Apple's China-specific AI Launch Looms, Testing Time for Baidu

![]() 05/12 2025

05/12 2025

![]() 674

674

In 2005, Apple's founder, Steve Jobs, approached Intel with the hope of collaborating on a mobile CPU for the inaugural iPhone. After weighing Apple's offer and the associated risks, Paul Otellini, then CEO of Intel, proudly declined. As history tells, Intel missed out on the entire mobile internet era as a result of this decision.

In the era of generative AI, no major model vendor wants to repeat Intel's mistake. This applies equally to OpenAI, Google, Baidu, and Alibaba, all vying to become Apple's AI technology service provider.

Late last year, foreign media reported that Apple's China-specific AI was primarily in talks with Baidu. By February of this year, Alibaba also announced that Apple had chosen to partner with them to implement AI functions on mobile phones.

Those familiar with Apple's operational style know that the company has never favored sole sourcing. Following Alibaba's announcement, industry insiders began to speculate on why it wasn't Baidu.

Just a few days ago, Bloomberg journalist Mark Gurman revealed that the Chinese version of Apple's iOS 18.6 will introduce certain Apple Intelligence features, supported jointly by Baidu and Alibaba. Alibaba will handle the review engine, while Baidu's AI will integrate with Siri and Visual Intelligence, suggesting that Baidu will replace OpenAI's ChatGPT and Google Search in China.

According to insiders, based on past experience, the security module typically accounts for only about 10% of AI services, hinting that Baidu might provide core AI capability support to Apple.

Now, the question arises: why Baidu? And can Baidu turn the tables after being "selected" by Apple?

01 A Mutual Gamble

Public attention and capital market reactions demonstrate that in the AI industry, becoming an Apple AI service provider is far more significant than brushing ranking lists, publishing papers, or investing in daily active users.

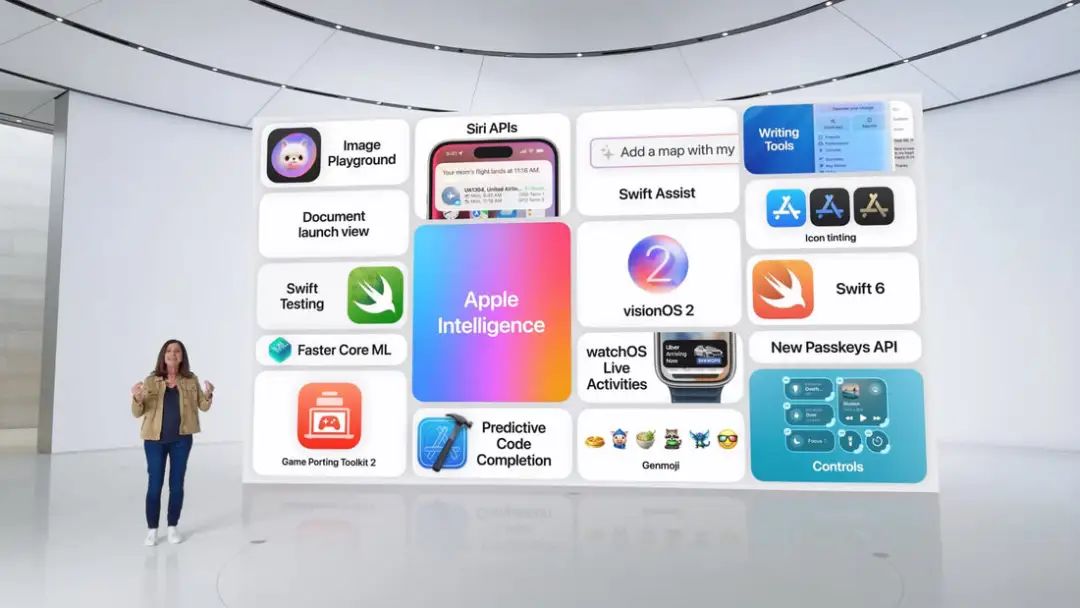

▲The choice of domestic partners for Apple Intelligence has always been keenly anticipated by the outside world

After Alibaba announced its AI collaboration with Apple in February, Alibaba's Hong Kong stocks closed up 8.48% on the day. Similarly, after Bloomberg journalists revealed Apple's AI partnership with Baidu, Baidu's stock price also surged.

Large model technology is advancing rapidly, making it challenging for laypeople to discern truth from fiction. However, everyone generally believes that Apple is meticulous when screening service providers, and the chosen ones possess substantial comprehensive strength. This is the crux of Apple's endorsement effect.

However, in our view, Apple's partnership with Baidu is a mutual need and a shared gamble.

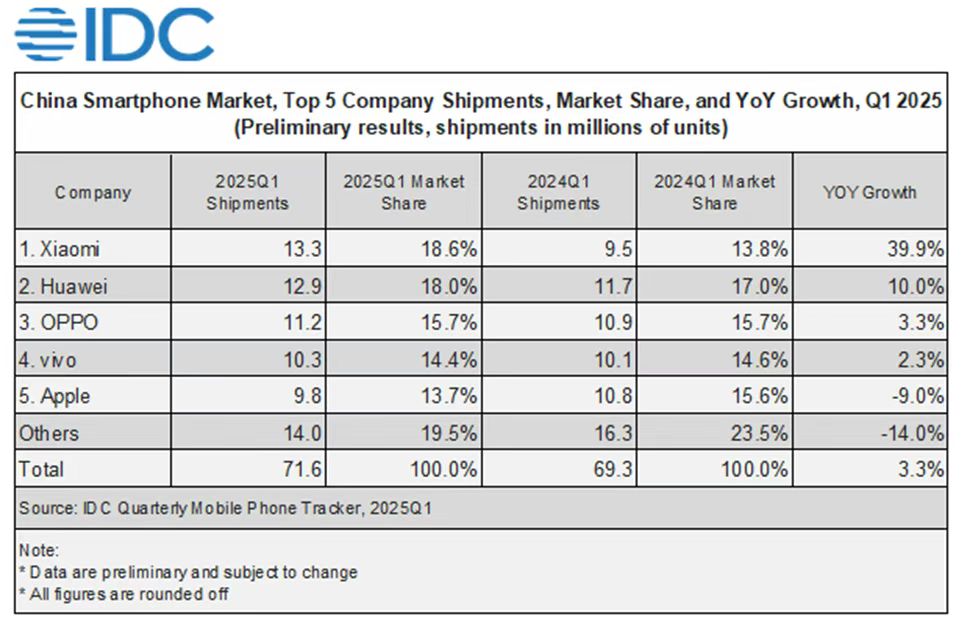

Apple's situation in the Chinese market is evident. IDC data shows that Apple's shipments in the Chinese market fell to 9.8 million units in the first quarter of this year, with its market share sliding from 17.4% in the previous quarter to 13.7%, ranking fifth in the Chinese smartphone market, behind Xiaomi and Huawei.

This represents a mid-game collapse for Apple in its largest overseas market.

Currently, both the "support for Apple's ecosystem" and "seamless connection with Apple devices" favored by the Android camp, and the progress made by domestic smartphone manufacturers in generative AI, are driven by the goal of capturing market share.

Previously, an Omdia analyst pointed out that Apple is lagging behind in the field of generative AI and needs significant innovation to stand out. The competitive pressure on Apple is easy to imagine.

Under such circumstances, there is no room for error in selecting AI technology service providers for the China version of the iPhone. If the Chinese AI capabilities of the China version are on par with, or even surpass, ChatGPT and Google, Apple might leverage AI to turn the tables and give hesitant Apple fans a compelling reason to switch phones. Conversely, it risks losing ground in the Chinese market.

The choice of AI service providers is essentially a gamble that Apple is placing on its brand reputation.

As for Baidu, it needs to find a widely used consumer-end scenario to showcase its AI technology prowess even more.

In fact, before rumors of collaboration with Apple AI surfaced, Baidu had already established AI partnerships with smartphone manufacturers like Samsung, Honor, and Xiaomi. Mainstream models such as Samsung Galaxy S24, Honor Magic6, and Xiaomi have integrated the ERNIE Bot large model.

Among them, Galaxy S24 marks the first implementation of Samsung Galaxy AI, and this annual flagship model is seen as Samsung's masterpiece to outshine the iPhone. In Galaxy S24, Google AI handles the global version, while the China version accesses Baidu AI, responsible for "instant search by circling," text summarization, and other AI functions.

▲The "instant search by circling" function is featured in the Galaxy S24 promotional photo

Top smartphone manufacturers and such a pivotal model choosing to collaborate with Baidu AI is, in essence, an endorsement of Baidu's AI capabilities. Although some netizens praise the more authentic Chinese translation and search results of Galaxy S24, which are closer to Chinese users' needs, considering Samsung's market share in China, the attention it garners is relatively limited.

Becoming an Apple AI service provider is different. Apple effectively controls the end-user entry for AI application implementation and needs Siri to better understand Chinese and provide more grounded search results. Baidu's localization advantages in language processing and image recognition have already been validated by Samsung users. The true weight of Baidu's AI technical capabilities may soon be tested directly and in real-time by over 200 million Apple users.

If the collaboration with Apple AI progresses smoothly, it will undoubtedly present a significant opportunity for Baidu Search and other technical products. The aforementioned Omdia analyst commented in an interview with foreign media that Apple's strength lies in introducing innovative application cases and killer apps for various technologies.

Of course, the risks are substantial. If Baidu AI fails to meet user expectations, Apple users might develop distrust towards other Baidu products. Therefore, from Baidu's perspective, the AI collaboration with Apple is akin to a peak stress test.

02 Can Baidu Rise to the Occasion?

The question arises: can Baidu seize Apple's opportunity and use it to turn the tables in the AI vendor competition?

In previous rounds of competition among large model vendors, due to issues such as the closed-source model approach and conservative market strategies, Baidu's voice in ERNIE Bot and other AI applications like ERNIE Bot Lite was quieter than some competitors.

Objectively speaking, since the emergence of DeepSeek, AI giants have adjusted their strategies in response to market shifts. Sam Altman, CEO of OpenAI, candidly stated that he believes the company's initial closed-source strategy was misaligned with historical trends, and currently, OpenAI is beginning to explore open-source options.

Baidu's turnaround and business progress have been rapid. On April 26, Baidu's newly released ERNIE Bot 4.5 Turbo and X1 Turbo surpassed competitor DeepSeek in multiple benchmark tests, with a call cost of only 25% of the latter. Moreover, Robin Li also announced that ERNIE Bot 4.5 will be officially open-sourced on June 30.

This business progress may explain why Baidu swiftly integrated DeepSeek in February and why Apple AI chose Baidu. As the industry often states, it is meaningless for large models to compete solely on capabilities. Therefore, both Baidu and Alibaba follow an ecological route.

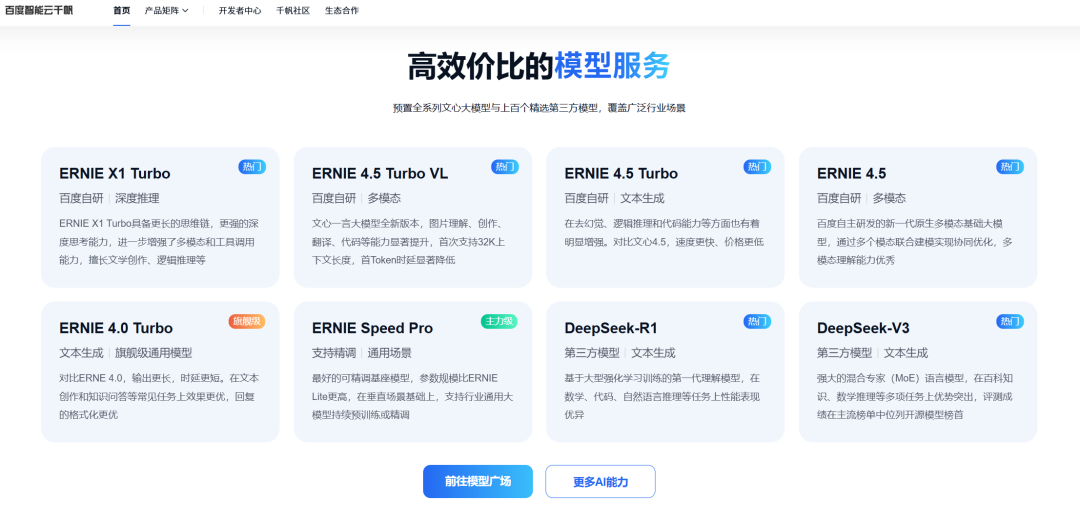

Specifically for Baidu, it has established a four-layer full-stack technology route of "chip - framework - model - application" over the years, forming the foundation for becoming an AI ecological platform. For example, on Baidu Qianfan's large model platform, developers can invoke both the ERNIE Bot large model and other vendors' open-source models. Adding DeepSeek allows for additional traffic handling.

▲Qianfan's large model platform integrates multiple large model services

Simultaneously, its own ERNIE Bot large model must evolve vigorously. The recently released ERNIE Bot 4.5 is Baidu's first native multimodal large model, supporting more application-layer explorations. For instance, the upgraded ERNIE Bot Lite already possesses capabilities such as image question and answer, AI-generated images, and videos. These capability upgrades all point towards a smarter and more efficient AI experience.

▲Using ERNIE Bot Lite to generate a steampunk-style animated image of Einstein

If the large model competition is likened to a sports event, Baidu's approach should be described as "triathlon," a comprehensive and all-around mode. Its advantage lies in the fact that even if it fails to create surprises, it generally performs stably. Hence, we observe that Baidu emphasizes full-stack capabilities daily and makes relatively rapid progress in implementing B-end applications in fields such as finance and energy, winning some significant orders. For example, in 2024, Baidu Intelligent Cloud ranked first in terms of the number of winning bids, the number of industries covered, and the number of winning bids from central and state-owned enterprises.

These rapidly occurring, bottom-up iterative update capabilities might also be one of the reasons why Apple is placing its bet on Baidu. The AI capabilities Apple needs do not necessarily have to be the best in the industry but must be stable, reliable, and compliant. Put bluntly, they must instill a sense of security.

From the industry landscape perspective, the evolution of AI technology is increasingly resembling a long-distance race, where determining the winner and strength based on a single model update or a groundbreaking application is unnecessary. The key lies in Chinese and foreign peers jointly promoting technological evolution.