WeRide Reports Doubling Robotaxi Revenue, Accelerates Global Expansion

![]() 05/22 2025

05/22 2025

![]() 506

506

Editor | Zhang Lianyi

As Pony.ai's Robotaxi business surges, how is WeRide faring?

Quite well, actually.

On May 21, autonomous driving company WeRide released its financial report, revealing revenue of 72.4 million yuan (about 10 million USD) for the first quarter of 2025, a slight increase of 1.8% from the 71.2 million yuan reported in the same period last year.

Following Pony.ai's footsteps, WeRide's Robotaxi business witnessed the fastest growth in the first quarter of 2025, with revenue reaching 16.1 million yuan. This significantly increased its share of total revenue to 22.3%, up from 11.9% in the same period of 2024, representing a jump of 10.4 percentage points.

However, unlike Pony.ai's focus on the "China market priority," WeRide has a more international outlook.

"Our collaboration with Uber will expand to 15 new cities, confirming a clear judgment: large-scale deployment of Robotaxi is no longer a theoretical assumption but a commercially viable reality," noted Han Xu, founder and CEO of WeRide. "Currently, we have over 1,200 autonomous vehicles operating on the roads, with fully unmanned commercial operations fully rolled out, allowing global users to enjoy autonomous driving services in a more convenient and economical manner."

During the financial report conference call, WeRide also indicated that Robotaxi deployment strategies will differ between domestic and international markets. In China, deployment in first-tier cities will gradually increase; abroad, further deployments will primarily be through collaborations with local authorities and enterprises.

Simultaneously, WeRide announced that its board of directors has authorized the repurchase of up to $100 million worth of shares within the next 12 months.

01

Revenue Growth Amid Persistent Losses: Commercialization Challenges Remain

Despite the revenue increase, similar to Pony.ai, WeRide is still unprofitable.

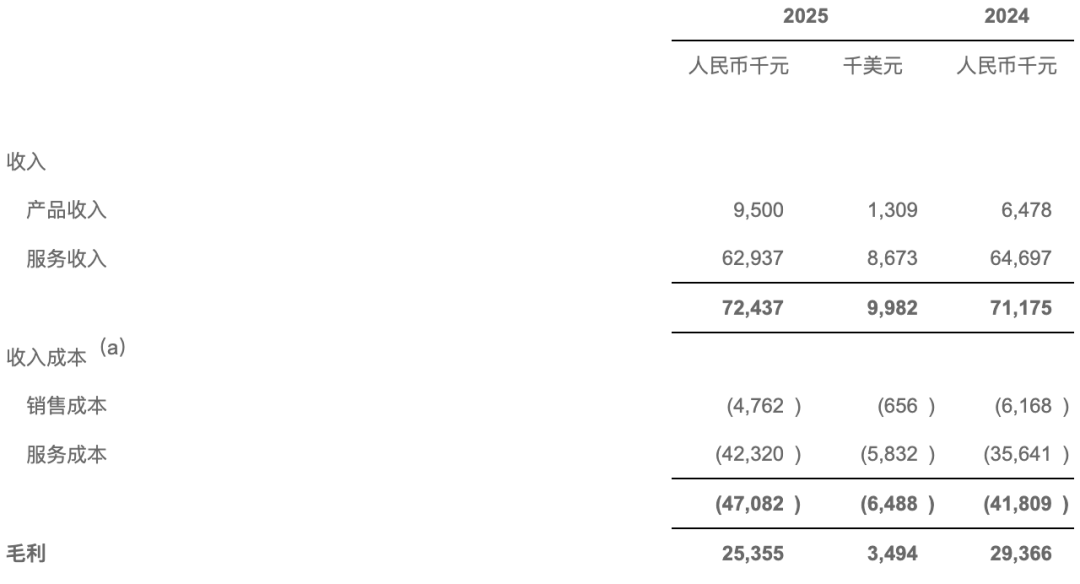

The financial report shows that WeRide's revenue for the first quarter of 2025 was 72.4 million yuan, primarily sourced from two major business segments: hardware product sales (including Robobus, Robotaxi, and unmanned sweeping vehicles, as well as related sensor kits) and service sales (comprising revenue from L4 autonomous driving operation services and ADAS software solutions).

WeRide's Business Financial Performance for the First Quarter of 2025

Among them, product revenue increased from 6.5 million yuan in the same period of 2024 to 9.5 million yuan, primarily due to increased sales of autonomous taxis and autonomous sweeping vehicles in the first quarter of 2025, partially offset by a decline in autonomous bus sales.

Service revenue decreased from 64.7 million yuan in the same period of 2024 to 62.9 million yuan, mainly due to the completion of customized R&D services for certain customers in the third quarter of 2024, resulting in a 33.5 million yuan decrease in ADAS R&D service revenue. However, smart data service revenue, which began in the second half of 2024, increased by 29.8 million yuan, and with more technical support services entering the operational stage, operation and technical support service revenue increased by 1.9 million yuan.

The gross margin for the first quarter of 2025 was 35%. Among them, product gross profit was 4.7 million yuan, with a gross margin of 49.9%; service gross profit was 20.6 million yuan, with a gross margin of 32.8%.

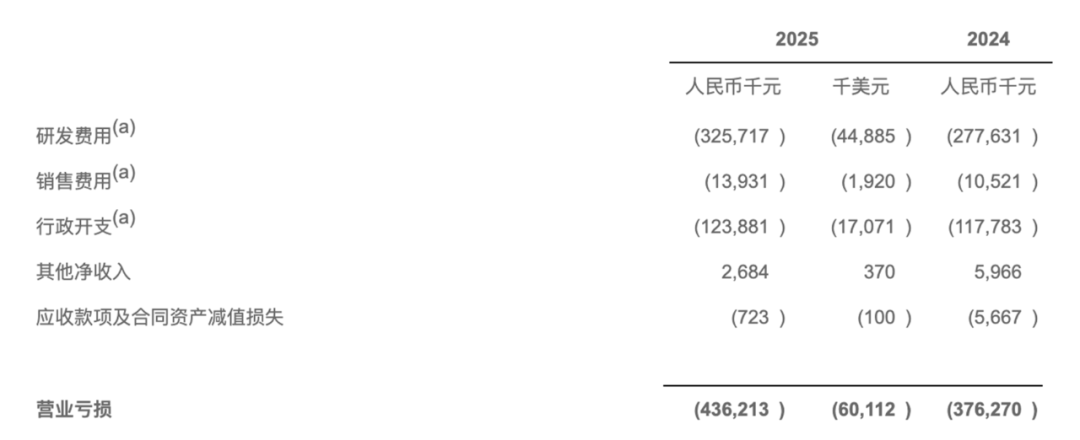

While revenue grows, WeRide's operating expenses are also increasing.

In the first quarter of 2025, WeRide's operating expenses amounted to 463.5 million yuan, compared to 405.9 million yuan in the same period of 2024.

R&D expenses, the largest expenditure, reached 325.7 million yuan, compared to 277.6 million yuan in the same period last year. Excluding share-based compensation expenses, R&D expenses were 278 million yuan, a 54.0% increase from 180.5 million yuan in the same period last year.

WeRide attributed the significant increase in R&D expenses to three factors: increased personnel-related expenses of 60.9 million yuan due to an increase in the number of employees and average wages; increased professional service fees of 20.2 million yuan for the development of autonomous driving domain controllers; and increased material consumption and asset depreciation and amortization expenses of 12 million yuan.

WeRide's Operating Expenses for the First Quarter of 2025

Combining revenue and expenses, WeRide remains in a loss state.

In the first quarter of 2025, WeRide's net loss was 385.1 million yuan, compared to 468.1 million yuan in the same period of 2024; the adjusted net loss under non-IFRS was 294.6 million yuan, compared to 141.5 million yuan in the same period of 2024.

As a result, WeRide's total cash and cash equivalents and time deposits have decreased, from 4.8884 billion yuan at the end of last year to 4.4285 billion yuan in the first quarter of this year, with financial assets measured at fair value through profit or loss of 1.7477 billion yuan and restricted cash of 14.7 million yuan.

Despite sufficient capital reserves, increasing revenue and achieving profitability remain challenges that WeRide needs to overcome.

02

Robotaxi Flourishes Domestically and Internationally with Potential for Further Cost Reduction

WeRide's business scope is extensive, and after successfully listing on Nasdaq, it has been labeled as the "first global general autonomous driving stock" by the outside world.

From high-level autonomous driving to high-level intelligent driving assistance, from Robotaxi to unmanned sweeping vehicles, WeRide relies on its general autonomous driving technology platform, WeRide One, to design autonomous driving services for urban-centric, all-weather conditions.

Robotaxi was the first scenario for WeRide to enter the autonomous driving industry. In 2019, WeRide launched the country's first Robotaxi fleet in Guangzhou, officially starting operation services, and began unmanned testing in 2020. In the following two years, WeRide began producing commercial Robotaxi and preparing for large-scale commercialization.

In the first quarter of this year, WeRide's Robotaxi made rapid progress.

The financial report shows that as of the first quarter of 2025, WeRide's fleet size has increased to over 1,200 vehicles, with a cumulative public operation time of over 2,000 days, and no regulatory penalties have been received due to autonomous driving system failures.

Under this circumstance, the Robotaxi business grew the fastest, with revenue of 16.1 million yuan in the first quarter of this year, increasing its share of total revenue to 22.3%, up 10.4 percentage points from 11.9% in the same period of 2024.

Currently, this business is continuously advancing, showing a flourishing situation both domestically and internationally.

Domestically, since the beginning of this year, WeRide has primarily accelerated its layout in its headquarters in Guangzhou, expanding Robotaxi commercial operations to more core areas of the city.

In May 2025, WeRide introduced eight pilot operation routes for Robotaxi autonomous taxis in downtown Guangzhou, constructing a 24-hour autonomous ride-hailing network covering major landmark buildings in Guangzhou such as Guangzhou Tower, Canton Fair Exhibition Hall, Garden Hotel, and Zhujiang New Town, as well as transportation hubs like Guangzhou Baiyun International Airport and Guangzhou South Railway Station.

Abroad, there have been more actions.

In April, WeRide announced that it would integrate its autonomous taxis into Dubai's public transportation system through the Dubai Roads and Transport Authority (RTA) and Uber. This collaboration will also explore data insights, safety protocols, and regulatory frameworks to support the construction of Dubai's urban autonomous driving blueprint.

In May, WeRide announced the further expansion of its strategic partnership with Uber, which will cover an additional 15 cities within the next five years. In these cities, WeRide's Robotaxi services will be available through the Uber app, with Uber responsible for fleet operations.

As part of the expanded collaboration, Uber has committed to increasing its investment in WeRide by 100 million USD on top of its existing investment. It is expected that this investment will be redeemed early by WeRide and completed in the second half of 2025.

Also in May, WeRide signed an expanded strategic collaboration agreement with Tencent Cloud to support WeRide's autonomous driving R&D, Robotaxi commercialization, and international market expansion.

As part of the collaboration, the two parties will explore the commercialization of L4 autonomous driving Robotaxi. WeRide's Robotaxi services will be integrated into platforms such as Tencent Smart Transportation WeChat Mini Program, bringing users a safer, more convenient, and more comfortable new autonomous driving travel experience.

It is foreseeable that, similar to Pony.ai, accelerating the large-scale deployment of Robotaxi will also be a key focus for WeRide in the future. Of course, policies and regulations, technical reliability, and cost control remain key challenges.

During the financial report interview session, WeRide also shared its thoughts on vehicle costs. Currently, it has achieved the ability to share 90% of components across different products and continuously reduces costs through technical means, expecting the cost of the next generation of Robotaxi to be reduced by 20%-30%.

03

Multi-Scenario Approach Drives Successive Advancement of Multiple Business Lines

In addition to Robotaxi, WeRide's other businesses have also made varying degrees of progress.

Among them, Robobus is also advancing in both domestic and international markets.

Abroad, in March this year, WeRide's Robobus obtained a trial operation permit in France, becoming the first and, to date, the only autonomous driving company with operating permits for its products in five countries: China, the United Arab Emirates, Singapore, France, and the United States.

Domestically, in May, WeRide officially launched a commercial service for L4 autonomous driving toll buses in downtown Guangzhou. The project covers a total length of 13.6 kilometers, with a one-way operating duration of approximately 55 minutes, connecting major landmark buildings in Guangzhou.

In terms of unmanned logistics delivery vehicles, in early 2021, WeRide fully acquired autonomous driving freight company Muyue Technology. A few months later, it launched China's first L4 autonomous driving van (Robovan), collaborating upstream with JMC Motor and downstream with Zhongtong Express for scenarios.

In February this year, WeRide released the Robovan W5. In April, the new vehicle obtained the first batch of unmanned road test licenses in Nansha District, Guangzhou, authorized to conduct unmanned testing on public roads.

In terms of unmanned sweeping vehicles, the service scope has covered multiple Chinese cities such as Guangzhou, Dongguan, Zhengzhou, and Erdos. In the first quarter of 2025, especially in Guangzhou and Dongguan, its operation scope has expanded to more areas beyond the original service areas from last year. WeRide expects to sign deployment agreements in more cities in Hebei, Sichuan, and Jiangsu provinces in the second quarter of 2025.

Additionally, in May this year, WeRide's small unmanned sweeping vehicle, WeRide S1, also began trial operations in Jurong Lake Gardens, Singapore.

As for the high-level intelligent assisted driving business for passenger vehicles, WeRide has not updated more news on business landing. However, in April this year, WeRide announced a collaboration with QNX, a subsidiary of BlackBerry. The two companies will work together to help global OEMs and suppliers accelerate the development and deployment of software-defined vehicles (SDVs).

Han Xu also pointed out that the company is advancing end-to-end mass-market ADAS solutions to bring real value to today's OEMs.

Overall, WeRide's logic for autonomous driving implementation is based on the general autonomous driving technology platform, WeRide One. After completing basic technical verification in the most difficult scenario (Robotaxi), it uses a set of underlying technologies, from difficult to easy, from high-speed to low-speed, from large to small scenarios, and from unmanned to manned services, gradually landing. In the second half of this year, WeRide will further upgrade its computing platform.

As the business continues to expand, competition will also become more intense.

In response, Han Xu stated that technology, proven business models, reliability records, and partner networks are the four pillars of WeRide.

"Competition is everywhere. If you fear competition, you are not qualified to be a leading company. We welcome competition as long as the winner can bring the best service quality and the most reliable unmanned driving services to all ordinary people."

-END-