From a Rejected $23 Billion to a Final $10 Billion Increase: Google's Strategic Acquisition of the Mysterious Israeli Company

![]() 03/27 2025

03/27 2025

![]() 691

691

Largest Acquisition in Google's History

On March 18th, it was confirmed that Alphabet, Google's parent company, will acquire the cloud security startup Wiz for $32 billion in cash. Upon completion, Wiz will be seamlessly integrated into Google Cloud, marking the largest acquisition in Google's merger and acquisition history.

This is not only Alphabet's largest deal to date but also the biggest in the cybersecurity sector in 2024. According to TechCrunch, in addition to the acquisition price, there is an additional $1 billion earmarked as retention bonuses for Wiz to ensure the retention of its talented team. The company, which now boasts 1,700 employees, offers an average compensation of over $588,000 per employee (individual salaries may vary).

Last July, Wiz turned down Google's acquisition offer. I covered this in detail at the time, as documented in "Rejecting Google's $23 Billion Acquisition: What Does the 4-Year-Old Wiz Rely On?" At that point, Wiz's CEO expressed confidence in the company's potential to achieve greater value, setting an ambitious goal of reaching $1 billion in ARR (Annual Recurring Revenue) and pursuing an IPO.

Cloud Computing Competition Intensifies with Generative AI

During an investor call, Alphabet CEO Sundar Pichai highlighted that artificial intelligence brings both new risks and opportunities, emphasizing that "they are seeking cybersecurity solutions that can enhance cloud security across multiple clouds."

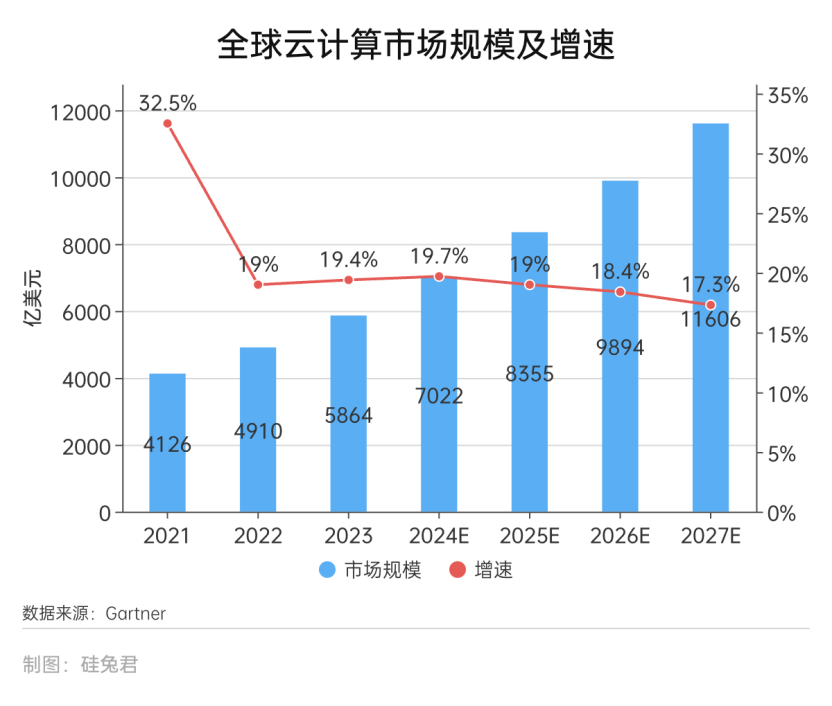

This proactive stance is well-founded. While cloud migration was once an option for enterprises, the era of generative AI, with its exponential data growth, has made cloud migration a necessity. Cloud services have become critical infrastructure for large models. According to previous Gartner statistics, the global cloud computing market is projected to reach $835.5 billion by 2025.

Gartner's research reveals that as generative AI introduces new attack surfaces, enterprises must transform their application and data security practices, along with user monitoring, to provide robust protection. By 2025, the adoption of GenAI will lead to a surge in cybersecurity resources required by enterprises, resulting in over a 15% increase in application and data security spending, further driving the demand for cybersecurity solutions. According to statistics from FreeBuf, a third-party consulting agency, global funding for AI security was approximately $20 million in 2022, which skyrocketed to approximately $200 million in 2023. As of July 2024, there have been 102 funding rounds in global AI security, totaling over $1 billion, representing a year-on-year increase of 500%.

Boosting Google's Cloud Computing Strength

From Google's perspective, its persistence in acquiring Wiz, even after an initial rejection, and its subsequent offer of an additional $10 billion within less than a year, underscores its intentions and urgency. Firstly, it aims to bolster its cloud computing capabilities, and secondly, to strengthen its cybersecurity prowess. Google subsequently stated that this acquisition represents an investment in two growing trends in the AI era: improving cloud security and enabling multi-cloud capabilities.

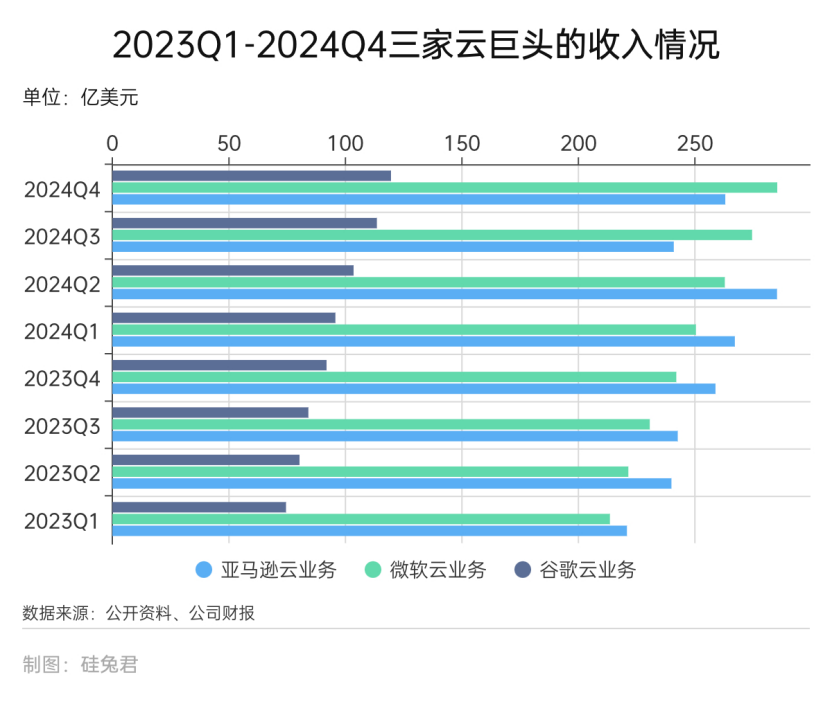

In the cloud computing arena, Google Cloud has consistently lagged behind Microsoft and Amazon. According to Canalys, a third-party market research firm, Amazon Web Services (AWS) held a 33% market share in the third quarter of 2024, ranking first, followed by Microsoft Azure with a 20% market share, and Google Cloud in third place with a 10% market share. In a tech industry dominated by the top two players, Google Cloud, ranking third, trails significantly in terms of revenue and gross profit. Acquiring Wiz could help Google gain market share in the fiercely competitive cloud security industry.

Who is Wiz, and What Makes It Unique?

With numerous cybersecurity companies (statistics show over 50 cybersecurity startups globally valued at over $1 billion), what makes Wiz stand out to Google?

Firstly, the team members and their backgrounds at Wiz are unparalleled in Silicon Valley. The four founders met at Talpiot, an elite military academy that trains students in science, mathematics, and computer science, while also exposing them to different armed forces. After Talpiot, they joined Unit 8200, known as the "most feared cyber espionage unit," comparable to the U.S. National Security Agency, with formidable capabilities in electronic warfare and surveillance. This unit brings together the brightest minds in cybersecurity from Israel and around the world, with many veterans founding tech companies, making it a hotbed of technological innovation in Israel. The founding team of Wiz previously co-founded Adallom, a cloud cybersecurity company later acquired by Microsoft for $320 million.

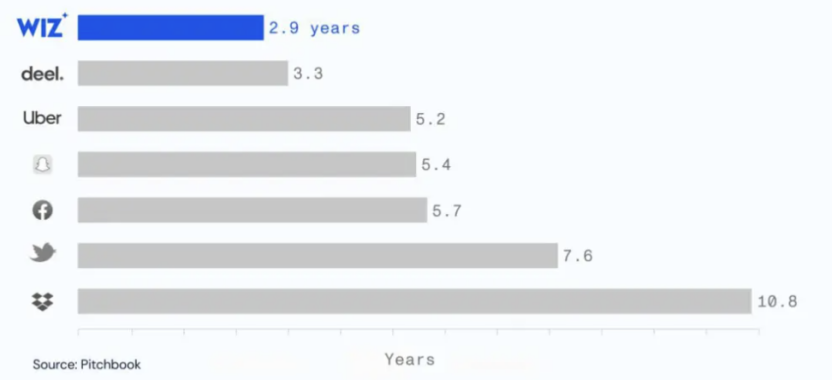

Founded in 2020, Wiz set the record for the fastest cybersecurity company to reach $100 million in ARR within 18 months. In May 2024, Wiz announced that its ARR reached approximately $350 million, and by July, it had surpassed $500 million, with plans to hit $1 billion by 2025. According to Pitbook, a data analytics agency, Wiz became a $10 billion company in just 2.9 years.

Technology Companies with a Valuation of $10 Billion

Secondly, Wiz's product represents a groundbreaking innovation that simplifies complexity, unlike traditional cybersecurity products. This has become the moat for the rapid growth of this cybersecurity company, enabling it to acquire numerous clients in a short period – over 45% of Fortune 100 companies are Wiz's clients. For clients, its products offer cost-effectiveness and convenience, providing an integrated product that runs on various platforms, identifying and prioritizing increasingly complex computing environment risks. Additionally, Wiz has developed a method for swiftly scanning virtual machines that comprise the cloud network and capturing daily activities on each machine. This process generates a ranking of the most urgent security risks and provides tools to address them. Another innovation is that Wiz's product allows enterprises to monitor security threats to their virtual machines without installing additional software, circumventing the complex processes of previous cloud security services. Furthermore, Wiz's security products ensure that every virtual machine in a client's cloud network is scanned and accounted for. Neil MacDonald, an analyst at Gartner, stated that Wiz pioneered the use of graphical analysis to understand the relationships between all assets in an organization's multi-cloud environment.

Moreover, Wiz has enhanced its product capabilities through acquisitions, allocating $1 billion specifically for mergers and acquisitions in 2024. In November last year, it was reported that Wiz was acquiring Dazz, an expert in security remediation and risk management. Dazz's products primarily target the remediation and situational management areas of the cybersecurity market, which Wiz had not yet fully covered. Remediation measures help enterprises understand and address their security vulnerabilities, while security situational management enables enterprises to better comprehend the overall status, conditions, and functions of their networks, thereby building superior security services.

Last year, The Wall Street Journal reported that the failure of Google's first round of acquisition negotiations with Wiz stemmed from the two companies' inability to agree on whether Wiz should operate as an independent division or be integrated into Google Cloud. However, TechCrunch cited sources familiar with the deal, stating that another reason was the Biden administration's stringent scrutiny of large transactions.

Madhu Namburi, the global chair of technology investment banking, has noted that large deals in the tech sector have been hindered by regulatory reviews lasting 12 to 18 months or longer, and this prolonged regulatory scrutiny is expected to change under the Trump administration. Google's acquisition of Wiz still requires regulatory approval and may be completed next year.