Sino-US Robot Industry Summit: Current Landscape, Ecological Insights, and Future Dominance

![]() 05/12 2025

05/12 2025

![]() 557

557

I. Current Development Status of the Sino-US Robot Industry

(I) China's Robot Industry

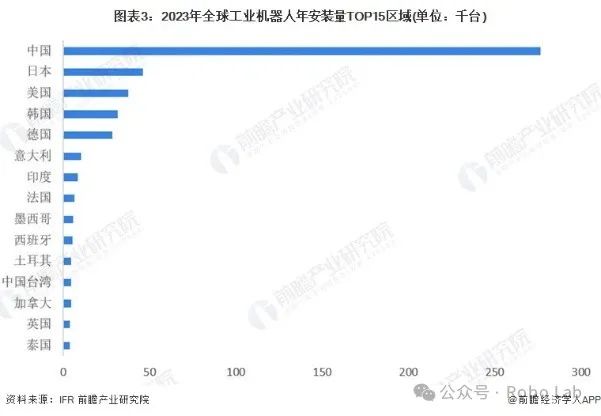

In recent years, China's robot industry has flourished, emerging as one of the world's largest markets. By 2024, the industry's market size surpassed 155 billion yuan, with the industrial robot segment poised to exceed 70 billion yuan and the service robot segment projected to reach 85.7 billion yuan. This growth is fueled by rising labor costs, an aging population, and the evolution of the manufacturing sector. National policies, such as "Made in China 2025," which designates robotics as a key development area, and surging market demand have further accelerated industry progress. Since 2013, China has consistently ranked as the world's largest industrial robot market, accounting for over half of global new installations. In 2023, China sold 137,000 industrial robots, a 21.6% increase year-on-year. Meanwhile, advancements in service robots, particularly in healthcare, education, and household services, have met diverse market needs.

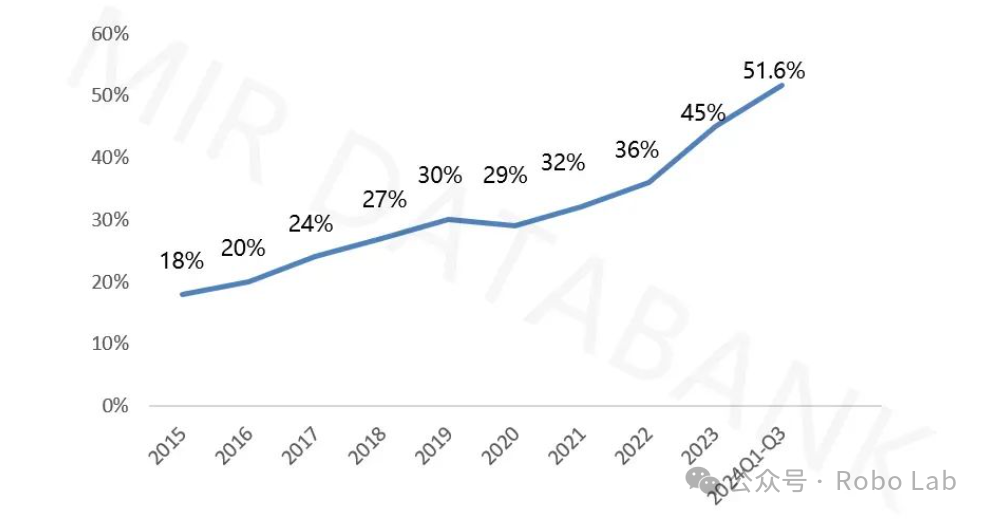

Despite its momentum, China's robot industry faces challenges, including a lack of high-end technology and reliance on imported key components. Market competition is fierce, with international giants like ABB and KUKA dominating due to their technological prowess and brand influence. However, domestic enterprises are making strides, with a 21.1% year-on-year growth rate in the first three quarters of 2024, surpassing overall market growth. Forecasts predict that China's robot market will exceed 410 billion yuan by 2029, driven by technological breakthroughs and industrial chain improvements.

Industrial Robot Localization Rate from 2015 to Q1-Q3 2024 (Data source: MIR DATABANK)

(II) US Robot Industry

The US robot industry has also expanded rapidly, with a market size of $12.5 billion in 2023, accounting for 19.3% of the global share. By 2024, it is expected to reach $15 billion, growing at a 4.41% CAGR from 2024 to 2028, reaching $19.33 billion by 2028. The US industry spans industrial, service, and consumer robots. Industrial robots excel in high-end manufacturing like automobiles, aerospace, and electronics, enhancing production efficiency and quality through AI and automation. Service robots facilitate healthcare, education, and household services, while consumer robots, led by iRobot's Roomba, dominate the smart home market. Technological innovation, particularly in AI, machine vision, and autonomous navigation, underpins US industry growth. Government support through legislation and funding further bolsters this innovation.

However, the US faces competition from Asian markets, where demand is surging, and US market share is declining. Labor shortages and rising costs prompt enterprises to rely more on robotics, revealing structural issues in US manufacturing.

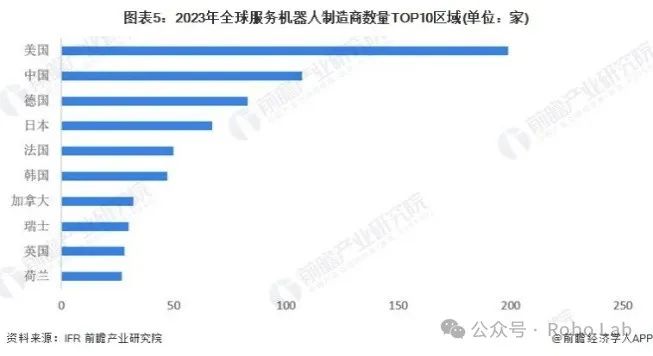

(III) Global Market Influence

In the global robot market, China and the US are key players. China holds 51% of the global market share, with 276,000 industrial robot installations in 2023. Chinese brands account for 49% of the market, compared to 18% for US brands. In service robots, China's demand for smart cities and healthcare projects drives innovation. The US, with a 19.3% share, leads in high-end technology and software ecosystems, generating $7 billion in revenue in 2022. China dominates the global market, especially in industrial robots, while the US maintains advantages in high-end technology. Future Sino-US competition and cooperation will significantly impact the global robot industry.

II. Industrial Ecosystem of the Sino-US Robot Industries

(I) China's Robot Industry Ecosystem

1. Upstream Core Components

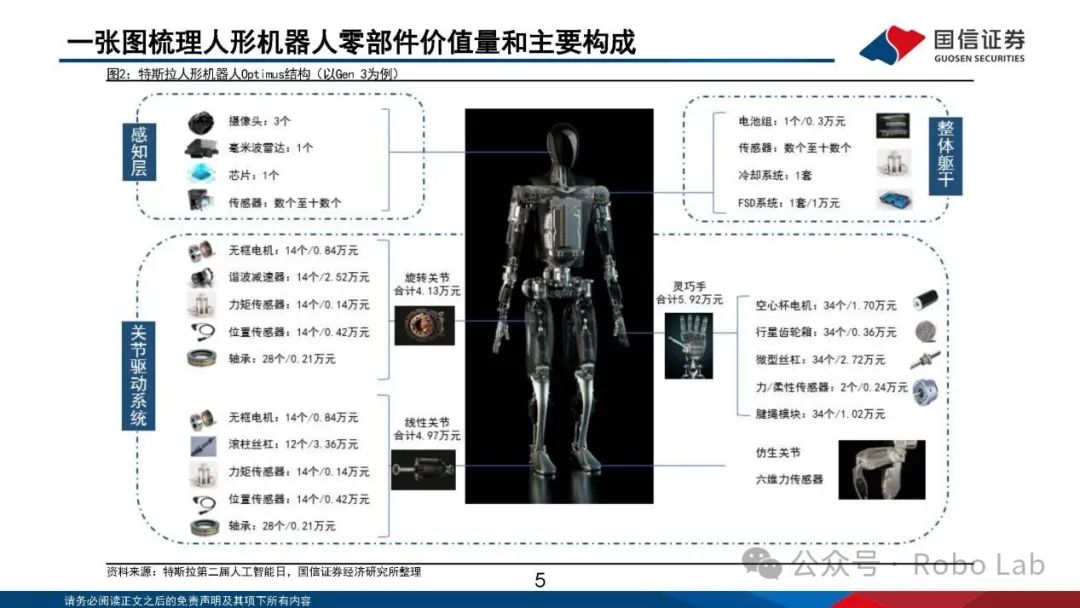

China's robot industry chain's upstream includes core components like controllers, servo motors, and reducers, accounting for 60%-70% of a robot's cost. Reducers, servo systems, and controllers constitute the primary costs, at 30%-40%, 20%-30%, and 10%-15%, respectively. China's localization rate in core components is rising, with breakthroughs in controllers and servo systems reducing costs and enhancing autonomy. However, high-end components still rely on imports.

2. Midstream Equipment Manufacturing

China's midstream robot manufacturing is concentrated in regions like Guangdong, Jiangsu, Zhejiang, and Shanghai, forming industrial clusters. Leading enterprises like Estun, Efort, SINTA, and TOPSTAR contribute significantly to the industry's revenue. Technological innovation and market expansion have improved product quality, establishing a strong domestic and international presence. Increasing localization offers cost advantages, supporting market competitiveness.

Image source: Estun Automation official website

3. Downstream System Integration Applications

China's robot industry's downstream applications span industrial manufacturing, warehousing, logistics, healthcare, commercial services, and households. Industrial robots support manufacturing processes, while service robots enhance quality of life. Advances in AI and IoT are boosting robot intelligence and expanding application scenarios, fostering sustainable industry growth.

(II) US Robot Industry Ecosystem

1. Upstream Core Components

The US excels in upstream robot component technology, with deep expertise in reducers, servo systems, and controllers. US enterprises dominate high-performance, high-reliability component supply for high-end robots. Additionally, the US leads in semiconductor chips and high-end sensors, underpinning the industry's intelligent development.

2. Midstream Equipment Manufacturing

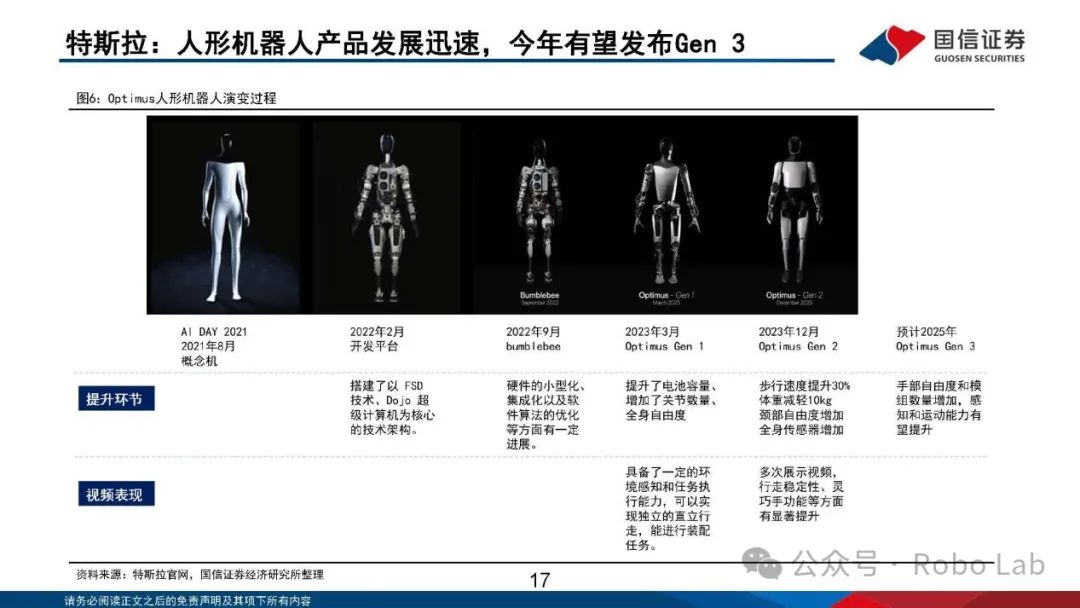

Leading US midstream manufacturers include Boston Dynamics and Tesla. Boston Dynamics, known for its mobile robots, excels in motion control, environmental perception, and autonomous navigation, serving scientific, military, and industrial fields. Tesla's Optimus humanoid robot sets an industry benchmark, integrating AI and autonomous driving expertise, hinting at future industry directions.

Boston Dynamics' Atlas performing a somersault (Image: The Paper)

Source: Tesla's Second AI Day, Tesla Optimus structure (Gen3 example)

Source: Tesla official website, compiled by Guosen Securities Economic Research Institute

3. Downstream System Integration Applications

The U.S. robot industry boasts a diverse array of downstream applications, spanning industrial, service, emerging, agricultural, military, and entertainment/education sectors. In the industrial realm, robots are extensively utilized in automobile manufacturing, electronics, food processing, pharmaceuticals, and other industries for tasks such as welding, assembly, handling, inspection, and painting, significantly enhancing production efficiency and quality. In the service sector, medical robots, including surgical and rehabilitation robots, underpin the precision and intelligence of medical services, while household cleaning and companion robots cater to diverse household needs. Furthermore, the U.S. leads the way in agricultural, military, and entertainment/education robots, continuously broadening the industry's reach through technological innovation and application expansion.

III. Driving Factors and Policy Environment for Technological Innovation in the Sino-US Robot Industries

(I) Driving Factors and Policy Environment for Technological Innovation in China's Robot Industry

1. Driving Factors

Technological innovation stands as the cornerstone of China's robot industry development. In recent years, China has achieved remarkable breakthroughs in artificial intelligence, sensors, and core components (e.g., reducers, servo motors), transitioning from a follower to a leader. Methodological and structural innovations, such as virtual prototyping technology, AI algorithms, and multimodal perception technology, support the intelligent and automated design of robots. Domestic universities and research institutions have made strides in basic research, laying a solid theoretical foundation for enterprise technological innovation. Simultaneously, enterprises have accelerated the transformation and application of technological achievements by increasing R&D investment and collaborating with universities and research institutions, fostering rapid growth in the robot industry.

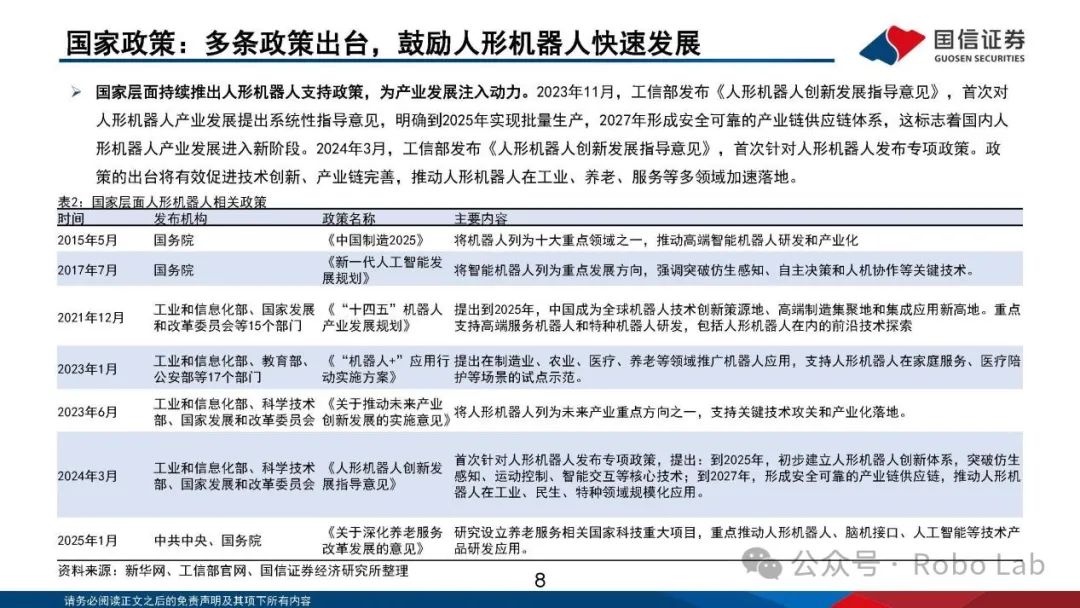

2. Policy Environment

The Chinese government recognizes the significance of the robot industry and has enacted a series of supportive policies to foster a conducive environment for technological innovation. The "14th Five-Year Plan for the Development of the Robot Industry" outlines development goals and key tasks, directing industrial resources towards pivotal areas and core technologies. The "Implementation Plan for the 'Robot+' Application Action" promotes widespread robot technology adoption across industries and accelerates the construction of the industrial ecosystem. Additionally, the government encourages enterprises to increase R&D investment and supports innovative projects and startups through tax incentives, financial subsidies, and discounted loans. These measures reduce innovation costs, stimulate innovation vitality, and ensure the sustainable development of the robot industry.

Source: Xinhua Net, MIIT official website, and Guosen Securities Economic Research Institute

(II) Driving Factors for Technological Innovation in Robotics in the United States and Policy Environment

1. Driving Factors

Technological innovation and intelligence drive the U.S. robotics industry. Advancements in deep learning and computer vision enable robots to better comprehend and adapt to complex work environments. For instance, reinforcement learning algorithms allow robots to self-optimize behavioral strategies without human intervention, enhancing efficiency and accuracy. The U.S.'s preeminence in AI, machine learning, and computer vision provides robust technical support for the intelligent development of robotics. Additionally, American universities and research institutions excel in basic research, accelerating technological transformation and application through close industry collaboration, fostering continuous robotics innovation.

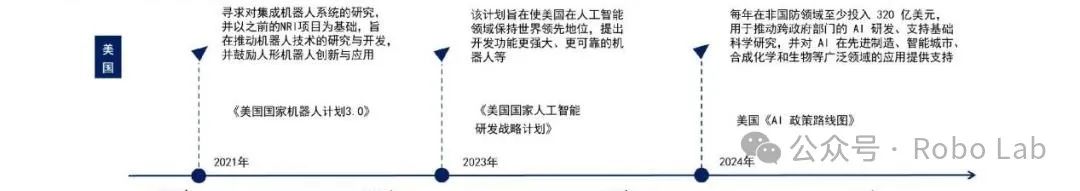

2. Policy Environment

The U.S. government has formulated a national robotics strategy, establishing the Central Robotics Office and National Robotics Council to integrate scientific, industrial, educational, and policy resources, preventing resource fragmentation. These institutions provide unified planning and coordination, fostering cross-sectoral and cross-domain cooperation and innovation. The government also promotes tax incentives, government demonstrative applications, and increased support for basic research and commercial innovation. Tax deductions encourage R&D investment, government procurement supports robotics in public services, and research funding drives breakthroughs in basic and cutting-edge technology. These policies offer a favorable environment and resources for robotics innovation.

Source: Government official website, and Guosen Securities Economic Research Institute

IV. Development Strategies and Trends of Robotics in China and the United States

(I) Development Strategies and Trends of Robotics in China

1. Strategies

China's robotics strategy emphasizes vertical integration through policy and industrial capital, fostering industrial chain development. The government formulates industrial policies and guides social capital investment, promoting coordinated upstream-downstream enterprise development and enhancing industry competitiveness. Additionally, China focuses on integrating industry, academia, research, and application, accelerating technological transformation and application through university-research-enterprise collaboration, fostering rapid robotics industry upgrades.

2. Trends

China's robotics industry will evolve towards electric drive and embodied intelligence paradigms. By 2027, industrial robot penetration is expected to surge, and humanoid robots will transition from "tools" to "partners," creating a trillion-level market. With AI, IoT, and 5G integration, robots will exhibit enhanced autonomous learning and interaction capabilities, expanding into healthcare, elderly care, education, and entertainment. China will continue strengthening technological innovation, increasing high-end component localization, and transitioning from technology catching up to leadership, contributing Chinese wisdom and solutions to global robotics.

(II) Current Development Status of the Robotics Industry in the United States

1. Strategies

The U.S. robotics strategy revolves around a technology giant-led innovation ecosystem. Through interdisciplinary cooperation and integration of industry, academia, local governments, and non-profits, the U.S. forms a national innovation network. Technology giants like Google, Amazon, and Microsoft, with deep technical expertise in AI, cloud computing, and big data, collaborate with robotics enterprises to drive intelligent and networked robotics development. The U.S. also focuses on maintaining global leadership through standard formulation and intellectual property protection.

2. Trends

The U.S. robotics industry will maintain its high-end software ecosystem leadership, focusing on high-end manufacturing and medical scenarios. Future efforts will center on a standards war involving communication protocols (5G/Starlink), operating systems (ROS/HarmonyOS), and joint module interfaces, enhancing global influence through industry standard formulation and promotion. In high-end manufacturing, robots will integrate with AI and IoT for highly automated and intelligent production. In healthcare, surgical and rehabilitation robots will continue to evolve, supporting precision and personalized medical services. Additionally, the U.S. will increase investment in basic research and cutting-edge innovation, exploring robotics in extreme environments like space and deep-sea operations, fostering continuous technological breakthroughs and expansions.

V. Conclusion

China and the U.S. each excel in robotics development. China, with vast market demand, rapid technological progress, and strong policy support, is the world's largest robotics market and a leader in industrial robots. Looking ahead, China's robotics industry will advance towards high-end, intelligent, and diversified directions, enhancing independent innovation and achieving technological leadership. The U.S. maintains its edge in high-end technology and software ecosystems, promoting intelligent and networked robotics through a technology giant-led innovation ecosystem and interdisciplinary cooperation, reinforcing its global lead through standards and intellectual property protection.

In a globalized context, China-U.S. robotics competition and cooperation profoundly impact the global industrial landscape. Moving forward, both countries should strengthen collaboration in technological innovation, standard formulation, market expansion, and other areas, jointly fostering sustainable robotics development and contributing to human progress and well-being.

WeChat ID | Robo Lab

Reconstructing the way machines "see the world".

Using hardcore science popularization + practical cases to dissect the technological revolution behind the beams.