General Agent Turmoil: ByteDance Narrowly Survives, MainFunc Wins First Fortune

![]() 05/13 2025

05/13 2025

![]() 451

451

By Leon

Edited by cc Sun Congying

Since January 2025, alongside DeepSeek, the most buzzed-about development in AI has been Manus, claiming to be the first "General AI Agent." Its invitation code was once auctioned for 80,000 yuan. Soon, General Agents became the new frontier for internet titans and AI unicorns, rapidly intensifying competition.

In the global arena, OpenAI, Claude, Microsoft, and others swiftly launched Agent products or platforms, and domestic companies followed suit in April.

In April, ByteDance, Alibaba, and Baidu entered the General Agent market, emphasizing complex multi-tasking and workflow functionalities, offering free services to individual users. Tencent promptly updated Tencent Yuanqi's API interfaces and tools, aiding developers in creating Agents and deploying them on platforms like WeChat and QQ. Meanwhile, Lenovo unveiled "Tianxi Personal Super Agent" at its spring launch event, becoming the first PC OEM to integrate a General Agent into a hardware terminal. (For details, see: AI Digital Humans Enter the Second Half, Unveiling the Confidence and Ambitions of Tencent Cloud)

As most products are still in the invitation-only beta phase, public awareness remains low. A common question arises: Compared to traditional AI conversational apps, are General Agents "genuine functional AI" or just another AI industry fad?

What is a General Agent?

A "General Agent" can be simply understood as a comprehensive AI tool with autonomous planning, context transfer, and multi-task execution capabilities, akin to an assistant. In contrast, AI conversational apps like DeepSeek and Doubao function more like advisors, capable of searching for answers and offering suggestions but not participating in execution.

A simple application example: If you ask DeepSeek to research an industry and generate a detailed report, you'll mostly receive a lengthy text. However, using an Agent, it can produce a comprehensive report with detailed text and complex charts (like pie and line graphs) and save it as an HTML or PDF file. Additionally, they differ in hardware requirements, cost structures, etc., as shown in the table below:

It's worth noting that an exceptional General Agent doesn't necessarily require a self-developed large model. For instance, Manus's co-founder Ji Yichao has publicly stated that it uses the Claude model and a fine-tuned Alibaba Qwen model. For startups, the barrier to entry for developing General Agents is relatively low, but it's not just "slapping a label on." Using Manus as an example again, its technical architecture comprises three core components: Claude's MCP protocol application, a dedicated RL small model, and a self-developed toolkit ecosystem. Through meticulous design and deep integration, Manus has achieved a leading position in this field.

Another significant aspect of General Agents is that they've propelled the MCP protocol (Model Context Protocol) to become the industry's mainstream standard. MCP is a communication protocol specifically designed for AI models, enabling standardized collaboration and resource management to enhance efficiency, akin to the "USB interface of the AI ecosystem."

Baidu CEO Robin Li described MCP at the Create 2025 Conference as follows: "Developing Agents based on MCP is akin to developing mobile apps in 2010." This underscores its importance. Currently, Agent products from global giants like Google, Microsoft, Alibaba Cloud, Tencent, Baidu, and numerous startups all support the MCP protocol. (For details, see: Changes in Baidu's AI Strategy Behind the Indecisive Robin Li)

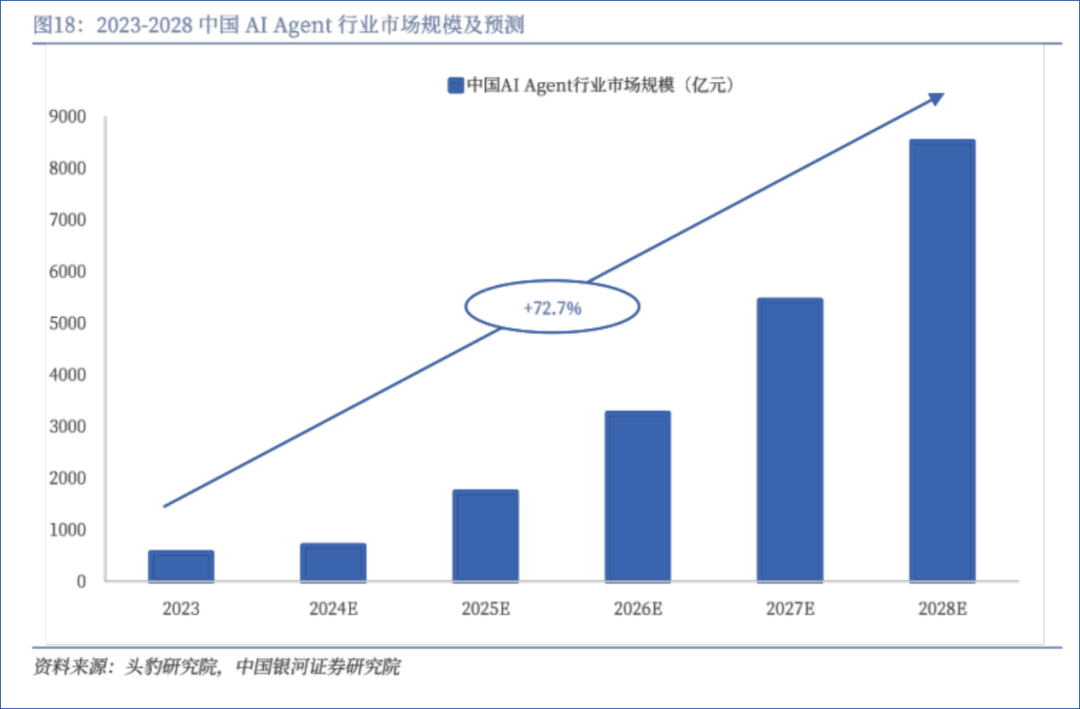

With global popularity and endorsement from a universal protocol, the General Agent market is undoubtedly poised for takeoff. According to relevant research, China's AI Agent industry market size is expected to grow at a compound annual growth rate of 72.7% from 2023 to 2028, reaching a scale of approximately 800 billion yuan. For entrepreneurs, this presents a new funding and listing opportunity, leading to financial freedom; for internet giants, it's a crucial traffic entry point, bearing the responsibility of conversion and empowerment.

ByteDance's General Agent Narrowly Survives

In the AIGC market, well-funded tech giants can swiftly integrate resources to replicate hit products down to the pixel. So, how do they fare in actual usage? To find out, "Wall Street Tech Eye" briefly tested the General Agents of two major companies, ByteDance's "Kouzi Space" and Alibaba's "Xinliu".

ByteDance's "Kouzi Space" utilizes multiple models based on Doubao 1.5 Pro and is currently in a closed beta phase, requiring an application and waiting period for access. It positions itself more as a "full-skilled intern" capable of making PPTs, generating industry reports, etc. Its highlight is integrating numerous mainstream MCP tools like Feishu, Gaode Maps, and Github, making it user-friendly for internet professionals.

Kouzi Space's business model is relatively clear, with a profit strategy comprising three parts: subscription services (45%), technology licensing (25%), and enterprise solutions (20%). Among them, the basic version for individuals is free, while the advanced, team, and enterprise versions are priced at 9.9 yuan/month, 178 yuan/month, and 4980 yuan/month, respectively. Currently, Kouzi Space has secured a $75 million financing round, valuing it at $200 million.

Alibaba's "Xinliu" focuses on advanced research, with a processing duration of at least 20 minutes in this mode, suitable for in-depth research, report writing, or coding, consuming more Token resources. Similarly, Xinliu is also in a testing phase, requiring an application and approval for access.

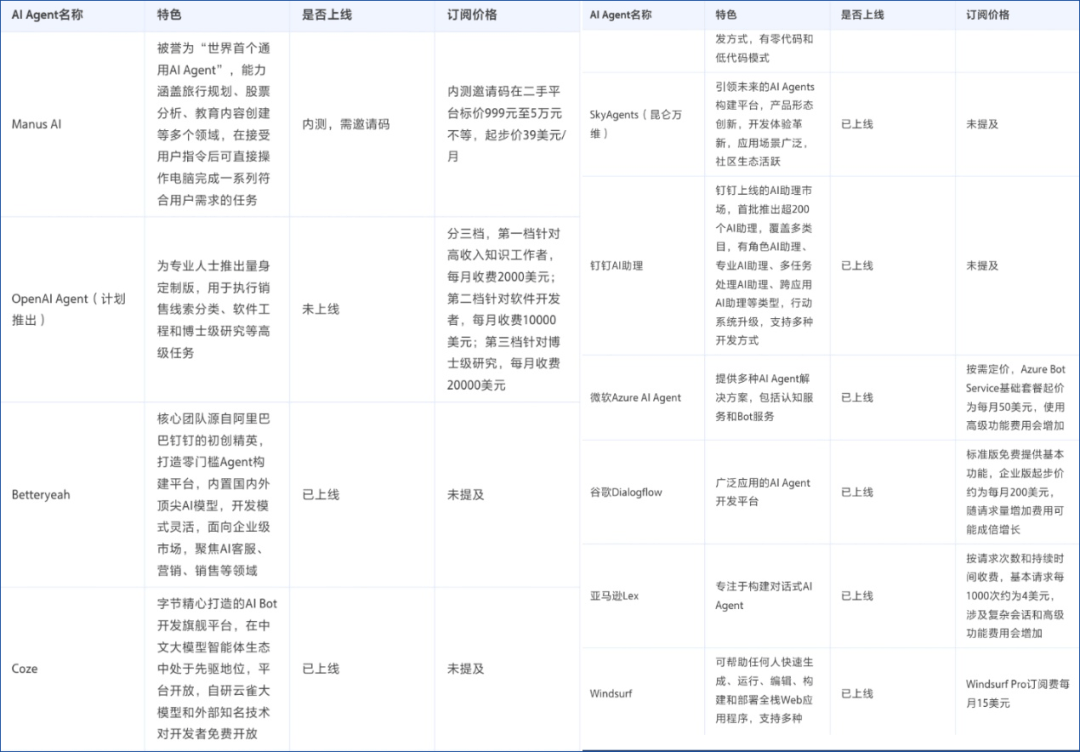

The specific task assigned by the author was to compile a list of all general AI Agents across the web, including each Agent's features, current availability, subscription price, etc. Let's first review the test results:

Kouzi Space completed the task swiftly, within a few minutes. Relatively, Kouzi Space had a more precise understanding of the keyword "general," listing Manus, Kouzi (Coze), DingTalk AI Assistant, etc.; the inaccuracy lies in categorizing BetterYeah, Amazon Lex, etc., as general Agents, when in fact, they are one-stop AI Agent development platforms, not specific products. Additionally, Kouzi Space can save the results as MD tables and PDF files.

Figure: Kouzi Space generated results

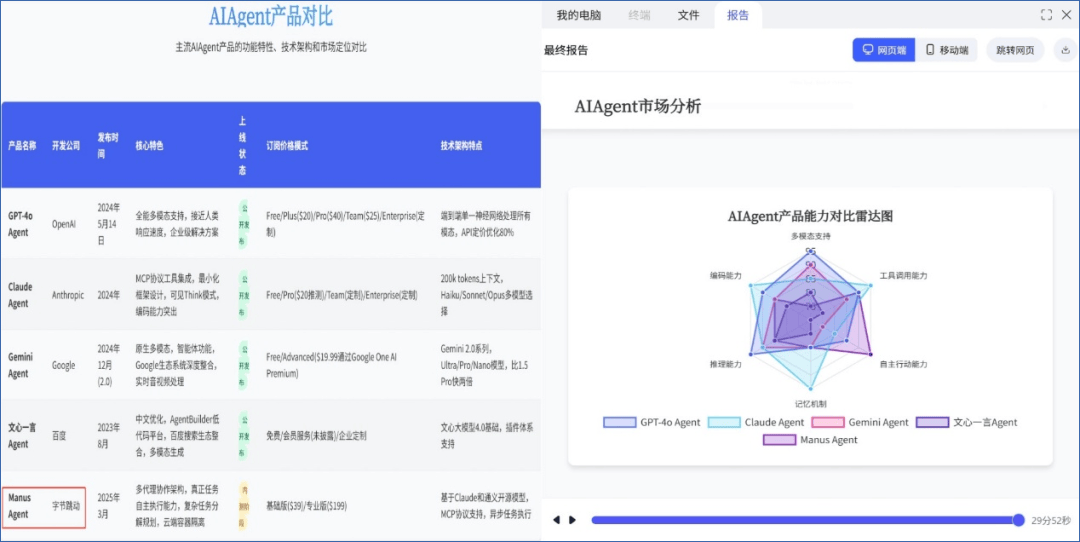

In contrast, Xinliu, in its advanced research mode, took 29 minutes and 52 seconds to complete the task due to browsing significantly more data, leading to a longer processing time. Thoughtfully, Xinliu notifies users via email upon task completion. The report generated by Xinliu is highly detailed and illustrated, using curves and six-dimensional graphs to enrich the content, supporting HTML downloads, though PDF functionality is temporarily unavailable. However, Xinliu's understanding of "General Agent" is entirely off, listing mainstream large model AI applications like GPT-4, and mistakenly writing Manus's development company as ByteDance, significantly diminishing the report's actual value.

Figure: Xinliu generated results

Regarding this test result, Kouzi Space's output is usable after filtering, barely earning a score of 60; Xinliu is clearly failing, having made errors in the core definition. Considering numerous test results of Manus online, it's evident that current products from large companies don't have a clear advantage, indicating that startups still have certain development space, but the window for technological superiority is shrinking rapidly.

Startups Have Already Started Making Money

Unlike large companies, startups are more eager for the commercialization of General Agents. Jing Kun, the former CEO of Xiaodu, left to start his own venture, and his startup MainFunc has secured $60 million in funding and released its first product, the AI search engine Genspark.

In early April, Genspark launched a new product, Super Agent, focusing on data retrieval, PPT generation, and in-depth research, recently adding the AI Sheets toolset, showcasing comprehensive performance. According to Jing Kun, within 9 days of Super Agent's release, its annual recurring revenue (ARR) surpassed $10 million. Calculated at a subscription fee of $20/month, its paying users have exceeded 10,000.

Figure: MainFunc founder Jing Kun

However, Genspark's current market focus is still on overseas markets, and Jing Kun doesn't seem to have plans to return to the domestic market yet, as Genspark blocks domestic IPs, rendering it unusable.

As the first General Agent, Manus's performance is naturally the best so far, with overseas market subscription models of $39/month and $199/month, fully demonstrating its confidence. According to Feifan Research data, one month after Manus's launch, its ARR reached $41.49 million, with a monthly recurring revenue (MRR) increasing by 755% month-on-month, indicating it has started to turn a profit. Currently, Manus has successfully raised $75 million, valuing it at $500 million, and has announced a partnership with Alibaba Tongyi to develop a Chinese version.

Big Tech Entry, Converging on the Same Goal

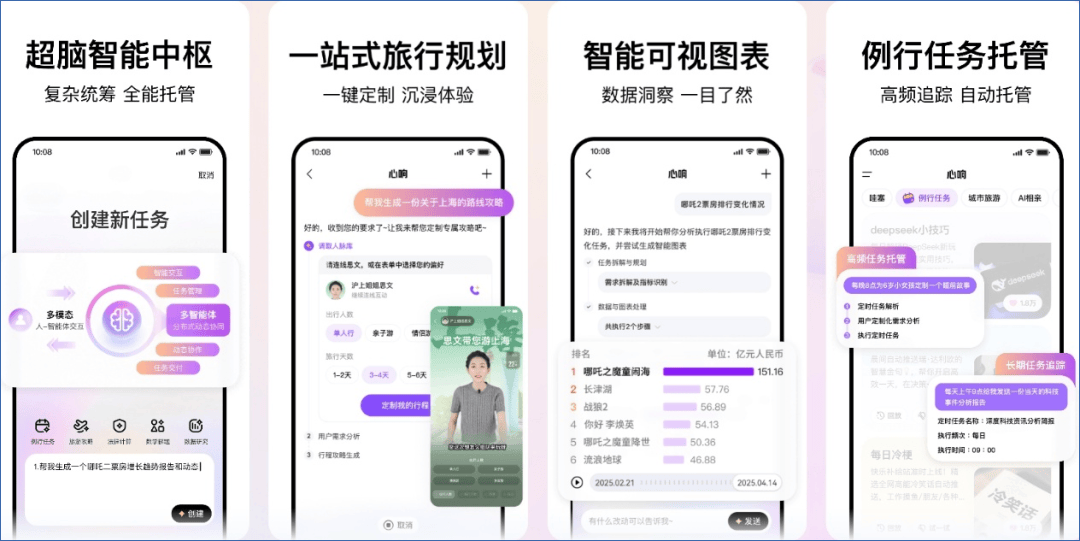

Besides ByteDance and Alibaba, Baidu also has a "Xinxiang" Agent, currently only available on Android, with iOS and PC versions yet to be launched. Baidu's direction differs from its competitors, being closer to ordinary consumers. Use cases provided on its official website include travel planning and AI matchmaking, reminiscent of Wenxiaoyan but with a stronger focus on one-stop planning and task delegation scenarios.

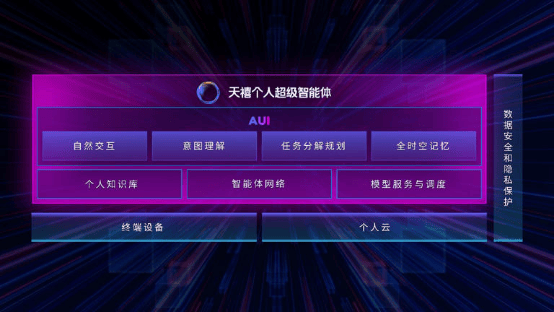

Besides internet giants, Lenovo is the first hardware vendor to launch a general-purpose Agent. The newly released Tianxi Personal Super Agent is a typical General Agent, adopting a hybrid end-cloud deployment architecture. It's reported that its intelligence level has partially reached Level 3. In fact, from a computing power perspective, the "PC + General Agent" solution is very ideal, as thin-and-light laptops can leverage the processor's NPU, while high-end graphics cards in gaming laptops or desktops even exceed the computing power of many new energy vehicle chips.

For large companies, General Agents may be temporarily unusable, but they cannot be overlooked. On one hand, these applications are deeply integrated with each company's cloud services, like Volcano Engine and Alibaba Cloud, playing a role in diverting traffic to ToB businesses to a certain extent. On the other hand, in the process of developing General Agents, some technologies and application forms can empower their own businesses, such as e-commerce and hardware, opening new realms of imagination.

As Alibaba Group CEO Wu Yongming recently stated on Alibaba's internal network: "Alibaba must set aside its past achievements and return to its entrepreneurial roots, embarking on a new journey with the mindset of an entrepreneur." The term "AI-driven" has frequently appeared in Alibaba's financial reports in recent years, multi-dimensionally empowering its e-commerce and cloud computing businesses, attracting new partners like Apple. In fact, whether it's domestic BAT or Microsoft, Google, Amazon, the ultimate vision is to become an AI platform and technology provider. The AI battle in 2025 will be ignited by General Agents.