Alibaba Cloud claims that JD Cloud's price reduction is an imitation, and the gunshots in the cloud market ring out again

![]() 04/01 2024

04/01 2024

![]() 919

919

The market structure is far from its conclusion - those leading companies that seem so superior and disdainful of other enterprises today still have the possibility of being overtaken by the market or even eliminated.

Author | Liu Shanshan

Editor | Cindy

The gunshots of the price war in the cloud computing field ring out again.

On March 28, at the 2024 City Conference Shenzhen Station, JD Cloud officially announced the "Spring Breeze Plan," indicating continuous upgrades in products, prices, and services. Among them, the focus of much outside attention was the announcement of setting up a "1 billion price comparison fund" for long-term price comparisons of all public cloud products, promising compensation for overpriced purchases.

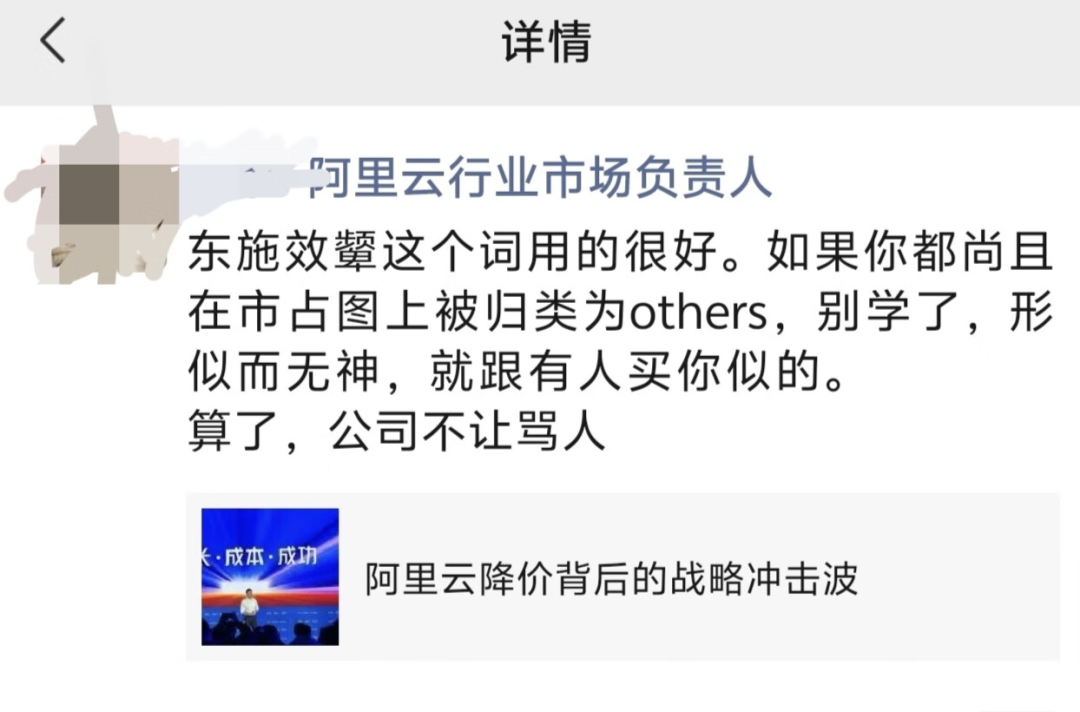

Previously, a responsible person from Alibaba Cloud even described JD Cloud's price reduction behavior using expressions such as "imitation," "resembling without spirit," and "it's like someone is buying from you."

The person in charge made such statements because JD Cloud actively intensified the price war in 2024. Previously, on February 29, both Alibaba Cloud and JD Cloud announced significant price reductions for their products. Among them, Alibaba Cloud announced the "largest price reduction in history," and JD Cloud also officially announced "comparing prices across the entire network, breaking through low prices, further reducing by 10%, and compensating for overpriced purchases," which took effect on March 1.

Within just one month, JD Cloud once again emphasized its price comparison strategy and set up a "price comparison fund" of up to 1 billion yuan. In the context of the AI big model boom and the stock competition stage of the cloud computing market, how will the "long-term price comparison" strategy impact the cloud computing market structure and consumers?

01

The cloud market needs price comparisons across the entire network

Behind the price war in the cloud market, there have long been undercurrents and a strong sense of gunpowder.

"The term 'imitation' is used very well." Recently, a responsible person from Alibaba Cloud forwarded an article on WeChat moments and said, "If you are still classified as 'others' on the market share chart, don't learn from it. It resembles without spirit, just like someone is buying from you."

"Never mind, the company doesn't allow insults." The person in charge said.

The responsible person from Alibaba Cloud's statement on WeChat moments, which is "slightly lacking in perspective," undoubtedly targets JD Cloud directly. In the article they forwarded, they used the term "imitation" to evaluate JD Cloud's follow-up price reduction and emphasis on price comparisons across the entire network.

According to JD Cloud, they have always taken achieving extreme cost-effectiveness as their main direction while ensuring stability and security. "It's not about engaging in a price war with competitors, but based on technological innovations honed through large-scale internal and external practices, gradually accumulating confidence."

In the business world, low-price competition is a perfectly normal market competition means. In the cloud computing service market, price reductions are also the most common strategy. Starting with the launch of the "Alibaba Cloud 1218 event" in 2013, Alibaba Cloud has always been the first to raise the "price war" weapon for over a decade to boost sales and market share.

Industry insiders believe that since Alibaba Cloud has never been accused of "disrupting the market," it is understandable for Tencent Cloud, Huawei Cloud, JD Cloud, Tianyi Cloud, and other competitors in the same track to respond to market competition with "low market prices" - this has nothing to do with market share or whether the competitors are considered "others".

From an economic logic perspective, so-called price comparison refers to comparing similar, homogeneous, or identical products or services with lower prices, allowing consumers to obtain benefits. It originated in the e-commerce industry and has now become a major competitive and promotional focus that major e-commerce platforms, live streaming, group buying, and other industries strive to create.

Observers believe that price comparisons proactively undertaken by enterprises during the sales process, as long as they are based on objective reality, are normal marketing strategies that stimulate consumers' purchase desires and increase product sales.

In fact, from the perspective of consumer demand, the cloud computing service market needs "long-term price comparisons across the entire network" even more.

Based on previous understanding from "Extreme Business," there are two issues in the current public cloud industry (Alibaba Cloud is lost in the "low price" gimmick). On the one hand, market prices are extremely opaque, and there may even be a several-fold difference in prices between different companies using products of the same specifications. On the other hand, the cloud service market has complex products and diverse playing methods. The so-called "price war" does not necessarily mean "true low prices" - previously, multiple industry insiders said that even after Alibaba Cloud lowered its prices multiple times, its product prices are still high within the industry.

Eliminating the information asymmetry gap through price comparisons and quickly finding truly cost-effective goods is the expectation of many consumers.

In a previous IDC survey on IT procurement behavior among SMEs in the Asia-Pacific region (including China), attractive prices and flexible, transparent billing methods were the most important influencing factors for SMEs during the final procurement stage. They often need to compare service packages and pricing offered by different suppliers.

"My thinking logic for choosing a cloud service provider is very simple: usability and affordability are the most important." A relevant person from Zunyi Dongpei Business Management Co., Ltd. said that they operate a commercial complex and the company is not large, using a total of 5 cloud hosts to deploy the company's internal management system and member mini-programs.

The relevant person said that now there are various cloud service provider products that are dazzling, but 90% of them are not used. The most basic cloud hosts, storage, and security products are sufficient. "We have tried out the products of several cloud service providers, and the performance and stability are more or less the same. Ultimately, what I care about most is the prices of these basic products."

"We deliver an analysis and testing system to universities, which generally requires 2-3 cloud servers with basic configurations, with an annual cost of over 10,000 yuan. We will compare prices at multiple cloud service providers." Shenzhen Daye Industrial Equipment Co., Ltd. also said that they operate smart carrier businesses and will consider switching cloud service providers for a 20% cost savings.

02

When low prices become a long-term business strategy

Although price wars in the cloud service market are often initiated by Alibaba Cloud, JD Cloud has been implementing a strategy of price comparisons across the entire network specifically targeting cloud vendors since May last year.

In May 2023, JD Cloud aggressively entered the market and conducted the first public price comparison in the Chinese cloud market, announcing that all its core products would be compared with three major cloud vendors - Alibaba Cloud, Tencent Cloud, and Huawei Cloud, promising "compensation for overpriced purchases."

During last year's 6.18 and Double 11 shopping festivals, JD Cloud doubled down twice, further extending the price comparison time to "all products" and "regular price comparisons" and made commitments such as "discounting by another 10% on top of the lowest transaction price of specific cloud service providers, with compensation for overpriced purchases."

If we add the two reinforcements this year, JD Cloud's "price comparison across the entire network" has actually become routine, normalized, and long-term, becoming a long-term business strategy for JD Cloud.

In the eyes of industry insiders, JD Cloud's strategic choice is not surprising. Since Liu Qiangdong proposed that "low prices are the most important weapon for JD's past success and will continue to be the only basic weapon in the future," almost all JD's business lines have been focused on price competitiveness in 2023.

Pan Helin, an economist and researcher from the United Business School of Zhejiang University, previously commented, "Whether it's the C-end or B-end, JD hopes to obtain high performance at low prices."

Whoever can achieve the lowest price can control the retail industry. JD stated during the latest earnings call that the overall performance of its low-price mindset construction in 2023 met expectations, and it will continue to focus on price competitiveness and platform ecosystem construction in 2024.

For JD's increasingly important and focused cloud business within its technology segment, continuing JD Group's low-price strategy is also traceable.

"Price comparisons are sustainable. We have truly reduced costs through technology. For example, if the cost of providing resources to customers was 1 yuan in the past, through technology cost reduction, it only requires 80 cents, allowing us to pass on the savings." A relevant person in charge of JD Cloud once said that "price comparisons across the entire network" conform to the business logic of the cloud computing industry.

Now, the gunshots ring out again, and the competition for price competitiveness is destined to run through the entire cloud service market in 2024. How to ensure product quality and after-sales service on top of low prices is the key for major cloud service providers to attract more users.

Multiple industry insiders believe that combining the current status of the cloud service market and the entrepreneurial trends brought about by the AI big model wave indicates that the outcome of this market is still unclear, and the market structure is far from its conclusion. Those leading companies that seem so superior and disdainful of other enterprises today still have the possibility of being overtaken by the market or even eliminated.

This is not groundless speculation. From the current Chinese cloud service market, some subtle changes are taking place.

For example, although Alibaba Cloud has entered a stage that places more emphasis on high profit margins, according to the latest data, the combined cloud business revenue of the three major operators in 2023 reached 231.5 billion yuan, exceeding Alibaba Cloud's revenue by more than two times. Moreover, Alibaba Cloud's growth rate lags far behind the three major operators. Among them, Tianyi Cloud's revenue is already very close to Alibaba Cloud and is expected to surpass it in 2024.

END

Producer: Huang Qiangqiang