Gartner Quadrant Grand Slam: Alibaba Cloud's "All-Rounder" Victory

![]() 11/25 2025

11/25 2025

![]() 562

562

Alibaba Cloud's "hard power" in the AI era has become more tangible.

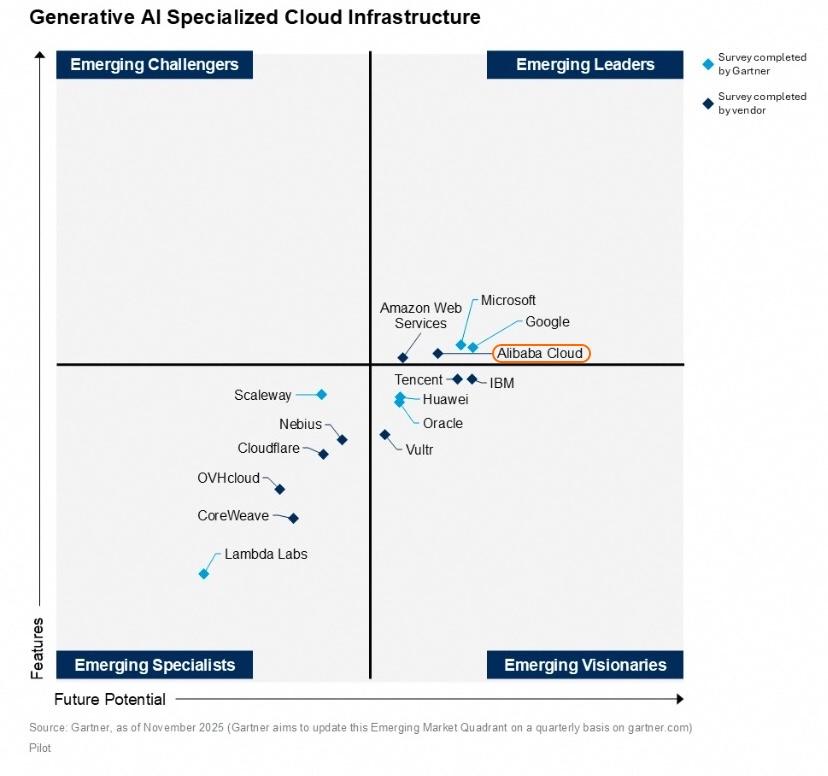

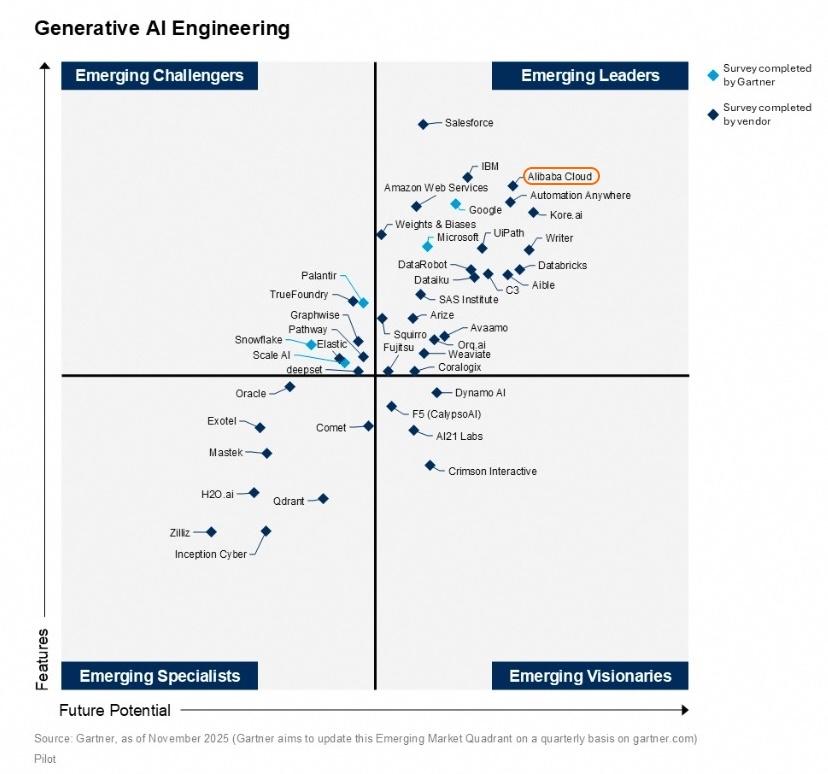

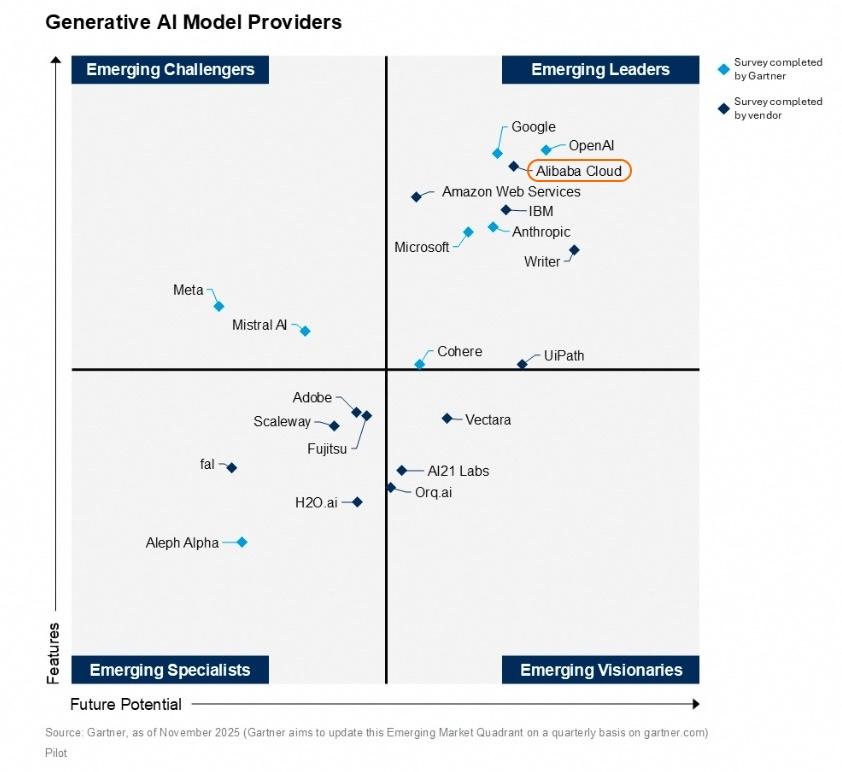

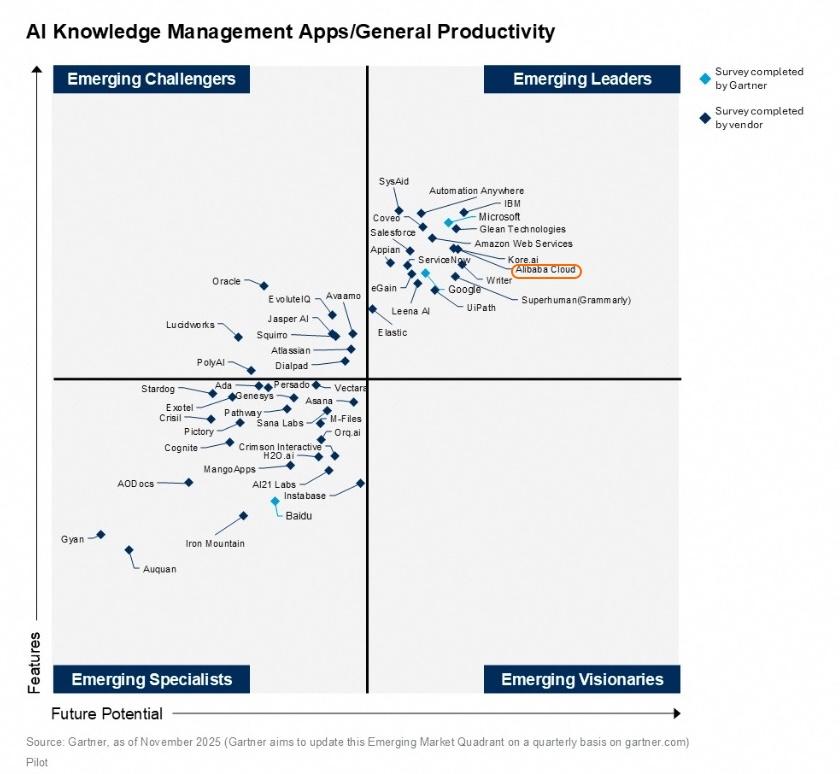

In mid-November 2025, international market research firm Gartner released four technical innovation reports on GenAI. Following a top-down technology stack logic, the reports are divided into four evaluation dimensions: GenAI Cloud Infrastructure, GenAI Engineering, GenAI Models, and AI Knowledge Management Applications.

Notably, Alibaba Cloud is positioned in the Emerging Leaders quadrant across all four evaluation dimensions, competing closely with OpenAI and Google.

Specifically, in the "GenAI Infrastructure" dimension, the Emerging Leaders quadrant includes Alibaba Cloud, Microsoft, Google, and AWS, with Huawei Cloud and Tencent Cloud in the Visionaries quadrant.

In the "GenAI Engineering" dimension, Alibaba Cloud is in the Leaders quadrant, outperforming AWS, Google, and Microsoft in both "Features" and "Future Potential" metrics.

In the "GenAI Model Providers" dimension, Alibaba Cloud is in the Leaders quadrant, surpassing AWS and Microsoft in "Features" and ranking just behind Google and OpenAI.

In the "AI Knowledge Management Applications/General Productivity" dimension, Alibaba Cloud is in the Emerging Leaders quadrant and is the only domestic cloud provider selected.

The robustness of these four reports lies in their adoption of market- and industry-recognized segment (segmented) evaluation criteria, balancing technological advancement with implementation effectiveness. For example, Gartner refines infrastructure assessment into optimizations for model training, inference, and service delivery, while productivity evaluation is deconstructed into core capabilities such as search, conversational platforms, and productivity tools.

Behind Alibaba Cloud's phased (phased) "answer sheet" lies Alibaba's strategic determination and high-intensity, sustained iterative capability in top-down full-stack AI investment. Amidst new era (new era) transformations with countless challengers, Alibaba Cloud has never been absent, from the internet to AI large models.

**Determination in Full-Stack AI Investment**

For a commercial giant like Alibaba with intricate business operations, any major transformation is akin to an "elephant turning." Alibaba's full-stack bet on cloud computing may seem like a "gamble" to outsiders, but it represents a top-down consensus and resolve.

This strategic resolve was further translated into a clear action roadmap after Wu Yongming took office. In September 2023, Alibaba identified "User-Centric, AI-Driven" as its two strategic focuses, signaling a concentration on core businesses and resources for e-commerce and AI.

During the February earnings call this year, Wu Yongming articulated the cloud division's strategic priorities for the first time, emphasizing increased investment in three areas: (1) AI and cloud computing infrastructure; (2) AI foundational model platforms and applications; and (3) AI-driven transformation and upgrading of existing businesses.

To support this blueprint, Alibaba plans to invest over RMB 380 billion in cloud and AI hardware infrastructure over the next three years, surpassing the total of the past decade and setting a record for China's private sector in related fields.

While unprecedented domestically, this figure underscores the strategic importance of the sector and the intensity of global AI infrastructure competition. The current AI race, seemingly shifting to infrastructure, is laying the groundwork for next-stage intelligence capabilities.

Against this backdrop, international leaders have launched larger-scale investment plans: OpenAI announced plans to invest approximately $1.4 trillion over the next eight years in building and expanding AI data centers; Meta plans to invest $600 billion in U.S. infrastructure and employment over three years. Looking back, Alibaba's decision accurately anticipates market and future trends.

In the new AI era, the question of "where the future lies" has left many players adrift. Amidst a barrage of new technologies, the future seems shrouded in fog.

Alibaba Cloud is among the few vendors with a clear answer. At the 2025 Cloud Town Conference, Wu Yongming outlined the evolutionary path to ASI: Phase 1 - "Emergent Intelligence," where AI achieves generalized intelligence through learning vast human knowledge; Phase 2 - "Autonomous Action," where AI masters tool usage and programming to "assist humans" (the current industry phase); and Phase 3 - "Self-Iteration," where AI achieves "surpassing humans" through physical world connectivity and self-learning.

To achieve this, Wu Yongming defined Alibaba Cloud's future strategic path: large models as the next-generation operating system and super AI clouds as the next-generation computers. On this basis, Alibaba Cloud will evolve into a full-stack AI service provider, with "full-stack" being emphasized again.

Alibaba Cloud's "full-stack" layout essentially creates an "AI capability conversion chain" from technology to business. Starting from its self-developed computing base and Tongyi large models, it transforms cutting-edge AI technologies into easily integrable services through platforms like BaiLian, seamlessly connecting to industry-specific applications and empowering enterprises to achieve rapid intelligent upgrades, turning frontier technologies into commercial productivity.

This layout is not just technological accumulation but embodies a clear strategic logic. On one hand, Alibaba Cloud aims to become the "Android system" of the AI era through its open-source Tongyi models, building ecological barriers. On the other, by creating the "next-generation computer" - the super AI cloud - it provides a solid computing foundation. The "full-stack" advantage lies in synergy: Alibaba Cloud's self-developed AI infrastructure and Tongyi models can undergo deep collaborative optimization, maximizing efficiency in cloud-based model calling and training while enhancing enterprise delivery outcomes.

**Maintaining Sustained Leadership**

Competition in the business world is a short-term "speed" race and a long-term "endurance" test. Navigating cycles is a critical capability. In the cloud computing arena, many seek to overtake, but few sustain vitality and leadership.

Upon closer inspection, among the four Gartner report charts, Google Cloud and Alibaba Cloud emerge as relatively more "all-rounder" players. The AI era's competition is essentially a vertical integration battle of "cloud + models + chips."

Google forms a closed loop with its TPU chips, Gemini models, and Google Cloud. Alibaba builds its foundation with Yitian/Hanguang chips, Tongyi Qianwen (Qwen) models, and Alibaba Cloud. In contrast, while Amazon and Microsoft have deep cloud and chip layouts, their models lag in capability and ecological influence. Meanwhile, star companies like OpenAI, though head (leading) with models like ChatGPT, remain dependent on underlying computing infrastructure.

Interestingly, Google and Alibaba represent two current large model competition routes. Google establishes technological barriers with its closed-source Gemini, shaping its moat through head (leading) capabilities and API services. Alibaba, through its open-source Qwen, builds ecological alliances, winning market share through technological inclusivity and developer ecosystems. This not only divides commercial choices but defines two possible future forms of AI.

In August 2023, Alibaba Cloud open-sourced its 7 billion-parameter Qwen-7B model, sparking the first major open-source move by a large firm. After its initial open-sourcing, Qwen continued to release larger and more models at a staggering pace, open-sourcing a 72 billion-parameter Qwen-72B that filled the gap for a high-quality open-source model comparable to Llama 2-70B in China, deemed the "strongest open-source model" by the industry. Simultaneously, by open-sourcing models as small as 1.8B parameters and audio large models, it achieved a "full-size, full-modality" strategic layout.

Qwen has rendered Llama obsolete and is hailed as the true "OpenAI." HuggingFace CEO tweeted 12 times in a row recommending Qwen3-Coder to global developers, while NVIDIA CEO Jensen Huang publicly stated, "Qwen has captured most of the open-source model market share and is expanding its lead."

According to our understanding, Qwen is becoming the choice for To B enterprises to build their businesses. This is due to comprehensive considerations: Qwen offers full-size and full-modality products, facilitating easy deployment and testing across various scenarios. Many enterprises report cost-effectiveness in running Qwen models, crucial for those with limited budgets for new business ventures. Qwen's vibrant developer community is a vast "treasure trove," with collective wisdom yielding numerous scenario-specific enhanced Qwen versions, lowering usage barriers for some enterprises.

As of now, the Qwen series models have surpassed 600 million cumulative downloads across major global model communities, with over 170,000 derivative models, becoming one of the most widely adopted open-source models by global developers and enterprises. Qwen continues to update at a rapid pace, with the next-generation model architecture Qwen3-Next achieving record-high training and inference efficiency, reducing model training costs by 90% and increasing long-text inference throughput by 10x.

If B-end competition is about "building foundations," C-end rivalry is about "preaching." Google and Alibaba understand that true influence lies not just in serving enterprises but in redefining how ordinary users interact with AI. Once technological capabilities are unleashed through widespread terminal applications, a complete ecological closed loop (closed loop) from infrastructure to consumer scenarios can be constructed.

From AI podcasts to text-to-image and video editors, Google has been exploring C-end application possibilities. Recently, Google's Nano Banana2 gained minor traction, with users creatively generating One Piece storyboard comics and designing posters without modifications, while its Chinese comprehension impressed.

Similarly, Alibaba is accelerating its C-end market layout (layout). On November 17, Alibaba officially announced the "Qianwen" project, planning deep integration with various lifestyle scenarios within the Alibaba ecosystem to create a unified AI portal behind Alibaba's services.

Third-party data shows that the Qianwen App public beta surpassed 10 million downloads in its first week, outpacing ChatGPT, Sora, and DeepSeek to become the fastest-growing AI application in history. Its explosive growth even sparked "Qwen Panic" discussions on overseas social media.

With the release of the Kuake AI glasses, Alibaba can further extend Qianwen's intelligence from virtual apps to physical hardware, breaking the virtual-real boundary and providing users with a more seamless and immersive AI-native experience.

**Cloud Computing: A Long-Term Marathon**

Gartner's evaluation dimensions primarily reflect cloud vendors' "hard power." Undeniably, full-stack AI capabilities from chips and computing power to model platforms are the foundation for cloud computing in the AI era.

However, some vendors have built equally robust moats through unique "soft power" beyond Gartner's standards. For example, Microsoft leverages its seamless integration with enterprise applications, creating high user stickiness through Copilot.

Cloud vendors' advantages accumulated in the internet era are extending into the AI era. Amazon capitalizes on the synergistic effect of its global e-commerce ecosystem and AWS, transforming its scalable infrastructure operations into AI service foundations. Microsoft leverages its deep roots in enterprises and developers, converting its binding with Azure and OpenAI into "trust credits" for enterprise AI applications. Google internalizes its advantages in search and mobile ecosystems into natural strengths in data and distribution networks.

Thus, in the AI era, cloud vendors are deeply integrating their traditional advantages with AI technologies, forming differentiated competitive paths: some excel in ecosystems, others in enterprise services, and some in technological breakthroughs, collectively shaping a diversified industrial landscape.

Beyond Alibaba Cloud, we increasingly see Chinese forces emerging. The Gartner list also includes Tencent Cloud and Huawei Cloud, listed as Visionaries in dimensions like "GenAI Infrastructure."

Meanwhile, Chinese AI vendors exhibit startup vitality. For example, Yuezhi'anmian Kimi open-sourced its programming large model and tested its deep research Agent, while MiniMax continuously iterates its reasoning and video generation models, gaining traction overseas with its AI video tools and C-end AI applications.

Transforming "airports" into cloud computing battlegrounds and vying for "first" status has been a hallmark phenomenon in the industry this year. Yet, this appears to be a positive signal. Competition has not led to vendor exhaustion but collectively expanded the market. This proves that after embracing AI technologies, the cloud market has returned to a high-growth, high-value core track.

When cloud and large-scale computing become societal infrastructure like water, electricity, and coal, the cloud computing market will inevitably belong to long-termists.

The heavy asset, long cycle, and strong technological nature of this field naturally screen out players chasing short-term gains. Ultimately, the winners will be those with strategic patience, sustained technological investment, and complete ecological construction.