Comparing Ecovacs and Roborock: A Financial Analysis of Two Leading Robotic Vacuum Cleaner Manufacturers

![]() 05/21 2025

05/21 2025

![]() 587

587

Key Points:

1. In terms of revenue scale, Ecovacs, with revenues of up to 16 billion yuan, remains the leading enterprise in the cleaning market. Its robust performance showcases a double-digit growth trend in both revenue and net profit. Conversely, Roborock, though experiencing rapid expansion, faces challenges such as increasing revenue without corresponding profit growth, declining gross margin, and profit pressure.

2. From a revenue growth perspective, Ecovacs' dual-brand strategy and overseas market have significantly propelled its performance. Roborock, too, benefits from its globalization strategy, with the overseas market contributing significantly to its overall revenue growth.

3. Ecovacs, with its earlier establishment, boasts deep technological and brand accumulation, maintaining stable expenditures across various costs. Through various cost-reduction measures, it has enhanced its overall gross margin, enabling profits to recover from a two-year trough. In contrast, Roborock, with high investments, achieves high growth through technological innovation and market expansion, leading to a decline in gross margin and negative cash flow. Its profit quality needs improvement, and it seeks a balance between expansion and profitability.

Article by Yang Jianyong

In the era of generative AI, all sectors are embracing the trend, particularly with the advent of DeepSeek. Various sectors are rapidly integrating large model services, including smart hardware devices that leverage these models for more intelligent interaction. This not only revitalizes products but also drives the transformation of smart home products towards intelligence, quality, and personalization.

Smart home hardware, such as smart cameras, smart door locks, and robotic vacuum cleaners, are utilizing AI and large model services, becoming key drivers of market growth. According to IDC data, the global smart camera market shipped 137 million units in 2024, with a year-on-year growth of 7.7%; the global smart robotic vacuum cleaner market shipped 20.603 million units in 2024, with a year-on-year growth of 11.2%.

In the smart home market, Chinese manufacturers are shining globally. Four out of the top five players in the global smart camera market are from China. Hikvision retains its top position in consumer camera shipments, while Xiaomi, Dahua Technology's Lechange, and others are accelerating their overseas expansion, leveraging their home ecosystem and channel advantages. Chinese manufacturers currently hold a significant advantage in the global consumer camera market.

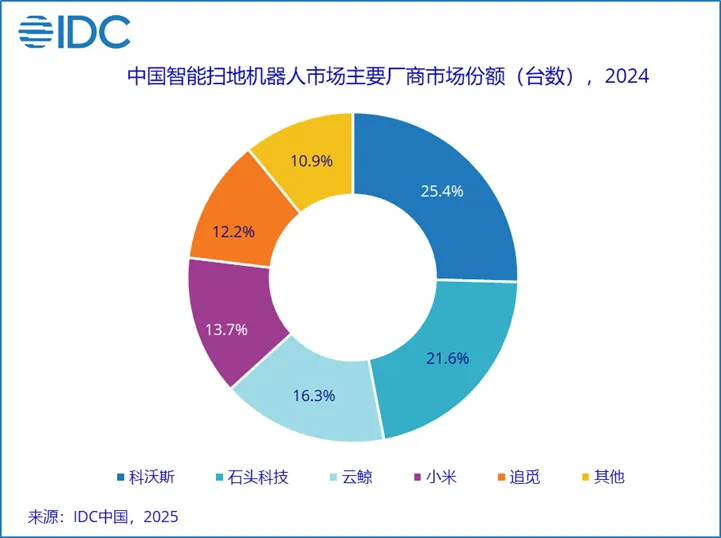

In the smart robotic vacuum cleaner market, four out of the top five manufacturers are also from China: Ecovacs, Roborock, Xiaomi, and Dreame. In the Chinese market, nearly half of the market share is held by Ecovacs and Roborock, with a combined market share of 47%, specifically 25.4% and 21.6%, respectively. So, which of these two robotic vacuum cleaner manufacturers is superior?

Ecovacs, the "Sweeper King," Makes a Strong Comeback: Double Growth Validates the Success of Its Dual-Brand Strategy

In 2024, Ecovacs achieved a revenue of 16.542 billion yuan, a year-on-year increase of 6.71%; net profit reached 806 million yuan, a year-on-year increase of 31.7%. In the first quarter of 2025, revenue was 3.858 billion yuan, a year-on-year increase of 11.06%; net profit was 475 million yuan, a year-on-year increase of 59.43%. The gross margin was 49.68%, an increase of 2.5 percentage points. Net cash flow from operating activities was 894 million yuan, a year-on-year increase of 1005%.

Judging from the financial report data, Ecovacs' performance has been stable with continuous recovery. Notably, its profitability has rebounded from the trough of the past two years, with net profit significantly increasing, demonstrating the effectiveness of cost control and efficiency improvement. Through technological innovation, it has enhanced product competitiveness, leading to a double-digit growth pattern in both revenue and net profit.

Firstly, the dual-brand strategy drives the company's revenue growth. Both the Ecovacs and Tineco brands have achieved growth, with business volumes exceeding 8 billion yuan each.

Many smart hardware manufacturers adopt a multi-brand strategy to cater to different consumer needs and markets, driving revenue growth through new brands. For instance, Haier Smart Home, a home appliance manufacturer, currently owns seven brands, including Haier, Casarte, Leader, GE Appliances, Candy, Fisher & Paykel, and AQUA, covering global households. In overseas markets, relying on strategically acquired brands, Haier Smart Home has achieved rapid growth in multiple markets.

In the Chinese market, Haier Smart Home covers high-end, mainstream, and niche market segments through the Casarte, Haier, and Leader brands. Notably, the Casarte brand is one of the core drivers of revenue growth, while the Leader brand caters to the needs of young users. It is evident that Haier Smart Home has fully leveraged its multi-brand layout advantage, achieving continuous revenue growth and record highs in the fiercely competitive home appliance industry.

As Ecovacs' core business, robotic vacuum cleaners remain the leading domestic enterprise. According to IDC data, Ecovacs holds a 25.4% market share in China, continuing to rank first in the market.

This is primarily attributed to Ecovacs' technological innovation, which has enhanced its competitiveness. In 2024, it launched smart robotic vacuum cleaners such as the T30, T50, and X8 series. Among them, the X8 series floor-washing robot, with its industry-first constant-pressure roller washing function, not only drives technological innovation in the industry but also gains widespread user recognition, driving steady growth in overall robotic vacuum cleaner shipments.

Furthermore, Ecovacs anticipated that consumer subsidy policies would bring significant market stimulus effects. Therefore, it began sufficient stockpiling from the third quarter of last year to meet surging market demand, thereby achieving product sales growth. With the continuation and intensification of consumer policies this year, Ecovacs will continue to leverage its supply chain capabilities to fully ensure sales supply during key periods such as the 618 promotion and Amazon Prime Day.

In 2024, Ecovacs shipped 2.95 million service robots globally, a year-on-year increase of 16.9%, and has been the largest player in China's robotic vacuum cleaner market for 10 consecutive years, according to market research firm AVC.

Overall, Ecovacs' dual-brand business strategy has successfully opened up new brands and new tracks in the increasingly competitive robotic vacuum cleaner market, entering the global market and bringing new revenue growth. Behind this success lies years of technological accumulation, providing strong impetus for sustainable development. Its products have achieved impressive consumer reputation and performance in both domestic and international markets, successfully building a dual-wheel-driven business model of Ecovacs plus Tineco. Simultaneously, the balanced revenue contribution of the dual-wheel drive indicates the beginning of a new milestone.

Roborock: Increasing Revenue Without Increasing Profit, Struggling to Find a Balance Between Global Expansion and Profitability

In 2024, Roborock achieved a revenue of 11.945 billion yuan, a year-on-year increase of 38%; net profit was 1.976 billion yuan, a year-on-year decrease of 3.64%. In the first quarter of 2025, revenue was 3.428 billion yuan, a year-on-year increase of 86.22%; net profit was 267 million yuan, a year-on-year decrease of 32.92%, with a gross margin of 45.48%, a year-on-year decrease of 11 percentage points. Net cash flow from operating activities was -42.1867 million yuan, compared to 233 million yuan in the same period last year, a year-on-year decrease of 118%.

In terms of revenue growth, Roborock's performance is quite impressive, showcasing a rapid growth trend. This high growth is fueled by the advancement of its globalization strategy, with overseas revenue surpassing that of the domestic market. In 2024, overseas revenue reached 6.388 billion yuan, a year-on-year increase of 51%, and the revenue share also increased to 53.47%, becoming an important engine driving overall revenue growth.

Regrettably, during its rapid expansion, Roborock faces certain risks. For instance, obtaining market share through sales tactics has led to a decline in gross margin, sacrificing some profit, resulting in increasing revenue without corresponding profit growth and short-term profit pressure. Secondly, finding a balance between scale expansion and profitability is a primary consideration during the enterprise development process.

For Roborock, high costs pose potential hidden dangers for its future growth. Notably, the net cash flow from operating activities was negative in the first quarter of 2025, indicating certain pressure on the company's operations and profitability. Moving forward, Roborock will also have to face the challenge of finding a balance between expansion and profitability.

In terms of R&D investment, Roborock invested 971 million yuan in 2024, a year-on-year increase of 56.93%. The size of the R&D team expanded from 622 in 2023 to 1043 in 2024, a year-on-year increase of 68%. In terms of sales expense, sales expenses in 2024 amounted to 2.967 billion yuan, a year-on-year increase of 73.23%, accounting for 24.84% of total revenue. Among them, advertising and marketing expenses in 2024 reached 1.923 billion yuan, an increase of 840 million yuan compared to 2023, a growth of 77.56%. This year, it continues to grow significantly. In the first quarter of 2025, sales expenses were 951 million yuan, an increase of approximately 598 million yuan compared to the first quarter of 2024, a year-on-year increase of 169%.

Overall, compared to Ecovacs, Roborock, established later, has continuously increased its investment in R&D and marketing to catch up in terms of technology and brand. As a result, the size of the R&D team has expanded rapidly, and marketing expenses have increased significantly, achieving double growth in sales volume and sales amount.

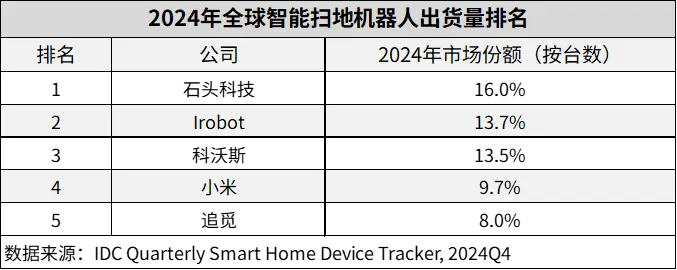

Throughout 2024, Roborock sold a total of 3.449 million smart robotic vacuum cleaners, a year-on-year increase of 32.91%. In the global smart robotic vacuum cleaner market, it surpassed iRobot. According to an IDC report, Roborock ranks first globally with a 16% market share.

It should be noted that, thanks to technological innovation and substantial marketing promotion, while topping the global market for robotic vacuum cleaners, Roborock also faces the risk of a single product line. The robotic vacuum cleaner business remains its significant revenue source, with smart robotic vacuum cleaners and accessories accounting for 90.8% of revenue, indicating relatively limited revenue diversity.

Conclusion

As one of the most promising sectors in consumer technology, the smart home market has enormous potential. According to Omida data, the global smart home market size is expected to exceed $279 billion by 2026. China is a vital global smart home market. In particular, robotic vacuum cleaners have developed rapidly in recent years and have become one of the largest robotic vacuum cleaner markets globally. Furthermore, encouraging and promoting the trade-in of consumer goods is crucial for the home appliance industry, as trade-ins represent a significant industrial dividend.

In the first quarter of 2025, cleaning appliances continued the high growth trend from the fourth quarter of last year, leading the overall home appliance market. AVC's total data shows that cleaning appliance sales in the first quarter of 2025 amounted to 10 billion yuan, a year-on-year increase of 32.3%, with sales volume reaching 7.84 million units, a year-on-year increase of 18.2%.

Against this backdrop, the two leading enterprises, Ecovacs and Roborock, exhibit distinct strategic choices. Ecovacs focuses on improving profit quality, achieving rapid net profit growth through new product iteration and innovation, cost structure optimization, and expense control. In contrast, Roborock adopts a more aggressive strategy to capture domestic market share, but this path choice places high demands on the company's full-link capabilities, including product innovation, manufacturing stability, supply chain risk resistance, cash flow management, and market service capabilities. Shortcomings in any of these areas may lead to potential risks. For example, to boost 618 sales, Roborock chose Li Jiaqi for live streaming, but multiple consumers reported being unilaterally refunded after placing orders for Roborock robotic vacuum cleaners, and customer service indicated that the price was mislabeled and unable to fulfill orders. It is hoped that this can be resolved properly in the end.

In essence, the two companies make different strategic choices based on their respective development stages. Roborock is following a development strategy that Ecovacs has already traversed. Currently, Ecovacs' supply chain construction and offline layout are mature, giving it advantages in cost control and efficiency improvement. For Roborock, whether it can find a balance between expansion and profitability remains a significant challenge.

It is worth noting that in recent years, numerous companies have focused on overseas markets, which have emerged as a pivotal driver for revenue growth. The success of Chinese companies in these markets is prominently showcased by the continuous enhancement of Chinese products and services. Once synonymous with "Made in China," they are now transforming into "Intelligent Made in China," resulting in a growing number of Chinese brands solidifying their positions in the international market. From smartphones, smart home appliances, and various other smart devices becoming global leaders, companies like Haier Smart Home, TCL Smart Home, Ecovacs, Roborock, and Anker Innovation have also made significant strides in overseas markets. This achievement is underpinned by the robust strength of technological innovation, propelling Chinese brands to prominence in the global arena.

Looking ahead, with the relentless evolution of technology and further market expansion, the cleaning appliance industry is poised to embrace broader development opportunities and emerge as a standout sector within the smart home field.

Yang Jianyong, a contributor to Forbes China, offers his personal views and is committed to providing an in-depth analysis of cutting-edge technologies, including IoT, cloud services, AI, and smart homes.