Volcano Engine Dominates Large Model Invocations: What's Behind the Success?

![]() 04/18 2025

04/18 2025

![]() 794

794

Volcano Engine has recently garnered significant attention for its performance in a recent data report.

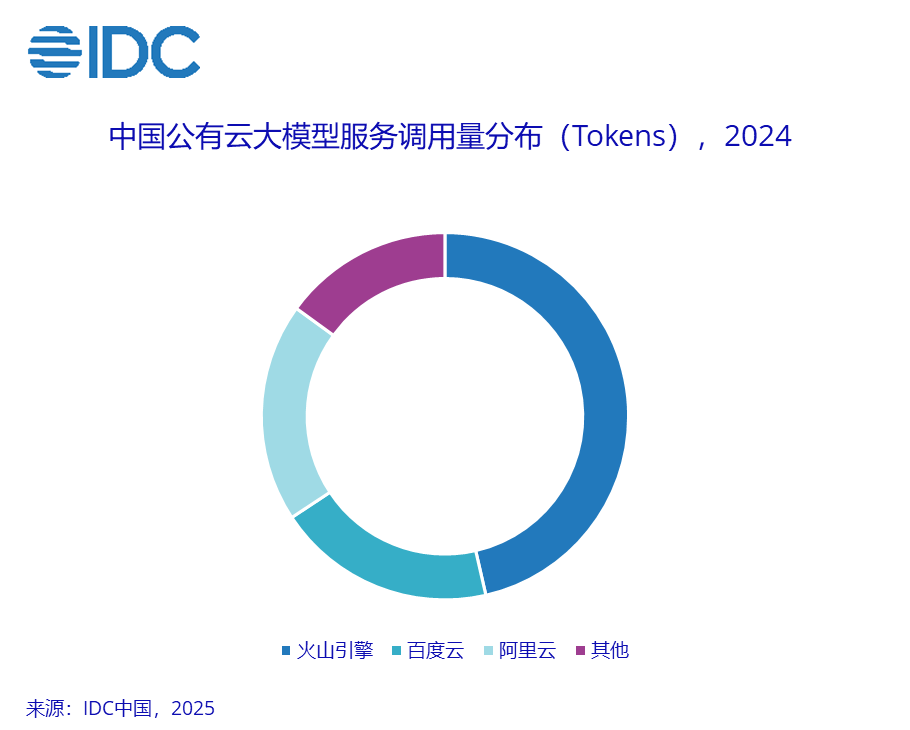

According to the IDC report titled "Analysis of China's Public Cloud Large Model Service Market Landscape, 1Q25," Volcano Engine led the market in terms of large model invocation volume on China's public cloud in 2024 with a 46.4% market share, followed by Baidu Cloud and Alibaba Cloud.

It's important to note that this dimension excludes invocation volumes from MaaS platforms used by overseas users or from major model apps. Essentially, it focuses solely on the domestic market and excludes volumes from overseas users and C-end applications.

Looking back at ByteDance's AI explorations in 2024, Volcano Engine, despite entering the cloud computing market relatively late, leveraged its deep integration with the Doubao large model and Doubao's influence in AI-to-C applications to carve out a niche as a cloud provider offering large model services (MaaS) through "Doubao." This business strategy aligns well with IDC's statistical method, making Volcano Engine's market share leadership in this dimension unsurprising.

However, as the AI landscape intensifies in 2025, the current size of the MaaS market is relatively small and shares characteristics similar to the SaaS market. Amidst high growth trends, the MaaS market still faces numerous uncertainties.

01. Expanding Horizons: How Will Volcano Engine Navigate the MaaS Market in 2024?

Prior to the era of large models, Volcano Engine's focus was on developing its cloud computing capabilities. However, with the advent of large models, Volcano Engine and To C applications gained significant momentum.

Nevertheless, Volcano Engine didn't have a significant advantage in exploring the cloud computing market before the large model era. It entered the public cloud market in 2021, relatively late compared to Alibaba Cloud (2009) and Tencent Cloud (2013), when the market was already segmented.

Previously, cloud computing statistics were primarily based on IaaS, PaaS, and SaaS. According to the "Cloud Computing White Paper" released by the China Academy of Information and Communications Technology (CAICT) in 2024 (with a statistical time dimension earlier than 2024), Volcano Engine wasn't among the top six players in China's public cloud IaaS and PaaS markets (SaaS primarily focuses on overall scale due to its characteristics).

These markets were dominated by cloud providers from the internet industry, such as Alibaba Cloud, Baidu Cloud, and Tencent Cloud, as well as providers from the telecommunications industry, including Huawei Cloud, China Telecom Tianyi Cloud, China Mobile Cloud, and China Unicom Cloud. Previous years' results were similar.

As mentioned in a previous "New Standpoint" article titled "Volcano Engine and Jueliang Engine: Changes in Douyin's Most Expensive and Most Profitable Businesses," Volcano Engine's first key turning point was the "dual-engine drive" proposed in 2022, combining Jueliang Engine and Volcano Engine. The second key turning point came with the era of large models.

In terms of AI-to-C, ByteDance employs a business model where C-end applications drive the popularity of large models. In 2024, Doubao was the second most downloaded AI application, trailing only behind Quark. ByteDance excels in creating C-end applications, and as stated in a previous "New Standpoint" article, distribution is inherent in ByteDance's DNA.

In cloud computing, ByteDance's business model involves leveraging the popularity of large models to drive market attention towards Volcano Engine, which is deeply integrated with the Doubao large model. This unique AI exploration model, combining ByteDance's strengths, isn't common among mainstream cloud providers.

The emergence of new concepts often leads to market reshuffling. With Volcano Engine's cloud computing infrastructure still needing further investment, ByteDance naturally chose MaaS as a key bridge in 2024 to simultaneously deploy AI-to-C and cloud computing. Anchoring on the MaaS market, Volcano Engine built upon the already segmented IaaS, PaaS, and SaaS markets. From this perspective, Volcano Engine's business genes and deployment model are highly consistent with the logic of cloud providers offering MaaS services.

The key lies in this layout's deep integration with the "Doubao" brand. In other words, compared to other cloud providers and their large model brands, Doubao's performance significantly impacts Volcano Engine's market performance.

Doubao's strong market performance in 2024 garnered considerable attention. Coupled with Doubao's strategy of being the first to reduce prices for its large model, these factors were crucial in Volcano Engine's ranking as the top cloud provider in terms of model invocation volume in the IDC data report. Since model invocation volume ranking is positively correlated with MaaS services ranking, this also largely reflects Volcano Engine's high overall MaaS market share.

However, this ranking may face uncertainties this year.

As mentioned in a previous "New Standpoint" article titled "Tencent and ByteDance: Two Extremes in AI to C Meet at the Top," in 2024, Tencent's Yuanbao and Hunyuan large models were nearly absent from the C-end market. According to Qimai statistics, Doubao's cumulative downloads in 2024 were at least 20 times those of Tencent's Yuanbao. However, with the emergence of DeepSeek in 2025, the landscape changed, with Tencent's Yuanbao and ByteDance's Doubao now competing at the top of the download charts.

Additionally, after Volcano Engine initiated a price war in the large model market last year, competitors followed suit. If Doubao's app and large model don't outperform AI applications like Yuanbao and AI large models like Tongyi this year, and Volcano Engine is still in an infrastructure investment window period, the market's token pricing strategy could shift at any time.

Therefore, it remains uncertain whether Volcano Engine will retain its position as the top cloud provider in terms of large model invocation volume on the MaaS platform this year.

02. How do Other Cloud Providers View the MaaS Market in 2025?

To predict the MaaS market situation this year, in addition to Volcano Engine's own development and current positioning, the key lies in whether other established cloud providers will actively address this "shortcoming" and catch up with Volcano Engine in terms of model invocation volume and the MaaS market in the public cloud this year.

From the perspective of the MaaS market's development process and scale, 2024 was the first year of full-scale deployment of AI large models, and 2024 was also the first year that MaaS-related statistical dimensions appeared in major reports. However, the current scale of MaaS is relatively small compared to IaaS, PaaS, and SaaS.

According to IDC's report prediction from the first half of last year, the MaaS market size was 500 million yuan in 2024. Considering the growth rate of model invocation volume in the second half of 2024, the actual situation may be higher, but the annual MaaS market size will likely remain in the order of 2 billion yuan. In 2024, the domestic large model invocation volume was 114.2 trillion tokens. Using a simple estimation based on Doubao's 1.5pro32k large model at 0.001 yuan per thousand output tokens (invocation volume includes input and output, with output prices higher than input; here, the scale is estimated simply based on bulk output prices), the scale of model invocation fees in 2024 was likely in the order of 100 million yuan.

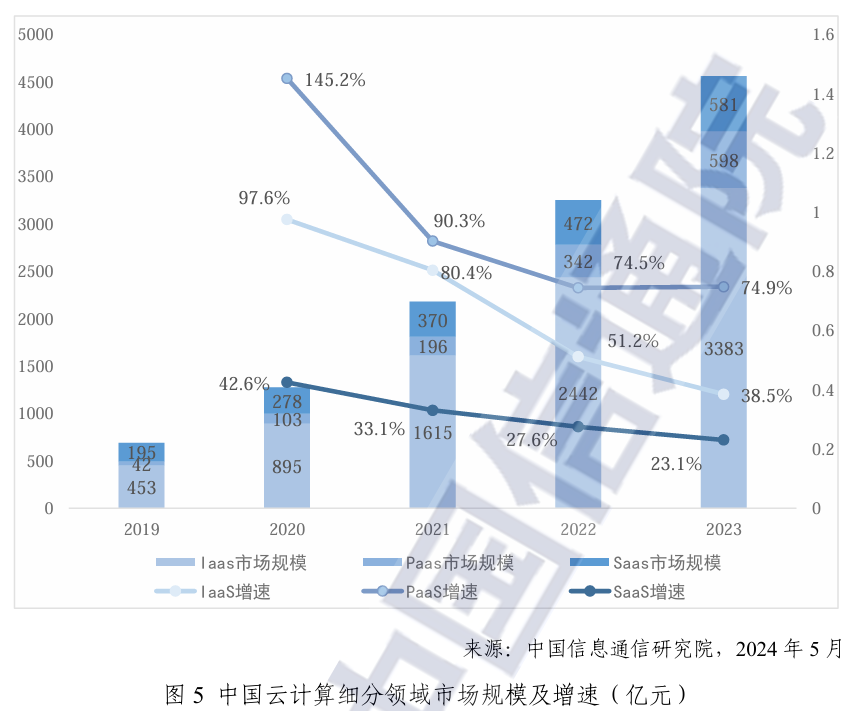

According to the China Academy of Information and Communications Technology report, the market sizes of IaaS, PaaS, and SaaS in 2023 were 338.3 billion yuan, 59.8 billion yuan, and 58.1 billion yuan, respectively, indicating a significant gap with the MaaS market size.

More crucially, how to measure the dimension of "public cloud large model service invocation volume" is also noteworthy.

Taking the SaaS market as an example, it is dominated by a large number of small and medium-sized SaaS service providers with diverse business types. Moreover, some SaaS service providers' business models sometimes require purchasing products from multiple cloud service providers. Cloud providers offer cloud services to SaaS service providers, who in turn provide SaaS systems to merchants, who then offer consumer services through these systems to end-users. In the SaaS ecosystem, it's challenging to calculate the market share of cloud providers in SaaS, as reflected in previous cloud computing reports.

The MaaS ecological model is similar to SaaS. For example, Alibaba Cloud not only has the Tongyi large model series but also collaborates with various large model vendors. However, these large model vendors' infrastructure services may not all come from the same cloud provider. When the market counts the invocation volumes of these large models, it's unclear if it can distinguish the invocation volumes that clearly belong to a specific cloud provider. This key question remains doubtful.

Nonetheless, the MaaS market will undoubtedly experience a period of rapid growth. The question remains whether established cloud providers will continue to increase their investment in the MaaS business model after this growth phase.

Currently, "New Standpoint" believes that as DeepSeek's popularity drives model training costs to new lows, major cloud providers and C-end applications integrate with DeepSeek, and the popularity of agents surges due to the popularity of Manus. Before the legendary AGI emerges, services provided by large model vendors to downstream clients, developers, and consumers will become increasingly vertical.

Vertical large model services require implementation across various industries, necessitating deeper service capabilities that reach into the capillaries of these industries. Established cloud providers accustomed to the service model in the IaaS and PaaS markets may either dismiss the still relatively small MaaS market or lack the energy to support long-term MaaS services.

03. Final Thoughts

Data statistics are not just a business but also create consensus and more certainty in the market, especially in today's vast and multidimensional AI large model ecosystem, which inherently requires creating more certainty.

Currently, whether it's Alibaba Cloud, Tencent Cloud, or Baidu Cloud, these cloud providers have their own native large models. Perhaps IDC's report on the share of public cloud model invocation volume reflects the invocation volume share (excluding apps) of these cloud providers' native large models. IDC's statistical results align with the public opinion heat of the "brands" of Doubao, Wenxin, and Tongyi last year.

However, as mentioned above, cloud providers also collaborate with other large model vendors. This statistical dimension cannot reflect the overall layout level of cloud providers in the era of large models. The future development of the MaaS market still requires further observation.

*The lead image and images in the text are sourced from the internet.