Revenue surge, Pony.ai aims to crack the profitability puzzle of autonomous driving with Robotaxi

![]() 05/21 2025

05/21 2025

![]() 520

520

Author | Zhang Lianyi

Pony.ai releases its latest quarterly financial report, highlighting the Robotaxi business as its most significant achievement.

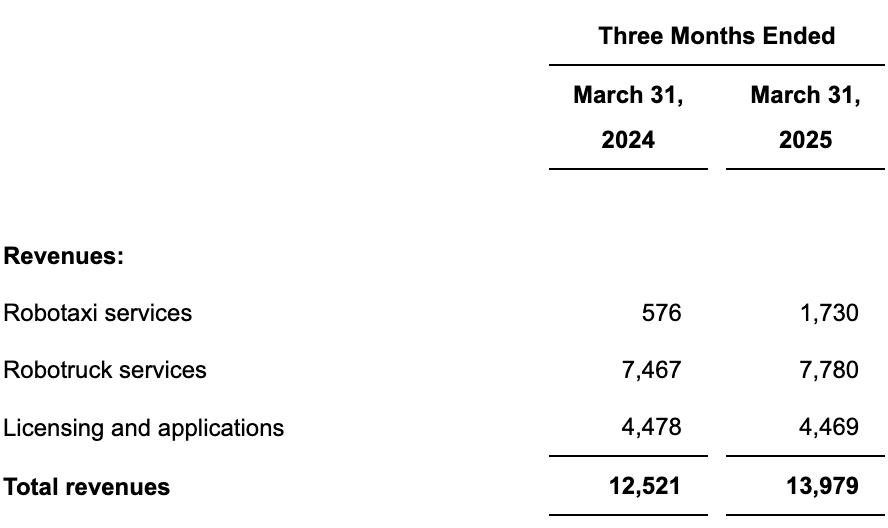

On May 20, Pony.ai released its financial report for the first quarter of 2025, revealing a total revenue of $14 million (approximately RMB 102 million), up 12% year-on-year. This growth is primarily attributed to the expansion of its Robotaxi services. In Q1 2025, Robotaxi business revenue reached $1.73 million, a 200% increase from the same period last year.

According to Pony.ai CEO Peng Jun, 2025 marks the year of mass production for Pony.ai's Robotaxi. With the reduction in the cost of the 7th-generation Robotaxi's autonomous driving system and an increase in production speed, the Robotaxi fleet size is expected to expand to 1,000 vehicles by the end of 2025.

Pony.ai's core business includes three main segments: autonomous ride-hailing services (Robotaxi), autonomous freight services (Robotruck), and technology licensing and application services.

Currently, its revenue structure is not fully stable, and the company is still in the exploratory stage of commercializing its autonomous driving business.

From 2022 to 2023, technology licensing and application services accounted for over 50% of revenue. Starting in 2022, due to the expansion of the Qingzhi Logistics fleet, a joint venture between Pony.ai and Sinotrans, and the increase in operating miles driving up transportation service fees, Robotruck business revenue saw a significant increase, currently accounting for the highest proportion of revenue.

Pony.ai's Q1 2025 revenue by business segment (in thousands of USD)

In the future, as the Robotaxi business moves towards large-scale mass production, it is expected to contribute significantly to the company's main revenue in the long run.

This is why Pony.ai adheres to the business strategy of "prioritizing the Robotaxi business, prioritizing the Chinese market, and prioritizing first-tier cities."

"In summary, the large-scale mass production and deployment of the 7th-generation Robotaxi is our top priority. Through continuous technological innovation, we will witness accelerated production and a significant reduction in costs, enabling the 7th-generation Robotaxi to offer better commercial returns," said Peng Jun during the earnings call.

01

Robotaxi as the growth engine, next step is cost reduction and efficiency enhancement

As Pony.ai's fastest-growing business in Q1, Robotaxi revenue primarily comes from two sources: passenger fares and technical solution project fees.

Pony.ai Robotaxi operating in downtown areas of multiple cities

Data shows that Pony.ai's passenger fare revenue increased significantly in Q1 2025, up 800% year-on-year. This is due to the expansion of paid Robotaxi services in first-tier cities: currently, Pony.ai's Robotaxi commercial operations cover Beijing, Shanghai, Guangzhou, Shenzhen, and other cities, with a total area exceeding 2,000 square kilometers, encompassing key transportation hubs such as central urban areas, airports, and high-speed railway stations. Additionally, it benefits from refined operational strategies targeting different user groups, with the number of registered users increasing by over 20% quarter-on-quarter.

Meanwhile, the ratio of remote assistants to vehicles continues to expand, achieving a capability of 1:20, compared to only 10-12 vehicles per remote assistant at the end of last year. According to Pony.ai's previous plans, this ratio will further expand to 1:40 or even 1:50 in the future.

Next, Pony.ai aims to reduce costs and enhance efficiency, accelerating the scale and mass production of its Robotaxi business.

A crucial step in this process is the mass production of the 7th-generation Robotaxi.

During the Shanghai Auto Show in April this year, Pony.ai unveiled its 7th-generation automotive-grade autonomous driving software and hardware system solution, along with three mass-production models from the 7th-generation Robotaxi family. The new vehicles are expected to enter mass production in mid-2025.

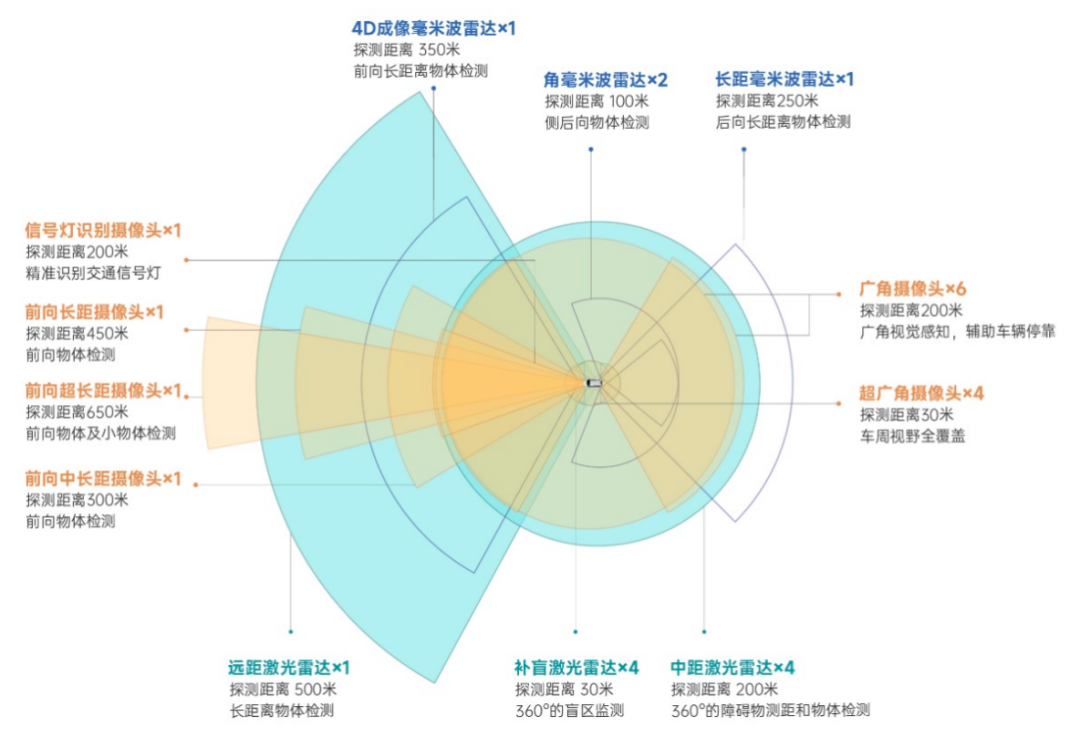

"The Robotaxi models equipped with the 7th-generation autonomous driving system feature 100% automotive-grade components, a 70% reduction in the total cost of the autonomous driving kit compared to the previous generation, and platform-based adaptation design," according to Pony.ai CTO Lou Tiancheng. "Through a three-fold optimization of inference computing efficiency, the 7th-generation Robotaxi is the world's first model to achieve full-scene, all-weather L4 autonomous driving on automotive-grade chips. This not only extends the product life cycle but also optimizes hardware costs."

Lou Tiancheng introducing the "World Model + Virtual Driver" technology

Behind this achievement lies the support of the "PonyWorld + Virtual Driver" technology.

Lou Tiancheng stated that PonyWorld constructs a high-fidelity training environment and evaluation system, generating over 10 billion miles of test data weekly.

The Virtual Driver continuously evolves within the world model, enabling it to serve in complex scenarios while continuously optimizing operating costs and efficiency, thereby reducing commercial insurance costs and the costs of computing platforms, lidars, and other hardware.

In Pony.ai's view, the 7th-generation Robotaxi represents a milestone towards mass production for the company.

At the same time, Pony.ai will also accelerate its global layout.

To access larger markets and achieve better revenue, going global is an inevitable choice.

For autonomous driving companies venturing overseas, it can break through growth ceilings and explore larger commercialization spaces from a market perspective. From a technical perspective, diverse data can enhance algorithmic competitiveness. From a capital perspective, a global story can attract more investments to support long-term research and development. From a competitive perspective, the autonomous driving industry also follows the principle of "the winner takes all," making first-mover advantage crucial.

Therefore, in recent years, a large number of autonomous driving enterprises have announced their overseas expansion plans, and Pony.ai is no exception.

On May 6, Pony.ai announced a strategic partnership with Uber, with its Robotaxi fleet and services set to be integrated into the Uber platform in the second half of this year, starting in the Middle East market and gradually expanding to more international cities.

Pony.ai to expand into international markets in partnership with Uber

Additionally, since the beginning of this year, Pony.ai has obtained Robotaxi testing permits in Luxembourg, commenced road tests in Gangnam District, Seoul, South Korea, and launched its first joint autonomous ride-hailing service project with ComfortDelGro.

All these efforts are aimed at accelerating the large-scale commercialization of the Robotaxi business and achieving profitability.

Beyond Robotaxi, Pony.ai's Robotruck business has also made certain progress.

The financial report shows that in Q1 2025, Robotruck service revenue was $7.8 million, up 4.2% from $7.5 million in Q1 2024, primarily driven by contributions from new customers.

Technology licensing and application services remained largely unchanged from the same period last year, with Q1 2025 revenue at $4.5 million. However, Pony.ai noted an increase in orders and deliveries of its domain controllers, mainly driven by new robot delivery customers.

02

Significant increase in R&D expenses, Pony.ai still in the red

Despite progress across various business segments, Pony.ai remains in a loss position, with net losses increasing.

In Q1 2025, Pony.ai's operating loss was $56 million, compared to $34.7 million in the same period last year; non-GAAP operating loss was $47 million, compared to $33.9 million in Q1 2024.

In terms of net loss, Pony.ai reported a net loss of $37.4 million in Q1 2025, compared to $20.8 million in the same period last year; non-GAAP net loss in Q1 2025 was $28.4 million, compared to a net loss of $25.7 million in Q1 2024.

Members of Pony.ai's 7th-generation Robotaxi family

Pony.ai attributed this to the significant increase in R&D expenses due to substantial investments in the mass production of the 7th-generation Robotaxi in Q1.

Data shows a notable increase in Pony.ai's R&D expenses in Q1 2025.

In Q1 2025, Pony.ai's R&D expenses amounted to $47.5 million, up 59.8% from $29.7 million in Q1 2024; non-GAAP R&D expenses were $40.6 million, up 38.1% from $29.4 million in Q1 2024.

As a result, Pony.ai's operating expenses also surged in Q1 2025, from $37.3 million in the same period last year to $58.4 million, an increase of 56.3%; non-GAAP operating expenses were $49.3 million, up 35.0% from $36.5 million in Q1 2024.

Behind this increase, in addition to the rise in R&D investments, Pony.ai cited reasons such as stock awards following the IPO and increased employee salaries and benefits.

Pony.ai rings the bell on the US stock market in November 2024

Considering various factors, Pony.ai's gross profit and gross margin also declined in Q1 2025.

Gross profit in Q1 2025 was $2.3 million, compared to $2.6 million in the same period last year; gross margin in Q1 2025 was 16.6%, down from 21.0% in Q1 2024.

Pony.ai pointed out that the decline in gross margin was primarily due to changes in the revenue structure and an increase in ADC sales from new robot delivery customers in Q1. In the future, Pony.ai will continue to actively take measures to reduce the volatility of gross margin.

Consequently, Pony.ai's total cash equivalents and long- and short-term investment holdings decreased from $825 million at the end of last year to $738.5 million in Q1 this year.

03

Unlocking the door to profitability with the 7th-generation Robotaxi

Pony.ai's financial report reflects a common dilemma in China's autonomous driving industry: accelerated technological breakthroughs but persistent difficulties in large-scale commercialization.

This has led to the widespread issue of autonomous driving companies being unprofitable.

However, Pony.ai is very confident about achieving break-even and even long-term profitability.

Just before the financial report release, on May 14, Peng Jun and Lou Tiancheng signed agreements to voluntarily extend their share lock-up periods by 540 days, expressing the founding team's firm belief in the company's long-term value.

Behind this confidence lies the certainty of mass production for the 7th-generation Robotaxi.

Pony.ai's 7th-generation autonomous driving system mass production sensor solution

Peng Jun emphasized that the 7th-generation Robotaxi will enter mass production in mid-2025 and expand its fleet size to 1,000 vehicles by the end of the year.

To achieve this, Pony.ai is making preparations in three areas.

First, it is collaborating with automakers such as Toyota, BAIC BJEV, and GAC AION, actively cooperating in component procurement, assembly, and other aspects to ensure the quality and quantity of Robotaxi production.

Second, it is adopting flexible procurement methods for key components to meet the various needs of Robotaxi and ensure supply chain stability and large-scale production execution.

Third, it is establishing good relationships with local governments to ensure the safe and effective advancement of operations.

Pony.ai's layout reflects its optimism about the inflection point for the commercialization of Robotaxi.

On the policy front, since 2024, first-tier cities such as Beijing, Shenzhen, and Guangzhou have issued further policies on driverless vehicles. Among second-tier cities, Wuhan has made significant progress. Currently, Beijing, Guangzhou, Shenzhen, and Wuhan all support charging for external operations.

In terms of vehicle costs, according to data from Soochow Securities and information from leading enterprises, the latest generation of pre-installed Robotaxi models in the industry is about to enter mass production. The cost per vehicle has generally dropped from over $1 million to around $300,000. On this basis, the gross profit per vehicle is expected to shrink from -$280,000 to -$40,000. The further expansion of the ratio of supervisors to vehicles is accelerating the profitability of single Robotaxi vehicles.

At the enterprise level, leading companies have implemented Robotaxi services in key cities and mostly possess capabilities comparable to those of manned taxis.

Under these circumstances, Pony.ai's asset-light model for providing operational services offers certain advantages.

Currently, the autonomous ride-hailing market is mainly composed of three types of participants: autonomous driving technology companies, internet and mobility platforms, and automakers.

Among them, autonomous driving technology companies represented by Pony.ai have high bargaining power in the cooperative ecosystem and are most likely to simultaneously form triple advantages in technology barriers, vehicle costs, and platform traffic.

Compared, OEMs are focusing on L2 assisted driving, unable to fully concentrate on autonomous driving technology iteration; internet and travel platforms have R&D and traffic advantages, but cooperation with others is relatively challenging.

Meanwhile, autonomous driving technology companies such as Pony.ai provide technical solutions, mainly participating in Robotaxi operations and technology licensing. This "light" model is conducive to avoiding problems such as sales monitoring faced by traditional automakers. Of course, the premise is to cooperate with OEMs to obtain low-cost models and collaborate with ride-hailing platforms to obtain traffic, thereby building a complete travel ecosystem.

This is also the critical reason why Peng Jun insists that 2025 will be a year of Pony.ai's scale-up.

Currently, the autonomous driving industry has passed the trough of the "technological bubble" and entered the stage of "mass production determines victory." Short-term losses are inevitable for technology companies; only through continuous R&D and ecological cooperation can they occupy a dominant position in the wave of large-scale commercialization.

With policy deregulation, cost reduction, and the expansion of fleet size, the commercial inflection point of Robotaxi may accelerate. Whether Pony.ai can take the lead in implementing a profitable model with its seventh-generation technology will become a key sample for observing the success or failure of China's autonomous driving industry.

-END-