Nvidia's Market Value Plummets: Can Huang Renxun's China Visit Stem the Tide?

![]() 05/20 2025

05/20 2025

![]() 869

869

In mid-April, Nvidia CEO Huang Renxun made a surprise appearance in Beijing, just three months after his previous visit to China and 48 hours after the US imposed an "indefinite export control" on Nvidia's H20 chips.

However, the timing of Huang Renxun's visit garnered more attention than the reasons behind it. Observers noticed changes in his demeanor, such as ditching his iconic leather jacket for a black suit, signifying the importance he attached to this trip.

Furthermore, social media clips revealed that Huang Renxun adhered to local customs during a dinner, raising his glass to toast with a group of business partners.

Since the start of the year, Nvidia's "market value myth" has been unraveling. Despite achieving double-digit growth in revenue and profit in the first quarters of 2024 and 2025, uncertainty in Sino-US trade relations has accelerated capital withdrawal from the company.

Recently, Bloomberg reported that several business leaders, including Nvidia CEO Jensen Huang, will visit the White House on Wednesday local time. Nvidia has previously announced plans to produce AI supercomputers in the US, aiming to develop AI infrastructure worth up to $500 billion over the next four years.

Huang Renxun has publicly acknowledged the significance of the Chinese market to Nvidia, but navigating the complex Sino-US landscape and leading Nvidia out of its darkest hour won't be easy.

1. The Leather Jacket Cult Leader Trades In His Jacket for a Suit

On the eve of this year's Spring Festival, Huang Renxun embarked on a week-long visit to China, transforming into a "salesperson extraordinaire." He visited Nvidia's Shenzhen office and hosted a dinner for Chinese partners, nurturing these relationships.

However, post-Spring Festival, the emergence of the "dark horse" large model DeepSeek upended the AI industry's "computing power is everything" mantra. This algorithmic revolution is seen as potentially breaking large models' dependence on computing power.

Subsequently, Nvidia released its 2024 performance report, which, despite exceeding expectations, led to a share price drop rather than an increase. Investors are concerned that Nvidia's performance has hit a bottleneck, and high-level capital withdrawal is accelerating the share price decline.

Moreover, the tax policies enacted by President Trump after taking office have tangibly hit Nvidia's "pain points." On April 15, Trump announced an "indefinite" export license control on Nvidia's H20 chips, meaning the chip, designed to circumvent "chip export restrictions," has now been included in the restricted range, effectively "blocking" Nvidia's last major AI product in the Chinese market.

Faced with these setbacks, Nvidia's share price has plummeted nearly 40% from its January high of $153.1, eroding over a trillion dollars in market value. Huang Renxun's anxiety is understandable.

His urgent visit to China following the chip restrictions was aimed at "putting out the fire." Although some joked that Huang Renxun looked odd in a suit, it underscored his emphasis on the Chinese market.

On one hand, Huang Renxun needed to clarify that Nvidia wasn't unwilling to sell H20 chips but was "not allowed to sell." He sought to reassure customers and discuss potential future collaborations, including launching products adapted to the new policy.

Due to export controls, Nvidia faces potential losses of about $5.5 billion from delivery defaults, but insiders estimate the actual impact could exceed $10 billion.

On the other hand, Huang Renxun was seeking new business opportunities. The Financial Times reported that he met with DeepSeek founder Liang Wenfeng during this visit, discussing new chip designs for Chinese customers. However, neither Huang Renxun nor Liang Wenfeng has commented on this news.

If the export of Nvidia's H20 chips continues to be restricted, the company will undoubtedly explore new business areas to address the challenges. As China's latest "technology representative" in the large model industry, Liang Wenfeng is indeed a suitable candidate for collaboration.

During Huang Renxun's January visit to China, he also met with leading Chinese robot manufacturers, including Wang Xingxing, CEO of Unitree Robotics, and Wang He, founder of Yinhe General, signaling his intention to explore more business opportunities in China's technology industry.

2. Chinese Chips Will Not "Wait in Place"

Although Huang Renxun aims to continue "mutual discussion and win-win cooperation" with China's technology industry, enterprises must prepare for both eventualities amid the current market situation to avoid being strangled by chip issues.

The new energy vehicle industry offers a clear example. At CES 2025, Huang Renxun showcased Nvidia's "automotive army," including domestic automakers like BYD, Zeekr, Xiaomi, and Li Auto.

In the smart driving chip sector, Nvidia, with its high computing power and CUDA ecosystem, firmly holds the top spot in the global market.

In 2024, Nvidia's Orin-X chip installations totaled 2.1002 million units, a 91.8% year-on-year increase, capturing a 39.8% market share. Tesla's FSD followed with a 25.1% share, while Huawei's Ascend series accounted for 9.4%.

Earlier this year, Huang Renxun announced the official mass production of the next-generation autonomous driving chip Thor, reportedly offering over 60 times the performance of Orin.

However, Thor's mass production schedule had been postponed several times, with news in January suggesting a delay until 2026. These uncertainties are forcing domestic automakers to accelerate domestic substitution efforts.

XPeng's self-developed AI smart driving chip "Turing" will enter mass production in the second quarter of this year. NIO's Shenji NX9031 will be equipped on its high-end sedan ET9, with mass production and delivery expected in the first quarter. Xiaomi announced that its first SUV model, YU7, equipped with its self-developed "Xuanjie" chip, will launch in the second quarter.

In addition to new force automakers, Chery Automobile announced its self-developed high-end smart driving chip plan in March this year, covering MCU and SoC. Geely also launched the full-scenario high-end autonomous driving chip "Xingchen No. 1" last year, planning mass production for 2025.

Domestic automakers are reducing their dependence on Nvidia due to supply chain security considerations, especially amidst escalating Sino-US trade frictions. They also hope to achieve differentiated competitiveness through technological autonomy and cost reduction.

As end-to-end smart driving technology becomes mainstream, high-end smart driving competition has shifted from simple computing power accumulation to a combination of "self-developed chips + algorithm closed loop." Self-developed smart driving chips, designed based on each automaker's large autonomous driving model, can achieve more efficient software and hardware coordination, enabling high-level smart driving functions with lower computing power, typically reaching 3-4 times that of mainstream chips.

In the fiercely competitive automotive industry, self-developed chips can help automakers establish a "technological image," strengthening their brand image despite considerable R&D expenses.

However, the automotive business isn't Nvidia's primary revenue source. In 2024, it accounted for only 1.3% of total revenue, showing a yearly downward trend.

In contrast, the data center is Nvidia's core business, contributing about 90% of its revenue. Yet, amidst US chip export restrictions, domestic chip manufacturers like Huawei Ascend and Moore Threads have accelerated their R&D processes in recent years.

Following the restriction on Nvidia's H20 chip exports, Huawei immediately unveiled the next-generation Ascend 920 AI chip, expected to enter mass production in the second half of this year.

According to test data from the Nanjing University Artificial Intelligence Laboratory, using Ascend 920 to train a large model with 10 billion parameters achieved 78% of the efficiency of Nvidia's H100, suggesting Ascend 920 could fill the market void left by the H20 chip.

US analysts predict that as US chip manufacturers like Nvidia and AMD are unable to export AI chips to China, it may prompt Chinese chip manufacturers, led by Huawei, to intensify efforts to seize market leadership, with the US government inadvertently handing over opportunities to China.

3. Tech Giants' "China Dependence"

US analysts' concerns are shared by Huang Renxun.

According to Nvidia's fiscal 2025 financial report, its 2024 total revenue was $130.5 billion, with revenue from China amounting to $17.108 billion, a 66% increase from the previous year, reaching an all-time high and accounting for 13.1% of total revenue.

Admittedly, the Chinese market isn't Nvidia's core revenue source, but in the current global economic weakness, it's a crucial region with both market size and consumer demand. Nvidia's options would be limited if it exited the Chinese market.

This sentiment is shared by other global top enterprises. Since the start of the year, various entrepreneurs, including Apple CEO Tim Cook, Qualcomm CEO Cristiano Amon, Pfizer CEO Albert Bourla, and Bridgewater founder Ray Dalio, have visited China, recognizing the potential of the Chinese market in terms of consumption scale and supply chain cooperation.

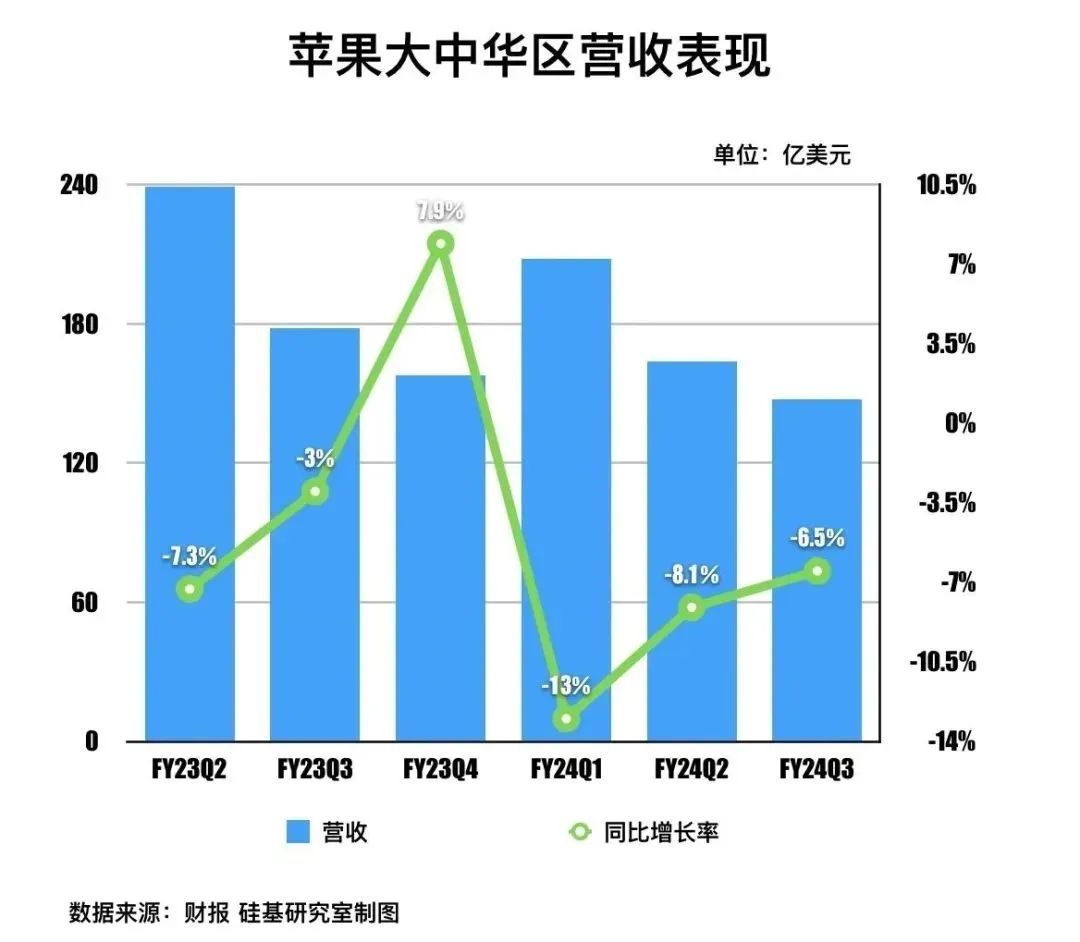

Taking Apple as an example, its 2024 revenue was $124.3 billion, with revenue from Greater China totaling $18.513 billion, accounting for 14.9% of total revenue. As early as 2023, Cook stated that China had surpassed the US as the largest single market for iPhones globally.

Similarly, Qualcomm achieved nearly $33.2 billion in fiscal 2024 revenue, with 46% coming from China. For these global brands, the Chinese market is undeniably an important market that cannot be ignored.

This is not only due to China's vast consumption power of 1.4 billion people but also its robust supply chain capabilities. Cook once explained that Apple builds factories in China not just because of low labor costs but because of the highly skilled craftsmanship there.

However, geopolitics has created a dilemma for both domestic technology enterprises needing overseas advanced chips and American enterprises eager for the Chinese market and supply chain.

Therefore, a series of corporate executives, led by Huang Renxun, have visited China since the start of the year. On one hand, they aim to deepen ties with domestic political and business circles and maintain their existing market share in China. On the other hand, they actively seek cooperation solutions under tariff pressure, such as establishing a localized supply chain system in China, akin to Tesla's Shanghai factory.

While the Sino-US tariff game may continue to simmer in the short term, Huang Renxun emphasized during his China visit that Nvidia will unwaveringly serve the Chinese market. This sentiment echoes the idea and attitude of global and Chinese enterprises seeking cooperation.

Huang Renxun trading in his leather jacket for a suit reflects his respect and recognition of the Chinese market. Similarly, Chinese enterprises aren't afraid of technology blockades but hope to collaborate with global enterprises for mutual development.

In this game, Chinese enterprises are accelerating technological breakthroughs and industrial upgrades to cope with external pressures. Meanwhile, international enterprises like Nvidia strive to balance multiple interests and seek continued cooperation with the Chinese market.

This interdependent yet competitive relationship poses a challenge and a new driving force for global technology and economic development. Amidst the global technology game, while globalization may recede, the wave of technological innovation will always move forward.