Big Tech Firms Battle for AI Agent Supremacy: A New Era in AI Discourse Power

![]() 05/19 2025

05/19 2025

![]() 455

455

What Can AI Agents Accomplish?

After 60 days of unprecedented popularity, the once elusive AI Agent platform Manus has finally opened its doors to new registrations.

In March of this year, Manus emerged, earning itself the moniker "DeepSeek moment" in the AI Agent industry. Prior to its meteoric rise, the startup company Monica, the brains behind Manus, had already secured funding from prestigious entities such as Tencent, ZhenFund, and HSG, the predecessor of Sequoia China. Recently, media reports indicated that Monica completed a fresh round of funding amounting to $75 million, propelling the company's valuation to nearly $500 million.

Image Source: Weibo Screenshot

Unlike conventional AI conversation products, Manus excels in executing more intricate work and life tasks through textual commands. These tasks include creating video presentation materials, designing and deploying webpages and apps, customizing travel itineraries, and more.

Following Manus's success, major tech companies significantly accelerated their investments in AI Agents. ByteDance and Baidu, for instance, introduced Agent products like Xinxiang APP and Kouzi Space. Concurrently, the enthusiasm of numerous investment firms is shifting from large models to other AI applications, such as Agents.

01. Big Tech Firms Compete for Discourse Power

"What sets Manus apart from DeepSeek?"

In March, Xiao Ye (pseudonym), a text editor, noticed that her friends were all clamoring for Manus invitation codes. However, even after witnessing her colleagues use it, she couldn't discern the difference between Manus and AI search applications like DeepSeek.

After ByteDance and Baidu unveiled their Agent products, Xiao Ye promptly tried them out. Her experience revealed that AI Agents function more like assistants aiding in tasks, whereas DeepSeek serves as a tool for swiftly organizing information and generating content. "To put it crudely, one executes tasks, while the other facilitates thinking."

An AI Agent is an execution system grounded in large language models. Currently, Agent products on the market are primarily categorized into three types:

The first type comprises general Agents aimed at ordinary users, emphasizing a "one-stop-shop" approach to solving tasks. Examples include Manus, Baidu's Xinxiang, and ByteDance's Kouzi, which recently opened their registrations.

The second type includes vertical Agent applications tailored for B-end industries, such as smart customer service in e-commerce and smart financial coaching that offers financial advice to banking customers.

The third type consists of platforms enabling ordinary developers to build Agents. Examples include Baidu's Wenxin Agent platform and Ant Group's "Treasure Chest," where even beginner programmers can create an Agent within three minutes and deploy it on Alipay's mini-programs.

Among these, general Agents catering to C-end users are the most vocal and fiercely contested segment, attracting not only major tech firms like Baidu and ByteDance but also startups like Monica.

Big tech companies are competing in the Agent space to find practical applications for the continuously evolving capabilities of large models and to secure entry points in the AI Internet era. When user behavior shifts from navigating apps to issuing commands to Agents, which then invoke various software to complete specific tasks, Agents will undoubtedly become the new core interactive gateway.

Paul (pseudonym), an entrepreneur with years of experience in artificial intelligence, explained that large companies often venture into new businesses out of a top-down anxiety. In the case of general Agents, profit is not the primary motive; rather, it's about "occupying the territory." The objective is to accumulate sufficient experience before the advent of AGI (Artificial General Intelligence).

On this inevitable path, the leading tech companies have opted for diverse development strategies.

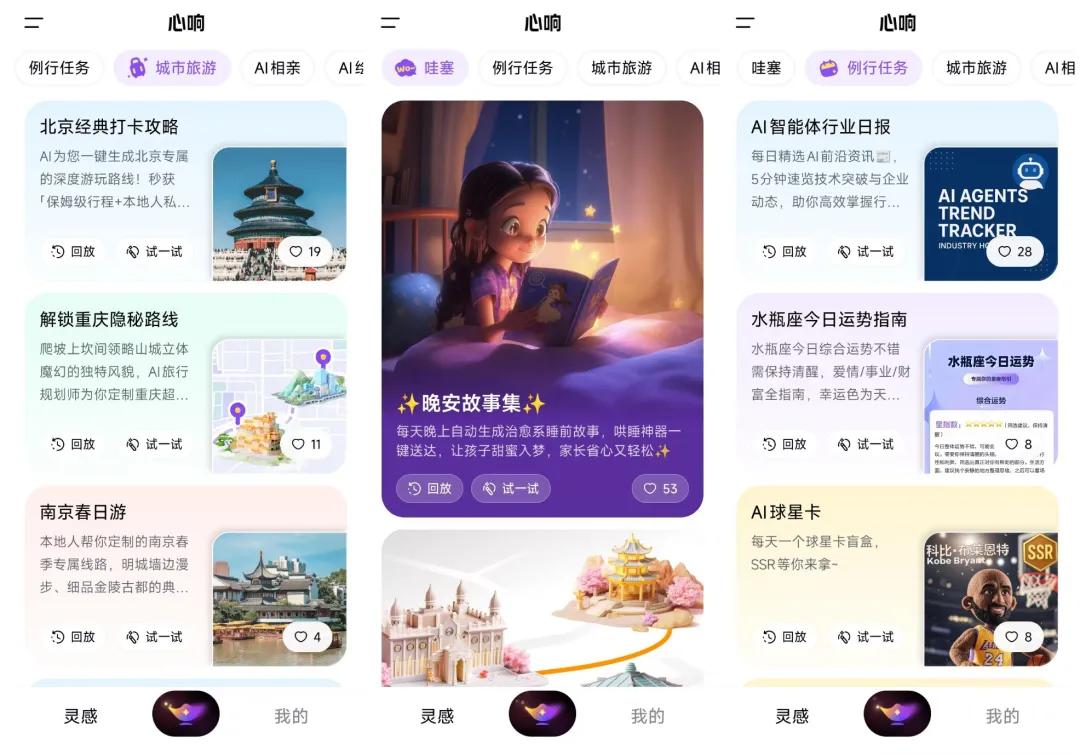

Judging by the primary functions highlighted on their interfaces, Baidu's Xinxiang is more consumer-centric. As Li Yanhong previously mentioned, AI will have "super apps" but must be "super useful." Among the top ten excellent application scenarios mentioned by Huang Jizhou, the head of Xinxiang, are AI picture books, AI blind dates, fishing games, and other lifestyle-oriented entertainment scenarios.

Image Source: Xinxiang Screenshot

ByteDance's Kouzi Space focuses on collaborative office work, featuring "Exploration Mode" and "Planning Mode." The former can handle simple needs like generating meeting minutes, while "Planning Mode" delves into complex projects such as cross-industry market research, seamlessly integrating with Feishu documents.

Image Source: Kouzi Official Website Screenshot

Alibaba has directly partnered with Manus to realize all Manus functionalities based on the Tongyi Qianwen model. Additionally, Alibaba's AI Agent "Xinliu" recently commenced its public beta, where users can fill out a questionnaire and await an invitation. This Agent is touted for its ability to automatically assist with research, report writing, and coding, akin to a human expert.

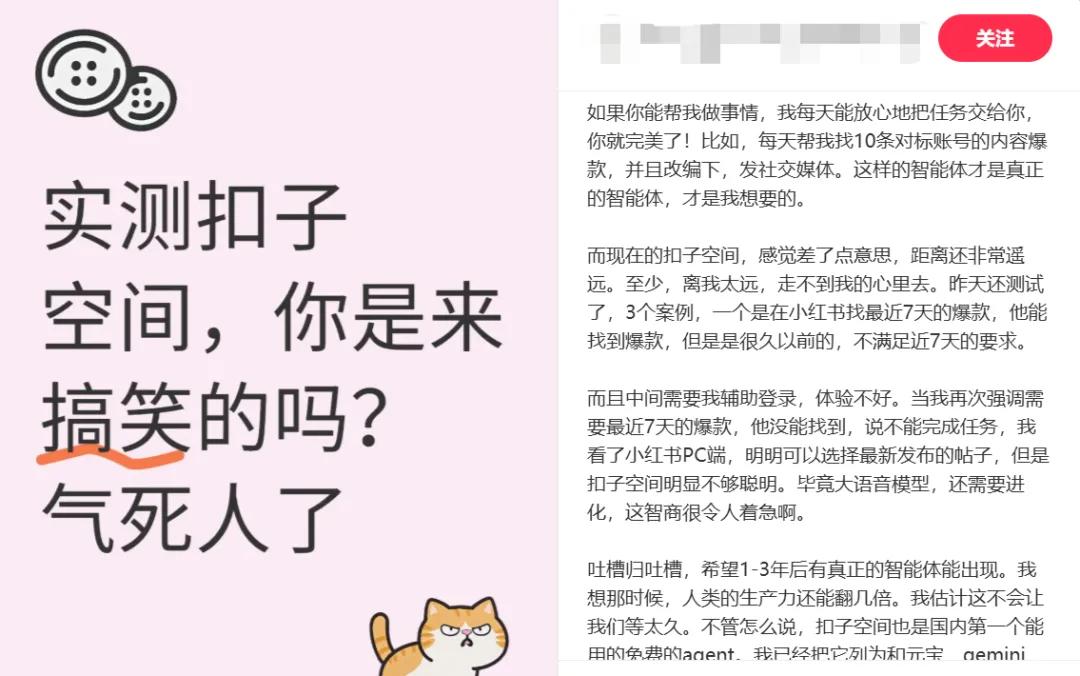

Although the Agent sector is booming, a general Agent capable of fully addressing user pain points has yet to emerge. Comparative usage revealed that Kouzi Space and Xinxiang currently perform well in content-level tasks, such as customizing travel itineraries, clothing matching, and organizing data to create PPTs. However, when it comes to cross-application operations or tasks requiring in-depth research, their performance is "questionable."

Some users bluntly stated that they'd prefer Agents to assist with ordering takeout and booking tickets rather than writing reports and storytelling. Currently, they can't even help post a status update on WeChat Moments.

Image Source: Xiaohongshu Screenshot

As work and life assistants, the prerequisite for Agents to invoke different apps and other applications is for Agents to interact and connect with these applications. However, due to differences in internal data and models, applications often exist in a state of "isolation," necessitating a unified standardized interface for interconnection and interoperability.

The MCP protocol launched by Anthropic addresses this issue. Li Yanhong has publicly underscored the importance of MCP, stating, "MCP, the Model Context Protocol, provides a solution to the inefficiencies caused by the lack of standards in the era of AI proliferation. MCP allows AI to invoke tools more freely."

Tencent, Alibaba Cloud, Baidu, and other companies have recently announced their support for the MCP protocol. However, the number of companies currently accessing MCP remains small. Some practitioners bluntly stated that accessing MCP means relinquishing the traffic entry point. For instance, if Agents are used for ordering takeout instead of Meituan and Eleme, these apps cannot retain users and even lose the opportunity to display splash screen ads. Companies are unlikely to easily forsake the users they've painstakingly cultivated.

He Bin, the founder of Topick.AI, believes that the imperfect ecosystem has hindered the development of a viable business model for general Agents. On one hand, emphasizing "general" raises user expectations, but the lack of application interconnectivity and subpar experience fails to retain users. On the other hand, valuable data content is controlled by large companies, making it challenging for startups to create a 100-point product to accumulate users. "For large companies, should their core data be paid and opened to other firms? Or should it remain closed until they develop their Agents? There are numerous complex, ecological considerations here."

02. "General Agents Are Still at the Kids' Table"

Despite the surge in industry attention, many practitioners express pessimism about the prospects of general Agents.

Neil, a long-time researcher of large models, once discussed in a podcast that the poor user experience of general Agents involves numerous technical intricacies. Agents need to browse and comprehend webpages to execute tasks, necessitating models with advanced visual capabilities. Furthermore, cross-application operations demand high technical proficiency, an area where maturity is still lacking.

Neil attempted to use Open AI's general Agent "operator" to book tickets on a ticketing website but found that it couldn't even select the correct date.

Image Source: Xiaohongshu Screenshot

He Bin believes that general Agents are a misconception, and their "general" nature poses two dilemmas: they must be simple and user-friendly, yet address a myriad of user needs; and they must be sufficiently professional to solve practical problems. These two aspects are inherently contradictory.

"I used AI to select team collaboration software, and it provided me with a perfect comparison table. However, this comparison neglected the team's usage habits, budget constraints, and special requirements." He Bin contends that these preferences, which cannot be easily quantified, are the core of decision-making. "Perhaps prolonged interaction with general Agents can overcome this issue, but if I'm spending energy training Agents, why not just customize or directly use more specialized industry Agents?"

The facts indeed align with practitioners' assertions. Both domestically and internationally, there are currently vertical Agents tailored to specific industries and scenarios, and their development maturity surpasses that of general Agents.

Hu Guanglong, the head of algorithms at remio.ai, explained that B-end scenarios are often more focused and vertical, allowing for deep customization according to customer needs, making it relatively easier to yield results. Neil also mentioned that B-end Agents can assist enterprises in repetitive tasks, which have lower technical requirements and are more stable compared to general Agents. For example, smart customer service and data analysis platforms are genuinely effective tools that can replace human labor.

Jared, a partner at YC and a seasoned investor, once pointed out that vertical AI Agents, as an emerging B2B software, are expected to become a market ten times larger than SaaS. A research report by Kaiyuan Securities mentioned that AI Agent applications will flourish in multiple areas by 2025, with AI Agents anticipated to lead the way in B-end commercialization, accelerating their implementation in scenarios such as e-commerce, marketing, CRM, finance, and law.

The growth potential of this industry is also evident in the financial reports of some B-end Agent enterprises. For instance, "Fourth Paradigm," listed on the Hong Kong stock exchange, has been focused on enterprise intelligent transformation services. In the first quarter of this year, it launched an AI Agent full-process development platform, and its Xianzhi AI platform revenue surged by 60.5% year-on-year to 805 million yuan, accounting for nearly 80% of total revenue.

Image Source: Tonghuashun Screenshot

Zhang Zhenguang, CEO of Sipu Technology, once told 36Kr that the B-end is the primary focus area for AI to create value in the early stages, and C-end applications are highly susceptible to disruption by advancements in large model technology. The disparity in implementation difficulty has also sparked ridicule among many practitioners: "B-end Agents are already productive, but general Agents are still at the kids' table."

Many ordinary developers, even beginners with zero foundation, have also set their sights on the B-end Agent business. On social media platforms, some developers have shared their experiences of earning money by creating Agent applications, receiving over a dozen custom orders and earning more than 50,000 yuan. There are also users posting custom demands for "Xiaohongshu automatic posting" Agents, stating that they have received quotes ranging from 30,000 to 60,000 yuan.

03. Is This the Dawn of the Agent Era?

According to "Qujiexieshang," the development threshold for Agents is currently not high. Through zero-code, low-code development frameworks, and abundant plugins, even ordinary users can quickly get started and create their Agents.

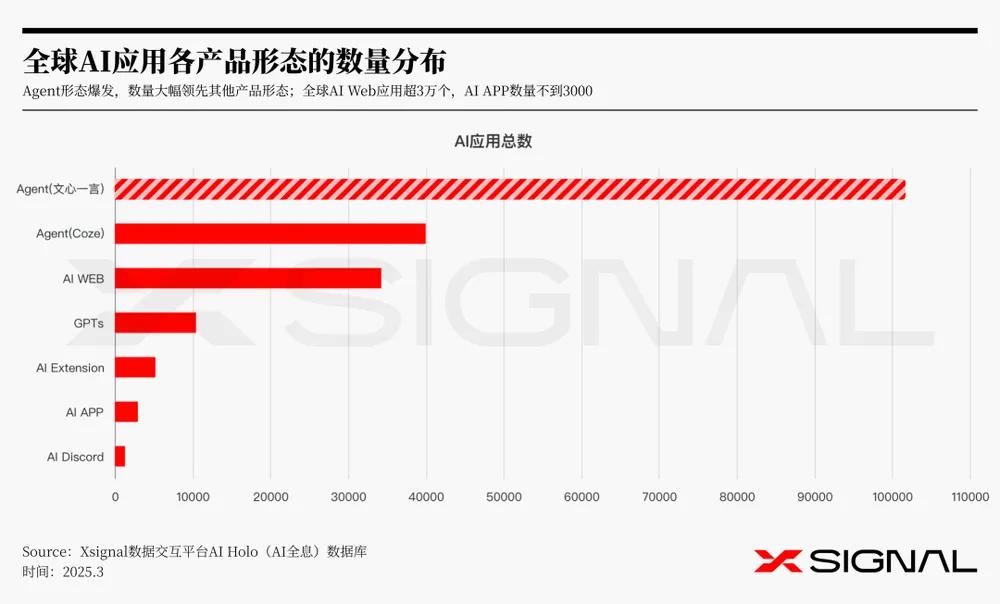

Over the past year, leading companies such as Tencent, Baidu, and Alibaba, in addition to developing general Agents, have been promoting their Agent development platforms to attract more developers to "mine gold" on their platforms. According to Xsignal's report, as of the first quarter of 2025, the total number of Agent (Wenxin Yiyan) applications has exceeded 100,000, and the number of Agents (Coze) is close to 40,000, far surpassing other types of AI applications.

Image Source: Xsignal

Li Yanhong has repeatedly mentioned in public that the future will be an era where "money can be made just by having ideas." Baidu's Agent platform facilitates the realization of these ideas. Baidu's Wenxin Agent platform already boasts over 100,000 Agent applications with commercial components, and in November last year, a single Agent achieved a conversion income of 100,000 yuan.

Agents created by developers on the Agent platform can monetize through affiliate marketing, commercial advertising, paid consultations, and other methods. Some users have shared on Xiaohongshu that their Agents have received over 7,000 yuan in "appreciation incentives" on the Wenxin Agent platform.

Image Source: Xiaohongshu Screenshot

He Bin contends that tech giants constructing Agent platforms are fostering innovation while also selling computing power. These platforms spot promising products and readily replicate them. However, for aspiring entrepreneurs, developing Agents on these platforms lacks significance and often results in them becoming mere "adjuncts" to the platforms.

"The user base of platforms such as Wenxin and Kouzi is confined. If Agent applications aim to expand their user base and achieve commercialization, they will inevitably need to venture beyond these platforms."

Industry experts predict that 2025 will mark the inaugural year of the Agent product explosion. The lowered entry barrier and the allure of monetization are drawing a surge of entrepreneurs into this field. According to Laimi PEVC data, since 2024, funding in the global AI Agent sector has surpassed 66.5 billion yuan. Additionally, Ebrun reports that in the fourth quarter of 2024, there were 218 domestic AI financing events, with Agent-related projects accounting for 35% of them.

Despite the unprecedented enthusiasm among practitioners, Agents, akin to large models, are still in their infancy. Fu Sheng, Chairman of Cheetah Mobile, once predicted that the AI application market would explode in 2025, with general Agents becoming the super apps of the AI era. Nonetheless, due to various technical hurdles, general Agents have yet to gain widespread recognition.

Many experts anticipated a boom in AI applications in 2024, but ultimately, expectations were not met. Earlier this year, Li Yanhong publicly noted that although various application cases have emerged across different scenarios, they tend to be more concentrated in the ToB (business-to-business) sector. In the ToC (consumer-to-consumer) sector, no so-called super apps have materialized yet.

Like other AI applications, Agents still face numerous challenges. How can B-end Agents identify the right application scenarios? How can general Agents break down ecological silos? Only by addressing these issues can the industry truly mature, and the era of AGI (Artificial General Intelligence) may then be within reach.