Soaring Robot Stock Doubles in Two Months: Who's Betting Big?

![]() 06/19 2025

06/19 2025

![]() 563

563

This article is based on public information and intended for informational purposes only, not constituting investment advice.

Since March this year, the humanoid robot sector has entered a phase of adjustment, with market focus shifting towards "new consumption." Despite this broader decline, certain leading stocks have defied the trend, with Siling shares standing out as a prime example.

In early April, Siling shares dipped below the 50 yuan mark alongside the overall market correction. However, within just two months, it not only recovered but continued to set new highs, achieving a maximum increase of over 140%.

Chart: Siling shares price K-line, Source: Wind

Notably, despite significant negative news such as major shareholders reducing their holdings, Siling shares have remained resilient, whereas a significant proportion of robot concept stocks have retreated to their April 9th lows. This raises questions about the market's enthusiasm behind Siling shares.

01

The Enigma of Public Fund Holdings

Headquartered in Xinchang, Zhejiang—known as the "hometown of bearings"—Siling shares boasts a geographical label that merits attention. This region has historically been a hotbed for dark horses and bull stocks in the humanoid robot sector, with notable names like Changsheng Bearing, Shuanglin Co., Zhejiang Rongtai, and Meili Technology originating from the same province.

The company's main products encompass hub bearings, tapered bearings, and clutch bearings, among others, with brake system bearings accounting for nearly 80% of its offerings, primarily serving the automotive bearing aftermarket. In 2017 and 2019, Siling shares acquired Youlian Bearing and Kaiyuan Bearing, respectively, enabling its entry into overseas markets and successfully expanding its international customer base, including NAPA and Federal-Mogul. As a result, the proportion of overseas revenue has steadily increased from 40% in 2018 to nearly 70% in 2024.

With a significant proportion of overseas business, Siling shares faces potential operational risks amid the current anti-globalization sentiment and Sino-US competition. However, the company established a factory in Thailand in 2019, which helps mitigate the negative impacts of tariffs to some extent.

Over a longer timeframe, Siling shares' performance growth has been impressive. From 2019 to 2024, revenue and net profit attributable to shareholders increased at rates of 20% and 50%, respectively. In the first quarter of this year, the company reported revenue of 200 million yuan, up 19.8% year-on-year, and net profit attributable to shareholders of 50 million yuan, down 1.2% year-on-year. However, after deducting non-recurring gains and losses, net profit attributable to shareholders was 43 million yuan, up 11% year-on-year.

In terms of profitability, there has been a notable improvement. From 2019 to Q1 2025, the gross profit margin has increased from 24% to 33%. This can be attributed to two factors: firstly, the overseas aftermarket (AM) and original equipment manufacturer (OEM) markets serve different customer segments, resulting in significant differences in production line organization, order acquisition, and profit models. The gross profit margin of the AM market is significantly higher than that of the OEM market. Secondly, multiple mergers and acquisitions have enabled the company to enter the supply chains of overseas automotive giants like Tesla, increasing the proportion of revenue from high-priced hub bearing units. Coupled with the decline in prices of important raw materials like steel, these factors have jointly driven the overall gross profit margin upwards.

Compared to the gross profit margin, Siling shares' net profit margin has seen even greater improvement, rising significantly from 8% to 23.8% over the same period. The three-fee rate (sales, management, and financial expenses) has dropped from 15% to 6.8%, indicating strong internal management and cost control. This net profit margin level ranks tenth among 255 listed automotive parts companies, surpassing peers with relatively monopolistic market positions such as Fuyao Glass (20.5%) and Zhejiang Rongtai (22%).

Generally speaking, the higher the absolute values of gross profit margin and net profit margin, the stronger the barriers to the main business, and the more capable the enterprise is of avoiding low-price internal competition. The capital market is also more inclined to give such enterprises higher valuations. From this perspective, even if the expectations for the humanoid robot business are set aside, Siling shares' valuation should inherently be higher than that of ordinary automotive parts enterprises.

Overall, Siling shares' main automotive parts business demonstrates good growth potential and strong profitability, which forms the core logic behind institutional heavy holdings.

According to Wind statistics, as of the first quarter of this year, the holding ratio of public funds reached 12.7%, an increase of 7.3% from the previous quarter. This increase in holdings ranks second only to robot companies such as Zhejiang Rongtai, Zhenyu Technology, Huachen Equipment, Zhongdade, and Longsheng Technology.

The high proportion of institutional holdings is also one of the key factors behind the stock price explosion in April.

02

Rapid Progress in Robot Business

Siling shares' ability to defy the trend is not solely due to the support of its main business but also to the substantial progress made in its humanoid robot business.

In 2023, Siling shares officially established a research and development team and initiated pre-research on three core components: harmonic reducers, planetary roller screws, and actuator modules. This early layout reflects the company management's forward-looking judgment on industry trends.

In April 2024, the company formally established the Robot Components Business Department and plans to invest 117 million yuan to build a robot components production base, covering products such as harmonic reducers, actuator modules, ball screws, and planetary roller screws.

In the field of screws, the technical barriers are considered the highest among humanoid robot components, and the cost of a single unit accounts for the largest proportion. Currently, Siling shares has completed the development of the first sample of the planetary roller screw and indirectly entered Tesla's supply chain through its Tier 1 supplier, Top Group.

In the field of actuator modules, the mechanical transmission components are independently researched, designed, and developed by the company, while the motor components are jointly developed with cooperating enterprises. Notably, the linear actuator, as a component assembly module, includes a frameless torque motor, roller screw, torque sensor, encoder, bearing, etc., accounting for 22.8% of the total cost of the Optimus robot.

Currently, there are few publicly announced enterprises with actuator module research and development capabilities. Besides Siling shares, only a handful of companies, such as Zhenyu Technology, as well as automotive assembler-originated Top Group and Sanhua Intelligent Controls, possess such capabilities.

In the field of harmonic reducers, there is a significant expectation gap. According to institutional research and market information, Siling shares has solved the two major technical difficulties of noise control and automated assembly of harmonic reducers. However, the veracity of these claims still needs to be verified through subsequent practice.

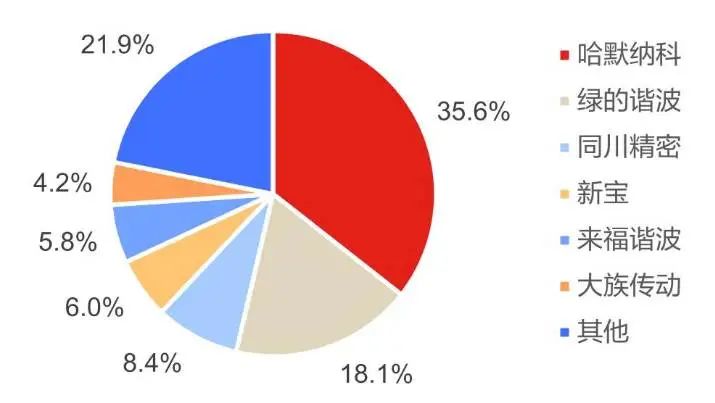

If this progress is confirmed, it will break the long-standing monopoly of Harmonic Drive of Japan—in the global harmonic reducer market in 2023, Harmonic Drive accounted for 80%, while Green Harmonic only accounted for 8%; in the domestic market, Harmonic Drive accounted for 35.6% and Green Harmonic accounted for 18.1% in the first half of 2024.

Chart: China Harmonic Reducer Market Structure in H1 2024, Source: Laimi Data

As a new participant in the harmonic reducer field, Siling shares' breakthrough in a short period of time illustrates two points: firstly, the company's R&D team has high efficiency; secondly, the barriers to entering the harmonic reducer market are not considered insurmountable.

More importantly, becoming a Tier 1 supplier through various resources and technological breakthroughs holds significant meaning. On the one hand, it allows for future collaboration with OEMs in research and development, trial production, and mass production, and OEMs are likely to allocate a larger proportion of humanoid robot orders to Tier 1 suppliers. On the other hand, Tier 1 suppliers are less replaceable, providing stronger certainty for future operations, whereas Tier 2 suppliers face stiffer competition.

Overall, Siling shares is one of the few enterprises in the A-share market that simultaneously deploys screws, harmonic reducers, and actuator modules. While it remains to be seen whether this is mere concept speculation or a result of actual strength, such a concept label has become a clear driving force behind its stock price surge against the trend.

03

Risks That Cannot Be Ignored

After Siling shares' continued surge, it indeed faces certain risks ahead.

The first is the potential downward pressure on the overall market.

The positive signals released during the China-US call on June 6th indicated that tariff and trade issues were evolving towards a resolution. Following the London talks between China-US teams, the market was optimistic about the outcome. With the high-level tone set, current tariff and trade issues are no longer the main contradictions in the market, which means expectations for domestic demand policy stimulus may decrease. This macroeconomic reality is evident in the trends of commodities.

Although the national team's stabilization efforts this year have prevented a sustained downtrend similar to last year, the market still needs to digest valuation pressure—after all, the A-share market is already close to the high levels seen in March this year.

Against this backdrop, A-share trading volume has gradually shrunk, with daily trading volume recently falling below the 1 trillion yuan mark. This scarce liquidity makes it difficult to support a comprehensive strengthening of the humanoid robot sector.

However, the market structure in the short to medium term (within 1 month) may be conducive to the recovery of technology stocks. On the one hand, new consumption and technology are the two main lines competing for market liquidity, creating a seesaw effect. The current easing of tariff issues and weakening expectations for domestic demand stimulus have weakened the logic of continuous speculation in the new consumption sector (the core driving factor for the sector's surge in the past three months was policy expectations).

On the other hand, technology stocks have been adjusting for three months and offer certain cost-effectiveness compared to the new consumption sector in terms of valuation.

Therefore, technology stocks, including humanoid robots, may experience a less smooth rebound but will still be constrained by potential overall market weakness and the continued impact of converging market risk appetite in the coming months.

Secondly, high valuation is the source of stock price volatility risk.

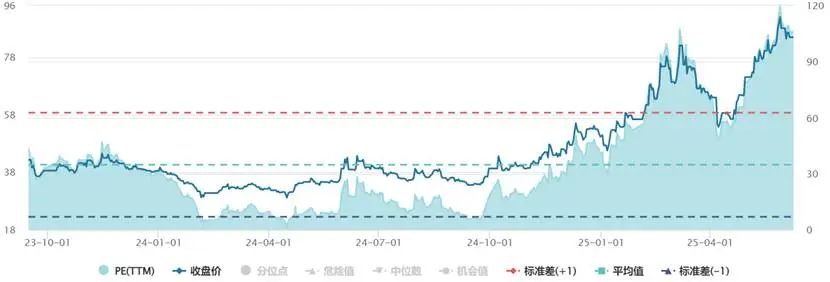

As of June 11th, Siling shares' latest PE ratio was 84 times, the highest level since its listing in 2023. Whether viewed from an absolute value or compared with other robot peers with intensive institutional participation, its valuation level is already high, posing a short-term risk of overvaluation for the robot business.  Chart: Siling shares PE trend chart, Source: Wind

Chart: Siling shares PE trend chart, Source: Wind

Notably, on June 10th, Siling shares announced that its supervisor, Yang Shunjie, intended to reduce his holdings by 0.0376% of the company's shares. Generally, internal share reductions by companies often serve as an early warning sign.

In summary, while Siling shares' automotive parts business still holds growth potential, and its progress in the humanoid robot business offers long-term upside potential, caution should be exercised at present.