A Deep Dive into the "Second Tier" of Internet Companies in China and the US

![]() 06/27 2025

06/27 2025

![]() 827

827

This article, based on publicly available information, aims to facilitate information exchange and does not constitute investment advice.

An intriguing phenomenon in the internet industry: The top company thrives, capturing most revenue and profits, favored by investors, and leading trends for years. Beneath the giants' shadow, second-place companies in various industries tread carefully, carving out unique paths to survive.

Among the diverse business models in the internet industry, no field attracts as many intelligent minds and cutting-edge technologies as online advertising. Both in China and abroad, companies with the highest revenue, market value, and top positions often have advertising as their primary business or derive significant revenue and profits from it.

In this fiercely competitive landscape, the gap between the first and second tiers is stark:

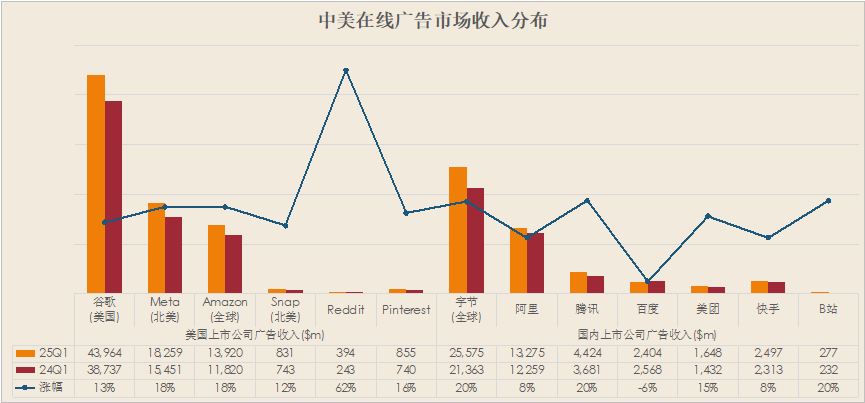

Chart: Revenue distribution of the online advertising market in China and the US. Click to enlarge. Data Source: Company financial reports. ByteDance's 2024 revenue was $15.5 billion, converted to RMB at an exchange rate of 7.2. The advertising revenue share refers to Kuaishou's 55%, calculating quarterly advertising revenue of RMB 153.8 billion. According to reports, ByteDance's 2025 revenue target is $186 billion, with advertising revenue calculated based on a 55% quarterly revenue share. Alibaba's advertising revenue uses domestic e-commerce retail revenue.

Google stands as the indisputable "king," with its advertising revenue accounting for 56% of the total revenue of the six leading US internet companies included in this statistic.

Meta and Amazon are also catching up vigorously. Meta's global revenue is closing in on Google's global online advertising revenue, while Amazon's advertising business has surged from behind, catching up with Meta.

For now, these three can be classified as the first tier. Snapchat, Reddit, and Pinterest automatically fall into the second tier.

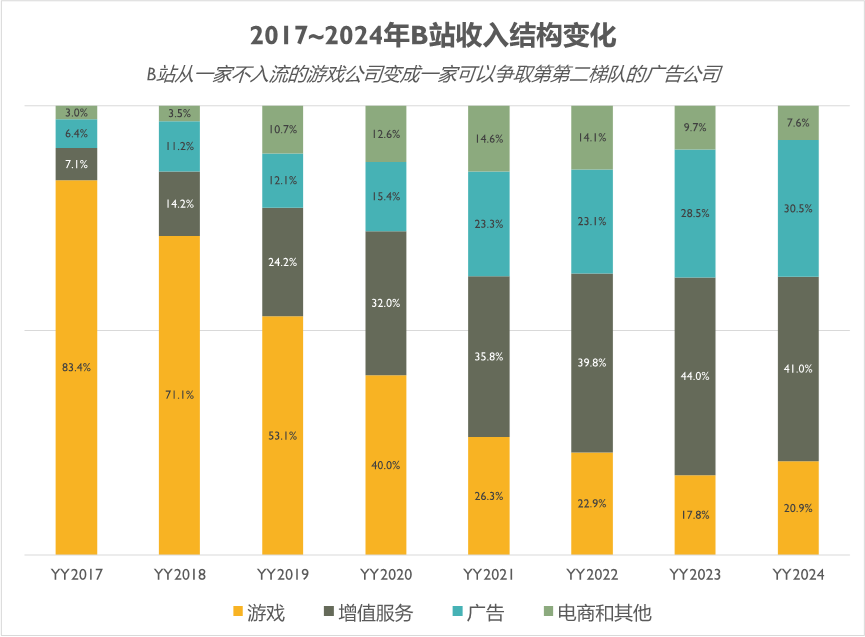

The domestic competitive landscape differs slightly. ByteDance, not yet listed, occasionally discloses its revenue through foreign media. With a business model similar to Kuaishou, relying on advertising and live streaming revenue, ByteDance can be compared with other companies if its advertising revenue share mirrors Kuaishou's.

Our estimates suggest that, while ByteDance's advertising revenue advantage in China is not as pronounced as Google's, it has already surpassed the second and third places. Therefore, ByteDance, Alibaba, and Tencent constitute the first tier, while Baidu, Meituan, and Kuaishou fall into the second tier, with Bilibili in the third tier. If ByteDance is excluded domestically, then Meituan and Bilibili comprise the second tier.

Another interesting observation is that Reddit, with an advertising business volume similar to Bilibili, only generates 2.2% of Meta's revenue, placing it in the second tier. Similarly, Bilibili's revenue is merely 2.1% of Alibaba's (the dominance of first-tier companies in both China and the US makes high comparability challenging).

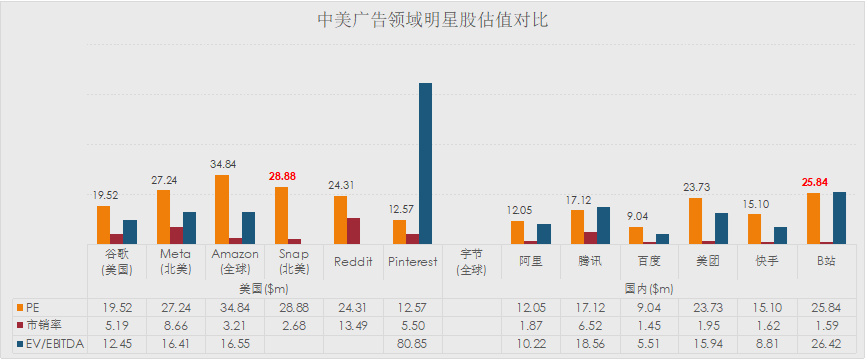

Under the pressure of first-tier companies, the ROI growth models of second-tier companies often fall short. However, many investors remain optimistic about the second tier, evident from their valuation:

Chart: Valuation comparison of star stocks in online advertising in China and the US. Click to enlarge. Data Source: Seekingalpha. Bilibili and Snapchat incurred net losses in the first quarter of 2025, and the PE data represents the forward P/E ratio.

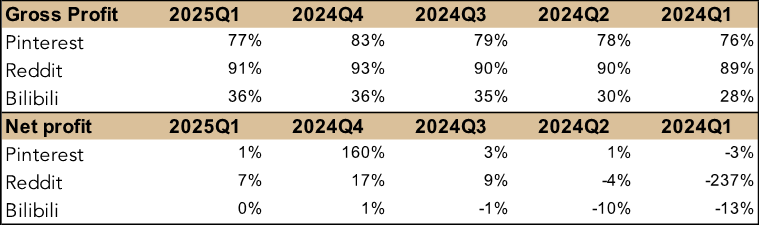

It is evident that some second-tier companies' PE data is on par with that of the first tier, such as Reddit, Snapchat, and Bilibili. By reviewing their financial reports, we find that investors' favor stems from the companies' expectations for new business areas and the accompanying innovation potential.

The market naturally holds high expectations for top companies, typically expecting them to be both leaders and innovators. However, these companies are also cautious about Capex and focus on the input-output ratio.

Conversely, investors and the market have higher expectations for innovation from second-tier companies, with less stringent ROI requirements for such innovation. This provides second-tier companies with more room for business innovation and expansion.

In this study, we selected Reddit and Pinterest from the US and Bilibili from China for observation and analysis. We found that for second-tier companies, technological innovation and platform product iteration are the main drivers of business growth.

Compared to giants, their businesses exhibit greater flexibility, allowing for timely adjustments or even personalization to meet demand. Continuous platform product iteration (also known as continuous trial and error) is more effective in meeting and guiding customer needs, enhancing customer loyalty, and laying the foundation for future revenue growth.

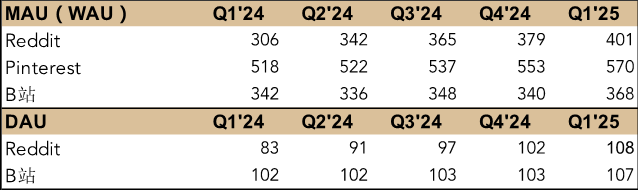

Another reason for choosing these three as observation objects is that they have all performed well over the past two years, making strides in online advertising with similar business models and user volumes—DAU around 100 million and MAU fluctuating between 400-500 million.

Data Source: Company financial reports, Reddit only disclosed WAU.

In advertising, companies like Meta and Google have long educated advertisers to become believers in performance marketing. Reddit, Pinterest, and Bilibili must follow this strategy, but performance marketing hinges on technology and platform size—areas where these three companies lack an advantage. Thus, they continue to explore new models (which may result in losses and revenue/profit shortfalls).

As of the first quarter of 2025, we found that these three companies have adopted synchronized coping strategies:

01 Reddit

Reddit, an internet veteran established in June 2005, turned 20 this year and went public in March 2024. It is truly a slow-growing company.

Since going public, Reddit has faced criticism and even user defections regarding its user experience, but its revenue has skyrocketed:

Total revenue in the first quarter of 2025 was $392 million, a year-on-year increase of 61%, marking the third consecutive quarter with growth exceeding 60%.

Not only did revenue surge, but its high gross margin is enviable. Net profit turned positive in the second quarter of 2024. In terms of user volume, DAU was 108 million, and WAU exceeded 400 million in the first quarter of 2025.

Data Source: Company financial reports.

Reddit's revenue comes almost entirely from advertising (with a small portion from user subscriptions and data licensing): advertising revenue in the first quarter was $359 million, a year-on-year increase of 61%, with performance advertising accounting for about 60% and driving most of the growth. The number of active advertisers increased by over 50% year-on-year.

Various factors drive Reddit's advertising growth, including the conventional increase in the number of advertisers and ad load, both closely tied to the platform's user volume.

Our analysis revealed that, in addition to higher advertising pricing and more vertical industry advertisers, the launch of a new advertising platform fueled by technological upgrades and the improved ROAS resulting from technological optimization are noteworthy:

1. Increased advertising pricing and more vertical industry advertisers are rare for medium-sized advertising platforms

Reddit raises advertising pricing by tapping into more precise and segmented traffic scenarios, such as ads on conversation pages and in comment sections. Comment section ads account for 6% of total impressions, offering a highly contextual traffic scenario where users discuss specific services and products, beneficial for precise ad targeting.

In the first-quarter financial report, management revealed that scaled channels, including mid-market and SMB advertisers, contributed over half of the quarter's revenue growth. Ten out of the top 15 vertical industries grew by over 50% year-on-year (pharmaceuticals, retail, automotive, telecommunications, and finance leading the way).

To compete in this market, at the end of March 2025, Reddit Ads Manager introduced the Campaign Import feature, allowing SMBs to import Meta platform campaign settings to the Reddit advertising platform with one click, simplifying the promotion setup process.

Simultaneously, SMBs can streamline ad parameter management and achieve fast, accurate conversion and tracking through Reddit Pixel's one-click GTM integration.

2. Advertising platform upgrades and technological optimization enhance delivery efficiency

The iterative upgrade of the advertising platform underpins other driving factors, especially for performance advertising. Reddit's current marketing solutions include the Ads Manager advertising platform, the DPA online shopping advertising platform, and the Conversions API (CAPI) conversion attribution tool.

The DPA platform for e-commerce entered beta testing in April 2024 and was officially launched in May 2025.

DPA works by extracting information in real-time from advertisers' product catalogs and intelligently matching products with the most active audiences and relevant conversations, thereby automatically generating personalized advertising experiences. Advertisers can use DPA for prospecting (new users) and remarketing (lost users).

Beta test data shows that the DPA platform significantly improves ROAS compared to traditional delivery methods. Compared to advertising campaigns during the same period, DPA ads achieved an average Return on Advertising Spend (ROAS) increase of over 94% in the first quarter (comparison between different advertisers).

On the DPA platform, advertisers can easily join and build product catalogs containing millions of items, increasing delivery granularity and refining ad targeting.

Technology is crucial for platform iteration and upgrades, with machine learning models now ubiquitous in internet companies. However, in second-tier companies, model improvements seem to exert greater influence.

This financial report mentions that improvements to machine learning models enhance ad targeting and relevance, thereby improving ROAS. In the first quarter of 2025, for advertisers running both DPA and standard conversion ad campaigns, DPA achieved double the ROAS.

Moreover, ML improvements significantly enhance the accuracy of first-party data monitoring, crucial for ad effect attribution. Many performance advertising platforms fail to gain traction due to attribution failures, where effects are not recognized by advertisers.

Reddit is also testing the integration of Smartly, allowing advertisers to plan, create, publish, and measure Reddit DPA ad campaigns directly within the Smartly platform, enabling creative automation, cross-channel insights, and better results at scale. This undoubtedly provides an opportunity to attract "fragmented" advertisers and offer these small advertisers quantifiable delivery results.

02 Pinterest

In the fourth quarter of 2024, Pinterest's advertising revenue surpassed $1 billion for the first time, falling back to $855 million in the first quarter of 2025, a year-on-year increase of 16%. Adjusted EBITDA was $172 million, with an adjusted EBITDA margin of 20%, a year-on-year increase of 300 basis points.

Previously, when describing its marketing effectiveness, Pinterest often emphasized its platform's advantage in the Top funnel. With a vast number of "Pins" (posts), it helps advertisers achieve brand exposure to target groups. However, in an era emphasizing conversion effects, advertisers need both brand exposure and conversions.

Recognizing the shift towards performance marketing, Pinterest first made product-side modifications and officially launched the automated ad buying platform Performance+ in October 2024.

This marketing product uses generative AI to automatically generate ad creatives and automate media buying, reducing the time and cost of creating ad campaigns. As anyone familiar with online advertising knows, advertising involves significant knowledge and experience accumulation in creating promotional activities, which can significantly impact subsequent delivery ROI.

Performance+ stands out by reducing the time and cost of creating ad campaigns while improving the effectiveness of low-funnel ads. It also allows advertisers to optimize bidding based on set ROAS, abandoning the traditional method of simply setting bids based on click-through rates and conversion rates, indirectly overturning the platform's historical Top Funnel advantage.

The commendable self-denying courage of this enterprise is evident. Its Chief Revenue Officer (CRO) disclosed that low-funnel revenue already comprises over 60% of total advertising revenue.

In the latest quarterly financial report, management provided quantitative data showcasing the improvement of Performance+ indicators:

1. 80% of Performance+ ad campaigns outperform traditional ad campaigns;

2. The conversion rate of Performance+ Creative has increased by an average of 14%, while the cost per acquisition (CPA) has decreased by 10%. Performance+ can reduce creation time by up to 50% or more;

3. Advertisers targeting both upper and lower funnels witnessed a near doubling of their click-through rates.

Subsequently, Pinterest introduced a creative generation tool that automatically extracts images and generates new creative visuals, synergizing with Performance+ to further reduce online promotion costs.

For e-commerce advertisers with tens of thousands of SKUs, the utility of this tool in generating ad materials alone is sufficiently attractive.

Our exploration of multiple marketing-related subforums on Reddit revealed that many small advertisers favor this tool. What once required outsourcing for ad materials can now be handled internally, saving costs that can be reallocated to new ad placements.

The CRO described Pinterest's latest marketing vision as such: Pinterest integrates the upper, middle, and lower funnels within a single interface and consumer experience, enabling it to seamlessly connect these stages for both users and advertisers.

Breaking away from traditional strengths to establish new barriers is no easy feat. A D2C marketing executive commented that ROAS on Pinterest is a "long game" because consumers pin items and return to purchase them later. This represents a significant concern among advertisers regarding Pinterest's lower funnel performance. Performance+ needs to showcase more success stories to substantiate its capabilities.

03 Bilibili

Currently, Bilibili faces a pivotal choice: evolve into a stable second-tier advertising platform or a third-tier gaming company, or even lower.

Given Bilibili's current user base, talent, and technology reserves, it's unrealistic for both businesses to rank in the second tier, or even simultaneously in the third tier. Many believe that becoming a lesser version of Tencent should not be the future path for Bilibili, a large platform with the most unique content and user ecology on the Chinese internet.

Data Source: Bilibili Financial Report

Our research shows that Bilibili's marketing solutions already cover a comprehensive range. The "MATES Audience Asset Model" launched in late 2024 filled the gap in "marketing methodology." It currently encompasses the entire marketing chain, from audience and content screening, insights, targeted placement, intelligent placement and bidding tools, website promotion, to post-campaign analysis.

Bilibili's strength lies in its unique content ecosystem and highly engaged young, educated users in first-tier cities. The former fosters many exclusive Bilibili contents and drives user growth through external diffusion; the latter boasts clear user labels, significantly lowering the technical threshold for audience targeting (or audience packs on the marketing side).

Opinions on Bilibili are divided. Some believe it sits on a gold mine of high-quality content that remains unmonetized. Others argue that Bilibili's users are inherently picky, making conversions challenging. These are two typical perspectives.

A more prevalent consensus views the contradiction between Bilibili's fundamental community culture and commercialization as overarching, encompassing the aforementioned difficulties in monetizing content and users.

Bilibili's launch of the "MATES Audience Asset Model" in late 2024 may be an attempt to address this dilemma. Although it's slightly "immature" (switching trust and identification to form the word "mate," which doesn't align with common mental shifts), some advertisers prefer this methodology, especially when combined with Bilibili's content quantitative indicators, allowing clearer quantification of placement effects.

In our view, this model is too "unique" and may only be applicable to Bilibili, making it difficult to compare marketing quantitative data with other platforms. Advertisers can only compare the ROAS effects of different promotion platforms at the final conversion stage.

Currently, in the realm of "performance marketing," Bilibili still lacks confidence, a deficiency that stems from the top. At the executive level, the management team hasn't demonstrated a firm commitment to developing the advertising business – at least we see more enthusiasm and investment in gaming.

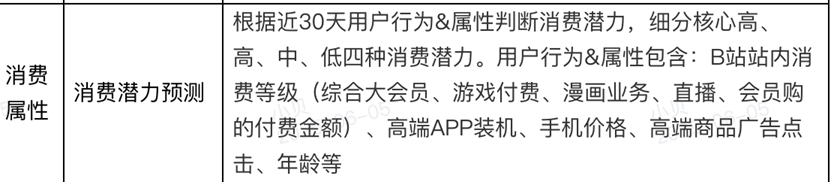

At the middle level, Bilibili's content and user persona tags are too simplistic. For instance, user spending power tags are still determined by conventional methods like "mobile phone brand, model, and price" and the type of content consumed. The rationality of user tag logic impacts the accuracy of audience targeting and audience asset packs, thereby affecting ad placement effectiveness.

At the bottom level, Bilibili lacks technical talent and foundational reserves in the marketing field. Here, insufficient reserves don't imply product bugs that hinder user experience but a lack of purpose for technology-driven products to evolve to a higher level.

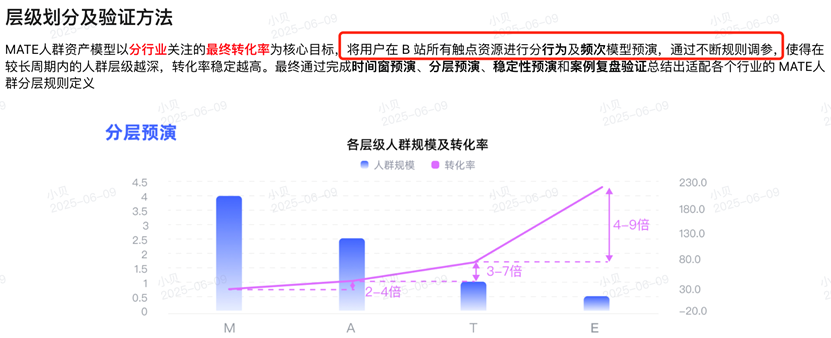

For example, Bilibili's product manual for the newly launched MATES Audience Asset Model mentions, "Pre-enact user behavior and frequency models across all Bilibili touchpoint resources, and through continuous rule adjustments, the deeper the audience tier within a longer period, the more stable the conversion rate will be." This indicates that the audience tier is still segmented based on behavior frequency rather than real intent or behavioral understanding.

This segmentation isn't wrong; it's just not precise enough. Post-large model emergence, user repositioning can now be based on content understanding and audience matching, but currently, Bilibili doesn't seem enthusiastic about such evolution.

It can be argued that Bilibili has never been a technology-strong company. Traditional marketing theories combined with a unique community ecosystem support its current advertising business, but to ascend to the first tier, technology must undergo substantial transformation and innovation.

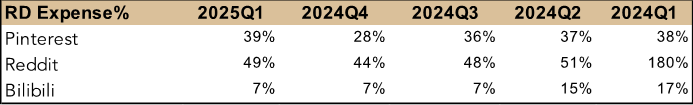

Compared to Pinterest and Reddit, Bilibili's R&D expense ratio is only around 7%. While this reflects the general domestic trend of "cost reduction and efficiency enhancement," it also unveils a lack of purpose for technology-driven goals among management.

Insufficient technology investment directly results in slow product upgrades and transformations. Especially with the rise of large models, many companies have proven this trend feasible for comprehensive advertising technology transformation – both Pinterest and Reddit have model-driven advertising core products, like Reddit's DPA (Dynamic Product Ads) and Pinterest's Performance+, which practically meet user needs and drive ad revenue growth.

However, despite launching its self-developed large model product Index and AI-driven intelligent tool "Insight Agent" in 2024 and 2025, respectively, Bilibili's large model hasn't significantly driven revenue growth. In Q3 2024, management revealed that performance marketing had increased ad revenue but didn't disclose specifics.

Judging from recent quarterly financial reports and management statements, Bilibili's ad revenue relies more on increased ad load and placements due to intensified competition in vertical fields, driven by the marketing coverage expansion brought about by "more mature users," as Chen Rui noted.

Thus far, we haven't clearly seen the team's "spontaneous efforts" to boost ad business revenue.

Considering Bilibili's actions in the ad business analyzed earlier, it's not about a lack of effort but perhaps about choice being more crucial than effort. Whether Bilibili's revered "MATES" marketing methodology will remain effective against ROAS and ROI is a big question mark.

As a second-tier (or perhaps third-tier) advertising platform, Bilibili must recognize this reality: An advertiser's budget allocation on Bilibili may only be a fraction of that on ByteDance or Tencent – an industry basic fact. As Pinterest's Chief Revenue Officer mentioned in a podcast, if brand advertising dominates 30% of the budget on Meta and Google advertising platforms, Pinterest may only receive 3%-15% of that budget.

Only by accumulating enough small percentages can Bilibili amass 10%, 20%, or even 50%. Embracing high-quality products from small and medium-sized advertisers and vertical industries, these small businesses prioritize ROI over marketing theoretical models, content, or audience asset packs. Introducing solutions directly leading to sales is the opportunity for ad revenue to soar again.

04 Common Challenge for the Second Tier: Effect Attribution

This common challenge shares a common backdrop: Advertisers vote with their money.

During Pinterest's earnings call, management acknowledged that a single Performance+ couldn't significantly drive revenue growth and market share gains; it must be combined with measurement tools to propel ad revenue.

No matter how appealing advertising platforms, large models, algorithms, or marketing methodologies are, without tangible ROI, they may ultimately become gimmicks deceiving investors and not sustainable solutions.

Both Chinese and American online advertising landscapes present a "one superpower and many strong players" scenario. To survive, it's crucial to prove to advertisers that one is also competitive in certain areas – the method of localized victories.

These areas require achieving higher ROI than giants, necessitating that each company, while laying a solid foundation, reaches consensus on effect quantification – i.e., effect attribution aligned with giants' quantification methods.

Pinterest and Reddit's approach is to align with giants on their attribution tools and be compatible with industry-standard performance monitoring tools. However, after studying multiple Bilibili marketing materials, we found that Bilibili hasn't yet provided effective attribution tools.

Finally, the emphasis is on AI large models, potentially the industry's biggest technological opportunity:

– In large model technology, the first tier is responsible for creation, while the second tier is responsible for utilization.

Giants like Meta and Google won't easily implement new technologies on a large scale on their advertising platforms. They often rely on vast data and engineering teams to quickly test and adjust through small-traffic A/B testing before promoting. Second-tier companies can leverage the "time difference" to accelerate trial and error and promotion processes to gain opportunities.

And first-tier companies' small-scale test results can be applied on a large scale to second-tier companies. We refer to this characteristic as the "new technology amplification effect."

While the revenue contribution of large models to first-tier companies can't yet be accurately calculated, in second-tier companies, they've proven applicable in upstream and downstream processes like audience targeting, user personas, content understanding, and material generation in performance marketing, significantly reducing placement costs and enhancing ROI.

They possess vast data and engineering teams that can verify new technologies with minimal marginal risk through small traffic volumes and then quickly advance.

Above are our humble opinions on the second tier of the internet industry, hoping to provide insights to the industry and investors.