Essential Technological Upgrades for Achieving Universal Intelligent Driving in Autonomous Vehicles

![]() 05/09 2025

05/09 2025

![]() 515

515

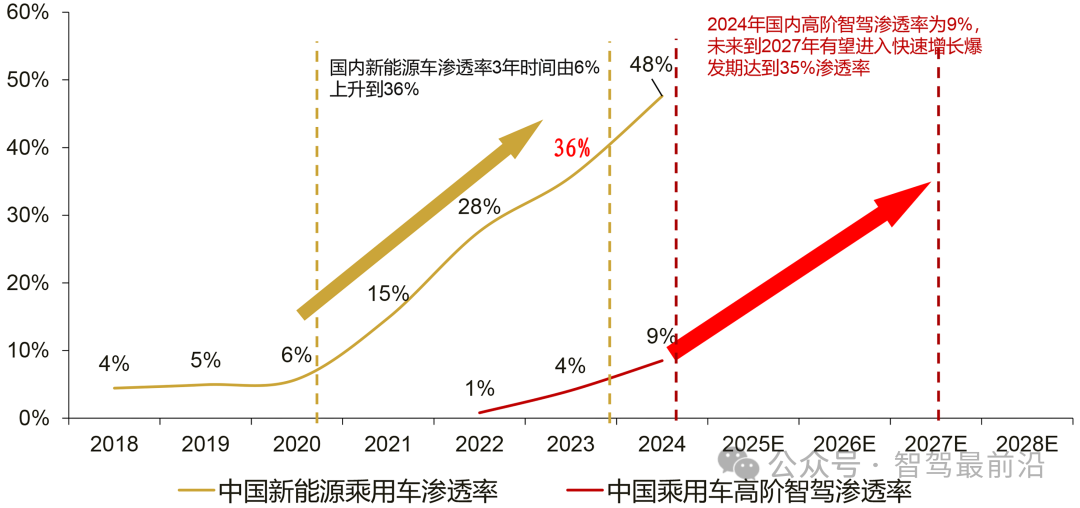

In recent years, the rapid proliferation of new energy vehicles, coupled with advancements in artificial intelligence and big data technology, has ushered in unprecedented opportunities for the development of intelligent driving technology. From early driving assistance systems to the current state of high-level intelligent driving, the technological roadmap has continually evolved, prompting profound changes across all segments of the industrial chain. Notably, China's new energy passenger vehicle market penetration rate has surged from less than 10% to over 30% within a few years. While the penetration of high-level intelligent driving systems started relatively late, it is anticipated to witness explosive growth in the coming years, reaching approximately 35%.

Intelligent driving is poised to enter a period of rapid market expansion.

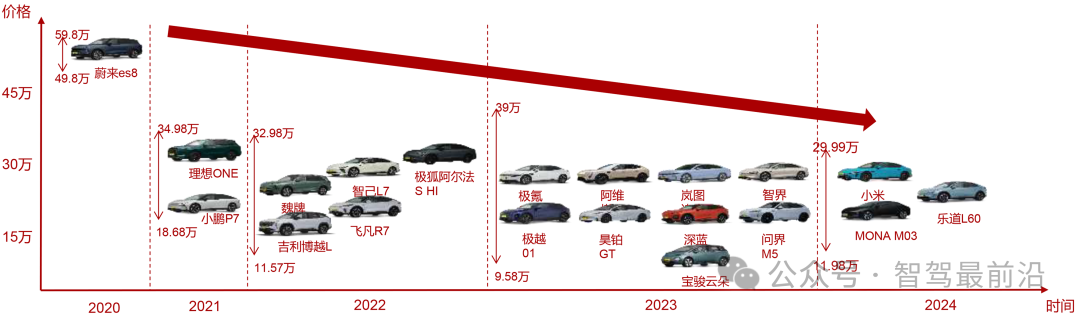

The evolution of intelligent driving technology can be categorized into several stages, ranging from the initial L0 with no autonomous capabilities, to L1 driving assistance, L2 partial autonomous driving, and advancing to higher levels of conditional autonomous driving (L3), highly autonomous driving (L4), and fully autonomous driving (L5). Currently, market offerings dominated by L2 and L2+ systems are gradually transitioning towards L3. Over the past few years, passenger vehicles have achieved a significant leap, moving from sporadic experiments to large-scale applications in both new energy and intelligent driving. This transition is primarily attributed to the continuous reduction in costs across OEM technology and various supply chain links, along with the transformation of algorithms from traditional rule-based systems to end-to-end deep learning iterations. With the ongoing progression of intelligent driving technology, high-level intelligent driving capabilities are extending from high-end models to mid-to-low-end models priced between 100,000 and 200,000 yuan.

The price of Chinese models equipped with high-speed NOA (Navigation on Autopilot) functionality has gradually decreased from over 500,000 yuan in 2020 to below 150,000 yuan in 2024.

Breakthroughs in Core Hardware and System Architecture

The core of the intelligent driving system lies in the co-evolution of hardware and software. From a hardware perspective, key components encompass in-vehicle chips, LiDAR, cameras, millimeter-wave radars, ultrasonic radars, and other sensor modules, as well as domain controllers. Major automakers and suppliers are dedicated to achieving cost reduction, performance enhancement, and more integrated system solutions through independent research and development and strategic collaborations.

1. In-vehicle Chips and Computing Power Enhancement

As the 'nervous center' of intelligent driving, in-vehicle chips are pivotal for the response speed and data processing capability of the entire vehicle system. The report indicates that the domestic market size for intelligent driving chips is projected to grow from 5.6 billion yuan in 2024 to 25.5 billion yuan in 2027, at a compound annual growth rate of 66%. Currently, mainstream chip platforms such as Huawei Ascend 610 and Horizon Journey 5 have already secured a significant share in standard pre-installation, with their computing power often measured in TOPS (trillions of operations per second). From high-performance chips to low-compute platforms, intelligent driving systems can select appropriate hardware platforms tailored to different scenarios, not only meeting the requirements of high-speed NOA but also achieving a cost-benefit balance for urban NOA.

2. LiDAR

As an integral part of the intelligent driving perception system, the technological roadmap for LiDAR is gradually shifting from traditional mechanical scanning to MEMS solid-state and purely solid-state solutions. While traditional mechanical LiDAR excels in resolution and accuracy, its large size, high cost, and susceptibility to vibration hinder its application in vehicles. Currently, MEMS LiDAR has emerged as the mainstream due to its low cost, compact size, and high reliability. Additionally, micro-mirror LiDAR based on ToF (Time of Flight) ranging technology also holds a substantial market share. LiDARs employing different technological pathways each have their own emphasis in terms of price, number of lines, and performance. Manufacturers such as RoboSense and Hesai Technology have distinguished themselves in market competition. Concurrently, the pure vision solution leverages cameras and neural networks to construct a three-dimensional environment. Despite certain limitations in long-tail scenario coverage and algorithm iteration cycles, it is still applied in some models due to its cost-effective advantage.

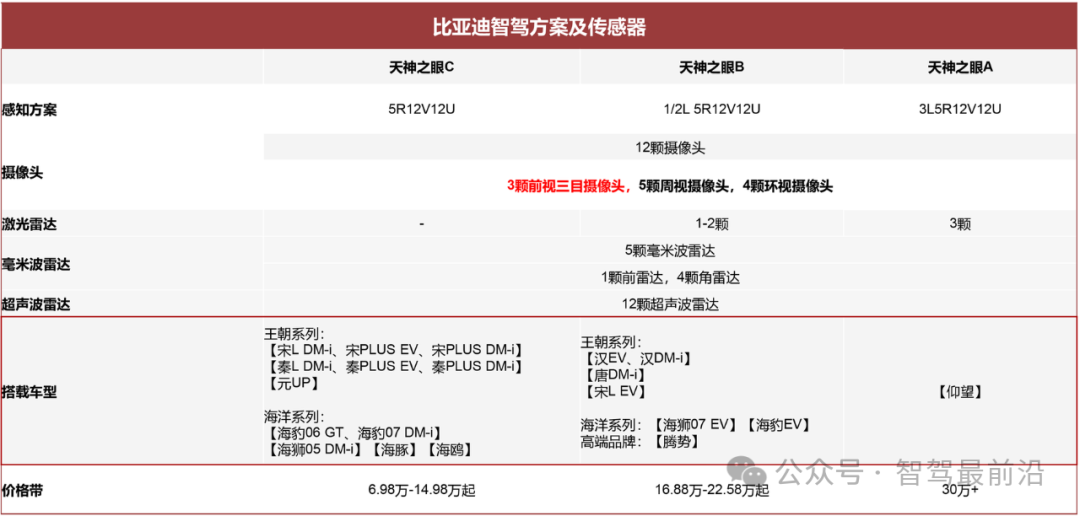

3. Cameras and Stereo Vision Systems

Stereo vision systems achieve precise modeling of the environment in front of the vehicle through the combination of binocular or trinocular cameras. Taking BYD's 'Tian Shen Zhi Yan' series as an example, its products across different price points adopt a forward-looking trinocular camera solution, achieving point cloud perception effects akin to LiDAR through strictly controlled lens spacing and high-precision calibration technology. The micron-level precision requirements under extreme temperature conditions pose significant challenges to the design and manufacturing of the camera system. However, once breakthroughs are made, it can significantly reduce the overall vehicle cost and elevate the level of intelligence.

BYD's Intelligent Driving Solution and Sensors

4. Domain Controllers and Vehicle Integration

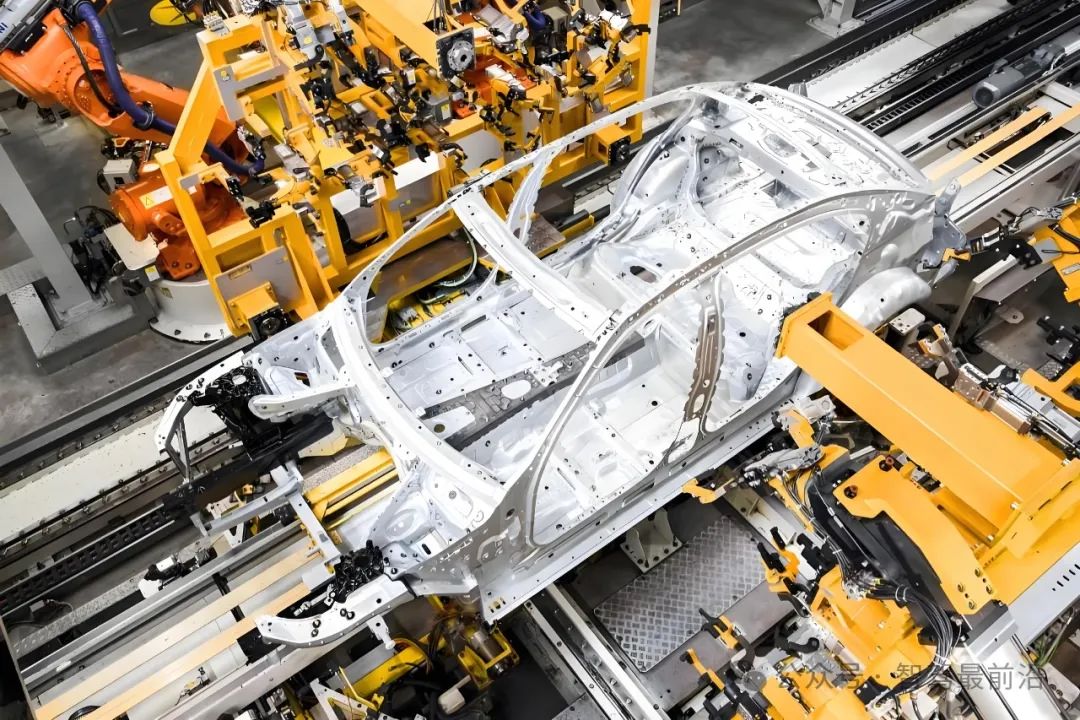

The intelligent driving system necessitates not only robust perception and computing capabilities but also an efficient control platform to integrate data from various modules and execute multi-scenario collaborative decision-making. As a crucial node in the vehicle's electronic architecture, domain controllers have diverse supply modes, including direct procurement by OEMs, independent research and development, and cooperation with external foundries. Currently, automakers such as BYD and Geely have achieved full-stack independent research and development, forming a comprehensive system from chips, sensors to domain controllers. This model not only enhances the overall vehicle performance but also fosters significant advantages in data closed-loop and rapid iteration.

Intelligent Driving Algorithms and Big Data Closed-loop

The intelligence level of intelligent driving systems is contingent not only on hardware capabilities but also on the depth of software algorithms and the support of big data. Currently, intelligent driving is gradually transitioning from initial rule-based assistance systems to end-to-end deep learning models. By collecting real road condition data through shadow mode, the model iteration cycle is significantly shortened to 7 days, with an anticipated daily training mileage reaching 150 million kilometers by 2025. This data-driven closed-loop system enables continuous algorithm optimization, thereby improving the system's adaptability to various complex traffic scenarios.

1. Deep Learning and End-to-End Systems

With the continuous maturation of neural network and large model technologies, intelligent driving systems are gradually transitioning from traditional multi-modular algorithms to end-to-end systems. Taking BYD as an example, its 'BAS 3.0+ Superhuman Driving Assistance' system not only encompasses the traditional two-stage end-to-end technology but also delivers a safer and more comfortable driving experience through vehicle perception, free power control, and chassis stability control. The integration of vehicle-end and cloud-end capabilities through the DeepSeeK large model constitutes a dual-cycle closed-loop system, markedly improving data generation and algorithm iteration efficiency.

2. Data Closed-loop and Model Iteration

The data closed-loop system is pivotal to the successful implementation of intelligent driving. Through continuous data collection in real road scenarios, enterprises can promptly capture environmental changes, driving behaviors, and abnormal situations in specific scenarios, subsequently updating model parameters through big data analysis and deep learning technology. The seamless transmission of vehicle-end and cloud-end data enables model iteration to occur not only in the cloud but also efficient deployment on the in-vehicle system, ensuring that the entire system maintains a high level of decision-making capability in complex environments.

3. High-Precision Maps and Environmental Modeling

While LiDAR and cameras provide rich environmental perception data, high-precision maps remain indispensable as an auxiliary tool in practical applications. Currently, intelligent driving systems achieve real-time modeling and prediction of the vehicle's surrounding environment through the fusion of sensor data and high-precision maps, providing robust technical support for autonomous driving decisions. Especially in urban NOA scenarios, the dynamic update of high-precision maps and the integration of multi-sensor information become crucial for enhancing system safety and robustness.

Strategic Layout of Automakers and Supply Chain Integration

Amidst ongoing technological breakthroughs, the integration of the intelligent driving industry chain and the strategic layout of automakers are also evolving rapidly. Domestic and foreign OEMs have increased investments in intelligent driving research and development, accelerating product launches and market promotion through full-stack independent research and development or collaboration with third-party suppliers. Leading players such as BYD, Geely, XPeng, and Huawei have also made strategic layouts, aiming to secure a leading position in the future autonomous driving market by independently researching AI chips, integrating high-precision sensors, and creating end-to-end intelligent driving systems.

1. Full-Stack Independent Research and Development and Third-Party Cooperation Models

Faced with technological barriers and market competition pressures, some automakers opt for full-stack independent research and development to build a unique intelligent driving ecosystem. For instance, BYD relies on its 'Tian Shen Zhi Yan' series of products to establish a comprehensive intelligent driving solution through forward-looking trinocular cameras, vehicle-wide perception, and cloud big data closed-loop. Concurrently, other automakers collaborate with third-party high-level intelligent driving suppliers to swiftly implement intelligent driving functions in models priced between 100,000 and 200,000 yuan, achieving a dual breakthrough in technology and cost. Both models present their respective advantages and disadvantages, with full-stack independent research and development posing technical challenges, while the cooperation model facilitates faster large-scale promotion.

2. Supply Chain Collaboration and Industrial Ecosystem Construction

Intelligent driving represents not just a breakthrough in individual technologies but also the construction of an entire ecosystem. From chips, sensors, domain controllers to the entire vehicle system, all segments work in tandem to form a highly integrated industrial chain. Currently, domestic chip manufacturers such as Horizon Robotics and Black Sesame Technologies, through strategic investment collaborations with OEMs like BYD and Geely, not only increase their market share but also achieve cost-effectiveness while enhancing technology. Other crucial supply chain links, including LiDAR manufacturers, intelligent chassis, and domain controller suppliers, are continually optimizing product performance and cost structure, collectively propelling the entire intelligent driving industry to new heights.

3. Market Landscape and Future Competition Scenario

With technological maturity and growing market demand, the field of intelligent driving is undergoing a new round of competitive reshuffling. The penetration rate of intelligent driving functions in models across different price bands is gradually increasing, and the variations in technological pathways, product configurations, and data accumulation among major automakers will directly influence the future market landscape. Achieving breakthroughs in safety, stability, and user experience has become the linchpin of competition among various enterprises. In the future, besides the iteration of technology itself, management determination, talent investment, and marketing capabilities will also emerge as crucial factors determining the success or failure of the intelligent driving market.

Conclusion

Intelligent driving technology stands at a pivotal point of rapid evolution and expansive application. From the steadily rising market penetration of new energy vehicles, to breakthroughs in hardware and algorithms for autonomous driving, and the strategic planning of automakers along with the development of supply chain ecosystems, every facet is demonstrating robust growth potential. Leveraging the ongoing enhancement of data closed-loops and large-scale model capabilities, coupled with the versatility of both full-stack independent R&D and third-party collaboration models, intelligent driving will usher in sweeping advancements in safety, reliability, and cost-efficiency, propelling the entire automotive sector into a new epoch of intelligence and automation. Amidst technological hurdles and market rivalries, enterprises must not only maintain consistent investment in technological R&D but also prioritize the holistic optimization of the vehicle system and the relentless enhancement of user experience to secure a competitive edge in the fiercely contested market.

-- END --