AI Layout: Zhu Xiaohu's Words Versus Zhou Yahui's Actions

![]() 05/08 2025

05/08 2025

![]() 527

527

The path for Chinese AI enterprises to earn overseas and spend domestically hinges on both technological breakthroughs and commercial implementations.

Written by | Lan Dong, Zhao Weiwei

Zhu Xiaohu and Zhou Yahui are longstanding friends.

A decade ago, amidst a vibrant market, they swiftly acted and invested in the live streaming company Inke. Zhu Xiaohu entered at the angel round with 3 million yuan, securing 15% of Inke's shares, while Zhou Yahui entered slightly later with 68 million yuan, accounting for 18% of Inke's shares. With their support, Inke soared to become a unicorn worth over $1 billion in less than six months, bringing them both substantial returns.

"We are both sharpshooters," Zhou Yahui remarked at the time, evaluating himself and Zhu Xiaohu.

The fundamental difference between them lies in Zhu Xiaohu's role as a professional investor and Zhou Yahui's position as the founder of the internet company Kunlun Wanwei. Consequently, during a later conference, Zhu Xiaohu asked Zhou Yahui, "How do you manage a listed company while also excelling in investments?" Zhou Yahui responded that investment is merely a means for him to learn and that he devotes at most 10% of his time to it.

A decade later, the AI wave continues to rage, and they remain in the same industry.

Zhu Xiaohu's views on AI often become the focus of public opinion. Initially skeptical of the large model market in China, he claimed not to consider any of them. However, as DeepSeek gained popularity, he changed his stance and saw a path toward AGI realization. Even after a wave of humanoid robot companies exited the market, causing industry shockwaves, he continued to caution against wasting money on training underlying models, emphasizing that applications reign supreme and that barriers should be established through "hard work" beyond AI capabilities, highlighting differentiated opportunities in overseas markets.

On the other hand, Kunlun Wanwei's strategy has long shifted to "All in AGI and AIGC." In the first quarter of 2025, overseas market revenue accounted for 94.4% of total revenue. The company has flourished in AI application markets for short videos, music, and social networking. In 2024, AI business annualized revenue reached $140 million, making it the fastest-growing Chinese AI enterprise in terms of overseas revenue. It is evident that the path of AI application + globalization is a consensus shared by both Zhou Yahui and Zhu Xiaohu.

The divergence lies in Zhu Xiaohu's talking and Zhou Yahui's doing. Kunlun Wanwei continues to push the boundaries of underlying model technology. The Skywork R1V multimodal reasoning model has achieved open-source SOTA (state-of-the-art), the AI music model has also topped the industry SOTA, and SkyReels has open-sourced multiple SOTA models for short videos. Additionally, it has independently developed underlying technologies for AI computing power chips, constructing a full-chain layout encompassing "computing power infrastructure - large model algorithm - AI application."

In the unfolding story of Chinese realist AI, who is right—Zhu Xiaohu or Zhou Yahui? Looking back in a few years, perhaps the answer will have emerged.

Listen to Zhu Xiaohu talk, watch Zhou Yahui act.

Zhu Xiaohu believes that Chinese AI enterprises going global are akin to picking low-hanging fruits. In regions like Japan, Southeast Asia, and the Middle East, there is a high acceptance of Chinese AI applications, coupled with relatively low competition. This is because only China and the United States possess global AI capabilities, and Chinese teams excel in implementation efficiency and cost control, even penetrating the US market in reverse.

Conversely, the domestic market is fiercely competitive, with frequent price wars, necessitating enterprises to focus on commercial implementation at the application level. As DeepSeek's open source lowers the technological threshold, AI applications should establish commercial barriers through non-technological capabilities such as manual "hard work" to achieve a closed loop of commercial logic.

In particular, Zhu Xiaohu noted that AI application revenue has begun to explode. "In the past six months, many AI application companies in both China and the United States have witnessed rapid revenue growth. Achieving $10 million in ARR (annual recurring revenue) within 6-12 months is a verification indicator of PMF (product-market fit)."

Viewing Kunlun Wanwei through this lens, it is clear that Zhu Xiaohu's judgment has been validated by Zhou Yahui in sectors such as short videos, music, and social networking:

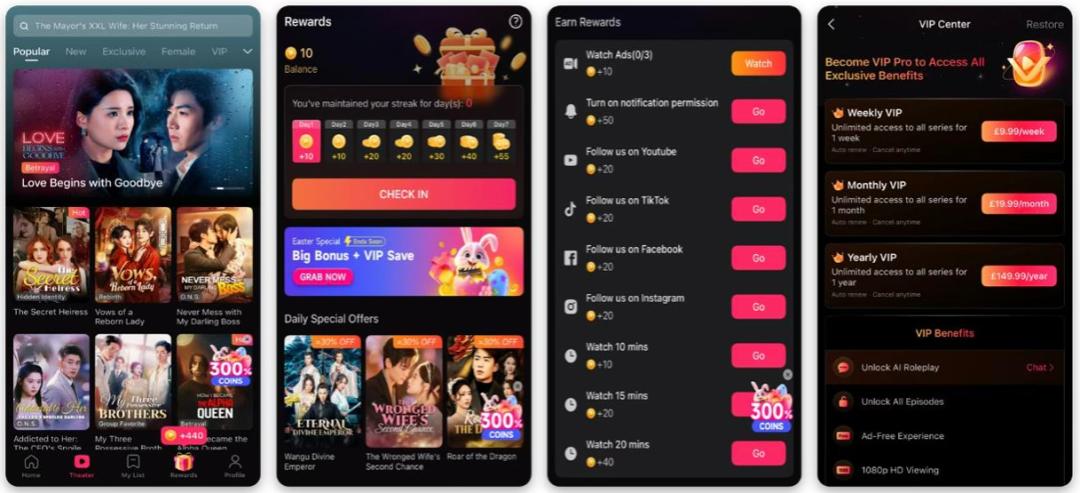

Firstly, in the short video sector, Kunlun Wanwei entered the fray with "production + distribution." The AI video generation platform SkyReels has been online for over six months and is widely loved by users. Its DramaWave short video content platform has achieved an ARR of approximately $120 million, with monthly revenue of about $10 million.

As of March this year, DramaWave's downloads surpassed the 30 million mark, and monthly active users exceeded 10 million. The user base has successfully ranked among the top five in the industry, firmly establishing itself as a tier-one player in the overseas short video sector.

The emergence of a series of popular short videos has secured DramaWave's place in the market. For instance, "Engagement Storm" surpassed 10 million views within just five days of its launch. This propelled DramaWave to rank in the top 10 of South Korea's Google Play entertainment app chart since April 5, even topping the chart and surpassing Netflix.

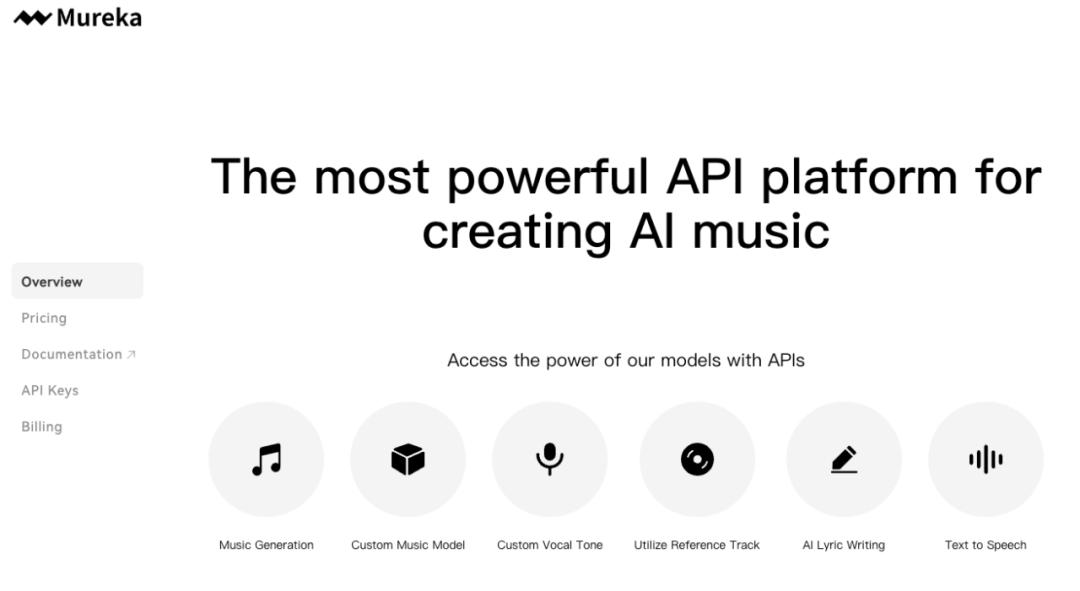

Secondly, in the AI music sector, as of the end of March 2025, Kunlun Wanwei's ARR reached approximately $12 million, with monthly revenue of about $1 million, and its user base spans over 100 countries and regions worldwide.

This is because the AI music creation platform Mureka provides users with a full-chain service from creation to publication and has synchronously developed the world's first batch of API services and model fine-tuning functions, laying the groundwork for Mureka's commercialization.

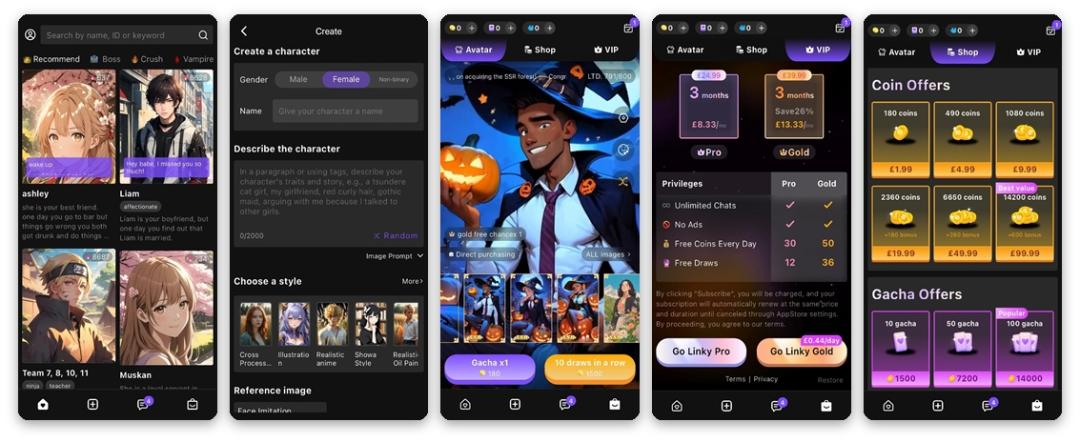

Thirdly, the AI social networking sector is the main arena of competition among mainstream Chinese and American internet giants and the most challenging aspect of current AI applications. Kunlun Wanwei's Linky is a successful exploration in this sector, with a monthly maximum revenue exceeding $1 million, cumulative downloads surpassing 10 million, and monthly active users reaching 3 million.

Unlike traditional social networking products, Linky offers low-threshold personalized interactions and fosters a unique social ecology. Users can create custom virtual characters and interact with them, as well as initiate chats with virtual characters created by others.

Thus, looking globally, grasping user needs, transforming AI into perceivable application scenarios, and realizing the commercial implementation of user value are three obvious signals and actions that align with the consensus of both Zhu Xiaohu and Zhou Yahui.

Should we invest in underlying technology?

While embracing AI and emphasizing applications, Zhu Xiaohu advises against investing in underlying technology and studying underlying models. The latter half of his view has been heavily criticized.

It is crucial to clarify the premise. Zhu Xiaohu's perspective is tailored to startups. As an early-stage investor, he naturally understands the costs associated with startups investing in large model underlying technology. Startups' strength lies in their deeper understanding of products and users. Underlying models can be realized through open-source models, inherently benefiting companies engaged in underlying technology research and development through the co-construction of a developer ecosystem.

Kunlun Wanwei continues to iterate its "Tiangong" series of large models through independent research and development technologies, achieving multiple breakthroughs in complex task processing, multimodality, and other aspects. Its overall AI technology strength firmly ranks in the industry's first tier. Zhou Yahui's aim is to compete with giants like Bytedance and transform Kunlun Wanwei into a small yet formidable enterprise in the era of intelligent virtuality. The hard power of underlying technology research and development cannot be overlooked.

Taking Kunlun Wanwei's industry-leading AI music large model as an example, last April, it launched the AI music generation large model Tiangong SkyMusic. Less than a year later, Kunlun Wanwei officially unveiled the Mureka O1 model and Mureka V6 model. As the world's first music reasoning large model, Mureka O1's performance comprehensively surpasses Suno, successfully topping SOTA, once again showcasing China's technological prowess to the world and continuing to lead the development trend of the AI music industry.

Without the exclusive capability of the AI music large model SOTA, there would not be the industry-leading AI music application creation platform Mureka.

In the first quarter of this year, in terms of underlying model capabilities, Kunlun Wanwei's Skywork R1V multimodal reasoning model reached open-source SOTA. In the field of video generation, the SkyReels-V1 model and the SkyReels-A1 algorithm, which supports precise expression and motion control, rank among the world's leaders, with the latter achieving a groundbreaking SOTA.

Examining the overall landscape of China-US AI competition, AI research and development is a high-investment endeavor and a necessary condition for winning the competition.

Computing power is paramount. The training and reasoning of large models require robust computing power support, with high-performance chips serving as the core carrier of this power. Amidst chip controls against China, the independent controllability of domestic AI chips has become an inevitable requirement of the times.

"The company has overcome multiple core technological challenges, and the overall research and development progress has passed the halfway mark, taking a solid step towards mass production," Kunlun Wanwei mentioned in its first-quarter financial report. As early as two years ago, it acquired control of the AI computing power chip enterprise Beijing Aijieke Core Technology Co., Ltd. through capital increase. Nowadays, it continues to increase investment in computing power businesses, finally pushing the AI chip research and development project to achieve breakthrough progress.

Particularly in chip research and development, Kunlun Wanwei's research and development investment in AI computing power chips, large models, and applications increased by 23.4% year-on-year this quarter, reaching 430 million yuan. Last year, its research and development expenses also reached 1.54 billion yuan.

Consequently, the number of Aijieke Core's employees has now approached 200, encompassing professionals in multiple fields such as chip design, algorithm research and development, and system integration, providing a strong guarantee for the efficient advancement of research and development work.

In fact, there are multiple types of AI chips, and Kunlun Wanwei and domestic peers are continuously seeking independent paths in AI chips, particularly on NPU products targeted by Aijieke Core Technology. Huawei has series such as Ascend 310 and Kirin 970, while Cambricon also offers NPU products like Cambricon 1A, Cambricon 1H, and Cambricon 1M. They all aim to break Nvidia's chip monopoly and provide new options for high-performance AI computing, which is also the core direction of future competition.

Investing in underlying technology opens up the entire industrial chain process of "computing power infrastructure - large model algorithm - AI application," balancing the layout of the foundation layer, technology layer, and application layer. Startups should "avoid the heavy and take the light" to achieve differentiation, while Kunlun Wanwei aims for a full industrial chain layout to achieve a breakthrough.

What's next?

For AI layout, will Zhu Xiaohu's talk prevail or Zhou Yahui's actions? This year may be the turning point when the answer begins to unfold.

Investors' logic often involves betting when there is no consensus and exiting when there is. For Kunlun Wanwei, which is "All in AGI and AIGC," after becoming the Chinese AI enterprise with the highest overseas revenue, the path toward AGI must continue to advance steadily.

For instance, general-purpose agents are considered a crucial direction for future technological development, capable of connecting thinking and action to complete various complex tasks. Zhu Xiaohu is not optimistic about general-purpose agents due to their quality still being challenging to reach commercialization levels. This track is more of an opportunity for large companies like Tencent.

However, after Manus was launched in March this year, it sparked heated market discussions, followed by Zhipu releasing its intelligent agent product. Kunlun Wanwei will unveil Skywork.ai, the world's first general-purpose agent platform for productivity scenarios, in May this year, focusing on personal productivity scenarios to address the pain point of "general but not proficient."

In Kunlun Wanwei's financial report "spoiler," Skywork.ai is an intelligent system comprising five expert-level AI agents, each deeply optimized for professional documents, spreadsheets, presentations, podcasts, and web content.

Each agent has undergone specialized model training and component enhancement, forming differentiated advantages in professional depth, detail granularity, and visual presentation of output content. It is also equipped with a deep research module (deep research) that benchmarks the same level of research quality as OpenAI, serving as the underlying support.

Skywork.ai ensures full-chain traceability and tracking for all generated content, transcending the conventional black box model and establishing a robust credibility guarantee mechanism. In terms of interaction, it seamlessly integrates online natural language editing with visual circle selection, offering versatility. Users can export results as local files or directly integrate them into Google Workspace for collaborative creation, thereby facilitating a seamless workflow from decision-making to modification and secondary creation. Furthermore, the system facilitates batch uploads of multimodal files and links, fostering personalized content production through the construction of customized knowledge graphs. This marks a significant step towards the deep integration of intelligent tools within workflows.

Another noteworthy advancement in the To B market is the game engine. Kunlun Wanwei's proprietary AI-native game engine, "Spark AI," will debut in July this year, distinguished by its four core AI capabilities: AI assistant, code generation, asset generation, and gameplay logic analysis and generation. These features promise to drastically reduce game development costs and propel the industry towards end-to-end automatic game creation.

Looking ahead, Kunlun Wanwei foresees the current era as a pivotal phase for AI large models, characterized by application deployment and revenue growth, with profitability anticipated post-2027.

Following the spring rain of DeepSeek, China's AI landscape is thriving, with industry standards undergoing rapid transformation.

In the domestic market, general-purpose AI assistants have emerged as key entry points for leading manufacturers. Tencent's Yuanbao and ByteDance's Doubao are pioneering this path, while vertical scenario-based AI applications are also accelerating their development. Alibaba's Quark and Baidu Wenku are redefining scenarios such as search and office work through innovative products.

Kunlun Wanwei's global AI strategy has solidified its position as the Chinese AI enterprise with the highest overseas revenue. This success is built on both the implementation of a commercial closed loop and continuous breakthroughs in underlying AI technology. Behind this paradigm lies a comprehensive "computing power infrastructure - algorithm innovation - application deployment" layout, underscoring the necessity of full-factor competitiveness.