Chinese Software Titans Battle for Innovation and Global Dominance | JuChao

![]() 09/04 2025

09/04 2025

![]() 640

640

Author | Lao Yu'er

On June 12, 2025, the Chinese enterprise software industry marked a historic milestone: Kingdee International's market value surpassed HK$50.4 billion (approximately RMB 46.1 billion), overtaking its long-time rival UFIDA Network (RMB 45.48 billion) for the first time.

This event has garnered significant attention within the industry, with many viewing it as a pivotal moment in the competitive dynamics between the two titans.

However, shifting our focus beyond the immediate 'win-lose' narrative and examining the broader picture reveals a compelling question: Why do Kingdee and UFIDA consistently stand out, and what drives their remarkable resilience?

Over the past three decades, the relentless competition between UFIDA and Kingdee has fueled continuous innovation, profoundly shaping the landscape of China's enterprise management software industry.

Their 'love-hate relationship' has significantly curtailed the market share of foreign brands in China's enterprise management software market, thereby advancing the management capabilities of numerous Chinese enterprises and securing their commercial data. This sustained and independent growth in such a critical sector is rare in China's technology landscape.

Today, both companies find themselves at another historic juncture: embracing AI transformation and expanding globally.

This article is an in-depth analysis by the content team at JuChao WAVE. Follow us on multiple platforms for more insights.

Unity Amidst Opposition

The case of UFIDA and Kingdee showcases numerous instances of opposition and unity.

From an oppositional standpoint, the two are fierce competitors. This was evident in a recent anecdote: During UFIDA's 2025 Global Business Innovation Conference in Shenzhen from August 15 to 17, industry insiders were greeted by Kingdee's massive advertising banners at the airport. Kingdee 'coincidentally' dominated all prominent advertising spaces, leading to the industry buzz: 'UFIDA holds the conference, Kingdee dominates the screens.'

In fact, the competitive history of UFIDA and Kingdee spans over three decades, mirroring the development of China's software industry. Both began with financial software and have battled fiercely through the ERP and cloud service eras, up to the current era of globalization, with no clear victor yet.

In the capital market, disputes between the two have been persistent. Even their listing timelines seemed like a contest of strength. On February 15, 2001, Kingdee International debuted on the Growth Enterprise Market (GEM) of the Hong Kong Stock Exchange, becoming the first mainland private software enterprise to list on the GEM. Just three months later, on May 18, 2001, UFIDA Network listed on the main board of the Shanghai Stock Exchange, making Wang Wenjing the 'richest software tycoon in China' at the time.

Since then, the market value gap between the two has remained narrow, making it difficult to determine a definitive winner.

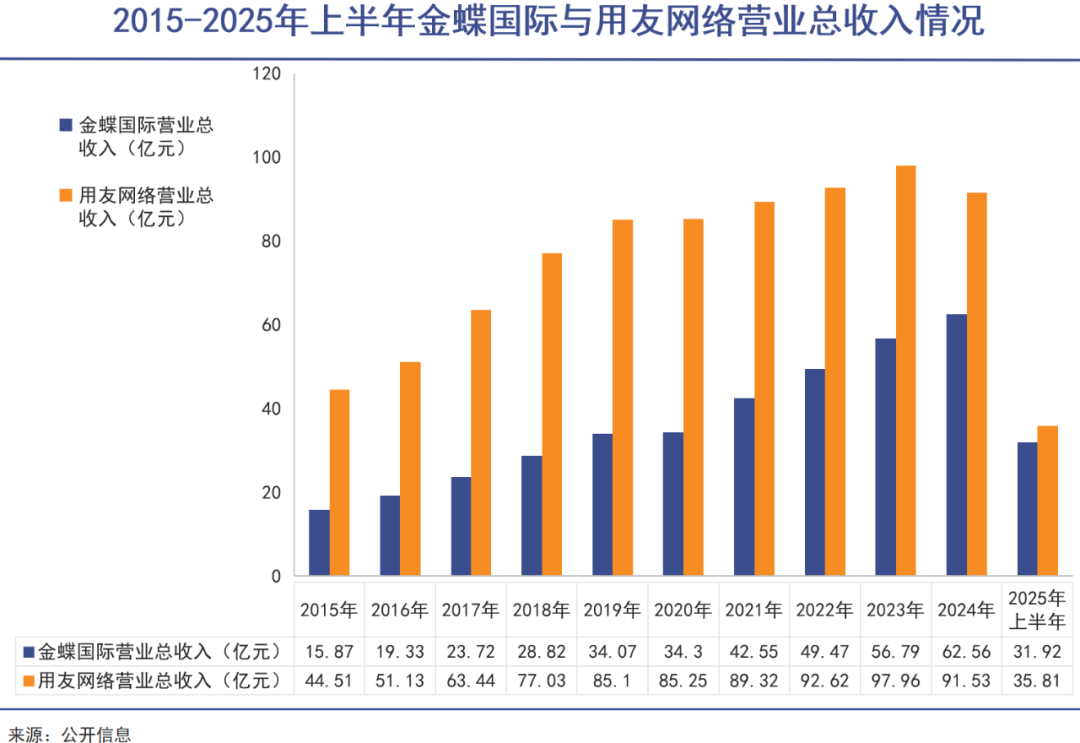

Overall, UFIDA leads in total business scale due to its dominance in large enterprise customers. As of the end of the first half of 2025, UFIDA Network's revenue was RMB 3.58 billion, with RMB 2.318 billion from large enterprise customers. It has signed 46 tier-one central enterprises and served 382 Fortune 500 clients, accounting for 76.4% of its revenue. During the same period, Kingdee's revenue was approximately RMB 3.192 billion, with its large customer-focused clouds, Kingdee Cloud Xinghan and Kingdee Cloud Cangqiong, generating a combined revenue of approximately RMB 845 million, or one-third of UFIDA's.

Kingdee has consistently maintained its edge in small and medium-sized enterprises and standardized products, creating a pattern of dislocated competition.

However, the two enterprises and their founders embody more unity than opposition. Both were established around 1990 (UFIDA in 1988 and Kingdee in 1993). The founders share similar backgrounds, having resigned from public service to start their own ventures.

Moreover, their development paths are nearly identical. Both began with financial software: UFIDA's initial product was UFO, a report preparation software, while Kingdee's was its eponymous financial software. After capital accumulation, both simultaneously transitioned to ERP. They progressed side by side, with similar directions, rhythms, and market shares, leading to the saying in the ERP market: 'UFIDA in the north, Kingdee in the south.'

Driven by these two enterprises, China's ERP software market accelerated its development. According to Zhiyan Consulting's '2025-2031 China ERP Software Industry Market Research Analysis and Investment Prospects Assessment Report,' China's ERP software market size grew from RMB 20.97 billion in 2016 to RMB 50.53 billion in 2024, with a compound annual growth rate of 11.62%. It is estimated that in 2025, China's ERP software industry output value will reach RMB 39.13 billion, demand will reach 1.3948 million sets, and the market size will rise to RMB 54.53 billion.

In 2012, both companies embarked on their cloud transformation. In 2014, Xu Shaochun demonstrated his commitment to full cloud transformation by personally smashing a customer's server at the company's anniversary celebration, symbolizing a 'burning of bridges.'

However, this transformation presented more complex challenges.

Challenging Transformation

In the era of traditional on-premises services, enterprises paid a high one-time permanent license fee for software services (like traditional ERP software costing millions), with subsequent maintenance and upgrades being their responsibility. For many small and medium-sized enterprises, such costs were prohibitive.

Therefore, the demand for more flexible cloud services surged.

Cloud services involve deploying software applications and related resources on cloud platforms, developed and operated through servers and resources provided by cloud service providers. This eliminates the need for enterprises to purchase expensive hardware or employ professional operation and maintenance personnel. Moreover, cloud services typically adopt a subscription model, with monthly or annual payments, reducing operational pressure.

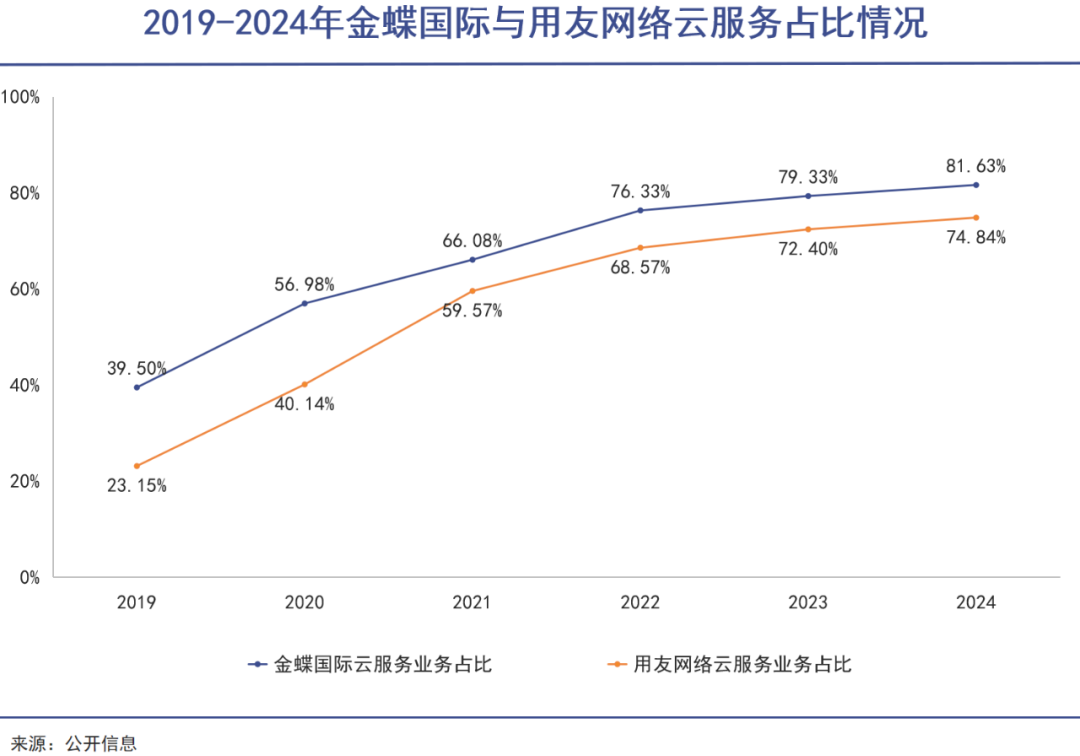

This transformation catered to market demand. Over the past five years, cloud services have gradually dominated the business mix of UFIDA and Kingdee. Kingdee International's cloud share soared from less than 40% to over 80%, while UFIDA Network's surged from just over 20% to over 70%.

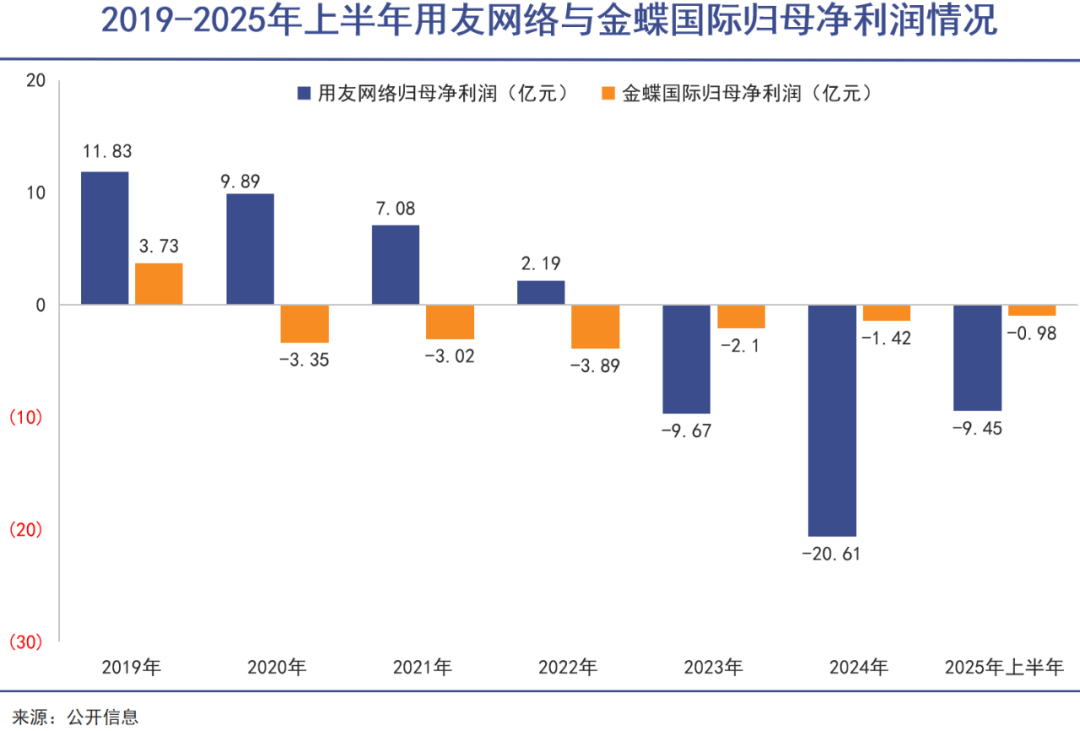

However, this time, the performance figures—especially profitability—did not reflect the transformation's success. Kingdee, which was more aggressive in its cloud transformation, incurred losses immediately after the full transition, sustaining losses for four consecutive years from 2020 to 2024. Coupled with a RMB 97.738 million loss in the first half of this year, Kingdee International's cumulative losses exceeded RMB 1.4 billion over the past five and a half years.

UFIDA's situation is similar. Although it has fewer loss years, it lost over RMB 2 billion last year. Coupled with a RMB 945 million loss in the first half of this year, its total loss amount over the past two and a half years is nearly RMB 4 billion.

Why do the more successful transformations lead to greater losses? This is a financial data shift due to transformation. In the on-premises era, sales revenue was one-time. In the cloud era, it spreads out the originally one-time revenue over each year or month, causing short-term revenue pressure.

In other words, the cloud business does make money, but UFIDA and Kingdee are financially transforming a large portion of originally short-term one-time revenue into extended revenue over a longer period.

Simultaneously, investments in R&D and sales expenses for cloud services increase, particularly in R&D and sales. In 2024, UFIDA and Kingdee's R&D investments were RMB 2.122 billion and RMB 1.514 billion, respectively, while their sales expenses were RMB 2.622 billion and RMB 2.185 billion, respectively, showing an increase rather than a decrease. This leads to a situation where, while overall enterprise revenue is under pressure, gross profit margins also decline.

Such financial changes necessitate a long-term approach, requiring enterprises to retain the vast majority of customers in their service system for an extended period. The core lies in continuously enhancing product strength to attract customers to renew subscriptions, with renewal rates becoming a key performance indicator.

In the first half of this year, UFIDA Network's renewal rate for large enterprise customers (core product YonBIP) was 95.4%, and for medium-sized enterprise customers (YonSuite) it was 94%. Kingdee International's net cloud subscription renewal rate for Kingdee Cloud Cangqiong and Kingdee Cloud Xinghan targeting large enterprises was 108%, and for Kingdee Cloud Xingkong targeting medium-sized enterprises it was 94%.

Both companies maintain high renewal rates, indicating that their product strength fully meets current market demands.

AI + Going Global

China's enterprise management software has completed its cloud transformation, planting the seeds for future growth. However, these two enterprises are not content to wait for the results.

On March 18, 2024, at Kingdee International's performance briefing, Xu Shaochun announced that 'Kingdee's cloud transformation has been successful, and the next goal is AI transformation.' By May, Kingdee officially declared its full transformation into an 'enterprise management AI company.'

UFIDA's corporate strategy has also advanced towards AI. On July 4, 2025, at the 4th National Enterprise Digital Transformation High-Level Forum of the 2025 Global Digital Economy Conference, UFIDA Network Chairman and CEO Wang Wenjing stated: 'The deep integration and innovation of Chinese enterprise software and large Chinese models will accelerate the application of AI in enterprises.'

UFIDA Software Chairman Wang Wenjing

As the AI era deepens, both companies have upgraded simultaneously, jointly deploying AI products and overseas businesses.

According to public information, in the first half of this year, UFIDA signed the first batch of AI project customers, including renowned enterprises like Anshan Iron and Steel, Baigong Iron and Steel, Towngas Group, and Zhongyou Gas. Additionally, AI projects with Shuangliang Group, Sinochem, BASF (China), Liugong Machinery, Juneyao Airlines, and Tsinghua University have also been successfully launched.

Kingdee has introduced the 'Cangqiong AI Agent Platform 2.0' and AI products such as Golden Key Financial Reporting, ChatBI (Question Intelligence Agent), Travel Intelligence Agent, Recruitment Intelligence Agent, BOSS Assistant, and Quotation Intelligence Agent. In the first half of this year, its cumulative AI contract amount exceeded RMB 150 million, with 170,000 active users of AI assistants.

It is evident that both companies have initiated and advanced their AI strategies, with the competition far from over.

From the perspective of China's enterprise software industry, the presence of these two companies has thwarted foreign software giants' ambitions in the Chinese market. Not only can they maintain their dominance in the Chinese market, but they also have the opportunity to compete globally.

Since 2003, UFIDA has had an overseas headquarters in Hong Kong. In recent years, its 'Globalization 2.0' strategy has accelerated, deeply cultivating the Asia-Pacific region while actively expanding into the Americas, Europe, and the Middle East. Financial report data shows that in the first half of this year, its overseas business revenue increased by 24.9% year-on-year, and the amount of overseas business contracts increased by 42.5% year-on-year.

Kingdee Software Chairman Xu Shaochun

Kingdee's primary overseas expansion focuses on Southeast Asia, the Middle East, and other regions, particularly Chinese enterprises going abroad. In the first half of this year, it signed a total of 259 Chinese enterprises going abroad and overseas local enterprises.

In February 2025, Kingdee established Kingdee Qatar and officially entered the Middle East market. Xu Shaochun stated that Qatar will serve as a bridgehead to expand business in the Middle East and North Africa markets, promoting the digital transformation of local enterprises.

Postscript

Competition is an inevitable reality for all enterprises, particularly in China, where the fierceness among commercial entities surpasses that seen in European and American countries. However, there has been limited discussion and clarity on what constitutes healthy and positive competition.

The outcome of competition and the gaming strategies employed in certain industries has resulted in an industry-wide shift towards a fragmented market characterized by low prices and subpar quality. This pattern is prevalent in sectors such as home furnishing, decoration, catering, and various small manufacturing industries. Consequently, consumers and users find it challenging to access higher-quality products and superior services, while Chinese enterprises grappling with intense competition often struggle to grow and are frequently overshadowed by overseas giants.

Furthermore, some intense competitions have culminated in near-collapse scenarios for entire industries, leading to widespread losses over a specific period. Examples of this can be found in the coal, steel, and apparel industries, which are not uncommon in China. These intense and intricate competitions often result in losses for multiple parties or even the exploitation of domestic resources by overseas capital through raw materials, supply chains, or online platforms.

Fortunately, in the realm of Chinese enterprise management software, vicious competition has yet to surface. Despite the rivalry between UFIDA and Kingdee, they have consistently united against overseas software giants. This has significantly contributed to safeguarding the data security of both large and small Chinese enterprises, especially state-owned and central enterprises. This unity holds great significance for the entire Chinese business community.