Salesforce: Unable to Support the Narrative of AI Applications, Will U.S. AI Stocks Take a Break?

![]() 03/07 2025

03/07 2025

![]() 630

630

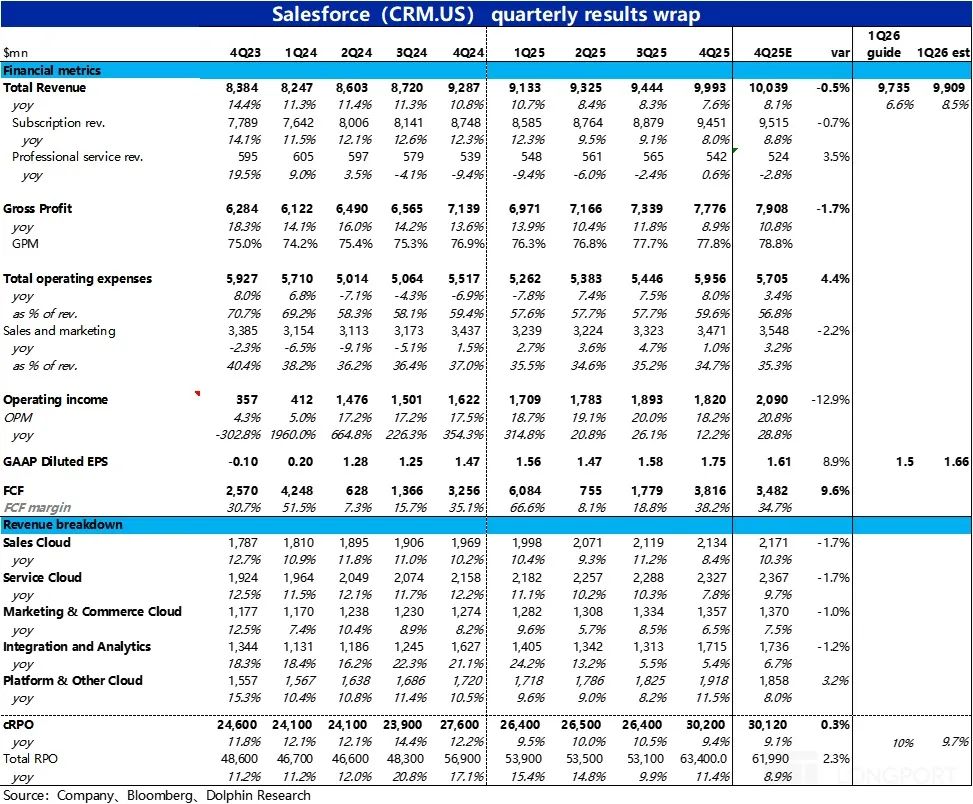

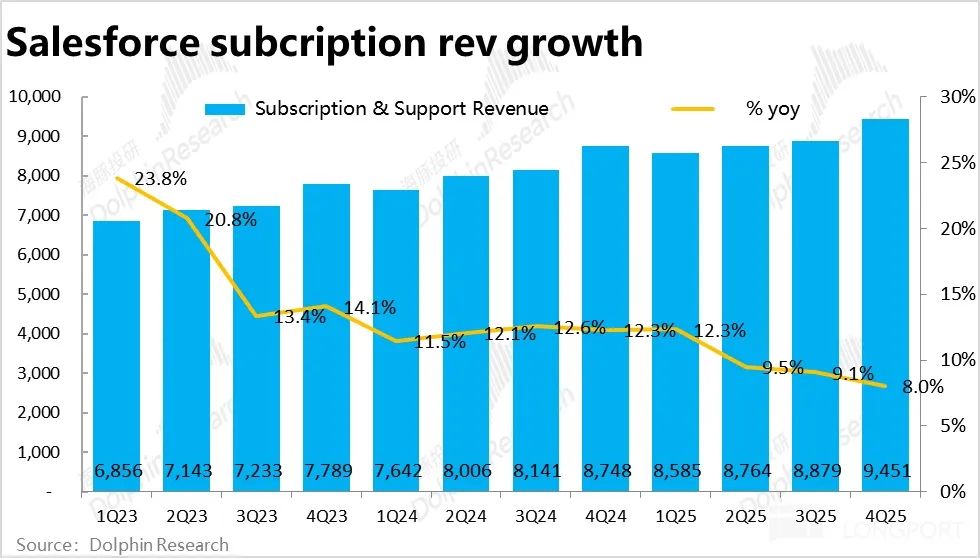

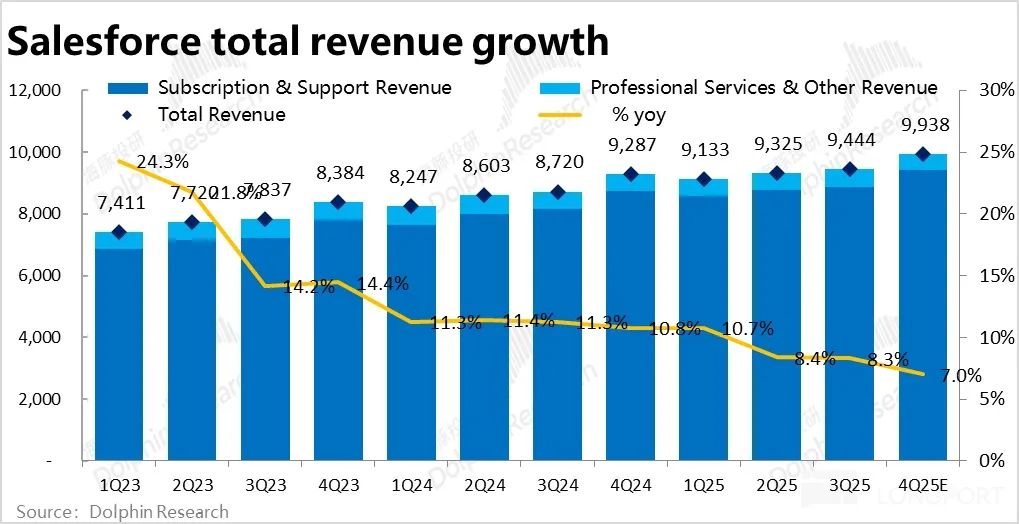

1. Salesforce's core subscription revenue for this quarter was $9.45 billion, a year-over-year increase of 8%, about 1.1 percentage points slower than the previous quarter and also lower than the consensus estimate of 8.8%. Salesforce's growth decline over the past three years has not improved. According to guidance for the next quarter, growth will continue to decline (impacted by exchange rates and leap year bases).

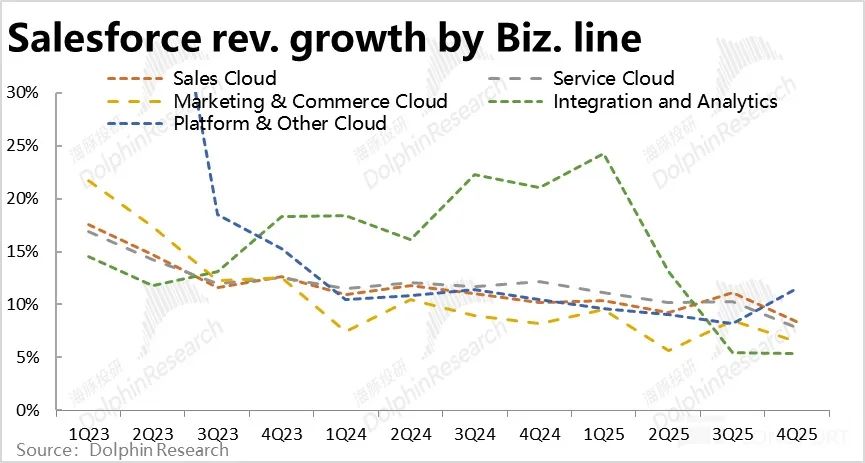

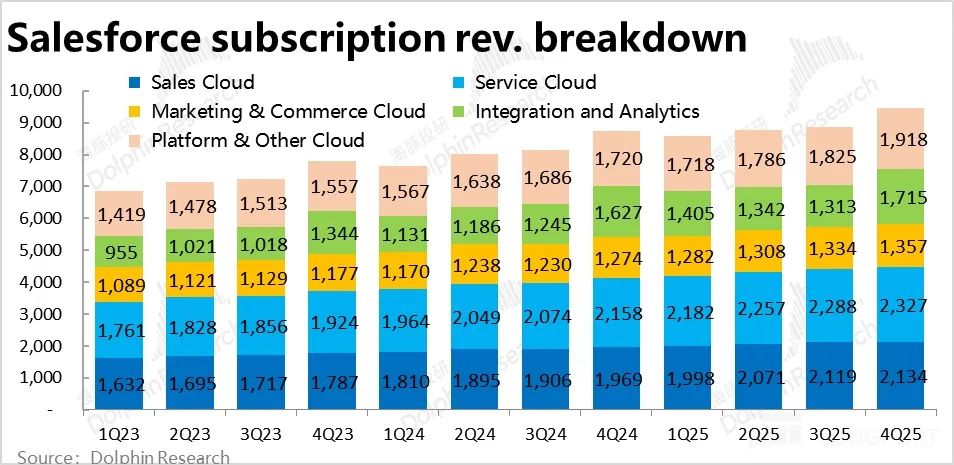

Breaking down the performance of the five major clouds, the growth rate of Platform & Data Cloud significantly increased from 8.2% in the previous quarter to 11.5%, significantly higher than the market expectation of 8%, and was the only one showing an acceleration trend. This should be partly due to contributions from AI & Agentforce.

In addition, the growth of the other four major clouds continued to decline comprehensively and was generally 1% to 2% lower than market expectations. Apart from the imagination space brought by Agentforce, the growth of the company's existing businesses remained quite weak.

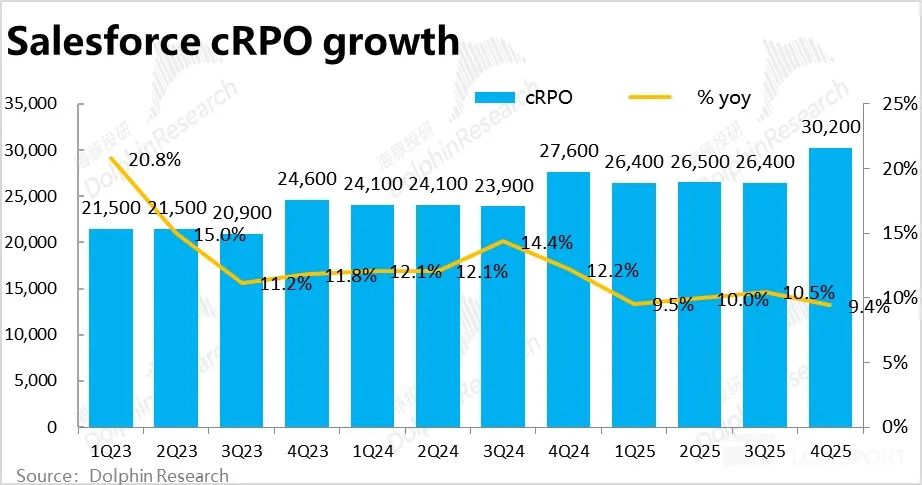

2. The leading indicator of growth, PRO (remaining performance obligation), showed relatively better signals. The year-over-year growth rate of cRPO (contracted but not recognized performance obligation) declined from 10.5% in the previous quarter to 9.4%, but it was slightly better than expected. Excluding the impact of exchange rates, the actual comparable growth rate of cRPO was 11%, accelerating by 1 percentage point quarter-on-quarter.

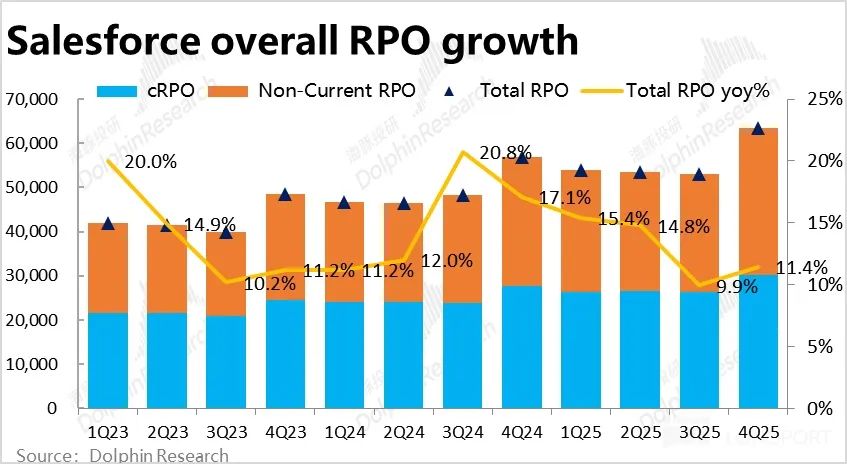

The growth of total remaining performance obligations, including those over 12 months, was even better. Even under GAAP, which includes the impact of exchange rates, the growth rate increased from 9.9% in the previous quarter to 11.4%. It can be seen that the growth of long-term remaining performance obligations was stronger than that of short-term obligations in this quarter. The proportion of long-term RPO reached 52%, a high since fiscal year 2021.

This may suggest that while AI & Agentforce have not yet brought significant incremental revenue in the short term, they have indeed sparked customer interest, leading to some long-term contracts.

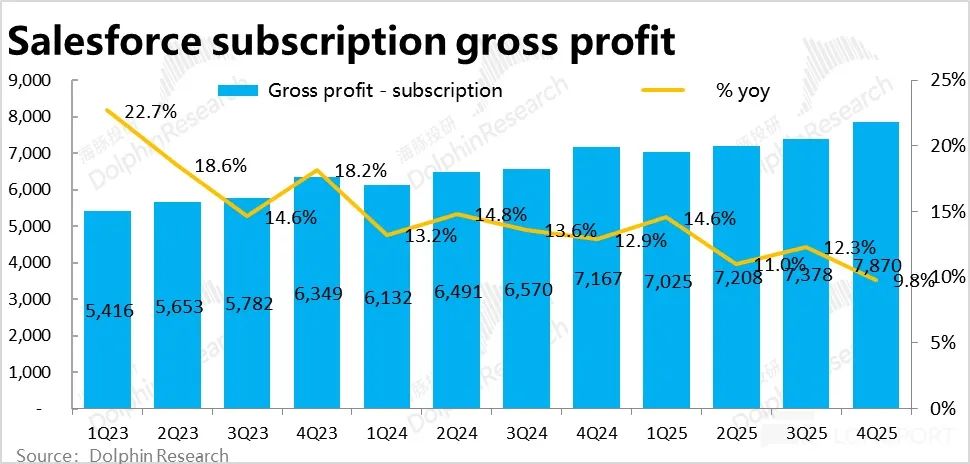

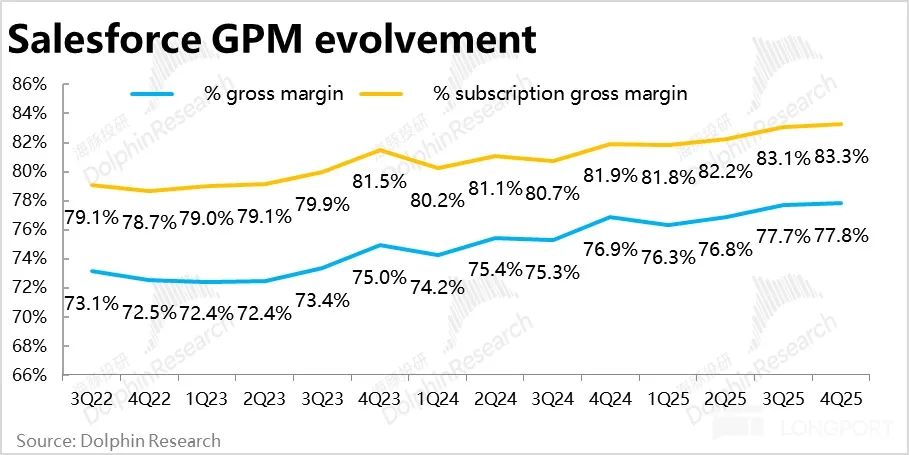

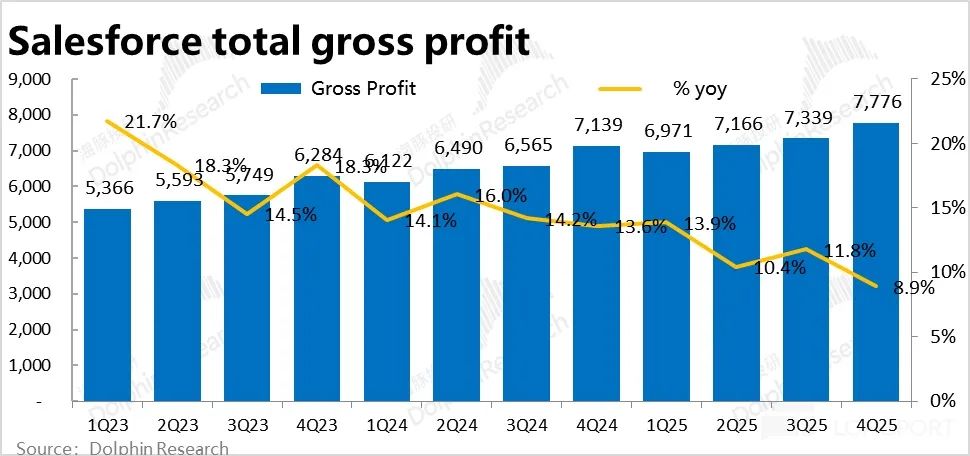

3. At the gross margin level, Salesforce's subscription revenue generated a gross profit of $7.87 billion in this quarter, a year-over-year increase of 9.8%. Although it outpaced revenue growth, the trend was significantly slower than the 12.3% in the previous quarter. The gross margin was 77.8%, an increase of 0.9 percentage points year-over-year. However, compared to the previous three quarters of this fiscal year, when gross margins improved by more than 2 percentage points, the improvement trend in gross margins in this quarter was significantly slower. Dolphin Investment Research boldly speculates that upfront investments in AI & Agentforce may have dragged down gross margins. The actual reason will require attention to management's explanation.

Adding a gross loss of $95 million from service revenue, Salesforce's total gross profit for this quarter was approximately $7.78 billion, lower than the expected $7.91 billion, and the gross margin of 77.8% was 1 percentage point lower than expected. Gross margin performance also fell short of expectations.

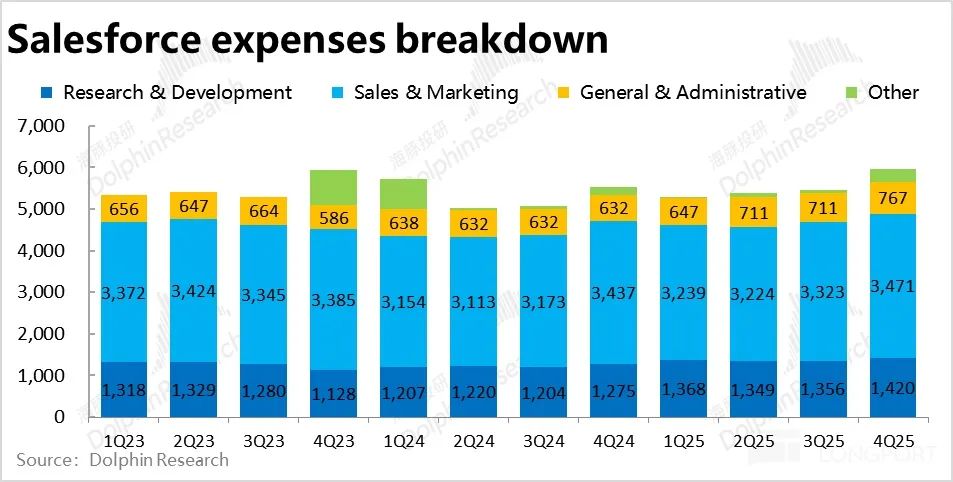

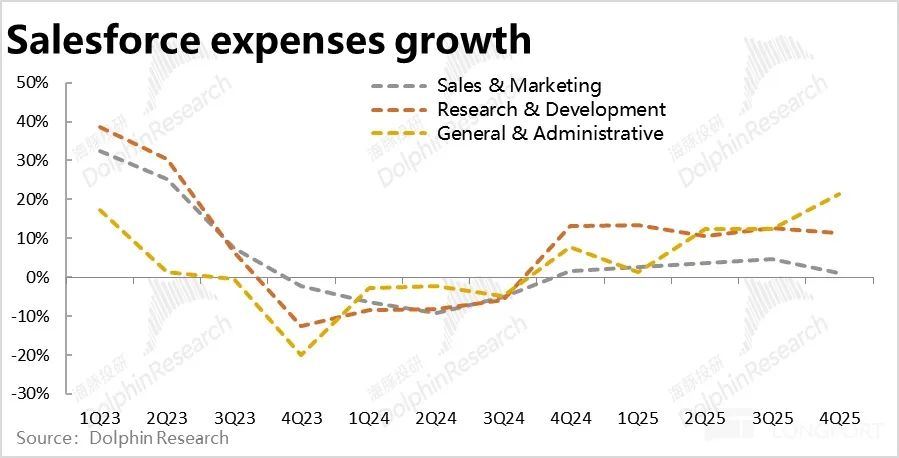

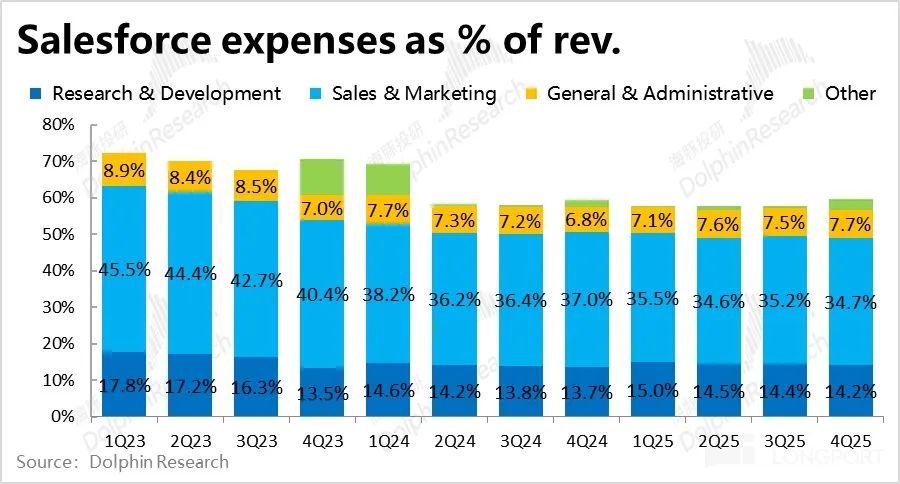

4. From a cost perspective, Salesforce's total operating expenses for this quarter were $5.96 billion, higher than the expected $5.71 billion. The proportion of expenses to revenue increased by 0.2 percentage points year-over-year to 59.6%, ending the narrowing trend of the expense ratio that had lasted for several years and resuming expansion.

Among them, the largest proportion of marketing expenses was $3.47 billion, lower than the expected $3.55 billion, with a year-over-year increase of only 1%. Currently, the company has not increased marketing investment due to the promotion of new businesses such as Agentforce.

The main reason for the re-expansion and higher-than-expected total expense was a significant year-over-year increase of 21% in administrative expenses for this quarter, along with the recognition of nearly $300 million in restructuring costs.

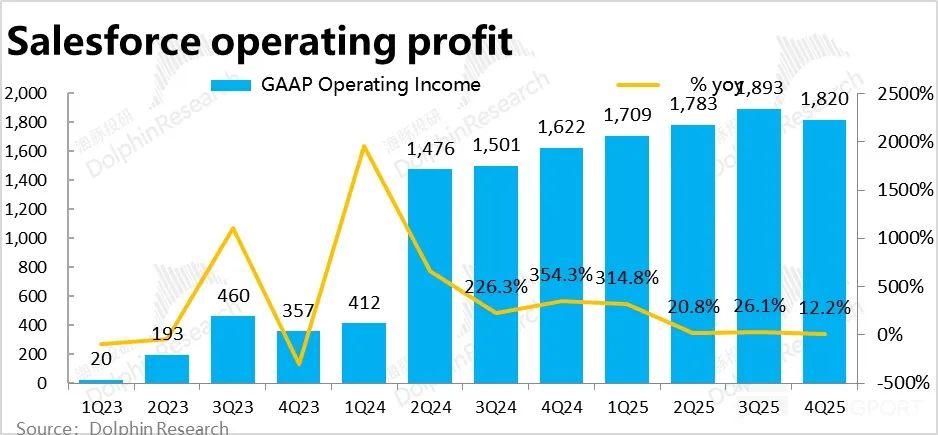

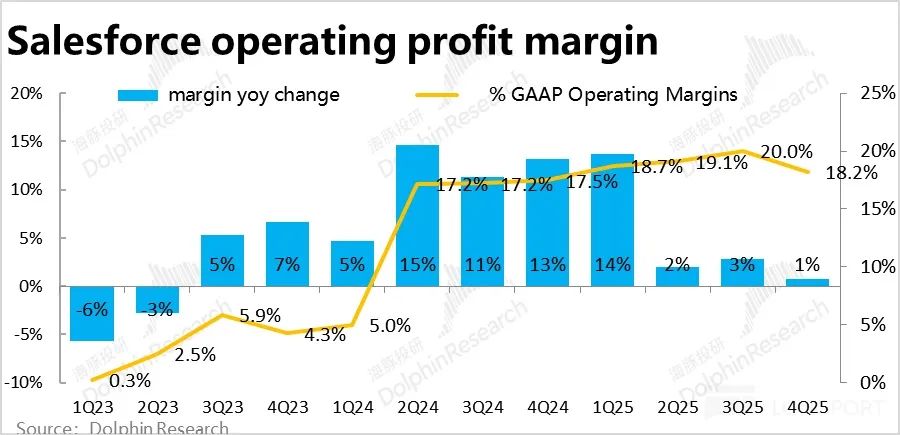

5. Due to the slowing improvement in gross margins and higher-than-expected expenses, the operating profit margin under GAAP declined from 20% in the previous quarter to 18.2% in this quarter.

Affected by this, the company's operating profit for this quarter was $1.82 billion, a year-over-year increase of only 12%, a cliff-like drop from the previous two quarters' levels of over 20%.

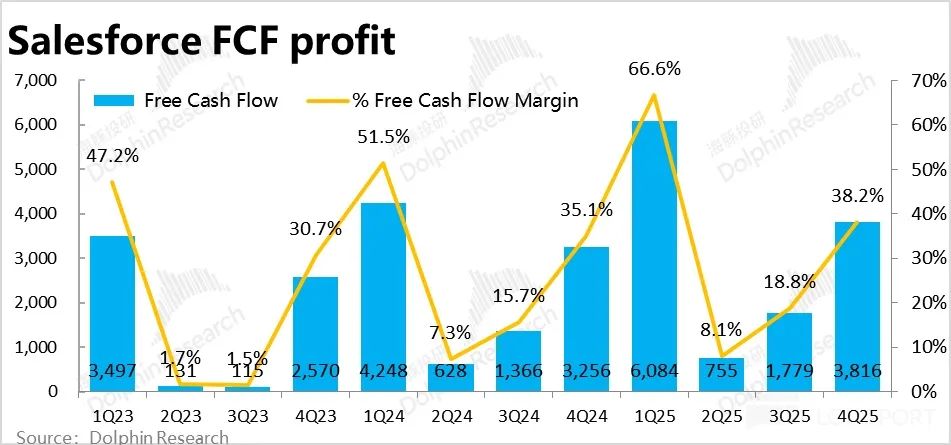

Fortunately, the company's free cash flow profit, which it pays more attention to, still performed well, reaching $3.82 billion in this quarter, higher than the expected $3.48 billion. The cash flow profit margin was 38.2%, still an increase of 3.1 percentage points year-over-year, mainly due to favorable tax expenses and lower-than-expected Capex.

Dolphin Investment Research Viewpoint:

Summarizing the above comments, it can be seen that Salesforce's performance this time was unsatisfactory. First, except for Platform & Data Cloud, which may have benefited from the initial benefits of AI and showed some acceleration, all other business segments still showed a trend of slowing growth.

In addition, the narrowing of gross margin improvement and the expansion of expense expenditures in this quarter, when combined, led to a reversal of the company's previously sustained profit expansion cycle, even as growth was still on a downward trend. Relying on profit improvements to compensate for the lack of a growth narrative no longer held true this quarter.

This also seems to suggest that while AI & Agentforce have not yet brought significant incremental revenue (market expectations are for significant contributions by the end of fiscal year 2026 or even fiscal year 2027), they have led to an increase in upfront investments.

Similar to upstream cloud service providers, it seems that Salesforce must also endure a period of upfront expenses and profit declines for an uncertain growth space. The only bright spot is that the RPO indicator seems to suggest that AI functions such as Agentforce may bring some long-term contracts, but due to the early stage of development, their recent business contributions are still quite limited.

Regarding the incremental contributions of AI and Agentforce, as of now, the incremental annualized revenue of AI-related data clouds is $900 million, a year-over-year increase of 120%, or about a 2.4% incremental contribution. Since October, the company has signed approximately 5,000 Agentforce contracts, which should be in line with market research and expectations.

The company's guidance for the next quarter is also not good. The company expects median revenue of $9.74 billion in the next quarter, lower than the expected $9.9 billion. The implied growth rate is 6.6%, continuing to decline from the 7.6% in this quarter (impacted by exchange rates and the leap month last year).

On the profitability front, the company expects diluted EPS under GAAP to be $1.5 in the next quarter, also lower than the expected $1.66, suggesting that the negative profit trend in this quarter will continue into the next quarter.

For the full fiscal year 2026, the company expects revenue growth of around 7% to 8% at constant exchange rates, a continued decline from this year's growth rate but should be no lower than market expectations. The company guides for operating cash flow growth of 10% to 11%, with profit growth further aligning with revenue, indicating that profit margin improvements for the entire next fiscal year will also be limited. This again suggests that AI investments will drag down profit improvements.

With U.S. AI+ semiconductor stocks hovering at high levels, the market expects Salesforce, as a super SaaS giant on the AI application side, to shoulder the responsibility of application implementation (Note: Microsoft's Copilot essentially failed, leaving only vertical SaaS players like Applovin and Palantir. True AI SaaS implementation is still largely in pan-scenarios). This way, the market can continue to build a stage for AI agents, and the generalization and implementation of applications can also continue to drive the U.S. semiconductor market.

However, judging from Salesforce's guidance for this quarter and the next, performance is clearly disappointing. The new business represented by Agentforce has not emerged as a dark horse with immediate results, while traditional businesses are still deteriorating marginally. The new business cannot fill the hole left by the weakening of the old business, making the overall situation even worse.

With high expectations and rising valuations, the market is obviously not satisfied with a few leading indicators, such as new contract balances and remaining performance obligations. After all, Microsoft's such indicators soared this quarter, but it still could not stop the stock price from falling. From this perspective, Salesforce has not lived up to market expectations and cannot bring the logic of software AI agents to more SaaS companies. However, Dolphin will continue to pay close attention to the implementation of AI agents in the SaaS community.

Below is a detailed interpretation of this quarter's earnings report.

I. Revenue Growth Slowdown Has Not Been Reversed

On the growth front, Salesforce's core subscription revenue for this quarter was $9.45 billion, a year-over-year increase of 8%, about 1.1 percentage points slower than the previous quarter and also lower than the consensus estimate of 8.8%. Salesforce's recent problem of continuous growth decline has not shown any signs of improvement. According to guidance for the next quarter, growth will continue to decline (of course, impacted by exchange rates and leap year bases).

Looking at the performance of the five major clouds under subscription revenue, the growth rate of Platform & Data Cloud increased significantly from 8.2% in the previous quarter to 11.5%, significantly higher than the market expectation of 8%, and was the only one showing accelerated growth. We believe this may be partly due to the small incremental revenue contributions from AI & Agentforce. However, apart from that, the growth of the other four major cloud businesses continued to decline comprehensively, and was generally 1% to 2% lower than market expectations. In other words, apart from the imagination space brought by Agentforce, the growth difficulties of the company's existing businesses are not small.

Due to the core subscription revenue growth falling short of expectations, coupled with approximately $540 million in service revenue for this quarter (which had a negligible impact), Salesforce's total revenue for this quarter was $9.99 billion, a year-over-year increase of 7.6%, lower than the expected growth rate of 8.1%.

II. Leading Indicators Initially Show Signs of Improvement, Will the Future Be Better Than Now?

The leading indicator of subsequent growth, cRPO (contracted but not recognized performance obligation), showed a year-over-year growth rate decline from 10.5% in the previous quarter to 9.4%, but it was slightly better than expected. Excluding the impact of exchange rates, the comparable growth rate for this quarter was 11%, accelerating from 10% in the previous quarter.

Similarly, the growth of total remaining performance obligations, including those over 12 months, was even better. Even under GAAP, which includes the impact of exchange rates, the growth rate increased from 9.9% in the previous quarter to 11.4%. It can be seen that the growth of long-term remaining performance obligations was stronger than that of short-term obligations in this quarter. The proportion of long-term obligations in this quarter reached 52%, a first since fiscal year 2021. This change may suggest that while AI & Agentforce have not yet brought significant incremental business in the short term, they have indeed sparked customer interest, leading to some long-term contracts or usage commitments.

Overall, although revenue growth continued to slow in the current quarter, the growth of short-term and long-term RPOs, excluding exchange rates, both improved, with long-term improvements outpacing short-term ones. This may mean that revenue growth will tend to accelerate in the future (after a few quarters).

III. Gross Margin Improvement Trend Paused?

At the gross margin level, Salesforce's subscription revenue generated a gross profit of $7.87 billion in this quarter, a year-over-year increase of 9.8%. Although it still outpaced revenue growth, the trend was significantly slower than the 12.3% in the previous quarter.

The gross margin was 77.8%, an increase of 0.9 percentage points year-over-year, while the gross margin improvements in the first three quarters of this fiscal year were all above 2 percentage points. In other words, the trend of improving gross margins that had lasted for several years significantly slowed down in this quarter, and gross margin performance was also poor.

We speculate that upfront investments in AI & Agentforce versus minimal short-term revenue contributions may have dragged down gross margins. The actual reason will require attention to whether management explains it during the conference call.

Adding the gross loss of 95 million USD from long-term loss-making service revenue (also higher than usual), Salesforce's total gross profit for this quarter was approximately 7.78 billion USD, lower than the expected 7.91 billion USD, with a gross margin of 77.8%, 1% lower than expected. It is evident that gross profit performance fell short of expectations.

IV. Substantial Increase in Administrative Expenses, Dragging Down Profits

In terms of expenses, Salesforce's total operating expenses for this quarter amounted to $5.96 billion, higher than the expected $5.71 billion. The proportion of expenses to revenue increased by 0.2% year-on-year to 59.6%, ending the narrowing trend of the expense ratio that had lasted for several years and reversing to an expansion trend.

However, specifically, the largest proportion of marketing expenses was $3.47 billion, lower than the expected $3.55 billion, with a year-on-year increase of only 1%. Therefore, the total expenses exceeding expectations were not due to increased marketing investment for promoting new businesses such as Agentforce.

The main reasons were a significant 21% year-on-year increase in administrative expenses and the additional recognition of nearly $300 million in restructuring expenses for this quarter. These two factors were the primary reasons for the expansion and overestimation of total expense expenditures. Attention can be paid to the company's explanation for the sharp increase in administrative expenses.

R&D expenses maintained a steady growth rate of 11.4% year-on-year, with no significant changes.

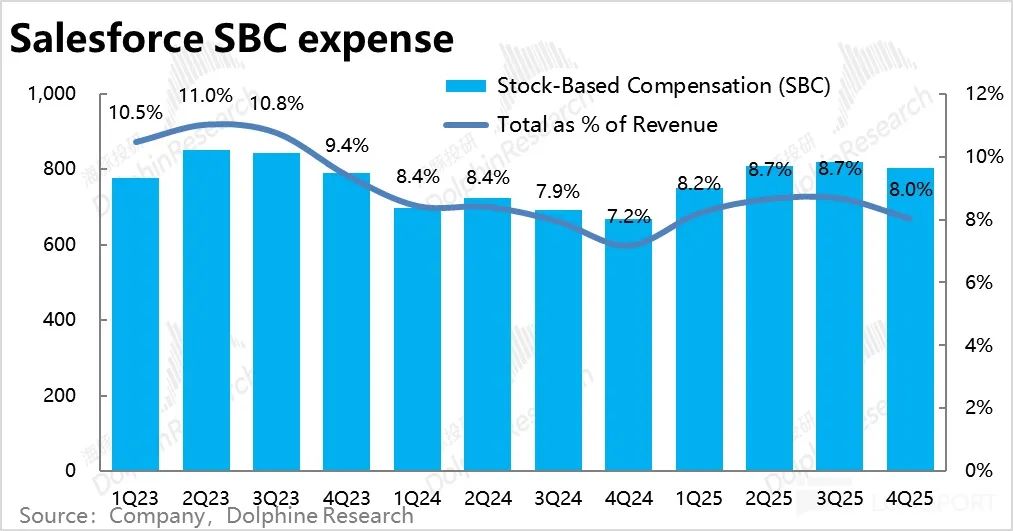

As an important component of expenses for SaaS companies, share-based compensation (SBC) expenses for this quarter were approximately $800 million, accounting for 8% of revenue. Following the previous seasonal trend, the proportion declined quarter-on-quarter. However, the proportion of SBC expenses for the entire fiscal year 2025 is still comprehensively higher than that of fiscal year 2024. There is also a trend of re-expansion in the proportion of SBC expenses.

V. Decline in Operating Profit Margin but Solid Cash Flow

As mentioned above, Salesforce's gross margin improvement slowed down this quarter, falling short of expectations. On the expense side, due to higher-than-expected administrative and restructuring expenses, the company's operating profit margin under the GAAP basis dropped from 20% in the previous quarter to 18.2%.

Affected by this, the company's operating profit for this quarter was $1.82 billion, with a year-on-year increase of only 12%, a steep decline from the levels above 20% in the previous two quarters. Although Salesforce has been experiencing sluggish growth recently, it previously achieved significant results in profit release through cost reduction and efficiency enhancement. However, even profit performance was unsatisfactory this quarter.

Nevertheless, the company's free cash flow performance, which it pays more attention to, remained solid, reaching $3.82 billion this quarter, higher than the expected $3.48 billion. The cash flow profit margin was 38.2%, still an increase of 3.1% year-on-year. One significant contributing factor was that tax expenses for this quarter were nearly $200 million lower than expected. Additionally, Capex expenditures for this quarter were only $150 million, a decrease from the previous quarter's $200 million. There was no increase in capital investment due to AI & Agentforce, which might also be one of the reasons for the free cash flow exceeding expectations.

- END -

// Reprint Authorization

This article is an original creation of Dolphin Investment Research. For reprinting, please obtain authorization.

// Disclaimer and General Disclosure Note

This report is for general comprehensive data use only, intended for general browsing and data reference by users of Dolphin Investment Research and its affiliated institutions. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referring to the content or information mentioned in this report bears the risk themselves. Dolphin Investment Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are for reference purposes only. Dolphin Investment Research strives but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions mentioned in this report shall not be construed or deemed as an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute recommendations, inquiries, or promotions of relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for distribution to citizens or residents of jurisdictions where the distribution, publication, provision, or use of such information, tools, and data violates applicable laws or regulations or would result in Dolphin Investment Research and/or its subsidiaries or affiliated companies being subject to any registration or licensing requirements in such jurisdictions.

This report only reflects the personal views, opinions, and analysis methods of the relevant creative personnel and does not represent the position of Dolphin Investment Research and/or its affiliated institutions.

This report is produced by Dolphin Investment Research, and its copyright belongs solely to Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no organization or individual may (i) produce, copy, reproduce, reprint, forward, or create any form of copies or reproductions in any way, and/or (ii) directly or indirectly redistribute or transfer them to other unauthorized persons. Dolphin Investment Research reserves all relevant rights.