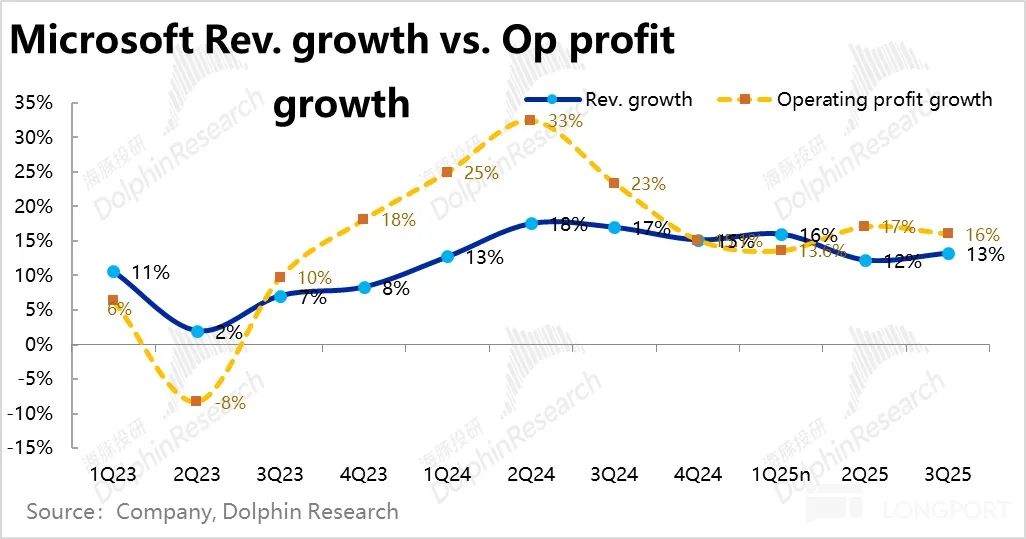

Due to excellent operating expense control offsetting the decline in gross margin, Microsoft's overall operating profit margin still increased by 1.1ppt year-over-year this quarter. Consequently, operating profit grew 16% year-over-year, still outpacing revenue growth.

7. Next Quarter's Guidance Also Positive: Broadly speaking, guidance for total revenue and operating profit in 4Q is 2.6% and 2.8% higher than market expectations, respectively. This implies revenue growth of 13.9% and operating profit growth of 14.4% in the next quarter. It's expected that revenue growth will continue to accelerate in the next quarter (with the impact of currency shifting from adverse to favorable, revenue growth at a constant currency rate should decline). Profit growth will also continue to outperform revenue growth, with profit margins expanding. Microsoft remains on a positive earnings trajectory. However, it's also noted that the margin by which profit outpaces revenue has narrowed compared to this quarter, indicating that the drag on profits from high investment will become more significant.

In terms of guidance for key businesses, as mentioned earlier, Azure's growth rate at a constant currency will remain between 34%~35%, which is clearly good news. However, the growth rate of commercial M365 at a constant currency is 14%, down 1ppt from this quarter, suggesting that Copilot likely still hasn't made a significant contribution.

Dolphin Investment Research Viewpoint:

In summary, Dolphin Investment Research believes that Microsoft's performance in this quarter's earnings was outstanding. Core logic-wise, compared to the market's original expectations of significantly slowing revenue growth and profit margins ceasing to rise and turning downward due to investment impacts; actual performance saw accelerated revenue growth and continuing profit margin expansion, shattering the market's overly pessimistic expectations in both directions (rather than just in degree).

In terms of core businesses, although Copilot didn't bring the expected surprises, the most core Azure business accelerated its growth again, a key inflection point that the market has been anticipating, arriving earlier than expected. This also shattered market doubts about Microsoft's massive Capex investment gradually putting pressure on profits while failing to bring about actual accelerated revenue growth. It also validated the strong demand and growth for AI and the necessity of Capex investment. This has important guiding significance for the entire AI industry chain, from upstream to downstream.

However, despite recognizing the quality of Microsoft's performance this time, Dolphin Investment Research holds a cautiously optimistic attitude towards Microsoft's earnings trend in the medium term going forward.

On the one hand, judging from the two leading indicators of new contract values this quarter and short-term unfulfilled balances, growth this quarter wasn't robust and actually declined somewhat compared to the previous quarter. While guidance for the next quarter is better than current expectations, it's also better than overly conservative expectations. In reality, excluding the impact of currency, implied revenue growth will slow compared to this quarter, and the year-over-year increase in profit margins will also narrow.

In terms of segment businesses, besides Azure, which indeed performed well in both this quarter and next quarter's guidance (and the outperformance wasn't due to much stronger-than-expected AI demand but rather less-than-feared traditional demand), other businesses, including commercial M365, and the growth of new contracts are showing a trend of slowing down.

Pre-earnings panic sentiment due to tariffs, among other factors, caused Microsoft's share price to slide by more than 10% from its highs, pushing market expectations to a relatively conservative level. Therefore, after this impressive performance, the share price will naturally experience a period of recovery. However, as the first quarter hasn't yet been substantially affected by factors such as tariffs, which will gradually materialize starting in the second quarter, it requires cautious consideration whether Microsoft's performance will be better or worse in the medium term over the next 1~2 quarters.

From a valuation perspective, Microsoft's current market capitalization corresponds to a PE valuation of approximately 29x~30x for fiscal 2025. Absolutely speaking, this isn't a low valuation but is roughly at Microsoft's valuation center, so it's not overpriced nor does it offer obvious value for money.

However, in the long term, Dolphin Investment Research is confident in the long-term development and growth potential of AI. We believe that AI indeed has the potential to revolutionize many industries and has an incredibly vast market space. As a leader in the AI industry and with significant barriers in cloud computing and office SaaS, Microsoft still has a relatively high probability of emerging as one of the winners in the AI era.

Below is a detailed analysis of the earnings report:

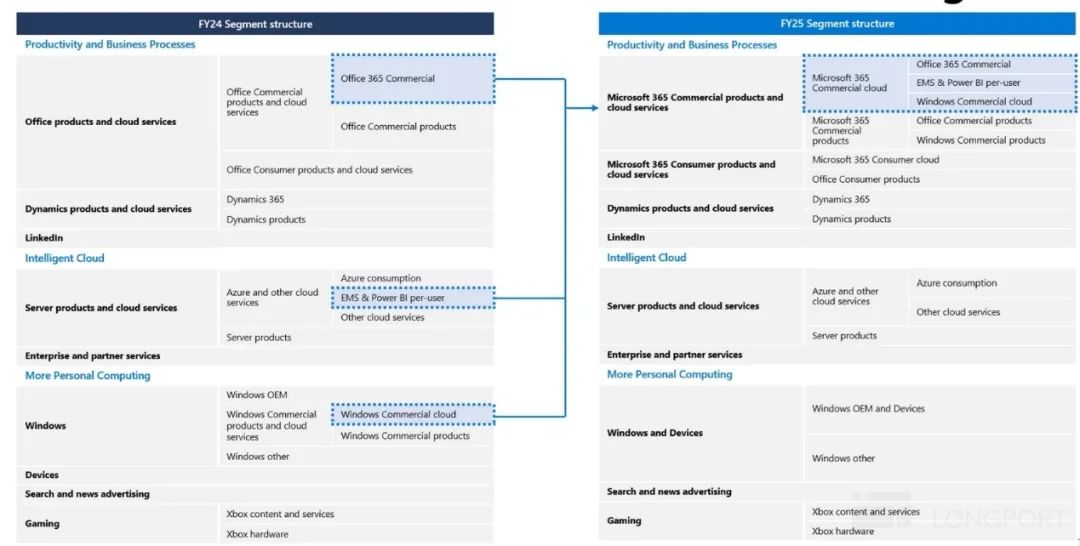

I. Overview of Changes in Financial Report Disclosure Scope:

After the previous quarter's financial report, Microsoft officially announced significant adjustments to the departmental structure of financial report disclosures starting in fiscal 2025. The idea behind the adjustment is to integrate all Microsoft 365 service projects for enterprises (such as enterprise Office 365, Windows 365, and Security 365) from their respective original segments into the larger Productivity & Processes (PBP) department. Dolphin Investment Research provided a detailed interpretation of this adjustment during the first adjustment in the new fiscal 2025 and will not repeat it in each financial report. The figure below briefly summarizes the changes from this adjustment. For more details, please refer to the 1Q25 review.

II. Segment Performance: Azure Shines Again, but Copilot's Time to Shine Hasn't Arrived:

1.1 Strong AI Demand Drives Azure to Accelerate Ahead of Forecasts:

The Azure business, which is the most closely watched, achieved 33% year-over-year revenue growth this quarter under the new reporting scope, with a growth rate of 35% after excluding currency impacts, up 2ppt and 4ppt sequentially from the previous quarter. This notably outstripped the company's previous guidance and market expectations of flat sequential growth for Azure.

According to Dolphin Investment Research, Azure's growth fell slightly below expectations in the previous earnings report, with guidance indicating declining growth rates. Additionally, several foreign bank surveys for the first quarter revealed unexpected weakness in enterprise IT investment and renewed concerns about macroeconomic weakness. Consequently, market expectations for Azure's growth rates remained subdued, staying flat compared to the previous quarter. At the same time, the anticipated key signal of "Azure growth accelerating again" was significantly delayed, and confidence in its occurrence waned.

This is illustrated by BNP Paribas' expectations, which show that the inflection point for Azure's non-AI traditional business to bottom out and rebound has been pushed back to the first quarter of fiscal 2026.

Azure's substantial acceleration this quarter caught the market (at least sellers) completely off guard. With the company's guidance for the next quarter's Azure growth also at 34%~35% (constant currency), the "Azure growth acceleration" inflection point has been confirmed to have occurred earlier than anticipated, backed by two consecutive quarters of strong performance.

Structurally, AI-related businesses contributed a 16% growth rate to Azure this quarter, a substantial quarter-on-quarter increase of 3 percentage points, representing the largest single-quarter improvement since the second quarter of 2024. However, the market had anticipated an increase in AI contributions, with Bloomberg consensus estimates at 15.4%, which is not significantly different from actual performance. The primary reason for Azure's growth exceeding expectations this quarter was that demand for traditional non-AI businesses was not as weak as anticipated.

As shown in the figure below, the implied growth rate of non-AI traditional business contributions this quarter was 17%, still down 1 percentage point from the previous quarter. However, this is significantly higher than the 14.7% growth implied by sell-side consensus estimates.

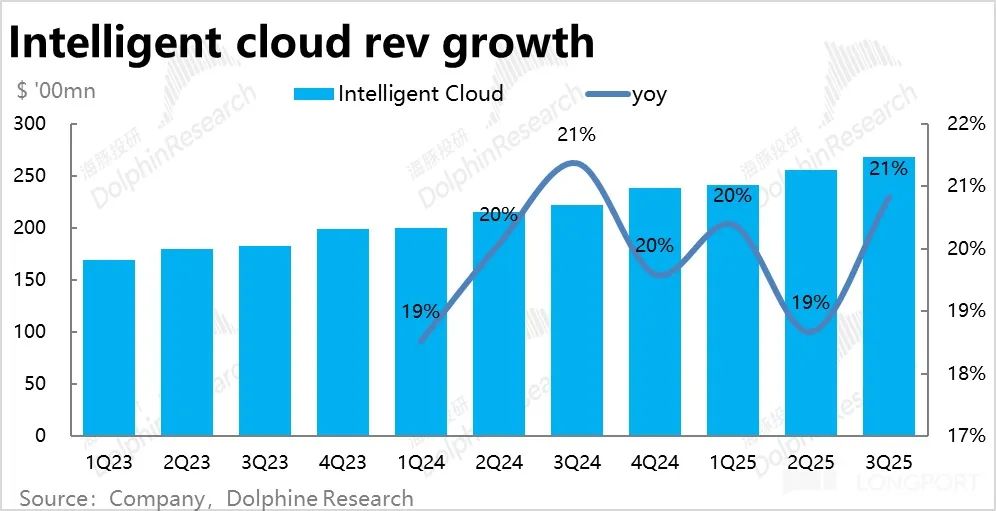

Overall, due to Azure's better-than-expected growth, the Intelligent Cloud segment generated total revenue of $26.8 billion this quarter, a year-on-year increase of 21% and a quarter-on-quarter acceleration of 2 percentage points. This significantly exceeded the company's original guidance and market expectations of only $26 billion in revenue.

1.2 The Expected Strong Growth of Copilot Was Not Reflected

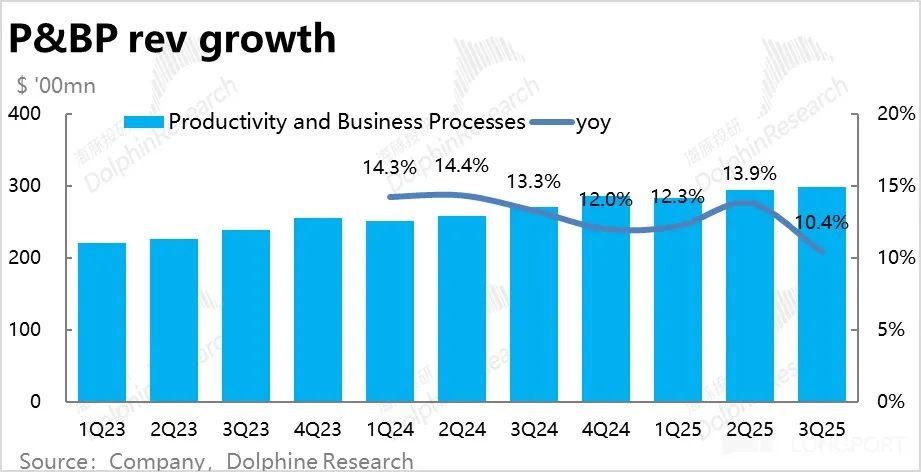

Microsoft 365 Commercial cloud, the second most important and closely watched business segment, saw revenue grow by 12% this quarter. While this appears to be a significant slowdown from the previous quarter, it is primarily due to adverse currency exchange rates. At constant exchange rates, the growth rate was 15%, roughly the same as the previous quarter.

From a volume-price perspective:

- The number of commercial M365 subscription seats increased by 7% year-on-year, with the growth rate remaining flat compared to the previous quarter. According to the company, this was primarily driven by increased usage among small and medium-sized enterprises and cutting-edge workers interested in new technologies.

- The year-on-year increase in average revenue per user (ARPU) appears to have dropped significantly from 8.4% in the previous quarter to 4.7%, but this is also mainly due to adverse currency exchange rates. Overall, both volume and price growth rates are relatively stable.

Recently, we have learned from multiple sources that the user penetration rate of M365 Copilot seems to have improved. Microsoft management recently stated at an investment conference that the initial cohort of M365 users has expanded their subscriptions by about 10x. A BNP survey of enterprises also showed that the strongest demand among Microsoft products was for Azure AI services and M365 Copilot. The market now inclines to believe that as Copilot adds more features (thereby increasing usage scenarios) and adjusts pricing models (such as offering discounts or converting to pay-as-you-go pricing), Copilot, which was previously considered a "near failure," may perform better than expected in the future.

Therefore, before earnings, sellers were generally optimistic about the growth of Microsoft 365 Commercial (while expectations for Azure were not high). However, in reality, the growth of Microsoft 365 Commercial was only roughly in line with expectations. It does not seem to reflect a significant contribution from Copilot. We believe that while there may have been a noticeable increase in Copilot adoption rates recently, the results show that even with several times growth based on low single-digit penetration rates, Copilot has not yet become a successful product capable of generating significant revenue growth.

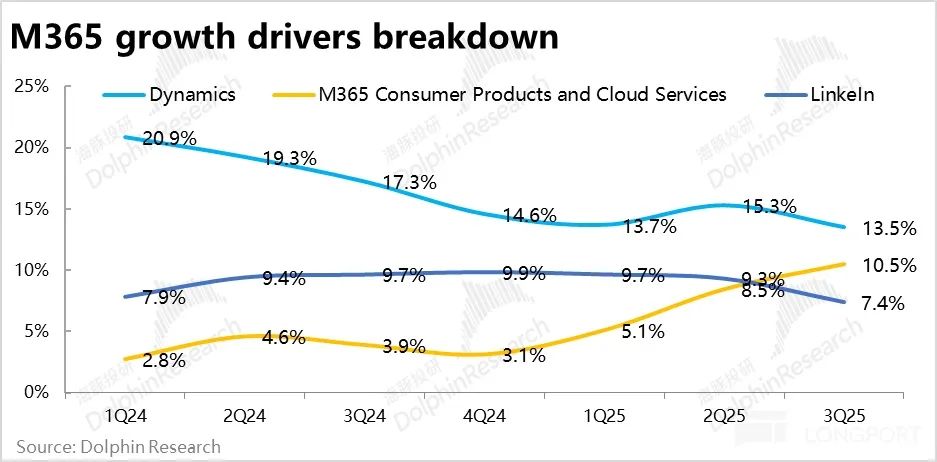

Among other businesses in the Productivity segment, the growth rate of personal M365 accelerated to 10.5% this quarter, an increase of 2 percentage points. Breaking down the volume-price drivers, the number of personal user registrations increased by about 8.5% year-on-year, actually slowing down compared to the previous quarter. Therefore, the revenue acceleration this quarter was mainly due to the positive impact of the price increase in January this year.

Meanwhile, the revenue growth rates of Dynamics and LinkedIn both slowed slightly by 1-2 percentage points quarter-on-quarter, with no particular highlights. This generally reflects the impact of adverse currency exchange rates and marginal changes in the macroeconomic environment.

Overall, due to the relatively flat actual growth of the core commercial M365 business, there were few highlights. After accounting for currency exchange rate impacts, except for the positive impact of the price increase on the personal M365 business, the growth of all other business segments was marginally declining. The overall revenue growth rate of the Productivity and Business Processes segment fell to just 10.4%, slightly higher than the expected 9.4%.

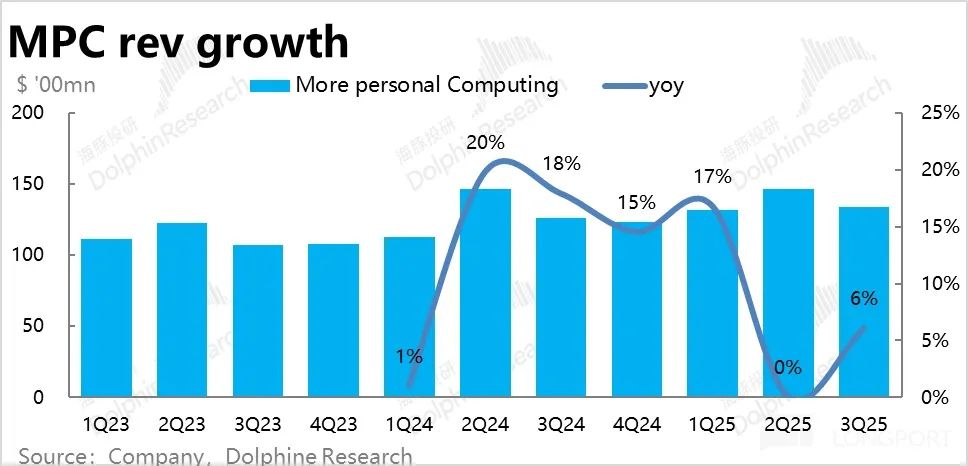

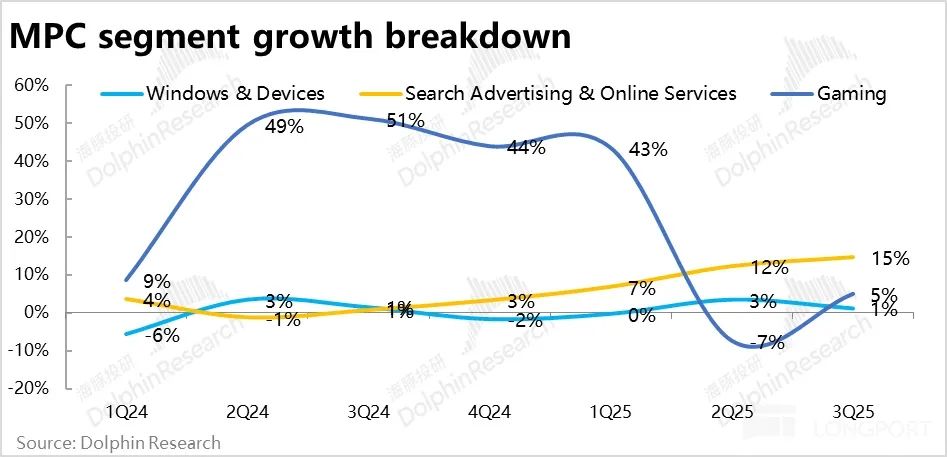

1.3 Personal Computing: Gaming Segment Bottoms Out and Rebounds, Search Continues to Accelerate Growth

After fully overcoming the impact period of the Activision Blizzard acquisition, the growth of the More Personal Computing segment began to return to normal. Revenue grew by 6% this quarter, a significant improvement from the nearly 0% growth rate in the previous quarter and higher than market expectations of 0.5% growth.

Specifically:

- The primary improvement was in the gaming business, with growth rebounding from -7% in the previous quarter to 5%, making it the main contributor to the overall outperformance of the MPC segment.

- Combined revenue from Windows and related hardware devices increased by 1%, continuing to slow down compared to the previous quarter. It appears that the concept of AI PCs has not yet led to a significant recovery in PC demand.

- The growth of the advertising business, which includes the Copilot pro business, continued to accelerate slightly, from 12% to 15%. The positive effect of AI on the search end is still continuing.

II. Capex: Slowdown in Growth of Investments, Not Reduction in Investments

In addition to the ongoing debate about how much incremental revenue AI actually generates, another key focus and point of contention in the market is whether AI has temporarily fallen into a phase of "overinvestment." At the end of February to early March this year (before the impact of Trump's tariffs), a foreign bank research report claimed that Microsoft had confirmed the cancellation of a data center lease with a capacity of 2GW. The main reason was the change in the exclusive partnership between Microsoft and OpenAI, with some of OpenAI's training needs shifting to other cloud computing platforms.

Furthermore, multiple sources claimed that the total amount of data center leases actually canceled or postponed by Microsoft over the past few months was far greater than the aforementioned 2GW. In early April, an outsider also stated that Amazon had suspended some data center lease negotiations. It is evident that concerns about the slowdown in AI Capex investment are not unfounded. This has important guiding significance for the recent performance impact on the upstream semiconductor industry and subsequent medium-term judgments on the prospects of AI downstream needs.

Actually, Capex for this quarter was $21.4 billion, a slight decrease from the previous quarter, announcing the end of the phase of continuously escalating Capex investments quarter-on-quarter. This does reflect, to a certain extent, a slight shift in Microsoft's investment attitude. However, the absolute investment value, still above $21 billion, is still not low and is still in line with the company's previous guidance of over $80 billion for the full year and market expectations of around $86 billion in Capex budget.

During the earnings call, management stated that the absolute amount of Capex in the fourth quarter would be higher than this quarter, while maintaining the original Capex investment guidance for FY25 and the guidance that Capex expenditures in FY26 will continue to grow but at a slower year-on-year rate. This shows that even though Microsoft may have indeed reduced/slowed down some investments in data centers, its attitude towards continuing to increase investments remains unchanged. It is more about a shift towards a more rational attitude rather than a reduction or postponement of investments. In fact, the better-than-expected growth of Azure this quarter also validates the necessity of Capex investments. This is good news for the upstream semiconductor sector, stabilizing confidence.

III. Leading Indicators Fluctuate, Not Ruling Out the Possibility of Subsequent Slowdown in Corporate IT Spending

Microsoft's overall revenue for this quarter was $70.1 billion, a year-on-year increase of 13.3%, and even reached 15% after excluding the impact of exchange rates. Both figures accelerated by 1 percentage point and 3 percentage points, respectively. Compared to the market's original expectation that overall growth would continue to slow down due to the drag of the macroeconomic environment, the actual accelerated growth performance was quite impressive.

However, contrary to the situation in the previous quarter when revenue growth was poor but leading indicators were strong, this quarter saw significant fluctuations in leading indicators despite revenue growth exceeding expectations. Specifically:

The growth rate of newly signed enterprise contract amounts was only 18% this quarter (also 17% at constant exchange rates), a significant drop from the previous quarter's surge of 67% to previous normal levels. Combining recent news, it is possible that OpenAI has migrated some computing power needs to other platforms, but it cannot be ruled out that in the context of a weakening macroeconomic outlook, companies have indeed reduced new IT spending.

However, the year-on-year growth rate of the backlog of pending enterprise contracts, a stock indicator, still reached 34%, not significantly different from the growth rate after the obvious jump in the previous quarter. Among them, the year-on-year growth rate of the portion to be recognized within 12 months was only 17%, while the year-on-year growth rate of the long-term portion over 12 months was 47%. It can be seen that the growth of pending balances with higher certainty in the short term is not very high, roughly matching the growth rate of new contracts. The certainty of the eventual conversion of long-term pending balances into revenue is relatively low. Therefore, under the changes in the macroeconomic environment, the possibility of subsequent slowdowns in overall corporate IT spending still warrants attention.

IV. Profit Margins Continue to Expand, Excellent Cost Control Offsets the Impact of High Investments

In terms of costs and profitability, Microsoft's performance this time was also impressive. The market originally expected the end of the profit margin expansion cycle and operating profit growth lagging behind revenue growth, but in reality, Microsoft's profit margins continued to expand.

1) In terms of gross profit, Microsoft's gross margin for this quarter was 68.7%, a year-on-year decrease of 0.4 percentage points, indeed reflecting the drag on gross profit to some extent by high Capex investments. However, it is still better than the expected 68%. And with actual revenue exceeding expectations by $2 billion, the actual COGS for this quarter was $21.9 billion, still within the guidance range of $21.7-21.9 billion. It is also evident that the drag on gross profit from investments is not as significant as the market feared.

2) In terms of cost, Microsoft's combined expenses for marketing, research and development, and administration grew by just 2.4% year-on-year this quarter. Given that revenue significantly surpassed initial projections, the actual total expenditure of $16.15 billion was even below the lower end of the guidance range of $16.4-16.5 billion. This underscores the company's effective cost control measures, which have mitigated the impact on final profits despite the drag on gross profit from high investments.

3) Overall, Microsoft's operating profit margin expanded by 1.1 percentage points year-on-year this quarter, primarily due to the control of operating expenses compensating for the decline in gross profit margin. Consequently, the final operating profit reached $31.7 billion, marking a 16% increase year-on-year, outpacing revenue growth. The profit margin expansion trend persists.

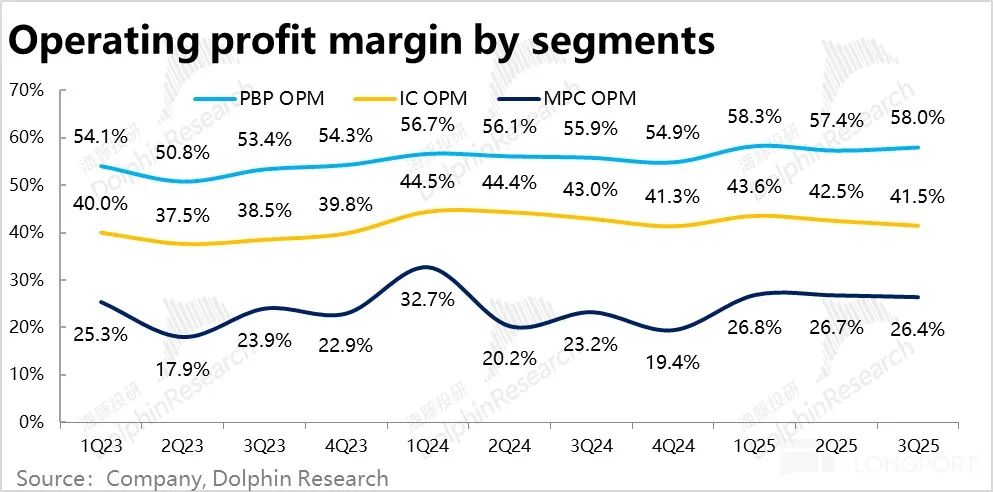

4) By segment, the Productivity and Business Processes (P&BP) segment demonstrated the strongest profitability, showing growth both year-on-year and quarter-on-quarter. In contrast, the Intelligent Cloud segment, which incurs the highest capital expenditures (Capex), experienced declines both quarter-on-quarter and year-on-year. Although the profitability of the More Personal Computing (MPC) segment decreased quarter-on-quarter, it made a significant contribution to this quarter's operating profit due to a lower base from the same period last year, outperforming revenue growth on a year-on-year basis.

- END -

// Repost Authorization

This article is an original piece by Dolphin Investment Research. Please obtain authorization for republication.

// Disclaimer and General Disclosure

This report serves as general comprehensive data intended for general browsing and data reference by users of Dolphin Investment Research and its affiliated institutions. It does not account for the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any individual receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any individual making investment decisions based on or referencing the content or information in this report assumes the risk themselves. Dolphin Investment Research shall not be held liable for any direct or indirect responsibilities or losses arising from the use of the data contained in this report. The information and data in this report are sourced from publicly available information and are for reference purposes only. Dolphin Investment Research endeavors to ensure the reliability, accuracy, and completeness of the relevant information and data but does not guarantee it.

The information or opinions expressed in this report must not be construed or deemed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction. They do not constitute recommendations, inquiries, or promotions for relevant securities or related financial instruments. The information, tools, and data in this report are not intended for distribution to citizens or residents of jurisdictions where such distribution, publication, provision, or use would violate applicable laws or regulations or require Dolphin Investment Research and/or its subsidiaries or affiliates to comply with any registration or licensing requirements.

This report solely reflects the personal views, opinions, and analysis methods of the relevant creative personnel and does not represent the position of Dolphin Investment Research and/or its affiliated institutions.

This report is produced by Dolphin Investment Research, and the copyright belongs exclusively to Dolphin Investment Research. Without Dolphin Investment Research's prior written consent, no institution or individual may (i) produce, copy, replicate, reprint, forward, or make any form of reproduction in any manner, and/or (ii) directly or indirectly redistribute or transfer it to other unauthorized persons. Dolphin Investment Research reserves all related rights.