Alibaba Aims for a More Lucrative Cloud Business

![]() 06/09 2025

06/09 2025

![]() 785

785

Written by | Hao Xin

Edited by | Wu Xianzhi

Alibaba Group's dual strategy is crystallizing: Taobao and Tmall prioritize stability, while Cloud Intelligence eyes the future. These two pillars embody Alibaba's dual focus, with Taobao and Tmall serving as the breadwinners awaiting the day when cloud computing reciprocates.

The latest financial report underscores that Taobao and Tmall Group have essentially accomplished their objectives, achieving a twofold increase in revenue and profit.

Conversely, amidst the rising popularity of AI narratives, the market harbors high expectations for Alibaba Cloud. However, its performance fell short, barely meeting benchmarks.

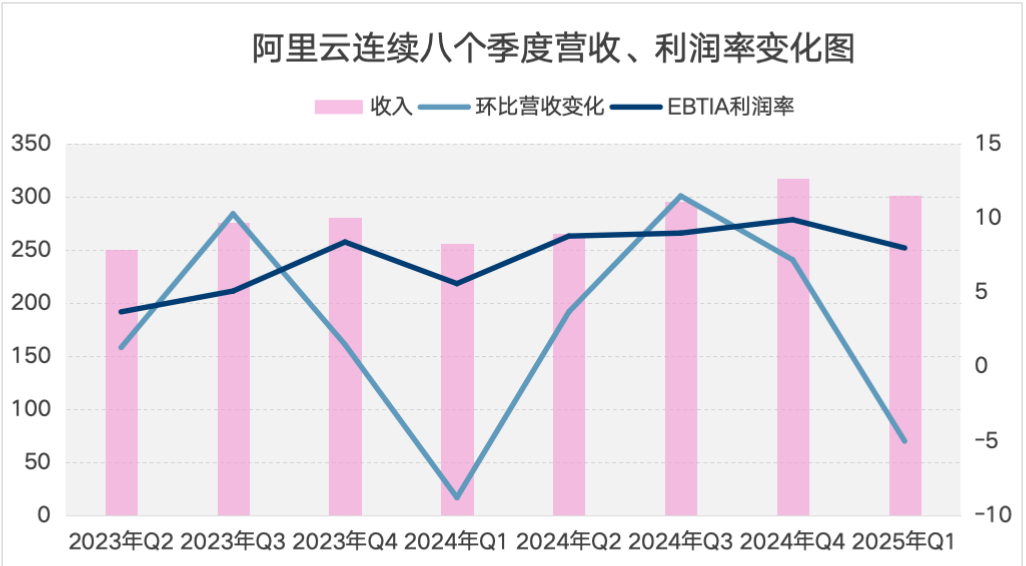

Notably, despite Alibaba's substantial investment and lofty expectations, Alibaba Cloud's adjusted EBITA margin slipped to 8% in the new quarter, marking a 22.9% quarter-on-quarter profit decline.

Photon Planet has learned from multiple sources that Alibaba Cloud's paramount metric now is "profitability." "Cloud vendors employ diverse strategies, and Alibaba Cloud's current objective is to transition to public cloud and generate profits." Judging by the first-quarter report, the outcomes are somewhat disappointing.

Maintaining technological advancement and pursuing profits in public cloud are akin to the opposing ends of a rubber band. When one end tightens, the other feels the pinch. Hence, how will Alibaba Cloud narrate the tale of AI profitability?

Alibaba Cloud's 'Open Strategy'

A senior cloud industry practitioner commented, "Cloud computing represents Alibaba's open strategy in the AI era."

This expert believes Alibaba is playing with an "open hand," pursuing four parallel paths: Firstly, leveraging the open-source Tongyi Qianwen rankings to gain community traction and attract developers and enterprises with "coupons"; secondly, investing in and acquiring AI startups, binding them to Alibaba Cloud AI infrastructure through "cloud resource vouchers" to consume excess computing power; thirdly, continuing to expand investment in cloud computing infrastructure, betting on the future of AI and large models; and fourthly, initiating AI transformation across the entire group, internally transforming AI achievements to achieve cost reduction and efficiency enhancement.

In the short term, Alibaba Cloud's approach isn't markedly different from other vendors, focusing on cloud resource consumption and token invocation volume. However, in the long run, the core lies in its integration with the Alibaba ecosystem. An example is the open-source Qianwen large model series, which offers a "full suite" spanning various sizes and modalities. Photon Planet understands that considering model and ecosystem integrity, many enterprises prefer continuing with Tongyi's new models.

"Finally stopping the issuance of vouchers and completing the closed loop between the AI ecosystem and commercial revenue. This progressive approach is relatively clear."

Another group views Alibaba Cloud as "bold and risk-taking." Among major companies, few have elevated AI to the level of group management will as Alibaba. Alibaba CEO Wu Yongming previously announced that the company would invest 380 billion yuan over the next three years in cloud and AI hardware infrastructure, surpassing the total investment of the past decade.

A cloud responsible person from a telecom operator shared that regardless of how Alibaba Cloud's "gamble" ultimately unfolds, it can at least attract "real" customers. From automakers and star large model companies to emerging embodied intelligence fields, these company cases are traceable. In some telecom operators, cloud-attracted customers exhibit mobility. To obtain government subsidies, "most customers release their computing power after booking it for a few months," leading to a lack of long-term follow-up services.

From Revenue to Profit

IDC's recently released 'China Public Cloud Service Market Tracker' report reveals that in the second half of 2024, China's public cloud services (IaaS/PaaS/SaaS) market size totaled $24.11 billion. In terms of public cloud IaaS vendor market share, Alibaba topped the list with a 30.2% share; for PaaS vendors, Alibaba ranked second with a 24.4% share. In both indicators, Alibaba has outpaced its competitors, holding a clear advantage. However, in the MaaS market share, Baidu, SenseTime, and ByteDance are in close competition.

We understand that currently, major cloud vendors on the market adopt diverse strategies. Cloud computing is a "slow and steady endeavor," where market entry order and accumulation are crucial. Based on this, cloud vendors can be broadly categorized into two groups: early entrants and late entrants. Due to their different roles, they employ distinct strategies in the era of large models.

Late entrants include ByteDance's Volcano Engine and Baidu Cloud. As newcomers, their primary goal is to expand cloud revenue. This manifests in a "do-it-all, sell-it-all" approach to instill confidence in investors and the market.

In comparison, ByteDance is currently the most aggressive vendor in China, relentlessly promoting the Doubao large model on various occasions, using large model token invocation volume as a key performance metric. A headhunter told Photon Planet that currently, only Volcano Engine is aggressively hiring, and one-third of the Alibaba Cloud employees they know have moved to ByteDance, "making it feel like attending an alumni reunion when participating in events."

On the other hand, Baidu has adopted its predecessors' worn-out tactics, taking orders through a project general contracting model. This model emphasizes market share, offering the advantage of expanding customer scale and increasing revenue but the disadvantage of poor profit margins and unprofitability. A piece of data supports this: last year, Baidu Cloud had the highest number of related bids and covered the most industries for large models.

Market early entrants like Alibaba Cloud and Tencent Cloud have transitioned from revenue to profit, placing greater emphasis on return on investment. Alibaba Cloud seeks stability, currently aiming to migrate profits to public cloud and reduce privatization projects in the industry. Its financial report also mentioned, "Gradually reducing project-based contract revenue with lower profit margins and offsetting the impact of the decline in the former with revenue from public cloud and AI-related products."

(Photon Planet Chart)

In essence, Alibaba Cloud must prioritize "profit" now and in the future.

However, Alibaba Cloud's profit data is less than stellar. In response, Wu Yongming explained during the earnings call, "The surge in reasoning demand during the Spring Festival resulted in large-scale launches of related customer projects concentrated after February-March (such as April-May), so the growth rate in subsequent months (such as Q2) can better reflect normal business trends."

Historically, Q1 of each year is indeed a low point for profit and revenue. However, excluding Q1 data, Alibaba Cloud's quarterly profit margin and quarter-on-quarter growth (decline) rate exhibit significant fluctuations, indicating an unstable trend. Although the "6+1+N" adjustment once boosted Alibaba Cloud's profit, it has never surpassed the 10% threshold.

In later stages, as Alibaba further expands its computing power and infrastructure investment, the profit growth target for cloud computing may be impacted. The capital market is equally sensitive, with Alibaba's share price fluctuating whenever changes occur.

Living in Inertia

As mentioned, in the public cloud market, Alibaba Cloud has established a leading position, making it determined to "seek stability."

Stability and innovation are inherently contradictory. The public cloud market is characterized by low barriers to entry, multi-party sharing, preferential pricing, and pay-as-you-go models, making it more suitable for small and medium-sized enterprises and traditional industries.

In a rapidly evolving market environment, Alibaba Cloud must confront the challenges posed by new variables. In recent years, Alibaba Cloud's leading position in China has been continuously contested. One key factor stems from private clouds, whose primary customer base includes central and state-owned enterprises, top private enterprises, and non-internet private enterprises. They require privatization product solutions to address business issues. Consequently, Alibaba Cloud's market share has been quietly eroded by some vendors. When Alibaba Cloud recognized this and attempted to promote business in the government and enterprise sectors, it faced numerous practical challenges.

Furthermore, existing inertia is not easily broken. Internally, during Alibaba Cloud's development, there has always been a tug-of-war between technology and commercialization.

A report indicates that if calculated based on the domestic IaaS and PaaS industry size disclosed by IDC and Alibaba Cloud's market share, and assuming that the proportion of SaaS has gradually increased from a single-digit in recent years, as of 24H1, the proportion of Alibaba Cloud's IaaS revenue was approximately 68%.

Cloud computing-related technical personnel introduced to us that in the context of public cloud, the original Cloud Virtual Machine (CVM) and current cloud-native technology belong to two distinct systems, with the former focused on the present and the latter on the future.

Alibaba Cloud's early-built CVM system achieved cost advantages through economies of scale, specifically manifested in Alibaba Cloud's multiple consecutive price reductions, creating a price advantage in the market. Benefiting from this architecture, Alibaba Cloud also achieved the largest market share growth. Under this premise, it's easy to form a path dependence.

"In any industry, as a core leading product, it both benefits and is constrained by its legacy." Due to inertia, whenever Alibaba Cloud attempts to break through the existing architecture, it often encounters obstacles.

This gradual evolution leads to compatibility conflicts between the underlying architecture and upper-layer cloud-native technology, while large models have stringent requirements for resource management, training efficiency, and deployment costs. In the future, a cohort of "native" AI enterprises will thrive atop this massive cloud architecture.

Organizational restructuring and significant personnel changes. All these historical issues in cloud computing still need to be addressed by Wu Yongming and Zhou Jingren.