28-year veteran employee reports chairman, IBM China 'in crisis'

![]() 10/17 2024

10/17 2024

![]() 721

721

Where is the 'Blue Giant' headed?

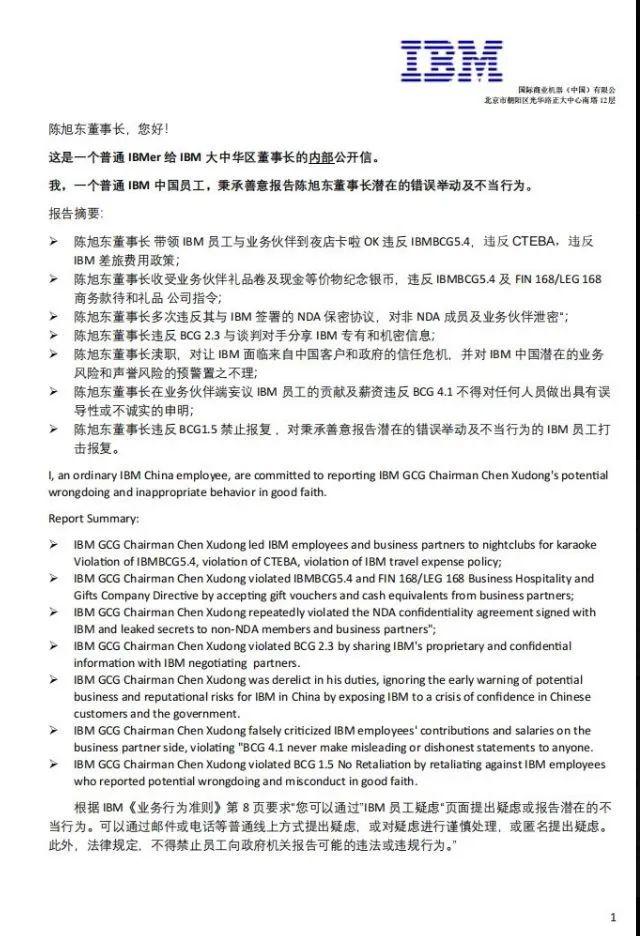

'I, an ordinary IBM China employee, report in good faith on Chairman Chen Xudong's potential wrongdoings and misconduct!'

Recently, a senior IBM China employee released an internal whistleblower letter, reporting real-name allegations of multiple violations by IBM China Chairman Chen Xudong, mainly enumerating his 'seven deadly sins' including accepting gifts from channels, privately leaking company secrets, making poor decisions, forming cliques, nepotism, and retaliating against disobedient employees.

Image source: Weibo screenshot

If the allegations in the report are true, then Chen Xudong and IBM China will face significant crises; in fact, the current 'Blue Giant' IBM is facing multiple challenges in the Chinese market due to both internal management issues and changes in the external competitive environment.

01. 15-page internal letter, veteran employee reports chairman

This whistleblower letter, spanning 15 pages, details Chen Xudong's various misconducts, causing a major uproar within IBM China and the industry as a whole. In response, IBM officially acknowledged the existence of the internal letter and stated that it would 'attach great importance to and thoroughly investigate any behavior that may violate the company's code of business conduct.'

It is understood that the real-name whistleblower, Li Hongyan, has worked at IBM for 28 years and previously served as General Manager of Data, AI, and Automation for IBM Greater China's Technology Business Unit. The incident may have stemmed from the sudden notice she received from the chairman at the end of September, informing her that her contract would be terminated due to subpar performance.

Image source: Weibo screenshot

As Chairman of IBM China, Chen Xudong shoulders heavy responsibilities, but this real-name whistleblowing incident has plunged him and IBM China into a whirlwind of public opinion.

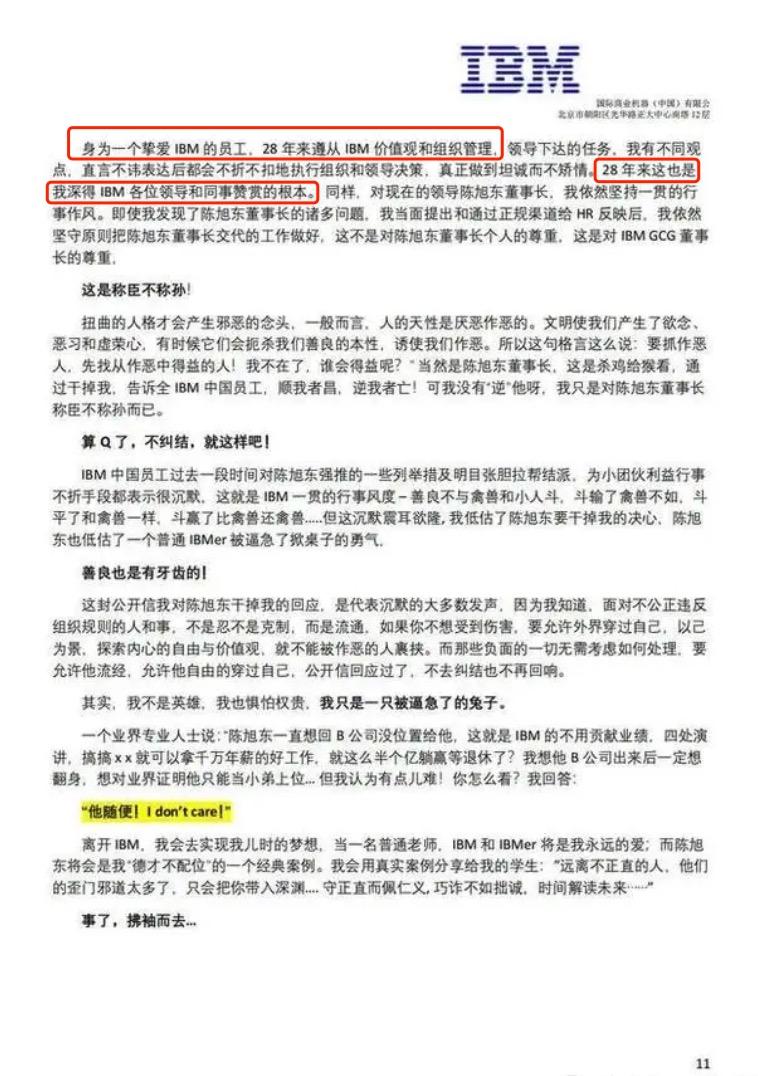

According to 'Interesting Business Insights,' before joining IBM, Chen Xudong held executive positions at several well-known tech companies, with extensive industry experience and leadership skills.

Public records show that Chen Xudong graduated from Peking University with a degree in probability and statistics and joined Lenovo Group shortly after graduation. During his 24-year tenure at Lenovo (1993-2017), he led various emerging businesses, including Lenovo personal computers, smartphones, and global services.

During his time at Lenovo, Chen Xudong made significant contributions to establishing Lenovo as a market leader in China's PC market, significantly increasing market share and profitability.

Image source: Weibo screenshot

After leaving Lenovo, Chen Xudong had three relatively brief career stops, serving as Global Executive Vice President at Sanpower Group in 2017, Senior Vice President at Meituan Dianping Group in March 2018, and Executive Vice President at Tsinghua Unigroup in April 2019. Notably, while at Meituan, Chen Xudong was responsible for the B2B business (Kuailv Business) within the Retail Business Unit and led the expansion of the food supply chain business to over 40 cities nationwide with a team of 5,000 people.

Drawing on his rich experience and leadership skills across different industries, Chen Xudong 'parachuted' into IBM in March 2022 as General Manager of Greater China, and later assumed the roles of Chairman and General Manager of IBM Greater China, becoming the 'number one' in the region.

Image source: Weibo screenshot

In fact, Chen Xudong is no stranger to IBM. As a 24-year Lenovo veteran, he experienced Lenovo's acquisitions of IBM's PC and x86 server businesses, which undoubtedly gave him a deeper understanding of IBM's business model, corporate culture, and market positioning. Industry insiders believed that IBM's decision to 'parachute' in a local figure like Chen Xudong indicated dissatisfaction with performance in the Chinese market and a desire for someone who understands the business and is proficient in the Chinese market to expand it.

At the beginning of 2024, Chen Xudong outlined IBM China's three strategic priorities: deepening engagement with key clients, breaking into new markets, and vigorously expanding channels. He hoped to revitalize IBM's presence in the Chinese market through these strategic focuses.

However, with the occurrence of this real-name whistleblowing incident, Chen Xudong's leadership journey at IBM China, which he joined just two and a half years ago, seems overshadowed. As of now, IBM Greater China has not disclosed the progress of its investigation, and there has been no public information about Chen Xudong's activities since the whistleblower letter surfaced.

02. IBM China's declining performance amidst fierce external competition

Regardless of the outcome of this real-name whistleblowing incident, it exposes non-negligible internal management issues within IBM China. In terms of performance, IBM China has also shown clear signs of decline.

According to IBM's 2023 financial report, the company's annual revenue was $61.86 billion, with a net profit of $7.502 billion. Compared to a decade ago, IBM's revenue has shrunk by nearly 40%, and its net profit has halved. Regionally, while IBM's revenue in the entire Asia-Pacific region grew by 1.6% annually, its revenue in China plummeted by 19.6%.

By the first half of 2024, IBM China's performance continued to decline, with sales falling by 5% year-on-year. In contrast, IBM's revenue in the Asia-Pacific region as a whole grew during the same period, highlighting the contrast with IBM China's performance and underscoring the severity of the situation facing the company in China.

Image source: Baidu Stock Connect screenshot

Currently, IBM faces considerable challenges in the Chinese market. Besides the inability of its product innovation to fully keep pace with market changes, increasing external competitive pressures are also significant factors.

In recent years, as local tech companies like Alibaba, Huawei, and Tencent have risen to prominence, they have continually expanded their footprints in key areas such as cloud computing and AI, gradually eroding IBM's market share.

According to 2023 data, IBM holds around 3% of the global cloud infrastructure services market but fails to rank among the top players in China's cloud computing market. In contrast, local cloud computing giants like Alibaba Cloud, Huawei Cloud, and Tencent Cloud have significantly increased their market shares in China. According to 'Interesting Business Insights,' in 2023, Alibaba Cloud held 39% of the Chinese market, followed by Huawei Cloud with 19%, and Tencent Cloud with 16%.

Compared to these local giants, IBM primarily focuses on hybrid cloud solutions and enterprise services. However, domestic players like Alibaba Cloud, Huawei Cloud, and Tencent Cloud can better cater to local customer needs and offer competitive advantages in pricing and innovation, further compressing IBM's market share in China.

Image source: Canned Stock Photo

Although IBM China considers cloud computing and software businesses as its core revenue sources, its late entry into the cloud computing field and missed opportunities to leverage open-source ecosystems for product and service development have rendered IBM relatively less competitive in China's cloud computing market.

As open-source ecosystems increasingly become a crucial driver of cloud computing development, domestic companies actively embrace open source, continuously enhancing their technical capabilities and product innovation through participation in open-source projects and code contributions. IBM's lag in this area makes it difficult to compete with leading domestic companies in terms of technological update speed and flexibility.

In the AI domain, since 2023, IBM has focused on generative AI and launched Watson X, an enterprise AI and data platform. Earlier this year, IBM also announced its continued emphasis on hybrid cloud and AI, focusing on enterprise AI applications and building an open ecosystem of partners to address new challenges in strategic transformation, overseas expansion, data governance, security compliance, and more.

Image source: Weibo screenshot

According to IBM's AI strategy, the company aims to expand its enterprise-grade foundation model customer cases beyond natural language processing and plans to open up customized models with over 100 billion parameters for specific clients.

According to 'Interesting Business Insights,' thousands of enterprise customers worldwide are currently evaluating and trialing Watson X, with over 700 pilot projects, more than 500 successful contracts, and over 150 case studies. While these figures are promising, IBM still faces comprehensive challenges from competitors in the AI domain.

Currently, the global AI market is dominated by technology giants like Google, Microsoft, Amazon, and OpenAI. Especially in the generative AI space, OpenAI's ChatGPT and Microsoft Azure OpenAI services have garnered significant market attention and practical applications.

In contrast, while Watson X demonstrates certain advantages in the enterprise AI market, IBM faces intense competitive pressure in terms of technological innovation and market recognition. For instance, Microsoft's collaboration with OpenAI has propelled the enterprise adoption of GPT models, and Google is actively deploying generative AI through projects like Bard. For IBM to stand out in this competitive landscape, the challenges are formidable.

Image source: Canned Stock Photo

In terms of market positioning and user education, Microsoft and Amazon's AI products offer greater flexibility in expanding into the SME market, simplifying the process of accessing AI services through cloud platform ecosystems. In contrast, IBM's AI products are more focused on the enterprise market, which, while offering significant growth potential, is characterized by long decision-making cycles, complex needs, and stringent requirements for data security and compliance. This necessitates IBM to invest more resources in customer education, needs matching, and project customization when promoting Watson X.

03. Closure of IBM China's R&D departments and strategic adjustments

With declining performance and product capabilities, IBM China has had to initiate business contractions and strategic adjustments.

In August this year, IBM China announced the complete closure of its R&D and testing departments, including the IBM China Development Lab (CDL) and IBM China Systems Lab (CSL), affecting over 1,000 employees. This move caused a significant stir in the industry.

Image source: Weibo screenshot

For IBM China, this large-scale layoff and department closure may be a reluctant choice amid its current difficulties. While IBM claims to adjust operations as needed to provide optimal services to customers, closing these core R&D departments may further weaken IBM's R&D capabilities and innovation in the Chinese market, making it difficult to quickly launch products and solutions tailored to the Chinese market.

In fact, signs of IBM's withdrawal from R&D in China may have been evident earlier.

In 2021, IBM quietly closed its China Research Lab (CRL), marking a significant adjustment to its R&D system in China. Established in 1995, IBM China Research Lab was one of IBM's 12 global research institutions and its first research center in a developing country. For a long time after its establishment, IBM China Research Lab remained at the forefront of technological innovation, bringing world-leading information technology concepts and achievements to China, covering areas such as AI, big data, cloud computing, and IoT.

The wheel of time keeps turning, and competition in the tech industry continues to intensify.

With the closure of IBM China Research Lab, IBM China Development Lab, IBM China Systems Lab, and other R&D departments, it is undeniable that while IBM has consistently expressed its commitment to and optimism about the Chinese market, the glory days of IBM China are quietly coming to an end. Meanwhile, local tech companies in China are rapidly rising in various sectors with their flexible innovation mechanisms and deep understanding of the local market.

Image source: Canned Stock Photo

Undeniably, as a century-old tech giant, 'Blue Giant' IBM still retains unique competitiveness and core advantages in both the global and Chinese markets, particularly in the fields of consulting and system integration, where IBM continues to provide comprehensive solutions to customers across various industries. This comprehensive service capability plays a vital role in helping clients achieve digital transformation and industrial upgrading.

In the Chinese market, IBM has been deeply entrenched for 40 years, boasting a broad customer base and ecosystem partnerships, which will continue to support and ensure its sustainable development in China.

Nowadays, facing the dual challenges brought about by internal management issues and changes in the external competitive environment, if IBM wants to regain its market share in China, it still needs to increase its resource investment and attention in China, and gain an in-depth understanding of the specific needs of different customers to launch products and services that better meet the needs of the Chinese market.

Perhaps the most pressing issue at hand is still how to properly handle the public opinion crisis caused by the chairman's real-name report of internal staff, as well as the problems in internal management and systems, and give a satisfactory explanation to employees and the public; this is not only related to the future of Chairman Chen Xudong, but also to the future direction of IBM in the Chinese market.