"AI Laggards Alliance" seeks to change fate

![]() 06/12 2025

06/12 2025

![]() 552

552

Editor|Yang Xuran

Current AI applications are like Korean idol groups, with new faces emerging constantly—before their faces are even recognized, new versions are released, followed by a flurry of publicity. The result is often a sense that their works and abilities do not match their popularity.

Meanwhile, most of the AI pioneers who debuted a decade ago are facing issues such as risks in technology paths, difficulties in transformation, and a lack of continued support from investors, falling behind by one or more tiers.

These two types of enterprises can share a common name: AI Laggards Alliance.

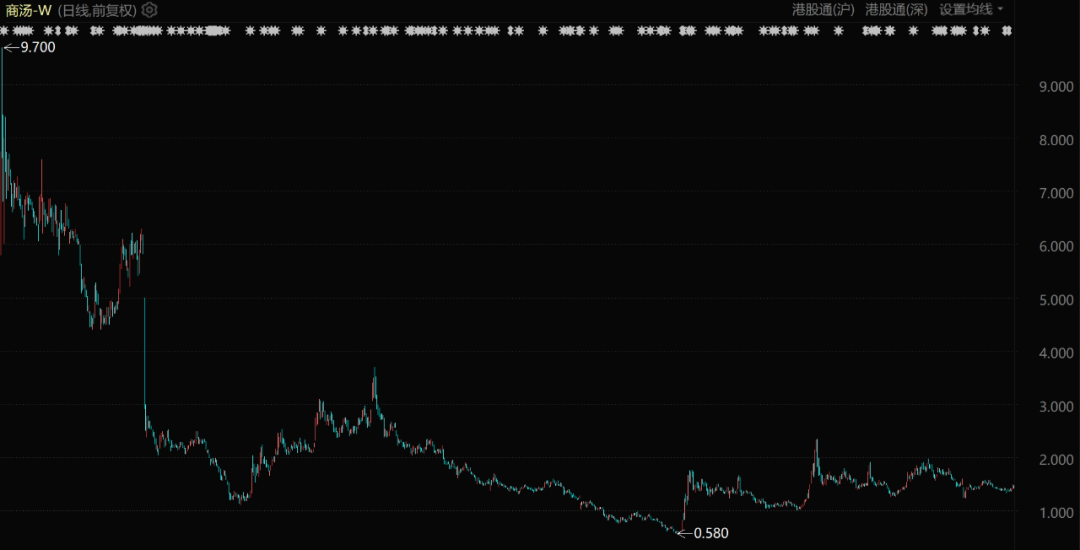

Taking SenseTime, once a leading enterprise in the industry, as an example, when it went public in Hong Kong in 2021, it was the world's most highly valued AI unicorn. However, its share price has been deeply declining since 2022. Currently, its market value has evaporated by more than HK$300 billion compared to its peak.

SenseTime's share price performance (from 2022 to present)

The departure of its founding team is even more lamentable. Mr. Tang Xiaou, known for his strong research capabilities and as a pioneer in face recognition technology, passed away suddenly in 2023. Co-founder Xu Bing also officially announced his resignation as Executive Director and Secretary of the Board before this year's Dragon Boat Festival, taking on the role of head of the AI chip business.

SenseTime emphasized in its announcement that this position adjustment is part of the company's overall talent deployment and business focus. To some extent, it can also be understood that the core technology of the AI 1.0 era cannot lead the 2.0 era.

To successfully transition, SenseTime has demonstrated its determination to start again.

There are many AI pioneers like SenseTime striving to surge into the 2.0 era. Of course, this also includes some newcomers who have quickly become the former wave.

This article is an in-depth value piece from the content team at "Great Waves". Welcome to follow us on multiple platforms.

Transformation

Perhaps the most notable event of the entire AI 1.0 era was in 2016, when AlphaGo defeated Lee Sedol, a top Korean Go player. However, compared to the deep learning technology behind AlphaGo, Chinese AI startups of the same era mainly bet on computer vision technology (CV).

The so-called computer vision (CV) technology mainly refers to face recognition and image detection technology. This track gave birth to the famous AI Four Little Dragons, namely SenseTime, CloudWalk, Megvii, and Yitu.

The reason why computer vision technology became the earliest sub-track to achieve breakthroughs in the AI 1.0 era was the result of the combined effects of technological maturity, clarity of application scenarios, data and hardware support, and market demand.

The founding teams of enterprises such as SenseTime and Megvii mostly came from top academic institutions such as The Chinese University of Hong Kong and Tsinghua University, capable of writing cutting-edge academic papers. The concentrated emergence of scientist entrepreneurs greatly shortened the transformation cycle from the laboratory to industrialization, creating conditions for the rapid growth of enterprises.

11 years ago, Face++, a face recognition system launched by Megvii in 2014, achieved an accuracy rate of 99.5%, far exceeding traditional methods. This technological breakthrough directly drove the willingness to pay in industries such as security and finance, forming the commercial foundation for the early landing of artificial intelligence technology.

China's vast application scenarios also provided unique data advantages for computer vision enterprises. SenseTime obtained traffic monitoring data through cooperation with the government, while CloudWalk accumulated financial scenario samples relying on bank clients, further upgrading their core technologies.

The AI Four Little Dragons developed very rapidly at that time and became big stars in the capital market.

But all this splendor was built on two most important assumptions: technological leadership would inevitably translate into commercial advantages, and government support would continuously create demand. After 2020, both of these assumptions were overturned.

In terms of policy, China's AI strategy shifted towards application implementation after 2020. The shift in policy focus made business models that relied solely on policy support unsustainable.

Changes in this national-level strategy will largely determine investors' investment decisions. Simply put, investors are unwilling to provide unlimited ammunition to the AI Four Little Dragons, allowing them to continue burning money on research and development while ignoring losses. In the later stages, the market began to scrutinize the financial status of the AI Four Little Dragons with a magnifying glass and hoped that their products could generate actual business and cash flow in various industries.

Taking SenseTime as an example, although its revenue in 2024 reached 3.772 billion yuan, achieving a year-on-year increase of 10.8%, it was still 19.7% lower than the historical peak of 4.7 billion yuan in 2021. In 2024, the net loss was 4.278 billion yuan, equivalent to burning 11.72 million yuan per day. Although the loss narrowed by 33.7% compared to 6.43 billion yuan in 2023, the absolute value still exceeded the annual revenue.

Under financial pressure, human resource costs eventually became an unavoidable problem for the AI Four Little Dragons: Since 2021, SenseTime's total number of employees has been reduced from 6,113 to 4,672, with non-core businesses being cut; CloudWalk implemented a 20% pay cut for all employees last year, and this year, the core technical team left; Yitu Technology's layoff rate even reached a staggering 70%.

After ChatGPT ushered in the AI 2.0 era with a completely different technological path, technological transformation, especially proving to the market that they have the ability to enter the 2.0 era, has become the most important task for the AI Four Little Dragons.

Changing fate

Compared with the AI 1.0 era, the most significant feature of the 2.0 era is the rise of large-scale pre-trained models. These models acquire general language and image understanding abilities through pre-training on massive data and can then adapt to various specific tasks through fine-tuning.

The emergence of ChatGPT marks a fundamental shift in artificial intelligence technology. Artificial intelligence in the 2.0 era seems to be the type of artificial intelligence that society truly needs for progress. The fundamental differences in technical architecture between AI 1.0 and AI 2.0 directly lead to huge distinctions in application scenarios and commercial value between the two.

Liang Wenfeng changed the landscape of China's AI industry

Taking the Fourth Paradigm as an example, this company was doing machine learning platforms a decade ago and has now transformed into an Agent service provider. This business iteration itself illustrates changes in industry trends.

The so-called AI Agent refers to an intelligent agent that can actively perceive the environment, plan goals, and use tools to perform tasks. To put it simply and vividly, it is the enterprise's "digital employee." This model is quite effective in the commercialization of vertical fields.

Because vertical fields usually have clear business processes and standardized requirements, AI Agents can be deeply optimized for these fixed scenarios. Moreover, the accumulated industry-specific data, such as financial transaction records and medical imaging data, can be easily replicated into process optimization for other enterprises in the same vertical category.

Therefore, the Fourth Paradigm clearly proposed a dual-core architecture of "Agents handling communication needs, and world models solving vertical problems," allowing this new Agent business to support the old Prophet platform business.

Recently, the Fourth Paradigm released an AI Agent solution for the medical industry, providing medical institutions with a comprehensive intelligent upgrade from diagnostic services to operational management through the "AI Agent + Medical Industry Model." As a result, the company's share price fluctuated, rising by more than 4% on June 4 and surging by 9.79% on June 9.

Dai Wenyuan, founder of the Fourth Paradigm

AISpeech follows a similar model, finding gaps for its survival among a group of competitors with large factory backgrounds and general large models through vertical fields. However, compared to the "software route" taken by the Fourth Paradigm, AISpeech takes the "hardware route."

AISpeech's hardware products mainly include AI voice chips, AI modules, AI terminals, etc., widely used in intelligent automobiles, smart homes, consumer electronics, and other fields. As of 2024, the annual shipment volume of AISpeech's self-developed AI chips has exceeded 20 million, with 160 million new IoT devices added.

It is not easy for a startup to achieve this result. However, during AISpeech's first attempt at an IPO, the Listing Review Committee of the Shanghai Stock Exchange still questioned whether AISpeech's core technology possessed sufficient hard technology attributes and whether its differentiated advantages in market competition were effective during the deliberation process.

This doubt actually applies to all AI startups that can only survive in vertical scenarios. After all, once general large models are completely successful, AI companies in vertical fields will face issues such as the collapse of technological barriers and lowered growth ceilings.

In the 2.0 era, the capital market does not leave much time for everyone to prove their profitability and operational sustainability.

Attempts

SenseTime is very clear that as a "relic" of the 1.0 era, it needs to prove to the market that it has the ability to enter the multimodal arena to continue moving forward in the 2.0 era.

Computing power has become the foundation of all these plans. SenseTime's AI supercomputing facility has built an AI-native cloud computing power infrastructure for large model training and inference. Its Shanghai Lingang AIDC was officially launched in January 2022 with a peak computing power of 9400P, making it one of Asia's largest AI computing centers.

At the same time, SenseTime is continuously iterating its large models. Since the release of version 1.0 of its "RRI Large Model" in April 2023, it has now been updated to version 6 and is recognized by the authoritative large model evaluation institution SuperCLUE as being in the first tier of domestic large models.

However, looking at the names of other major companies on this list, it is clearly not easy for SenseTime to maintain its technological advantages and strive for commercial advantages.

Taking Tencent as an example, it originally did not stand out in the competition for self-developed large models. However, by seizing the technological dividend of DeepSeek's open source, combined with its Tencent Cloud and WeChat, it successfully achieved a commercial turnaround.

One piece of evidence is that access to DeepSeek increased the active users of Tencent's original business. As of March 31, 2025, the number of monthly active accounts on WeChat reached 1,402 million, an increase from 1,385 million as of December 31, 2024.

Tencent emphasized multiple times in its Q4 2024 and Q1 2025 financial reports that continued investment in AI technology will bring long-term growth momentum to the company.

The most serious profitability issues plaguing AI startups like SenseTime are far from life-threatening in front of large companies like Tencent. Relying on their human and financial resources, traffic inlets, business ecosystems, and the east wind of open-source AI technology, these large companies can reach heights that pure AI startups can never attain.

This point is probably also deeply felt by the "predecessors" of the AI 2.0 era, the Dark Side of the Moon.

Open-source models such as DeepSeek-R1 perform on par with GPT-4 and provide free open APIs, directly weakening Kimi's technical barriers for long texts. Large companies integrate open-source models to optimize their products—including Alibaba, the "investor" behind the Dark Side of the Moon, which can achieve high performance at a lower cost, leading to the loss of Kimi's differentiated advantages.

As a result, the Dark Side of the Moon also quickly faced questions about its return on investment and future profitability from the market. Compared to the AI Four Little Dragons, the current predicament of the Dark Side of the Moon essentially has many similarities. Therefore, the Dark Side of the Moon is also striving to prove its progress in the multimodal field.

Yang Zhilin, founder of the Dark Side of the Moon, recently told the media that multimodal is the company's current continuous focus of investment. After seeing the multimodal capabilities of GPT-4o released by OpenAI, for the Dark Side of the Moon, "it may explore some different paths to adapt to the practices of the market and users."

Yang Zhilin, founder of the Dark Side of the Moon

Yang Zhilin, founder of the Dark Side of the Moon

The so-called multimodal refers to the technical paradigm where artificial intelligence systems integrate multiple perceptual modalities (such as text, images, audio, video, etc.) for comprehensive understanding and generation.

Because it involves multiple perceptual modalities, the market is still full of confusion and disagreements regarding who will succeed and in what product form. Moreover, both input and output are numbers that are difficult to predict.

Just like Megvii, which failed to complete its IPO in the 1.0 era, it is promoting the integration of its multimodal large model with the Kirin AI PC operating system to respond to the country's information innovation policies, while also collaborating with Geely to place a heavy bet on high-level intelligent driving. Ultimately, it is because the path to successful commercialization is uncertain, so they can only try as many approaches as possible.