Weimob Group Increases Gross Profit Margin through Cost Reduction and Efficiency Enhancement: Over 4.5 Billion Losses in Four Years, Seeking a Way Out through Cross-border Short Films

![]() 05/13 2024

05/13 2024

![]() 763

763

From "Gangwan Business Observer", Shi Zifu - On March 28, Weimob Group (02013.HK) released its 2023 annual performance announcement, presenting its achievements for the past year to the public. In terms of performance, Weimob Group's losses in 2023 have narrowed, but it is still in the red. However, this annual report also has its highlights, as the company's cross-border layout in the recently popular "short film" track has attracted much attention.

01

Losses Exceeding 4.5 Billion Yuan for Four Consecutive Years

Founded in 2013, Weimob Group is a cloud-based business and marketing solutions provider dedicated to providing decentralized digital transformation SaaS products and full-chain growth services to merchants, supporting sustainable business growth. In 2019, Weimob Group listed on the Hong Kong Main Board (stock code 02013.HK). According to the company's 2023 annual report, Weimob Group achieved revenue of 2.228 billion yuan, representing a year-on-year increase of 21.1%; gross profit reached 1.484 billion yuan, a year-on-year increase of 36.0%. The company attributed the increase in revenue to the increase in income from subscription solutions and merchant solutions.

Weimob Group's revenue mainly comes from subscription solutions and merchant solutions. Subscription solutions include Weimob Group's business and marketing SaaS products and ERP solutions, covering micro-mall, smart retail, smart hotel, Haiding ERP, etc. Merchant solutions provide value-added services to merchants as part of an overall solution. In 2023, these two businesses accounted for 60.6% and 39.4% of the total revenue for the period, respectively.

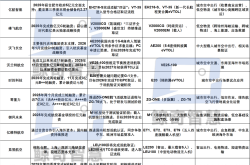

During the reporting period, revenue from subscription solutions was 1.349 billion yuan, representing a year-on-year increase of 4.5%; the number of paying merchants was 96,339, a year-on-year decrease of 3.3%; average revenue per user was 14,007 yuan, a year-on-year increase of 8.0%; and the number of new paying merchants was 23,411, a slight year-on-year decline of 157. At the same time, merchant solution revenue was 878 million yuan, representing a year-on-year increase of 60.5%; the number of paying merchants was 66,905, a year-on-year increase of 24.2%; and average revenue per user was 13,127 yuan, an increase of 2,964 yuan compared to the same period in 2022. The slight decrease in the number of paying merchants in subscription solutions was due to the pressure of insufficient deferred income caused by weak order volume in 2022 and the weak recovery of consumption in 2023.

In terms of profits, this annual report showed that Weimob Group's losses have narrowed over the past year. However, over a longer time frame, Weimob Group's losses have persisted for four years. In 2023, Weimob Group's operating loss for the period was 604 million yuan, a year-on-year narrowing of 67.3%; pre-tax loss was 726 million yuan, a year-on-year narrowing of 63.5%; and annual loss was 761 million yuan, a year-on-year narrowing of 60.3%. According to Eastmoney.com, from 2020 to 2023, Weimob Group's net profits attributable to shareholders for the period were -1.157 billion yuan, -783 million yuan, -1.829 billion yuan, and -758 million yuan, respectively, totaling 4.527 billion yuan in losses over four years.

Other profitability indicators are also not optimistic. From 2020 to 2023, Weimob Group's average return on net assets was -76.14%, -30.64%, -58.86%, and -31.27%, respectively; net profit margin on total assets was -25.26%, -10.24%, -21.01%, and -9.57%, respectively; net profit margin was -59.24%, -31.77%, -104.39%, and -34.17%, respectively; and annualized return on investment was -39.43%, 16.83%, -31.40%, and -12.38%, respectively. All four investment return indicators have been negative for four consecutive years.

02

The "Business Model" Behind Cost Reduction and Efficiency Enhancement?

Amid continuous losses, Weimob Group has also begun to "reduce costs and increase efficiency" to save expenses. In 2023, Weimob Group's sales cost was 744 million yuan, a slight year-on-year decrease of 0.6%; sales and distribution expenses were 1.552 billion yuan, a year-on-year decrease of 5.2%; general and administrative expenses were 714 million yuan, a year-on-year decrease of 28.2%; and research and development expenses were 587 million yuan, a year-on-year decrease of 28.4%. However, it can still be seen that even after adjusting various expenses, Weimob Group's sales and distribution expenses, general and administrative expenses, and research and development expenses totaled 2.853 billion yuan in 2023, significantly higher than the current revenue scale.

Zhang Yi, CEO of iMedia Consulting, pointed out to "Gangwan Business Observer" that Weimob Group's losses over the past few years can be mainly attributed to three aspects. Firstly, it is determined by the business model itself, which has no way to attract customers and drive traffic, and can only rely on a large amount of advertising and marketing for promotion, resulting in high customer acquisition costs.

"Weimob's products are mainly driven by the B-end, and there are also relatively strong competitors such as Iflytek and DingTalk in SaaS products. This creates high advertising and traffic costs behind the scenes. Taking last year as an example, Weimob Group's sales and marketing expenses accounted for nearly 60% of total revenue. Such high advertising expenses are also the company's large-scale marketing efforts to expand market share and increase brand awareness."

Regarding the high cost of various expenses, Zhang Yi said that advertising traffic cost is a very significant traffic cost. Compared to enterprise WeChat and DingTalk, which are also SaaS products, the former has a very strong platform effect and strong traffic acquisition capabilities.

"Of course, there is also a very crucial aspect, which lies in the management level of the enterprise. If the management level is not high enough, it can also easily lead to high costs. In the past, many internet companies that relied on capital and financing to grow had very low management levels, with extremely high employee salaries but extremely low efficiency." Although Weimob Group's expenses have slightly decreased over the past year, the financial pressure created by the company itself is also very apparent.

According to Snowball data, as of December 2023, Weimob Group's net cash flow generated from operating activities was -596 million yuan, representing a year-on-year increase of 18.38%; cash and cash equivalents were 2.203 billion yuan, down 11.61% year-on-year; current liabilities were 4.424 billion yuan, up 18.02% year-on-year; and total liabilities reached 5.066 billion yuan. On April 26, Weimob Group completed the placement of 277 million shares at a price of HK$1.13 per share. It is reported that Weimob successfully raised a total of US$125 million in funds, including net proceeds from the placement of HK$308 million and US$85 million in convertible bond funds.

However, the annual report showed that Weimob Group's gross profit margin has improved slightly. In 2023, Weimob Group's gross profit margin was recorded at 66.6%, representing a year-on-year increase of 7.3 percentage points. From 2020 to 2023, Weimob Group's gross profit margins were 50.93%, 56.47%, 59.31%, and 66.59%, respectively, representing an increase of 15.66 percentage points over four years.

Shortly after releasing its annual report, Deutsche Bank issued a report stating that management expects Weimob's SaaS revenue to continue to maintain steady growth in 2024 as the impact of corporate adjustments gradually subsides. Deutsche Bank expects that with continued rigorous management, Weimob's net sales margin is expected to further increase to 5% and 14% in fiscal years 2024 and 2025, respectively. Given the huge potential of WeChat video numbers in the coming years, Deutsche Bank maintains a constructive positive attitude towards Weimob's marketing business and maintains a "buy" rating.

In a March 31 announcement, Huatai Securities stated that Weimob Group's losses have narrowed significantly and is expected to continue to benefit from economic recovery and the commercialization of AI technology. It is expected that revenues for 2024-2026E will be 25.52/29.35/33.94 billion yuan, and EPS will be -0.03/0.05/0.13 yuan. Referring to comparable company 24E3.3xPS (Wind), it gives a 24E3.3xPS, corresponding to 3.22 Hong Kong dollars per share, and maintains a "buy" rating.

03

Cross-border Layout in Short Films to Find a Way Out?

Amid four consecutive years of losses, Weimob Group has also set its sights on cross-border ventures, choosing the previously popular field of short films. The 2023 annual report showed that in March 2024, Weimob Group strategically invested in Shanghai Banfan Information Technology Co., Ltd. (hereinafter referred to as Banfan Technology) to layout the short film track, building a full-chain short film business including IP creativity, film and television production, film distribution, and user growth, expanding more business scenarios that are expected to be deeply empowered by AI.

At the same time, during the reporting period, Weimob Group officially signed with Google CPP, becoming a first-tier agent in Google's China region and an official partner of Apple Ads. Earlier, on March 6, Weimob Group announced the acquisition of approximately 53.5% equity in the target company. On that day, Weimob Group's subsidiary, Shanghai Mengxun Information Technology Co., Ltd. (hereinafter referred to as Shanghai Mengxun), signed a share transfer agreement, capital increase agreement, and shareholder agreement with Banfan Technology and its founder shareholders.

Pursuant to the share transfer agreement and capital increase agreement, Shanghai Mengxun agreed to: 1) obtain approximately 24.4% equity in Banfan Technology through share transfer, with a consideration of 6 million yuan; 2) increase the capital of Banfan Technology by 25 million yuan, of which 625,000 yuan will be used as Banfan Technology's new registered capital, and the remaining amount will be included in Banfan Technology's capital reserve. After the completion of the above transfer and capital increase, Shanghai Mengxun will hold approximately 53.5% equity in Banfan Technology, making Banfan Technology a subsidiary of the company. The consideration for the aforementioned transactions will be funded by Weimob Group's internal resources. According to the shareholder agreement, Shanghai Mengxun agreed to grant a put option to the founder shareholders, subject to the fulfillment of certain conditions under the shareholder agreement, the founder shareholders have the right to require Shanghai Mengxun to purchase part or all of their equity in the target company during the put option period.

Weimob Group stated that after the completion of this transaction, Weimob Group and Banfan Technology will build a full-chain short film business including IP creativity, film and television production, film distribution, and user growth, expanding more business scenarios that are expected to be deeply empowered by AI, maximizing the benefits brought by technological changes. Public information shows that Banfan Technology was founded in March 2022 and is a film and television content producer mainly engaged in film and television production, distribution, content platform operation, and artist agency operations. Banfan Technology's Mingbai Studio has produced hit works such as "Princess Luo Yang," "The Favorite Daughter," "Reborn Sweet Wife," "My Arrogant Lord," "Your Highness, Please Advise!" and "My Paparazzi Girlfriend."

However, as a provider of business and marketing solutions, whether Weimob's cross-border layout in short films will be successful remains a big question mark. Many short film enthusiasts have expressed that although short films can attract attention in a short period of time, they can become "boring" after watching for a long time. Additionally, due to their short production time, pursuit of high excitement points, and fast pace, the key plotlines tend to be difficult to scrutinize, and the costumes and sets are difficult to match those of traditional dramas. Therefore, after catching up with short films for a while, many people still prefer to watch well-produced movies and TV dramas.

It should be noted that Weimob Group needs to speed up its layout in short films. According to past annual reports, Weimob Group's employee count has decreased from 8,562 in 2021 to 6,278 in 2022 and 4,584 in 2023, a reduction of 3,978 employees over three years, nearly halving compared to 2021. Given that the main business has not yet achieved sustainable profitability, how much leverage can betting on short films bring to Weimob Group? (Produced by Gangwan Finance)