Domestic HUD Pioneer Races for Hong Kong IPO: Backed by NIO, Xiaomi, and Li Auto, Revenue Triples in Three Years

![]() 05/15 2025

05/15 2025

![]() 662

662

Chinese automakers are fiercely competing on price and configuration, propelling the growth and maturation of local upstream supply chain enterprises.

Take air suspension as an example, and another is HUD (Head-Up Display) technology, which users can clearly see.

Recent news highlights that Zejing Technology, a leading domestic HUD supplier, has submitted a prospectus to the Hong Kong Stock Exchange for an IPO on the main board, with Haitong International and CITIC Securities as joint sponsors.

Public information reveals that Zejing Technology was founded in 2015, almost coinciding with the emergence of new automakers like NIO, Xiaomi, and Li Auto, and its business growth has mirrored this trend.

From 2022 to 2024, Zejing Technology's revenue surged from 214 million yuan to 578 million yuan, with a compound annual growth rate exceeding 64%. Its initial major customer and subsequent key clients included NIO and Li Auto.

Prior to this, HUD was primarily found in high-end models, with a negligible market size and penetration rate. Suppliers were established international giants such as Bosch and Denso.

The driving force behind this transformation is linked to the intelligence initiatives introduced by new automakers and the subsequent "technology democratization" effect among competitors.

01 Who is Zejing Technology?

In the prospectus, Zejing Technology positions itself as a pioneer and leader in China's innovative intelligent cockpit vision and interaction solutions.

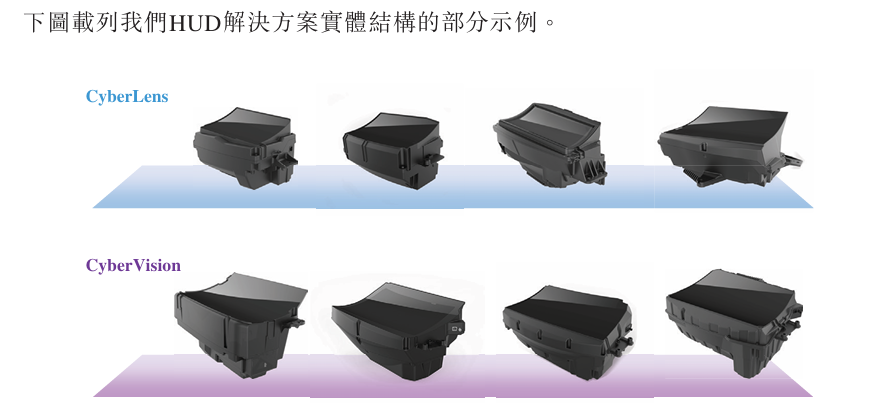

These solutions primarily refer to the company's two flagship products: the windshield HUD (W-HUD) solution CyberLens and the augmented reality HUD (AR-HUD) solution CyberVision. Additionally, the company offers auxiliary services such as testing solutions and other innovative visual technology solutions.

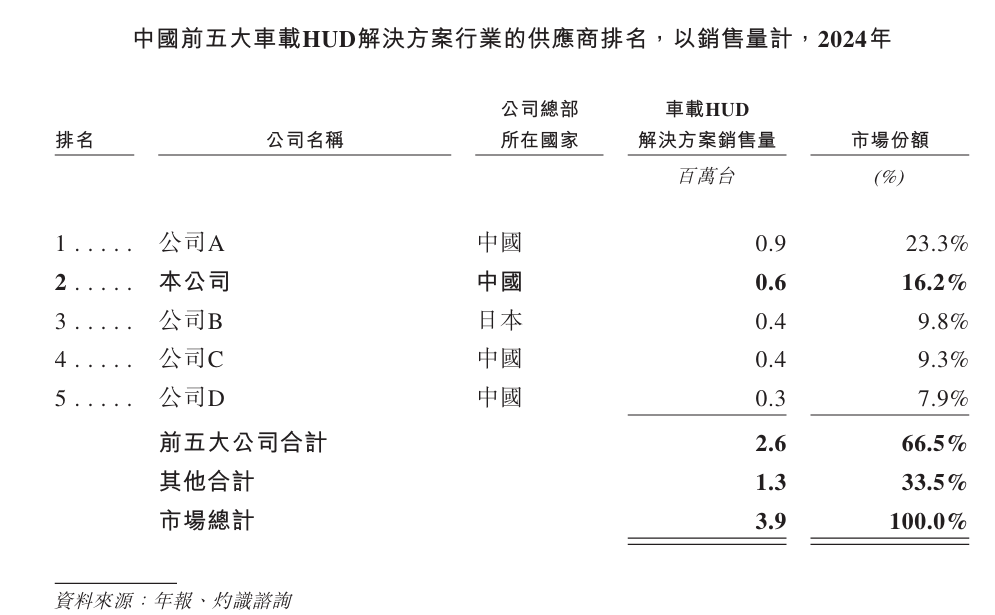

Zejing Technology's Market Share

Specifically, regarding market position, Zejing Technology's data indicates that, based on 2024 sales volume, the company ranks second among Chinese automotive HUD solution providers with a market share of 16.2%; second in W-HUD market share at 17.8%; and third in AR-HUD market share at 13.7%.

A fitting label for Zejing Technology is that of a leading supplier of domestic automotive HUD (Head-Up Display) solutions.

The domestic or international manufacturers ahead of Zejing Technology are typically established suppliers within the automotive industry chain with decades of history. Zejing Technology was founded in May 2015, marking the inception of the first wave of domestic new automakers represented by NIO, Xiaomi, and Li Auto.

NIO ES8

The establishment of Zejing Technology is also directly tied to this wave of new automakers. In 2016, without proven mass production capabilities, Zejing Technology participated in the competition for NIO HUD suppliers and ultimately secured the order for NIO's first model, the ES8.

In 2018, with the delivery of the first batch of ES8s, Zejing Technology broke into the market and gained industry recognition.

Data shows that as of the end of 2024, Zejing Technology had established cooperation with 22 OEMs, including major automakers such as NIO, Xiaomi, Li Auto, Geely, BAIC, Chery, FAW, Changan, BYD, Toyota, and Hongqi. A total of 90 models have been ordered, and product shipments have surpassed 1.5 million units.

Zejing Technology's success may partly be attributed to its founding team.

The prospectus reveals that Zhang Tao, co-founder and chairman of Zejing Technology, is a seasoned automotive industry veteran with both technical and management backgrounds. He graduated from Xi'an Jiaotong University with a major in industrial automation and holds an MBA from Arizona State University in the United States. He has 20 years of experience at SAIC Volkswagen from 1998 to 2018.

Another co-founder is Zhang Bo, Zhang Tao's younger brother, who serves as the vice president in charge of technology. He graduated from Xi'an University of Posts and Telecommunications with a major in computer software and worked as a technical engineer at Microsoft, with over 20 years of experience in the electronics field.

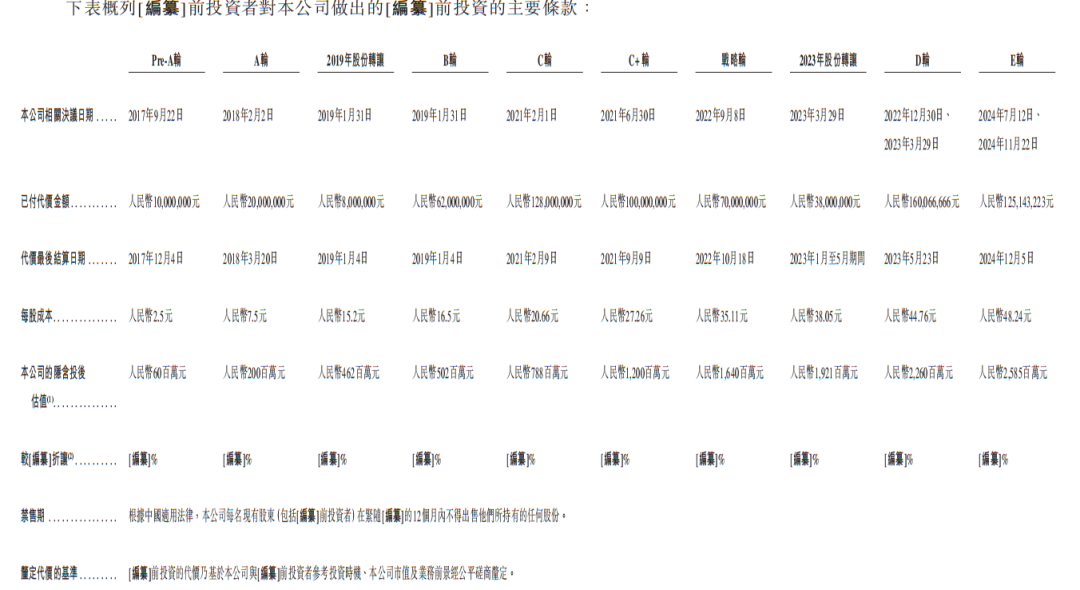

Zejing Technology's Financing Situation

The combined expertise of these founders may have been the original impetus behind securing the large order from NIO. As its business subsequently surged, capital followed suit. Data shows that since its inception, Zejing Technology has completed a total of 9 rounds of financing, with investors including Geely, FAW, and Xiaomi-related Shunwei Capital. After the last round of financing, its valuation neared 2.6 billion yuan.

In terms of products, the primary offerings are the aforementioned W-HUD and AR-HUD.

Among them, W-HUD technology CyberLens is the traditional windshield head-up display, which uses windshield projection display technology to project driving information onto the windshield in front of the driver through optical imaging.

It was precisely this technology that initially secured the order for NIO ES8. Currently, this mature product has formed a platform-based development matrix.

AR-HUD, also known as CyberVision, is the more cutting-edge augmented reality head-up display. It dynamically overlays virtual information onto real road scenes through high-precision AR algorithms and optical imaging technology, providing drivers with more intuitive and in-depth driving assistance information.

Zejing Technology's Products

Relying on this product, Zejing Technology has also become one of the first suppliers to launch AR-HUD solutions in China.

02 Financial Performance

Fundamentally, Zejing Technology's business growth has demonstrated a rapid increase over the past three years.

Zejing Technology's Financial Performance

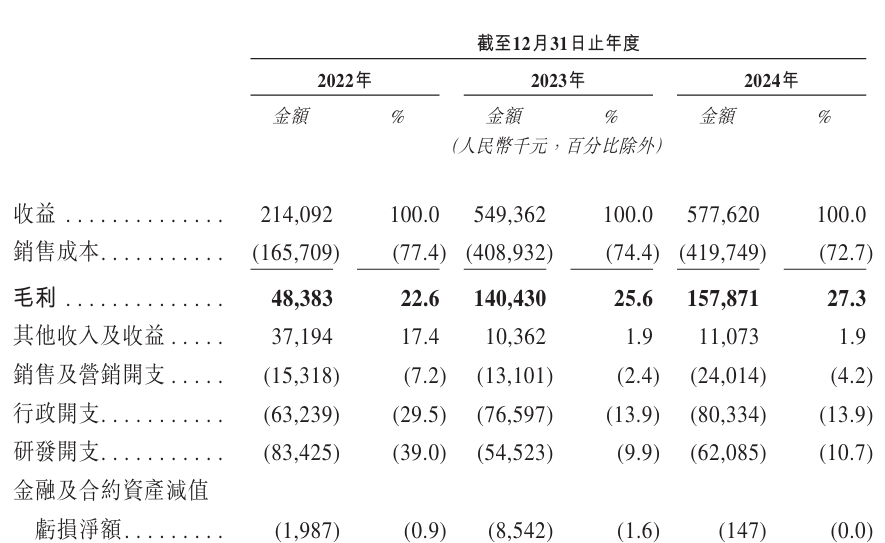

The prospectus indicates that from 2022 to 2024, Zejing Technology's revenue was 214 million yuan, 549 million yuan, and 578 million yuan, respectively, with a compound annual growth rate exceeding 64%.

Among these, HUD solutions constitute the primary revenue source, with this business's proportion in revenue increasing from 80% to 93.6% during the same period.

Sales costs also increased during this period, from 166 million yuan in 2022 to 420 million yuan in 2024, although the growth rate was slightly slower than revenue. The corresponding gross margin is steadily improving. Data shows that from 2022 to 2024, Zejing Technology's gross margins were 22.6%, 25.6%, and 27.3%, respectively.

In terms of expenditures, from 2022 to 2024, Zejing Technology's sales and marketing expenses were 15.31 million yuan, 13.1 million yuan, and 24.01 million yuan, respectively; administrative expenses were 63.24 million yuan, 76.6 million yuan, and 80.33 million yuan, respectively, during the same period.

R&D expenses have declined somewhat, from 83.43 million yuan in 2022 to 62.09 million yuan in 2024, stabilizing at around 10% of revenue.

As of 2024, Zejing Technology was still incurring losses, but the magnitude of these losses has narrowed. From 2022 to 2024, its annual losses were 256 million yuan, 175 million yuan, and 138 million yuan, respectively.

Another positive trend is the decrease in its dependence on major customers.

The prospectus shows that from 2022 to 2024, the revenue from Zejing Technology's top five customers accounted for 93%, 93.8%, and 80.9% of total revenue, respectively. Among them, the revenue share from the largest customer decreased from 47% to 23.2% during the same period.

Among the top customers, according to the prospectus, NIO and Li Auto, which are part of the new automaker forces, occupy a significant share.

Furthermore, Zejing Technology plans to utilize the funds raised this time for: promoting intelligent transformation and capacity expansion of production lines; increasing R&D investment to upgrade existing products and develop new technology derivatives; exploring strategic cooperation with enterprises in the fields of optical imaging and near-eye display; and supplementing working capital to ensure daily operations and strategic development needs.

03 Automakers Compete in Configuration, HUD Market Reaps Benefits

Looking back a decade, the HUD market was a niche dominated by foreign manufacturers, with a modest market size.

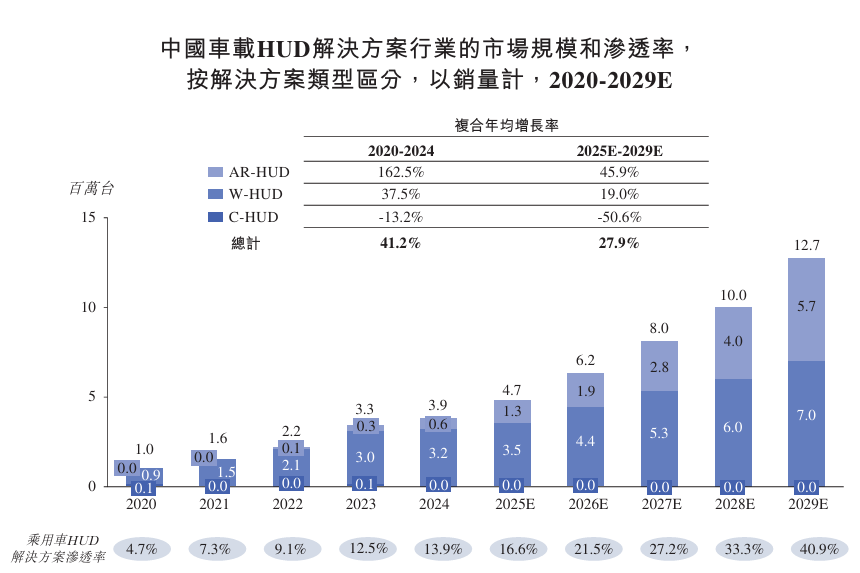

A primary reason for this is that before the last decade, HUD configurations were mostly found in high-end models, and the penetration rate remained low. Even by 2020, this figure was still not high. According to statistics from Cinno Research, the Chinese automotive HUD market was only 1 million units in 2020, with a penetration rate of 4.7%.

HUD Market Trends

This figure surged to 3.9 million units in 2024, with a compound annual growth rate of 41.2%, and the penetration rate reached 13.9% by 2024.

This is a logical trend, with the driving force stemming from the competition among domestic automakers in terms of price and configuration. Configurations similar to those found in models ranging from tens of thousands to millions of yuan, such as air suspension and HUD, are gradually being incorporated into lower-priced models.

Specifically for HUD, currently available models with HUD, such as the SL03, have a starting price of only 149,900 yuan.

According to current trends, the automotive HUD market is likely to continue expanding. According to Cinno Research's estimates, by 2029, the size of the Chinese automotive HUD market will reach 12.7 million units, with a penetration rate of 40.9%.

Simultaneously, this trend holds true in the global market. Cinno Research predicts that W-HUD sales will increase from 10.7 million units in 2024 to 20.9 million units in 2029, while AR-HUD sales will increase from 2 million units to 7.6 million units.

Zejing Technology stated that it is poised to seize overseas opportunities through local automakers expanding abroad or direct cooperation with overseas OEMs.

-END-