Aliyun Gets Lost in the "Low Price" Gimmick

![]() 03/14 2024

03/14 2024

![]() 734

734

"Price wars" once served as Aliyun's invincible weapon to capture markets, but why is it not as effective this time?

Author | Cindy

Editor | Yang Ming

Spring water warms up first.

"It's too late to engage in a price war now. A bunch of old users have left Aliyun, and the market response has been minimal so far." Zhang Jie, the head of a small and micro enterprise, said after learning that Aliyun had launched another price war. He was once a loyal Aliyun user for four consecutive years but switched to other cloud platforms when faced with renewal in January this year without much hesitation.

At the end of February this year, Aliyun announced a reduction in the official website prices of its cloud products across the board, with an average price reduction of 20% for over 100 products and over 500 product specifications, and a maximum reduction of 55%.

Later that day, JD Cloud announced that all its core products would continue to participate in price comparisons across the network, followed by Tencent Cloud, which announced discounts on AI products such as AI painting, face fusion, and audio file recognition.

In the cloud service market, price wars have long been a routine marketing tactic for major vendors. For example, after Aliyun launched its so-called "largest-ever" price reduction campaign in March last year, Tencent Cloud, JD Cloud, Huawei Cloud, Mobile Cloud, and others followed suit with significant investments.

However, according to observations by Zhang Jie and other industry insiders, compared to last year's "market-style promotion," Aliyun's latest "largest-ever" price reduction campaign has failed to create much impact in the industry.

On the one hand, more than ten days later, most competitors have not followed suit with price reductions—not only JD Cloud and Tencent Cloud have been relatively low-key, but also Huawei Cloud, Mobile Cloud, and Tianyi Cloud have not announced any price reduction.

"Our prices have always been lower than Aliyun's, with regular discounts that are even more favorable. There's no need to adjust our strategy." An insider from a cloud service provider said they have chosen not to follow suit for now.

On the other hand, after several serious operational accidents, Aliyun's service and quality have been questioned by the outside world. Many old users have found that renewal prices are more expensive than those for new users, and even several times more expensive. As a result, more and more companies feel that "the cost of using Aliyun is higher" and turn to other cloud platforms.

"Price wars" once served as Aliyun's invincible weapon to capture markets, but will it still work this time?

01

Gradually Ineffective Price Weapon

"This round of Aliyun's price reduction is aimed at attracting new student groups, individual users, and small and medium entrepreneurs." A person from an Aliyun service agent said that although the company has been frantically promoting via phone calls over the past half-month, with each salesperson making hundreds of calls daily, market acceptance and conversion rates have not increased significantly.

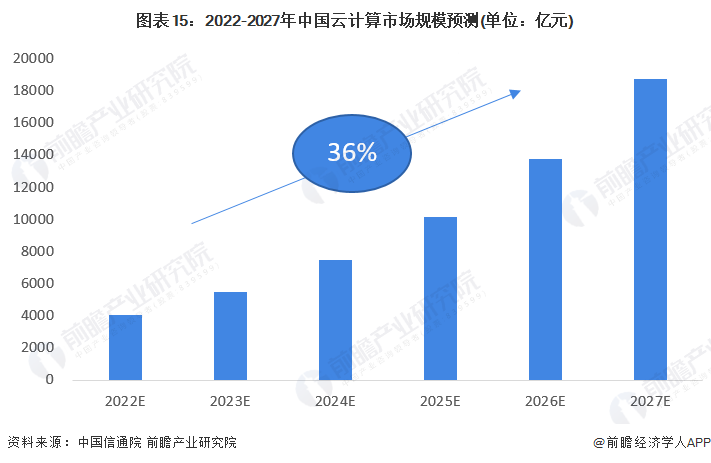

Under the urgent need for enterprise digital transformation, cloud adoption is a general trend. According to the "Cloud Computing White Paper (2023)," China's cloud computing market reached 455 billion yuan in 2022, an increase of 40.91% compared to 2021, and is expected to exceed one trillion yuan by 2025.

For most C-end enterprises or users, public clouds are typically chosen—that is, clouds provided by third-party providers that users can access, usually through the internet, to achieve shared resource services at low costs, including SaaS, PaaS, and IaaS.

Public clouds have been the most fiercely contested battleground for cloud vendors such as Aliyun, Huawei Cloud, Tianyi Cloud, Tencent Cloud, AWS, and Mobile Cloud over the years. Reflecting on the market, some companies choose the simple and粗暴strategy of price reductions to rapidly increase performance and expand market share.

Over the past decade, Aliyun has always been the first to initiate price wars.

In 2013, Aliyun launched the "Aliyun 1218 event"; in 2014, Aliyun reduced prices six times within a year; from October 2015 to October 2016, it set a record of 17 product price reductions in one year. Under Aliyun's influence, domestic cloud service providers of various sizes and ages have joined the price war.

"Marketing is not selling products, but selling prices." As marketing guru Kotler said, price reductions have contributed significantly to Aliyun's market capture.

For example, in the CDN (Content Delivery Network) market, Wangsu Technology and ChinaCache occupied 80% of the market share before 2015, but after Aliyun, Tencent Cloud, and Kingsoft Cloud opened up the market with "price wars," ChinaCache disappeared from the first tier, and Aliyun became China's largest CDN vendor with a market share of 30.6% in 2019.

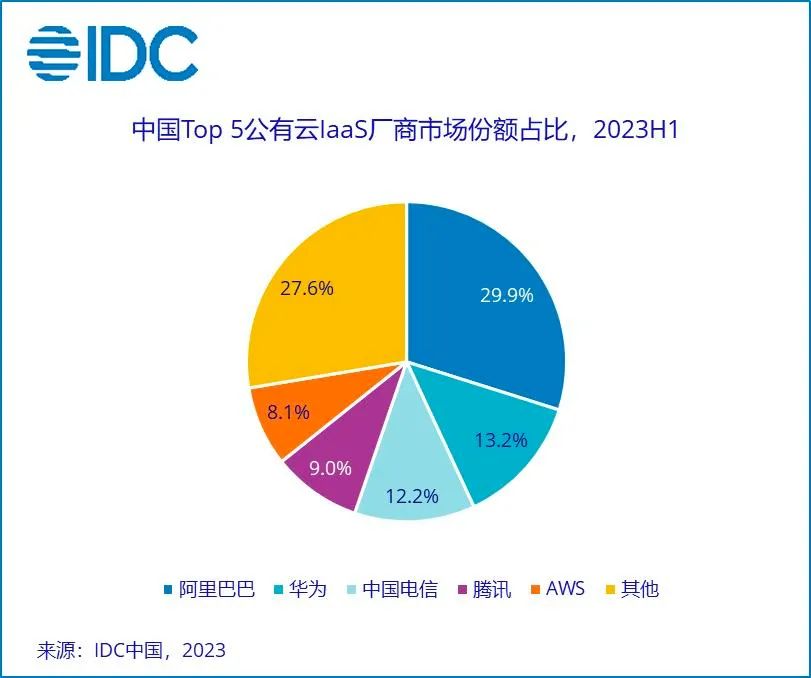

In the public cloud IaaS+PaaS market, Aliyun was once unstoppable, ranking first with a market share of 42.7% as early as 2018, even boasting the slogan "go to the cloud with Aliyun, with a market share exceeding the sum of the second to fifth places."

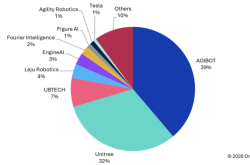

Price reductions are the least technical competitive means. With fierce competition from Tencent Cloud, Huawei Cloud, and others, as well as the peaking of internet user dividends and cautious demand from SMEs, Aliyun's market share has been quickly eroded, falling to 29.9% in the first half of 2023, a year-on-year decrease of 5.8 percentage points. Conversely, Huawei Cloud, Tianyi Cloud, and Mobile Cloud have seen an increase in market share.

Reflecting on the financial report, Aliyun has been wielding its "price sword" while its revenue growth rate has been declining—from 84% in fiscal 2019 to single-digit or negative growth in 2023.

Behind this is Aliyun's significant defeat in several important incremental markets such as manufacturing, energy, government affairs, and education, continuously losing ground to Huawei, Tencent, Baidu, and Mobile Cloud in the second half of the cloud computing competition.

Among them, Huawei Cloud is coming on strong. According to IDC data, Huawei Cloud accounts for 25.8% of China's government cloud infrastructure market, maintaining the top spot for several consecutive years. In an article by 36Kr, an Aliyun salesperson said that he had several government customers whose deals were almost closed, but the customers turned to Huawei Cloud instead. Within Aliyun, there has even been a saying that "every encounter with Huawei results in defeat."

In the end, even though Aliyun has made significant organizational adjustments, learned from Huawei, continuously adjusted its executives, laid off a large number of technical talents, or proposed an "AI-driven, public cloud-first strategy," the results have been minimal.

Entering 2024, after Alibaba explicitly suspended Aliyun's spin-off and listing plan, it further disappointed hopeful investors and raised doubts about Aliyun's future direction. Add to this the new management's proposal to "reignite growth momentum for the two core businesses of e-commerce and cloud computing," all of which require a more aggressive approach to achieve business breakthroughs and shake off the downturn or even negative growth—picking up the "price" weapon again is understandable.

02

Reliability is More Important than Price

After losing ground in incremental markets such as government affairs, public clouds have become the last domain that Aliyun must seize. The question is, Aliyun's "largest-ever" price reduction campaign last year did not yield results. Can the same weapon work this year?

From what "Extreme Business" understands, multiple factors indicate that this is not optimistic.

"The basic application capabilities between major cloud service providers are actually quite similar." A cloud service agent said that in the past, users valued cost-effectiveness the most, but in recent years, after repeated issues with the security and stability of major cloud service providers, the indicators have gradually changed.

In December 2022, Aliyun's data center in Hong Kong experienced a downtime incident due to a refrigeration failure, affecting multiple major customers. On the evening of the Double 11 promotion of Tmall in 2023, Taobao briefly went down; one day later, an Aliyun fault caused Taobao, Alipay, DingTalk, and others to crash, being classified as a P0 incident that lasted for over two hours, directly affecting tens of thousands of customers.

Many users with demand for cloud hosting services also believe that reliability is the most important indicator compared to the so-called "price reduction" gimmick—Aliyun's continuous outages have undoubtedly harmed customers, making many new and old users lose confidence in public cloud vendors' hosting services.

"Many users now have serious doubts about Aliyun's stability and security." After Aliyun announced its latest round of significant price reductions, a cloud agent said on social media that not only new users but also several old customers were asking him if they could migrate from Aliyun to other cloud platforms.

For Aliyun, it is difficult to satisfy every customer. Guo Jijun, the former general manager of Aliyun Intelligent Sales Management and Ecological Development Department, once stated that Aliyun initially started with top customers but faced shortcomings in its service capabilities, penetration capabilities, and support capabilities for mid-tier or waist-level enterprise customers, including the number of people, costs, and reach.

When operational accidents occur frequently, this unease is amplified, which is one of the important factors for Zhang Jie and others to migrate to other cloud platforms regardless of cost.

In practice, over the years, due to being "deeply bound" to cloud service platforms after migrating to the cloud, the subsequent real costs become increasingly expensive compared to a one-time purchase of "price reductions," which is a concern for many users. Even many industry insiders believe that public clouds are "pig-killing schemes."

There is a common saying in the cloud hosting service industry: "It's easy to go to the cloud but difficult to come down." In simple terms, companies not only migrate their critical data to the cloud but also deeply bind their basic LaaS and PaaS layers to cloud platform providers, with unimaginably high hidden migration costs. As long as performance and security are guaranteed, migration is generally not easily undertaken.

Since cloud services are typically renewed annually, subsequent renewals become an important source of income for vendors. In a live broadcast program, Feng Ruohang, CEO of Pangee Cloud, shared a personal experience: Before migrating to the cloud, the cost of a server room with hundreds of servers was about 10 million yuan per year. After adopting Aliyun's big data suite, the annual cost for computing was 30 million yuan and storage was 40 million yuan, resulting in a seven-fold increase in cloud costs without any change in efficiency.

"Cheap EC2/S3 to acquire customers, EBS/RDS to kill the pig. Cloud computing power costs are five times higher than self-built, and leased block storage costs can reach over a hundred times higher, making it the ultimate cost assassin." Feng Ruohang elaborated on the true business model of public clouds in an article. The best block storage service from public cloud vendors is basically the same in performance specifications as self-built PCI-E NVMe SSDs. However, compared to directly purchasing hardware, the cost of AWS EBS is up to 60 times higher, while Aliyun's ESSD can be as high as 100 times more expensive.

In the article "Cloud Cost: A Trillion-Dollar Paradox," a similar case is mentioned: the engineering director of a large consumer internet company found that the price of public cloud services could be 10 to 12 times higher than running their own data center.

"The public cloud industry is actually a market with extremely opaque pricing. The prices between different enterprises using the same specifications of products may even vary by several times." Some industry insiders believe that the deep binding model has led almost all cloud vendors to mainly earn money from old users, often attracting users with low prices, with new server users getting extremely low prices, while old users' renewal prices are more expensive than new users, and even several times more expensive.

In the promotion of public cloud vendors, the "price reduction logic" is mostly through economies of scale, reducing hardware costs and spreading out labor costs. The reality is that as long as the retention rate of old users can be guaranteed, vendors often give new users a significant discount, even selling at a loss, and still make a profit.

"Aliyun's original pricing was higher than competitors like Huawei Cloud and Tencent Cloud. Many friends around me didn't want to spend unnecessary money, but considering the hassle of either re-purchasing after cancellation or migrating platforms, they chose to renew." Zhang Jie said, but Aliyun's repeated operational accidents "forced me to make the decision to migrate to other platforms."

03

When Agents Cannot Make Money

Aliyun has obviously noticed the "complaints" and "voting with their feet" of old users.

In the latest price reduction campaign, Liu Weiguang, Senior Vice President of Aliyun Intelligent Group and President of the Public Cloud Business Department,特别强调that for the first time in history, both new and old customers will enjoy the entire new pricing system, and Aliyun is giving benefits to the unfulfilled part of existing customers' orders for the first time.

Old users who want to enjoy the price discounts for new users have a time limit—existing orders to be fulfilled must be renewed within the three-month period from February 29 to May 31. The intention to concentrate efforts on increasing the renewal rate of old users and making revenue look better in the short term is quite obvious. Aliyun has not specified whether it will revert to the original price, change the discount, or have other restrictions after that.

In fact, for SMEs, to truly "migrate to the cloud," in addition to choosing discounted products, they also need to configure and adjust many different combinations of resources based on their needs. Some people point out that currently, Aliyun only offers "discounts" on annual prices, and the list prices have not been reduced, which means that annual users still need to pay the original price if they want to increase resources.

However, whether Aliyun's price war will ultimately be effective depends more on whether the agents are effective in addition to sales from the official website.

The agent distribution mechanism is the main means for cloud service vendors to capture the SME market. The model is that agents are responsible for pre-sales promotion, order delivery, after-sales maintenance, and other tasks, and then the cloud vendor pays commissions to the agents.

Different cloud vendors offer varying rebates to agents. At Aliyun, there are five levels of agents: standard, preferred, leading, elite, and flagship, with clear grades and KPI assessments, allowing for different rebate percentages.

"Aliyun's rebates range from 10% to 30%, equivalent to Aliyun giving agents a commission of 1,000 yuan to 3,000 yuan for selling 10,000 yuan worth of products." Multiple Aliyun agents introduced that, in comparison, Huawei Cloud offers rebates that are 5% to 10% higher than Aliyun's, with a lower entry threshold.

This also makes agents who represent both Aliyun and Huawei Cloud more willing to recommend Huawei Cloud to customers. Figures show that Aliyun has 10,000 agents, while Tencent Cloud and Huawei Cloud have around 8,000 each—despite Huawei Cloud entering the public cloud market several years later than Aliyun