Autonomous Driving Firms Explore Overseas Opportunities: "Chinese Solutions" Venture into the Middle East

![]() 05/08 2025

05/08 2025

![]() 633

633

Author | Wang Lingfang

Editor | Zhang Lianyi

Expanding overseas is not merely a strategic imperative but a survival necessity.

On May 6, 2025, two leading Chinese autonomous driving technology companies, Pony.ai and WeRide, announced in-depth strategic cooperation with Uber to jointly advance the global rollout of Robotaxi services.

Prior to this, on May 2, Momenta and Uber jointly announced the official signing of a strategic cooperation agreement to integrate autonomous vehicles into the Uber platform, covering international markets excluding the United States and China. The initial phase of commercialization will commence in Europe in early 2026.

These actions underscore Uber's autonomous driving strategy, leveraging technology integration and localized operations to stay ahead in the race to commercialize autonomous driving while mitigating risks.

Similarly, partnering with Uber marks a crucial step for Chinese intelligent driving enterprises to transcend domestic development constraints, seek broader market horizons, optimize resource allocation, and achieve sustainable growth.

01

Cooperation Content: Technology + Platform, Accelerating Autonomous Driving Commercialization

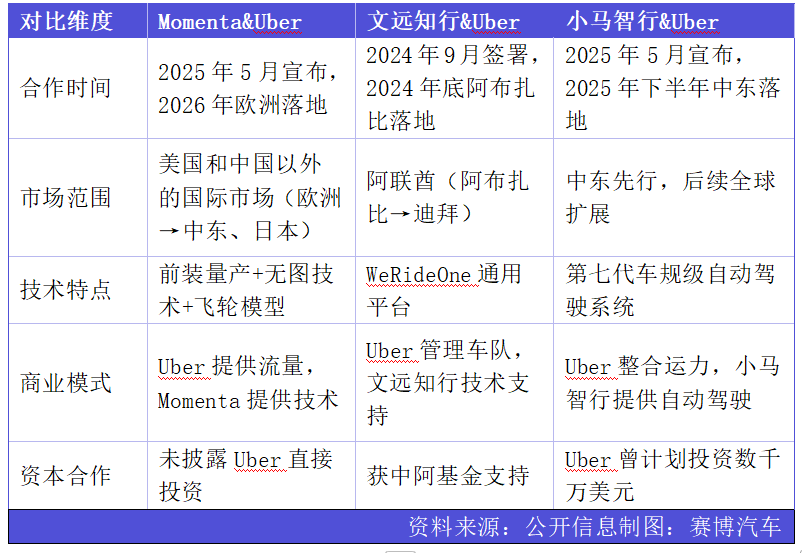

Momenta, WeRide, and Pony.ai have established strategic partnerships with Uber, merging their autonomous driving technologies with the Uber platform. By leveraging Uber's vast user base and extensive operational expertise in mobility services, they can swiftly realize autonomous driving technology commercialization in more international markets, enhancing service reach and user experience.

Momenta will integrate autonomous vehicles into the Uber platform, encompassing international markets beyond the United States and China. The first wave of commercialization will commence in Europe in early 2026, with onboard safety officers on duty.

Pony.ai's Robotaxi service will officially join the Uber platform in the second half of 2025, allowing passengers to book autonomous vehicles via the Uber App. In terms of cooperation mode, Pony.ai chose the Middle East market (such as the United Arab Emirates and Saudi Arabia) as its starting point, with plans to expand into Europe, the Americas, and Asian markets subsequently.

At the recent Shanghai Auto Show, Pony.ai unveiled its seventh-generation automotive-grade autonomous driving system solution, claiming 100% automotive-grade mass production of Robotaxi capable of adapting to extreme climates (like high temperatures and dust).

WeRide and Uber have expanded their cooperation, aiming to deploy Robotaxi services in 15 international cities (in Europe, the Middle East, etc.) over the next five years. Their collaboration began in September 2024 and went into operation in Abu Dhabi within months. In December 2024, WeRide commenced operations in Abu Dhabi, and by 2025, the fleet size will reach 50 vehicles, expanding to Dubai.

Regarding the operational model, Uber handles fleet management, while WeRide provides technical support, forming an "asset-light + localized" model. This model maximizes the strengths of both parties, combining Uber's operational management and market channel capabilities in mobility services with WeRide's autonomous driving technology, enabling optimal resource allocation and effective cost control.

A common thread in their cooperation is effectively circumventing policy risks in the Chinese and American markets and accelerating commercialization with the aid of Uber's global traffic network.

02

Development Status: China Leads in Technology, Yet Faces Prominent Commercialization Challenges

Currently, China's autonomous driving technology stands at the global forefront. L2-level assisted driving has been mass-produced on a large scale, while L3/L4-level autonomous driving has entered the nascent stages of testing and commercialization.

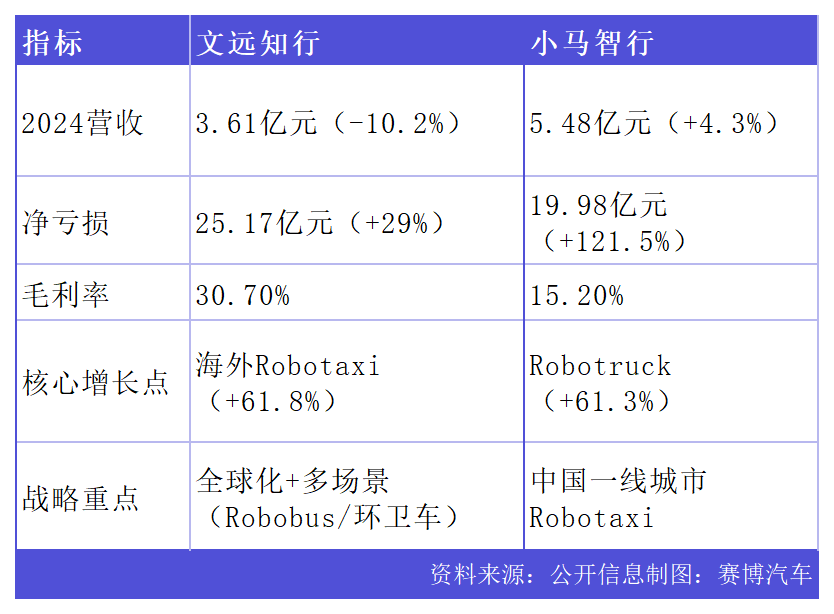

WeRide's globalization progress is swift, currently operating in 30 cities across 10 countries, indeed driving higher revenue growth. In the fourth quarter of 2024, product revenue surged by 45.5% year-on-year. For instance, Robotaxi revenue increased by 61.8% to 87.7 million yuan, mainly from overseas markets such as the Uber collaboration in the United Arab Emirates.

However, even so, WeRide's 2024 revenue amounted to 361 million yuan, still a year-on-year decrease of 10.2%. The contraction in domestic business and automakers' in-house research led to a decline in demand for WeRide's ADAS services. Additionally, WeRide's high R&D investment continues to erode cash flow.

Expanding overseas markets is an inevitable choice for WeRide.

Pony.ai's market strategy is "based in China, focused on the world," laying the groundwork for global expansion by accumulating operational experience in China's first-tier cities. However, the reality is less optimistic. Currently, it is expanding operations in Beijing, Guangzhou, and other locations, but the average daily orders stand at only 15, far from the 1,000-vehicle scale required for breakeven.

Revenue in 2024 reached 548 million yuan, a year-on-year increase of 4.3%, marking three consecutive years of growth but with widening losses. Among them, Pony.ai's Robotaxi service revenue in 2024 was 52.38 million yuan, a year-on-year decrease of 5.3%. The primary reason for the revenue decline is the reduction in service fees for providing autonomous vehicle engineering solutions based on the progress plan of cooperation projects. However, Robotruck service revenue increased to 290 million yuan, a 61.3% jump from 180 million yuan (25 million dollars) in 2023.

Momenta has yet to go public, so financial data is unavailable. However, its supporting situation remains relatively optimistic. According to ZoZo Research data, as of the end of 2024, Momenta's share in the third-party intelligent driving market for urban NOA exceeded 60%, ranking first in the market with a "cliff-like" advantage, while Huawei's HI mode accounted for nearly 30%, and together they occupied nearly 90% of the market share.

However, despite Momenta's "sexy" business narrative, intensifying competition within China's new energy vehicle industry makes it challenging for its revenue-generating capabilities not to be weakened.

Meanwhile, these three companies still face fierce market competition in China. On one hand, automakers like Li Auto, NIO, and Xpeng are developing their own intelligent driving systems, severely squeezing the market for third-party suppliers; on the other hand, Robotaxi is still a long way from large-scale commercialization.

Enterprises need to seek external breakthroughs.

After all, firstly, going overseas represents an additional revenue stream, which is undoubtedly an appealing piece of the pie for the autonomous driving industry that has yet to achieve large-scale commercialization. Secondly, there are diverse funding sources. The landing of overseas projects is also a way to showcase technological capabilities and business models to the outside world. Localized landing can also bring enterprises closer to local investors, such as Pony.ai's US$100 million revenue from its landing in Saudi Arabia. Therefore, heading overseas has become a must-talk topic and even a focal point of effort for major autonomous driving players.

03

Addressing "Oil Anxiety": The Middle East Introduces and Invests in Chinese Intelligent Driving Enterprises

Interestingly, the Middle East region is a keyword in the development plans of the aforementioned enterprises, featuring prominently in this series of collaborations.

The Middle East is seeking new industries to replace oil, and intelligent driving stands out as an excellent choice. Thus, Momenta, WeRide, and Pony.ai all view the Middle East as a vital market for globalization.

The Middle East's biggest advantages lie in policy dividends + capital support, devoid of trade disputes. The region, particularly countries like Saudi Arabia and the United Arab Emirates, is committed to diversifying its economy and reducing dependence on oil. Saudi Arabia's "Vision 2030" and the UAE's "D33 Economic Plan" explicitly propose vigorously developing emerging industries such as the digital economy and green technology. As a cutting-edge technology field, intelligent driving aligns with the direction of their economic transformation.

For instance, the UAE aims to achieve 25% autonomous driving by 2030, and WeRide has obtained a national-level autonomous driving license.

Furthermore, the governments of Dubai and Abu Dhabi have introduced special subsidies (up to US$25,000 per vehicle) and a relaxed regulatory framework to support the commercialization of autonomous driving technology.

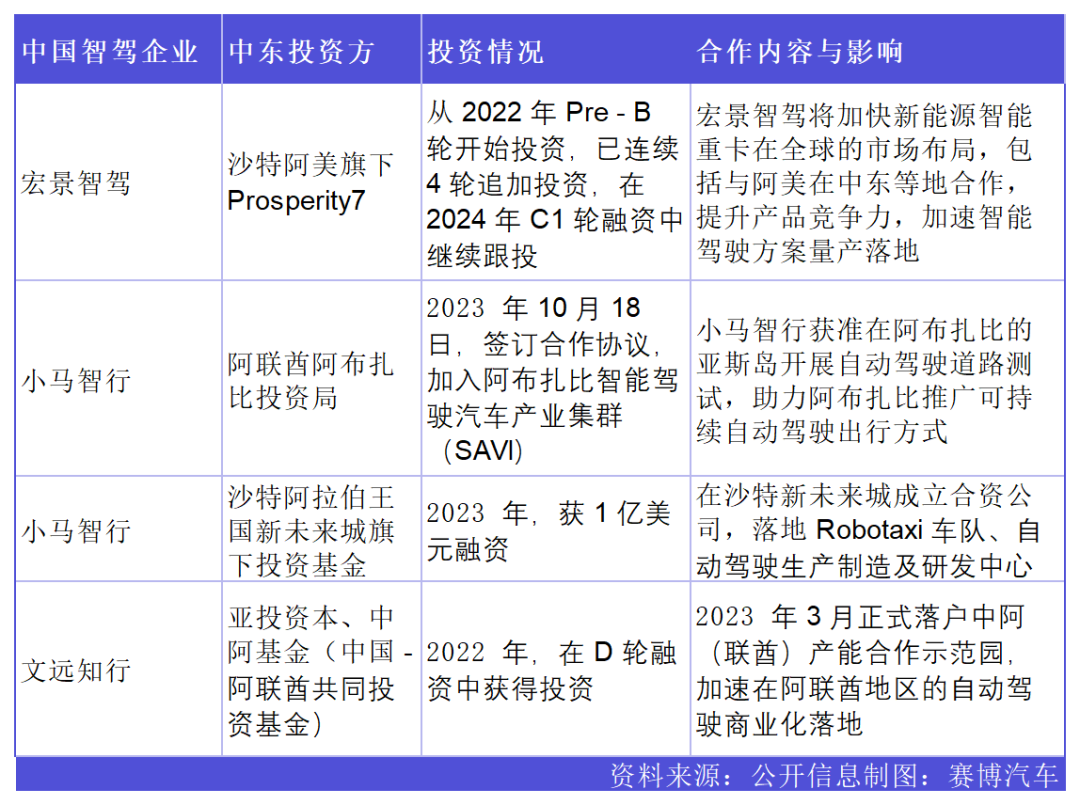

The Middle East also shows a penchant for investing in Chinese intelligent driving enterprises.

In March 2022, Pony.ai received D-round financing from the China-UAE Joint Investment Fund (Sino-UAE Fund); in October 2023, Pony.ai secured a US$100 million investment from Saudi Arabia's NEOM and its investment fund NIF (NEOM Investment Fund).

In March 2022, the Sino-UAE Fund participated in WeRide's D-round financing.

In February 2022, Horizon Robotics received exclusive investment from Saudi Aramco's VC arm Prosperity7 Ventures; in September 2024, Horizon Robotics secured B+ round financing from Prosperity7 Ventures.

Middle Eastern capital investment in intelligent driving enterprises not only yields investment returns but also facilitates cooperation between Middle Eastern governments and enterprises, combining their strengths in energy, finance, and other fields with the technology of intelligent driving enterprises to achieve mutual benefit and win-win outcomes. By actively introducing intelligent driving enterprises, local governments can help Middle Eastern countries secure a place in the global intelligent transportation arena and enhance their competitiveness in the international technology and economic sectors.

With mutual benefits for all parties, there will undoubtedly be more Chinese enterprises' success stories in the Middle East in the future.

-END-