Big Tech Agent Warfare: Ambitions and Dilemmas in Replicating Manus

![]() 05/08 2025

05/08 2025

![]() 721

721

When Xiao Hong, the founder of Manus, bluntly declared that "products have no secrets," big tech companies found themselves ensnared in a double bind: replicating technology and competing for traffic. According to Guangzhui Intelligence, numerous tech giants are internally setting up product teams to benchmark against Manus. Notably, ByteDance, renowned for its internal competitions, has at least five distinct teams developing AI agent products.

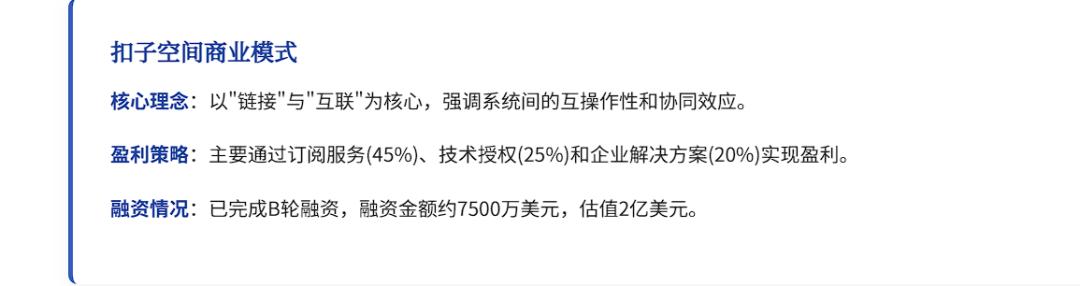

One month after Manus' release, big tech firms successively unveiled their AI agent offerings: ByteDance's 'Kouzi Space' swept the workplace with its fission-based invitation codes, Alibaba's 'Xinliu' leveraged ultra-long tasks to delve into research depth, and Baidu's 'Xinxiang' stormed the mobile front with vertical scenarios in healthcare and law.

However, behind this seemingly prosperous wave of general-purpose agent releases lies an awkward reality—none of the products have surpassed the existing capability boundaries of agents.

From neglecting agent platforms last year to submitting 60-point answers this year, it is evident that agents have transcended the 1.0 stage of general-purpose agents, leveraging planning and tool capabilities, and have entered the 2.0 stage of autonomous agents.

Currently, the cluster of released agents is capable of initially performing the tasks of an 'intern,' tackling time-consuming and low-difficulty tasks in human daily life. For instance, they complete part of data collection based on user needs and provide viewpoints for users to sift through extensive information analysis. Another example is assisting users in basic operations, such as screening jobs, sending resumes, or targeting emails.

This battle for traffic entry points centered around agents is merely a footnote to the year of agent explosion in 2025. Besides large model companies and application firms, more players are joining the fray:

Today, Lenovo also released the 'Tianxi' AI agent for individual users and the 'Lexiang' AI agent for enterprises. Among them, the personal AI agent 'Tianxi' boasts autonomous operation and memory interaction as its selling points and is integrated into four of its products. Besides autonomously completing operations like ordering and strategy planning, it also offers tailored budget and preference recommendations based on user preferences and habits.

Where does the battle for AI agents currently stand, with big tech companies pouring in resources?

Who can seize the traffic entry point by replicating Manus in batches?

In April, general-purpose agents became a key player in big tech companies' launches and product updates.

First, ByteDance released the general-purpose agent product 'Kouzi Space' on April 18, initiating a free test and preemptively seizing the market with a fission method of five invitation codes per person. On April 22, Alibaba's AI assistant 'Xinliu' launched advanced research functions, featuring report research akin to OpenAI's DeepResearch-style agent. Then, on April 25, Baidu officially announced the agent 'Xinxiang' at its Developer Conference, focusing on task experiences in multiple life scenarios such as healthcare, law, and picture books.

After the impact of DeepSeek, how to leverage mature products to drive traffic has also become a consideration for agents in their upcoming launches.

Currently, most big tech companies are in a mode of internal team self-research, such as ByteDance and Baidu. However, Alibaba had already negotiated cooperation with Manus when Manus ignited market enthusiasm. Currently, besides the launch of its self-developed product Xinliu, Alibaba's large model team Tongyi Qianwen also sealed the deal as the exclusive model support for the Chinese version of Manus as early as March, securing a slice of the pie in model cooperation.

For Baidu, ByteDance, and Alibaba—these three big tech companies that emphasize AI self-research and take a hands-on approach from large model development to application products—it is also crucial to develop AI agents leveraging their own strengths.

The agents released in clusters have diverse product concepts.

ByteDance's 'Kouzi Space' is positioned as an 'intern proficient in various skills,' offering various case studies that function more like work assistants, such as generating industry reports and user survey analysis.

After testing by Guangzhui Intelligence, Kouzi Space feels like a more comprehensive passing product. It not only integrates MCPs like Gaode to enhance usability with tools but also achieves graphical and textual output in reports, highlighting its multimodal capabilities. However, there is room for further optimization in the depth of the content of the output reports.

In contrast, Alibaba's AI assistant 'Xinliu' has launched advanced research functions closer to deep research application scenarios. During multiple tests, a notable feature of Xinliu was its consumption of more token resources and longer duration. For example, in the 'Agent Research' task, Xinliu's processing time exceeded one hour, and the number of web pages browsed was significantly more than the other two products.

A large amount of resources and sacrifice of efficiency have resulted in more in-depth generated content, which is also why Xinliu can only be tested through an approval system. Large-scale openness is currently a difficult problem to balance in terms of computational consumption and cost. However, Xinliu's performance in object selection accuracy is average. For instance, in the agent report, it mostly selects products that are large model AI assistants and mistakenly places information about Manus's $75 million funding in the analysis of Kouzi Space.

Compared to ByteDance and Alibaba's general-purpose agents, which chose to launch on the PC end, Baidu's Xinxiang opted for its first launch on the mobile app end, with the PC end to follow.

Different smart hardware ends determine the difference in the audience they face: the PC end mainly caters to users with work and learning needs, focusing on report research and content analysis; while mobile phone users are more eager to experience various AI functions implemented in real-life scenarios.

Combining Baidu's advantages in healthcare, law, and other industries, as well as Baidu's past exploration in AI virtual social networking and other directions, Xinxiang's final launch form has become one that primarily promotes vertical scenarios.

Currently, the main interface of the Xinxiang app recommends experiences in scenarios such as AI dating, travel planning, medical/legal consultation, etc. After actual testing, Xinxiang has high accuracy in medical and legal issues. For example, when answering the question about hit-and-run after drunk driving, Xinxiang invoked multiple agents and finally gave a sentencing result of seven years, which is also consistent with real-life lawyers' opinions.

However, in other businesses that deviate from the accumulation of vertical knowledge, Xinxiang's accuracy still needs to be optimized. For example, in a task requiring travel location suggestions, Xinxiang clearly judged that the location did not belong to the Chaoyang District but still recommended attractions that did not meet the user's set conditions.

Based on the evaluation results of the three general-purpose agents, the AI agents of the big tech tier can currently only be used to complete some basic-level work, and their capabilities have not yet reached the stunning effect similar to Manus.

However, in the short term, the answers submitted by big tech companies have already piqued market users' excitement and curiosity about the concept of AI agents.

Whether it's ByteDance's or 360's agent, server crashes have occurred during recent large-scale open testing. It can be said that even big tech companies with sufficient computing power have consumed far more than expected.

And in the race for AI agents, the participants are not only internet giants and startups. Leveraging their hardware advantages, companies with smartphones and computers have also set their sights on the prospects of AI agents.

Today, Lenovo announced at its press conference the 'Tianxi' AI agent for individuals and the 'Lexiang' enterprise super AI agent. For individuals, its AI agent is already capable of performing various autonomous operations such as providing travel suggestions, making itineraries, and placing orders.

Faced with the lucrative 'AI agent' market, everyone is eyeing it covetously.

Manus has not yet been surpassed, but how long can the technological dividend last?

In 2025, known as the 'Year of Agents,' big tech companies and startups are submitting their answers within their capabilities.

However, the products currently launched by the three big tech companies reflect a cruel reality: even with ecosystems and computing power, replicating Manus is not something that can be accomplished in the short term.

At the beginning of Manus' release, its founder Xiao Hong already expressed his opinion: Manus has no secrets.

'From a product manager's perspective, you should use the best large model. Product managers care about how much commercial value can be generated by using the best things,' said Xiao Hong.

Manus' core competence is built on model capability overflow, but at the earliest stage of establishing market awareness, Manus excelled in both model capability invocation and product thinking:

First, agents need to simultaneously handle diverse tasks such as multimodal understanding, complex reasoning, and code generation, which places extremely high demands on the comprehensive invocation capabilities of the underlying model. Most general-purpose agents currently available on the market use not just one large model but multiple models invoked according to different needs, such as invoking a large model with stronger multimodal capabilities when image content needs to be understood.

Taking ByteDance as an example, according to reports by LatePost, when the Kouzi team was developing Kouzi Space, they considered prioritizing the use of DeepSeek-R1 but found its ability to invoke tools insufficient after testing. Finally, considering capability performance and cost, multiple models, with Doubao 1.5 Pro as the main one, were used.

Moreover, based on better model capabilities, transforming technology into user experience is also a challenge.

However, different ideas have already been demonstrated in the agents submitted by various companies. For example, in search experience, Baidu's agent product adopts a 'multiple keywords + search engine' strategy, using multiple sets of keywords to attempt searches, while Zhipu lets its AutoGLM ponder and search on different platforms such as Xiaohongshu and Zhihu, breaking the boundary of data welding from not using applications.

In the short term, the current technological landscape presents an interesting phenomenon: startups represented by Manus and GensPark still maintain a leading edge in key indicators. For instance, GensPark's performance in the GAIA benchmark test has surpassed that of Manus.

In contrast, the agent products currently launched by big tech companies are more '60-point solutions.' However, with the same goal as Manus, big tech companies need to seize a portion of the market first during the relatively blank stage of general-purpose agents.

Differences in technological routes directly influence the choice of commercialization strategies, and the two types of players are heading down distinctly different paths:

Currently, mainstream big tech companies still prioritize the free strategy, attempting to steal away a portion of users. Products from ByteDance, Alibaba, and Baidu all adopt a free supply approach.

However, cost pressure forces startups to initiate commercialization earlier. Currently, GensPark has accumulated 10,000 paying users, with an ARR (Annual Recurring Revenue) of $22 million. Manus, meanwhile, offers two pricing models in overseas markets: a basic version for $39 per month and a premium version for $199 per month, with pricing comparable to OpenAI's membership.

However, from the perspective of basic large models to application products, the window period for current technological advantages is shortening, leaving little time for startups.

Big tech companies now submit 60-point answers in less than a month. When new general-purpose agents are upgraded to 70 or 80 points, coupled with free strategies, they are bound to further impact startups.

This race is still in its infancy, and all clashes before the capabilities of general-purpose agents leap again are merely the prologue to the year of agent explosion in 2025.