Giant 'Marriage Crisis': Has Apple Unwittingly Speeded Up Google Search's 'AI Disruption Crisis'?

![]() 05/12 2025

05/12 2025

![]() 468

468

On the evening of May 7, Google's stock price plummeted following news that 'Apple is beginning to focus on AI search.' After reviewing the original Bloomberg article, Dolphin Insights has identified two pivotal points, which we will briefly discuss below.

1. The Erosion of Traditional Search by AI Search

Indeed, it exists, primarily in terms of user search share, a point repeatedly emphasized in Dolphin Insights' recent reviews as a valuation suppression factor. While the immediate impact on advertisers' budget allocation may be limited, Apple executives' comments undoubtedly heightened market concerns about the potential disruption to Google Search on an emotional level.

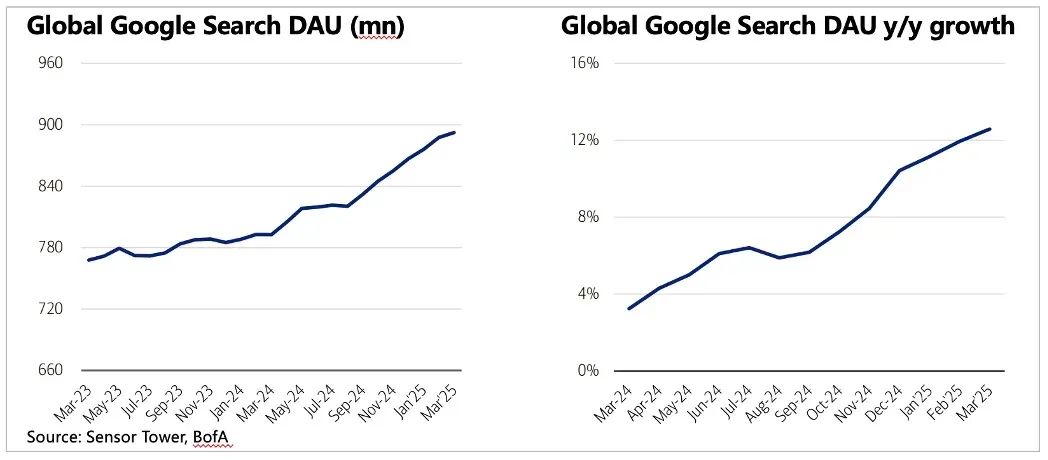

In April, Apple Safari's search volume declined for the first time, which Cue attributed to the diversion effect of AI search. However, during Google's earnings call, it was revealed that as the penetration rate of AI Overview increases, overall search volume is rising, supported by data from third-party agencies on search activity.

Why do these two giants hold opposing views?

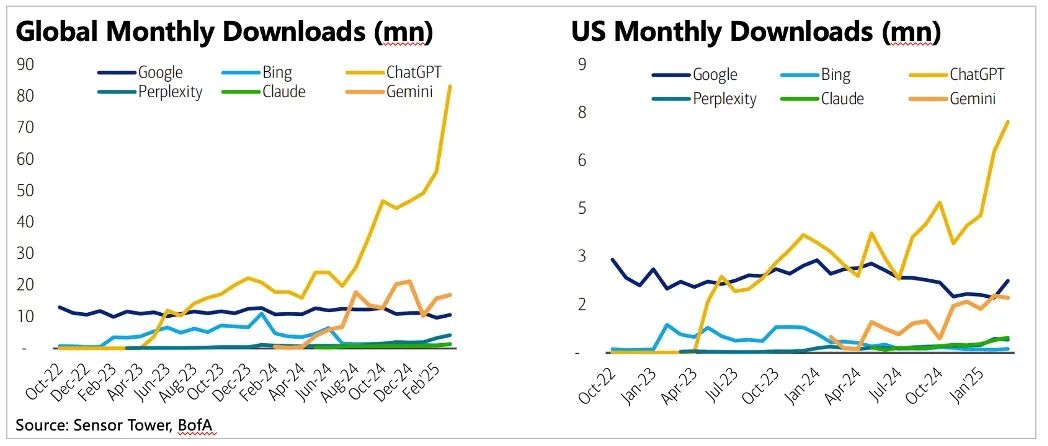

Dolphin Insights believes it is likely due to differences between platforms. On mobile devices, the search and Q&A experience of AI Apps is seamless, making it easy for users to switch from Safari to an AI chatbot/AI professional search App (like ChatGPT and Perplexity) or even Google's own Chrome or Gemini.

On the PC side, however, Chrome's dominant position and product habit advantage are more pronounced, which explains why Google believes search volume is increasing.

Nevertheless, this increase in search volume may have a limited impact on Google's monetization growth. Due to the incomplete commercialization of AI search, several platforms have yet to explore a model that maximizes advertising monetization (AI search is more 'result-oriented,' reducing monetizable jump link display opportunities during the Q&A process). Therefore, both ChatGPT and Perplexity rely on paid subscriptions.

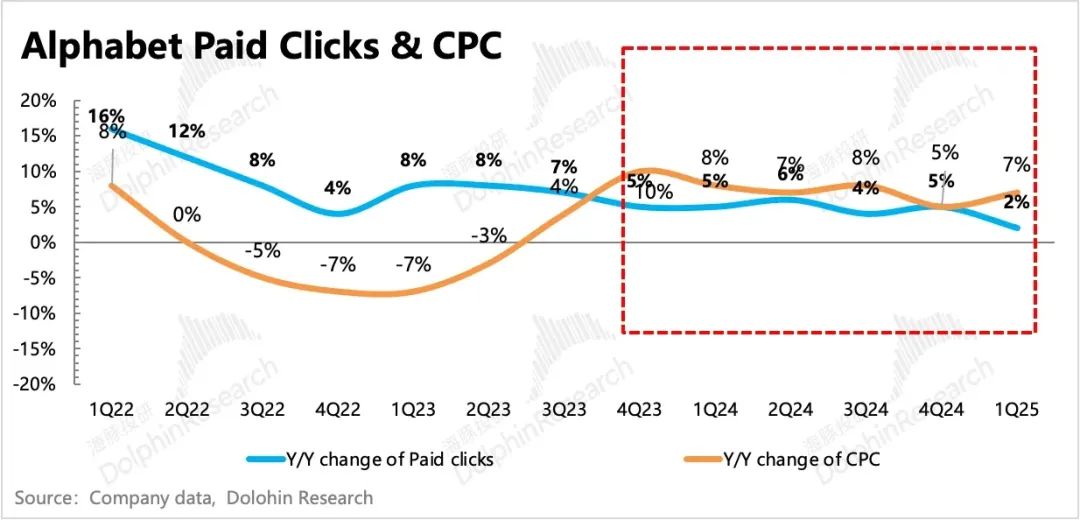

To mitigate the erosion of traditional search by AI search, Google has refrained from increasing the penetration of AI Overview in key advertiser areas like finance, culture and tourism, and healthcare. Meanwhile, as AI competitors have not ventured into advertising, Google's ad slots integrated with AI Overview have become rarer, indirectly increasing CPC.

Regardless, the erosion of traditional search user share by AI search is inevitable. Future search is likely to be fragmented across various AI applications or even disappear as AI Agents complete tasks independently (without users needing to guide step-by-step questions).

In other words, the more task-oriented Agents become, even if they cannot directly monetize advertising well, they will ultimately diminish the value of traditional search in the long run.

2. Has Google's Position in the Apple Ecosystem Been Weakened?

Not really. Cue mentioned that Google's default search position in Safari remains unchanged, and Google's commercial ecosystem advantage ensures it will not be significantly affected for the time being.

Cue's logical chain of thinking is: Since AI search has affected Safari, Safari needs to introduce more AI search technology providers. Among these providers, Google's ecosystem is more complete, offering superior overall experience and user habits, hence the default position remains unchanged for now.

The implication is that if a better provider emerges, a change will be considered.

Dolphin Insights believes that Cue's statement that 'Google currently has the best experience by far' refers not only to user experience but also to the advertising ecosystem we have always emphasized. Apple's Safari is not a charity; it must ensure user needs while determining the monetization value behind search and who can maximize this value.

Obviously, Google is still undoubtedly the one with the highest overall score at the moment. While ChatGPT and Perplexity offer good user experiences, their business model is paid, and the paying power of consumers is limited, preventing exorbitant prices. Therefore, the monetization value of consumer-paid models is much smaller compared to B-end advertisers.

For example, a simple calculation: Regarding Chrome's search revenue on Apple, Google pays Apple a 36% share. Based on approximately $20 billion in shared fees in 2022 from previous litigation documents, the reverse calculation yields Google's search revenue on Apple of $55 billion, accounting for about one-third of Google's overall search revenue.

In 2022, there were approximately 1 billion Safari users, meaning each person would have to pay at least a $55 annual subscription fee, a significant amount for users in emerging countries and regions. However, the crucial point is that if AI search can only be monetized through subscriptions, this $55 billion in revenue, after sharing $20 billion with Apple, may leave the remaining $35 billion unable to cover the full cost of AI search inference calls and other basic operating expenses.

For instance, OpenAI, as the largest independent AI search platform, currently has 500 million monthly active users, one-sixth of Chrome's 3 billion. Therefore, its Q&A volume is much smaller than that of Chrome, a traditional search engine. Nevertheless, OpenAI's inference costs last year reached $4 billion. If a simple and direct comparison is made, Safari's 1 billion users would correspond to inference costs of $8 billion or more. Without effective advertising monetization, this business operation would not only fail to generate substantial profits but also become a burden.

The ecosystem required for such advertising monetization is beyond the capabilities of small and medium-sized AI platforms, making it crucial to focus on OpenAI or even Google itself. However, before Google has a comprehensive response plan in place, it has little motivation to actively revolutionize itself.

In summary, Dolphin Insights believes that Cue's remarks have brought Google's potential threat from AI search to the forefront, forcing Google investors to confront this hidden risk that has loomed for two years.

However, despite the impact on the user side, given the significant gap in business ecosystems between traditional search and AI search, Apple is equally cunning and has not changed Google's default search position for the time being.

The 'AI search disruption' hangs like the sword of Damocles, but the timing of its final fall depends largely on whether Google accelerates its self-transformation beyond focusing on product experience to avoid users voting with their feet. These developments coincide with Google's antitrust hearings, making market sentiment more sensitive and tense, not ruling out the possibility of excessive short-term fright or, more accurately, premature fright.