AI Agent: The Disruptor of SaaS?

![]() 05/22 2025

05/22 2025

![]() 803

803

How potent is the wave of AI Agent?

At the close of 2024, Microsoft CEO Satya Nadella boldly predicted: "Software-as-a-Service (SaaS) applications will crumble in the age of AI Agent."

As a global SaaS titan, Microsoft's assertion stands as a significant endorsement of AI Agent's potential, possibly the most authoritative one.

Yet, at this juncture, can we truly foresee AI Agent's tide washing away SaaS?

The answer remains far from crystal clear.

I. The Cracks Beneath the $300 Billion Market

Like AI Agent today, SaaS once reigned as the "golden child" of venture capital.

SaaS is a cloud computing model where users subscribe to web-based software services, eliminating the need for local installation. The vendor handles updates and maintenance.

Stars like Salesforce and Shopify have thrived on SaaS, while giants like Microsoft and Adobe have transformed, making SaaS a cornerstone of their strategies.

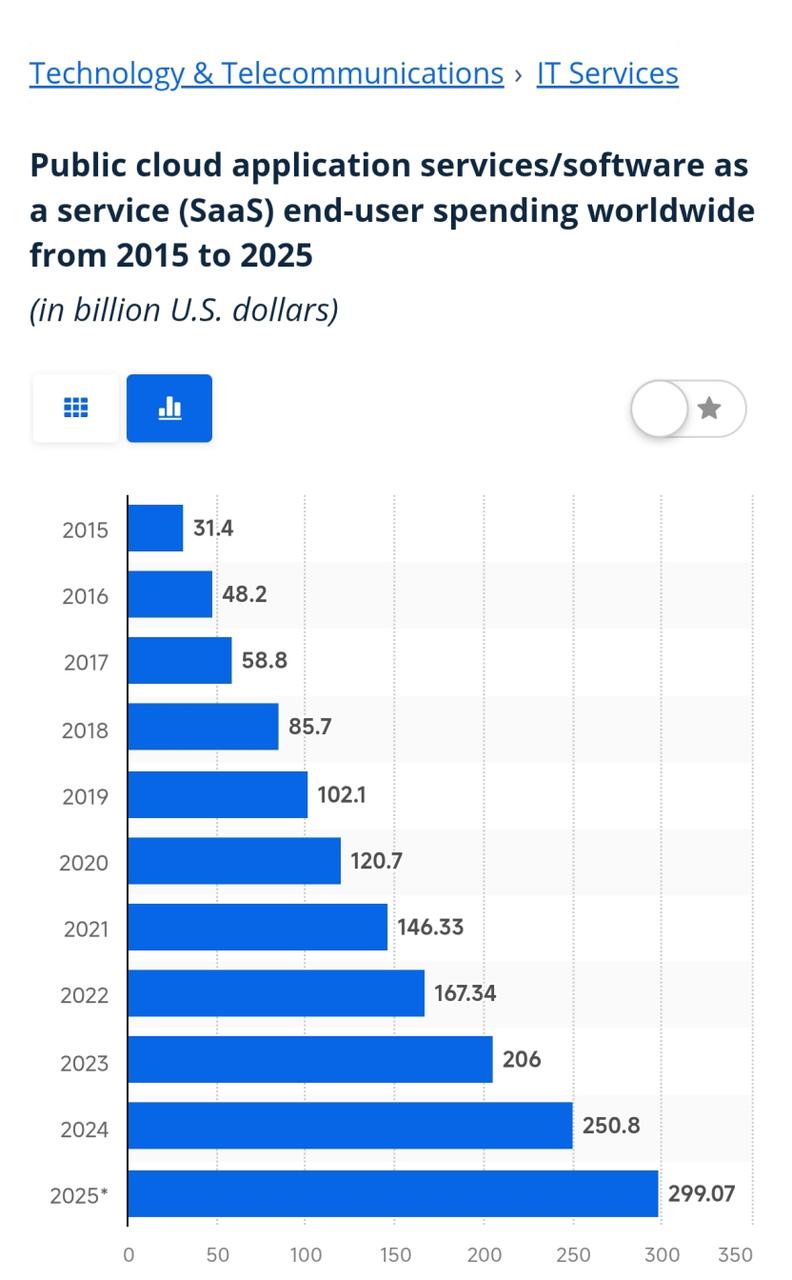

According to Statista, the SaaS market has soared annually since 2015, from $31.4 billion to an estimated $300 billion in 2025, showcasing rapid growth.

Salesforce, as the industry bellwether, peaked at over $340 billion in market capitalization.

However, beneath this prosperity lies unresolved pain points that have become shackles.

Today, SaaS is a crowded field with over 30,000 global vendors (2023 data) and 4,500 in China (2021 data).

To stand out, vendors pour resources into promotion and sales. The "Research Report on the Development of China's Enterprise-level SaaS Industry (2024)" by the China Academy of Information and Communications Technology notes that Chinese SaaS vendors' sales and marketing, and R&D expenses exceed half their revenue.

Recently, domestic vendors like Kingdee, Beisen, and Jushuitan have seen sales and marketing expenses ratios above 40%, with Weimob exceeding 70%.

High sales and marketing costs erode gross margins, leading to "losing money to gain popularity."

Traditional SaaS is mature, with similar underlying technologies and features across vendors, limiting groundbreaking innovations.

Switching vendors is easy, leading to low user retention. Pricing sensitivity discourages customization, weakening user stickiness.

This vicious cycle hinders new user acquisition and retention.

Beyond business model bottlenecks, traditional SaaS has "inherent flaws." Limited functionality and data interoperability are evident.

Enterprises subscribe to multiple SaaS products to meet diverse needs, but data silos hinder seamless integration, reducing efficiency.

Data security concerns also deter users. By choosing SaaS, enterprises entrust data management to vendors, making security and compliance crucial.

These pain points, despite SaaS's commercial success, offer opportunities for new technologies like AI Agent to shine and reshape the landscape.

II. AI Agent: The Disruptor Arrives?

AI Agent can be defined as an artificial intelligence system that perceives the environment, makes decisions, and acts to achieve goals autonomously.

While not a new concept, large language models (LLMs) like ChatGPT have reignited discussions and research on AI Agent.

On March 30, 2023, AutoGPT based on GPT-4 launched, hinting at AI Agent's potential to land.

With multimodal capabilities and chains of thought (CoT) for problem-solving, AI Agent possesses a brain and "senses," making its "thinking" closer to humans.

In some scenarios, AI can tangibly replace humans.

In the SaaS context, can AI Agent, with automation and intelligence, instantly address existing pain points?

In some aspects, AI Agent looks promising.

Theoretically, AI Agent can significantly enhance customization. Unlike SaaS, which requires users to adapt, AI Agent creates workflows based on user needs.

While SaaS offers graphical interfaces, AI Agent can simplify to conversational interfaces, allowing personalized visual design.

AI Agent can "guess preferences" and reconstruct UI and functions, even with developer permissions.

Integrating multiple SaaS solutions is cumbersome, but AI Agent lets users state desired outcomes, handling intermediate processes, enhancing user experience.

Users can instruct AI Agent in natural language, akin to Siri or XiaoAi.

AI Agent's autonomous thinking and cross-module data analysis potential make it more than a tool; it can proactively offer business suggestions, evolving into an assistant.

In traditional SaaS, using an ERP system involves manual data entry and familiarity with functional modules. With AI Agent, users can simply state, "Increase Product A production by 20%," and AI handles the rest, including risk warnings and alternative solutions.

Such a user experience naturally boosts retention, no longer a SaaS vendor's stumbling block.

III. The Future of AI Agent and SaaS: Integration or Disruption?

AI Agent's impact on SaaS is evident, with companies like Salesforce, Microsoft, Yonyou, and Weimob launching AI Agent solutions.

Currently, AI Agent is integrated into SaaS, handling planning and decision-making at specific nodes. The future may unfold in two trends.

First, SaaS will coexist with AI Agent, deeply integrating to "reshape" itself. AI Agent will embed into business processes, and SaaS will serve as an API-like tool.

Under this model, SaaS moves behind the scenes but isn't replaced. AI Agent integrates SaaS, forming a symbiotic relationship.

Salesforce CEO Marc Benioff supports this, believing AI Agent needs a reliable data foundation and sophisticated applications (SaaS) to maximize effectiveness, evolving SaaS into Service-as-Software (SaSo).

The second trend is more radical – since SaaS can be seen as "database + business logic," why not let AI Agent directly interact with the database and handle logic?

Nadella's vision aligns with this, but have we reached the dawn?

For now, AI Agent faces obstacles to truly disrupting SaaS.

As a large model "shell," AI Agent's capabilities are constrained by its LLM foundation. LLM's reasoning, multimodal abilities, and hallucination rates affect AI Agent's usability.

In the OSWorld benchmark test, the best AI Agent score is 42.5% (ByteDance's UI-TARS-1.5), below the human average of 70%. This may suffice for personal tasks but falls short for enterprise needs.

From a cost perspective, while LLM vendors reduce pricing, the economic threshold for large-scale deployment hasn't been reached. Complex tasks incur high invocation costs, potentially leading to rapid resource consumption.

Model fine-tuning, deployment, and optimization in vertical industries require significant technical and financial investments. Being "cool" isn't enough for enterprises to fully embrace AI Agent.

Moreover, AI Agent doesn't fundamentally solve SaaS's data security and compliance issues, introducing new uncontrollable factors.

Tracing and accountability are complex compared to SaaS's clear traceability.

While AI Agent flourishes, no "killer application" at the enterprise level has emerged to replace SaaS.

In summary, AI Agent may reshape the SaaS industry, but the transformation's prelude has just begun. SaaS vendors must seriously consider transformation or integration; hesitation could be fatal.