Baidu: The Inevitable Shift to All-in AI

![]() 08/22 2025

08/22 2025

![]() 599

599

Despite Li Yanhong's repeated denials that he has ever stated "All in AI," Baidu's Q2 2025 financial report suggests that the company may soon be compelled to adopt this strategy.

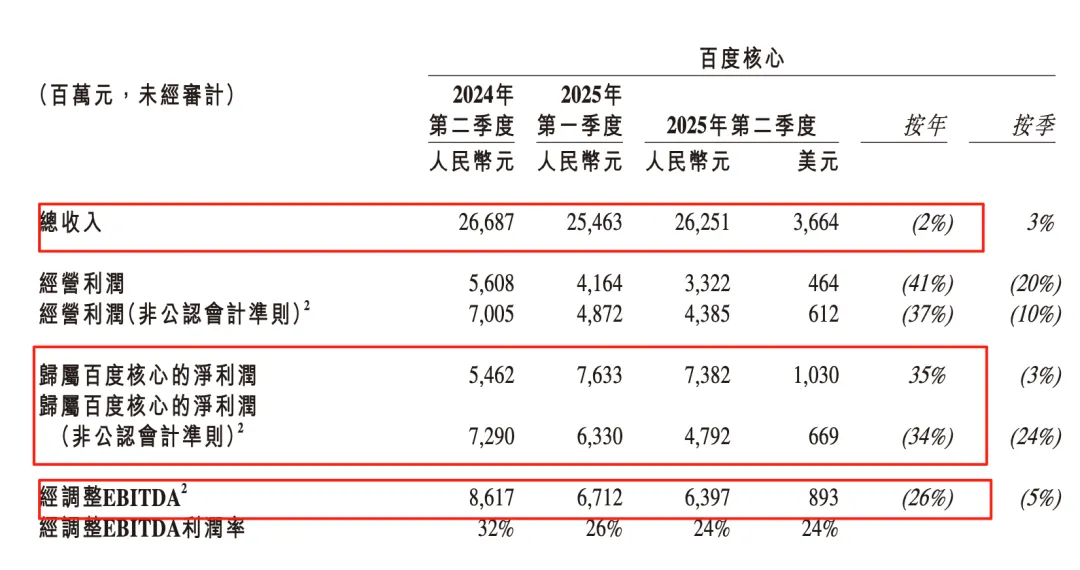

The report revealed that Baidu's total revenue for the second quarter amounted to RMB 32.71 billion, marking a 4% year-on-year decline—the largest drop in nearly three years and slightly below analysts' expectations of RMB 32.76 billion.

While Baidu's net profit attributable to shareholders increased by 33% year-on-year to RMB 7.32 billion, under Non-GAAP, it declined by 35% to RMB 4.795 billion, down from RMB 7.396 billion in the same period last year.

During the financial report conference, Baidu's founder Li Yanhong noted that the healthy growth of the smart cloud business was attributed to the company's continuous investment in full-stack AI capabilities and end-to-end AI products and solutions. Thanks to the rapid development of AI technology, Baidu's emerging business revenue, particularly the smart cloud business, surpassed the RMB 10 billion mark for the first time, with a year-on-year growth rate of 34%.

The day after the financial report was released, Baidu's U.S. and Hong Kong shares both opened lower, with U.S. shares closing down nearly 3%. Clearly, the decline in the search business has raised market skepticism about this financial report. For Baidu, the story of decelerating search and accelerating AI may be a necessary transition.

Search: A Shifting Gear with Loss of Speed

As Baidu continues to pivot towards AI, its once lucrative search business appears to be stuck in a gear-shifting stall, which is perhaps the market's biggest concern.

According to Citigroup's analysis, it is estimated that Baidu's core advertising revenue will decrease by 23% year-on-year in the third quarter. However, due to the strong momentum of its cloud business and autonomous taxi business, Citigroup maintained its buy rating on Baidu's stock, albeit with a reduced target price from USD 139 to USD 138.

Is search no longer profitable? Recent advertising agency incidents at Baidu may suggest so.

In July this year, Baidu reportedly eliminated the exclusive agency mechanism in six cities, including Jinan, Chongqing, Wuhan, Fuzhou, and Xiamen, adopting instead a service provider operation model. However, Baidu's agents in many regions are facing difficulties, with some agencies owing large sums of employee salaries and the company's financial hotline going unanswered. This adjustment has caused short-term disruptions in advertising sales channels in some areas, directly impacting revenue recognition.

Industry insiders bluntly state that the difficulties faced by multiple core agents may reflect a deeper issue—Baidu's advertising business is in decline.

Behind the adjustment of the commercialization model may lie the next wave of momentum building up. While the market is currently skeptical, the core search business still has room for growth. However, Baidu's outlook on its AI business may not be as optimistic.

AI: Fertile Ground Given to Outsiders

"Full-stack AI" is the cornerstone of Baidu's long-term strategy. Baidu hopes to leverage this platform to determine the breadth of its ecological expansion, with applications directly facing users and the market, realizing a commercialization closed loop. Fortunately, Baidu's AI+cloud expansion has yielded fruitful results. However, what is worrisome is that applications facing users and the market are retreating step by step.

Li Yanhong stated on the conference call that the growth of AI+cloud is due to the company's continuously strengthened full-stack AI capabilities and end-to-end AI products and solutions. The company is accelerating the transformation of search AI and the globalization of Robotaxi, focusing on new AI fields with the most potential for long-term value creation.

As a highlight in the financial report, Baidu's smart cloud business grew significantly in Q2. According to the IDC report "China AI Public Cloud Service Market Share, 2024," Baidu Smart Cloud ranked first for six consecutive years. In the latest IDC report released on August 20, Baidu Smart Cloud ranked first in the large model platform market.

Revenue for the second quarter increased by 27% year-on-year to RMB 6.5 billion, with the majority contributed by the enterprise cloud business. This may be related to the self-developed domestic chip Kunlun chip cluster with 30,000 cards launched by Shen Dou, head of Baidu's Smart Cloud Business Group (ACG), in March this year. Relying on its self-developed Kunlun chip and Baige AI heterogeneous computing platform, Baidu Smart Cloud provides enterprises with high-performance and cost-effective computing power support. It can be said that Shen Dou and Baidu Smart Cloud are driving Baidu forward. AI computing power still offers Baidu vast imaginative potential, and B-end revenue has become a "hot favorite".

However, from a C-end perspective, Baidu's AI has not kept pace. According to Questmobile data, in the first half of 2025, DeepSeek, Doubao, and Tencent Yuanbao ranked among the top three in AI-native app growth, with user scale increments of 163 million, 58 million, and 22 million, respectively. Wenxiaoyan (the original ERNIE Bot) is losing traffic and users at a rate of -0.8%.

AI is redefining the essence of search, with fierce competition from AI-native apps like DeepSeek and Doubao at the forefront and new AI search features on super portals like WeChat and Douyin posing a threat from behind. Regarding AI redefining search, the beneficiary may not be Baidu. The fertile ground of AI search has shifted to outsiders.

Autonomous Driving: Still Promising for the Future

As the most imaginative aspect of Baidu's business, autonomous driving remains a source of pride for the company.

In Q2, Robotaxi provided over 2.2 million global travel services, marking a 148% year-on-year increase. Cumulative services exceeded 14 million, with coverage in 16 cities. The cost of the sixth-generation self-driving car is 60% lower than that of the previous generation, and strategic cooperation has been established with Uber and Lyft to deploy fleets in Asia, the Middle East, and Europe. Li Yanhong emphasized that Robotaxi is one of the very few companies globally that has achieved large-scale operations of fully autonomous driving in complex urban areas, with cities like Wuhan nearing break-even.

Autonomous driving is undoubtedly a trump card for Baidu in its "fight for the future." If all business lines advance, the progress of Robotaxi will be highly anticipated. However, at this stage, the continuous landing of overseas business seems more like a reluctant choice for Baidu amid the shrinking search business. Baidu's Chief Financial Officer He Haijian noted that due to AI search monetization still being in a very early stage and not yet achieving scale, revenue and profit margins will face considerable pressure in the short term, with the third quarter expected to be particularly challenging. These challenges seem to be uniquely positioned for Robotaxi.

It is often said that Baidu "fell behind" in the mobile internet era. Whether Baidu can catch up in the AI era remains to be seen. Luo Rong, head of Baidu's Mobile Ecosystem Business Group (MEG), even described Baidu as one of the "most radical companies" using AI to transform search, which also implies Baidu's determination to make a complete turnaround. However, in terms of investment in technology research and development with strong AI demand, Baidu's R&D expenses decreased by 13% to RMB 5.1 billion in this financial report, compared to Tencent's R&D investment increasing by 17% year-on-year to reach RMB 20.251 billion and Alibaba's ambitious investment of RMB 380 billion in cloud and AI over the next three years. Baidu may be facing a tough choice between "opening up sources" or "cutting costs".