From Lucy Guo to Wang Xingxing: How Post-90s Entrepreneurs Are Shaping the Global Value Chain

![]() 05/09 2025

05/09 2025

![]() 541

541

When Forbes unveiled its 2025 World's Billionaires list, history was subtly witnessing a paradigm shift.

Icons of the Internet era, such as Musk and Zuckerberg, remain prominent, yet the underlying currents have quietly transformed.

Alexandr Wang, co-founder and CEO of the AI data annotation unicorn Scale AI, emerged as the youngest self-made billionaire. His co-founder, Lucy Guo, surpassed American singer Taylor Swift to become the world's youngest self-made female billionaire.

A 19-year-old Chinese boy and a 21-year-old woman founded a tech company valued at over $25 billion. This exemplifies how post-90s entrepreneurs are driving intergenerational changes in wealth creation.

Similar stories are unfolding across the globe. Peng Zhihui, a post-90s "prodigy," founded embodied intelligence company Zhiyuan Robotics, valued at over RMB 15 billion. Xiao Hong, the founder of Manus, has further focused attention on AI Agents.

Undoubtedly, a wealth storm even more profound than the Internet has swept in. The investment code for the next decade lies hidden in these young entrepreneurs' ambitions to "embark on an unseen world."

The Rise of Genius Post-90s: A New Era of Wealth Creation in AI

Recently, Chinese tech entrepreneur Lucy Guo has become a sensation.

With nearly 5% of Scale AI's shares, Guo defeated Taylor Swift to become the world's youngest self-made female billionaire.

Scale AI serves numerous renowned companies such as OpenAI, DoorDash, Pinterest, General Motors, and NVIDIA, establishing itself as a U.S. AI data annotation unicorn. In 2025, Scale AI's valuation reached $25 billion, making Guo's share worth close to $1.2 billion.

Guo's story underscores the AI industry's wealth-creation capabilities.

It's evident that in the battle for the future of intelligent landscapes, as long as large language models continue to adhere to the scaling law driven by data, high-quality AI data remains a strategic resource. This fertile ground of data will undoubtedly yield more wealth-creation opportunities in the future.

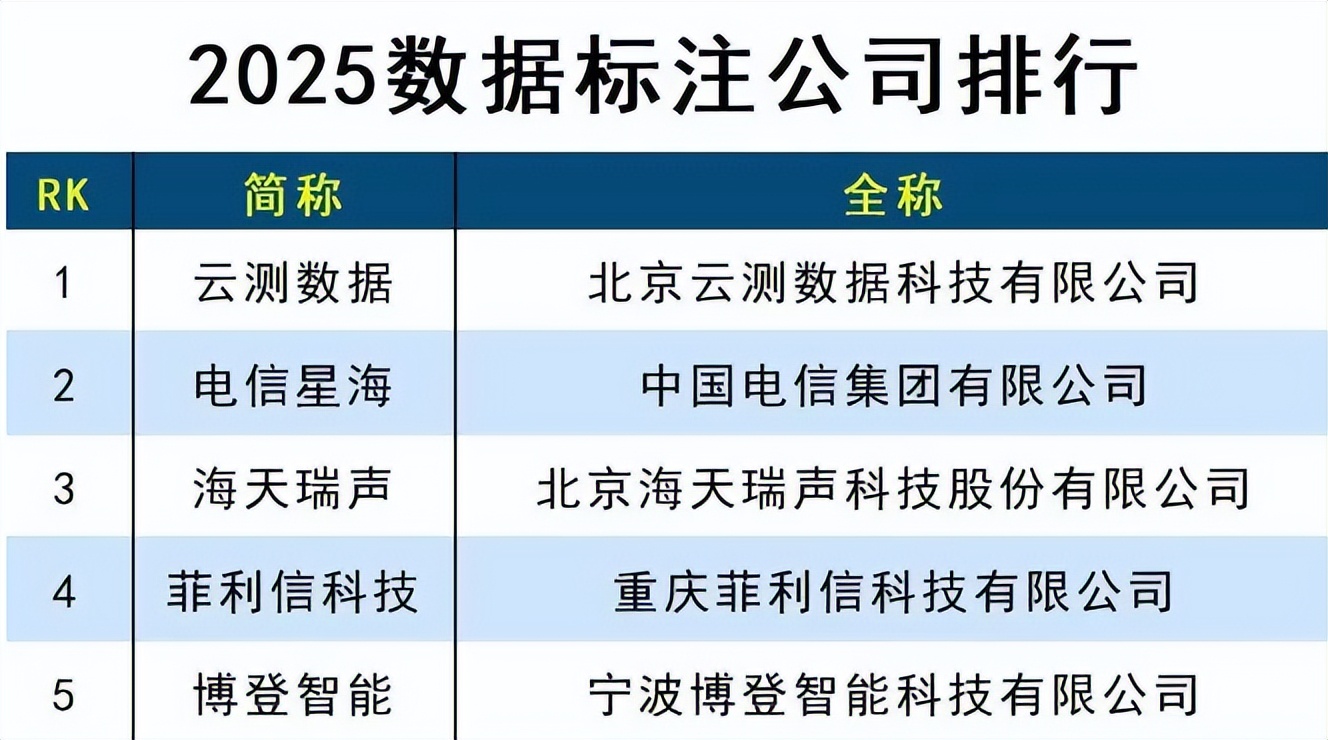

In China, several AI data annotation unicorns have emerged in the AI industry. According to the 2025 Data Annotation Company Rankings jointly researched by Internet Weekly, Deben Consulting, and the RDIC of the Chinese Academy of Social Sciences, companies like Testin, Telecom Xinghai, Hisilicon, and Feilixin Technology have stood out.

Source: Internet Weekly, Deben Consulting, RDIC of the Chinese Academy of Social Sciences

Amidst the rise of multiple players in the data annotation field, it's clear to see China's talent dividend exploding.

For example, at Baidu Intelligent Cloud's Shaoguan Data Industry Base, 16.87% of data annotators are post-90s, and 83.13% are post-00s, with over 96% holding a college degree or above. Behind this lies the country's commitment to providing a vast pool of specialized and high-quality talent reserves for the industry through large-scale talent cultivation and school-enterprise cooperation. This is also a microcosm of AI development in China.

The essence of AI competition has shifted from breakthroughs in isolated technological points to the construction of talent ecosystems. BV Baidu Ventures, Hillhouse Capital, Matrix Partners China, and Qiming Venture Partners have all invested in DeepTech. Lei Jun, the founder of Xiaomi, offered a multi-million-yuan salary to recruit Luo Fuli, a "post-95 AI prodigy" and key developer of the DeepSeek open-source large model DeepSeek-V2, further proving this point.

Computing power and data can be quickly accumulated through capital, but the cultivation cycle of top talent is lengthy, and the replacement cost is high, making their creativity and technology transformation capabilities hard to replicate.

Young people have converged into a powerful force driving AI industry development, with "post-90s AI prodigies" gradually becoming the backbone of this round of AI 2.0 development.

Xiao Hong, the founder of the recently popular AI agent Manus, is one of the "strongest post-90s" entrepreneurs. Sun Weijie and Zhang Linfeng, the co-founders of DeepTech, a leader in scientific research paradigms in the AI pharmaceutical sector, are also post-90s. Wang Xingxing, the founder of Unicorn Robotics, and Peng Zhihui, the founder of Zhiyuan Robotics, are both post-90s as well.

In the wave of AI entrepreneurship, these post-90s entrepreneurs are rewriting the game order at an astonishing pace. Unlike the previous generation of internet entrepreneurs who relied on traffic dividends, success in the AI era relies more on the dual-wheel drive of "hardcore innovation + scenario implementation."

Obviously, the new generation of entrepreneurs possesses a stronger technological gene, scenario insight, and capital operation capability, propelling China's technology industry from a "copy mode" to "asymmetric innovation," potentially incubating more global technology giants and leading China in international AI competition.

Key Variables in Technology-Driven Wealth Creation

From "Copy to China" to "Innovate for Global," a group of young people born in the digital wilderness look back at the footprints of previous generation entrepreneurs from BAT and the Magnificent 7 who connected the world with the internet. They then venture into "no-man's lands" such as embodied intelligence, biocomputing, and general large models, marking new coordinates on the path of technological revolution.

Whether it's DeepSeek reshaping the AI industry landscape or Unitree Robotics becoming a "price killer" in the quadruped robot sector, the new generation of entrepreneurs has shown through practical actions that compared to the previous wave of internet entrepreneurship, the core of current technology entrepreneurship has shifted from "traffic scale" to a three-dimensional competition of "technological depth × scenario adaptation × business closed-loop."

This transformation is not only an inevitable outcome of the technological cycle's evolution but also reflects the new generation of entrepreneurs' pursuit of innovation leadership, abandoning the burn-and-grab approach, and adopting a more pragmatic entrepreneurial attitude.

Observing the development of these emerging technology companies reveals two major insights:

First, technology startups must possess the strategic wisdom to seize structural opportunities in the technological change cycle.

In the first year of the AI agents explosion, Manus fired the first shot in China. Behind this lies the "Andy-Bill's Law of the New Era" proposed by Manus' founder Xiao Hong, who grasped the explosion of demand for AI agents from industrial laws.

Source: Manus official website

Similarly, in the development of embodied intelligence, Unitree Robotics took the lead in cutting into the market with quadruped robots, achieving scene breakthroughs in non-humanoid routes and successfully occupying a high position in the value chain of niche sectors, demonstrating precise control over the pace of technology diffusion.

Second, it's necessary to construct a demand pyramid and possess the ability to rigidly grasp demand.

In the large AI model sector, Manus' founder Xiao Hong believes that entrepreneurs should focus on solving specific technical problems and pay attention to whether they can solve users' problems. Therefore, his team integrates large model APIs to create differentiated experiences, becoming a dark horse in AI applications.

In the robot sector, Unitree Robotics' quadruped robots have captured the needs of industries such as power, petrochemicals, agriculture, and mining in scenarios like inspection and rescue, rapidly advancing robot commercialization. Zhiyuan Robotics has seen that industrial automation is a "survival need" for factories, focusing on interactive intelligence and operational intelligence in research and development, and investing significant resources. This year, Wang Laichun, the founder of Luxshare Precision, visited Zhiyuan Robotics, validating Zhiyuan's prediction of the demand for humanoid robots in industrial scenarios.

The breakthrough paths of these "unicorns" essentially lie in finding the optimal balance between technological feasibility, demand rigidity, and business models. This also reflects the more pragmatic and restrained business thinking of the younger generation of entrepreneurs.

From past interviews, it's not difficult to feel this point.

For example, regarding the "show-off" phenomenon in the humanoid robot sector, Zhiyuan Robotics' founder Peng Zhihui stated that they are more concerned with the robot's ability to walk, grab, carry, and ship, which can truly enter factories, than with complex actions like backflips.

Similarly, Unitree Robotics' founder Wang Xingxing has also demonstrated his pragmatic attitude towards product application landing in various interviews. For example, Unitree Robotics has always promoted commercialization with a set of cost control logic. Wang Xingxing once said in an interview, "Cost has always been the KPI for everything we do. The core is to make money."

Understanding of technology, application scenarios, and supply chains permeates the entrepreneurial journey of these "post-90s prodigies." From the application and landing of large AI models to the low-cost mass production of robots, it undoubtedly prepares the ground for a new round of wealth feasts.

Understanding Opportunities in the 'Eye of the Storm' from the Entrepreneurial Wave

The entrepreneurial code of the new generation of entrepreneurs essentially lies in leveraging their professional capabilities to accurately position themselves in the technological industry cycle.

From the perspective of the Kondratieff cycle, we are currently at an inflection point transitioning from the fifth information technology revolution to the sixth artificial intelligence and biotechnology revolution.

Among them, investment opportunities in the field of artificial intelligence are showing multi-dimensional growth momentum. Recently, international technology giants such as Amazon, Google, Microsoft, and Meta released first-quarter data showing significant increases in their capital expenditures, primarily used for AI and cloud services infrastructure construction.

Against the backdrop of the Sino-US technology competition, China's policy support and industrial chain advantages will also bring structural opportunities to related sectors in the Hong Kong stock market. In this regard, CITIC International pointed out that the increase in AI capital expenditures by technology giants will help strengthen the investment sentiment in the Hong Kong stock market's AI industry chain (hardware and software), and related stocks in the AI industry chain, robotics, and intelligent driving are expected to continue to obtain excess returns.

In the long run, China's AI industry is expected to benefit from policy and industry synergy.

In terms of policies, the national "Robot+" strategy, special support policies for large models, and local funds have joined forces to promote the rapid mass production of new-generation technology companies such as Unitree Robotics and Zhiyuan Robotics.

In terms of the industrial chain, China's manufacturing industrial chain has significant advantages. For example, Unitree Robotics has rapidly risen with its self-developed hardware, business pragmatism, and low-cost advantages. The mass-produced version of its humanoid robot G1 released last year had a starting price of only RMB 99,000, making it the first time that the price of a bipedal humanoid robot has dropped below RMB 100,000. As Wang Xingxing said, "China's advantages in hardware manufacturing are unique." This full-chain capability of "technology-manufacturing-market" has positioned China at the high end of the value chain in the field of embodied intelligence.

Source: Unitree Robotics official website

Undoubtedly, China's AI industry will accelerate in the long-term competition, incubating a large number of new technology tycoons, such as DeepTech, Unitree Robotics, Zhiyuan Robotics, and others.

It's foreseeable that as large model applications and embodied intelligence enter the stage of large-scale landing, the capital market landscape will also be reshaped, just as internet companies that have flooded into the capital market over the past two decades have impacted the market landscape dominated by traditional industries.

It's worth noting that against the backdrop of concerns about the "delisting of Chinese stocks" in the U.S. stock market, the Hong Kong stock market is expected to become the "eye of the storm" for a new round of technological change.

In fact, popular technology sectors in the Hong Kong stock market, such as the robotics sector, have formed four giants: Horizon Robotics, UBTECH, UR Robot, and Geek+. Not long ago, Unitree Robotics' founder Wang Xingxing also talked about the topic of listing in Hong Kong and said it was possible but uncertain.

This indicates that by deeply focusing on the upstream, midstream, and downstream of the AI industry chain, this wave of entrepreneurship triggered by technological iteration will bring more wealth-creation opportunities to the Hong Kong stock market. In this regard, Wall Street institutions have recently successively expressed their bullish views on the Chinese stock market and predicted that with the boost of China's AI development, the Chinese stock market will usher in a more sustainable rise.

In summary, from the internet to AI, the underlying logic of wealth creation has never changed. A group of post-90s entrepreneurs is grasping the core variables of the technological revolution with faster iteration speed and a stronger technological belief, accurately positioning themselves on the eve of the industry explosion, and writing a new round of wealth epics. The hard technology companies they have created will become the new darlings of capital.

Perhaps, the next "Tencent and Alibaba of the AI era" are growing robustly.

Source: Hong Kong Stock Research Society